The FTSE SmallCap index +12.4% is the best performing index so far this year, ahead of the S&P500 +9% and Nasdaq +7%. Surprisingly both the French CAC40 and Germany’s DAX are +11%, despite the well-publicised problems with the vaccine rollout in Continental Europe. The US 10y Treasury yield was +1.68%, the UK was +0.88%, whereas France and Germany’s negative 10y Govt bond yields are likely reflecting a more realistic view of near term problems than the stock market indices.

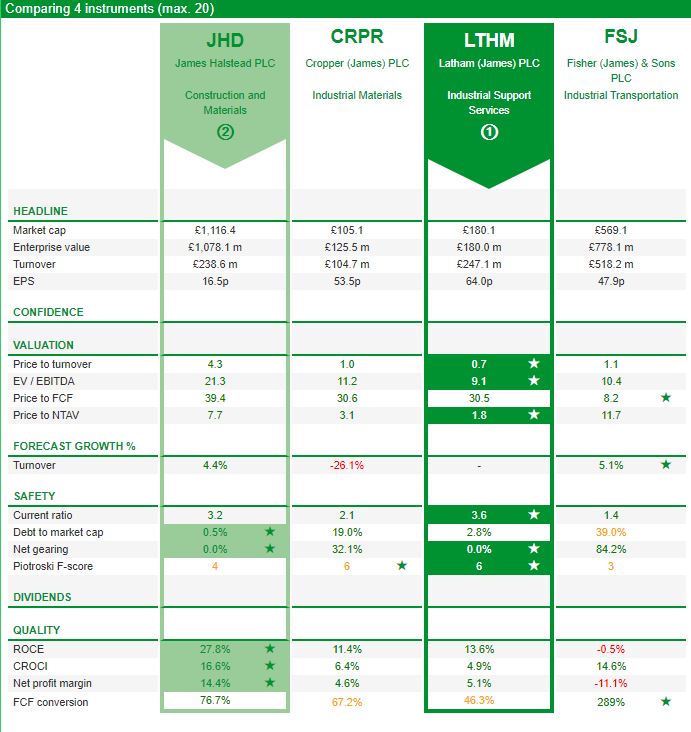

We are most of the way through result season for companies with December year ends. One trend that I’ve noticed is that companies with better track records of share price performance over the years also have “cleaner” disclosure in their results. Just a general observation; for instance James Halstead, which Richard wrote about last October, is an example. I cover their results below. I tend to confuse James Halstead with James Latham (building wood supplier, established 1757), James Cropper (paper and packaging, established 1845) both also covered by Richard previously and James Fisher (maritime services, established 1851).

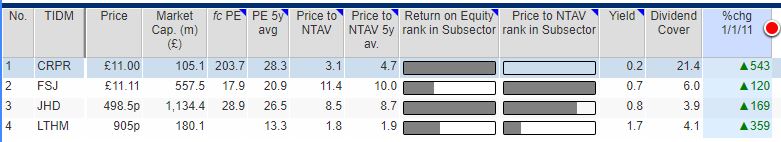

All four are long-term compounders. Over the last 10 years you would have done reasonably well investing in any UK listed equity beginning with James. Even the worst performer, James Fisher, is up +120% (ie more than doubled) and the best performer is James Cropper: +543% in the last decade. Who said investing is hard? Just buy companies that are more than 100 years old, named after someone called “James” and if you really want to diversify, there’s always Andrews Sykes: +275% in the last 10 years.

In contrast, companies with less traditional sounding names and more inconsistent track records, such as Bango and Cenkos, tend to have more evasive disclosure too. I pointed out a couple of weeks ago that Bango’s press release didn’t have a reconciliation of cash from operating activities. But I missed that Cenkos’ headline £32.7m cash figure was helped by rising payables (that is, deferring staff costs) which wasn’t in their RNS, and instead readers needed to dig into the Annual Report. Thanks to Mark and Leo at Small Caps Life who flagged that.

In my view, Cenkos and Bango’s share price performance will be driven by revenue growth (or revenue disappointment) rather than playing “hide and seek” with cash flow numbers. It’s understandable that company managements wish to show their figures in the best light, and it’s a grey area what crosses the line beyond acceptable. As an aside, if you think Cenkos and Bango’s names inane, then you’ll probably enjoy that someone in New York has called their FinTech Unicorn Ramp.

Banks, which like to project an image of solidity also used to play games with their disclosure. For example, HBOS and Barclays both used to re-state their divisional performance each year, and reallocate a large central cost to the prior year, which had the effect of flattering the divisional performance growth of the most recently reported year. Lloyds was well known for making all sorts of adjustments to flatter “underlying” profits, if you adjusted out the “exceptional” bad stuff (mis-selling costs for example, that had a curious habit of recurring). Unsurprisingly, the bank’s “underlying” profit numbers looked better than statutory profits. Lloyd’s share price would sometimes sell off 5% or more on the morning of the bank’s result announcement, despite achieving consensus forecasts.

So trying to make their results superficially more attractive didn’t work for banks, they’ve been terrible investments for the last 20 years: investors weren’t fooled. Given the share prices reflected the deteriorating economics of banking, I wonder if disclosure games are actually a signal that management are trying to fool themselves. Which, if you think about it, is a more worrying conclusion.

This week, along with James Halstead I look at a couple of forex currency companies: Equals and Argentex. Plus a brief comment on Wey Education’s recommended bid.

James Halstead H1 to Dec

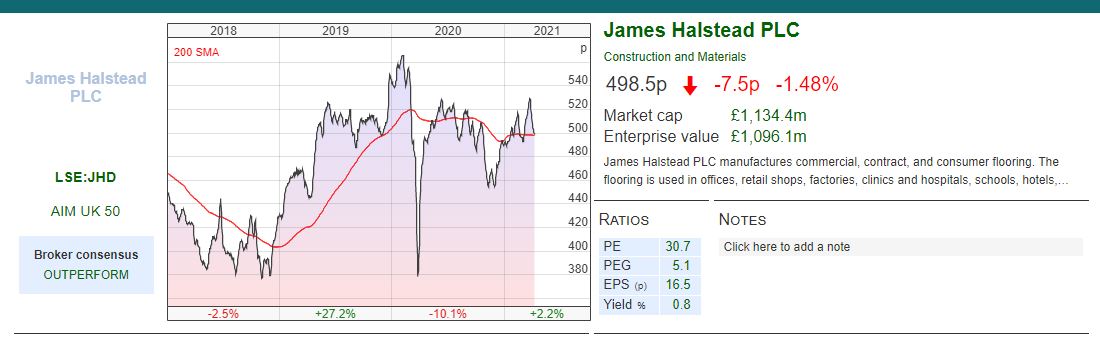

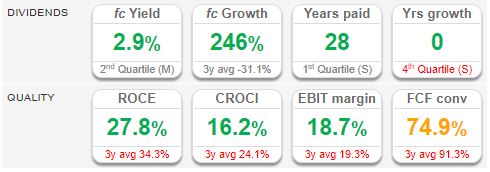

This family run and owned commercial floor coverings company reported H1 results to December, with H1 revenue flat at £130m and PBT up 3.3% to £26m. At the end of December it had £74m of cash on balance sheet. The company’s ROCE of 27.8%, CRoCI of 16.6% and 18.7% EBIT margin are all impressive signals of quality. Richard wrote up the company six months ago here.

Outlook statement Management have warned that their exports to Europe have been disrupted by BREXIT, despite their exports being duty free. Freight companies, border control and customs officials are confused by the bureaucracy, and customers specifically have been confused by VAT procedures in their home jurisdictions. The company has also been impacted by sea freight costs, which they flagged in a trading update on 1st February. Finally they draw attention to a shortage of basic raw materials, but having noted all these adversities they have continued confidence in the performance in H2.

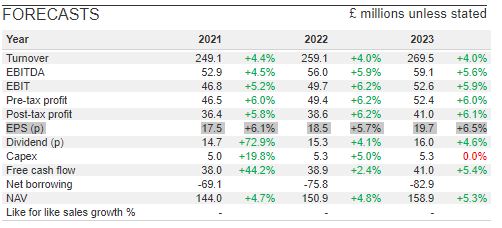

Forecasts Revenue is forecast to grow at +4% CAGR out to 2023F and PBT +6% CAGR. This puts the stock on 19.7p of EPS in 2023F implying a PER of 25x.

Pension deficit James Halstead was founded in 1915. One downside of investing in companies that have a long heritage is that they tend to have large pension schemes. James Halstead’s deficit was recorded on the balance sheet at £13m on 31 Dec 2020, down from £23m at the June FY. That deficit is the balance between two large numbers; the obligations were £90m at June 2019 and the fair value of plan assets were £67m. This year there is a triennial review, so management paid an additional £2m contribution in August 2020 to the pension scheme.

I’ve been wondering if there is an opportunity to find companies with large pension schemes in the hope that rising bond yields may reduce the obligations. The accounting treatment is to discount obligations at the AA corporate bond yield, so as bond yields rise, all else being equal, deficits should fall (the discount rate of future obligations rises, reducing their value). This may be too simplistic though, because there are other assumptions embedded within pension scheme obligations, such as life expectancy of beneficiaries, inflation, as well as legal judgements. Note 26 of James Halstead’s Annual Report refers to a High Court judgement in relation to Lloyds Banking Group’s defined benefit pension schemes which concluded that schemes should equalise pension benefits for men and women. The impact of this ruling has been included in the calculation of James Halstead’s pension liabilities, but it shows that pension deficits have a habit of surprising unwary investors.

Ownership A family trust, the John Halstead Settlement owns 17% and Rulegale Nominees (which is linked to the private client stockbroker James Sharp) owns 17.8%. Octopus were the only institution above the 3% disclosure threshold, owning 5%.

James Halstead looks to be the pick of the James’s with the highest RoCE and CRoCI, but it’s also the most expensive in terms of price/sales of 4.3x, Price to FCF 39x, and EV/EBITDA of 21x. This strikes me as a stock that will reward long term patience, though the list of near term challenges does make me a little cautious in the short term.

Argentex FY March Trading Update

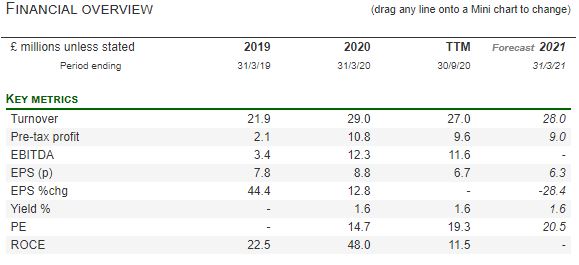

This forex group with Lord Digby Jones as Chairman put out a trading statement saying that FY to March revenues were “stable” at £28.1m (down 3% from £28.9m last year to be precise, if that’s not being churlish?) They’d previously put out a trading update in January saying that trading had improved since the half year, but giving no numbers. PBT last year was £12.7m excluding IPO costs and profit allocated from the former ownership structure. No year end cash figure was given in the most recent update (they must know how much cash they had in the bank at the end of March!) It was £38m at Sept 2020, of which £18m was client balances, so there’s £20m of net cash that belongs to the company.

History Founded in 2011, Argentex listed on AIM in June 2019 at 106p, raising £12.5m and selling £46m from existing holders valuing the company at £120m market cap. The broker’s customers are corporates who need to convert between £1m and £500m annually. Private Clients is just 2% of revenue. Top 20 clients represent 41% of revenue; management say that the top 20 clients evolves over time, it’s not the same top 20 each year. On their website they list corporate customers such as Brakspear brewery, Thatchers Cider and Triumph Motorcycles (the latter two of which Digby Jones is also Non Exec Chair.) Argentex doesn’t take market risk, they make money from the currency spread. Repeat business was 78% of revenue last year and was split 49% spot rate and 51% forward; the latter attracts higher spreads due to increased client credit risk.

Banks are roughly 85% of UK corporates’ forex flow trading, so you might think that large global banks with huge economies of scale and captive customers would mean that this company wouldn’t exist. However when I worked at Seymour Pierce, I was always curious to ask smaller companies whether they used banks for hedging their currency exposure. The answer often came back “no – hedging is too expensive with our bank” or “no – they tried to sell us a complicated derivative and we’re never doing that again” so there probably is a niche for companies like Argentex, Equals and Record. This is confirmed by Argentex, who say most of their clients had previously been using their high street bank, but switch to them because they are dissatisfied with the forex service that they’ve been receiving.

Ownership The largest holder is Pacific Investment Limited 12.5%, the original backers of Argentex, a family office for the Beckwiths. Sir John Beckwith, the chairman of PIL, is the uncle of “It girl” Tamara Beckwith, but the younger generation, Henry Beckwith who is Non Exec on the Board of Argentex ,also holds 6.6% of the shares in his own name. Carl Jani and Harry Adams co-Chief Execs both own 12.1%, so management have considerable “skin in the game”.

In total, 56% of the shares held are not in public hands. Institutions that own the shares are Gresham House 4.6%, Amati 4.2%, Premier Miton 3.3%.

Opinion This company strikes me as being similar to Equals, which I cover below. Both companies have roughly £30m of revenue, but Argentex has a far superior track record of profitability. Hence the market cap is twice the size and the price to revenues is 5.0x v Equals 2.2x. I’m trying to focus my investing on “quality” rather than loss-making/turnaround situations. There could be more upside in Equals, but for me I think Argentex fits my “buy quality, hold on” process better.

Equals

This payments group started out focusing on forex as FairFX, but changed its name to Equals and has broadened its scope to (vaguely defined) banking services and payments, for instance with pre-paid multi-currency cards. Unfortunately Wirecard was their card issuer, so they’ve had to take a provision of £652k against card stock after the demise of the issuer, but at least client money was ring-fenced. The main problem was that Equals management had to spend the second half of last year migrating their customer base of 150,000 cards over to Equals own platform.

Revenue was down -1.9% to £29m, in line with the trading update on 6th Jan. Management say that they achieved cash breakeven in Q4, but they still reported a FY 2020 statutory loss of £9m (or £6.9m net of R&D tax credits) and increased loss versus the previous year of £7.9m FY 2019 (or £5.4m net of FY2019 R&D tax credits). I’m not sure how sustainable that “cash breakeven” figure is, because payables (ie deferred costs) rose by £3.0m, and receivables fell by £401k, so overall there was a benefit in working capital movements of £2.65m, v £315k cash from operating activities before the tax credit of £2.5m. In table 14, Equals shows a £1,485k negative movement in working capital, and explains the difference between their figure and my £2.65m as “balances which fall outside the FCA safe guarding regime”. I think I’d ask for a reconciliation to understand the different figures from their table and the face of the cashflow statement. There was also £4.5m of capitalised software costs which hasn’t gone through the p&l or cash from operating activities. That £4.5m figure will be recorded on the balance sheet within total intangibles, which are £34.8m v shareholders’ equity of £42m.

Adjusted EBITDA was £1.2m. Net of £2m of Government CBILS borrowing the group had £8m of cash at year end; by the end of March this had grown to £9.0m.

Outlook Q1 2021 revenue was £8.0m v £8.1m Q1 2020. Management have reduced costs by around 25% and revenue per head is now £120K v £90K, but they don’t give any guidance on how they think revenue will progress for the rest of the year. If international travel does recover, the company should benefit from their retail cards and travel cash.

The company will hold a virtual Capital Markets Day for investors on Thursday, 6 May 2021 between 11am and 1pm. You can register on their site here. CMDs can be useful for investors to learn about a business, but they can also signal that the company would like to come back and ask investors for more money. Equals cash on the balance sheet has increased by £1m to £9m over Q1, so that may not be the case here. But the track record of profits is patchy and as a payments company they need to operate with a margin of safety.

Forecasts The most recent broker note from Cenkos was following the trading update in early January, so it doesn’t look like forecast expectations will rise following these set of results. Sharepad shows revenue forecast to grow +10% to £32m FY2021F and +16% FY2022F, with forecast EPS of 2p in FY 2022F, putting the stock on 20x PER 2022F.

Opinion The risk is, in my view, that management have cut cost too deeply and revenue growth disappoints. Or future revenue growth does come through, but operational gearing is illusory because management need to invest further and the bottom line doesn’t benefit. It’s a fine balance, I feel like management have difficult trade-offs.

My other worry is that deep pocketed FinTech unicorns that are currently focused on consumer banking could easily move to SME banking, and start eating Equals lunch. The latest FinTech Ramp, which specialises in corporate payments cards has just been valued at $1.6bn by Stripe in a funding round in New York.

A few years ago I published a 100 page report looking at over 30 new entrants into banking across the globe “How to Eat a Banker’s Lunch”. I warned that Skype was a sobering example of a disruptive threat. The Swedish/Estonian VoiP company won 30% of the international phone-call market, but it did not win 30% of the revenue. Instead phone calls became much cheaper for customers and Skype shrunk the revenue pool available, while still making a profit because of its structurally lower costs. That risk is already playing out for banks, but Equals could suffer too. In contrast, Argentex looks like the opposite of FinTech, offering a high touch, bespoke service for corporates frustrated that their bank is no longer doing traditional relationship banking.

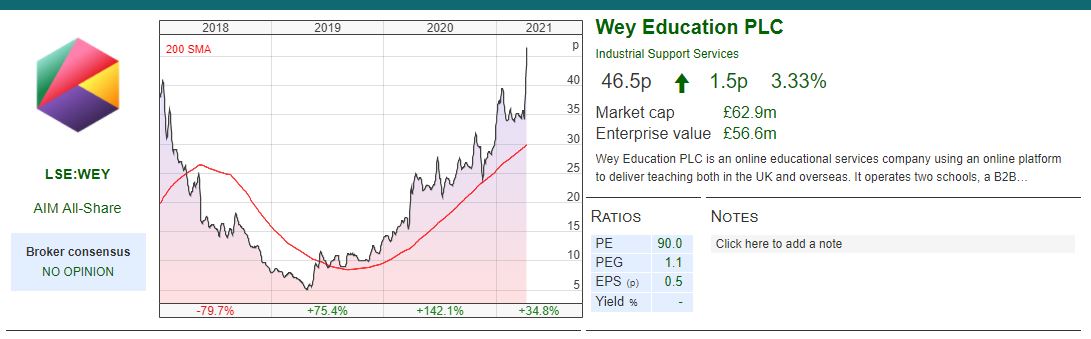

Wey Education recommended cash bid at 47.5p

Wey Education, the online school, received a recommended cash offer from Inspired Education Holdings for 47.5p (a 46% premium to the 32p closing price on 31st March, the day before the announcement). The takeover is structured as a Scheme of Arrangement which requires 75% approval. The bidder has received irrevocable undertakings from management and David Massie’s (former Chairman) estate representing 41% of the share capital in total. Including non-binding letters of intent from investors, this rises to 53% in favour of the deal.

I wrote about Wey FY results to Aug last November, when the shares were 23.5p per share. The bid values the firm at 103x historic FY 2020 (to August) PER. That ratio drops to 53x FY Aug 2021F PER and 6.5x 2021F revenues. I couldn’t find forecasts further out, but the growth trend seems likely to continue. So effectively, the bidder is paying up for a couple of years’ growth, which seems fair. This is a share where the range of outcomes are particularly wide, and this is reflected in the volatility of the share price: from being valued at over 40p per share in 2018, to 5p per share mid 2019 before recovering when investors realised that the pandemic would be helpful to online education.

Opinion I paid less than 7p per share for this stock in Feb 2019, but my position sizing was far too cautious. It’s not much use having a small position in a big winner. Leo who writes this blog has been consistently excellent on Wey, and it was a much higher conviction holding for him. Well done. There’s a George Soros quote “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” Marking my homework on Wey, I’d give myself a “could do better”.

Notes

The author owns shares in Wey Education

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary 12/04/21: Equity. James Equity.

The FTSE SmallCap index +12.4% is the best performing index so far this year, ahead of the S&P500 +9% and Nasdaq +7%. Surprisingly both the French CAC40 and Germany’s DAX are +11%, despite the well-publicised problems with the vaccine rollout in Continental Europe. The US 10y Treasury yield was +1.68%, the UK was +0.88%, whereas France and Germany’s negative 10y Govt bond yields are likely reflecting a more realistic view of near term problems than the stock market indices.

We are most of the way through result season for companies with December year ends. One trend that I’ve noticed is that companies with better track records of share price performance over the years also have “cleaner” disclosure in their results. Just a general observation; for instance James Halstead, which Richard wrote about last October, is an example. I cover their results below. I tend to confuse James Halstead with James Latham (building wood supplier, established 1757), James Cropper (paper and packaging, established 1845) both also covered by Richard previously and James Fisher (maritime services, established 1851).

All four are long-term compounders. Over the last 10 years you would have done reasonably well investing in any UK listed equity beginning with James. Even the worst performer, James Fisher, is up +120% (ie more than doubled) and the best performer is James Cropper: +543% in the last decade. Who said investing is hard? Just buy companies that are more than 100 years old, named after someone called “James” and if you really want to diversify, there’s always Andrews Sykes: +275% in the last 10 years.

In contrast, companies with less traditional sounding names and more inconsistent track records, such as Bango and Cenkos, tend to have more evasive disclosure too. I pointed out a couple of weeks ago that Bango’s press release didn’t have a reconciliation of cash from operating activities. But I missed that Cenkos’ headline £32.7m cash figure was helped by rising payables (that is, deferring staff costs) which wasn’t in their RNS, and instead readers needed to dig into the Annual Report. Thanks to Mark and Leo at Small Caps Life who flagged that.

In my view, Cenkos and Bango’s share price performance will be driven by revenue growth (or revenue disappointment) rather than playing “hide and seek” with cash flow numbers. It’s understandable that company managements wish to show their figures in the best light, and it’s a grey area what crosses the line beyond acceptable. As an aside, if you think Cenkos and Bango’s names inane, then you’ll probably enjoy that someone in New York has called their FinTech Unicorn Ramp.

Banks, which like to project an image of solidity also used to play games with their disclosure. For example, HBOS and Barclays both used to re-state their divisional performance each year, and reallocate a large central cost to the prior year, which had the effect of flattering the divisional performance growth of the most recently reported year. Lloyds was well known for making all sorts of adjustments to flatter “underlying” profits, if you adjusted out the “exceptional” bad stuff (mis-selling costs for example, that had a curious habit of recurring). Unsurprisingly, the bank’s “underlying” profit numbers looked better than statutory profits. Lloyd’s share price would sometimes sell off 5% or more on the morning of the bank’s result announcement, despite achieving consensus forecasts.

So trying to make their results superficially more attractive didn’t work for banks, they’ve been terrible investments for the last 20 years: investors weren’t fooled. Given the share prices reflected the deteriorating economics of banking, I wonder if disclosure games are actually a signal that management are trying to fool themselves. Which, if you think about it, is a more worrying conclusion.

This week, along with James Halstead I look at a couple of forex currency companies: Equals and Argentex. Plus a brief comment on Wey Education’s recommended bid.

James Halstead H1 to Dec

This family run and owned commercial floor coverings company reported H1 results to December, with H1 revenue flat at £130m and PBT up 3.3% to £26m. At the end of December it had £74m of cash on balance sheet. The company’s ROCE of 27.8%, CRoCI of 16.6% and 18.7% EBIT margin are all impressive signals of quality. Richard wrote up the company six months ago here.

Outlook statement Management have warned that their exports to Europe have been disrupted by BREXIT, despite their exports being duty free. Freight companies, border control and customs officials are confused by the bureaucracy, and customers specifically have been confused by VAT procedures in their home jurisdictions. The company has also been impacted by sea freight costs, which they flagged in a trading update on 1st February. Finally they draw attention to a shortage of basic raw materials, but having noted all these adversities they have continued confidence in the performance in H2.

Forecasts Revenue is forecast to grow at +4% CAGR out to 2023F and PBT +6% CAGR. This puts the stock on 19.7p of EPS in 2023F implying a PER of 25x.

Pension deficit James Halstead was founded in 1915. One downside of investing in companies that have a long heritage is that they tend to have large pension schemes. James Halstead’s deficit was recorded on the balance sheet at £13m on 31 Dec 2020, down from £23m at the June FY. That deficit is the balance between two large numbers; the obligations were £90m at June 2019 and the fair value of plan assets were £67m. This year there is a triennial review, so management paid an additional £2m contribution in August 2020 to the pension scheme.

I’ve been wondering if there is an opportunity to find companies with large pension schemes in the hope that rising bond yields may reduce the obligations. The accounting treatment is to discount obligations at the AA corporate bond yield, so as bond yields rise, all else being equal, deficits should fall (the discount rate of future obligations rises, reducing their value). This may be too simplistic though, because there are other assumptions embedded within pension scheme obligations, such as life expectancy of beneficiaries, inflation, as well as legal judgements. Note 26 of James Halstead’s Annual Report refers to a High Court judgement in relation to Lloyds Banking Group’s defined benefit pension schemes which concluded that schemes should equalise pension benefits for men and women. The impact of this ruling has been included in the calculation of James Halstead’s pension liabilities, but it shows that pension deficits have a habit of surprising unwary investors.

Ownership A family trust, the John Halstead Settlement owns 17% and Rulegale Nominees (which is linked to the private client stockbroker James Sharp) owns 17.8%. Octopus were the only institution above the 3% disclosure threshold, owning 5%.

James Halstead looks to be the pick of the James’s with the highest RoCE and CRoCI, but it’s also the most expensive in terms of price/sales of 4.3x, Price to FCF 39x, and EV/EBITDA of 21x. This strikes me as a stock that will reward long term patience, though the list of near term challenges does make me a little cautious in the short term.

Argentex FY March Trading Update

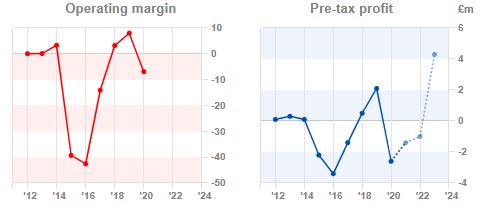

This forex group with Lord Digby Jones as Chairman put out a trading statement saying that FY to March revenues were “stable” at £28.1m (down 3% from £28.9m last year to be precise, if that’s not being churlish?) They’d previously put out a trading update in January saying that trading had improved since the half year, but giving no numbers. PBT last year was £12.7m excluding IPO costs and profit allocated from the former ownership structure. No year end cash figure was given in the most recent update (they must know how much cash they had in the bank at the end of March!) It was £38m at Sept 2020, of which £18m was client balances, so there’s £20m of net cash that belongs to the company.

History Founded in 2011, Argentex listed on AIM in June 2019 at 106p, raising £12.5m and selling £46m from existing holders valuing the company at £120m market cap. The broker’s customers are corporates who need to convert between £1m and £500m annually. Private Clients is just 2% of revenue. Top 20 clients represent 41% of revenue; management say that the top 20 clients evolves over time, it’s not the same top 20 each year. On their website they list corporate customers such as Brakspear brewery, Thatchers Cider and Triumph Motorcycles (the latter two of which Digby Jones is also Non Exec Chair.) Argentex doesn’t take market risk, they make money from the currency spread. Repeat business was 78% of revenue last year and was split 49% spot rate and 51% forward; the latter attracts higher spreads due to increased client credit risk.

Banks are roughly 85% of UK corporates’ forex flow trading, so you might think that large global banks with huge economies of scale and captive customers would mean that this company wouldn’t exist. However when I worked at Seymour Pierce, I was always curious to ask smaller companies whether they used banks for hedging their currency exposure. The answer often came back “no – hedging is too expensive with our bank” or “no – they tried to sell us a complicated derivative and we’re never doing that again” so there probably is a niche for companies like Argentex, Equals and Record. This is confirmed by Argentex, who say most of their clients had previously been using their high street bank, but switch to them because they are dissatisfied with the forex service that they’ve been receiving.

Ownership The largest holder is Pacific Investment Limited 12.5%, the original backers of Argentex, a family office for the Beckwiths. Sir John Beckwith, the chairman of PIL, is the uncle of “It girl” Tamara Beckwith, but the younger generation, Henry Beckwith who is Non Exec on the Board of Argentex ,also holds 6.6% of the shares in his own name. Carl Jani and Harry Adams co-Chief Execs both own 12.1%, so management have considerable “skin in the game”.

In total, 56% of the shares held are not in public hands. Institutions that own the shares are Gresham House 4.6%, Amati 4.2%, Premier Miton 3.3%.

Opinion This company strikes me as being similar to Equals, which I cover below. Both companies have roughly £30m of revenue, but Argentex has a far superior track record of profitability. Hence the market cap is twice the size and the price to revenues is 5.0x v Equals 2.2x. I’m trying to focus my investing on “quality” rather than loss-making/turnaround situations. There could be more upside in Equals, but for me I think Argentex fits my “buy quality, hold on” process better.

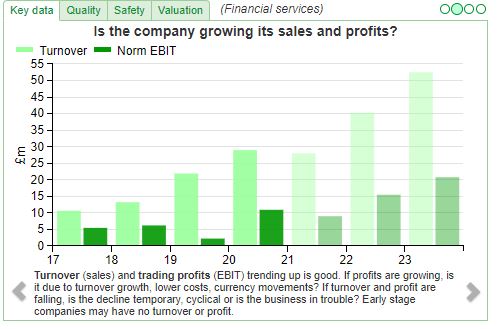

Equals

This payments group started out focusing on forex as FairFX, but changed its name to Equals and has broadened its scope to (vaguely defined) banking services and payments, for instance with pre-paid multi-currency cards. Unfortunately Wirecard was their card issuer, so they’ve had to take a provision of £652k against card stock after the demise of the issuer, but at least client money was ring-fenced. The main problem was that Equals management had to spend the second half of last year migrating their customer base of 150,000 cards over to Equals own platform.

Revenue was down -1.9% to £29m, in line with the trading update on 6th Jan. Management say that they achieved cash breakeven in Q4, but they still reported a FY 2020 statutory loss of £9m (or £6.9m net of R&D tax credits) and increased loss versus the previous year of £7.9m FY 2019 (or £5.4m net of FY2019 R&D tax credits). I’m not sure how sustainable that “cash breakeven” figure is, because payables (ie deferred costs) rose by £3.0m, and receivables fell by £401k, so overall there was a benefit in working capital movements of £2.65m, v £315k cash from operating activities before the tax credit of £2.5m. In table 14, Equals shows a £1,485k negative movement in working capital, and explains the difference between their figure and my £2.65m as “balances which fall outside the FCA safe guarding regime”. I think I’d ask for a reconciliation to understand the different figures from their table and the face of the cashflow statement. There was also £4.5m of capitalised software costs which hasn’t gone through the p&l or cash from operating activities. That £4.5m figure will be recorded on the balance sheet within total intangibles, which are £34.8m v shareholders’ equity of £42m.

Adjusted EBITDA was £1.2m. Net of £2m of Government CBILS borrowing the group had £8m of cash at year end; by the end of March this had grown to £9.0m.

Outlook Q1 2021 revenue was £8.0m v £8.1m Q1 2020. Management have reduced costs by around 25% and revenue per head is now £120K v £90K, but they don’t give any guidance on how they think revenue will progress for the rest of the year. If international travel does recover, the company should benefit from their retail cards and travel cash.

The company will hold a virtual Capital Markets Day for investors on Thursday, 6 May 2021 between 11am and 1pm. You can register on their site here. CMDs can be useful for investors to learn about a business, but they can also signal that the company would like to come back and ask investors for more money. Equals cash on the balance sheet has increased by £1m to £9m over Q1, so that may not be the case here. But the track record of profits is patchy and as a payments company they need to operate with a margin of safety.

Forecasts The most recent broker note from Cenkos was following the trading update in early January, so it doesn’t look like forecast expectations will rise following these set of results. Sharepad shows revenue forecast to grow +10% to £32m FY2021F and +16% FY2022F, with forecast EPS of 2p in FY 2022F, putting the stock on 20x PER 2022F.

Opinion The risk is, in my view, that management have cut cost too deeply and revenue growth disappoints. Or future revenue growth does come through, but operational gearing is illusory because management need to invest further and the bottom line doesn’t benefit. It’s a fine balance, I feel like management have difficult trade-offs.

My other worry is that deep pocketed FinTech unicorns that are currently focused on consumer banking could easily move to SME banking, and start eating Equals lunch. The latest FinTech Ramp, which specialises in corporate payments cards has just been valued at $1.6bn by Stripe in a funding round in New York.

A few years ago I published a 100 page report looking at over 30 new entrants into banking across the globe “How to Eat a Banker’s Lunch”. I warned that Skype was a sobering example of a disruptive threat. The Swedish/Estonian VoiP company won 30% of the international phone-call market, but it did not win 30% of the revenue. Instead phone calls became much cheaper for customers and Skype shrunk the revenue pool available, while still making a profit because of its structurally lower costs. That risk is already playing out for banks, but Equals could suffer too. In contrast, Argentex looks like the opposite of FinTech, offering a high touch, bespoke service for corporates frustrated that their bank is no longer doing traditional relationship banking.

Wey Education recommended cash bid at 47.5p

Wey Education, the online school, received a recommended cash offer from Inspired Education Holdings for 47.5p (a 46% premium to the 32p closing price on 31st March, the day before the announcement). The takeover is structured as a Scheme of Arrangement which requires 75% approval. The bidder has received irrevocable undertakings from management and David Massie’s (former Chairman) estate representing 41% of the share capital in total. Including non-binding letters of intent from investors, this rises to 53% in favour of the deal.

I wrote about Wey FY results to Aug last November, when the shares were 23.5p per share. The bid values the firm at 103x historic FY 2020 (to August) PER. That ratio drops to 53x FY Aug 2021F PER and 6.5x 2021F revenues. I couldn’t find forecasts further out, but the growth trend seems likely to continue. So effectively, the bidder is paying up for a couple of years’ growth, which seems fair. This is a share where the range of outcomes are particularly wide, and this is reflected in the volatility of the share price: from being valued at over 40p per share in 2018, to 5p per share mid 2019 before recovering when investors realised that the pandemic would be helpful to online education.

Opinion I paid less than 7p per share for this stock in Feb 2019, but my position sizing was far too cautious. It’s not much use having a small position in a big winner. Leo who writes this blog has been consistently excellent on Wey, and it was a much higher conviction holding for him. Well done. There’s a George Soros quote “It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.” Marking my homework on Wey, I’d give myself a “could do better”.

Notes

The author owns shares in Wey Education

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.