Bruce thinks that net outflows from professional fund managers could eventually create an opportunity for amateur investors because we’re not forced to sell when markets fall. Companies covered K3C, SOLI, MSI, and SDI.

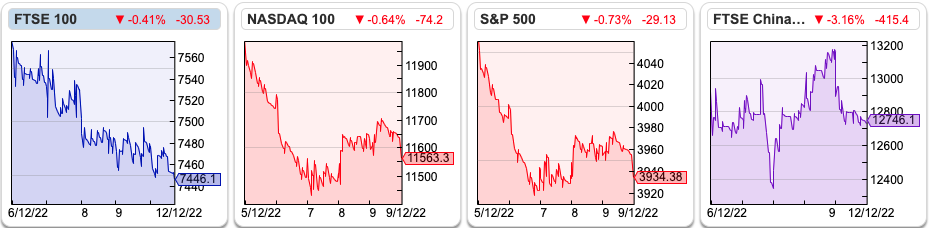

The FTSE 100 was down -1.6% in the last five days to 7,446. The S&P500 -3.4% and Nasdaq100 -3.6% were even weaker. The FTSE China’s 50 re-opening rally petered out, as the index is down -1.4% in the last five days. Brent crude has fallen -11% in the last five days to $76 per barrel.

Hedge funds are suffering redemptions, according to this Institutional Investor article which quotes data from eVestment. Investors’ net outflow from hedge funds reached $14 billion in October, the largest for the month since 2016. That’s the fifth consecutive month of negative net flows out of hedge funds, according to the article. Long-short equity, macro, and credit strategies were the main drivers of that, according to data from eVestment.

This is worth keeping an eye on, because pension funds, which are managed by trustees and are subject to regulators and consultants encouraging them to behave in risk-averse ways can be a good contrarian indicator. In 2009 fund redemptions created an opportunity for amateur investors, it was clear that Central Banks were providing trillions of liquidity but hedge fund clients were asking for their money back in Q4 2008 and Q1 2009, so the professionals were having to sell at just the wrong point. So, I view stories about hedge fund redemptions as a positive signal for amateur investors, because we are managing our own money so don’t get redemption requests and can buy when others are forced to sell. Hopefully, this message eventually reaches Ocean Wilsons management, the Brazilian ports business reporting strong results, but with their $283m hedge fund portfolio declining -19.5% for the 9M to Sept.

Separately I’m sure many readers are enjoying the World Cup Finals. I am of course referring to the Microsoft Excel Spreadsheet Financial Modelling World Cup Finals. I hadn’t realised, but E-Sports has progressed from watching teenagers play “shoot’em up” Fortnite to management consultants and corporate finance juniors competing to build Excel models and solve problems. Although Sky, the BBC and ITV don’t seem to have been bidding up the rights to show these events, the matches are available on YouTube. Rather than a middle-aged Portuguese man sitting on the bench, the big star seems to be this youngster. Separately, Microsoft which also owns Minecraft is trying to buy Call of Duty and World of Warcraft gaming company Activision for $75bn. Regulators in the UK and USA are looking at the merger, fearing that it will reduce competition. The MSFT is also investing in the London Stock Exchange, while LSEG spends £2.3bn with on cloud infrastructure with the software company. I presume that regulators are not too worried about Microsoft’s domination of the Excel spreadsheet e-sports niche though.

This week I look at two companies that seem to be benefiting from on-shoring and the pick-up in defence spending: Solid State and MS International. Plus a brief comment on SDI, but I start with the Private Equity approach for K3 Capital.

K3 Capital approach by Private Equity

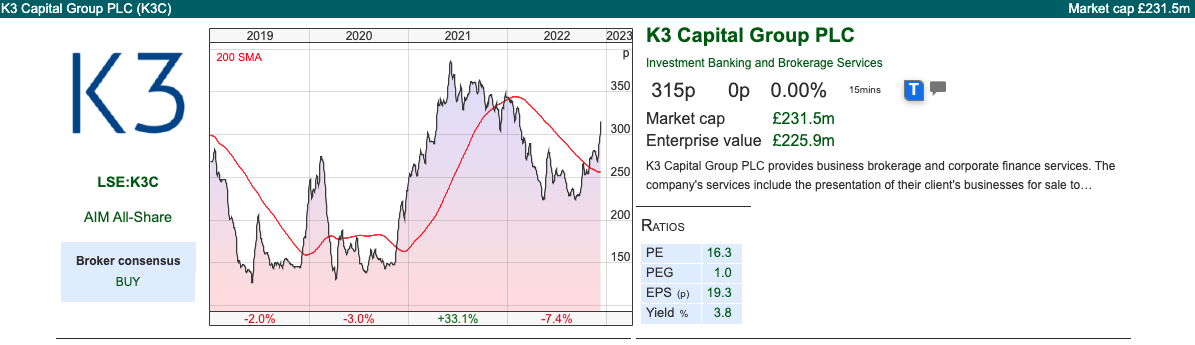

This professional services firm, which specialises in smaller companies, has itself received an approach last week from Private Equity. Sun Capital has many indicative approaches at 350p per share. That’s a +17% premium to the closing price on 7th Dec, and values the company at 15x 2024F PER. Then on Monday K3C put out a trading statement saying that they expect to report H1 Nov revenues of £42m (more than half FY May 2023F of £79.5m), and profits ‘comfortably inline’ with the Boards expectations.

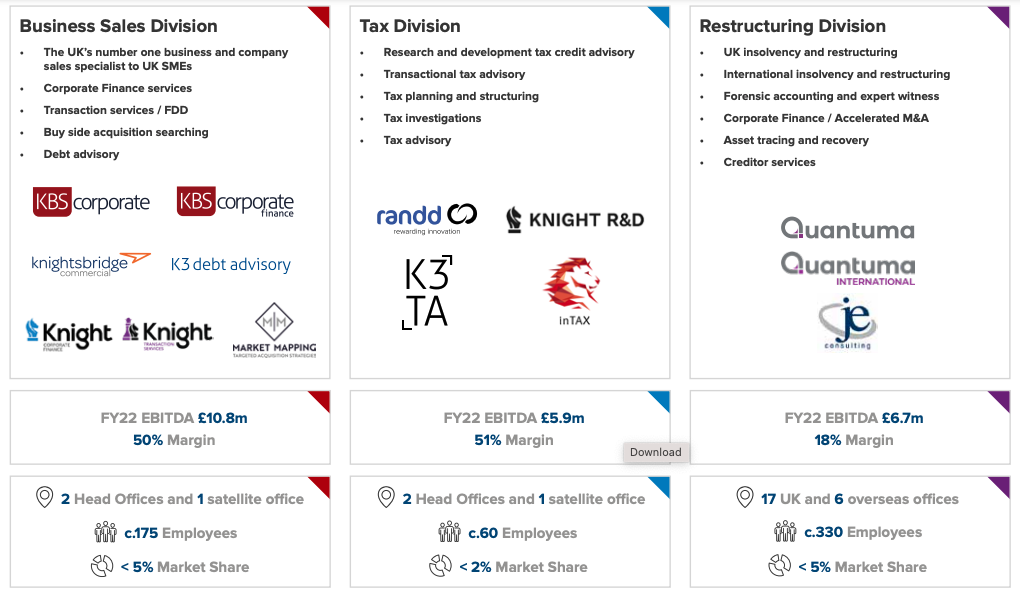

K3 Capital listed on AIM in April 2017, at a placing price of 95p raising £2m, and valuing the firm at £40m market cap. In 2018 insiders sold over £4m of shares at 300p. They then acquired RANDD, an R&D tax credit specialist for £9m (75% cash, 25% shares) + earnout and then raised £30m in a placing at 150p to buy Quantuma in August 2020, which does restructuring and insolvency advice, for £26m initial consideration plus £15m deferred. They also raised £10m at a placing price of 340p in July 2021.

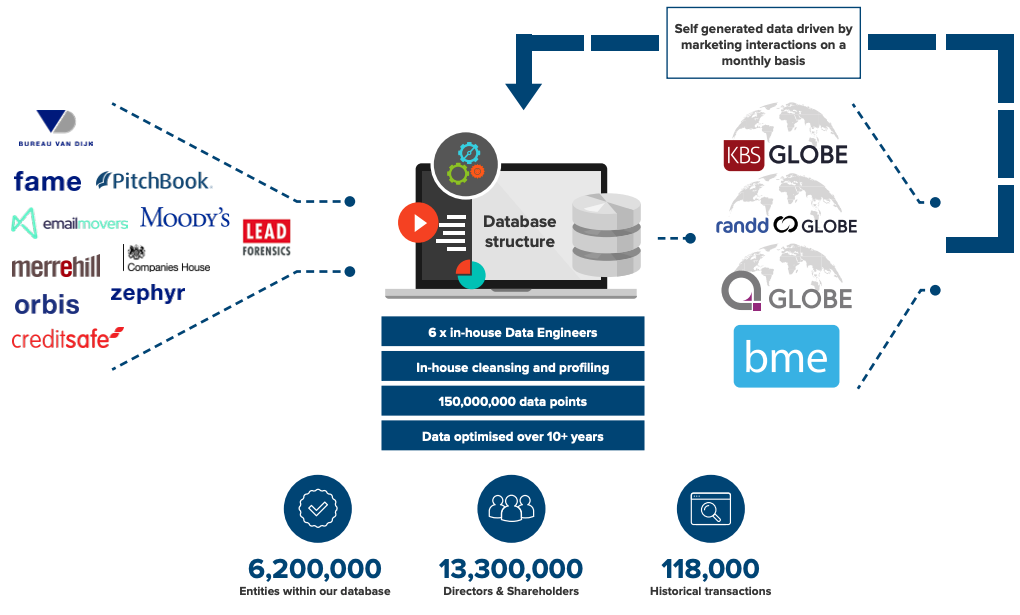

Those acquisitions do mean that it’s a professional services firm with 86% of shareholders’ equity in intangible assets. They also had £6m of contingent consideration on their balance sheet from those acquisitions, so despite the impressive top-line growth, the business hasn’t received an expensive rating. Perhaps to assuage investors’ concerns about ‘key man risk’ and the assets walking out of the building every evening, management have suggested that they have a proprietary database, which generates leads and builds revenue.

As a general rule, database businesses tend to be highly valued, an extreme example would be Snowflake in the US, which trades on 35x sales. That’s not directly comparable because SNOW helps other organisations collect and organise data. With K3C it’s the proprietary data that they’ve collected themselves over 10 plus years that’s valuable, so perhaps a RELX trades on 6x sales, is a better example of positive feedback loops from owning proprietary data?

Opinion: Comments from readers on the Sharepad chat function suggest that management could be selling out too cheaply. I can see their point: a 17% premium and 15x earnings doesn’t seem very attractive, particularly as insiders sold shares at 300p in 2018 and the share count has increased since then by +74% to 73.5m.

As a general comment, Private Equity returns seem to come from i) buying companies that have been built-up with capital from public markets and have developed a runway for future growth ii) selling overpriced companies back to public markets that are near the end of their runway and which then go on to crash within 18 months. Unfortunately, pension funds and other asset allocators don’t seem to realise that the source of Private Equity returns comes from reducing public market returns. If you haven’t read it, I recommend Warren Buffett’s parable of the “Gotrocks family” from page 18 onwards of the 2005 Berkshire Hathaway Annual Report, which describes how a whole army of fee-charging ‘helpers’ extract wealth from the fictional Gotrocks family, who own 100% of the assets of the economy.

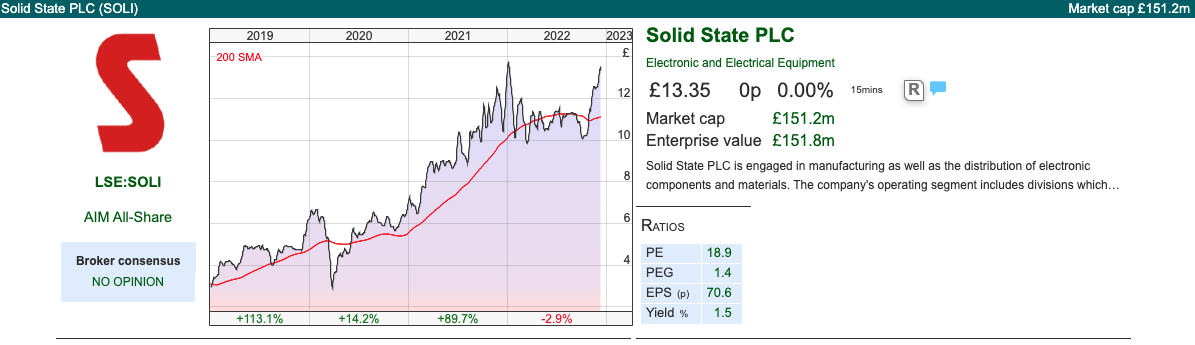

Solid State H1 to September

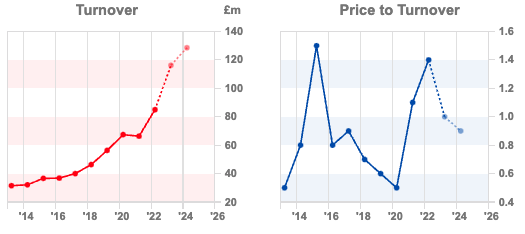

This “rugged” computing, power and communications company announced strong H1 results to September, with reported revenue +51% to £59m. Reported PBT doubled to £4.2m v H1 last year. They did buy a US business, Custom Power, which was completed in August this year, but on constant currency, organic revenue growth was +31% y-o-y.

Net debt has grown to £16m at the end of Sept 2022, from £5m March 2022 and less than £2m H1 last year. Included in that net debt figure is £14.4m of deferred consideration, with cash of £16.0m only slightly less than bank borrowing of £17.8m. Other than Custom Power, the reason for net debt increasing is that management need to invest in higher inventories and increased order cover. That seems reasonable given supply chain disruption and the open order book at the end of September has doubled to £113m from H1 last year, and £86m March 2022.

They bought Custom Power for £24m initial cash consideration, and £36m maximum consideration. They paid for this by raising £25m at 1,025p. Management said that Custom Power has expertise in high-performance battery packs for drones, which require specialist-engineered solutions including the use of lightweight materials and battery heating technologies. I would imagine that if you want to fly a drone in the Ukrainian winter, that tech might come in useful. Before that in March 2021 they also made a couple of other acquisitions: Willow Technologies and Active Silicon. Following these acquisitions just under half of revenue comes from overseas. It seems to me there’s likely a one-off benefit from prior year acquisitions, when they talk about H1 +31% “organic revenue growth” just reported, compared to +8% organic revenue growth FY Mar 2022 and +9% organic revenue growth forecast by their broker FY Mar 2024F.

Then in November, they put out a couple of announcements saying that they had a contract win from NATO. The first RNS was for a £7m contract, then a week or so later they announced a further £9.8m follow-on contract. At the time they didn’t raise guidance, but it was clear that there was an upwards bias to expectations, hence the shares are up +36% since mid-November.

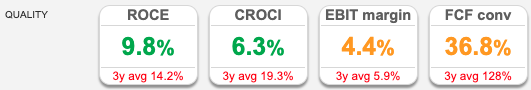

The Group is split into two divisions: i) Systems (Steatite, Active Silicon & Custom Power) £24m of revenue, growing at +58% including Custom Power and ii) Components (Solid State Supplies, Pacer, Willow Technologies & AEC) £35m of revenue, growing at +46%. They’ve been listed on AIM since 1996, and the company was founded in 1971. One thing to note is that both RoCE and EBIT margins look a little low, I’m hoping that as the company expands they can demonstrate increasing returns from scale.

Valuation: FinnCap their broker have raised revenue forecasts by +2.6% FY Mar 2023F and +0.8% FY March 2024F. That doesn’t sound particularly impressive, given last week’s. The forecast increase in revenue growth results in a +8.5% increase in EPS to 80p for this year. The broker is also forecasting 80p of EPS FY Mar 2024F (ie no growth), putting the shares on a PER of 17x, this year and next.

Opinion: I last wrote about the company in April this year. This is a long-term hold for me, so I’m hoping that the tailwind from Government funded sectors like defence, security and transport will continue. Ideally, I would like to see is the Solid State EBIT margin and RoCE improve, as evidence that top-line growth and acquisitions generates increasing profitability ratios.

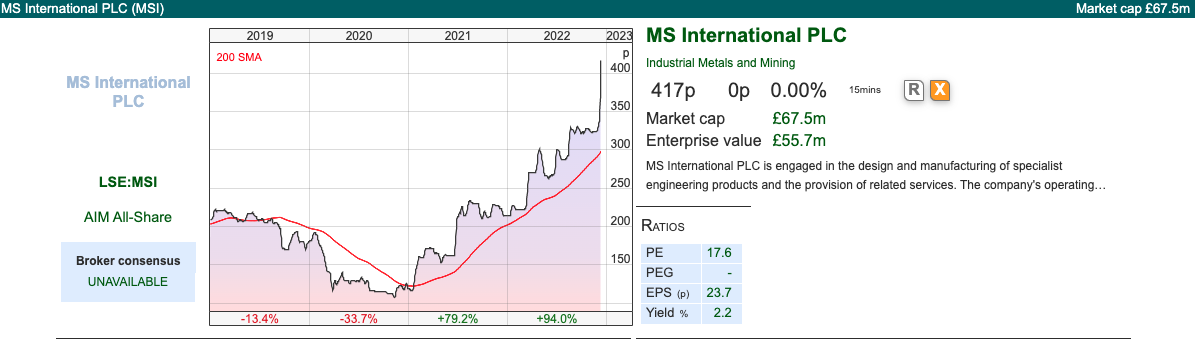

MS International Group H1 to October

This petrol stations to naval artillery business reported H1 results to October. Revenue was up +27% to £42m and statutory PBT was up 4.5x to £3.5m. For a company of £67.5m market cap, it’s slightly surprising how diverse their activities are i) Defence, a third of revenue, this includes a 30mm gun being tested by the US Navy and a land-based “counter-drone” weapon, that has attracted considerable attention; ii) Forgings, 30% of revenue, fork-arms and open die; iii) Corporate Branding, 16% of revenue media facades, signage, lighting and similar; iv) Petrol Stations, 21% of revenue, consists of construction and maintenance of petrol station superstructures.

Pleasingly the two largest divisions are also showing the best top-line growth, with Defence up +27% and Forgings +69%. There’s no bank debt, but there is a £4.3m pension liability and £21m of contract liabilities, versus £23m of cash on the balance sheet. Similar to CML Microsystems this company has been listed for several decades, Sharepad has financial data going back to 1982 (when revenue was £64m, versus 40 years later £75m FY Apr 2022).

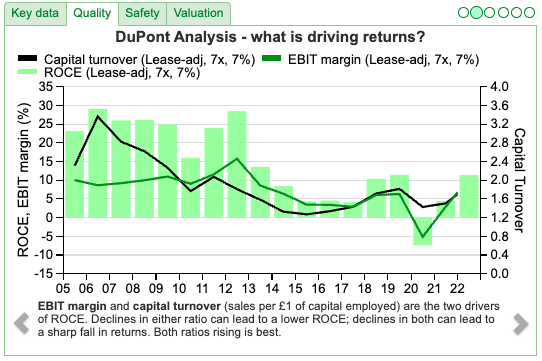

Valuation: The company doesn’t pay for broker forecasts. The long-term history shows a decline in RoCE and more recently the ratio has fluctuated between -7.3% when the company was loss-making at the beginning of the pandemic in April 2020, recovering to a 11.4% RoCE reported last year. I would imagine some of that has been caused by lumpy contracts? Annualising H1 diluted EPS of 16.8p suggests a multiple of 12x PER which still appears good value, even though the shares are up +94% YTD.

Opinion: The lack of growth since the 1980s is a little concerning, but there now do seem to be favourable tailwinds. I bought some shares a few years ago when Lord Lee mentioned them, but I haven’t really followed developments closely, so I was surprised to see that they’d been my best performer this year. Of course, I should have increased my position size in the April 2020 panic, because the cash on the balance sheet meant they could easily withstand a loss-making year (or more). Easy to say with hindsight.

There’s less than 30% free float because company insiders and family members own large stakes. Not one for traders, because the shares are illiquid but I can see that this could appeal to other ‘buy and hold’ style investors.

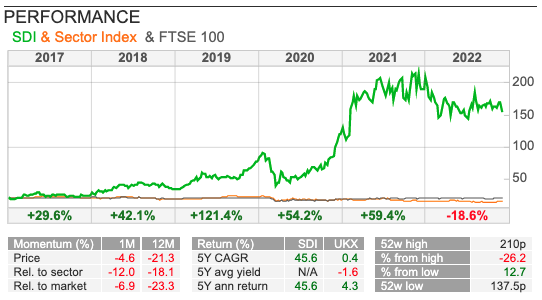

SDI Group H1 to October

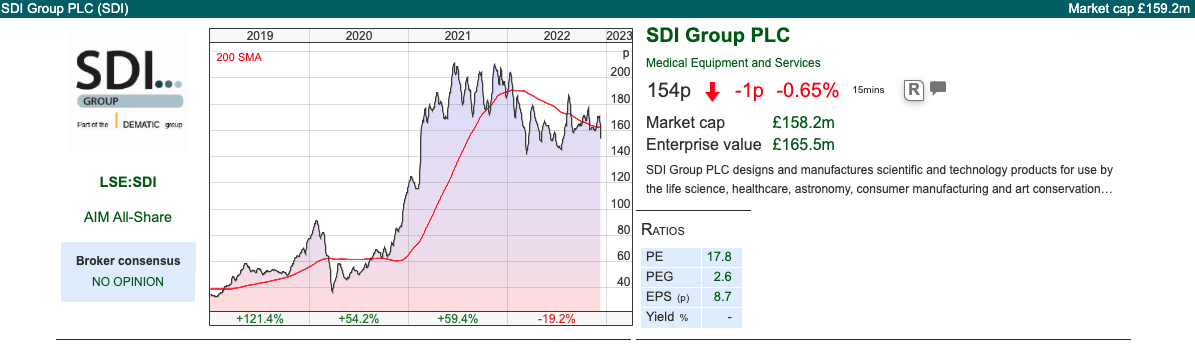

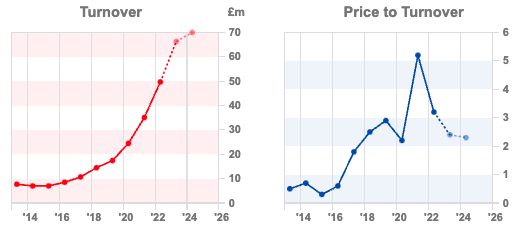

A brief comment on this digital imaging and sensors company, that benefitted from their Atik Cameras being used in PCR tests. Revenue came in at £31.7m up +28% including acquisitions, but +3.8% on an organic basis. Reported PBT was up +3.9% to £5.3m and net debt (ex deferred consideration for acquisitions) was £15m v a net cash position of £1.1m at the end of April this year.

Management said that they expect to deliver FY April 2023F results in line with market expectations of £66.3m sales and £12.8m adjusted operating PBT. Yet the shares fell -9% in response to the RNS. I dug out the broker forecasts (Progressive and FinnCap) and both research houses have left their revenue forecasts unchanged but reduced reported PBT by between -6% (FinnCap) and -13.5% (Progressive) in FY 2023F. The reduction is driven by higher interest cost. The rising cost of borrowing shouldn’t be news to anyone and it represents a real ongoing cost that shouldn’t be excluded from forecasts.

I wanted to flag this as an example of a broader trend. In a bull market, corporate management tend to pay brokers to say nice things about them. Even though we are going into a recession, we are still seeing some corporate managements making upbeat, positive noises in their RNS, but then paying brokers to cut forecasts and generally highlight the more negative aspects of the outlook. I think this is a grey area, but investors should be aware that a company RNS may not give the full story. I will quote SDI’s outlook statement, and leave readers to form a judgement:

“A higher interest rate environment will lead to a small increase in interest rate expense in the second half. We look forward to delivering a full year trading performance in line with market expectations.”

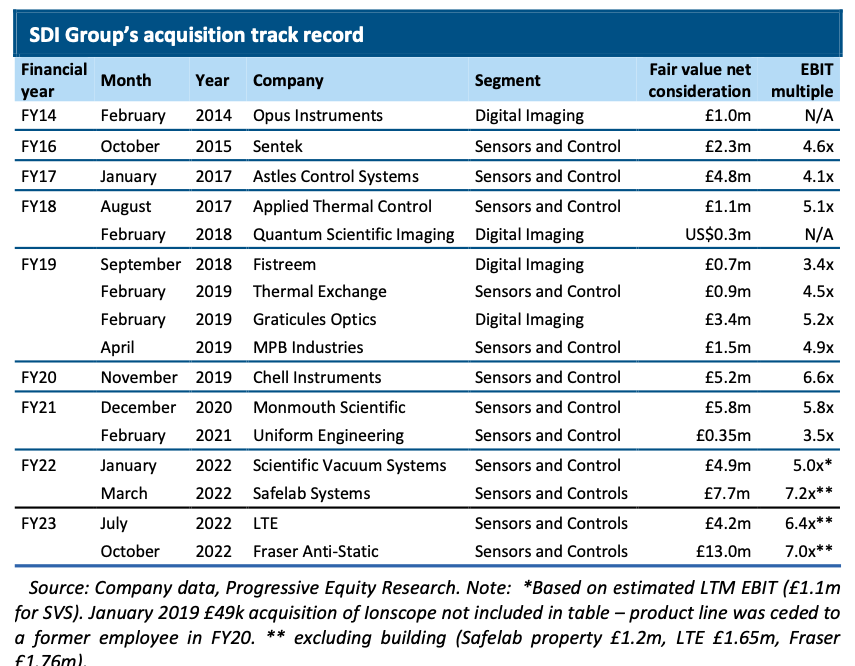

Balance sheet: The balance sheet is top heavy with £47m of goodwill which means tangible book value is negative £6m. Ian Robertson at Progressive has produced this very helpful table summarising multiples paid for the businesses that SDI have acquired over the years.

Valuation: Progressive are forecasting 7.3p of reported EPS FY 2024F and FinnCap are forecasting 7.7p. Taking the average of the two forecasts gives a PER multiple of 20.5x.

Outlook: SDI has been a fantastic consistent long-term performer but has been weak YTD -19%. I can imagine that could continue into 2023, as investors worry that the acquisition-led strategy could unwind or that organic growth could disappoint. That’s not my central scenario, but it’s worth being aware of the risks. It could also present an opportunity to buy into the long-term story.

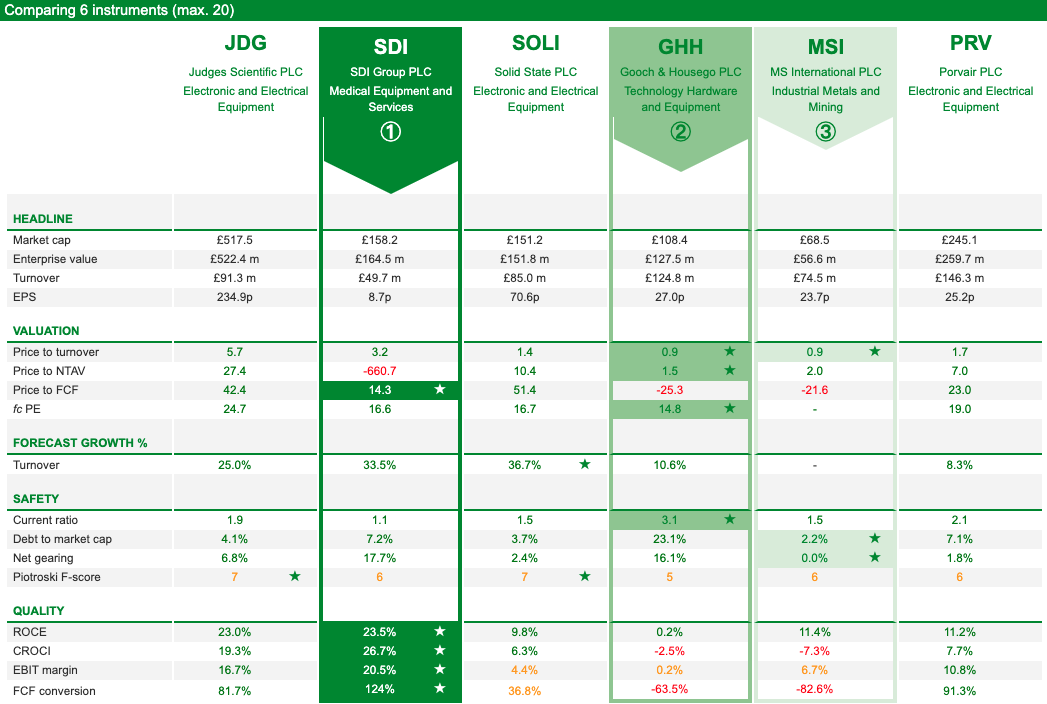

Below I’ve used Sharepad’s “compare” tool, to look at SDI versus Judges, plus SOLI, MS International, Gooch & Housego and Provair which have all reported recently. Interestingly Sharepad’s automated ranking system still rates SDI first, followed by GHH then MSI.

Notes

The author owns shares in Ocean Wilsons, Solid State, SDI and MS International.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 13/12/22 | K3C,SOLI, MSI, SDI | Redemption Song

Bruce thinks that net outflows from professional fund managers could eventually create an opportunity for amateur investors because we’re not forced to sell when markets fall. Companies covered K3C, SOLI, MSI, and SDI.

The FTSE 100 was down -1.6% in the last five days to 7,446. The S&P500 -3.4% and Nasdaq100 -3.6% were even weaker. The FTSE China’s 50 re-opening rally petered out, as the index is down -1.4% in the last five days. Brent crude has fallen -11% in the last five days to $76 per barrel.

Hedge funds are suffering redemptions, according to this Institutional Investor article which quotes data from eVestment. Investors’ net outflow from hedge funds reached $14 billion in October, the largest for the month since 2016. That’s the fifth consecutive month of negative net flows out of hedge funds, according to the article. Long-short equity, macro, and credit strategies were the main drivers of that, according to data from eVestment.

This is worth keeping an eye on, because pension funds, which are managed by trustees and are subject to regulators and consultants encouraging them to behave in risk-averse ways can be a good contrarian indicator. In 2009 fund redemptions created an opportunity for amateur investors, it was clear that Central Banks were providing trillions of liquidity but hedge fund clients were asking for their money back in Q4 2008 and Q1 2009, so the professionals were having to sell at just the wrong point. So, I view stories about hedge fund redemptions as a positive signal for amateur investors, because we are managing our own money so don’t get redemption requests and can buy when others are forced to sell. Hopefully, this message eventually reaches Ocean Wilsons management, the Brazilian ports business reporting strong results, but with their $283m hedge fund portfolio declining -19.5% for the 9M to Sept.

Separately I’m sure many readers are enjoying the World Cup Finals. I am of course referring to the Microsoft Excel Spreadsheet Financial Modelling World Cup Finals. I hadn’t realised, but E-Sports has progressed from watching teenagers play “shoot’em up” Fortnite to management consultants and corporate finance juniors competing to build Excel models and solve problems. Although Sky, the BBC and ITV don’t seem to have been bidding up the rights to show these events, the matches are available on YouTube. Rather than a middle-aged Portuguese man sitting on the bench, the big star seems to be this youngster. Separately, Microsoft which also owns Minecraft is trying to buy Call of Duty and World of Warcraft gaming company Activision for $75bn. Regulators in the UK and USA are looking at the merger, fearing that it will reduce competition. The MSFT is also investing in the London Stock Exchange, while LSEG spends £2.3bn with on cloud infrastructure with the software company. I presume that regulators are not too worried about Microsoft’s domination of the Excel spreadsheet e-sports niche though.

This week I look at two companies that seem to be benefiting from on-shoring and the pick-up in defence spending: Solid State and MS International. Plus a brief comment on SDI, but I start with the Private Equity approach for K3 Capital.

K3 Capital approach by Private Equity

This professional services firm, which specialises in smaller companies, has itself received an approach last week from Private Equity. Sun Capital has many indicative approaches at 350p per share. That’s a +17% premium to the closing price on 7th Dec, and values the company at 15x 2024F PER. Then on Monday K3C put out a trading statement saying that they expect to report H1 Nov revenues of £42m (more than half FY May 2023F of £79.5m), and profits ‘comfortably inline’ with the Boards expectations.

K3 Capital listed on AIM in April 2017, at a placing price of 95p raising £2m, and valuing the firm at £40m market cap. In 2018 insiders sold over £4m of shares at 300p. They then acquired RANDD, an R&D tax credit specialist for £9m (75% cash, 25% shares) + earnout and then raised £30m in a placing at 150p to buy Quantuma in August 2020, which does restructuring and insolvency advice, for £26m initial consideration plus £15m deferred. They also raised £10m at a placing price of 340p in July 2021.

Those acquisitions do mean that it’s a professional services firm with 86% of shareholders’ equity in intangible assets. They also had £6m of contingent consideration on their balance sheet from those acquisitions, so despite the impressive top-line growth, the business hasn’t received an expensive rating. Perhaps to assuage investors’ concerns about ‘key man risk’ and the assets walking out of the building every evening, management have suggested that they have a proprietary database, which generates leads and builds revenue.

As a general rule, database businesses tend to be highly valued, an extreme example would be Snowflake in the US, which trades on 35x sales. That’s not directly comparable because SNOW helps other organisations collect and organise data. With K3C it’s the proprietary data that they’ve collected themselves over 10 plus years that’s valuable, so perhaps a RELX trades on 6x sales, is a better example of positive feedback loops from owning proprietary data?

Opinion: Comments from readers on the Sharepad chat function suggest that management could be selling out too cheaply. I can see their point: a 17% premium and 15x earnings doesn’t seem very attractive, particularly as insiders sold shares at 300p in 2018 and the share count has increased since then by +74% to 73.5m.

As a general comment, Private Equity returns seem to come from i) buying companies that have been built-up with capital from public markets and have developed a runway for future growth ii) selling overpriced companies back to public markets that are near the end of their runway and which then go on to crash within 18 months. Unfortunately, pension funds and other asset allocators don’t seem to realise that the source of Private Equity returns comes from reducing public market returns. If you haven’t read it, I recommend Warren Buffett’s parable of the “Gotrocks family” from page 18 onwards of the 2005 Berkshire Hathaway Annual Report, which describes how a whole army of fee-charging ‘helpers’ extract wealth from the fictional Gotrocks family, who own 100% of the assets of the economy.

Solid State H1 to September

This “rugged” computing, power and communications company announced strong H1 results to September, with reported revenue +51% to £59m. Reported PBT doubled to £4.2m v H1 last year. They did buy a US business, Custom Power, which was completed in August this year, but on constant currency, organic revenue growth was +31% y-o-y.

Net debt has grown to £16m at the end of Sept 2022, from £5m March 2022 and less than £2m H1 last year. Included in that net debt figure is £14.4m of deferred consideration, with cash of £16.0m only slightly less than bank borrowing of £17.8m. Other than Custom Power, the reason for net debt increasing is that management need to invest in higher inventories and increased order cover. That seems reasonable given supply chain disruption and the open order book at the end of September has doubled to £113m from H1 last year, and £86m March 2022.

They bought Custom Power for £24m initial cash consideration, and £36m maximum consideration. They paid for this by raising £25m at 1,025p. Management said that Custom Power has expertise in high-performance battery packs for drones, which require specialist-engineered solutions including the use of lightweight materials and battery heating technologies. I would imagine that if you want to fly a drone in the Ukrainian winter, that tech might come in useful. Before that in March 2021 they also made a couple of other acquisitions: Willow Technologies and Active Silicon. Following these acquisitions just under half of revenue comes from overseas. It seems to me there’s likely a one-off benefit from prior year acquisitions, when they talk about H1 +31% “organic revenue growth” just reported, compared to +8% organic revenue growth FY Mar 2022 and +9% organic revenue growth forecast by their broker FY Mar 2024F.

Then in November, they put out a couple of announcements saying that they had a contract win from NATO. The first RNS was for a £7m contract, then a week or so later they announced a further £9.8m follow-on contract. At the time they didn’t raise guidance, but it was clear that there was an upwards bias to expectations, hence the shares are up +36% since mid-November.

The Group is split into two divisions: i) Systems (Steatite, Active Silicon & Custom Power) £24m of revenue, growing at +58% including Custom Power and ii) Components (Solid State Supplies, Pacer, Willow Technologies & AEC) £35m of revenue, growing at +46%. They’ve been listed on AIM since 1996, and the company was founded in 1971. One thing to note is that both RoCE and EBIT margins look a little low, I’m hoping that as the company expands they can demonstrate increasing returns from scale.

Valuation: FinnCap their broker have raised revenue forecasts by +2.6% FY Mar 2023F and +0.8% FY March 2024F. That doesn’t sound particularly impressive, given last week’s. The forecast increase in revenue growth results in a +8.5% increase in EPS to 80p for this year. The broker is also forecasting 80p of EPS FY Mar 2024F (ie no growth), putting the shares on a PER of 17x, this year and next.

Opinion: I last wrote about the company in April this year. This is a long-term hold for me, so I’m hoping that the tailwind from Government funded sectors like defence, security and transport will continue. Ideally, I would like to see is the Solid State EBIT margin and RoCE improve, as evidence that top-line growth and acquisitions generates increasing profitability ratios.

MS International Group H1 to October

This petrol stations to naval artillery business reported H1 results to October. Revenue was up +27% to £42m and statutory PBT was up 4.5x to £3.5m. For a company of £67.5m market cap, it’s slightly surprising how diverse their activities are i) Defence, a third of revenue, this includes a 30mm gun being tested by the US Navy and a land-based “counter-drone” weapon, that has attracted considerable attention; ii) Forgings, 30% of revenue, fork-arms and open die; iii) Corporate Branding, 16% of revenue media facades, signage, lighting and similar; iv) Petrol Stations, 21% of revenue, consists of construction and maintenance of petrol station superstructures.

Pleasingly the two largest divisions are also showing the best top-line growth, with Defence up +27% and Forgings +69%. There’s no bank debt, but there is a £4.3m pension liability and £21m of contract liabilities, versus £23m of cash on the balance sheet. Similar to CML Microsystems this company has been listed for several decades, Sharepad has financial data going back to 1982 (when revenue was £64m, versus 40 years later £75m FY Apr 2022).

Valuation: The company doesn’t pay for broker forecasts. The long-term history shows a decline in RoCE and more recently the ratio has fluctuated between -7.3% when the company was loss-making at the beginning of the pandemic in April 2020, recovering to a 11.4% RoCE reported last year. I would imagine some of that has been caused by lumpy contracts? Annualising H1 diluted EPS of 16.8p suggests a multiple of 12x PER which still appears good value, even though the shares are up +94% YTD.

Opinion: The lack of growth since the 1980s is a little concerning, but there now do seem to be favourable tailwinds. I bought some shares a few years ago when Lord Lee mentioned them, but I haven’t really followed developments closely, so I was surprised to see that they’d been my best performer this year. Of course, I should have increased my position size in the April 2020 panic, because the cash on the balance sheet meant they could easily withstand a loss-making year (or more). Easy to say with hindsight.

There’s less than 30% free float because company insiders and family members own large stakes. Not one for traders, because the shares are illiquid but I can see that this could appeal to other ‘buy and hold’ style investors.

SDI Group H1 to October

A brief comment on this digital imaging and sensors company, that benefitted from their Atik Cameras being used in PCR tests. Revenue came in at £31.7m up +28% including acquisitions, but +3.8% on an organic basis. Reported PBT was up +3.9% to £5.3m and net debt (ex deferred consideration for acquisitions) was £15m v a net cash position of £1.1m at the end of April this year.

Management said that they expect to deliver FY April 2023F results in line with market expectations of £66.3m sales and £12.8m adjusted operating PBT. Yet the shares fell -9% in response to the RNS. I dug out the broker forecasts (Progressive and FinnCap) and both research houses have left their revenue forecasts unchanged but reduced reported PBT by between -6% (FinnCap) and -13.5% (Progressive) in FY 2023F. The reduction is driven by higher interest cost. The rising cost of borrowing shouldn’t be news to anyone and it represents a real ongoing cost that shouldn’t be excluded from forecasts.

I wanted to flag this as an example of a broader trend. In a bull market, corporate management tend to pay brokers to say nice things about them. Even though we are going into a recession, we are still seeing some corporate managements making upbeat, positive noises in their RNS, but then paying brokers to cut forecasts and generally highlight the more negative aspects of the outlook. I think this is a grey area, but investors should be aware that a company RNS may not give the full story. I will quote SDI’s outlook statement, and leave readers to form a judgement:

“A higher interest rate environment will lead to a small increase in interest rate expense in the second half. We look forward to delivering a full year trading performance in line with market expectations.”

Balance sheet: The balance sheet is top heavy with £47m of goodwill which means tangible book value is negative £6m. Ian Robertson at Progressive has produced this very helpful table summarising multiples paid for the businesses that SDI have acquired over the years.

Valuation: Progressive are forecasting 7.3p of reported EPS FY 2024F and FinnCap are forecasting 7.7p. Taking the average of the two forecasts gives a PER multiple of 20.5x.

Outlook: SDI has been a fantastic consistent long-term performer but has been weak YTD -19%. I can imagine that could continue into 2023, as investors worry that the acquisition-led strategy could unwind or that organic growth could disappoint. That’s not my central scenario, but it’s worth being aware of the risks. It could also present an opportunity to buy into the long-term story.

Below I’ve used Sharepad’s “compare” tool, to look at SDI versus Judges, plus SOLI, MS International, Gooch & Housego and Provair which have all reported recently. Interestingly Sharepad’s automated ranking system still rates SDI first, followed by GHH then MSI.

Notes

The author owns shares in Ocean Wilsons, Solid State, SDI and MS International.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.