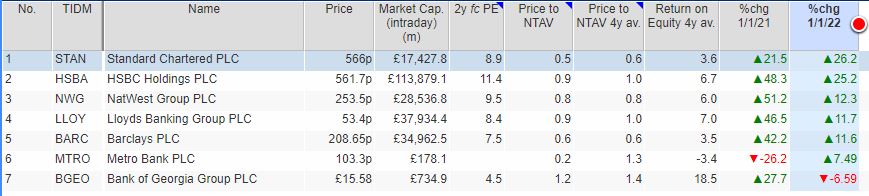

Bruce suggests that while long term “expensive quality” investments have become increasingly popular as discount rates have fallen, a natural hedge for such a portfolio is bank shares, which could now benefit as rates rise with inflation.

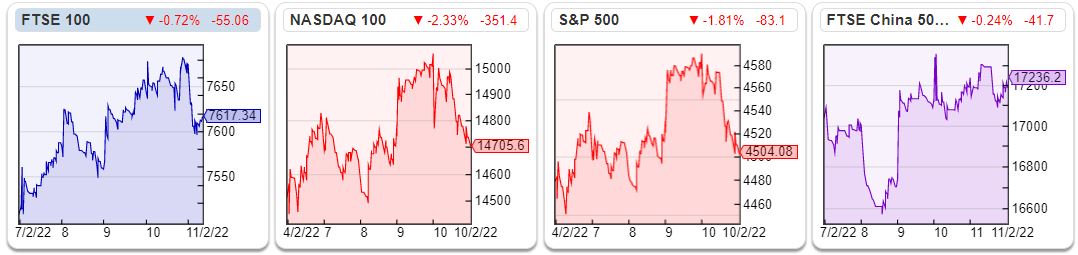

The FTSE 100 was up +2% to 7,617 last week. The S&P500 and Nasdaq100 were flat. The real excitement happened when the US 10 year bond yield broke the 2% threshold, before falling back slightly at the end of the week. The Bureau of Labor Statistics reported that US inflation reached 7.5%. We haven’t heard the word “transitory” for a while, so expect Central Banks to continue to raise interest rates in an attempt to regain credibility. The US 10Y bond yield is now up +28% since the start of the year.

Thank you to Jamie Ward for stepping in while I was away skiing. Jamie used to be a fund manager, and trained under the legendary Patrick Barton, who I also worked for at Credit Suisse. While Jamie is a similar age to me, Patrick was very much “old school”: unable to use a computer (he wrote out all his research notes by hand, for someone else to type up.) Despite not using spreadsheet models he still achieved a top 3 Institutional Investor ranking and was the first UK banks analyst to publish a SELL notes on Northern Rock and Royal Bank of Scotland, a couple of years before the wheels eventually fell off.

Here’s a link to an article about the fund that they used to run together, that I invested in. They highlight that if you invest in “quality” stocks, you’re also in “long duration assets” which are sensitive to movements in interest rates. Or put another way, quality investments often look expensive on 1 or 2 year forecast earnings but have benefited from a falling discount rate, which has meant that cashflows in 5+ years’ time become more valuable. A natural hedge for a quality portfolio is to also invest in bank shares, which ought to benefit from rising interest rates. “Expensive quality” became rather fashionable in the decade since the financial crisis, and some fund managers have even announced that they would never own bank shares. In the article from 2017, Patrick and Jamie made the case for owning banks as a source of diversified returns as economies “reflate”. They obviously failed to foresee the pandemic, but I think their logic still applies in 2022.

UK banks will start reporting their FY results over the next couple of weeks, but STAN and HSBC are already up +25% this year, while my favourite BGEO is lagging – perhaps due to concerns over geo-politics.

Last week, Martin Stamp, the founder of ShareScope in the mid 1990s was interviewed by David Stredder on Mello. I’d encourage interested readers to watch the interview. One thing that I didn’t know was that Martin was expelled from school, before going on to study a mathematics degree at Cambridge University. It’s astonishing to realise that ShareScope has been going for over 25 years, it really was a product ahead of its time but, if anything, more relevant today than ever.

Also at Mello, Steve Clapham was good value on the “BASH” event, prepared to ask difficult questions. In the past I have felt that experts on the BASH were rather too gentlemanly towards each other. When I presented ideas they were met with indifference – I had hoped for vehement attacks, which I could meet with brilliant retorts. You might not agree with Steve’s thought provoking buy case on Unilever (similar to PZ Cussons whose results I cover below) but he is prepared to match his conviction with his own name. I follow some anonymous Twitter accounts, but am discovering that it’s better to listen to people who match their own name to their online reputation.

This week, I also look at K3 Capital and Solid State, and would highlight the different treatment of earn-out acquisition liabilities in net debt. I’m all for aligning the interests of sellers and buyers, but think that shareholders should pay close attention to the deferred costs of acquisitions and how they’re accounted for.

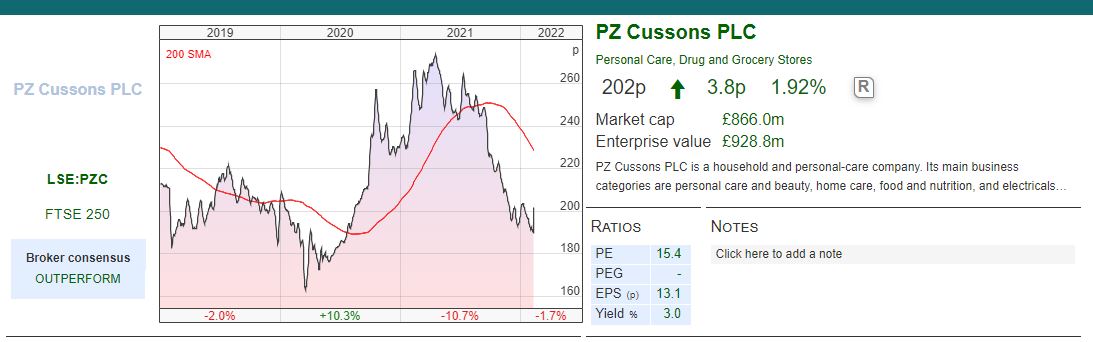

PZ Cussons H1 to Nov

A messy set of results for the “Imperial Leather” soap and consumer brands company. H1 Nov revenue was down -9% to £284m. That revenue decline was caused primarily by the rush to buy hand sanitiser (Carex brand) at the start of the pandemic, and the decline was similar to the -7% group revenue decline that Creightons reported in their H1 Sept 2021 results.

PZC has set out “alternative performance measures” showing a -8% decline in adjusted PBT from continuing operations, which is far worse than the growth in statutory PBT from continuing operations of +15%. That difference is caused by higher £35m alternative PBT figure in the prior year H1, which has resulted in y-o-y decline. The results are presented in a rather messy way, for what ought to be a simple business.

PZC has also sold a couple of businesses: a loss making milk business in Nigeria called Nutricima (recognising a £41m loss on disposal last year) and the five:am yoghurt business in Australia (£1m profit on disposal). Management say that Q2 2021 v Q2 2020 revenue growth was mid single digit, on a “like for like” basis, which adjusts for currency movements and disposals.

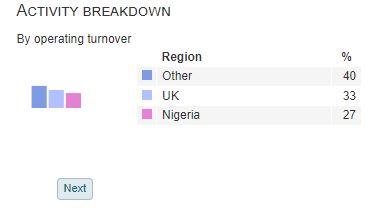

On a geographic basis they are seeing revenue decline in Europe, offset by strong growth in Africa. PZC’s largest market is Nigeria 27% of revenue, which as an oil exporting nation, is sensitive to the oil price in both directions. Currently they’re benefiting as Brent Crude is above $90 per barrel. Revenue from Africa is 36%, Europe and America’s 34%, Asia Pacific 30%, reflecting the group’s history in West Africa and Indonesia. Despite inflation driving commodity and freight costs, group margins improved +40bp. Net debt reduced to £10m v £31m six months earlier.

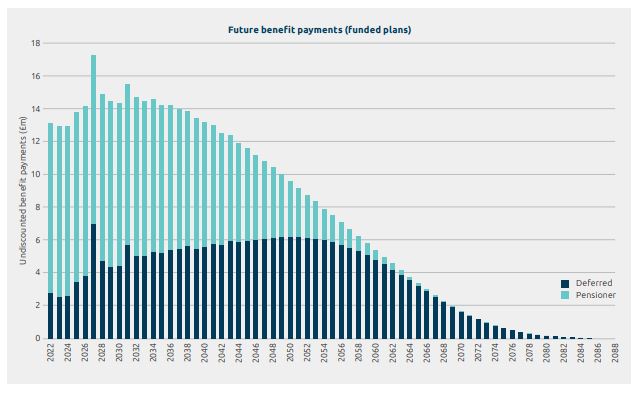

Pension There is a large pension scheme (assets £417m, obligations £334m) but it is in surplus. 86% of the scheme is currently held in bonds, which has been the right approach over the last couple of decades, however they put an interesting graphic in their Annual Report showing the long term nature of pension commitments. I think most other company’s pension liabilities would follow a similar curve, and PZ Cussons should be commended for showing the long term nature of their obligations.

It looks like the bulk of liabilities are after 2030, so I do wonder about the wisdom of having such a large weighting in bonds in an environment when inflation is picking up.

Outlook They expect to deliver adj PBT in the current range of analyst expectations, without giving any numbers. As management refer to a range, I think we can conclude that they are guiding expectations towards the bottom of the range, so those EPS forecasts above the midpoint are likely to reduce.

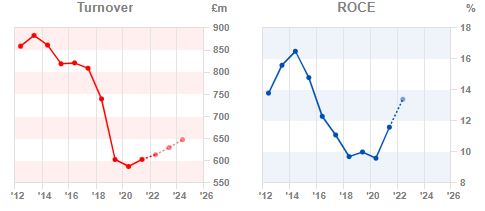

Revenue decline The main problem with PZ Cussons seems to be declining revenue, down from £858m FY May 2012 to £603m FY May 2021. That’s not what I’d expect to see from a consumer brands company, it suggests that they are losing market share in their core markets. Richard has written a couple of articles on PZ Cussons, because it appeared in his Keep it Simple, Stupid filter. The first article points out that in the first half of this decade, PZC management were overspending on acquisitions and over-distributing to shareholders. Poor cash generation led to underinvestment in brands, marketing was cut by a third from 2013 levels and net debt ballooned to £165m in May 2018. Richard then updated his PZ Cusson’s analysis in April 2021, following management being replaced and a new strategy. He points out that there’s a tendency for new Chief Executive’s to be brutally honest in their appraisal of a business, to reset expectations.

AH-O The expert at this was Antonia Horta-Osorio, who is widely credited with “turning around” Lloyds Bank. A closer reading events suggests otherwise. AH-O joined Lloyds in January 2011, when the bank’s share price was 70p and spent his first 12 months as the new Chief Exec talking the share price down, kitchen sinking estimates then taking a break for stress, co-incidentally causing his share options to be priced at a much lower level. Ten years and £56m cumulative pay-out to AH-O later, the Lloyds Bank share price halved under his tenure. Then, in early 2021, AH-O moved on to “turn around” Credit Suisse, before being ousted following some dubious behaviour involving the corporate jet and breaches in quarantine restrictions. He was paid $4.1m for less than nine months as Chair of Credit Suisse. Rewarding banking talent like that, I would prefer incompetence.

Turn-around Jonathan Myers, the new PZ Cussons Chief Exec’s, diagnosis at the March 2021 Capital Markets Day was correct in my view. They had underinvested in brands, spread their resources too thinly and taken their eyes off the consumer according to the presentation. The new strategy was to pour resources into eight “Must Win Brands”, responsible for 50% of sales but 66% of gross profit. However, we are now at the stage where the new management team will come under pressure to deliver results from their turn-around plan.

Valuation Following over 5 years of disappointment, the shares have de-rated and are currently on 15x PER May 2023. Net debt has been reduced, and hopefully with more focus from management we should now see RoCE improve towards the 16% the group achieved a decade ago, v 10.4% average the company has reported over the last 3 years.

Opinion The share price peaked at 430p in mid 2013. I bought a couple of years later, under estimating just how long a turnaround would take. PZC has long tested my patience, but I’m hoping that we are now finally at a point where the share price starts to outperform.

K3 Capital H1 to Nov

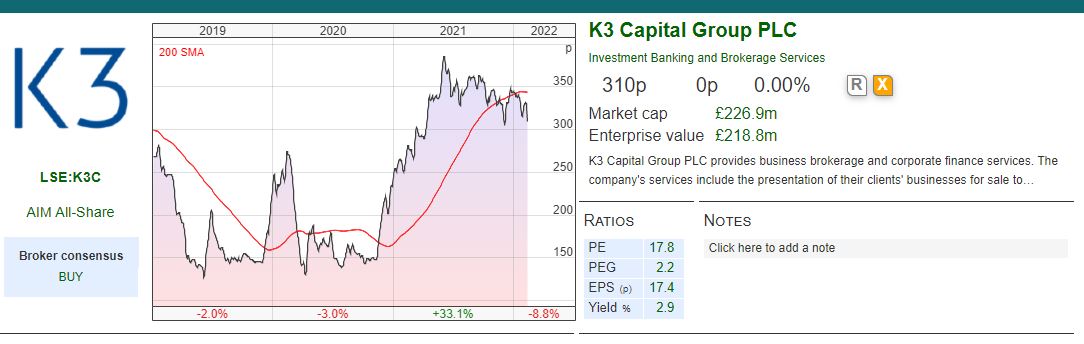

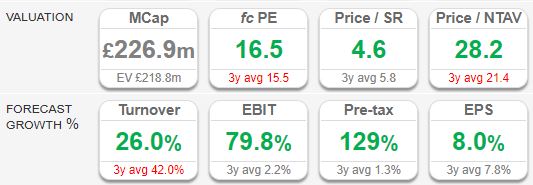

This professional services firm which specialises in Restructuring, (53% of revenue), M&A (31% of revenue), Tax (15% of revenue) advice announced H1 revenue of £31.2m. That’s versus guidance of more than £30m in a trading statement in mid December. The y-o-y revenue and profit growth figures aren’t meaningful because they acquired Knight Corporate Finance and Knight R&D, a specialist in helping SMEs apply for R&D tax credits, in July last year. The year before that they bought randd and Quantuma, that was paid for via £30.5m placing in June 2020 at 150p and then a further £10m placing at 340p in July last year, to buy Knight R&D and Knight Corporate Finance.

They don’t give an organic growth figure for the group (ie growth ex acquisition) but say that M&A from “existing brands” recovered strongly +53% versus H1 Nov 2020, which was obviously a difficult half.

Management are fans of adjusted EBITDA, which is a figure that I tend to ignore. Instead H1 statutory PBT was £5.2m. Net cash from operating activities was even lower at just £47K and down versus £4.2m H1 last year. That fall in operating cashflow was driven by a negative £3.4m increase in trade and other receivables (ie money that’s owed to the group) and £2.2m decrease in payables (ie money that the group owes, probably to employees?) That £47K of net cash from operating activities compares to £9.4m group adjusted EBITDA, which goes to show that cashflow from operations and adjusted EBITDA can be far apart.

Accounting for earn outs I have previously written about how the company accounts for earn-outs here. As of Novemeber 2021 there was £5.1m of “contingent consideration” on the balance sheet. However, that figure on the face of the balance sheet was much lower than the £23m of liabilities in the notes of the accounts of the May year end Annual Report. I can’t see a fair value estimate of that £23m of liabilities updated for the H1 but it’s worth bearing in mind in the context of £8.8m of net cash in November 2021.

Outlook The outlook statement reads positively, with a strong start to H2. The higher margin M&A Division seeing growing transaction fee pipelines. December was the most profitable month within the M&A division in FY2022F to date. The restructuring business has been hit by delays from the insolvency waiver and government support, but they say that their market share and fee earner base should mean that they can take advantage of the market returning. The restructuring division should be negatively correlated with cyclical M&A activity, which means that the business could be easier to manage, rather than going from feast to famine. There’s an Investor Meet Company presentation from these results here.

Valuation Acquisitive people businesses are hard to value, particularly if they are in cyclical sectors like M&A advice. The shares are trading on 16.5x May 2023F, which compares to 8.6x for The Mission Group and 7.7x 2022F for FinnCap. I’m not convinced that K3 Capital has really earned that premium.

Opinion In theory the combination of M&A, tax credit advice and restructuring should make revenues more stable through the cycle. So far, the strategy is working, but we’ve had a very helpful corporate finance and capital raising environment in the last 12 months. I’m wary because corporate financiers can often be over-confident about their ability to do deals and the main competitive advantage comes down to the skills and networks of employees. It does feel like the next couple of years may be a more difficult environment than the previous 12 months.

Solid State Trading Update FY Mar 2022

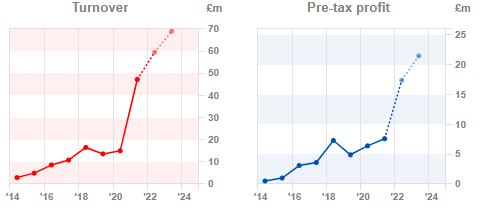

This “rugged” computer components manufacturer put out a trading statement saying that revenues would be “slightly ahead” of consensus of £78.4m, and adjusted PBT “well ahead” of £5.9m expectations. FinnCap their broker responded by increasing their FY Mar 2022F forecast in line with the company’s guidance and raising FY Mar 2023F by 10% to give an EPS of 65p next year.

The open order book at the end of January 2022 was £74.1m (30 November 2021: £70.3m). The recent acquisition Active Silicon is doing particularly well and the Group expects to further increase the earn-out provision by ~£0.5m which will be included in net debt at year end. They suggest that the fair value of deferred contingent consideration will amount to £5.75m (Active Silicon + Willow Technologies).

I think earn-outs are a good way to align the interests of buyers and sellers, but these do represent liabilities. So I am particularly pleased that Solid State is taking the cautious approach of including increasing earn-out liabilities within net debt – that overt conservatism reflects well on management.

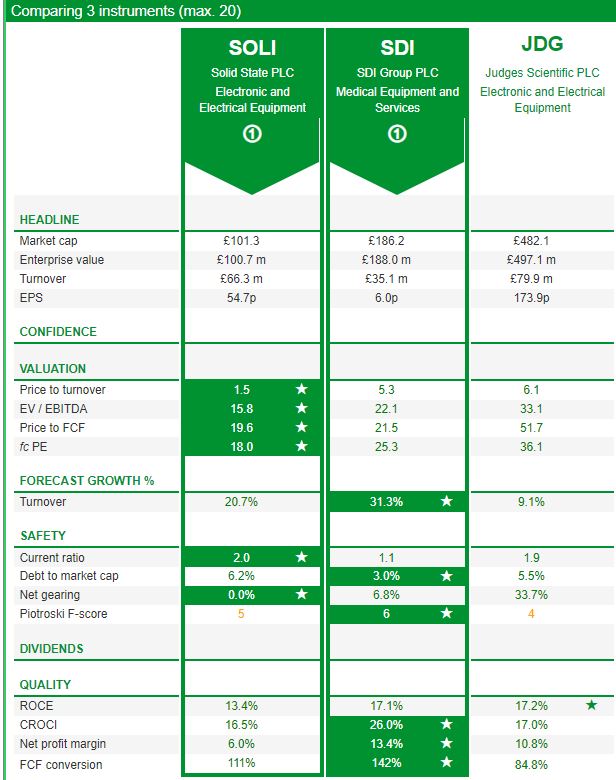

Valuation The shares are trading on 18x Mar 2023F RoCE is mid teens. It’s encouraging to see increased revenue growth dropping through to the bottom line. The gross margin has been just over 30% in the last couple of years, and the EBIT margin shows a steady improvement from 5.2% FY March 2019 to 8.3% last year and implied by FinnCap’s 2022F forecast. The other thing worth noticing is that Sharepad shows CashRoCI s higher than RoCE, so the company has a history of strong cash generation.

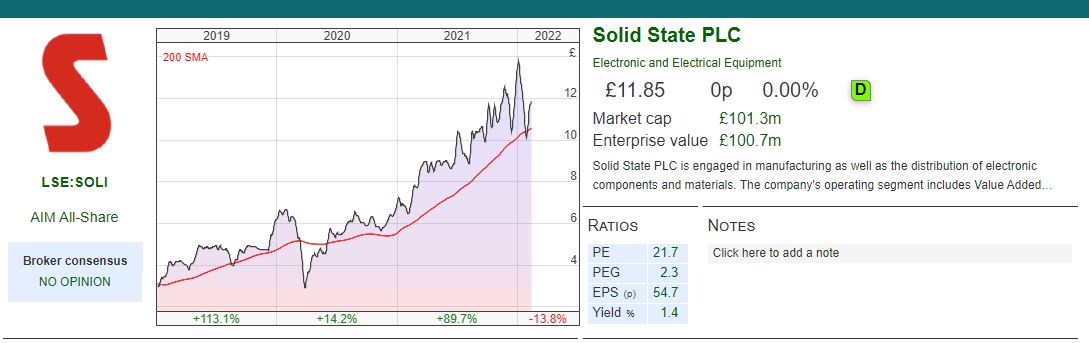

Opinion I own it already and rather like the look of the chart, bouncing off the moving average support level. Several investors I respect highlight SDI and Judges Scientific, but complain about the c. 30x PE multiple as being too expensive. At SOLI the margins aren’t as high, and RoCE has historically been lower but I think it’s worth highlighting this stock as also being in an interesting niche and with a valuation of 18x could be a more attractive entry point. I’ve used SharePad’s “compare” button to show their relative merits on the next page.

Bruce Packard

Notes

The author owns shares in Bank of Georgia, PZ Cussons and Solid State

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Highly recommended did this. Very interesting information. Thanks for sharing!

online casino app real money philippines