With the BoE now suggesting inflation peaks at 10% later this year, Bruce goes back to 1982 when Dexys Midnight Runners were topping the charts to compare household indebtedness then v now. Stocks covered WATR, CCT and TET.

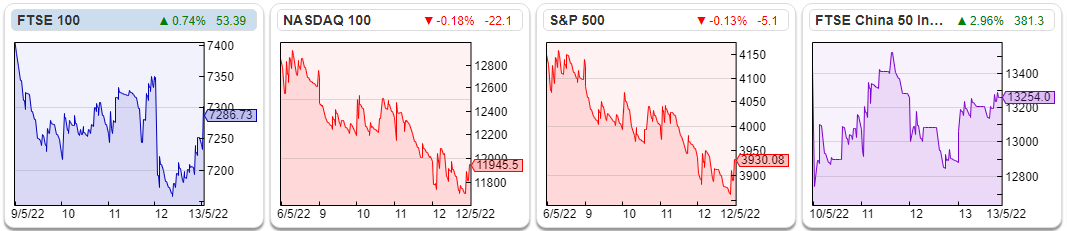

The FTSE 100 fell -1.3% to 7286 last week. The Nasdaq100 was down -7% and the S&P500 -5% following a brutal sell of at the beginning of last week. Bitcoin fell below $30,000, but recovered towards the end of the week. The US 10Y Government bond yield fell back below 3%. Brent crude fell to $108 per barrel.

The FTSE 100 fell -1.3% to 7286 last week. The Nasdaq100 was down -7% and the S&P500 -5% following a brutal sell of at the beginning of last week. Bitcoin fell below $30,000, but recovered towards the end of the week. The US 10Y Government bond yield fell back below 3%. Brent crude fell to $108 per barrel.

AIM has fallen -28% from it’s peak, so we’re now in a bear market for smaller stocks as well as Nasdaq100 which has fallen by a similar amount. I’m flummoxed by the timing, though not the reaction. Having been very bearish in March because I was convinced that the war in Ukraine and the sanctions would last longer than a few months. I believed that the war would not prevent Central Banks from raising interest rates to curb inflation. The markets seemed to take all this in their stride, so I assumed that the risks had been priced in and began cautiously putting my cash to work. Oooops, that was a mistake. I can’t see what’s changed – but markets sold off strongly over the past few weeks.

If I had to guess what else might go wrong, then I would suggest the UK residential property market. The 2 year fixed rate deals signed in the early stages of the pandemic will now be rolling off and needing to be remortgaged through the second half of this year at higher rates, at a time when the Bank of England expect inflation to peak at 10% with consumers under pressure from the rising cost of essentials (food and energy).

The BoE publishes a twice yearly Financial Stability Report, the most recent one last December talked about the rise in household debt and what the implications might be for financial stability. The Central Bank points out that before 2007 UK household debt/disposable income was 144%, whereas it has fallen back to 125% in 2021, as households de-leveraged. The BoE obviously track this ratio, but don’t like publishing a graph. I suspect that’s because they don’t want the graphic to appear in newspaper stories about how much households are in debt! Voluntary disclosure – what organisations choose to disclose and what they actively decide to leave out applies to Central Banks, not just companies.

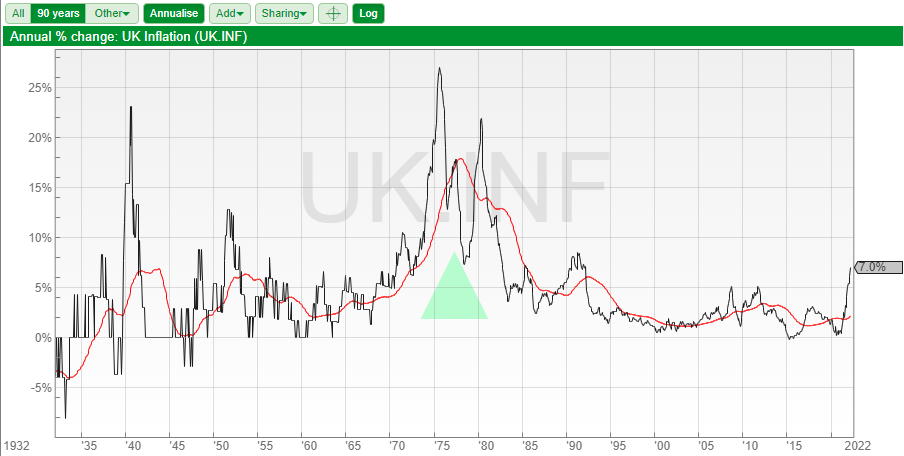

SharePad shows that the last time inflation reached 7% was 1992. Back then interest rates were 10% and household debt/disposable income was 93% – not very reassuring. The last time inflation was above 10%, Dexys Midnight Runners were the best selling chart single (Come on Eileen) in 1982. Interest rates were 14% and household debt/disposable income was 52%. The much higher levels of household indebtedness now means that the economy is far more sensitive to interest rate rises. That explains why the Old Lady of Threadneedle Street has been reluctant to raise interest rates, perhaps her first name is Eileen? Market implied projections are for UK interest rates to peak at 2.5% in mid 2023, so the real interest rate (ie adjusting for inflation) would be -7.5% when interest rates peak.

Before fully investing your savings deposits into the stock market, remember though that equities performance was dire in the first half of the 1970s when inflation peaked at over 25%. It was after inflation peaked in the mid 70s that markets started to rise. 50 years later could timing the market be similar?

As an aside, while looking up UK inflation on SharePad, I discovered that the system has the statistic (UK.INF) going back to the Great Depression. NB you need to click on “Annualise” to see the rate of increase year-on-year.

The Bank of England’s next FSR should be published in June – it will be interesting to see what they make of the first six months of this year, and also trying to spot what they choose to leave out.

The Bank of England’s next FSR should be published in June – it will be interesting to see what they make of the first six months of this year, and also trying to spot what they choose to leave out.

I won’t make it to the live event Mello in Chiswick, but David has some good speakers and companies. Lord Lee and Leon Boros, plus some youngsters like Mark Simpson and Michael Taylor. He also has several companies that I’ve written about here, including Zoo Digital, 1Spatial and Franchise Brands. For a full list of speakers and companies click here.

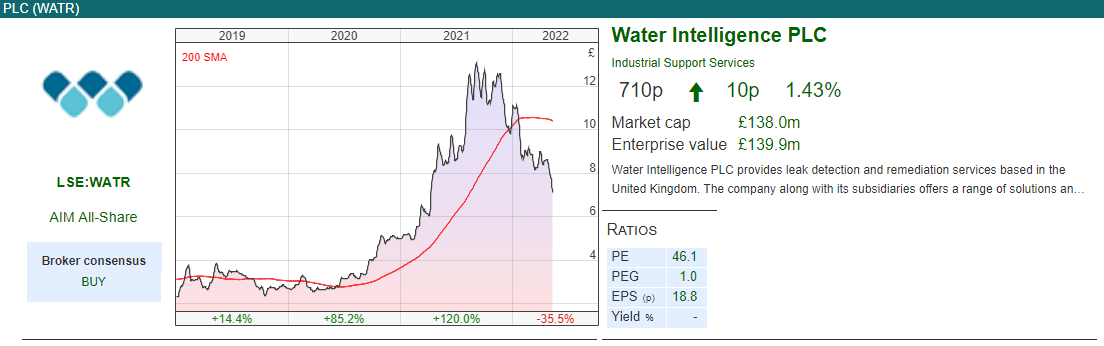

This week I look at Water Intelligence PLC, the US leak detection business Treatt, the flavourings business and Character, the children’s toy designer.

Water Intelligence PLC Q1 2022

This US based water leak detection business has the curious habit of publishing a Q1 update before it releases it’s Annual Report (the Dec 2020 AR was published in mid June last year). 80% of the revenue comes from the US, but they also have operations in the UK and Australia (c. 10% each).

This US based water leak detection business has the curious habit of publishing a Q1 update before it releases it’s Annual Report (the Dec 2020 AR was published in mid June last year). 80% of the revenue comes from the US, but they also have operations in the UK and Australia (c. 10% each).

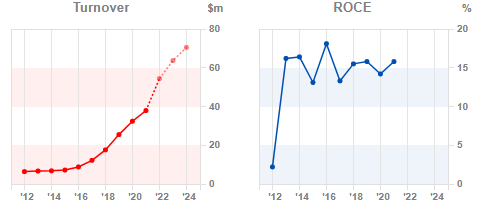

WATR are buying back their American Leak Detection franchises in the US, which means that reported sales growth has been very strong over the last few years. In Q1 they reported sales growth +44% to $16.5m. Without the impact of Q1 acquisitions sales growth was +26%, though given that they are continuously reacquiring franchises I’m not sure that I would describe that figure as “organic growth”.

Adjusted PBT was +16% to $2.1m in the quarter but statutory PBT declined by -17% to $1.4m. The adjustments are $400K of exceptional costs (Salesforce training and Australian floods in 2020) and $300K of share based payments. Those all sound like costs that could recur, rather than exceptional items.

The company raised $17m in Q4 2021 at a placing price of 1200p, but was also buying back shares at c. 960p in December 2021. In Q1 they reported $10m of net cash and have just negotiated a $17m credit facility in April. The revenue growth has been impressive. One thing to note is that Royalty Income still grew +3% in 2020, despite buying back franchises which would reduce the amount of Royalty Income. This would imply that the existing franchises are seeing good growth – in which case it’s odd that franchisees would choose to sell them back to WATR perhaps?

Ownership: Patrick De Souza, who is WATR’s Executive Chairman owns 28.9% of the shares. He also owns an interest in Plain Sight which owns a further 14% of WATR shares and counts as a related party. Plain Sight is mainly a technology holding company (investing in patents), with links to Yale University and the US Defense Department, according to WATR’s Admission Doc. Patrick De Souza’s background is law and corporate finance. Amati owns 4.75 and Herald Investment Trust 3.5%.

Valuation: WH Ireland, their broker are forecasting $63m of revenue in FY 2022F and EPS of 34c the same year. That implies a price to revenue of 2.6x and a PER of 28x.

Opinion: This stock has always puzzled me – I first wrote about it in Nov 2020, when the Exec Chairman was selling shares at 475p. The shares have almost halved from their peak in September last year, without having delivered any bad news.

WATR used to trade on a high multiple, and re-acquires it’s own franchises by paying lower multiples. For instance in January of this year they paid $7.7m or 2.1x revenue for their Dallas Fort Worth franchise. Now that the share price has fallen, the valuation gap between the franchises that it is buying back and its own valuation has narrowed. Maybe there’s a clever arbitrage between the value unlisted franchisee will sell for and what UK markets will value?

Most of the past few years the acquisitions have been funded by issuing shares on AIM to raise cash, rather than by borrowing money. Now that interest rates are rising, raising cash with equity placings could turn out to be very shrewd. I do have the uncomfortable feeling that I am missing something though.

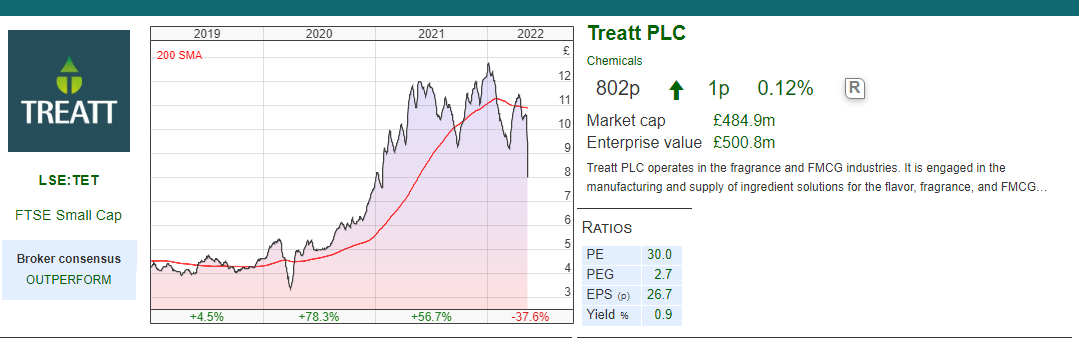

Treatt PLC H1 to end of March

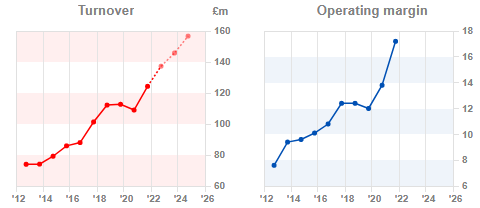

This flavourings, aromas and fragrance company reported H1 results to the end off March. Previously I had thought that they did artificial and synthetic ingredients, but the ESG section says that 75% of sales and 90% of their purchases are natural extracts. Citrus, their largest product category, is derived from by-products that would otherwise go to waste.

This flavourings, aromas and fragrance company reported H1 results to the end off March. Previously I had thought that they did artificial and synthetic ingredients, but the ESG section says that 75% of sales and 90% of their purchases are natural extracts. Citrus, their largest product category, is derived from by-products that would otherwise go to waste.

These results were in line with the numbers given in previous guidance (a trading statement in early April). Revenue +9% (or +11% in constant currency) to £66m. H2 weighting, in line with previous years. The growth in their order book has actually increased from +15% in the April RNS to +25% in last week’s announcement. Investors seem to have taken these results badly though.

One possibility is the fall in gross margin to 27.5% (v 35% H1 2021). There was however a Covid impact, resulting in higher H1 margin’s last year – in H1 2019 gross margin was 26.2%. I think it’s more likely that investors have been spooked by the working capital outflow of £15.1m and increase in net debt to £19.8m v £5.1m end of March 2021. A third of the working capital outflow was an increase in receivables, and the other two thirds was an increase in inventories. The latter will be related to supply chain disruption, and increasing inventory to £58m (ie almost 90% of H1 sales). As this is an issue affecting every company that makes physical stuff, I think probably the share price fall could be an over reaction?

H1 statutory PBT was £8.95m, though that contains an exceptional gain from the sale of their old factory, netted off against the relocation cost of moving to their new facility. Excluding that PBT was down -39% to £6.3m. Aside from the reduction in gross margin, payroll costs were also higher: administrative expenses rose +9% to £12m. The statement says that they are on track to achieve FY PBT of £21.7m (though that’s 9% Sharepad’s consensus figure of £23.8m at the start of last week – possibly reflecting some of the £2.6m exceptional item?) Longer term the group has demonstrated an impressive track record of increasing revenue and operating margin.

Valuation: The shares are trading on 25x September 2023F, after falling -25% in the last 5 days. RoCE is has been rising for the last three years, 13% in 2020 to 17.5% 2021.

Opinion: I like it, and think that this could be a buying opportunity. I don’t think that there’s anything fundamentally going wrong with the business, although the cashflow situation is worth keeping an eye on.

The recent stock market sell off seems to have particularly affected “long duration” assets – that is good quality companies, but expensive (Burberry -17% YTD, Sage -22% YTD, Experian -28% YTD) spring to mind, but I’m sure there are many others. Although much smaller, I’d put Treatt -38% since the start of May in the same bracket. In previous sell offs I’ve done well buying high quality companies at a reasonable price (Impax, Games Workshop), and not badly, but less well, buying obviously cheap single P/E companies that don’t re-rate (The Mission, Bank of Georgia). So I’m conscious that this sell off could present opportunities to buy stocks I admire, but in normal times reject on valuation grounds.

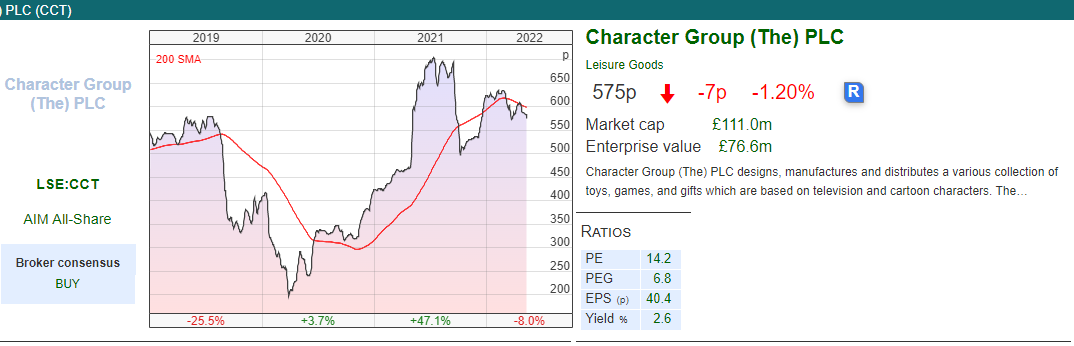

Character Group PLC H1 to Feb

This toy company, that currently has a contract to manufacture Peppa Pig wood products reported H1 results to end of February. To be clear, Character does not own the intellectual rights to Peppa Pig, but instead pays licence fees to their owners to manufacture the products. The group does own some in-house brands, but they are less well known than the ubiquitous Peppa. In 2019 Hasbro took over Entertainment One, owner of the Peppa Pig brand. Character had the contractual rights to manufacture until June 2021, but the fear was that Hasbro would bring manufacturing in house, causing a big hit to Character’s earnings. In December 2020 CCT announced that they had reached an agreement with Hasbro to extend the Peppa Pig wood products licence to end of 2023. I think that implies that they lost some other parts of the licence, but the share price recovered to 2019 levels as they said the Peppa Pig brand would be a central part of their product portfolio for many years to come.

This toy company, that currently has a contract to manufacture Peppa Pig wood products reported H1 results to end of February. To be clear, Character does not own the intellectual rights to Peppa Pig, but instead pays licence fees to their owners to manufacture the products. The group does own some in-house brands, but they are less well known than the ubiquitous Peppa. In 2019 Hasbro took over Entertainment One, owner of the Peppa Pig brand. Character had the contractual rights to manufacture until June 2021, but the fear was that Hasbro would bring manufacturing in house, causing a big hit to Character’s earnings. In December 2020 CCT announced that they had reached an agreement with Hasbro to extend the Peppa Pig wood products licence to end of 2023. I think that implies that they lost some other parts of the licence, but the share price recovered to 2019 levels as they said the Peppa Pig brand would be a central part of their product portfolio for many years to come.

Revenue was +22% to £91m, showing that they had a good Christmas despite the supply chain problems. Statutory PBT was down -15% to £6.5m, although there was a £2m gain on sale in the prior year. Adjusting for this PBT was up +7%. Cash from operations was £3.4m, and the difference between cashflow and profits was due to increasing inventory. That’s a similar trend as Treatt above, however unlike Treatt, Character has £22m of cash (20% of the current market cap), even after buying back £14m of shares via a tender offer at 630p per share.

Outlook: Although less than 50% of revenue comes from the UK, CCT is exposed to sterling weakness because it makes purchases in dollars. They also mention continuing covid concerns in China. With those caveats they still expect to achieve market expectations for FY August.

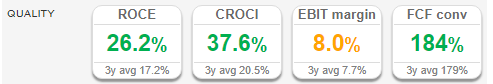

Valuation: The shares are trading on 13x FY Aug 2023F, and 0.8x sales the same year. Looking back they have an impressively high RoCE figure (in the 20s and 30x) for a company holding so much cash.

Ownership: This is a Lord Lee stock and has a somewhat idiosyncratic list of shareholders (by which I mean the only couple I’ve heard of is Ruffer and Close Brothers). Henry Spain Investments, a private client regional stockbroker, are the largest shareholder with 13.4%, Close Brothers and Forager both own 7.8%, Ruffer own 5.5% and Sweet Briar 4.7%. Joint Managing Directors Kiran Shah and Jon Diver own 9.9% and 6.5% respectively.

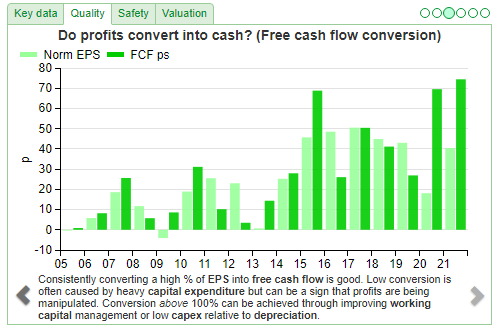

Opinion: I’ve noticed that companies with substantial net cash and/or buying back shares have been outperforming over the last couple of months during the sell off. That’s not surprising. Maynard wrote about the company’s history of buybacks 4 years ago, which gives a longer term perspective. They certainly do have an impressive track record of converting profits to cash.

Given the defensive nature of the balance sheet this looks like a safe stock to own if you are worried about markets continuing to sell off. I would want to understand how dependent they are on continue to extend their Peppa Pig contract with Hasbro, and also whether they might be able to develop their own brands.

Bruce Packard

brucepackard.com

Got some thoughts on this week commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on chat icon in top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 16/05/22 |WATR, CCT, TET| Come on Eileen

With the BoE now suggesting inflation peaks at 10% later this year, Bruce goes back to 1982 when Dexys Midnight Runners were topping the charts to compare household indebtedness then v now. Stocks covered WATR, CCT and TET.

AIM has fallen -28% from it’s peak, so we’re now in a bear market for smaller stocks as well as Nasdaq100 which has fallen by a similar amount. I’m flummoxed by the timing, though not the reaction. Having been very bearish in March because I was convinced that the war in Ukraine and the sanctions would last longer than a few months. I believed that the war would not prevent Central Banks from raising interest rates to curb inflation. The markets seemed to take all this in their stride, so I assumed that the risks had been priced in and began cautiously putting my cash to work. Oooops, that was a mistake. I can’t see what’s changed – but markets sold off strongly over the past few weeks.

If I had to guess what else might go wrong, then I would suggest the UK residential property market. The 2 year fixed rate deals signed in the early stages of the pandemic will now be rolling off and needing to be remortgaged through the second half of this year at higher rates, at a time when the Bank of England expect inflation to peak at 10% with consumers under pressure from the rising cost of essentials (food and energy).

The BoE publishes a twice yearly Financial Stability Report, the most recent one last December talked about the rise in household debt and what the implications might be for financial stability. The Central Bank points out that before 2007 UK household debt/disposable income was 144%, whereas it has fallen back to 125% in 2021, as households de-leveraged. The BoE obviously track this ratio, but don’t like publishing a graph. I suspect that’s because they don’t want the graphic to appear in newspaper stories about how much households are in debt! Voluntary disclosure – what organisations choose to disclose and what they actively decide to leave out applies to Central Banks, not just companies.

SharePad shows that the last time inflation reached 7% was 1992. Back then interest rates were 10% and household debt/disposable income was 93% – not very reassuring. The last time inflation was above 10%, Dexys Midnight Runners were the best selling chart single (Come on Eileen) in 1982. Interest rates were 14% and household debt/disposable income was 52%. The much higher levels of household indebtedness now means that the economy is far more sensitive to interest rate rises. That explains why the Old Lady of Threadneedle Street has been reluctant to raise interest rates, perhaps her first name is Eileen? Market implied projections are for UK interest rates to peak at 2.5% in mid 2023, so the real interest rate (ie adjusting for inflation) would be -7.5% when interest rates peak.

Before fully investing your savings deposits into the stock market, remember though that equities performance was dire in the first half of the 1970s when inflation peaked at over 25%. It was after inflation peaked in the mid 70s that markets started to rise. 50 years later could timing the market be similar?

As an aside, while looking up UK inflation on SharePad, I discovered that the system has the statistic (UK.INF) going back to the Great Depression. NB you need to click on “Annualise” to see the rate of increase year-on-year.

I won’t make it to the live event Mello in Chiswick, but David has some good speakers and companies. Lord Lee and Leon Boros, plus some youngsters like Mark Simpson and Michael Taylor. He also has several companies that I’ve written about here, including Zoo Digital, 1Spatial and Franchise Brands. For a full list of speakers and companies click here.

This week I look at Water Intelligence PLC, the US leak detection business Treatt, the flavourings business and Character, the children’s toy designer.

Water Intelligence PLC Q1 2022

WATR are buying back their American Leak Detection franchises in the US, which means that reported sales growth has been very strong over the last few years. In Q1 they reported sales growth +44% to $16.5m. Without the impact of Q1 acquisitions sales growth was +26%, though given that they are continuously reacquiring franchises I’m not sure that I would describe that figure as “organic growth”.

Adjusted PBT was +16% to $2.1m in the quarter but statutory PBT declined by -17% to $1.4m. The adjustments are $400K of exceptional costs (Salesforce training and Australian floods in 2020) and $300K of share based payments. Those all sound like costs that could recur, rather than exceptional items.

The company raised $17m in Q4 2021 at a placing price of 1200p, but was also buying back shares at c. 960p in December 2021. In Q1 they reported $10m of net cash and have just negotiated a $17m credit facility in April. The revenue growth has been impressive. One thing to note is that Royalty Income still grew +3% in 2020, despite buying back franchises which would reduce the amount of Royalty Income. This would imply that the existing franchises are seeing good growth – in which case it’s odd that franchisees would choose to sell them back to WATR perhaps?

Ownership: Patrick De Souza, who is WATR’s Executive Chairman owns 28.9% of the shares. He also owns an interest in Plain Sight which owns a further 14% of WATR shares and counts as a related party. Plain Sight is mainly a technology holding company (investing in patents), with links to Yale University and the US Defense Department, according to WATR’s Admission Doc. Patrick De Souza’s background is law and corporate finance. Amati owns 4.75 and Herald Investment Trust 3.5%.

Valuation: WH Ireland, their broker are forecasting $63m of revenue in FY 2022F and EPS of 34c the same year. That implies a price to revenue of 2.6x and a PER of 28x.

Opinion: This stock has always puzzled me – I first wrote about it in Nov 2020, when the Exec Chairman was selling shares at 475p. The shares have almost halved from their peak in September last year, without having delivered any bad news.

WATR used to trade on a high multiple, and re-acquires it’s own franchises by paying lower multiples. For instance in January of this year they paid $7.7m or 2.1x revenue for their Dallas Fort Worth franchise. Now that the share price has fallen, the valuation gap between the franchises that it is buying back and its own valuation has narrowed. Maybe there’s a clever arbitrage between the value unlisted franchisee will sell for and what UK markets will value?

Most of the past few years the acquisitions have been funded by issuing shares on AIM to raise cash, rather than by borrowing money. Now that interest rates are rising, raising cash with equity placings could turn out to be very shrewd. I do have the uncomfortable feeling that I am missing something though.

Treatt PLC H1 to end of March

These results were in line with the numbers given in previous guidance (a trading statement in early April). Revenue +9% (or +11% in constant currency) to £66m. H2 weighting, in line with previous years. The growth in their order book has actually increased from +15% in the April RNS to +25% in last week’s announcement. Investors seem to have taken these results badly though.

One possibility is the fall in gross margin to 27.5% (v 35% H1 2021). There was however a Covid impact, resulting in higher H1 margin’s last year – in H1 2019 gross margin was 26.2%. I think it’s more likely that investors have been spooked by the working capital outflow of £15.1m and increase in net debt to £19.8m v £5.1m end of March 2021. A third of the working capital outflow was an increase in receivables, and the other two thirds was an increase in inventories. The latter will be related to supply chain disruption, and increasing inventory to £58m (ie almost 90% of H1 sales). As this is an issue affecting every company that makes physical stuff, I think probably the share price fall could be an over reaction?

H1 statutory PBT was £8.95m, though that contains an exceptional gain from the sale of their old factory, netted off against the relocation cost of moving to their new facility. Excluding that PBT was down -39% to £6.3m. Aside from the reduction in gross margin, payroll costs were also higher: administrative expenses rose +9% to £12m. The statement says that they are on track to achieve FY PBT of £21.7m (though that’s 9% Sharepad’s consensus figure of £23.8m at the start of last week – possibly reflecting some of the £2.6m exceptional item?) Longer term the group has demonstrated an impressive track record of increasing revenue and operating margin.

Valuation: The shares are trading on 25x September 2023F, after falling -25% in the last 5 days. RoCE is has been rising for the last three years, 13% in 2020 to 17.5% 2021.

Opinion: I like it, and think that this could be a buying opportunity. I don’t think that there’s anything fundamentally going wrong with the business, although the cashflow situation is worth keeping an eye on.

The recent stock market sell off seems to have particularly affected “long duration” assets – that is good quality companies, but expensive (Burberry -17% YTD, Sage -22% YTD, Experian -28% YTD) spring to mind, but I’m sure there are many others. Although much smaller, I’d put Treatt -38% since the start of May in the same bracket. In previous sell offs I’ve done well buying high quality companies at a reasonable price (Impax, Games Workshop), and not badly, but less well, buying obviously cheap single P/E companies that don’t re-rate (The Mission, Bank of Georgia). So I’m conscious that this sell off could present opportunities to buy stocks I admire, but in normal times reject on valuation grounds.

Character Group PLC H1 to Feb

Revenue was +22% to £91m, showing that they had a good Christmas despite the supply chain problems. Statutory PBT was down -15% to £6.5m, although there was a £2m gain on sale in the prior year. Adjusting for this PBT was up +7%. Cash from operations was £3.4m, and the difference between cashflow and profits was due to increasing inventory. That’s a similar trend as Treatt above, however unlike Treatt, Character has £22m of cash (20% of the current market cap), even after buying back £14m of shares via a tender offer at 630p per share.

Outlook: Although less than 50% of revenue comes from the UK, CCT is exposed to sterling weakness because it makes purchases in dollars. They also mention continuing covid concerns in China. With those caveats they still expect to achieve market expectations for FY August.

Valuation: The shares are trading on 13x FY Aug 2023F, and 0.8x sales the same year. Looking back they have an impressively high RoCE figure (in the 20s and 30x) for a company holding so much cash.

Ownership: This is a Lord Lee stock and has a somewhat idiosyncratic list of shareholders (by which I mean the only couple I’ve heard of is Ruffer and Close Brothers). Henry Spain Investments, a private client regional stockbroker, are the largest shareholder with 13.4%, Close Brothers and Forager both own 7.8%, Ruffer own 5.5% and Sweet Briar 4.7%. Joint Managing Directors Kiran Shah and Jon Diver own 9.9% and 6.5% respectively.

Opinion: I’ve noticed that companies with substantial net cash and/or buying back shares have been outperforming over the last couple of months during the sell off. That’s not surprising. Maynard wrote about the company’s history of buybacks 4 years ago, which gives a longer term perspective. They certainly do have an impressive track record of converting profits to cash.

Given the defensive nature of the balance sheet this looks like a safe stock to own if you are worried about markets continuing to sell off. I would want to understand how dependent they are on continue to extend their Peppa Pig contract with Hasbro, and also whether they might be able to develop their own brands.

Bruce Packard

brucepackard.com

Got some thoughts on this week commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on chat icon in top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.