In this kind of market, it’s tough sticking with your process, picking stocks on fundamentals.

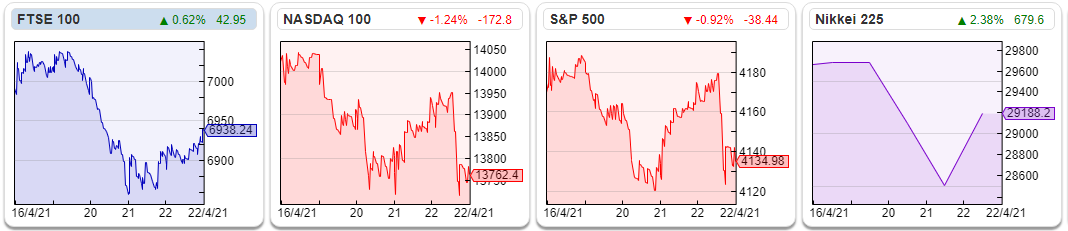

The US 10y bond yield, having peaked at around 1.75% earlier this month has fallen back to 1.57%, suggesting that some risk aversion is coming back to markets. Nasdaq was off a couple of percent last week, and the FTSE All Share was down 1%. Gold rose 1%, but is still down 5% since the start of the year. We’re coming up to May, so if I was into market timing I’d probably look to top slice some holdings. As it is, I’m going to receive a hefty amount of cash from Wey Education’s cash bid, and I think I’ll wait a few months before putting that money back into the stock market.

Assuming that you’re reading this on Monday 26th, the next Mello Event is this evening, with React, Trident Royalties, Belvoir and Wentworth Resources presenting, plus the evening culminates with the “BASH” where 3-4 people present their best investment idea. SharePad users can use this discount code which gives you a 50% reduction (so less than £10): MMScope21. I’ve heard whispered talk of a top-secret Discord channel where a few of the audience discuss the Mello presentations and the BASH ideas among themselves. Some of it is well -informed financial observations, but being an anonymous online forum apparently there are also some more colourful comments. I’m sure that it is all meant in good jest.

In any case, my source informs me that one of the more astute comments on the Discord forum was that none of the investment cases being made were obvious bargains. Perhaps, if some of the finest minds in the AIM investment community weren’t presenting convincing ideas, then market conditions are as frothy as a Bavarian’s beer glass? The FTSE All share is up +20% and AIM is up +29% so most of us owning equities should have done well in the last six months.

David Einhorn of Greenlight Capital’s rural New Jersey deli with amazing pastrami, sales of $35K but a $100m (or $2bn if you include the warrants) market cap, whose largest shareholder and CEO/CFO/Treasurer is also a high school wrestling coach, has been delisted. Whatever else Hometown International is, the deli is not a meme stock, it is not popular with the Wall Street Bets crowd on Reddit, and as Matt Levine of Bloomberg points out, you can’t trade it on Robinhood. Still it could be the equivalent of Michael Lewis’ 2007 Mexican strawberry picker in Bakersfield, California from his book ‘The Big Short’. With an income of $14,000 and no English, the strawberry picker was lent $724,000 at 100% Loan to Value to buy a house? In this kind of market, it is tough sticking with your process, picking stocks on fundamentals. It’s even tougher if you’re a strawberry picker or deli owner trying to stick to your day job.

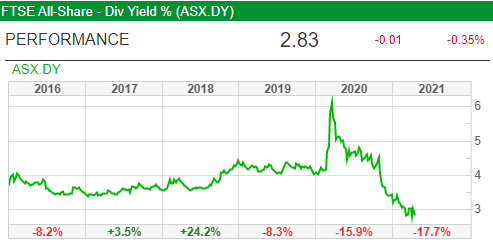

I’ve been playing about with some of the “macro” features on SharePad, and came across the index PER and dividend yields. Earnings for many companies would have been depressed, so it’s understandable that the index PE ratio looks high, but the dividend yield of the FTSE Allshare has fallen to 2.8%, which is well below the historic average, another reason to be cautious.

This week I look at a couple of companies where there is considerable management judgement in the accounting numbers. Revenue recognition and accruals accounting has tripped investors up before in the support services sector. Also fair value and acquisition accounting adjustments are fertile ground for companies who can use the opportunity to flatter their p&l numbers. My comments on Cerillion and RBGP may seem harsh, but we’re in a bull market where often investors are prepared to accept headline numbers and not delve too deeply below the surface. But that will not always be the case; I think that it’s important to have a rough idea where the rocks and sandbars are, so you don’t run aground when the tide goes out. Also covered this week is D4t4, which looks an interesting story in the same arena as Palantir and Snowflake.

Cerillion H1 Trading Update (Sept y/e)

This mobile billing company has said H1 to March has been its strongest ever. H1 revenue is up +25% to £12.8m and adjusted EBITDA is expected to be approximately £4.8m, a +77% increase. It’s worth noting that last year the company capitalised £1.1m of internally-generated software costs, and amortised £700K. The amortisation charge of £1.9m (which includes goodwill amortisation, as well as internally generated software) is larger than the depreciation charge of £1.1m. This really is a business that has very limited fixed assets and the value is in the intangibles.

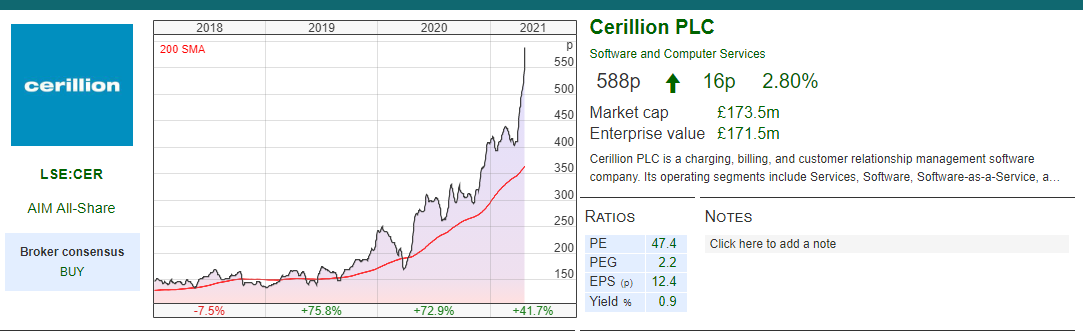

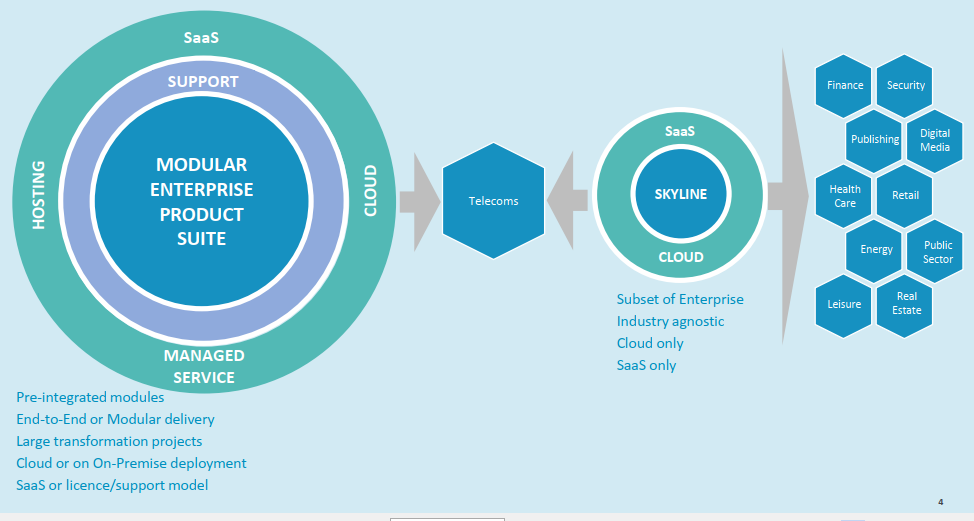

History The company’s history goes back to 1992, when it was the customer billing division of Logica. Louis Hall (current Chief Exec) and Guy O’Connor then led a management buyout from Logica in 1999. In 2006 they opened a call centre in Pune, India, which allowed them to win contracts in countries as diverse as Guinea, Gambia, Mauritania and Kenya. In 2013 they introduced “real time” (convergent) billing, which increased the addressable market and is viewed by management as a key differentiator vs competitors. Cerillion listed on AIM in March 2016, with a placing at 76p, raising £10m and valuing the company at £22.4m. I think management could explain better what they actually do: charging and CRM software mainly to telco’s but also to other industry sectors, including finance and utilities. I’ve included this product market overview from their slide presentation on the next page, although I’m not sure that helps either. They do include case studies on their website.

Risks This is a company with accruals of £8.5m at FY 2020 or 41% of revenue. There’s a chapter in Tim Steer’s book The Signs Were There on accruals accounting; management discretion plays a part in when to recognise revenue for multi-year contracts. Accrued income is uninvoiced income and is therefore only an estimate of what the company thinks that it is owed. Support services companies like Carillion were over optimistic in the past, or the worry is management are tempted to change the accruals assumptions in order to hit their numbers, which is what Utilitywise did. This merely builds up problems for the future and inevitably ends badly.

In Cerillion’s FY to Sept 2020 accruals grew +19% to £8.5m which outpaced revenue +11% to £20.8m. Worth noting too that last year Cerillion paid just £28K of tax on PBT of £2.6m. As I said with Burford, a couple of weeks ago, a low tax charge can indicate that statutory profits are lower quality. That said, unlike Burford or Carillion, Cerillion did have net cash on 31 March 2021 up +60% to approximately £7.7m (31 March 2020: £4.8m). Plus the Chief Exec owns 30.5% of the company, which hopefully means shareholders’ interests are aligned with management. However accruals and the tax charge are a couple of numbers to keep an eye on when the H1 results are released on the 17th May.

A couple of other risks are I) there is significant customer concentration, with the largest customer being 21.5% of FY 2020 revenue, and the top 10 customers are 80% of revenue. II) Management also flagged that they expect their customers to switch to managed service agreements, which would require more investment from the group. Within group revenue growth of +11% Sept FY 2020, rather unusually Software as a Service (Saas) revenue was down -16%, with “services” revenue picking up the slack, growing +43%.

Ownership Chief Exec Louis Hall owns 30.5%, Canaccord 16%, Gresham House 14.1% and BlackRock 6%. 63% of the company’s shares are not in public hands, so I wouldn’t be too worried about the lack of institutions on the shareholder register, as they’d struggle with the lack of free float.

Valuation Gross margin is an impressive 74%, but ROCE is a less impressive 13.8% FY Sept 2020 for a share on PER of 37x. If revenue growth continues, perhaps this could see increasing returns to justify the high valuation? Liberum, their broker, are forecasting EPS 15.5p FY Sept 2021 and 16p FY Sept 2022. As an aside, interestingly both ROE 16.5% and CROCI 25.8% FY Sept 2020 are higher than ROCE, according to SharePad. Normally companies can use leverage to improve ROE vs ROCE because Capital Employed would be a higher number than Equity. I find it odd that Cerillion has net cash of £4.4m last year, yet ROE is higher than ROCE.

Opinion I came across this company when it listed, because Lord Lee mentioned it at a ShareSoc event in Richmond upon Thames. I’m generally sceptical of IPOs, so I bought Quarto who were presenting at the event, which hasn’t worked out for me.

Quarto shares were down -80% at one point last year, whereas Cerillion is up 8x from its IPO price. I’m cautious on Cerillion for the reasons outlined above, but well done to holders who have enjoyed significant gains.

D4t4 H2 Trading Update (March y/e)

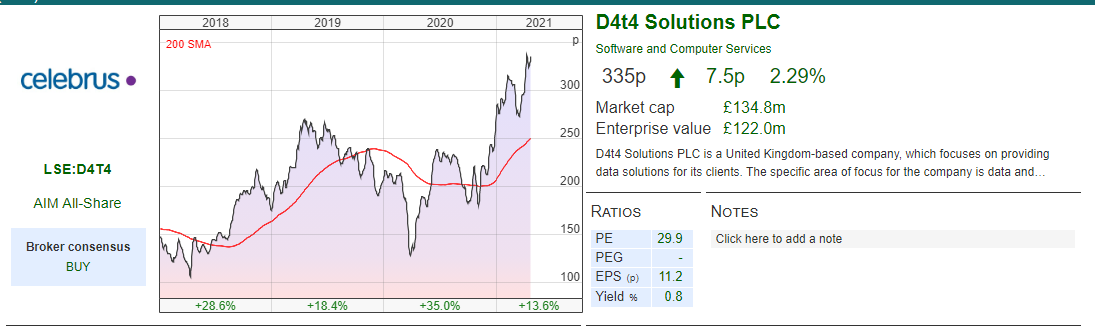

This enterprise data company had a strong H2, and now expects to report revenues of £22.8m (up +5% vs FY Mar 2020) and adjusted PBT of £4.8m (down -5% vs FY March 2020). Year end cash balance was £14.2m (v £12.8m FY 2020) and the group has no debt at the year end.

This enterprise data company had a strong H2, and now expects to report revenues of £22.8m (up +5% vs FY Mar 2020) and adjusted PBT of £4.8m (down -5% vs FY March 2020). Year end cash balance was £14.2m (v £12.8m FY 2020) and the group has no debt at the year end.

Their main product is Celebrus, which has two offerings: the Customer Data Platform (CDP) which captures customer behaviour across digital channels, and Customer Data Management (CDM) which gives multi-dimensional views for personalisation, recommendation systems, risk, fraud and analytics. The Chief Exec, Peter Kier, who co-founded the business in 1985 is stepping down, to be replaced by an internal appointment, Bill Bruno, currently head of the US operations.

History Founded as IS Solutions in 1985 as a hardware re-seller, this company started life as a listed stock on the LSE in 1997, before moving down to AIM in 2008. The reason given in the Admission Doc was that the listing requirements gave greater flexibility for corporate transactions.

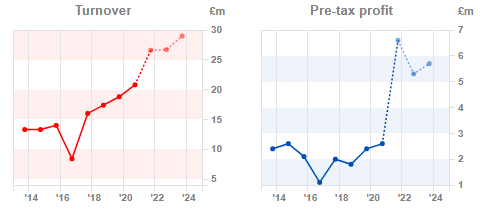

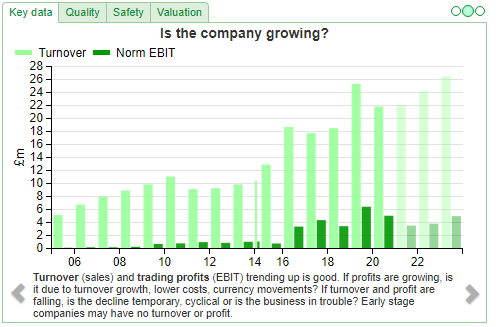

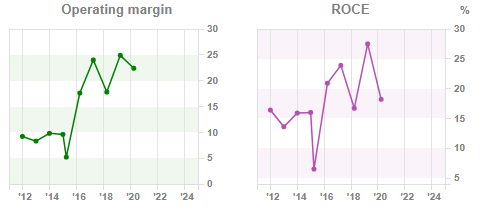

In 2015, IS Solutions acquired Speed Trap Holdings for £7.5m, which operated Celebrus, an enterprise customer data platform that is now the company’s core offering, and one year later rebranded as D4t4. At the time Speed Trap / Celebrus was loss-making, with revenue of £2m. The chart on the previous page shows that IS/D4t4 struggled for revenue growth in the wake of the financial crisis, but eventually recovered. The more recent dip from peak revenue in 2019A of £25.2m and Adjusted PBT of £6m, has been caused by a switch from perpetual licencing model to a recurring SaaS model. Recurring revenue is currently £10.6m or 46% of total revenue, up from 29% 2 years ago. Since the acquisition both operating margin and ROCE have improved, as you can see from the charts below.

I should mention that, like Cerillion, D4t4 also has accrued income on its balance sheet, though the amount is much smaller: £1.5m or 7% of last year’s revenue vs £8.5m or 41% of revenue for Cerillion.

Ownership Canaccord are the largest holder with 18%. Then Ennismore (who I haven’t heard of before) 8% and Herald the tech specialists own 6.8%. The departing co-founder Chief Exec owns 4%. 25.52% of shares are not in public hands.

Valuation FinnCap, their broker, updated their FY March 2021 forecasts accordingly, but left next year’s revenue of £24m and adjusted EPS of 8.0p unchanged. This gives 40x PER for a company that reported ROCE of 18% FY to March 2020. Though it’s encouraging to see contract wins, rollout of a new fraud prevention product and revenue growth this year and next, I’d like to see management confident enough to give their broker a better steer.

Opinion D4t4 sounds like it is in similar areas to the new wave of US tech companies, like Snowflake and Palantir, which means that it should attract a high valuation as long as they are not in exactly the same space and might lose out. The PER looks expensive, but it seems to me that they have asked their broker to be cautious, so we could see forecasts increased when the company reports on 29th June. Management also point to a new fraud prevention product that they’ve been working on for 2 years, scheduled to be launched this June, which might increase costs in the short term, but could be significant in the future if the rollout is successful.

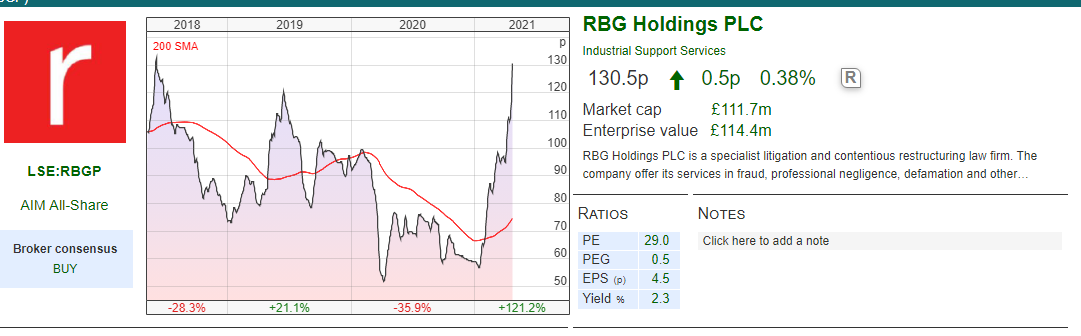

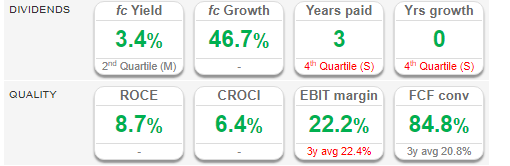

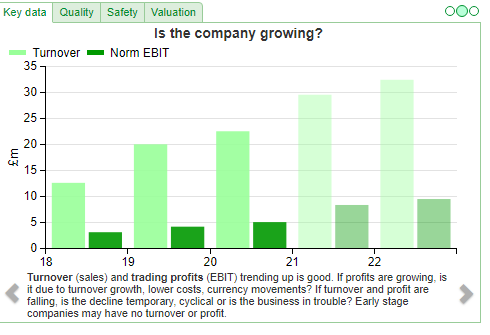

RBGP Acquisition and FY 2020 Results

RBGP Holdings, the law and corporate finance firm announced FY Dec 2020 results, with revenues up +8% to £25.6m and PBT up +1% to £7.7m. However that £7.7m is flattered by two large items, without which profits would have been down -56%.

RBGP Holdings, the law and corporate finance firm announced FY Dec 2020 results, with revenues up +8% to £25.6m and PBT up +1% to £7.7m. However that £7.7m is flattered by two large items, without which profits would have been down -56%.

Adjustments The first item is a £2.6m write back from the Convex Capital earnout. Checking back, the earnout was originally £4.38m (recognised on the 2019 balance sheet within “other payables”) of which £1.8m was to be paid in cash and £2.6m to be paid in shares at 92p, so it looks as if the £2.6m worth of shares that RBGP are not now going to issue to Convex staff has been written back through the p&l.

If the earn out had been achieved, revenue and profits would have been higher so perhaps I’m being harsh when I say this write back has flattered profits? But the tax man certainly doesn’t consider this write back as profit and I think investors need to be careful of acquisition accounting where there is an a-symmetry between adjustments made directly to the balance sheet, and later writing back amounts to the p&l. This was a favourite Fred Goodwin trick, to write down the value of fixed assets when RBS bought another bank, and he would afterwards spend the next few years writing up the value or releasing a provision which flattered profits. I note that RBGP shows an increase in “trade and other payables” of just £711K in the FY 2019 cashflow statement, but a £4.8m increase to £6.7m on the face of the 2019 balance sheet. Normally I’d expect the two figures to reconcile, which they do in the 2020 Annual Report (a £2.8m decrease in trade and other payables to £3.9m recorded on the face of the balance sheet) ex the £1m increase in long term payables which is the grant of options over LionFish, RBGP’s litigation funding arm which they launched in May 2020. Probably the payables on the 2020 cashflow statement should include the LionFish liabilities, but I can at least see why the numbers are different, whereas the 2019 numbers followed by the 2020 write back make much less sense to me.

That said perhaps the earnout has done what it was supposed to do and aligned the interests of Convex Capital staff, the corporate finance business they acquired in Sept 2019, with the interests of RBGP shareholders? Convex only completed two deals in FY 2020 (generating revenues of just £1.6m) due to the pandemic (hence the staff didn’t receive an earnout for last year), but there’s clearly been a lot of pent-up demand with 7 deals completed and £4.5m of revenue so far this year. They say that there are 33 deals in the pipeline. So judging the acquisition just on 2020 performance is unfair; it may prove a well-timed deal after all if market conditions remain buoyant.

The second item which flatters RBGP 2020 profits is a £1.9m fair value adjustment from litigation assets (there wasn’t an equivalent item in 2019). If we take the “hairshirt” approach of deducting both items from statutory PBT, then the fall is -56% vs 2019. Notable too that RBGP reports a low tax rate of 13% on their statutory PBT, which is even lower than Burford’s 18% rate.

Acquisition RBGP also announced the acquisition of Memery Crystal for £30m (£12m in cash, £11.2m of RBGP shares at 115p, and £6.8m in cash deferred across 12 months). Memery reported revenues of £23.4m and PBT of £8m last year. At 31 Dec RBGP had net cash of £3.5m, so the cash element of the purchase price is being funded with debt (Revolving Credit Facility £15m and acquisition financing of £10m). RBGP held a Capital Markets Day in February, and I wonder if this was to drum up interest so that management can come back to investors for more money?

This would seem sensible; I wouldn’t recommend investing in a company that was using debt finance to acquire highly cyclical people businesses. But it does highlight that RBGP expansion is likely to also mean that the share count increases too.

Outlook The business has traded within management’s expectations in Q1. They also point out that difficult times drive revenues at law firms specialising in contentious matters.

Balance sheet There were £6.3m of litigation assets recorded at fair value on the balance sheet at 31 Dec 2020, up from £2.2m the previous year. Of this, £1.9m was written up through the p&l, with the rest of the difference being additions/realisations netting off to £2.2m. At the year end there were £35.4m of intangible assets, of which £33m was goodwill and £1.3m brand. Also included within intangible assets is a £1m one-off payment made to Ian Rosenblatt for extending a non-compete clause, that was originally put in place at the IPO to an additional term through to 2023. Intangible assets look set to increase with the acquisition of Memery Crystal, and I would expect to see the group report negative tangible book value because shareholders’ equity was £40.5m at Dec 2020, so just £5m of tangible book value (i.e. shareholders equity less intangibles).

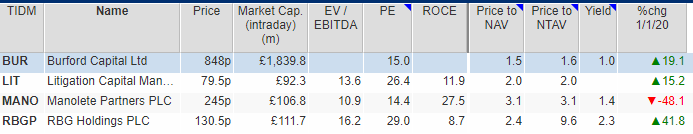

Valuation Law firms and litigation finance companies were supposed to offer returns uncorrelated with the stock market, but that hasn’t really played out in the 2020 sell off and rebound. RBGP is trading on a PER of 29x and looks very expensive on a price to net tangible book 9.6x, given so much of the balance sheet is intangibles. The shares are up +42% since the start of last year, and have doubled since the start of this year.

Opinion Inevitably management describe their balance sheet as “solid”, but to my mind with the intangibles and fair value assets it looks to me more like a colloid (mayonnaise perhaps). I think that it’s likely that they come back and ask shareholders for more money, but as long as the acquisition strategy works then maybe that’s no bad thing. Of the litigation companies, I own Burford, but am also tempted by Manolete after its share price decline.

Bruce Packard

Notes

The author owns shares in Burford

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary 26/04/21: A strawberry picker’s market?

In this kind of market, it’s tough sticking with your process, picking stocks on fundamentals.

The US 10y bond yield, having peaked at around 1.75% earlier this month has fallen back to 1.57%, suggesting that some risk aversion is coming back to markets. Nasdaq was off a couple of percent last week, and the FTSE All Share was down 1%. Gold rose 1%, but is still down 5% since the start of the year. We’re coming up to May, so if I was into market timing I’d probably look to top slice some holdings. As it is, I’m going to receive a hefty amount of cash from Wey Education’s cash bid, and I think I’ll wait a few months before putting that money back into the stock market.

Assuming that you’re reading this on Monday 26th, the next Mello Event is this evening, with React, Trident Royalties, Belvoir and Wentworth Resources presenting, plus the evening culminates with the “BASH” where 3-4 people present their best investment idea. SharePad users can use this discount code which gives you a 50% reduction (so less than £10): MMScope21. I’ve heard whispered talk of a top-secret Discord channel where a few of the audience discuss the Mello presentations and the BASH ideas among themselves. Some of it is well -informed financial observations, but being an anonymous online forum apparently there are also some more colourful comments. I’m sure that it is all meant in good jest.

In any case, my source informs me that one of the more astute comments on the Discord forum was that none of the investment cases being made were obvious bargains. Perhaps, if some of the finest minds in the AIM investment community weren’t presenting convincing ideas, then market conditions are as frothy as a Bavarian’s beer glass? The FTSE All share is up +20% and AIM is up +29% so most of us owning equities should have done well in the last six months.

David Einhorn of Greenlight Capital’s rural New Jersey deli with amazing pastrami, sales of $35K but a $100m (or $2bn if you include the warrants) market cap, whose largest shareholder and CEO/CFO/Treasurer is also a high school wrestling coach, has been delisted. Whatever else Hometown International is, the deli is not a meme stock, it is not popular with the Wall Street Bets crowd on Reddit, and as Matt Levine of Bloomberg points out, you can’t trade it on Robinhood. Still it could be the equivalent of Michael Lewis’ 2007 Mexican strawberry picker in Bakersfield, California from his book ‘The Big Short’. With an income of $14,000 and no English, the strawberry picker was lent $724,000 at 100% Loan to Value to buy a house? In this kind of market, it is tough sticking with your process, picking stocks on fundamentals. It’s even tougher if you’re a strawberry picker or deli owner trying to stick to your day job.

I’ve been playing about with some of the “macro” features on SharePad, and came across the index PER and dividend yields. Earnings for many companies would have been depressed, so it’s understandable that the index PE ratio looks high, but the dividend yield of the FTSE Allshare has fallen to 2.8%, which is well below the historic average, another reason to be cautious.

This week I look at a couple of companies where there is considerable management judgement in the accounting numbers. Revenue recognition and accruals accounting has tripped investors up before in the support services sector. Also fair value and acquisition accounting adjustments are fertile ground for companies who can use the opportunity to flatter their p&l numbers. My comments on Cerillion and RBGP may seem harsh, but we’re in a bull market where often investors are prepared to accept headline numbers and not delve too deeply below the surface. But that will not always be the case; I think that it’s important to have a rough idea where the rocks and sandbars are, so you don’t run aground when the tide goes out. Also covered this week is D4t4, which looks an interesting story in the same arena as Palantir and Snowflake.

Cerillion H1 Trading Update (Sept y/e)

This mobile billing company has said H1 to March has been its strongest ever. H1 revenue is up +25% to £12.8m and adjusted EBITDA is expected to be approximately £4.8m, a +77% increase. It’s worth noting that last year the company capitalised £1.1m of internally-generated software costs, and amortised £700K. The amortisation charge of £1.9m (which includes goodwill amortisation, as well as internally generated software) is larger than the depreciation charge of £1.1m. This really is a business that has very limited fixed assets and the value is in the intangibles.

History The company’s history goes back to 1992, when it was the customer billing division of Logica. Louis Hall (current Chief Exec) and Guy O’Connor then led a management buyout from Logica in 1999. In 2006 they opened a call centre in Pune, India, which allowed them to win contracts in countries as diverse as Guinea, Gambia, Mauritania and Kenya. In 2013 they introduced “real time” (convergent) billing, which increased the addressable market and is viewed by management as a key differentiator vs competitors. Cerillion listed on AIM in March 2016, with a placing at 76p, raising £10m and valuing the company at £22.4m. I think management could explain better what they actually do: charging and CRM software mainly to telco’s but also to other industry sectors, including finance and utilities. I’ve included this product market overview from their slide presentation on the next page, although I’m not sure that helps either. They do include case studies on their website.

Risks This is a company with accruals of £8.5m at FY 2020 or 41% of revenue. There’s a chapter in Tim Steer’s book The Signs Were There on accruals accounting; management discretion plays a part in when to recognise revenue for multi-year contracts. Accrued income is uninvoiced income and is therefore only an estimate of what the company thinks that it is owed. Support services companies like Carillion were over optimistic in the past, or the worry is management are tempted to change the accruals assumptions in order to hit their numbers, which is what Utilitywise did. This merely builds up problems for the future and inevitably ends badly.

In Cerillion’s FY to Sept 2020 accruals grew +19% to £8.5m which outpaced revenue +11% to £20.8m. Worth noting too that last year Cerillion paid just £28K of tax on PBT of £2.6m. As I said with Burford, a couple of weeks ago, a low tax charge can indicate that statutory profits are lower quality. That said, unlike Burford or Carillion, Cerillion did have net cash on 31 March 2021 up +60% to approximately £7.7m (31 March 2020: £4.8m). Plus the Chief Exec owns 30.5% of the company, which hopefully means shareholders’ interests are aligned with management. However accruals and the tax charge are a couple of numbers to keep an eye on when the H1 results are released on the 17th May.

A couple of other risks are I) there is significant customer concentration, with the largest customer being 21.5% of FY 2020 revenue, and the top 10 customers are 80% of revenue. II) Management also flagged that they expect their customers to switch to managed service agreements, which would require more investment from the group. Within group revenue growth of +11% Sept FY 2020, rather unusually Software as a Service (Saas) revenue was down -16%, with “services” revenue picking up the slack, growing +43%.

Ownership Chief Exec Louis Hall owns 30.5%, Canaccord 16%, Gresham House 14.1% and BlackRock 6%. 63% of the company’s shares are not in public hands, so I wouldn’t be too worried about the lack of institutions on the shareholder register, as they’d struggle with the lack of free float.

Valuation Gross margin is an impressive 74%, but ROCE is a less impressive 13.8% FY Sept 2020 for a share on PER of 37x. If revenue growth continues, perhaps this could see increasing returns to justify the high valuation? Liberum, their broker, are forecasting EPS 15.5p FY Sept 2021 and 16p FY Sept 2022. As an aside, interestingly both ROE 16.5% and CROCI 25.8% FY Sept 2020 are higher than ROCE, according to SharePad. Normally companies can use leverage to improve ROE vs ROCE because Capital Employed would be a higher number than Equity. I find it odd that Cerillion has net cash of £4.4m last year, yet ROE is higher than ROCE.

Opinion I came across this company when it listed, because Lord Lee mentioned it at a ShareSoc event in Richmond upon Thames. I’m generally sceptical of IPOs, so I bought Quarto who were presenting at the event, which hasn’t worked out for me.

Quarto shares were down -80% at one point last year, whereas Cerillion is up 8x from its IPO price. I’m cautious on Cerillion for the reasons outlined above, but well done to holders who have enjoyed significant gains.

D4t4 H2 Trading Update (March y/e)

Their main product is Celebrus, which has two offerings: the Customer Data Platform (CDP) which captures customer behaviour across digital channels, and Customer Data Management (CDM) which gives multi-dimensional views for personalisation, recommendation systems, risk, fraud and analytics. The Chief Exec, Peter Kier, who co-founded the business in 1985 is stepping down, to be replaced by an internal appointment, Bill Bruno, currently head of the US operations.

History Founded as IS Solutions in 1985 as a hardware re-seller, this company started life as a listed stock on the LSE in 1997, before moving down to AIM in 2008. The reason given in the Admission Doc was that the listing requirements gave greater flexibility for corporate transactions.

In 2015, IS Solutions acquired Speed Trap Holdings for £7.5m, which operated Celebrus, an enterprise customer data platform that is now the company’s core offering, and one year later rebranded as D4t4. At the time Speed Trap / Celebrus was loss-making, with revenue of £2m. The chart on the previous page shows that IS/D4t4 struggled for revenue growth in the wake of the financial crisis, but eventually recovered. The more recent dip from peak revenue in 2019A of £25.2m and Adjusted PBT of £6m, has been caused by a switch from perpetual licencing model to a recurring SaaS model. Recurring revenue is currently £10.6m or 46% of total revenue, up from 29% 2 years ago. Since the acquisition both operating margin and ROCE have improved, as you can see from the charts below.

I should mention that, like Cerillion, D4t4 also has accrued income on its balance sheet, though the amount is much smaller: £1.5m or 7% of last year’s revenue vs £8.5m or 41% of revenue for Cerillion.

Ownership Canaccord are the largest holder with 18%. Then Ennismore (who I haven’t heard of before) 8% and Herald the tech specialists own 6.8%. The departing co-founder Chief Exec owns 4%. 25.52% of shares are not in public hands.

Valuation FinnCap, their broker, updated their FY March 2021 forecasts accordingly, but left next year’s revenue of £24m and adjusted EPS of 8.0p unchanged. This gives 40x PER for a company that reported ROCE of 18% FY to March 2020. Though it’s encouraging to see contract wins, rollout of a new fraud prevention product and revenue growth this year and next, I’d like to see management confident enough to give their broker a better steer.

Opinion D4t4 sounds like it is in similar areas to the new wave of US tech companies, like Snowflake and Palantir, which means that it should attract a high valuation as long as they are not in exactly the same space and might lose out. The PER looks expensive, but it seems to me that they have asked their broker to be cautious, so we could see forecasts increased when the company reports on 29th June. Management also point to a new fraud prevention product that they’ve been working on for 2 years, scheduled to be launched this June, which might increase costs in the short term, but could be significant in the future if the rollout is successful.

RBGP Acquisition and FY 2020 Results

Adjustments The first item is a £2.6m write back from the Convex Capital earnout. Checking back, the earnout was originally £4.38m (recognised on the 2019 balance sheet within “other payables”) of which £1.8m was to be paid in cash and £2.6m to be paid in shares at 92p, so it looks as if the £2.6m worth of shares that RBGP are not now going to issue to Convex staff has been written back through the p&l.

If the earn out had been achieved, revenue and profits would have been higher so perhaps I’m being harsh when I say this write back has flattered profits? But the tax man certainly doesn’t consider this write back as profit and I think investors need to be careful of acquisition accounting where there is an a-symmetry between adjustments made directly to the balance sheet, and later writing back amounts to the p&l. This was a favourite Fred Goodwin trick, to write down the value of fixed assets when RBS bought another bank, and he would afterwards spend the next few years writing up the value or releasing a provision which flattered profits. I note that RBGP shows an increase in “trade and other payables” of just £711K in the FY 2019 cashflow statement, but a £4.8m increase to £6.7m on the face of the 2019 balance sheet. Normally I’d expect the two figures to reconcile, which they do in the 2020 Annual Report (a £2.8m decrease in trade and other payables to £3.9m recorded on the face of the balance sheet) ex the £1m increase in long term payables which is the grant of options over LionFish, RBGP’s litigation funding arm which they launched in May 2020. Probably the payables on the 2020 cashflow statement should include the LionFish liabilities, but I can at least see why the numbers are different, whereas the 2019 numbers followed by the 2020 write back make much less sense to me.

That said perhaps the earnout has done what it was supposed to do and aligned the interests of Convex Capital staff, the corporate finance business they acquired in Sept 2019, with the interests of RBGP shareholders? Convex only completed two deals in FY 2020 (generating revenues of just £1.6m) due to the pandemic (hence the staff didn’t receive an earnout for last year), but there’s clearly been a lot of pent-up demand with 7 deals completed and £4.5m of revenue so far this year. They say that there are 33 deals in the pipeline. So judging the acquisition just on 2020 performance is unfair; it may prove a well-timed deal after all if market conditions remain buoyant.

The second item which flatters RBGP 2020 profits is a £1.9m fair value adjustment from litigation assets (there wasn’t an equivalent item in 2019). If we take the “hairshirt” approach of deducting both items from statutory PBT, then the fall is -56% vs 2019. Notable too that RBGP reports a low tax rate of 13% on their statutory PBT, which is even lower than Burford’s 18% rate.

Acquisition RBGP also announced the acquisition of Memery Crystal for £30m (£12m in cash, £11.2m of RBGP shares at 115p, and £6.8m in cash deferred across 12 months). Memery reported revenues of £23.4m and PBT of £8m last year. At 31 Dec RBGP had net cash of £3.5m, so the cash element of the purchase price is being funded with debt (Revolving Credit Facility £15m and acquisition financing of £10m). RBGP held a Capital Markets Day in February, and I wonder if this was to drum up interest so that management can come back to investors for more money?

This would seem sensible; I wouldn’t recommend investing in a company that was using debt finance to acquire highly cyclical people businesses. But it does highlight that RBGP expansion is likely to also mean that the share count increases too.

Outlook The business has traded within management’s expectations in Q1. They also point out that difficult times drive revenues at law firms specialising in contentious matters.

Balance sheet There were £6.3m of litigation assets recorded at fair value on the balance sheet at 31 Dec 2020, up from £2.2m the previous year. Of this, £1.9m was written up through the p&l, with the rest of the difference being additions/realisations netting off to £2.2m. At the year end there were £35.4m of intangible assets, of which £33m was goodwill and £1.3m brand. Also included within intangible assets is a £1m one-off payment made to Ian Rosenblatt for extending a non-compete clause, that was originally put in place at the IPO to an additional term through to 2023. Intangible assets look set to increase with the acquisition of Memery Crystal, and I would expect to see the group report negative tangible book value because shareholders’ equity was £40.5m at Dec 2020, so just £5m of tangible book value (i.e. shareholders equity less intangibles).

Valuation Law firms and litigation finance companies were supposed to offer returns uncorrelated with the stock market, but that hasn’t really played out in the 2020 sell off and rebound. RBGP is trading on a PER of 29x and looks very expensive on a price to net tangible book 9.6x, given so much of the balance sheet is intangibles. The shares are up +42% since the start of last year, and have doubled since the start of this year.

Opinion Inevitably management describe their balance sheet as “solid”, but to my mind with the intangibles and fair value assets it looks to me more like a colloid (mayonnaise perhaps). I think that it’s likely that they come back and ask shareholders for more money, but as long as the acquisition strategy works then maybe that’s no bad thing. Of the litigation companies, I own Burford, but am also tempted by Manolete after its share price decline.

Bruce Packard

Notes

The author owns shares in Burford

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.