Bruce questions whether the value of intangible assets on Netflix’s balance sheet are of the same character as Disney’s intangible assets. Plus a mix of UK stocks that reported last week CBOX, SOLI and CAPD.

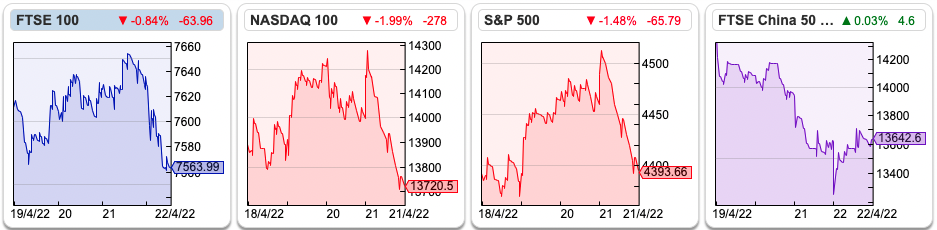

The FTSE 100 was down -0.2% to 7,563 last week. The Nasdaq100 was down -3.5% as Netflix was the latest high growth, high valuation “pandemic winner” to disappoint. That comes on the back of Facebook’s fall at the start of February. I wonder if this is the end of the FAANGs. As Facebook has changed its name to Meta, then really the acronym should now be MAANGs? The likes of Shell +71% and Glencore +67% are up strongly in the last 12 months, we may need a new moniker for shares in the energy and commodity sector. Brent crude was up +2% to $107. The US 10 year government bond yield continues to rise, reaching 2.92% half way through last week before falling back.

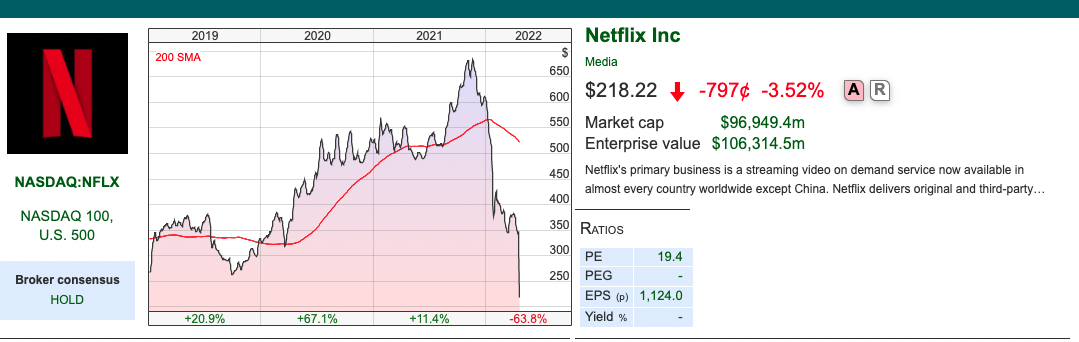

Netflix -35% decline came after it warned on subscriber growth numbers. Netflix had been a major beneficiary of the pandemic, so it should have been obvious that as people went out to physical events there might be an impact on NFLX. A couple of weeks before the profit warning Steve Clapham pointed out some issues with the intangible asset amortisation charge. Amortisation is a non cash item, but if the company is understating the charge then reported profits will be higher.

He believes that Netflix accounts for its content as “fixed assets” rather than “inventory”. Steve says, that categorisation allows the company to flatter the “cash from operations” figure. Companies know that investors tend to compare reported profits in the p&l with “cash from operations” in the cashflow statement, as a quick cross check. So shifting costs away from “cash from operations” can sometimes goes on. SharePad shows NFLX’s cash from operations was a $393m inflow, and cash from investing was a $1.3bn outflow last year.

Lion King v Tiger King: I think that intangible asset accounting is an area where investors need to apply their own judgement: some intangible assets last far longer than other items, even if the accountants treat the assets the same way. That’s not the case with physical machines, which tend to wear out and need to be replaced at a more predictable rate. Out of curiosity I compared Disney’s balance sheet with Netflix. The former has $95bn of intangible assets, or around 43% of its market cap as intangibles recorded on its balance sheet. That compares to $31bn or 32% of Netflix’s market cap. However, Disney has an incredible amount of intellectual property going back decades (Mickey Mouse, Snow White & the 7 Dwarfs, Lion King etc) that has already been amortised and is no longer recorded anywhere. I’m doubtful that Netflix’s content will last as long – people won’t be so keen for their children to be watching “Tiger King” in years to come.

Indeed NFLX’s own accelerated amortisation policies assume that their content quickly goes out of date. They say that amortisation is accelerated, as most viewing takes place when the content is new, with 90% amortised in the first four years. However, Steve Clapham concluded in March that the numbers which Netflix reports are inconsistent with the company’s stated policies on how it accounts for the intangible value of content. He points out that discrepancies like that are rarely a positive for investors.

NFLX is now down by 2/3rds from its peak in November last year – I think the conclusion to draw is that the price you pay for growth and cashflows matter, eventually. Interestingly Netflix shares are now -30% below where they were trading at the start of 2020, when the pandemic had yet to have an impact.

Mello: It’s been 3 years since David last organised a live Mello Event. The tickets are now on sale for the extravaganza he has organised in Chiswick at the end of May. I’m sure it will be fun to meet other investors face to face. There’s also an online event this Monday (25th April) with Tandem, RBG, CentralNic and Belvoir which you can sign up for here.

This week I look at Cake Box (egg free cakes), Solid State (electronics for rugged environments) and Capital (mining services in Africa) trading updates.

Cake Box FY March 2022 Trading Update

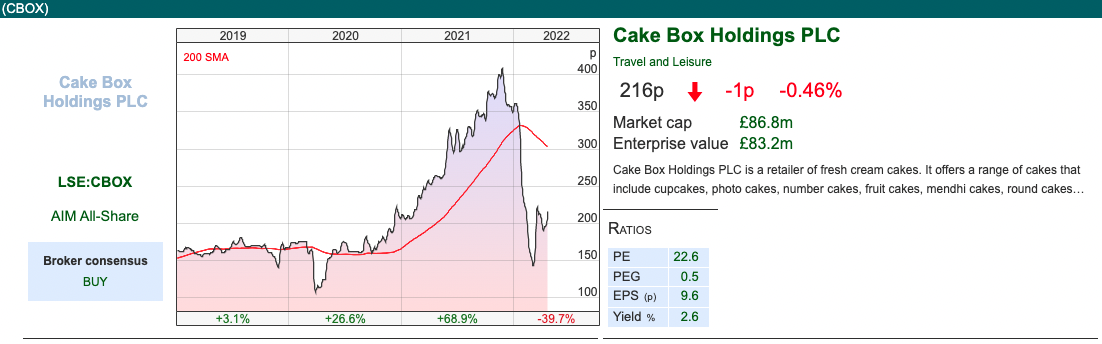

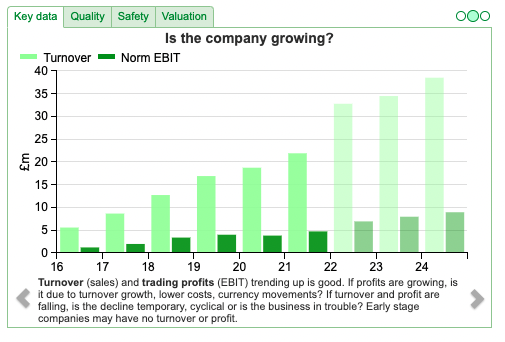

This egg free cake franchise business released a trading statement, with FY revenues growing +50% (lock downs in 2020 have helped the y-o-y comparison though) and adj PBT “in line” with market expectations – without saying what those expectations are. Shore Capital, their broker, are on £7m adj PBT FY Mar 2022F, which implies +49% growth v FY March 2021. Franchisees sales were up +12% on a like for like basis, which is a comparison which hasn’t been flattered by new store openings during the year. The year end cash position has increased from £3.6m Mar 2021 to £5.2m last month. This is not a Patisserie Valerie situation, we can be certain that the cash really is in the bank. A new trouble-shooter Finance Director has arrived and that would have been item one on his “to-do list” on the first day.

The shares were up +10% in response to the RNS, but at 216p are still well off their high of 420p achieved in November last year.

In January Maynard wrote up Cake Box here, which appears to have caused some kerfuffle. In March the company announced that Pardip Dass, co-founder and CFO, who qualified as an accountant while working for Starbucks would be stepping down. David Forth, who has a background as a trouble-shooter has been appointed Interim Chief Financial Officer in his place. CBOX have also announced Richard Zivkovic would be joining CBOX June 2022 as Chief Operating Officer. BDO has been appointed as internal auditor in August 2021 to assist in strengthening Cake Box’s Internal Control framework.

Following the resignation of RSM UK Audit LLP last September, they now have MacIntyre Hudson as their external auditor. That’s not a name I’ve come across before, but I note this FT report that says the auditor is part of Baker Tilly (the law firm) and is the 11th largest auditor of London-listed companies by market value. The FT article says that the FCA is investigating audits performed by MacIntyre Hudson in 2018-19 on a commodities company.

There’s an interview here with Paul Hill of Vox Markets, where Sukh Chamdal CEO/co-founder and the interim FD talk through the investment case. They say the growth in like for like +12% is mainly driven by volume, rather than raising prices to consumers. In the past they’ve absorbed input price increases by negotiating discounts from suppliers because they buy in bulk. The Chief Exec says that he doesn’t like putting prices up for customers. No doubt that’s true, but it’s hard to see how management can fail to pass on some costs if inflation is currently at +7% and they do say we’re in “uncharted waters” when it comes to consumer behaviour, when it comes to what people choose to spend their disposable income on.

Valuation: CBOX is trading on 13x Mar 2023F. That looks very good value if the growth and historic Returns on Capital can be sustained.

Risks: A risk that is specific to franchise business is “franchisee churn”. In their Admission Document list of risk factors they say “actual failings by franchisees is capable of causing damage to the Group’s brand, thereby potentially reducing the ability to sustain and/or grow revenues and which may have a detrimental effect upon the Group’s future trading performance and financial condition.” To be clear, I haven’t heard of any problems with churn at Cake Box. Rather than just focusing on the impressive revenue growth, it’s worth asking how that revenue growth has been achieved though.

Opinion: These results are encouraging. However, as they come from a Trading Statement, they lack the detail to put to rest Maynard’s concerns. My view is that the publicly disclosed inconsistencies that Maynard highlighted come from growing too fast, aside from that there’s nothing fundamentally wrong with CBOX. Once the new FD puts in place controls and reporting systems then there’s no reason why the business can’t flourish. The risk is that the transition might involve restating historic results, or reigning in some of the growth.

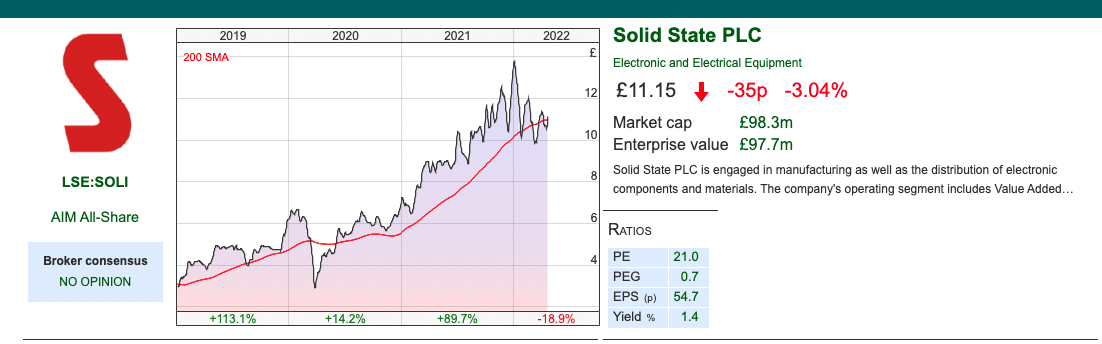

Solid State FY March 2022 Trading Update

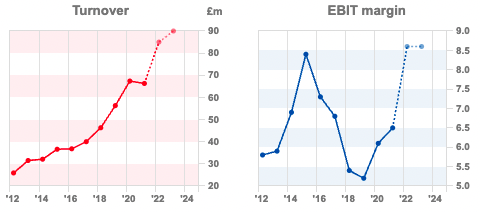

This specialist in “rugged” computer, battery and communications electronics put out a positive trading statement for FY March 2022. The RNS said they had a particularly strong Q4, so revenues should be +28% to £85m, and adj PBT +33% to £7.2m. SOLI made a couple of acquisitions in March 2021, Willow Technologies and Active Silicon – and both of these have performed better than management’s original assumptions. Excluding the acquisitions organic revenue growth was +8%. The figures in the RNS are +6% higher than consensus on the revenue line and +11% on the adj PBT line. Well done for the company for including the consensus figures in their RNS – it makes everyone’s life so much easier.

Order book: Encouragingly for the outlook the order book has doubled to £85.5m. Most of the time the trend in the order book is a useful indicator, the exception being when the outlook changes very rapidly and orders are cancelled at short notice. It sounds like the company is benefitting from both a higher oil price and increased aerospace & defence spending. That makes sense given that those sectors would be users of electronics in hostile environments. They say that defence is now 15% of group revenue.

Broker forecasts: FinnCap, their broker, have upgraded FY March 2022F accordingly. For FY Mar 2023F they have raised EPS by 11% to 72.5p. That puts the shares on 15x next year’s earnings.

Opinion: Looks good with the shares up +13% in response. This is one that I’ve owned for a while – hoping that it might turn its niche into a SDI/Judges style roll-up type story. That hasn’t happened, but SharePad’s quality metrics are positive – with the exception of EBIT margin. Management nod to this, suggesting that the top line growth should help the group to “win previously inaccessible high value contracts as customers engage across a broader product and service offering.” So we could see margins improve as the business grows.

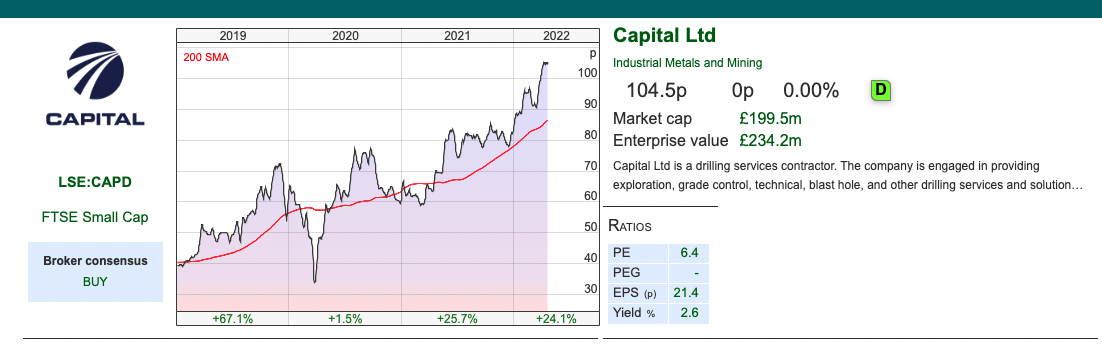

Capital Q1 2022 Trading Update

This African mining services company has released a strong Q1 update. I was intrigued by the company’s business development strategy of taking equity stakes in mining customers. Of course, this can go wrong if the stakes turn out to be worthless, but it strikes me that their “drill for equity” agreements are an interesting way of creating upside for shareholders to rising precious metals prices.

Q1 (Jan-March) revenue was +52% to $67m and flat on Q4 last year. Their fleet utilisation rate (ie how many of Capital’s drilling rigs are actually being used) is 82%, up from 67% in Q1 last year. They have reported contract wins in Guinea and Ivory Coast (both West Africa). 87% of group revenue comes from renting out services and equipment (drilling rigs) at mining sites.

They say that 28% of revenue comes from non drilling services, which is mainly an assay unit MSALABS, an environmentally friendly way of analysing gold samples to high precision. They’ve been “provisionally awarded” a 5 year deal with Barrick Gold (at $42bn market cap, one of the largest gold miners in the world) for Barrick’s Kibali gold mine in Congo. I note that 28% and 87% add up to more than 100% though.

Outlook: Revenue guidance for FY 2022F remains unchanged, with $270-280m (v $227m FY Dec 2021). The company is mainly exposed to gold mining, however they have recently announced some contract wins for mining battery materials (for instance Goulamina Lithium Mine in Mali).

Equity Holdings: At the end of December, the company held $52m of equity (fair value – mark to market) in listed gold mining companies, and $8.2m in unlisted companies. Contracts from investee companies represented $41m or 18% of FY Dec revenue.

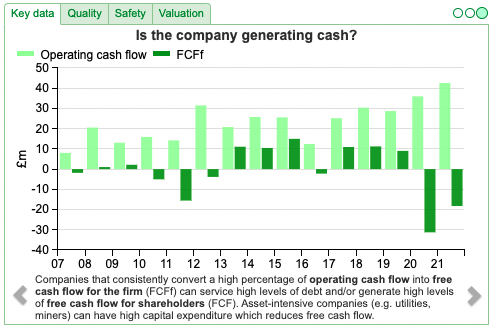

Cashflow: One SharePad feature that I find particularly useful is that in the summary tab, “Quality” measures like RoCE is right next to CashROCI. Most of the time the figures are similar, but occasionally, as is the case for Capital there’s quite a big difference (RoCE 22% v CRoCI -8%). Post tax reported profits were $70m, compared to $30m cash from operations. There’s a $33m fair value gain on their equity stakes, which doesn’t count towards cashflow. That gain is clearly labelled in the p&l, but I think investors would probably look through it an consider it a “one-off” rather than an indication of underlying performance (hence RoCE is overstated).

In the cashflow statement there’s a further $34m negative from working capital movements, mainly a $27m increase in receivables. Cash from investing activities was an outflow of $50m in 2021, as the company purchased $46m of property, plant and equipment. Hence the year end cash figure fell by $5m to $31m. I wouldn’t expect the large cash outflow buying equipment to be repeated each year – but I think it’s good to understand the different between the $82m reported PBT FY 2021 and the cash figure going backwards last year.

Valuation: Although the share price has been very strong, +51% in the last year CAPD are still only trading on 7x 2022F and 2023F P/E. That seems very good value to me, particularly given the equity stakes (23% of the market cap) and cash (12% of the market cap). Gold is still below $2,000 an ounce (ie the same level as 10 years ago), so although the environment is more helpful than 5 years ago, we are still not in boom times.

Opinion: The long term track record of some industrial equipment hire businesses (Andrews Sykes, for example) shows that this can be a model that rewards investors. I’m not sure how much upside there is from the lithium and battery materials mining side, but feel like after a difficult few years Capital should now be in a more helpful part of the commodity cycle. I bought the shares a couple of weeks ago.

Bruce Packard

Notes

The author owns shares in Capital Ltd and Solid State

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Thank you very much for sharing such a useful article. Will definitely saved and revisit your site

okbet casino philippines