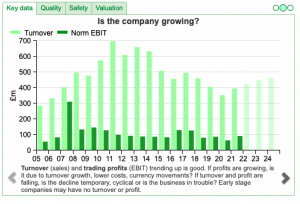

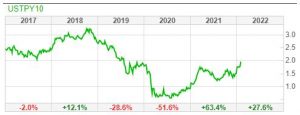

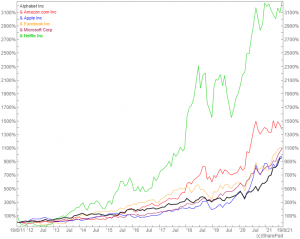

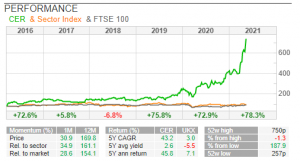

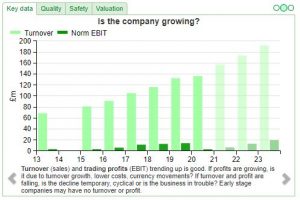

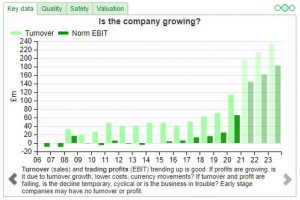

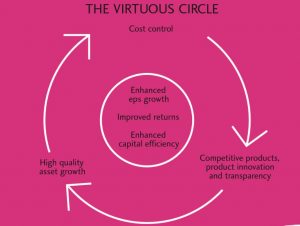

Bruce looks at the history of Brompton’s growth, and the trade-offs required to fund expansion. Plus a look at UK banks margin trends and James Cropper CRPR profit warning. The FTSE 100 rose +0.65% in the last 5 days and managed to consolidate above 7,000. Despite US tech stocks reporting a difficult quarter last week, […]