Bruce looks at a key aspect of long-term returns, holding on to your gains in down markets. Company covered CML.

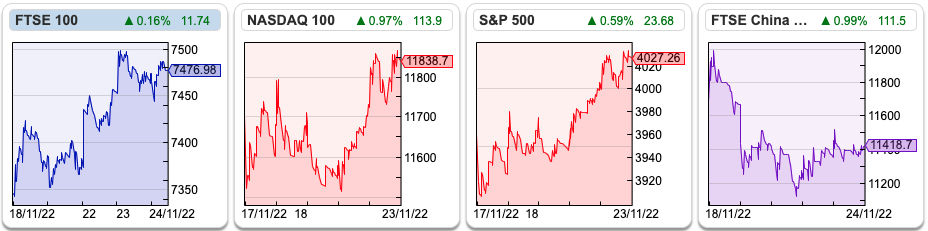

The FTSE 100 is up +1.8% in the last 5 days. Meanwhile, the S&P 500 is up +1.8% and Nasdaq100 was up +1.2%. China is worth keeping an eye on at the moment, as the lockdown disruption seems to be spreading. The FTSE China 50 fell -4.7% and the broader CSI 300 Shanghai index was down -1.6%.

Howard Marks has published his November Memo, titled ‘What Really Matters?’. The whole thing is worth reading in full, but I’ll summarise. He starts by listing a few things that don’t really matter:

- Short Term Events

- Trading Mentality

- Short Term Performance

- Volatility

- Hyper Activity

What really matters is long-term results. Of course! It’s obvious, but Howard Marks has $164bn of AuM and Warren Buffett as a fan of his memos, so what is obvious can still be valuable.

The final part of the memo, on asymmetry of returns is worth pondering. In bull markets, there’s always a Jerry Tsai, Bill Miller or Cathie Wood. That is, a new star fund manager who is outperforming, but 9 times out of 10 they give up all their excess returns and more when the bear market comes. Exceptional performance often comes when you perform OK in a bull market, but hold on to your gains through the cycle.

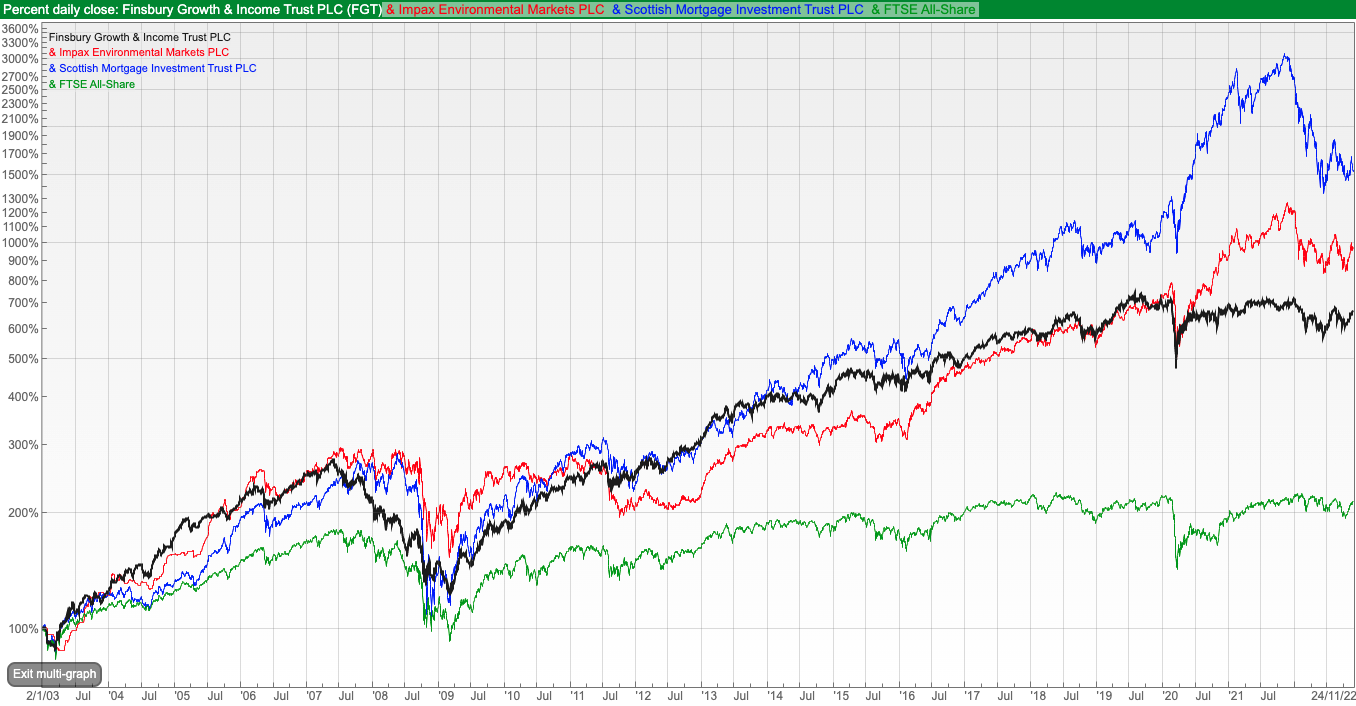

With that in mind, I was curious to use Sharepad to see how Nick Train’s Finsbury Growth Inv Trust had performed versus the more technology-focused Scottish Mortgage Inv Trust over the last 20 years. I’ve also added Impax Environmental Markets, which is Impax AM’s listed Inv Trust. All three have significantly outperformed the FTSE All Share.

Scottish Mortgage (blue) has done phenomenally well over the last couple of decades, but it does have a tendency to give back a lot of the gains in a bear market. IEM (red) is also up +1000% over that time frame, and you can see performance received a considerable boost from liquidity bubble following the April 2020 pandemic low.

Nick Train tries to pick long-term winners too, but looks for durable cashflows and ‘moats’ in more established sectors like Reed Elsevier (now called RELX), Diageo and the London Stock Exchange. Train has underperformed his benchmark for the last 18 months, and underperformed SMIT since 2016. I do wonder what this chart will look like in 5 years’ time though, and have recently moved some of my pension money in FGT.

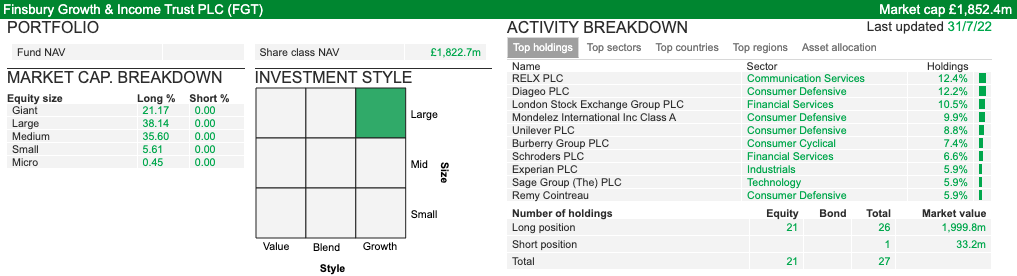

I tend to focus on individual companies, but Sharepad also has some great tools for looking at Investment Trusts, if you search for the trust and click on the ‘portfolio’ tab. Interestingly SMIT and FGT funds are ranked as “large cap growth”, whereas IEM is “mid-cap growth”. I’ve shown FGT as an example, but the same page is available (source with Morningstar data) for IEM and SMIT.

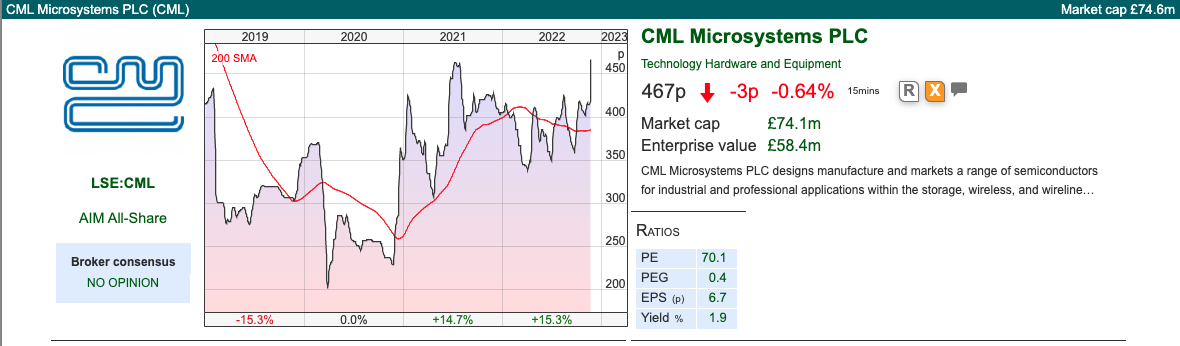

This week I look at a tech company with a history going back to 1968. Management have seen a few cycles, and I’m wondering if we are just at the start of something very exciting.

There seems to be less happening in markets now, so I will switch back to one weekly per week. For my timely updates, sometimes I post on the chat function (for instance, I already made a few comments on CML Microsystems as the price was spiking upwards this week.)

CML Microsystems H1 to Sept

This mixed signal, radio and microwave semiconductor company with operations in the UK, USA, Singapore and China announced H1 ahead of expectations results to September. Revenue was up +22% to £10m and PBT was up +81% to £1.8m. Management comment that there were one-off gains included in PBT, without detailing them. They do say that there were £250K of exceptional costs (moving from the LSE to AIM) which reduced last year’s PBT, without which this year’s PBT growth would have been a still impressive +46%. They have £23m of cash at the end of September, down from £25m at the end of March, as they bought back shares, paid a dividend and invested in R&D.

The reason they have so much cash is that at the beginning of 2021 they sold a subsidiary, Hyperstone, for $49m (£33m at the then exchange rate) in cash to Swissbit, an Internet of Things (IoT) company. They set up a B share scheme, as a tax-efficient method of returning £8m to shareholders. Investors at the time were given one B share for each ordinary share, which were then redeemed at 50p. The B shares were taxed as a capital gain, rather than income. This isn’t central to the investment case, but I hadn’t come across anything like this before and thought that it was rather clever.

History: The company was founded in 1968 as Consumer Microcircuits Ltd. Their original competence was in two-way radios and walkie-talkies. In 2003, recognising the importance of digital signalling they purchased a German company, Hyperstone, for £3.5m ex-cash, selling it for a 10x return a couple of decades later. They’ve been listed since 1984 on the USM, a precursor to AIM, and then in 1996 moved to the LSE main list.

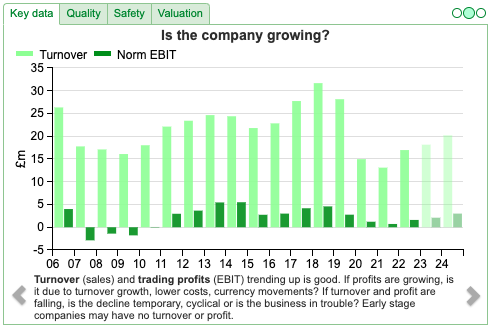

CML’s company history since the late 1990s has seen a share price peak of almost £9 per share in the internet bubble, falling to around 30p per share in the GFC of 2007-9. Although the summary chart (below) ‘only’ goes back 15 years, Sharepad actually has financial data on the company going back to 1983.

They have just moved over to AIM in 2021. I take this as a good sign. I’m slightly wary of small-cap stocks that are listed on the LSE rather than AIM, following Creigton’s management selling in H2 last year before they announced results between Christmas and New Year.

CML now develops mixed-signal, RF and microwave semiconductors for global communications markets. The website mentions satellites, 5G networks, IoT and aerospace & defence. They outsource the manufacturing but the testing is done in-house. The advantage of outsourcing manufacturing means CML can scale without the need for large capex on equipment, so if they do hit a rich seam of growth and demand, that can be extremely cash-generative. There’s a fascinating note from Ian Robertson (ex Seymour Pierce) which details the history and the business model, which I recommend if you think this is worthy of more research.

Outlook: They expect to surpass last week’s market expectations for FY Mar 2023F of £18m revenue (implying +7% growth) and £2.1m of PBT. That £18m previous forecast revenue is the same level as 2010 and below the figure reported in 1998, so the growth hasn’t been at a steady rate. Management warns that expenses are likely to increase too, and warns about supply chain issues in China.

CML haven’t given any figures, but Progressive have published research raising their revenue forecasts by +13% FY Mar 2023F to £20.5m and +14% 2024F to £23.3m. That implies +45% EPS growth this year and +32% next year.

Ownership: Miton owns 12.1%, Otus Capital Mgt 9.9%, Liontrust 8.4%, Herald IT 6.8%, Ruffer 4.2%, Schroders 3.7%. Chris Gurry, Group Managing Director owns 6.0% and Mike Gurry who is not on the board but is senior VP owns 5.7% and the estate of June Margaret Gurry owns 7%. Nigel Clark, the Executive Chair owns just over £100K.

Property: The company has £2m of freehold property “held for sale” on its balance sheet, which has been valued by third parties. CML also owns the freehold on its current Oval Park, Maldon (c. 28 acres site), and they have signed sale contracts with two separate parties, which are subject to planning permission to develop further office space (13 acres). They also have applied for planning permission to develop a business park (6 acres). They don’t expect to undertake the project themselves, but there’s clearly the potential for some sizeable property realisations.

Valuation: The shares are trading on a PER of 27x FY Mar 2023F and 24x PER. Cash is around a quarter of the market cap. If we deduct the cash from the market cap, the price/sales Mar 2023F falls to 2.5x sales, which seems an attractive valuation for a company that ought to have both double-digit top-line growth and operational gearing.

Low profitability: One thing to be aware off is that since 2015 RoCE has struggled to rise above 10% and the 3 year average is 3.1% (the cash figure is negative). That’s a sign that management are ploughing money back into the business in terms of R&D* spend, there’s £13m of development spend recorded on the balance sheet, and £9m of goodwill and other intangibles. But looking at the Annual Report note 16 – R&D costs have been £26m, of which half has either been impaired or amortised already. Hopefully there’s some valuable Intellectual Property that they’ve developed – the risk is that management are enjoying developing technology without focusing on the commercial applications.

Opinion: Fascinating little company with a surprisingly long history. I notice that there aren’t any management presentations on InvestorMeetCompany or PiWorld, so it’s hard to see much beyond the information that they present in their financial reports.

This situation reminds me of Boku, the payments business – where management have disposed of a business and may reinvest cash in a digital wallet opportunity (implying lower profits in the short term) rather than return the full amount to shareholders. CML management mention inorganic opportunities, implying that they may look to use their cash to buy other companies as well as spend money on R&D.

I like it, a GARP stock with a long (though mixed) track record. I’ve opened a starter position. I’m annoyed that I haven’t spotted this sooner, because the shares have already been a strong performer (plus the 50p buyback) this year. However, it’s easy to overlook small-cap stocks that are listed on the LSE rather than AIM, so that justifies management’s decision to move over to the latter.

Notes

*strictly speaking it’s development spend, rather than research & development. The accountants define these related concepts differently. There’s probably a technical IFRS definition, but unless any accountants want to correct me I think that the split is roughly:

research = the search for new ideas;

development = the process of turning those ideas into commercial products.

I’ve called it R&D to avoid confusion with the potential gains from property development.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary Part 2 | 24/11/22 | CML | Nothing else matters

Bruce looks at a key aspect of long-term returns, holding on to your gains in down markets. Company covered CML.

The FTSE 100 is up +1.8% in the last 5 days. Meanwhile, the S&P 500 is up +1.8% and Nasdaq100 was up +1.2%. China is worth keeping an eye on at the moment, as the lockdown disruption seems to be spreading. The FTSE China 50 fell -4.7% and the broader CSI 300 Shanghai index was down -1.6%.

Howard Marks has published his November Memo, titled ‘What Really Matters?’. The whole thing is worth reading in full, but I’ll summarise. He starts by listing a few things that don’t really matter:

What really matters is long-term results. Of course! It’s obvious, but Howard Marks has $164bn of AuM and Warren Buffett as a fan of his memos, so what is obvious can still be valuable.

The final part of the memo, on asymmetry of returns is worth pondering. In bull markets, there’s always a Jerry Tsai, Bill Miller or Cathie Wood. That is, a new star fund manager who is outperforming, but 9 times out of 10 they give up all their excess returns and more when the bear market comes. Exceptional performance often comes when you perform OK in a bull market, but hold on to your gains through the cycle.

With that in mind, I was curious to use Sharepad to see how Nick Train’s Finsbury Growth Inv Trust had performed versus the more technology-focused Scottish Mortgage Inv Trust over the last 20 years. I’ve also added Impax Environmental Markets, which is Impax AM’s listed Inv Trust. All three have significantly outperformed the FTSE All Share.

Scottish Mortgage (blue) has done phenomenally well over the last couple of decades, but it does have a tendency to give back a lot of the gains in a bear market. IEM (red) is also up +1000% over that time frame, and you can see performance received a considerable boost from liquidity bubble following the April 2020 pandemic low.

Nick Train tries to pick long-term winners too, but looks for durable cashflows and ‘moats’ in more established sectors like Reed Elsevier (now called RELX), Diageo and the London Stock Exchange. Train has underperformed his benchmark for the last 18 months, and underperformed SMIT since 2016. I do wonder what this chart will look like in 5 years’ time though, and have recently moved some of my pension money in FGT.

I tend to focus on individual companies, but Sharepad also has some great tools for looking at Investment Trusts, if you search for the trust and click on the ‘portfolio’ tab. Interestingly SMIT and FGT funds are ranked as “large cap growth”, whereas IEM is “mid-cap growth”. I’ve shown FGT as an example, but the same page is available (source with Morningstar data) for IEM and SMIT.

This week I look at a tech company with a history going back to 1968. Management have seen a few cycles, and I’m wondering if we are just at the start of something very exciting.

There seems to be less happening in markets now, so I will switch back to one weekly per week. For my timely updates, sometimes I post on the chat function (for instance, I already made a few comments on CML Microsystems as the price was spiking upwards this week.)

CML Microsystems H1 to Sept

This mixed signal, radio and microwave semiconductor company with operations in the UK, USA, Singapore and China announced H1 ahead of expectations results to September. Revenue was up +22% to £10m and PBT was up +81% to £1.8m. Management comment that there were one-off gains included in PBT, without detailing them. They do say that there were £250K of exceptional costs (moving from the LSE to AIM) which reduced last year’s PBT, without which this year’s PBT growth would have been a still impressive +46%. They have £23m of cash at the end of September, down from £25m at the end of March, as they bought back shares, paid a dividend and invested in R&D.

The reason they have so much cash is that at the beginning of 2021 they sold a subsidiary, Hyperstone, for $49m (£33m at the then exchange rate) in cash to Swissbit, an Internet of Things (IoT) company. They set up a B share scheme, as a tax-efficient method of returning £8m to shareholders. Investors at the time were given one B share for each ordinary share, which were then redeemed at 50p. The B shares were taxed as a capital gain, rather than income. This isn’t central to the investment case, but I hadn’t come across anything like this before and thought that it was rather clever.

History: The company was founded in 1968 as Consumer Microcircuits Ltd. Their original competence was in two-way radios and walkie-talkies. In 2003, recognising the importance of digital signalling they purchased a German company, Hyperstone, for £3.5m ex-cash, selling it for a 10x return a couple of decades later. They’ve been listed since 1984 on the USM, a precursor to AIM, and then in 1996 moved to the LSE main list.

CML’s company history since the late 1990s has seen a share price peak of almost £9 per share in the internet bubble, falling to around 30p per share in the GFC of 2007-9. Although the summary chart (below) ‘only’ goes back 15 years, Sharepad actually has financial data on the company going back to 1983.

They have just moved over to AIM in 2021. I take this as a good sign. I’m slightly wary of small-cap stocks that are listed on the LSE rather than AIM, following Creigton’s management selling in H2 last year before they announced results between Christmas and New Year.

CML now develops mixed-signal, RF and microwave semiconductors for global communications markets. The website mentions satellites, 5G networks, IoT and aerospace & defence. They outsource the manufacturing but the testing is done in-house. The advantage of outsourcing manufacturing means CML can scale without the need for large capex on equipment, so if they do hit a rich seam of growth and demand, that can be extremely cash-generative. There’s a fascinating note from Ian Robertson (ex Seymour Pierce) which details the history and the business model, which I recommend if you think this is worthy of more research.

Outlook: They expect to surpass last week’s market expectations for FY Mar 2023F of £18m revenue (implying +7% growth) and £2.1m of PBT. That £18m previous forecast revenue is the same level as 2010 and below the figure reported in 1998, so the growth hasn’t been at a steady rate. Management warns that expenses are likely to increase too, and warns about supply chain issues in China.

CML haven’t given any figures, but Progressive have published research raising their revenue forecasts by +13% FY Mar 2023F to £20.5m and +14% 2024F to £23.3m. That implies +45% EPS growth this year and +32% next year.

Ownership: Miton owns 12.1%, Otus Capital Mgt 9.9%, Liontrust 8.4%, Herald IT 6.8%, Ruffer 4.2%, Schroders 3.7%. Chris Gurry, Group Managing Director owns 6.0% and Mike Gurry who is not on the board but is senior VP owns 5.7% and the estate of June Margaret Gurry owns 7%. Nigel Clark, the Executive Chair owns just over £100K.

Property: The company has £2m of freehold property “held for sale” on its balance sheet, which has been valued by third parties. CML also owns the freehold on its current Oval Park, Maldon (c. 28 acres site), and they have signed sale contracts with two separate parties, which are subject to planning permission to develop further office space (13 acres). They also have applied for planning permission to develop a business park (6 acres). They don’t expect to undertake the project themselves, but there’s clearly the potential for some sizeable property realisations.

Valuation: The shares are trading on a PER of 27x FY Mar 2023F and 24x PER. Cash is around a quarter of the market cap. If we deduct the cash from the market cap, the price/sales Mar 2023F falls to 2.5x sales, which seems an attractive valuation for a company that ought to have both double-digit top-line growth and operational gearing.

Low profitability: One thing to be aware off is that since 2015 RoCE has struggled to rise above 10% and the 3 year average is 3.1% (the cash figure is negative). That’s a sign that management are ploughing money back into the business in terms of R&D* spend, there’s £13m of development spend recorded on the balance sheet, and £9m of goodwill and other intangibles. But looking at the Annual Report note 16 – R&D costs have been £26m, of which half has either been impaired or amortised already. Hopefully there’s some valuable Intellectual Property that they’ve developed – the risk is that management are enjoying developing technology without focusing on the commercial applications.

Opinion: Fascinating little company with a surprisingly long history. I notice that there aren’t any management presentations on InvestorMeetCompany or PiWorld, so it’s hard to see much beyond the information that they present in their financial reports.

This situation reminds me of Boku, the payments business – where management have disposed of a business and may reinvest cash in a digital wallet opportunity (implying lower profits in the short term) rather than return the full amount to shareholders. CML management mention inorganic opportunities, implying that they may look to use their cash to buy other companies as well as spend money on R&D.

I like it, a GARP stock with a long (though mixed) track record. I’ve opened a starter position. I’m annoyed that I haven’t spotted this sooner, because the shares have already been a strong performer (plus the 50p buyback) this year. However, it’s easy to overlook small-cap stocks that are listed on the LSE rather than AIM, so that justifies management’s decision to move over to the latter.

Notes

*strictly speaking it’s development spend, rather than research & development. The accountants define these related concepts differently. There’s probably a technical IFRS definition, but unless any accountants want to correct me I think that the split is roughly:

research = the search for new ideas;

development = the process of turning those ideas into commercial products.

I’ve called it R&D to avoid confusion with the potential gains from property development.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.