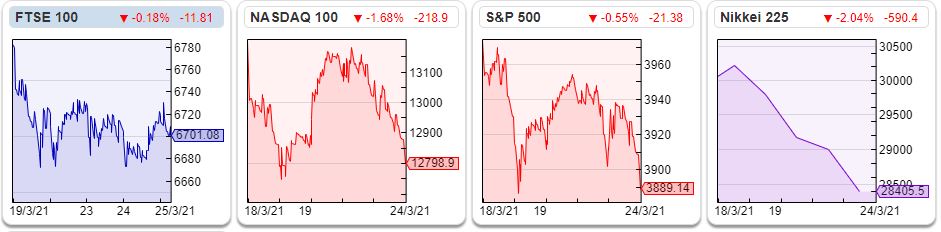

The FTSE at 6700 +4% from the start of the year seems to be holding up better than the likes of Nasdaq 12,800 and S&P500 3890, perhaps due to the amount of resource stocks in the index. The price of oil was $63 per barrel for Brent, up +60% since the first week of November when the vaccine was announced. Copper on the other hand is trading at $407 up +33% over the same time period. I’m surprised at this divergence of oil vs an industrial metal like copper, because the global economy seems to be recovering, but global travel is likely to lag some way behind. EasyJet and Ryanair both fell c. -10% this week as the UK government advised people not to book flights for their summer holidays, as case numbers on the continent remain high. The UK economy would also benefit from domestic consumer spending in bars and restaurants, as opposed to us spending our money overseas.

Bounce

SharePad user Joe has pointed out that since the March low last year, there have been at least 15 ten baggers in the UK.

I was surprised that Novacyt wasn’t on the list, but it’s “only” up +348% since the last week in March 2020, which is because between January and March last year the shares had already ten bagged. The clinical diagnostics company put out an announcement last week saying that they will release a new PCR test to detect the four Covid-19 variants of concern and two most significant mutations in a single kit. The shares are down -29% since the start of the year, and didn’t react to the announcement, but my feeling is that testing will probably go on longer that many assume, so there may still be hope for those like me who missed the opportunity last year.

Well done to anyone who has one (or more than one) of these 10 baggers. It does show the substantial gains available to those who can keep their head when the markets are falling through the floor. I didn’t trade at all in the first half of the year, in part because I own a craft beer bar and that was taking all my time and attention.

One stock not on the list, because it’s a US company, is Game Stop +1880% since the start of the year, but down -33% to $120 following their Q4 results last week. The Reddit favourite announced Q4 sales $2.12bn v $2.2bn Q4 2019. Online sales increased +175% and represented 34% of sales in Q4 2020 versus 12% in the same quarter the previous year. I think that it would be rather fun if the Reddit crowd who have piled into the stock now start buying computer games through the company, and help generate an operational turnaround. Or management use their high share price to raise more money, which means that the company can go on to transform into a successful online retailer. I know that this is a bit of a fairy tale, but the world needs fun stories at the moment.

This week I look at Tremor, Accesso, Cenkos and Burford; the first three now seem to have a fair wind behind them, and the charts look attractive. Cenkos has around 78% of its market cap in cash, which should mean that the shares are more defensive if the outlook darkens.

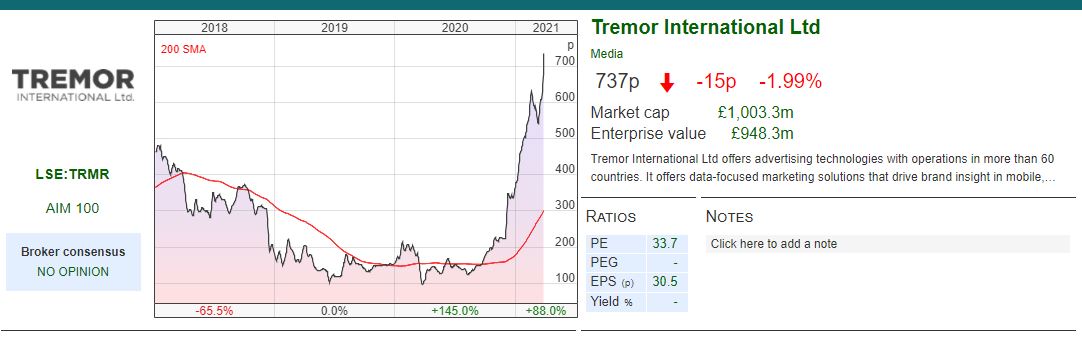

Tremor FY Dec 2020

Tremor released a Q1 trading update saying revenue in Q1 is “significantly ahead” and that trading for FY 2021 should also be “significantly ahead”. Oddly this comes less than 2 weeks after they’d released their FY results. It’s genuinely difficult for any management team to give guidance at the moment, and understandable that they want to err on the side of caution. Still, less than 2 weeks since the outlook statement in their FY results, it’s hard to believe anything has significantly changed in such a short space of time.

US competitor The Trade Desk Q4 v Q4 2019 revenue was up +48%, and FY 2020 v FY 2019 was up +26%. Magnite revenue was up +69% Q4 on Q4 or +20% on a pro-forma basis (ie excluding Telaria which they acquired on 1st April 2020), suggesting that the whole market is growing strongly, though I’m not sure whose lunch these Adtech businesses are eating.

Broker Forecasts FinnCap, their broker, didn’t raise forecasts following the FY results, but have now put out a note, raising FY EBITDA by +21% and +23% this year and next. They are now forecasting revenue growth of +18% to $251m in 2021F and +11% to $279m 2022F. This gives adjusted EPS of 30.5p this year and 40.4p in 2022F, which gives a PER of 24x this year and 18x 2022F.

The broker notes that if the momentum in Q1 continues then we could see substantial upside to these numbers and point to the proposed US listing in Q2 as a catalyst, as US listed businesses like TTD and Magnite are trading on much higher valuation multiples.

Opinion The shares were up +13% on the announcement and are up +75% since the start of the year, so well done to holders. This is an industry where things can change very quickly: for instance, Google has said that it will phase out “third party cookies” on its Chrome browser in 2022, The Trade Desk has developed a different identity system which it has persuaded publishers to sign up to. However, 15 States in the US claim that Google disabling third party cookies is anticompetitive, because it raises barriers to entry and cements Google’s position. Apple iOS 14 will also make it harder for cookies to track users. Having done lots of work for Fyber, a loss-making Berlin based Adtech firm 5 years ago, this is a sector that I’m very wary of, though I see that even perennially loss-making Fyber is now up +175% since the start of the year.

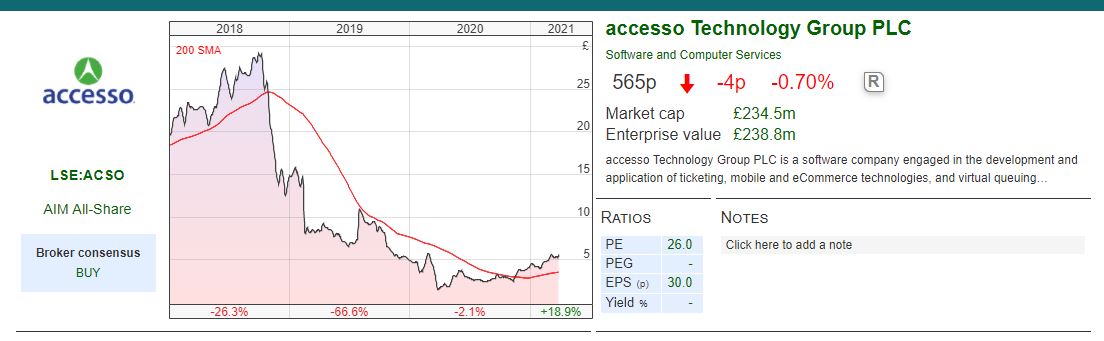

Accesso FY Dec 2020

This company has a ‘virtual queuing’ system for theme parks, announced FY Dec 2020 results, and were up +8% on the morning of the announcement. They’ve obviously been badly hit by the pandemic; Group revenue was down 52% to $56.1m, which shows more resilience than I would have expected. For instance, in April last year revenue was down 80% versus the same month in 2019.

FY statutory loss was $32.9m (which is an improvement on the $57.6m loss in FY 2019). Cashflow from operations was negative $14.5m, not helped by a $14m decrease in trade payables.

The company did a placing in June 2020 at 290p per share, raising $39.5m, at the time representing 41% of the company’s share capital. As an aside, rather oddly the figure given in the June placing announcement RNS is $39.5m net of costs, but in last week’s press release they say $46.1m was raised. I think what has happened is that they raised £32m, and that the dollar has weakened so that at the year-end exchange rate they have raised more dollars, which is the company’s reporting currency. But I thought I’d flag the disconnect. In any case, they now say that due to the placing they finished the year with $29.7m of net cash at 31 Dec 2020. They also have an unutilised credit facility with Investec, including a Government sponsored CLBILS loan at 3.5% margin (presumably it is a Libor plus loan) which in the outlook statement they say that they don’t anticipate on using in 2021.

Maynard wrote the company up a couple of years ago, having risen from 3p per share to £30 (a hundred bagger!) Maynard raised some concerns about the accounting, for instance treating a deferred acquisition cost as an interest expense, capitalising software development costs on to the balance sheet accompanied by low amortisation charges. He was right to be sceptical; the shares fell all the way back to 141p in March last year, partly due to the pandemic but also before that the company had taken large goodwill writedowns and put itself up for sale and failed to find a buyer. The shares have quadrupled since their March 2020 low and are now at 565p.

The company has $129m of intangible assets (down from $142m 2019 and a peak of $198m in 2017) which is 82% of shareholders equity. It’s worth noting that in 2019 they wrote down $54m of goodwill from a couple of acquisitions (TE2 and Ingresso). Then in 2020 when the pandemic struck, revenue fell -52%.

For investors in companies like Kape and Tremor I think this company is an interesting case study on how acquisition led growth, and balance sheets full of intangibles, can unwind very quickly. To be clear, it can work, but if it goes wrong, it tends to go badly wrong. The shares seem to be recovering well though, in expectation of a better summer season and an eventual end to lockdowns.

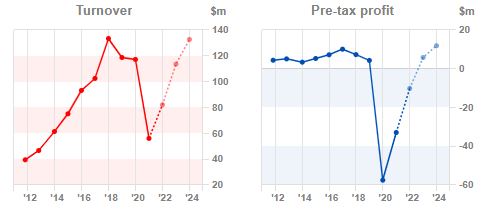

Outlook Disney has re-opened theme parks in Florida, but attractions in Europe and California have been closed for the first two months of the year. Despite this, Accesso revenue in the first 2 months of the year was only down 19% vs Jan and Feb last year. Accesso says that their largest customers are planning to open their theme parks ahead of the summer, assuming Government approval. They believe they will breakeven in 2021, based on revenue of $83m.

Wider opportunity Management speak candidly about different recovery speeds, with regional and local attractions likely to do better than ones that rely on international travel. Accesso says that 60% of business should recover quickly. There is also an opportunity of winning new customers, for instance ski resorts in North America. I also wonder if they could expand further, such as to theatres, cinemas, museums, festivals and even restaurants who could start using their system? Management have seen take-up by restaurants in ski resorts (Alterra Mountain Company) and are now looking at the broader opportunity.

Management Steve Brown, Chief Exec, stepped down in 2018 to be replaced by Paul Nolan. However, he returned to run the company in January 2020, perhaps persuaded by a LTIP of 9x salary of $400k per year. The company has also appointed a new CFO, Fern MacDonald.

Institutions Liontrust own 9.9%, BlackRock 8.1%, Amati 5.4%, M&G 4.3%. Amati and Liontrust particularly tend to focus on quality.

Valuation According to Sharepad revenue is forecast to rebound strongly to $114m next year (up +37% from managements guidance of $83m 2021F). This puts the business on 2.8x 2022F revenues. EBITDA is forecast to be $20.7m in 2022F. EPS is forecast to be 11c in 2022F but doubling to 22c in 2023F which puts the business on 70x 2022F but 35x 2023F.

Opinion This stock was mentioned at Mello a few weeks ago. I can see the potential here, especially if management refrain from making acquisitions and instead focus on the turnaround. The stock has already quadrupled, and is not “bargain” price but could enjoy decent momentum over the next 18 months.

Cenkos FY Dec 2020

Cenkos rose +10% on the day of their FY results with revenue +23% to £31.9m. PBT was £2.3m v £0.1m the previous year. Basic EPS was 3.7p, and management paid out almost all of those earnings with a 3.5p dividend (v 3.0p in FY 2019). At 31 Dec they had £33m of cash on their balance sheet, a £14.5m surplus cash relative to capital requirements. Book value was £25.6m, and there are 56.7m shares outstanding, so cash per share is 58p, and NAV per share is 45p.

Last year the broker raised £900m with 29 transactions, including 4 IPOs (FRP, Calnex, Round Hil and HeiQ).

Outlook Aside from saying that the pipeline is healthy and that they have almost 100 corporate clients, the outlook statement is rather light on detail. Corporate finance pipelines are notoriously fickle, deals can dry up without warning, so I wouldn’t see that as a particularly strong indicator of future performance. Given we’re at the end of March and markets have been strong, the lack of guidance is perhaps a little disappointing. FinnCap, which has a March year end, has already put out an RNS at the beginning of March saying that they expected their current year (ie 12 months to March 2021) revenue to be up +65%.

Opinion I think rather than large cap banks, miscellaneous financials like Cenkos, Equals, Duke Royalty, FinnCap, perhaps even K3 and RBG Holdings are a good way to play the recovery. These stocks are cyclical, benefitting from pent-up demand from last year and perhaps before that Brexit uncertainty. How long this lasts is anyone’s guess; the bear case is that we see a strong H1, but then disappointment later in the year.

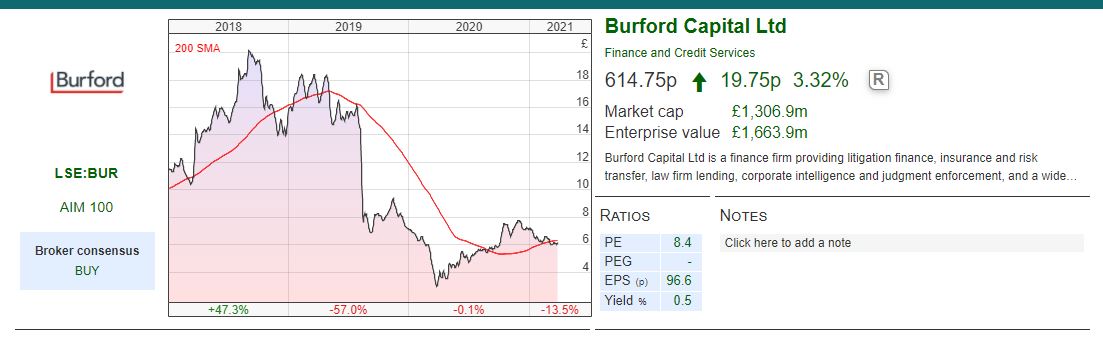

Burford FY Dec 2020

Burford released FY results, though they had already put out a very detailed trading statement on 17th February. Last week’s numbers came in slightly ahead, for instance total income: $357m on a consolidated basis (2019: $366m) was slightly above the range they put out in February, as was 353m Burford-only (2019: $357m) total income, which excludes the Third Party Assets (TPAs, funds that they co-invest in). Burford also gives a figure which excludes 2019’s fair value gain from their case against the Argentinian Govt for expropriating a publicly listed oil company (Petersen/YPF-related assets). Excluding the 2019 FV gain, Burford-only total income was up +110% and operating profit was up +226%.

Burford released FY results, though they had already put out a very detailed trading statement on 17th February. Last week’s numbers came in slightly ahead, for instance total income: $357m on a consolidated basis (2019: $366m) was slightly above the range they put out in February, as was 353m Burford-only (2019: $357m) total income, which excludes the Third Party Assets (TPAs, funds that they co-invest in). Burford also gives a figure which excludes 2019’s fair value gain from their case against the Argentinian Govt for expropriating a publicly listed oil company (Petersen/YPF-related assets). Excluding the 2019 FV gain, Burford-only total income was up +110% and operating profit was up +226%.

Tax charge There was a big jump in the tax charge, a 2.9x increase from $13m FY 2019 to $37m. Curiously the cash tax amount was much lower at $11m. Management say this was driven by higher realised gains in the US. There’s a long detailed discussion in their Annual Report around their tax charge that I won’t dissect, except to say that the worry is that if the tax man only thinks there’s $11m of tax to pay on $209m of accounting profits, this calls into question the quality of the accounting profits. I listened in to the conference call and one odd question was why the location of the audit partner who signed off their accounts had switched from Ernst & Young UK to Ernst & Young Guernsey. Management batted this question off easily, but again sometimes it’s the small doubts that stick in the mind.

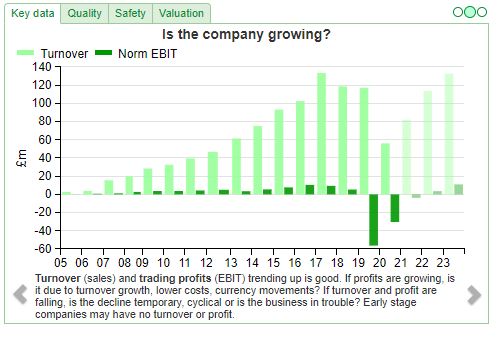

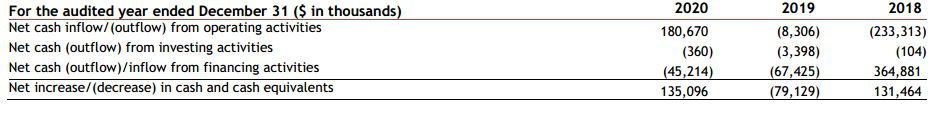

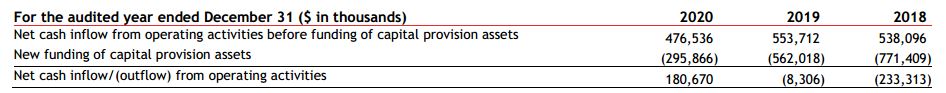

Cashflow The criticism of Burford specifically, and litigation finance companies generally, has been that they report eye-catching ROIC numbers, but have poor cashflow. This is a little unfair; in order to grow, the business has to fund more cases, and there is a time delay when they receive the cash back from settlements. In any case Burford have now put in a couple of tables which I think are new disclosure. They show cash from operating activities was $181m in 2020, reversing a -$8.3m negative in 2019 and a much larger –$233m in 2018. Burford finished Dec 2020 with $336m cash and cash equivalent assets, and an increase of $135m in the last 12 months (see bottom row of the table).

Burford raised $250m at 1850p in October 2018, which appears in the $364m in 2018 cash from financing activities. As a shareholder I’d much rather than management sell shares when the price is 1850p than face dilution when the shares fell below 300p in March last year. This $250m they raised in the market plus selling stakes in their Petersen case mean that new funding jumped in 2018 to $771m (see middle row in the table below). Assuming this $771m earns a return of 90% ROIC, in future years we should see a cumulative $1.5bn cash inflow at some point. The weighted average life of recoveries is 2.3 years, implying we should now begin to see significant cash coming in from the $771m deployed in 2018 and $562m deployed in 2019.

Management also announced that they intend to raise $350m of debt in the US capital markets. In part, this is to take advantage of very favourable market conditions at the moment (I commented a month ago that US high yield had had a record start to the year) and partly to take advantage of opportunities that are likely to result from Covid-19-related disputes.

Comparison with LIT Litigation Capital Management (LIT) released H1 results earlier in March (being an Australian company it has a June year end) showing the gross profit roughly halving to A$5.4m and a statutory loss before tax of A$ 1.4m (v A$6.8m H1 2019) due to delays in settlements from Covid-19. Importantly LIT does not use fair value adjustments to calculate their profits. Cash receipts from investments (eg resolutions, fees, reimbursements but before staff and third party costs) were up +15% to A$10.6m.

Cumulative ROIC for LIT over the last 9 1/2 years fell to 135% compared to Burford’s 92% in FY 2020 on concluded cases over a similar timeframe. LIT’s 135% ROIC figure has translated into a 11.9% Group RoCE in FY to June 2020 and 22% FY to June 2019. While those RoCE figures are still good, the gap does reveal that the 100% ROICs trumpeted by litigation financiers exclude Group operating costs. RoCE is much harder to calculate for Burford given their use of Fair Value accounting, though LIT’s figures imply Burford RoCE would be much lower. Burford’s “fair value” in 2020 RoE was 11% ($172m profit after tax divided by average net assets of $1.6bn). NB fair value accounting inflates both the numerator and denominator of the equation; if Burford reported using historic cost accounting profit would be smaller, but so too would be their net assets.

Shareholders Mithaq (the Saudi Arabian fund which also owns Manolete) own 10.5%, Conifer 6.4%, Invesco who were previously the largest shareholder owning 20% in March 2018 have now sold down their stake to 6.3%. Woodford’s stake has now been sold or at least is small enough not to be disclosable.

9% of the share capital is owned by employees. There’s an odd phrase that Rhomboid flagged on Twitter that staff are incentivised through LTIP awards and a “phantom carry”, which isn’t explained anywhere else in the Annual Report. Christopher Boggart and Jonathan Molot have invested $14m into Burford shares over the last two years, though I note that they both sold around 4.4m shares each at 1350p in March 2018. The company has a secondary listing on the New York Stock Exchange and believes approximately 42% of their shares are held by US residents, which could be an interesting metric for shareholders in 4D Pharma which listed on Nasdaq last week and Tremor who are now looking at a secondary listing in the US.

Valuation Burford’s reported net assets of $1.7bn versus a market cap of £1.4bn (1.1x book based on a forex rate = 1.37). On the asset side of the balance sheet the carrying value is $2,176m of which 35% is YPF / Petersen at a “mark to market basis” of $773m, 34% of the balance sheet ($740m) is held at fair value based on case milestones, and 31% ($670m) is held at historic cost.

Opinion It is hard to see Burford trading significantly above NAV until their huge Petersen case resolves one way or the other. Management said that the trial date is scheduled for January 2022, though it’s possible that there are further delays. If the case goes against them, I think management lose some credibility, and the shares will clearly sell off. But management have termed out their funding so I don’t think writing down that one large case to zero means the business experiences liquidity problems like banks did in 2008. If the Petersen case goes in their favour, there is likely still substantial upside to the carrying value on the balance sheet of $773m. This is a “wait and hope” stock for me, though I can see that it’s not for everyone.

Bruce Packard

Notes

The author owns shares in Burford

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

A very awesome blog post. We are really grateful for your blog post. You will find a lot of approaches after visiting your post.

okbet casino philippines