Bruce looks at how the market has de-rated on a price to sales metric since Q4 last year. But there are still 111 AIM shares trading on more than 10x revenue. Companies this week KNOS, MORE and RTN.

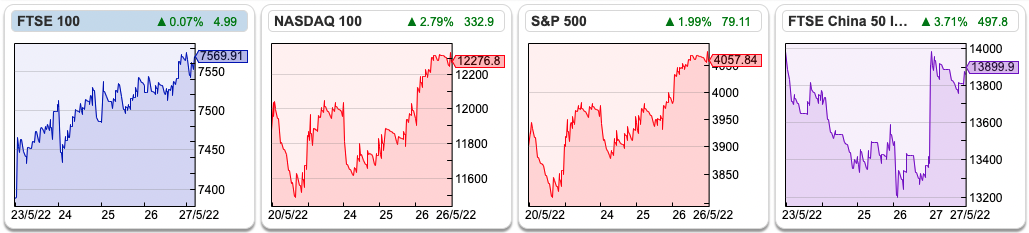

The FTSE 100 rose +2.5% to 7569 last week. The S&P500 +4% and the Nasdaq100 +3.4% both enjoying a revival over the last few days, despite Snap falling -30% at the start of last week after the company warned that it would miss revenue and profit expectations. They blamed “macro” conditions, but I think it is more likely that the online advertising market is softening. That could be bad news for the likes of Future, Tremor, S4 Capital and The Trade Desk, possibly Meta ($118bn revenue FY 2021) and Alphabet ($257bn in revenue FY 2021) too. Global online advertising is half a trillion dollars market. On the positive side, softening advertising costs may turn out to benefit the likes of Moneysupermarket and also BOTB, who have to devote considerable online marketing budgets to attract users to their sites.

The price of oil rose +5% to $114, while the US 10Y long bond yield fell back below 2.8%. So the bond markets imply that recession is becoming more of a risk than inflation, while the oil market disagrees. That may reflect inflows into “Commodity Trading Advisers”, trend-following hedge funds which have had a poor decade but are now having a bumper H1. Commodities are supposed to provide diversification from bonds and equities, but we saw in 2008 in a stressed scenario that they collapsed when everything else did (including the price of gold). My preference is to hold some cash and wait to see if inflation really has peaked; that cash might lose 10% of its purchasing power – but I’m prepared to take that risk as I’m not expecting good equity market returns if inflation and interest rates continue to rise.

Hopefully, everyone had a good time at the Mello event last week? If you have thoughts, observations or questions on any of the companies do post them in the “chat” function.

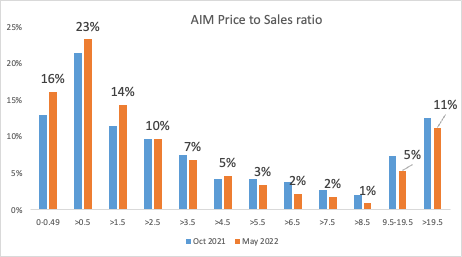

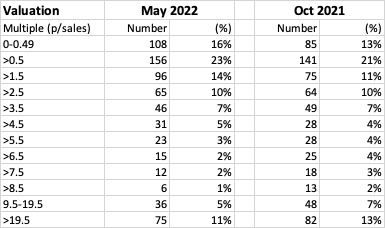

Following the -23% sell-off in AIM over the last 6 months I have dusted off my histogram of price/sales that I first published in October 2021. One of the great things about Sharepad is the ability to download data into a .CSV file and then create a graph. As a reminder, the Y-axis shows the percentage of stocks on AIM, and the X-axis shows the valuation multiple (price to sales). There are 858 companies listed on AIM, but just under 200 of them don’t generate any revenue, so I’ve excluded them from the analysis. That leaves a sample of 669 companies, with Falcon Oil & Gas trading on 62,000x turnover to UKrproduct trading on less than 0.1x revenue. Most of the outliers on both sides of the distribution are below the £100m market cap.

I could filter by market cap, and exclude the smaller stocks. However, if I did that then that would disqualify more than half the index from my graph. Instead, with a distribution that wild, it’s better to ignore the mean average which is skewed by outliers and focus on the median (ie the value of the company that falls sequentially in the middle). The median valuation of AIM has fallen -23% from 3x revenue last October to 2.3x last week, tracking the -23% decline in the AIM index over the same time period.

Or put another way 39% (16% plus 23%, the first two bins on the left of the graph below) of companies are now trading on less than 1.5x sales. That is an increase from 34% in October 2021. At the other end of the spectrum, there are still 111 companies on AIM or 16% trading on more than 9.5x revenue.

I’ve set out the data at the bottom of this weekly in an appendix. However, you can also download the data yourself into a .CSV file, by clicking on the “sharing” tab, and then “export table..”

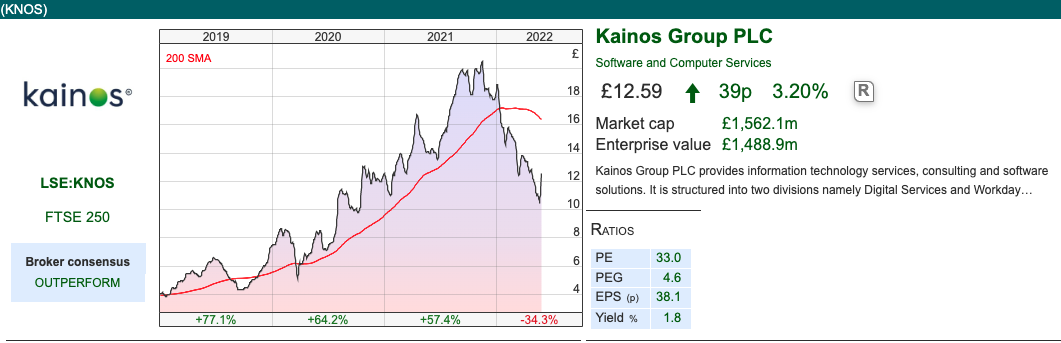

This week I look at Kainos, the software and IT services company plus The Restaurant Group’s and Hostmore’s trading updates. I’m not particularly keen on the restaurant or pub sector, but I do think it’s worth following to see how consumers’ behaviour is evolving.

Kainos Group FY March Results

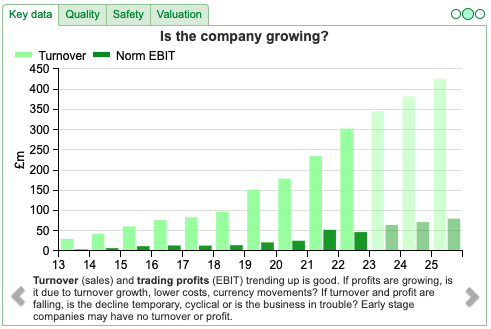

With so many profit warnings coming out from the US, it’s good to see a London listed company delivering on expectations. Kainos, the IT services company to the public sector, including healthcare providers reported FY March 2022 revenue +29% to £303m, and statutory PBT -9% to £59m. Excluding the acquisitions made last year, they grew at +26% organic, which is impressive.

The Digital Services division reported particularly strong revenue growth in healthcare (mainly the NHS) +52% to £66m and international +112% to £5.5m. They also implement Workday – an Enterprise Resource Planning software package (ie similar to PeopleSoft or SAP) and grew last year by acquiring four specialist consultancies (Cloudator, 55 people in Europe; Une Consulting, 42 people in Argentina; Blackline, 50 people in the USA; Planalyze 6 people in Europe). Workday division grew revenue +41% to £71m, or +30% organically.

Statutory PBT was down due to share-based payments of £3.7m, amortisation of intangibles £1.9m, earnouts £5.5m and acquisition costs £1.6m. I’m not a fan of adjusting out share-based payments or acquisition and earnout costs if the company is growing by making lots of acquisitions – it seems to me those costs are not exceptional but will recur in future years. The group’s gross margin was 46%, down quite sharply from 50% in FY 2021. That’s due to lower utilisation levels, increased salary and contractor costs. Digital Services (66% of group revenue) reports margins of 39% versus the Workday business which is half the size (33% of group revenue) but higher margin: 61%.

Outlook: On the 19th of April they released an “in line” trading statement. These results do look in line versus Sharepad’s forecasts at the beginning of last week, but the shares responded by rising +17% on the morning of the RNS, which is probably down to the upbeat outlook statement. “We remain extremely positive about the future of digitisation in the UK public sector and within the NHS, both immediately and over the long-term. We are confident that based upon our strong reputation and successful track record, we are well positioned to maintain a central role in this transformation drive. The digitisation pressures and opportunities within the commercial sector are similar, and therefore the growth prospects for us are substantial. Our progress in the past year provides confidence that we will deliver significant growth in the years ahead.”

Presumably, there has been a private conversation with their house brokers (Canaccord and Investec) which will translate those upbeat comments into forecasts. My feeling is that companies would be better off just putting some numbers into the RNS. Sharepad shows the revenue forecasts has increased +4% to £344m FY Mar 2023 and +3% to £378m FY Mar 2024F. However, the EPS forecast is flat this year and next (41p and 45p FY March 2024F).

History: The group was originally a joint venture from 1989 between ICL, a mainframe computer company that did a lot of business with the NHS, and Qubis, the commercial spin-off arm of Queen’s University Belfast. My own experience of ICL in the 1990s was doing data entry for a Patient Administration System database: two NHS Trust hospitals had merged and wanted to consolidate their data. However, the 2 hospitals databases (both ICL) didn’t talk to each other, it was cheaper to hire 5 students for 3 months and pay them £4 an hour inputting data by hand rather than paying programmers to find a technical solution. I spent the money I had saved up on a flight to Moscow then flew down to Mineralny Vody enjoying a couple of months skiing and heliskiing on the Russian side of the Caucasus mountains.

In the 1990s Kainos built enterprise software focussing on HR for Marks & Spencer, call processing software for BT and ticketing software for London Underground. Fujitsu bought ICL in 2002, which meant that Kainos then focused more on telcos and financial services. In 2007 Kainos staff bought out Fujitsu’s remaining 20% stake. In 2010 they entered the UK healthcare market, first working for The Ipswich Hospital NHS Trust, deploying their “Evolve” software. By 2014 this software was licensed to over 70 NHS hospitals in the UK. They listed on the LSE in July 2015, with selling shareholders (mainly Qubis, Brendan Mooney and other insiders) receiving £52m for 38m shares (approx. 32% of the company) with no new money raised. Since the IPO, revenue and statutory PBT have increased 5x since FY March 2015. The track record of Returns on Capital is impressive too, not just the top-line growth. An encouraging example of a company coming to market with selling shareholders cashing out some of their gains, but going on to achieve considerable success.

Ownership: The Chief Exec, Brendan Mooney who joined in 1989 owns 12%. Given the size of the company (mkt cap £1.6bn), there’s surprisingly high management ownership, although that likely reflects the rapid increase in valuation since the company listed on the LSE at 139p per share and £164m market cap in July 2015. Institutions on the shareholder register are Standard Life Abrdn 10.9%, Qubis 10.1% and Liontrust 7.4%.

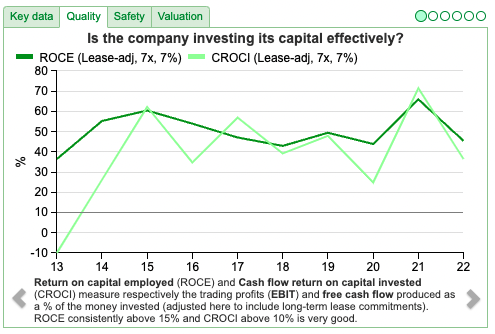

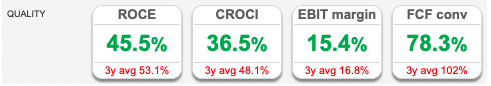

Valuation: The shares are trading on 28x March 2024F and 4x revenue the same year. That’s quite pricey in this market, but the track record is impressive. The company has demonstrated very high RoCE (3 year av 53%) and CashROCI (48% year average).

Opinion: Looks good. The shares have been weak, down -34% YTD. That seems to be market-driven, rather than anything that the company has said or done wrong. Implementing software systems into the public sector is a particularly tricky area, where billions can be wasted. It looks like Kainos have developed a good process and reputation in this area, though there are clearly risks that if the quality of their work falls they could face challenges.

The Restaurant Group and Hostmore Trading Statement

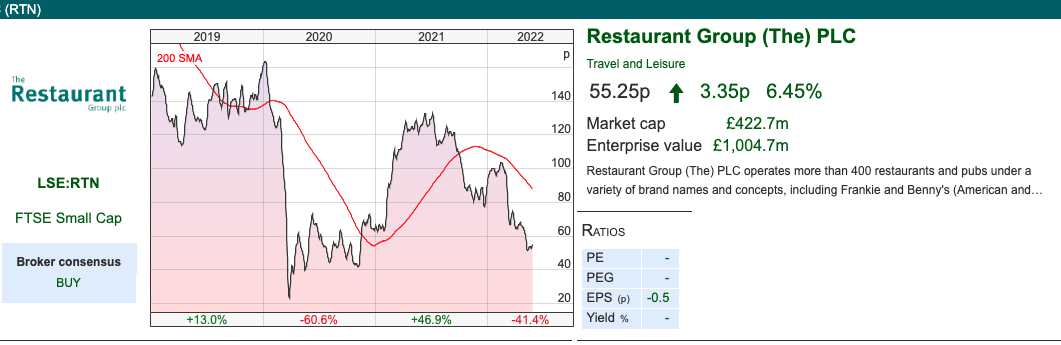

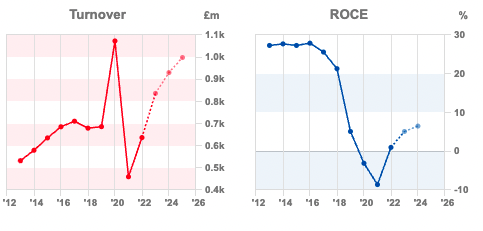

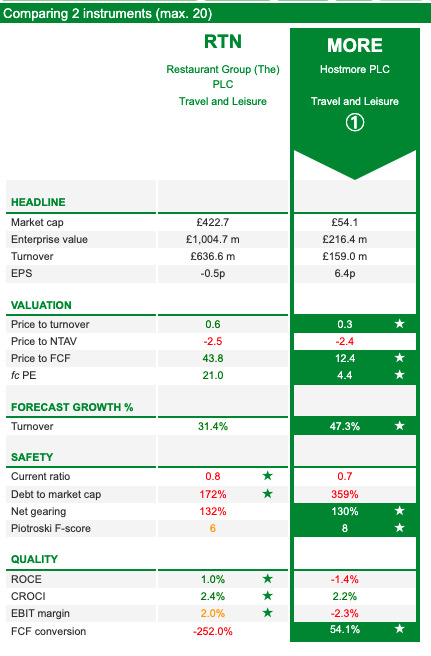

The Restaurant Group, which is approximately 400 restaurants and pubs including Wagamama, Frankie & Benny’s, plus UK airport concessions announced a trading update for the 19 weeks to May. All of the comparisons are made versus 2019, so distortions from the pandemic lockdowns are removed. The graphic below shows how turnover collapsed during the pandemic, but the recovery in profitability is taking longer than revenue bounce.

YTD Wagamama like-for-like sales were up +15% and pubs were up +10%. That’s a slowdown from Q1, which management explained as a withdrawal of VAT reduction (VAT was 12.5% in Q1, now back to the standard rate of 20%). Airport concessions are still struggling -20% YTD, although that’s not something management can control and presumably should pick up strongly in July in August?

RTN raised capital to buy Wagama for £559m enterprise value in November 2019. The rights issue raised £315m and were at a 57% discount to the then market price (252p). Then at the beginning of the pandemic in April 2020 they did a placing at 58p per share raising £57m. Less than a year later, in March 2021 they did yet another placing raising £166m at 100p per share. Despite these capital raisings, tangible book value is negative £160m (£600m of intangible assets are carried on the balance sheet mainly from the Wagamama acquisition). The Chief Exec is Andy Hornby, who I remember from his HBOS days – at least he has plenty of experience at emergency capital raising from the banking crisis.

Outlook: They expect food and drink inflation at between +9 and +10% versus previous expectations +5%. Management’s current expectations for FY22 remain unchanged, with continued robust trading in their Wagamama and Pubs businesses and the stronger recovery in Concession sales offset by the increased food and drink inflation. That’s quite a different outlook to Hostmore below:

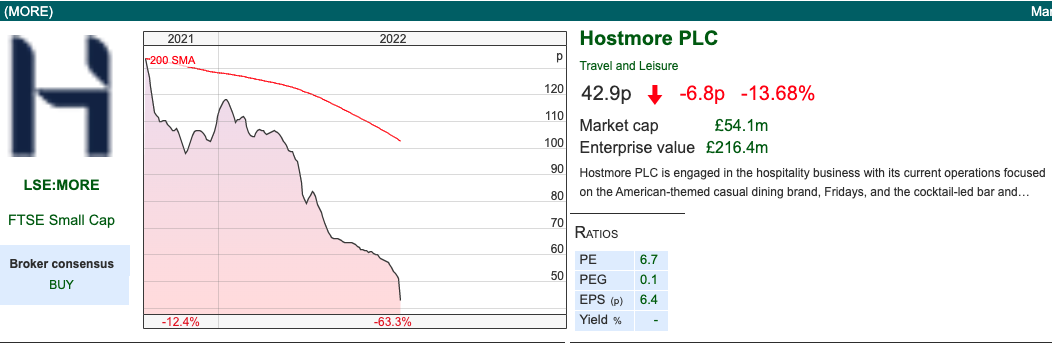

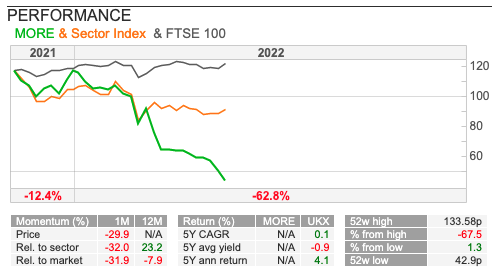

Hostmore: this demerger from Electra Private Equity which listed in November last year, also reported a trading update last week. MORE operates 89 American themed restaurants (TGI Friday’s, and cocktail/restaurant brand 63rd+1st). They had been saying that trading was ahead of 2019 levels and a positive trading update in January this year, said that FY 2021 EBITDA would be “well ahead” of 2020 consensus expectations. Last week’s RNS was less positive with like-for-like sales -6% lower than 2019. They are talking about a challenging consumer environment and believe like-for-like sales may reduce by -8% for the rest of FY 2022 v 2019. Net debt (which was £12m in December) to EBITDA is now expected to be in the midpoint of 0.75x to 1.5x. The shares are down -71% from the IPO opening price of 150p in November last year – I think Sharepad’s 52w high of 133p reflects the closing price on the first day of trading rather than the demerger price.

Valuation: MORE’s shares are on 4.4x PER Dec 2022F dropping to 3.5x PER 2023F. RTN shares are trading on PER 21x Dec 2023F dropping to 12x Dec 2023F. On an EV/EBITDA basis, both companies are on 6-7x this year’s forecast. More’s valuation is clearly signalling problems, but I do wonder if RTN, may run into similar headwinds.

Read-across: Having owned a craft beer pub through the pandemic, RTN or MORE really doesn’t interest me as an investment case. These are not easy businesses even during the best of times. I do think it’s worth keeping an eye on what restaurants and pubs are signalling about consumer discretionary spending though. There’s a lot of talk about a possible recession in H2, but it’s unclear to me whether the pain will be felt in corporate margins (ie companies failing to pass on rising input costs onto their customers) or households (ie companies pass on costs, and consumers spending is hit).

I think it is human nature that company management will say in outlook statements that they have pricing power, can pass on costs, and their margins will be fine. Reality may prove to be different.

A second observation about voluntary disclosure: very often if two companies are reporting diverging trends, it often signals problems may arise in the company with the more upbeat outlook statement. Management with weak balance sheets seeing a deterioration in trading can delay bad news hoping that the trend reverses. That was certainly true of HBOS during the banking crisis, which claimed to have a “strong balance sheet” in H1 2008. Despite the capital raising last year and the year before, Restaurant Group’s net debt, including leases, is £582m, which doesn’t leave much margin for error with negative tangible equity and a market cap of £423m.

So over the next six months, I think that it’s going to be particularly important to “read between the lines” of the guidance companies are giving.

Appendix

Breakdown of AIM companies price to sales multiple in histogram form. Excludes companies that don’t make any revenue.

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Your work is very good and I appreciate you and hopping for some more informative posts. Thank you for sharing great information to us.

OkBet: Online Casino Philippines