Bruce looks at the history of Brompton’s growth, and the trade-offs required to fund expansion. Plus a look at UK banks margin trends and James Cropper CRPR profit warning.

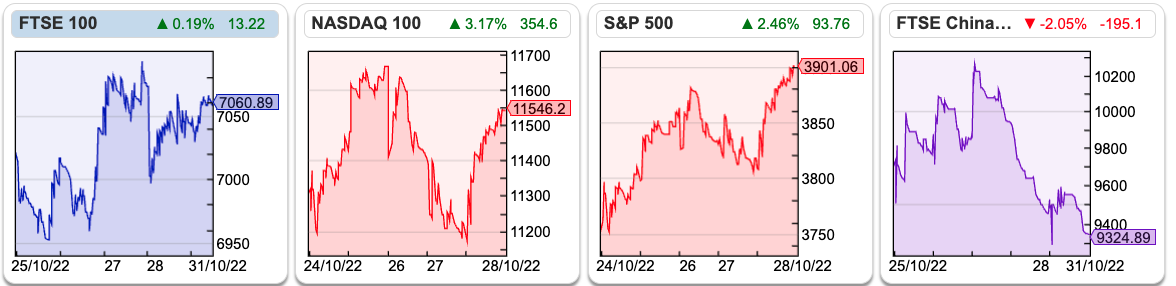

The FTSE 100 rose +0.65% in the last 5 days and managed to consolidate above 7,000. Despite US tech stocks reporting a difficult quarter last week, the S&P500 was up +2.7% and Nasdaq100 was up +1% over the last 5 days. Natural Gas (NG-MT) is down -37% versus its peak in August, as northern Europe has enjoyed a mild autumn. The UK 10y gilt is now yielding 3.5%, down 1% versus a peak of 4.5% in the middle of October. That all looks very reassuring.

I am currently reading The Brompton: Engineering for Change by Will Butler-Adams. I came across the book because it has been edited by Dan Davies, who also used to be a UK banks equity research analyst. Dan wrote a book on fraud which is well worth checking out, but I think this latest book is even more insightful for investing. In case you don’t know, Bromptons are the funny-looking foldable bicycles that you see people riding and carrying on public transport. The company was formed in the mid-1970s and didn’t make a profit until the early 1990s. The early days were clearly tough, Andrew Ritchie, the bike’s original inventor tried to sell the plans to Raleigh bikes, who turned him down saying they didn’t think there was a large enough market (between March 2010 and March 2020 Brompton sold 450,000 bikes) and the founder was turned down by every single bank he approached.

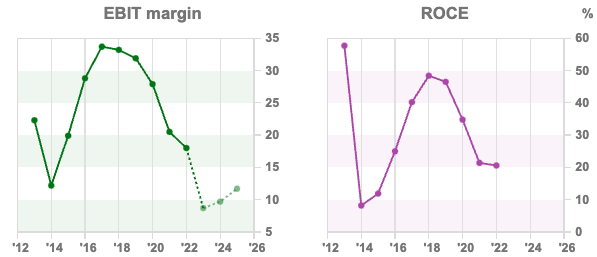

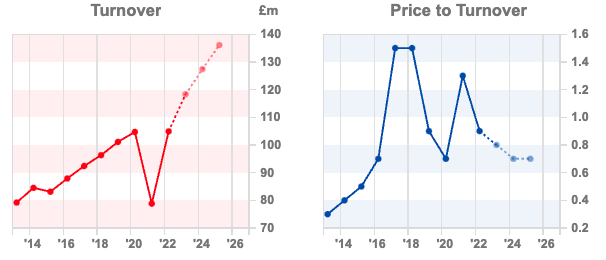

The book is full of penetrating thoughts about growing a business, the challenges and opportunity of scale. One of Sharepad’s most (if not the most) important ratios is the Return on Capital Employed, combined with the ability to quickly go back and see a company’s historic growth. I’ve always thought that RoCE can be misleading though because growth doesn’t come in steady increments. A good example is that Brompton moved from their Brentford factory in West London to a premise twice the size in Greenford – the move caused some disruption, followed by higher costs, margins falling and diminishing RoCE. Investors from the outside would have questioned whether there really were economies of scale, as it took time to increase production and show the value of the move to a bigger site. I think that you could make the case that Fevertree has experienced a similar stubble, opening local production facilities on the East coast of the USA, which has played a part in reducing EBIT margins and RoCE (see graphs below).

For Brompton, the short-term hit to numbers eventually turned to a long-term benefit. Some software companies can grow revenue with minimal investment, but most businesses need investment (ie higher costs) to fund growth. That’s just one example, I highly recommend the book because it gives an insiders’ view on many issues we only see from the outside.

Below I look and trends in UK banks net interest margins and also James Cropper’s profit warning.

Banks Net Interest Margin and adjustments

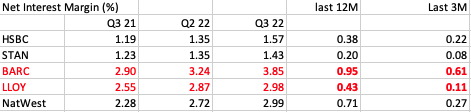

We’ve now come to the end of the UK banks reporting season. As the economy has deteriorated, the banks now expect bad debts to rise, which shouldn’t come as a surprise to anyone. More interesting for me was the trend in Net Interest Margin (the difference between what banks pay on customer deposits and what they earn lending out their customers’ money).

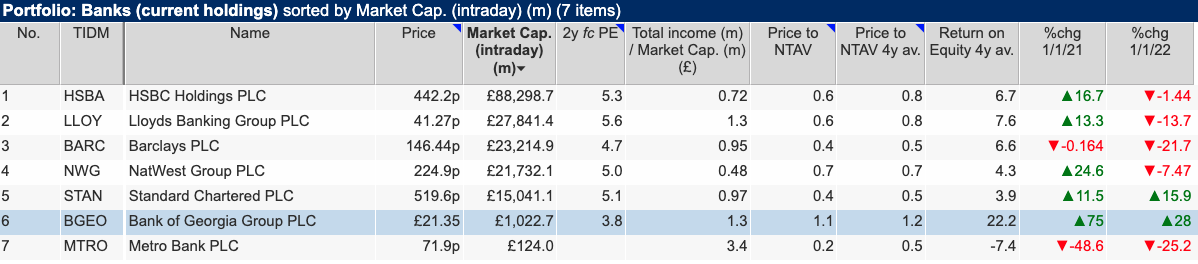

The table shows Q3 NIM last year, versus the previous and most recent quarter this year. The numbers aren’t directly comparable between banks as there are many moving parts (loans/deposit ratio, mix of corporate v retail lending etc). Barclays has the highest NIM because of its Barclaycard book, where net interest margin is higher, but where bad debts are also higher because the lending is unsecured. Mortgage lending, which is the majority of Lloyd’s book is lower margin, but have lower expected losses.

What is fascinating is that though Lloyds and Barclays have started in roughly the same place a year ago (BARC NIM 2.90%, LLOY 2.55%), Barclays has been able to expand margins much more aggressively by 95bp versus just 43bp at Lloyds. Lloyds has £310bn of mortgages, and they say in their presentation that margins on the new mortgages that were completed in Q3 were up 60bp (a figure in-line with Barclays). However, the majority of mortgages on Lloyd’s ‘back book’ have not yet been repriced.

That may just be a timing difference, with many UK mortgages on fixed rate deals meaning the re-pricing takes longer. However, it is worth considering the possibility that banks won’t be able to raise margins on mortgages, because UK wages are falling in real terms. Behaviour of customer deposits may also surprise.

Deposits:

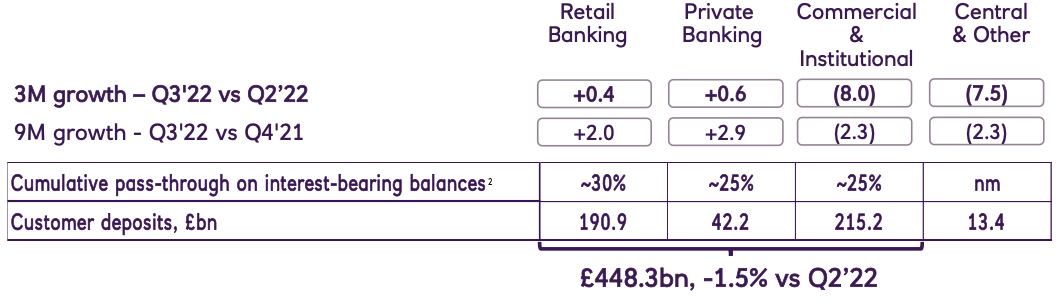

On the deposit side according to the NatWest slide deck, 40% of the bank’s £448bn of customer deposits don’t pay interest. The 60% (or £270bn) that do pay interest, the bank has passed on less than a third of the benefit to customers from the BoE raising rates from 10 basis points during the pandemic to the 2.25% current rate.

Savers are earning a negative yield of around 10% versus inflation, that’s clearly not sustainable. Lloyds saw a small outflow in retail savings accounts and NatWest saw customer deposits fall in Q3 at a group level.

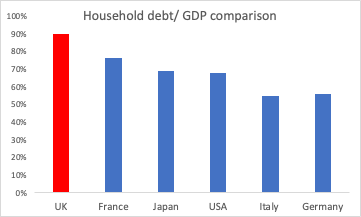

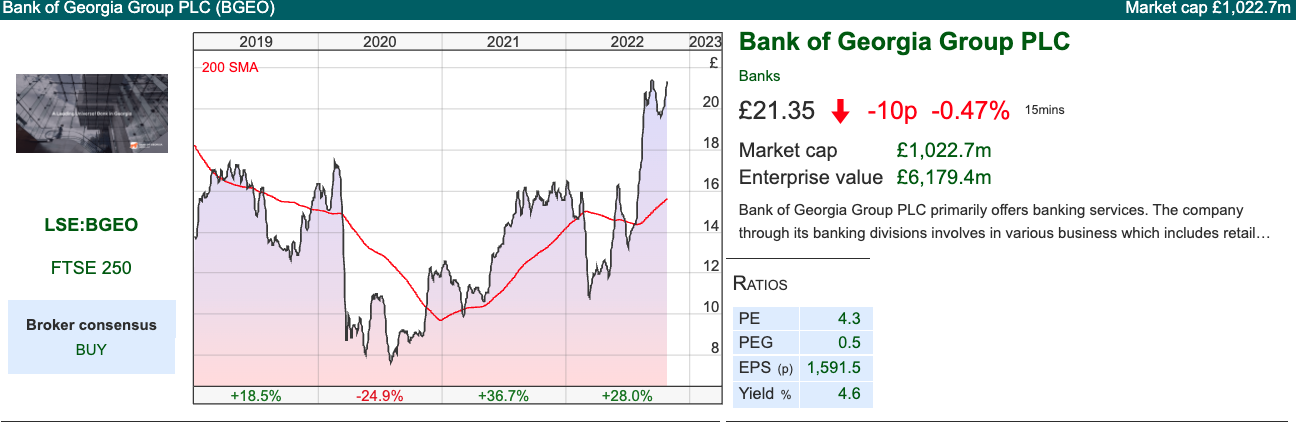

Opinion: We are beginning to see the benefits of rising interest rates for UK banks NIMs. However, with the exception of Bank of Georgia, which I own, the UK bank sector is trading on between 0.4 to 0.7x tangible book value. I suppose these banks could re-rate to 1.3x, maybe even 1.5x tangible book value, but it’s hard to believe that loan books or equity will grow faster than the UK economy. Household debt/GDP is higher in the UK than almost all developed economies, I’ve put the data from this website into chart form.

Alternatively, BGEO has a much better track record of growth, a 22% 4-year average RoE, and trades at just 1.1x book. Obviously, there’s some ‘Putin discount’ investing in Georgia, but for me, the bank makes sense as part of a diversified portfolio. BGEO shares are up +28% YTD and it is the best performing UK-listed bank, despite the Russia invasion of Ukraine, that suggests some investors at least are comfortable with the risks. BGEO Q3 results will be released on 11 Nov.

James Cropper profit warning

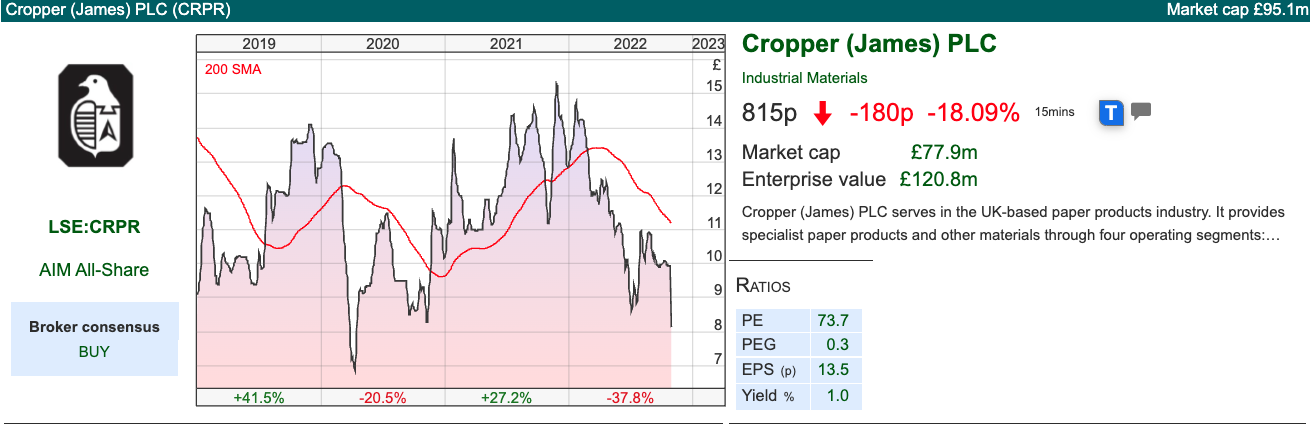

This family-owned paper firm with a March year-end put out a profit warning, caused by higher energy costs increasing +148% versus the prior year. Raw materials (which represent a larger proportion of overall costs) also rose +20%.

CRPR has reduced expectations by -63% for FY Mar 2023F to adjusted PBT of £2.0m against £5.4m previously. The skill with profit warnings is trying to identify if the causes are a one-off or a permanent deterioration. Cropper can point to some encouraging trends in H2:

“ …a recovery through aggressive pricing actions and surcharges, supported by the recently announced Government support on energy prices. Each division is projecting volume growth over the second half. Order books are full and the Company is focused on a range of enabling actions to build a solid foundation for continued future growth.”

The paper division is two-thirds of sales, which is low-volume, high-quality paper. Technical Fibre Products is 30% of sales and provides advanced materials for green and sustainable technology markets, including fuel cells. Loss-making Colourform (3% of sales) makes eco-friendly packaging designs which could also have a lot of potential.

Valuation: The shares are trading on almost 50x downgraded FY 2023F post-tax profit expectations. However, the price/sales ratio is below 1x, and if we assume that margins can recover that would imply c. 20x earnings. The fact that the shares have fallen -18% on the RNS, whereas PBT has been slashed by more than 60%, suggests that this looks like a temporary problem?

Opinion: I don’t like buying shares on the day of a profit warning. It could be that margins take longer to recover, which would result in further disappointment. However, this is a family owned business, that looks to me to be making good long-term decisions. It’s definitely on my watch list.

Notes

The author owns shares in Bank of Georgia

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary Part 1 | 1/11/22 |BGEO, CRPR| Costs for growth

Bruce looks at the history of Brompton’s growth, and the trade-offs required to fund expansion. Plus a look at UK banks margin trends and James Cropper CRPR profit warning.

The FTSE 100 rose +0.65% in the last 5 days and managed to consolidate above 7,000. Despite US tech stocks reporting a difficult quarter last week, the S&P500 was up +2.7% and Nasdaq100 was up +1% over the last 5 days. Natural Gas (NG-MT) is down -37% versus its peak in August, as northern Europe has enjoyed a mild autumn. The UK 10y gilt is now yielding 3.5%, down 1% versus a peak of 4.5% in the middle of October. That all looks very reassuring.

I am currently reading The Brompton: Engineering for Change by Will Butler-Adams. I came across the book because it has been edited by Dan Davies, who also used to be a UK banks equity research analyst. Dan wrote a book on fraud which is well worth checking out, but I think this latest book is even more insightful for investing. In case you don’t know, Bromptons are the funny-looking foldable bicycles that you see people riding and carrying on public transport. The company was formed in the mid-1970s and didn’t make a profit until the early 1990s. The early days were clearly tough, Andrew Ritchie, the bike’s original inventor tried to sell the plans to Raleigh bikes, who turned him down saying they didn’t think there was a large enough market (between March 2010 and March 2020 Brompton sold 450,000 bikes) and the founder was turned down by every single bank he approached.

The book is full of penetrating thoughts about growing a business, the challenges and opportunity of scale. One of Sharepad’s most (if not the most) important ratios is the Return on Capital Employed, combined with the ability to quickly go back and see a company’s historic growth. I’ve always thought that RoCE can be misleading though because growth doesn’t come in steady increments. A good example is that Brompton moved from their Brentford factory in West London to a premise twice the size in Greenford – the move caused some disruption, followed by higher costs, margins falling and diminishing RoCE. Investors from the outside would have questioned whether there really were economies of scale, as it took time to increase production and show the value of the move to a bigger site. I think that you could make the case that Fevertree has experienced a similar stubble, opening local production facilities on the East coast of the USA, which has played a part in reducing EBIT margins and RoCE (see graphs below).

For Brompton, the short-term hit to numbers eventually turned to a long-term benefit. Some software companies can grow revenue with minimal investment, but most businesses need investment (ie higher costs) to fund growth. That’s just one example, I highly recommend the book because it gives an insiders’ view on many issues we only see from the outside.

Below I look and trends in UK banks net interest margins and also James Cropper’s profit warning.

Banks Net Interest Margin and adjustments

We’ve now come to the end of the UK banks reporting season. As the economy has deteriorated, the banks now expect bad debts to rise, which shouldn’t come as a surprise to anyone. More interesting for me was the trend in Net Interest Margin (the difference between what banks pay on customer deposits and what they earn lending out their customers’ money).

The table shows Q3 NIM last year, versus the previous and most recent quarter this year. The numbers aren’t directly comparable between banks as there are many moving parts (loans/deposit ratio, mix of corporate v retail lending etc). Barclays has the highest NIM because of its Barclaycard book, where net interest margin is higher, but where bad debts are also higher because the lending is unsecured. Mortgage lending, which is the majority of Lloyd’s book is lower margin, but have lower expected losses.

What is fascinating is that though Lloyds and Barclays have started in roughly the same place a year ago (BARC NIM 2.90%, LLOY 2.55%), Barclays has been able to expand margins much more aggressively by 95bp versus just 43bp at Lloyds. Lloyds has £310bn of mortgages, and they say in their presentation that margins on the new mortgages that were completed in Q3 were up 60bp (a figure in-line with Barclays). However, the majority of mortgages on Lloyd’s ‘back book’ have not yet been repriced.

That may just be a timing difference, with many UK mortgages on fixed rate deals meaning the re-pricing takes longer. However, it is worth considering the possibility that banks won’t be able to raise margins on mortgages, because UK wages are falling in real terms. Behaviour of customer deposits may also surprise.

Deposits:

On the deposit side according to the NatWest slide deck, 40% of the bank’s £448bn of customer deposits don’t pay interest. The 60% (or £270bn) that do pay interest, the bank has passed on less than a third of the benefit to customers from the BoE raising rates from 10 basis points during the pandemic to the 2.25% current rate.

Savers are earning a negative yield of around 10% versus inflation, that’s clearly not sustainable. Lloyds saw a small outflow in retail savings accounts and NatWest saw customer deposits fall in Q3 at a group level.

Opinion: We are beginning to see the benefits of rising interest rates for UK banks NIMs. However, with the exception of Bank of Georgia, which I own, the UK bank sector is trading on between 0.4 to 0.7x tangible book value. I suppose these banks could re-rate to 1.3x, maybe even 1.5x tangible book value, but it’s hard to believe that loan books or equity will grow faster than the UK economy. Household debt/GDP is higher in the UK than almost all developed economies, I’ve put the data from this website into chart form.

Alternatively, BGEO has a much better track record of growth, a 22% 4-year average RoE, and trades at just 1.1x book. Obviously, there’s some ‘Putin discount’ investing in Georgia, but for me, the bank makes sense as part of a diversified portfolio. BGEO shares are up +28% YTD and it is the best performing UK-listed bank, despite the Russia invasion of Ukraine, that suggests some investors at least are comfortable with the risks. BGEO Q3 results will be released on 11 Nov.

James Cropper profit warning

This family-owned paper firm with a March year-end put out a profit warning, caused by higher energy costs increasing +148% versus the prior year. Raw materials (which represent a larger proportion of overall costs) also rose +20%.

CRPR has reduced expectations by -63% for FY Mar 2023F to adjusted PBT of £2.0m against £5.4m previously. The skill with profit warnings is trying to identify if the causes are a one-off or a permanent deterioration. Cropper can point to some encouraging trends in H2:

“ …a recovery through aggressive pricing actions and surcharges, supported by the recently announced Government support on energy prices. Each division is projecting volume growth over the second half. Order books are full and the Company is focused on a range of enabling actions to build a solid foundation for continued future growth.”

The paper division is two-thirds of sales, which is low-volume, high-quality paper. Technical Fibre Products is 30% of sales and provides advanced materials for green and sustainable technology markets, including fuel cells. Loss-making Colourform (3% of sales) makes eco-friendly packaging designs which could also have a lot of potential.

Valuation: The shares are trading on almost 50x downgraded FY 2023F post-tax profit expectations. However, the price/sales ratio is below 1x, and if we assume that margins can recover that would imply c. 20x earnings. The fact that the shares have fallen -18% on the RNS, whereas PBT has been slashed by more than 60%, suggests that this looks like a temporary problem?

Opinion: I don’t like buying shares on the day of a profit warning. It could be that margins take longer to recover, which would result in further disappointment. However, this is a family owned business, that looks to me to be making good long-term decisions. It’s definitely on my watch list.

Notes

The author owns shares in Bank of Georgia

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.