Bruce looks at how pound-cost-averaging can help when the investing environment is particularly uncertain or the relationship between asset classes breaks down. Companies covered BUR, TND and EQLS.

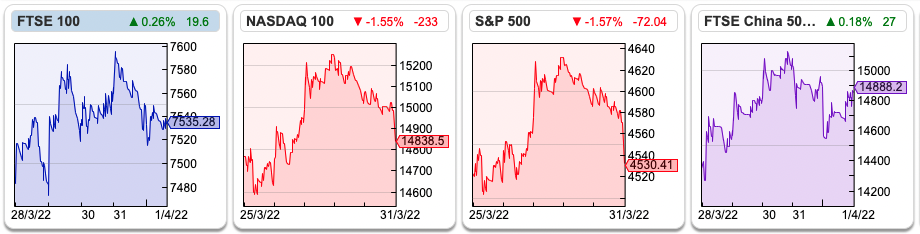

The FTSE 100 was up +0.8% last week to 7535. The Russian stock market was up +28%, after it re-opened following it being closed for a month, the Russian Rouble has also recovered. One dollar now buys 83 Roubles, versus 140 at the beginning of March and 75 at the beginning of the year. The US 10Y government bond yield was 2.32%, and has had its worst quarter in more than 40 years. The S&P500 is also down 5% since the start of the year.

So the historic relationship between Government bonds and equities (which normally move in opposite directions) has broken down. Diversification between asset classes doesn’t work as intended if assets become correlated (for instance the price of gold, which was supposed to be an uncorrelated hedge collapsed during the financial crisis.) One way to deal with this uncertainty is to use “pound cost averaging” – which is a form of diversification through time.

Michael Taylor’s technical analysis suggests AIM remains in a downtrend. I agree with his analysis, but it can make sense to invest into a falling market, if you feel confident that eventually the index (or share price) will recover. Buying doesn’t have to be a single decision, but instead imagine a stock that falls 10% a month for six months then recovers over the same time frame to the original value. Assuming that you invest the same amount each month, the volatility has allowed you to buy 28% more of the asset than you otherwise would have been able to. Assuming a 20% monthly fall (which would be a peak to trough decline of -67% in six months) and recovery allows you to buy 78% more. Some of my best investments have been companies which I bought in a long term downtrend (Sylvania Platinum and Wey Education, for example). I’ve just increased my position size in Argentex, the foreign exchange business despite being down -25% YTD and the chart looking dire. Time will tell.

You may well ask: “if you think an asset will fall in value, then recover, why not just buy at the lowest possible price?” It’s a good question, but similar to: “why not just concentrate your portfolio in shares that will be multi-baggers, and avoid buying the poor performers?” The answer is you don’t know beforehand, and pound cost averaging is a way of dealing with uncertainty. It’s unlikely any investor can identify the precise bottom, so we have to reconcile ourselves to either being too early (the value continues to fall) or too late (the value has already risen). Expected returns vary by time, as well as by asset.

I’m currently reading Gerd Gigarenzer’s new book. He used to head the Berlin Max Planck Institute, and I met him a few times – I used to play football with some of his cerebral younger colleagues, which always felt a bit like the German v Greek philosophers football match. Gerd’s one of the world’s most famous academic psychologists (people like Nassim Taleb, hedge fund billionaire David Harding and Mervyn King are all admirers of his work). In a world where algorithms and technology are given more and more weight, he’s been thinking about what human psychology is still good for:

“Complex algorithms work best in well-defined, stable situations where large amounts of data are available. Human intelligence has evolved to deal with uncertainty, independent of whether small or big data are available.”

The current investing environment feels like the latter! So I think spreading your buying decisions over time is a useful way of dealing with situations when the future doesn’t resemble the past. NB I suggest setting your intention beforehand, buying more simply because a share price has fallen is poor risk management, particularly if the investment case has deteriorated. I certainly would not average down with individual bank shares, or anything else that can fall to zero.

I enjoyed last Monday’s Mello, with a good mix of companies presenting, all with interesting stories. The BASH event at the end with a discussion between Kevin Taylor and Mark Simpson on Judges was also high quality. If you weren’t listening in, Kevin presented the buy case on Judges Scientific, while Mark took the case apart – pointing out that buying unlisted companies on 6x EV/EBITDA and using alchemy so that public markets then valued the same earnings stream on 24x EV/EBITDA was not sustainable. I could see both sides of the argument, the discussion outlined the issues and left investors to form their own view. David has organised a physical event in Chiswick (West London) with a funds and Investment Trusts day on the 24th May, then Wednesday and Thursday 25th-26th May a line up of companies and speakers. More details are on his website.

This week I look at bike retailer Tandem, who delivered strong results, but warned on the outlook. Plus Burford, the litigation financer and forex and payments Equals.

Tandem FY Dec 2021 Results

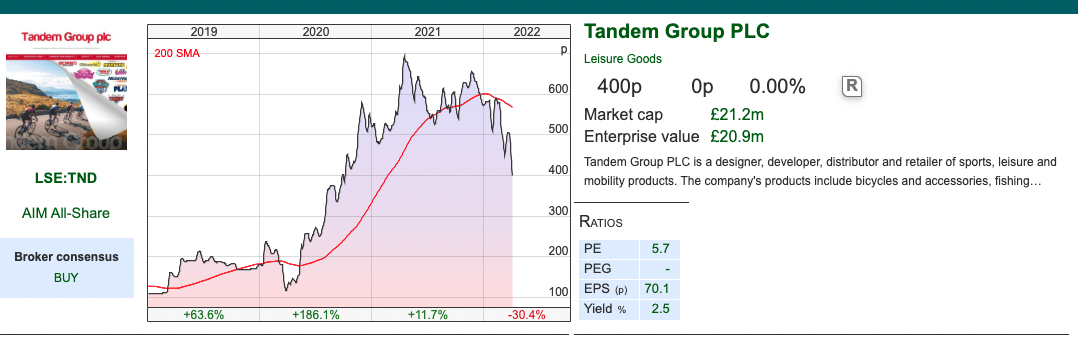

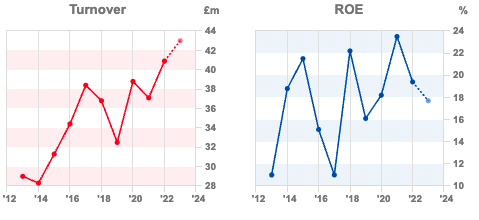

This bike and other leisure equipment company announced revenue +10% to £41m and statutory PBT +18% to £4.7m. Net cash was down to £2.3m (v £3.8m Dec 2020), following land purchases and construction. Bike sales actually fell -12% last year as stock availability was a problem – they outsource production to Asia are now sourcing from alternative factories, though don’t give more detail. That all sounds positive, but the share price fell -20% following the announcement, in reaction to the outlook statement, I think.

This bike and other leisure equipment company announced revenue +10% to £41m and statutory PBT +18% to £4.7m. Net cash was down to £2.3m (v £3.8m Dec 2020), following land purchases and construction. Bike sales actually fell -12% last year as stock availability was a problem – they outsource production to Asia are now sourcing from alternative factories, though don’t give more detail. That all sounds positive, but the share price fell -20% following the announcement, in reaction to the outlook statement, I think.

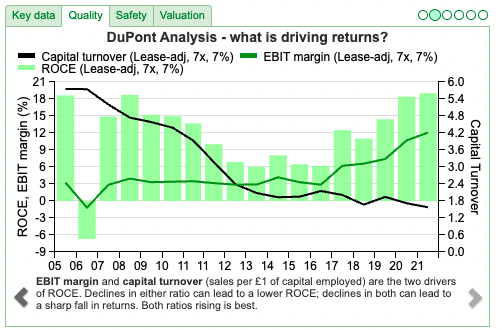

Outlook: They warn that this year has started more slowly than they would have liked, with revenue down -43% versus 2021. They do say though that last year was exceptional, and they are +7% of 2020 revenue. They also warn that many independent bike shops have surplus stock, so we’ve gone from a revenue decline due to lack of stock last year, to likely revenue decline from too much stock this year. Looking at SharePad’s DuPont analysis shows that although RoCE has been improving there’s a long term decline in capital turnover (that is, they are generating less revenue from their inventory, but able to increase margins to compensate).

Pension: There’s also a small pension deficit of £2.1m, which continues to be a drag on cash resources of the group. There’s an agreement with the pension trustees that if dividend payments exceed pension deficit contributions, then an additional contribution (£175K in 2021) is to be paid into the pension scheme.

The total contribution was £590K (or 13% of PBT) last year. The deficit actually shrank by half, due to bond yields rising through last year. I tend to avoid shares with large pension obligations, but this effect might be worth bearing in mind if you do own something like De La Rue, whose value could well be driven by the large pension liabilities. Tandem’s gross pension obligations are £12.2bn offset by £10.1bn of assets, of which a third are in corporate bonds. So the bond yield drives the value of the liabilities, but the fund assets are more diversified by asset class than just bonds (equities, real estate for instance).

Valuation: Cenkos published a note following the results, but the forecasts only go out to 2022F. The broker is forecasting a revenue decline of 7% and EPS decline by a third to 57p in 2022F. That leaves the shares are trading on 7x downgraded expectations, which is good value for a high teens RoCE busines… assuming that the brokers numbers are achievable. The outlook statement suggests that may not be the case though.

Opinion: I tend to wait following a profit warning and re-visit the investment case 3-6 months later. Nevertheless the results are worth paying attention to, as the trends in supply chain and pension scheme could have an interesting “read across” for other companies. Having worried about supply chain problems, companies seemed to have coped very well last year. I think we should be cautious about extrapolating that, because lockdowns in China and war in Ukraine imply things may get more difficult. Richard has just highlighted this risk with Luceco for example.

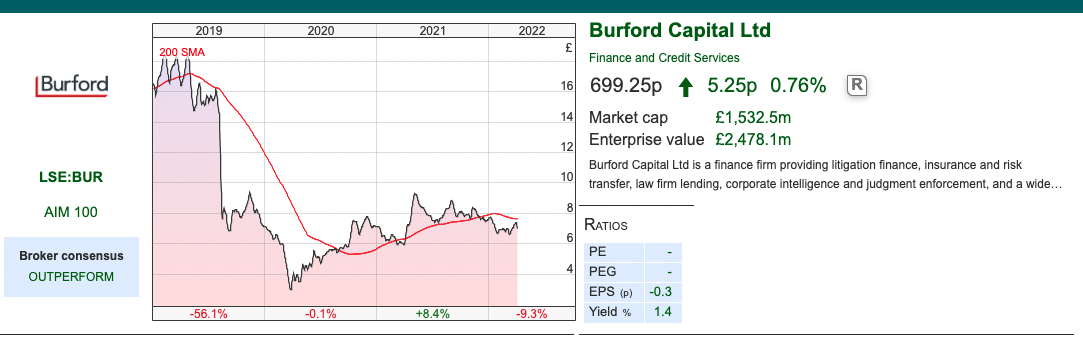

Burford FY Dec 2021 Results

Burford announced FY results, with Total Income down -62% to $133m and a loss before tax of $72m versus $165m PBT 2020. The consolidated accounts also include income from Third Party Assets (in total $2.8bn of Assets under Management that Burford co-invest in and earn a fee) which at the moment are not central to the investment case, in my view. For simplicity I will talk about the “Burford only” results that that company discloses. Cash was down -56% to $140m at the year end, if we add “marketable securities” in both year the decline is -6% to $315m, or 16% of the market cap of £1.5bn.

The Chairman’s first sentence in the Annual Report declares that this loss represents an “excellent 2021” for Burford. That may seem an odd assertion, but management explain that in 2021 they deployed $841m of cash in new legal assets but the year was quiet for realisations (that is, they haven’t lost many court cases, their legal assets are just taking longer to reach a conclusion due to the pandemic.) Realisations were down -29% to $128m, page 47 of the 20-F reveals that 80% of that 2021 figure was Tatiana Akhmedov’s divorce case without which realisations would have been just $26m.

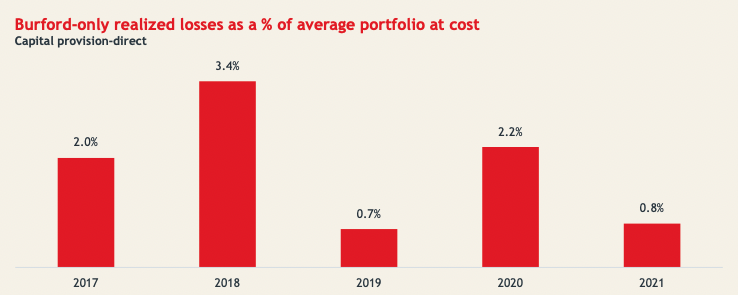

There was only $9m of realised losses in the year (0.8% of the portfolio at cost). That compares to $20m of realised losses in 2020 (2.2% of the portfolio at cost). For comparison HSBC took an $8.8bn charge on its trillion dollar loan book in 2020, which would also be c. 0.8%. The difference is that when HSBC do not suffer losses they only get paid back the full amount of their loan, whereas Burford expect to earn multiples on their portfolio of legal disputes.

One caveat is Muddy Waters, the infamous short seller, has suggested that Burford management delay recognising losses which then flatters the numbers management present to investors. It’s hard to tell from the outside whether or not this is going on. There are a few cases from 2010 and 2011 that have not yet concluded and still have a chance of going in their favour, according to Burford.

Outlook: The Petersen/YPF case which Burford has marked up to c. ¾ of a billion dollars has finished the discovery process and they expect summary judgement submissions by June, that is a possible judicial ruling without the case going to trial. If the judge decides that a trial is required, then it should begin 115 days following announcement of summary judgment decision.

Burford intend to switch to quarterly reporting, which is required by regulators but seems of limited benefit to shareholders as management emphasize that timing of realisations can’t be predicted one half to the next, so quarterly numbers will be even more volatile. They mention that Q1 in 2023 and subsequent years is likely to be loss making, as cases tend not to resolve early in the year.

Valuation: At the moment Burford earns just $26m from their $2.8bn of Third Party Assets, which is a modest amount considering how the funds complicate disclosure. If we value these at 4% of AUM in line with fund managers, that would suggest TPAs are worth $110m or 38p per share. However, at their investor event in November, Burford suggested the TPAs could generate $360m of performance fee income, which they’ve now updated to $400m in fee income (worth 140p per share).

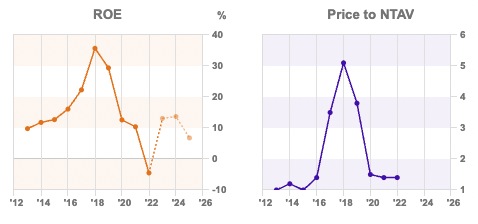

Burford’s book value was $1.55bn at Dec 2021 (£1.2bn or 560p per share) versus a market cap of £1.6bn, implying a price to book value of 1.3x. However that book value does include a mixture of historic cost and fair value accounting. They suggest that their portfolio ex YPF (the case against Argentina) could generate $3.8bn or c. 1340p per share – though they do also have c. $1bn of debt. The YPF case is on their balance sheet valued at ¾ of a billion dollars, but could return multiples of that amount. Hence it’s easy to see why the market has trouble valuing the company, with it having traded as high as 5x book value versus 1.3x currently.

For comparison, Blackstone, the “alternative asset manager” (mainly private equity and real estate) trades on 9.5x price to book in NYSE – they have $731 billion in total assets under management, including $528 billion in fee-earning AUM. Following the NY dual listing and switch to US GAAP, I imagine Chris Boggart the Chief Exec will be trying to convince US investors that Burford resembles Blackstone of 20-30 years ago and deserves a much higher p/book multiple.

Opinion: The obvious catalyst for a re-rating will be if Burford win their New York court case against Argentina in the next six months (and it is not settled in devalued Pesos without compensation for the time value of money.) YPF was expropriated in early 2012, since when the Peso has fallen by c. 95% against the dollar. As noted in the valuation section the case is valued at $777m on Burford’s balance sheet, though could be worth multiples of that if everything goes Burford’s way. I don’t think anyone can have a high conviction on that.

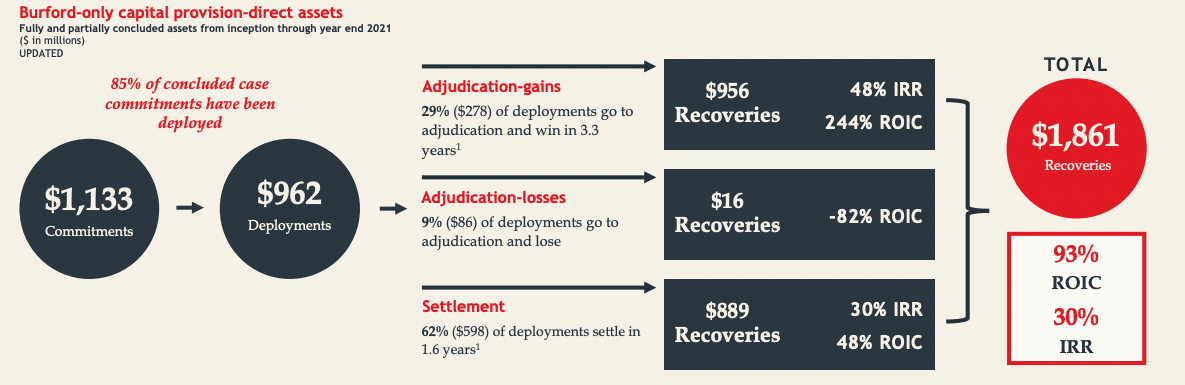

On a less binary level, Burford raised $250m of new equity in 2018 at 1850p per share, while loan capital increased by $408m in 2017-2018. That c. $600m was invested in legal disputes plus the capital that they generated internally, which should now be coming to fruition – so there are good reasons to believe the $3.8bn of realisations is possible. Hence cashflow should improve in 2022 and beyond. Burford says that historically they lose just 9% of their cases (adjudication losses in the graphic below). They win 29% of their cases in court (adjudication gains), but the majority of cases, 61%, are settled before going to court (settlement).

The uncorrelated nature of returns are an attraction for me. Legal disputes should be uncorrelated with other asset classes such as Government bonds or equities, which respond to economic cycles, oil price, supply chain disruption and the conflict in Ukraine. I continue to own the shares.

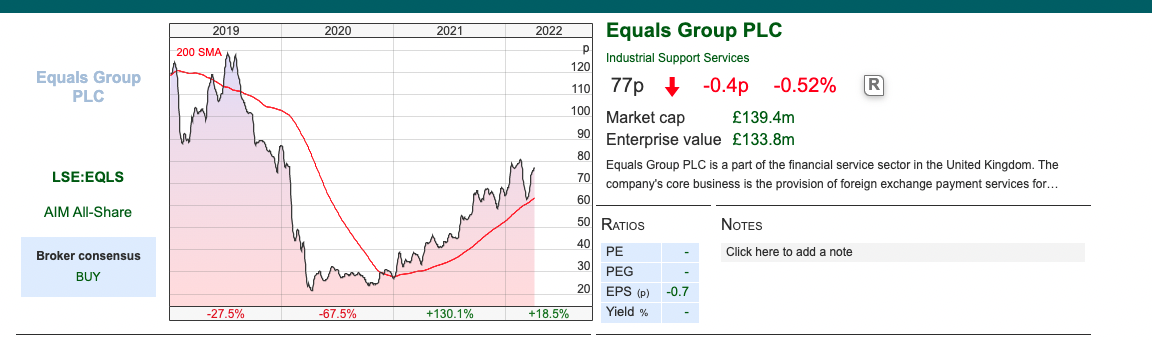

Equals FY Dec 2021 Results

This foreign exchange business reported revenue growth +52% to £44m but a statutory Loss Before Tax of £3.8m (versus a loss of £9m in 2020). The company has taken a £1.6m impairment charge against City Forex, which they bought in 2018 and amortised a further £5.8m of goodwill and similar intangible assets in 2021. Without these non cash items, PBT would have been £4.3m. Cash increased by £3.1m to £13.1m or 7.3p per share. The gross profit margin is an attractive 55%.

I do not that they receive £1.4 of R&D tax credits from HMRC. They may make future R&D claims, but they are unlikely to receive cash from the Government (ie they’ll need to report profits to benefit as a reduction in tax charge as a subsidy). The Group already has £17.2m of tax losses available, which is 12% of the market cap.

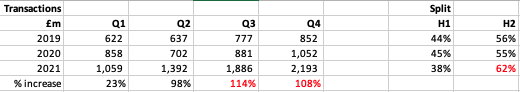

Outlook statement: The start of this year looks very strong for Equals, with revenues up +78% to £13.6m in Q1. That equates to £222K per day, or annualising the figure equates to £54.4m or implied +23% for this year versus 2021. The last 3 years Equals has shown a H2 weighting, which is unusual for a capital markets business – most banks enjoy seasonally strong Q1, but the second half of the year has August and December which tend to be quieter months for trading.

Even so, H2 to last year does look exceptionally strong– and has carried over to the first quarter of this year. I wonder if there’s any “read across” for Argentex (which I’ve been averaging down in), which has a March year end and should be issuing a trading update in early April.

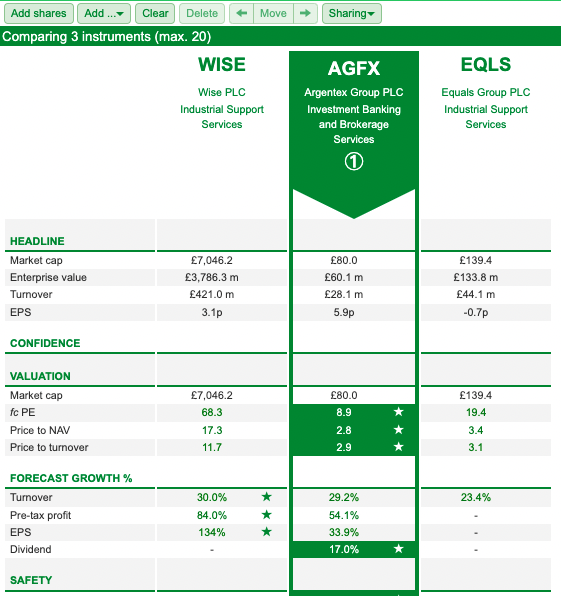

Valuation: The shares are trading on 14x 2023F and 2.6x forecast sales the same year, which is not expensive assuming that we don’t face another downturn. The business has had 3 years of losses, so it’s hard to know what a normal rate of through-the-cycle Return on Capital we should expect. I’ve used SharePad’s useful “compare” tool, to compare Equals to AGFX and Wise.

Opinion: These results are very encouraging. I think we need to be a little careful extrapolating though, it could be that Equals is benefiting from particularly favourable conditions. So far, this is a well executed turnaround plan, with the shares recovering from 20p in the April 2020 sell off. Well done to @Carcosa61 for flagging it on Twitter.

Bruce Packard

Notes

The author owns shares in Argentex and Burford Capital

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

This is a great website with lots of useful and informative posts. Please keep posting more

Don’t forget to visit

online casino games