Central Bankers are having their annual shindig in Jackson Hole, so Bruce looks at the long-term history of interest rates and questions how much policy rates control activity and inflation. Companies covered SMV, KBT and SPE.

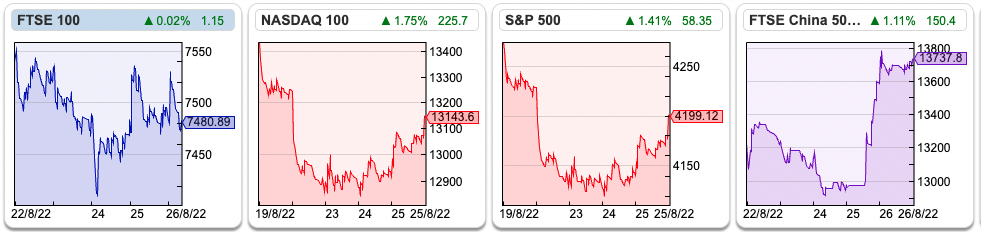

The FTSE 100 was down -0.7% last week. The S&P500 and Nasdaq100 were also down less than -1% over the same time period. US bond yields rose back above 3% to 3.08%, we could see further reaction following last week’s Jackson Hole annual shindig for Central Bankers. The theme this year is ‘reassessing constraints on the economy and policy’. In other words, Central Bankers have realised that they can neither keep interest rates low indefinitely nor continue to buy government bonds, without running into concerns about fiscal sustainability or the size of Central Bank balance sheets.

Meanwhile, Edward Chancellor has gone back to Mesopotamia in the 3rd century BC to look at the history of interest rates. He starts his book, The Price of Time with a cheerful quote:

Our earth is degenerate in these latter days: bribery and corruption are common; children no longer obey their parents; every man wants to write a book, and the end of the world is evidently approaching.

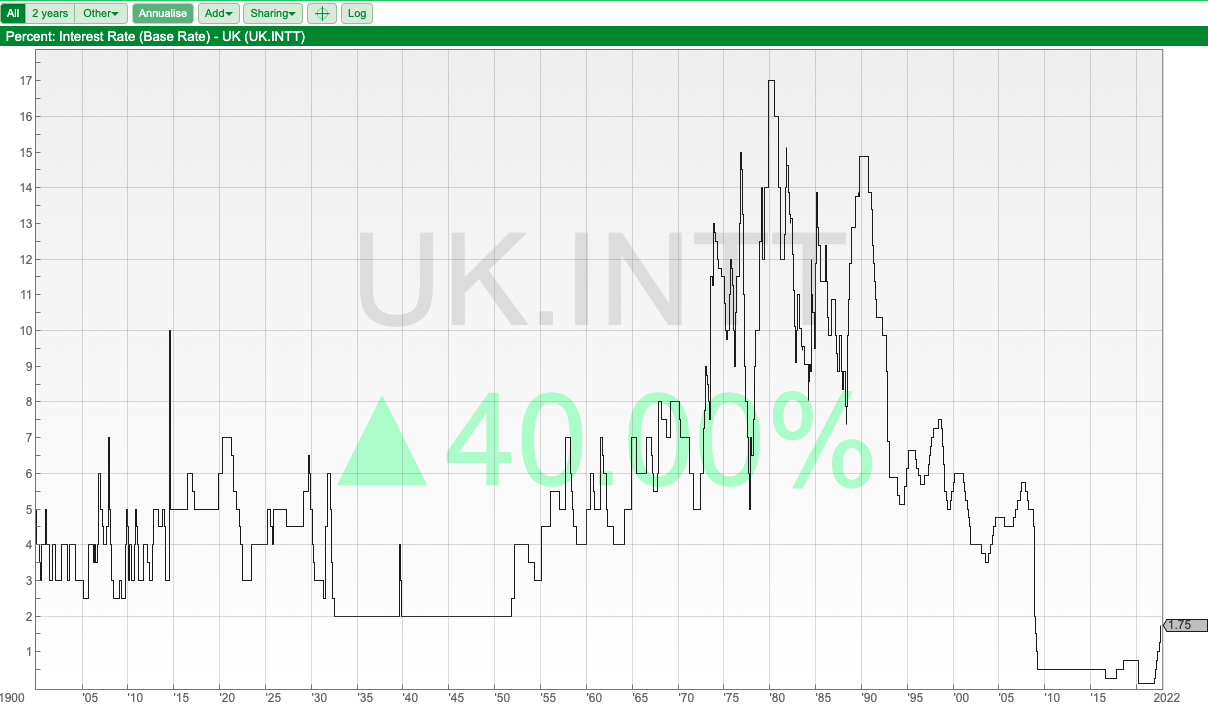

Good to see that bearish economic commentary is not a new phenomenon. Sharepad doesn’t have UK interest rates back to the Assyrian empire, but the chart below of 120 years is still impressive. The code is UK.INTT if you’d like to recreate the graph.

Edward Chancellor suggests that Central Bankers haven’t thought very deeply about the nature of interest, they assume short-term policy rates are the best tool for controlling activity. Superficially this has worked over the last couple of decades, but also led to asset price inflation and large debt burdens. That means risk has built up elsewhere in the financial system, he says. Rather than seeing interest rates as a tool to control behaviour, he suggests instead that Central Bank policy can’t compensate for dislocations within society.

I think that’s correct. Here’s a photo of me withdrawing my first million (Belarussian Roubles) from a cash point in Minsk a few years ago. I’m wondering which country I will next be able to withdraw a million from a cashpoint. The Turkish Lira has risen to 18 TRY/USD, the currency weakening 27% YTD, inflation is currently 80% per annum v Central Bank interest rates at 13%.

Meanwhile, the Swiss National Bank still has a policy of negative interest rates, as the strong currency seems to be supported by the decentralised political power among the Cantons. It’s similar to my point that companies which report above-average returns for longer, have Chief Executives who are prepared to decentralise power.

Chancellor thinks that we’ll see interest rates at artificially low rates and household and government debt will be eroded in real terms by inflation. That’s also what Merryn Somerset Webb suggested when she interviewed Andy Haldane last year, to which he replied ‘no, no – that’s not in our mandate’. He then quit the BoE last year. That may prove to be very good timing.

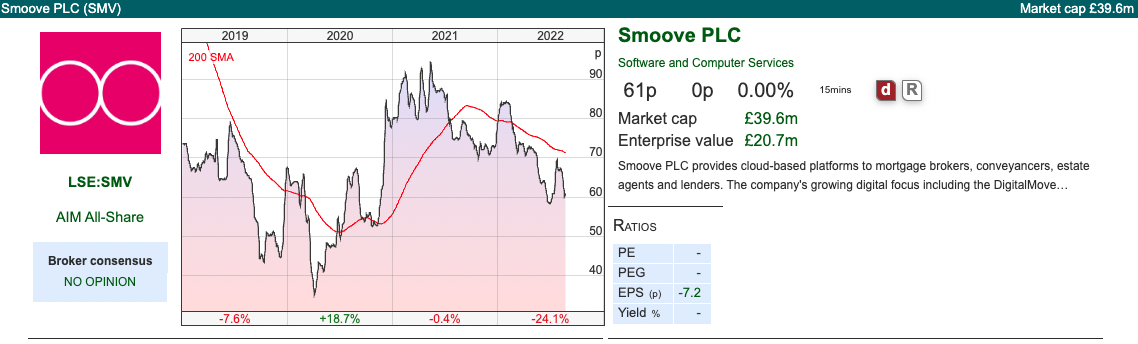

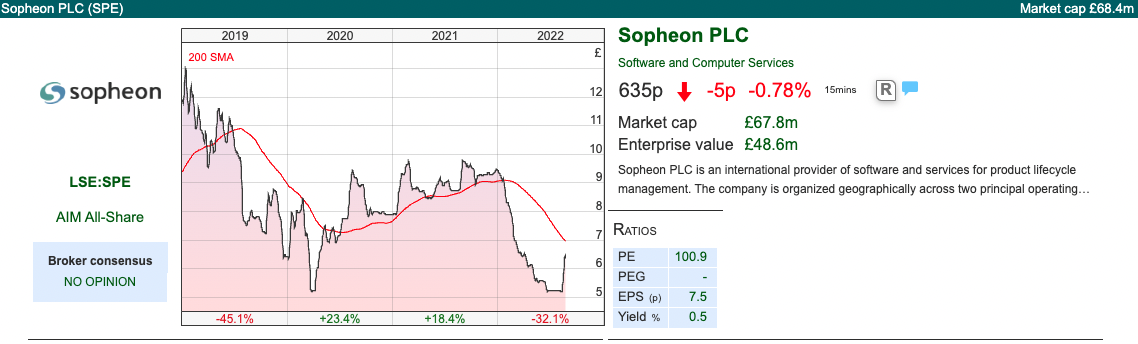

This week I look at Smoove, formerly ULS Technology which is trying to disrupt the property conveyancing market. Plus enterprise software companies K3 Business Technology and Sopheon. Both Sopheon and Smoove are holding plenty of cash (30% and 50% of their market cap respectively), though that cash hasn’t provided much support in the market sell-off, with SPE down -32% YTD and SMV down -24% YTD.

Smoove FY to March

This conveyancing company (previously known as ULS technology) that is trying to disrupt the conveyancing market and home moving process announced FY March results. As it has taken them almost 6 months to release results, we can already be confident that the numbers are disappointing.

Sure enough, they reported a statutory loss before profits of £4.9m, despite revenue on continuing operations rising +13% to £19m. Net cash was down by £4m to £20m. As a reminder, they sold Conveyancing Alliance Limited (CAL) in November 2020 for £27m, which resulted in a large cash balance, but revenues roughly halved from £30m FY Mar 2019. They have announced a tender offer of up to £5m, which they will seek approval for at their AGM in late September. They expect to complete the tender offer during October.

That still leaves the company with £15m of cash, which could be taken as a positive because it means they are not in financial distress. On the negative side, it might imply that management sees several years of losses ahead. Inflation is clearly reducing the value of their cash at double-digit rates too.

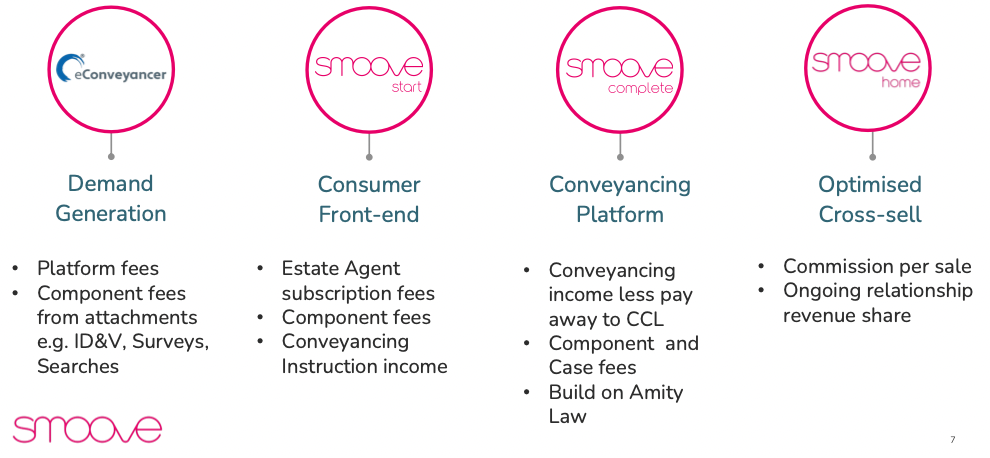

There are no forecasts from Panmure and the outlook statement lacks any detailed guidance. The company intends to hold a Capital Markets Day in October or November when they will begin giving forecast guidance and also do a demonstration of the product and a strategy update. For now, they mention Smoove Start, a subscription revenue business aimed at estate agents and Smoove Complete, aimed at conveyancing lawyers and which builds on their purchase of Lancashire-based Amity Law (£305K total consideration).

The group used to tout their DigitalMove product, which was supposed to be an online platform making buying and selling houses easier. They then wrote off £1.5m of capitalised development costs related to DigitalMove in FY Mar 2021 and it seems to be downplayed in the commentary too. I had an email exchange with the financial PR (Walbrook) who denied this and said DigitalMove was still a key part of the strategy, particularly the onboarding process.

SMV management have reported three different figures for number of cases DigitalMove has completed. In their April RNS, they said 75,000, in last week’s statement that has grown to 88,000 ‘to date’ while last week’s presentation says 78,000 to end of March. Again, I asked their financial PR for clarification, the 75K v 78K is just a rounding error and represents instructions to end of March, whereas the 88K refers to instructions to the end of June.

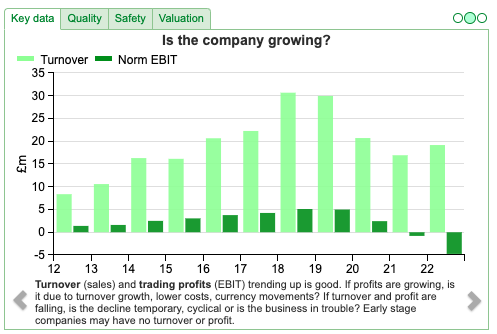

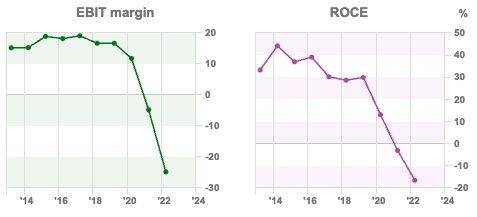

Other ‘voluntary disclosure’ decisions (ie no forecasts in the market, removing previous presentations from the website) also imply that progress has not been to plan. Theoretically, this ought to be an exciting growth story, but my impression is that management appears to be throwing mud at the wall to see what sticks. That’s a shame because the company was reporting above 30% RoCE and an impressive EBIT margin a couple of years ago.

Valuation: Housing market transactions have been strong in the last couple of years because of low-interest rates and stamp duty holidays, so it’s not clear how sustainable that double-digit revenue growth just reported is. The shares are trading on 2.2x FY March 2022 revenues.

Opinion: The cash on the balance sheet represents 50% of the market cap. However, with just £5m of capital return in the tender offer, it seems like the bulk of the money will be re-invested in the business. That means the investment case depends on management successfully disrupting the conveyancing market. They haven’t articulated what hasn’t worked in the past and what they will do differently. Hopefully, they can tell a good story at the Capital Markets Day, so although I own some shares I’m going to wait till then before deciding whether to increase my position or sell.

K3 Business Tech H1 to May

This enterprise software company announced revenue from continuing operations down -5% to £19.9m. Recurring (or predictable) revenue is 74%, and gross margin is 60%, so this ought to be an attractive business. However, despite the recurring revenue and high gross margin, they reported a loss of £2.8m. The cash flow statement is a bit concerning, with net cash from operations minus £5.2m, driven mainly by a large negative working capital movement of £5.7m.

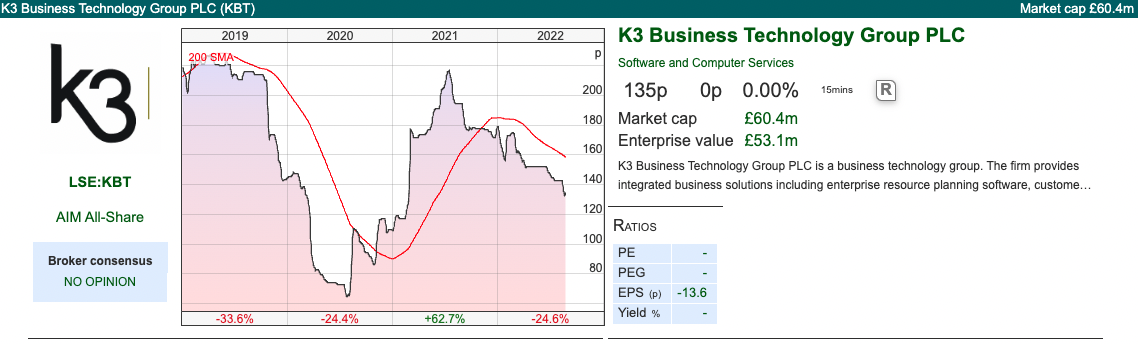

Net cash was just £1.4m at the end of May, though they expect that to be ‘significantly higher’ at the Nov year-end. Shareholders equity was £34m, but after deducting goodwill and other intangible assets that drop to less than £2m of tangible equity. The company has been loss-making since 2016, so Sharepad’s quality measures are not encouraging.

The company makes software that helps retailers (including IKEA) manage their operations and distribution. Clearly, the retail sector has had a challenging couple of years, and KBT had a difficult start to the pandemic, before trebling peak to trough in from mid-2020 to mid-2021, but seems to be struggling in 2022 with the shares down -25% YTD.

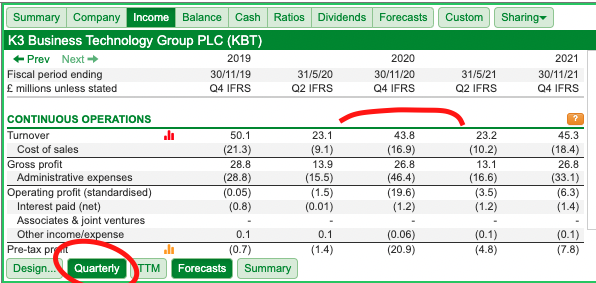

Outlook: Management sound surprisingly upbeat, talking about growth opportunities, cash generation and cost management. They say that trading in June and July has been encouraging, with the level of deals signed ahead of last year, as well as an increase in average software deal size. They talk about a historic seasonal H2 weighting, which is easy to check using Sharepad’s ‘quarterly’ tab. Unfortunately, their claim doesn’t stand up to scrutiny, with £23m turnover in H1 for the previous two years v FY turnover of £44m and £45m.

Forecasts: FinnCap their broker haven’t published any forecasts, presumably at the management’s request. FinnCap says that ‘while the Group has clear visibility on the pipeline for existing contract renewals, timing for new licence-based contract wins is unpredictable especially in current macroeconomic circumstances, giving rise to challenges to forecasting.’ That implies that revenue could be hit if retailers continue to struggle? I note that revenue has fallen from £118m in FY Nov 2017 to £45m Nov 2021 – with that sort of decline it’s going to be hard to cut costs fast enough.

Valuation: The shares are trading on 1.5x annualised revenue, which is not obviously cheap for a company where forecasting is difficult and which doesn’t have a strong balance sheet.

Opinion: I’m wary of management sounding upbeat and talking up their H2, but failing to back this up with broker forecasts. It seems to me the macro environment is going to be harder for KBT’s retailing clients over the coming months. KBT is an ‘avoid’ for me. Perhaps at some point, it could be an interesting turn-around story, but the shares are not yet trading at a distressed valuation.

Sopheon H1 to June

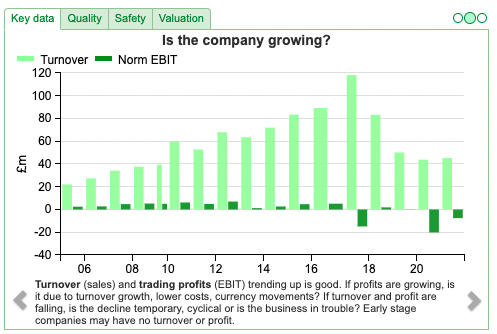

This is another enterprise software company, their products help with New Product Development (NPD) announced H1 revenue down -5% to $15.7m. However, they have good visibility on FY revenue, which they say is $34m up +9% versus the same time last year. The company also point investors to Annual Recurring Revenue (ARR) of $21.9m, growing at +12%. The company has a 98% client retention rate year to date, so it seems that once corporates start using their software, it becomes embedded in the processes.

FinnCap left their estimates unchanged, but are forecasting $37m FY 2022F revenue, implying +8% forecast FY revenue growth. Like KBT above, the high proportion of recurring revenue hasn’t prevented the company from reporting a loss (£791K for H1). Unlike KBT though, the cash generated from operations at £5.5m looks very healthy and the group has plenty of net cash of $23.5m.

In May Sopheon made a small acquisition, called Solverboard, for £750K initial consideration, plus £1.55m earn-out linked to ARR targets. They also announced this August a 5-year, $11.2m 5-year contract win with the US Navy, which is the single largest deal in the company’s history. That seems like good validation of Sopheon’s flagship Accolade product, which helps companies meet launch dates and reduce time to market by 15-30% and automate NPD. The Sopheon website claims that Accolade increases product success rates by up to 50%, although I think it would be hard to verify their claims independently. I also note that SPE revenues were $20m a decade ago, so this seems like a niche product with limited growth prospects.

Outlook: The outlook statement talks about commercial traction building, with Andy Michuda the Executive Chairman saying that this is one of the most exciting periods in his time at Sopheon. He was Chief Executive from 2000 onwards, before being appointed Exec Chair in March 2021. I note though that he owns just 0.6% of the shares and looking at Sharepad’s dealing history he doesn’t seem to have used this year’s share price weakness to buy more shares.

Ownership: There’s a large shareholder Myrtledare Corp/Rivomore Limited which owns 19.5% of the shares outstanding, down from 24% a couple of years ago. A google search reveals nothing on Rivomore, except that it was registered in the Isle of Man, with a British Virgin Islands address. I spoke to the broker (FinnCap) who said that Myrtledar/Rivomore were on friendly terms with the management, and have been long-term holders. Other large shareholders are Barry Mence 18%, who co-founded the business in 1993 and is now a Non-Exec and Universal-Investment GmbH 7%.

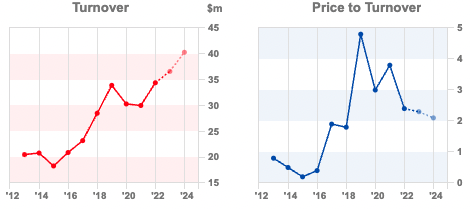

Valuation: The shares are trading on a very expensive looking 69x PER Dec 2023F. Price to turnover is a more modest 2.1x the same year. Sharepad shows that it has traded as high as 5x turnover pre-pandemic, so it’s de-rated significantly over the last couple of years on that basis.

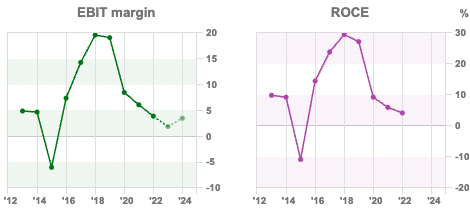

£20m of cash translates as 30% of the market cap. Although the business was loss-making in H1 this year, the 3-year average RoCE is 14.2% and 3-year average EBIT margin 11%.

Opinion: Hopefully as the business grows we should see some operational gearing and improved profitability. The cash on the balance sheet means that the downside is protected, but I do wonder if companies will cut back on NPD spending because of inflation. Sopheon’s product also seems to be rather niche – for instance, could they generate north of $50m of revenue in a few years’ time? If yes, then the current valuation could be a bargain, but it’s hard to form a strong conviction about the future prospects.

Notes

The author owns shares in Smoove

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 30/08/22 |SMV, KBT, SPE| Interest rates: the first 5,000 years

Central Bankers are having their annual shindig in Jackson Hole, so Bruce looks at the long-term history of interest rates and questions how much policy rates control activity and inflation. Companies covered SMV, KBT and SPE.

The FTSE 100 was down -0.7% last week. The S&P500 and Nasdaq100 were also down less than -1% over the same time period. US bond yields rose back above 3% to 3.08%, we could see further reaction following last week’s Jackson Hole annual shindig for Central Bankers. The theme this year is ‘reassessing constraints on the economy and policy’. In other words, Central Bankers have realised that they can neither keep interest rates low indefinitely nor continue to buy government bonds, without running into concerns about fiscal sustainability or the size of Central Bank balance sheets.

Meanwhile, Edward Chancellor has gone back to Mesopotamia in the 3rd century BC to look at the history of interest rates. He starts his book, The Price of Time with a cheerful quote:

Our earth is degenerate in these latter days: bribery and corruption are common; children no longer obey their parents; every man wants to write a book, and the end of the world is evidently approaching.

Good to see that bearish economic commentary is not a new phenomenon. Sharepad doesn’t have UK interest rates back to the Assyrian empire, but the chart below of 120 years is still impressive. The code is UK.INTT if you’d like to recreate the graph.

Edward Chancellor suggests that Central Bankers haven’t thought very deeply about the nature of interest, they assume short-term policy rates are the best tool for controlling activity. Superficially this has worked over the last couple of decades, but also led to asset price inflation and large debt burdens. That means risk has built up elsewhere in the financial system, he says. Rather than seeing interest rates as a tool to control behaviour, he suggests instead that Central Bank policy can’t compensate for dislocations within society.

I think that’s correct. Here’s a photo of me withdrawing my first million (Belarussian Roubles) from a cash point in Minsk a few years ago. I’m wondering which country I will next be able to withdraw a million from a cashpoint. The Turkish Lira has risen to 18 TRY/USD, the currency weakening 27% YTD, inflation is currently 80% per annum v Central Bank interest rates at 13%.

Meanwhile, the Swiss National Bank still has a policy of negative interest rates, as the strong currency seems to be supported by the decentralised political power among the Cantons. It’s similar to my point that companies which report above-average returns for longer, have Chief Executives who are prepared to decentralise power.

Chancellor thinks that we’ll see interest rates at artificially low rates and household and government debt will be eroded in real terms by inflation. That’s also what Merryn Somerset Webb suggested when she interviewed Andy Haldane last year, to which he replied ‘no, no – that’s not in our mandate’. He then quit the BoE last year. That may prove to be very good timing.

This week I look at Smoove, formerly ULS Technology which is trying to disrupt the property conveyancing market. Plus enterprise software companies K3 Business Technology and Sopheon. Both Sopheon and Smoove are holding plenty of cash (30% and 50% of their market cap respectively), though that cash hasn’t provided much support in the market sell-off, with SPE down -32% YTD and SMV down -24% YTD.

Smoove FY to March

This conveyancing company (previously known as ULS technology) that is trying to disrupt the conveyancing market and home moving process announced FY March results. As it has taken them almost 6 months to release results, we can already be confident that the numbers are disappointing.

Sure enough, they reported a statutory loss before profits of £4.9m, despite revenue on continuing operations rising +13% to £19m. Net cash was down by £4m to £20m. As a reminder, they sold Conveyancing Alliance Limited (CAL) in November 2020 for £27m, which resulted in a large cash balance, but revenues roughly halved from £30m FY Mar 2019. They have announced a tender offer of up to £5m, which they will seek approval for at their AGM in late September. They expect to complete the tender offer during October.

That still leaves the company with £15m of cash, which could be taken as a positive because it means they are not in financial distress. On the negative side, it might imply that management sees several years of losses ahead. Inflation is clearly reducing the value of their cash at double-digit rates too.

There are no forecasts from Panmure and the outlook statement lacks any detailed guidance. The company intends to hold a Capital Markets Day in October or November when they will begin giving forecast guidance and also do a demonstration of the product and a strategy update. For now, they mention Smoove Start, a subscription revenue business aimed at estate agents and Smoove Complete, aimed at conveyancing lawyers and which builds on their purchase of Lancashire-based Amity Law (£305K total consideration).

The group used to tout their DigitalMove product, which was supposed to be an online platform making buying and selling houses easier. They then wrote off £1.5m of capitalised development costs related to DigitalMove in FY Mar 2021 and it seems to be downplayed in the commentary too. I had an email exchange with the financial PR (Walbrook) who denied this and said DigitalMove was still a key part of the strategy, particularly the onboarding process.

SMV management have reported three different figures for number of cases DigitalMove has completed. In their April RNS, they said 75,000, in last week’s statement that has grown to 88,000 ‘to date’ while last week’s presentation says 78,000 to end of March. Again, I asked their financial PR for clarification, the 75K v 78K is just a rounding error and represents instructions to end of March, whereas the 88K refers to instructions to the end of June.

Other ‘voluntary disclosure’ decisions (ie no forecasts in the market, removing previous presentations from the website) also imply that progress has not been to plan. Theoretically, this ought to be an exciting growth story, but my impression is that management appears to be throwing mud at the wall to see what sticks. That’s a shame because the company was reporting above 30% RoCE and an impressive EBIT margin a couple of years ago.

Valuation: Housing market transactions have been strong in the last couple of years because of low-interest rates and stamp duty holidays, so it’s not clear how sustainable that double-digit revenue growth just reported is. The shares are trading on 2.2x FY March 2022 revenues.

Opinion: The cash on the balance sheet represents 50% of the market cap. However, with just £5m of capital return in the tender offer, it seems like the bulk of the money will be re-invested in the business. That means the investment case depends on management successfully disrupting the conveyancing market. They haven’t articulated what hasn’t worked in the past and what they will do differently. Hopefully, they can tell a good story at the Capital Markets Day, so although I own some shares I’m going to wait till then before deciding whether to increase my position or sell.

K3 Business Tech H1 to May

This enterprise software company announced revenue from continuing operations down -5% to £19.9m. Recurring (or predictable) revenue is 74%, and gross margin is 60%, so this ought to be an attractive business. However, despite the recurring revenue and high gross margin, they reported a loss of £2.8m. The cash flow statement is a bit concerning, with net cash from operations minus £5.2m, driven mainly by a large negative working capital movement of £5.7m.

Net cash was just £1.4m at the end of May, though they expect that to be ‘significantly higher’ at the Nov year-end. Shareholders equity was £34m, but after deducting goodwill and other intangible assets that drop to less than £2m of tangible equity. The company has been loss-making since 2016, so Sharepad’s quality measures are not encouraging.

The company makes software that helps retailers (including IKEA) manage their operations and distribution. Clearly, the retail sector has had a challenging couple of years, and KBT had a difficult start to the pandemic, before trebling peak to trough in from mid-2020 to mid-2021, but seems to be struggling in 2022 with the shares down -25% YTD.

Outlook: Management sound surprisingly upbeat, talking about growth opportunities, cash generation and cost management. They say that trading in June and July has been encouraging, with the level of deals signed ahead of last year, as well as an increase in average software deal size. They talk about a historic seasonal H2 weighting, which is easy to check using Sharepad’s ‘quarterly’ tab. Unfortunately, their claim doesn’t stand up to scrutiny, with £23m turnover in H1 for the previous two years v FY turnover of £44m and £45m.

Forecasts: FinnCap their broker haven’t published any forecasts, presumably at the management’s request. FinnCap says that ‘while the Group has clear visibility on the pipeline for existing contract renewals, timing for new licence-based contract wins is unpredictable especially in current macroeconomic circumstances, giving rise to challenges to forecasting.’ That implies that revenue could be hit if retailers continue to struggle? I note that revenue has fallen from £118m in FY Nov 2017 to £45m Nov 2021 – with that sort of decline it’s going to be hard to cut costs fast enough.

Valuation: The shares are trading on 1.5x annualised revenue, which is not obviously cheap for a company where forecasting is difficult and which doesn’t have a strong balance sheet.

Opinion: I’m wary of management sounding upbeat and talking up their H2, but failing to back this up with broker forecasts. It seems to me the macro environment is going to be harder for KBT’s retailing clients over the coming months. KBT is an ‘avoid’ for me. Perhaps at some point, it could be an interesting turn-around story, but the shares are not yet trading at a distressed valuation.

Sopheon H1 to June

This is another enterprise software company, their products help with New Product Development (NPD) announced H1 revenue down -5% to $15.7m. However, they have good visibility on FY revenue, which they say is $34m up +9% versus the same time last year. The company also point investors to Annual Recurring Revenue (ARR) of $21.9m, growing at +12%. The company has a 98% client retention rate year to date, so it seems that once corporates start using their software, it becomes embedded in the processes.

FinnCap left their estimates unchanged, but are forecasting $37m FY 2022F revenue, implying +8% forecast FY revenue growth. Like KBT above, the high proportion of recurring revenue hasn’t prevented the company from reporting a loss (£791K for H1). Unlike KBT though, the cash generated from operations at £5.5m looks very healthy and the group has plenty of net cash of $23.5m.

In May Sopheon made a small acquisition, called Solverboard, for £750K initial consideration, plus £1.55m earn-out linked to ARR targets. They also announced this August a 5-year, $11.2m 5-year contract win with the US Navy, which is the single largest deal in the company’s history. That seems like good validation of Sopheon’s flagship Accolade product, which helps companies meet launch dates and reduce time to market by 15-30% and automate NPD. The Sopheon website claims that Accolade increases product success rates by up to 50%, although I think it would be hard to verify their claims independently. I also note that SPE revenues were $20m a decade ago, so this seems like a niche product with limited growth prospects.

Outlook: The outlook statement talks about commercial traction building, with Andy Michuda the Executive Chairman saying that this is one of the most exciting periods in his time at Sopheon. He was Chief Executive from 2000 onwards, before being appointed Exec Chair in March 2021. I note though that he owns just 0.6% of the shares and looking at Sharepad’s dealing history he doesn’t seem to have used this year’s share price weakness to buy more shares.

Ownership: There’s a large shareholder Myrtledare Corp/Rivomore Limited which owns 19.5% of the shares outstanding, down from 24% a couple of years ago. A google search reveals nothing on Rivomore, except that it was registered in the Isle of Man, with a British Virgin Islands address. I spoke to the broker (FinnCap) who said that Myrtledar/Rivomore were on friendly terms with the management, and have been long-term holders. Other large shareholders are Barry Mence 18%, who co-founded the business in 1993 and is now a Non-Exec and Universal-Investment GmbH 7%.

Valuation: The shares are trading on a very expensive looking 69x PER Dec 2023F. Price to turnover is a more modest 2.1x the same year. Sharepad shows that it has traded as high as 5x turnover pre-pandemic, so it’s de-rated significantly over the last couple of years on that basis.

£20m of cash translates as 30% of the market cap. Although the business was loss-making in H1 this year, the 3-year average RoCE is 14.2% and 3-year average EBIT margin 11%.

Opinion: Hopefully as the business grows we should see some operational gearing and improved profitability. The cash on the balance sheet means that the downside is protected, but I do wonder if companies will cut back on NPD spending because of inflation. Sopheon’s product also seems to be rather niche – for instance, could they generate north of $50m of revenue in a few years’ time? If yes, then the current valuation could be a bargain, but it’s hard to form a strong conviction about the future prospects.

Notes

The author owns shares in Smoove

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.