FTSE weakened slightly to 6300 in the second half of last week, but the bounce of former “Covid losers” continued with Rolls Royce, Glencore, Shell and BP all up 8% in the last 5 days. Nasdaq continued to rise to 12152 and Tesla’s value exceeded half a trillion dollars.

airbnb IPO

Last week airbnb filed its 349 page S-1 document in preparation for an IPO. I couldn’t face reading it, but out of curiosity did a CTRL+F search for the word “platform” which appears 512 times in the document. Though the company has been operating for 13 years, it failed to make a post-tax profit in either 2018 or 2019. This year the business has suffered badly because of Covid 19, so it seems an odd time for a loss-making travel company to IPO. There are some stories that employees have become frustrated with being paid in “Restricted Stock Units”.* In the S1 document airbnb puts the size of these RSUs at $3.5bn, which presumably would have made the loss-making company’s p&l look even less attractive. In May this year the company made redundant a quarter of its staff.

airbnb spends around a third of its revenue on marketing. Whether you like the business rather depends on if you think this expense is building a valuable long term brand with loyal customers, or burning money. Is the platform finding that attracting new customers is too expensive? Or do existing customers stay on the platform and eventually pay back the company’s investment in their acquisition costs?

Put another way: who are airbnb’s competitors? Physical hotels? Or Booking.com? Or Google? The latter has its own travel offering, but is also a major beneficiary of airbnb’s marketing dollars. Platforms are supposed to enjoy network effects and deliver a virtuous circle of increasing returns. Yet neither airbnb nor Funding Circle, which updated the market last week and also claims to be a platform, can deliver profitable growth. Wouldn’t it be fun if we are seeing a massive transfer of value from “dumb” VC money backing unlisted businesses who are burning money on marketing into the pockets of investors in listed companies with genuine network effects (Google, Facebook, maybe even Future)?

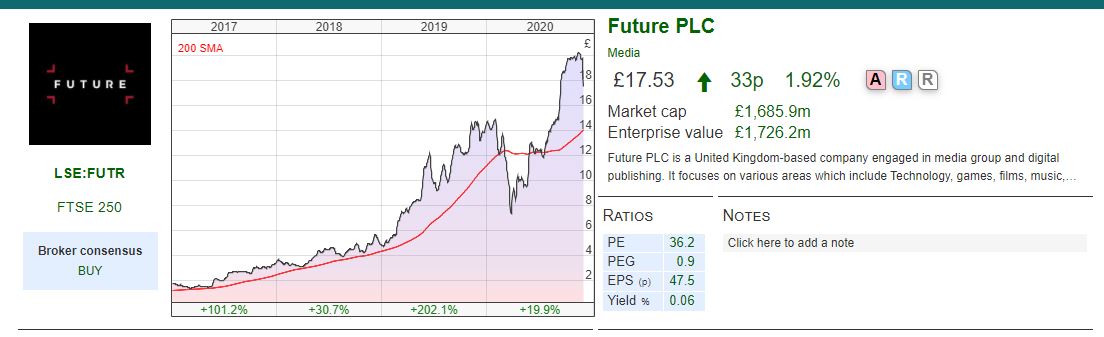

Future claims to be a platform leveraging data and insights. They reported strong FY results last week. At the same time their shares dropped almost 20% as they announced an agreed bid of £600m for GoCompare. I also add a couple of brief comments on James Latham and Codemasters both reported H1 results to 30th September.

Future FY results to 30 Sept and acquisition

This acquisitive media company put out FY results and announced a recommended offer for GoCompare, the price comparison website spun out of esure, itself an HBOS spin-off. The latter’s shareholders receive 0.052497 of Future shares, plus 33p of cash. This valued GoCo’s shares at 136p (a 24% premium to the previous day’s closing price) or £594m. GoCo’s shareholders would own 19% of the enlarged group.

GoCompare’s share price jumped to 134p on the open, before selling off to 118p. Future’s shares were down just under 20%, despite reporting strong results.

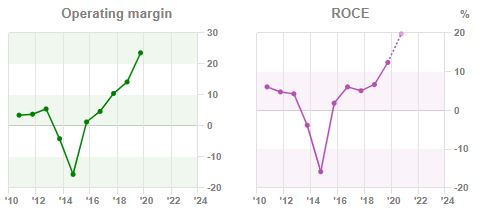

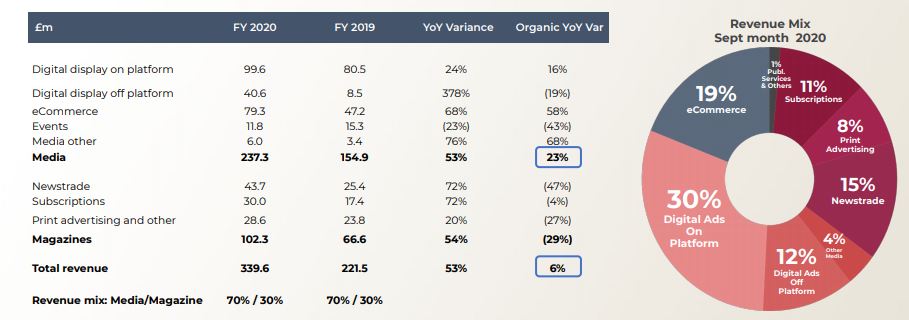

Platform model Yes another company that has jumped on the platform bandwagon! Their tagline is “a global platform for specialist media driven by technology, leveraging our data and insight”. 30% of revenue comes from specialist print magazine titles that the company owns (Guitar Player, FourFourTwo, Music Week, What Hifi? etc) which are in secular decline, but still generate cash. The company has been buying titles and migrating content online (they say they are experts at writing content that ranks high on SEO). Future then earn revenue from faster growing segments: eCommerce, events and digital advertising which are 70% of revenue. The example they give is “What Hifi?” which they converted from a UK magazine to website content which would also appeal to US audiences. They then generate revenue from advertising “click-throughs”. Their titles already reach one in three people in the US and UK (282m online pairs of eyeballs). This strategy seems to be working, with gross profit margins improving and Return on Capital Employed rising steadily from -16% FY 2014 to +12% 2020.

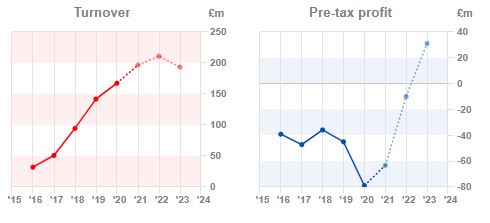

Results Future reported FY 2020 revenue of £340m +53%, and statutory PBT of £52m +309%. The Group acquired TI Media in April 2020 and Barcroft Studios in November 2019, so excluding acquisitions organic revenue growth was a less exciting +6%. The outlook statement says that FY2021 has started well, positive trends seen in FY 2020 expected to continue in FY2021.

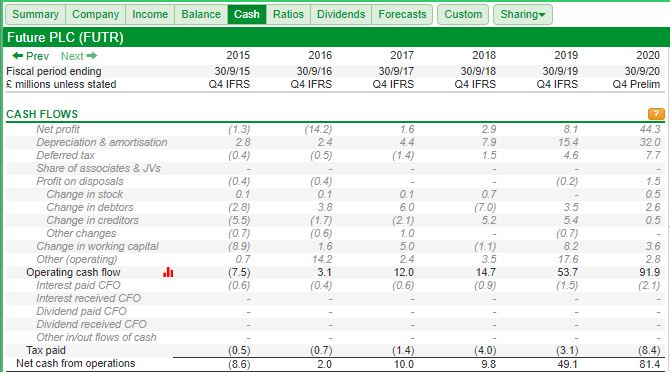

Year end cash was £19.3m, up £14m during the year. As an aside, I find this company’s own published cashflow statement rather odd. Normally cash flow statements start with profits at the top and show adjustments that they make to arrive at “cashflows from operation activities”. Future’s cashflow statement begins with “cashflow from operating activities”. Fortunately Sharepad’s “cash” tab on Financials does a reconciliation.

Given that revenue in Newstrade revenues fell 47% organically this year, I wonder what assumptions go into the company’s £32m depreciation and amortisation charge. Tangible assets are just £21m. Print media titles certainly seem to be a depreciating asset, so I wonder if some of the £494m of intangible assets on the balance sheet could be impaired. The company paid less than £8m of tax on £52m of statutory PBT, which the company attributes to tax deductible exceptional items and a fair value gain on contingent consideration for SmartBrief. I’ve never before come across changes in consideration paid for previous acquisitions as a way of juicing statutory profits.

Covid impact: The company estimates the impact of retail closures meant they lost around £20m of magazine sales. They also had to cancel 27 physical events, which last year made £8.9m of revenue. They hosted 32 virtual events, which made £1.4m of revenue, but presumably cost significantly less than the physical events to host.

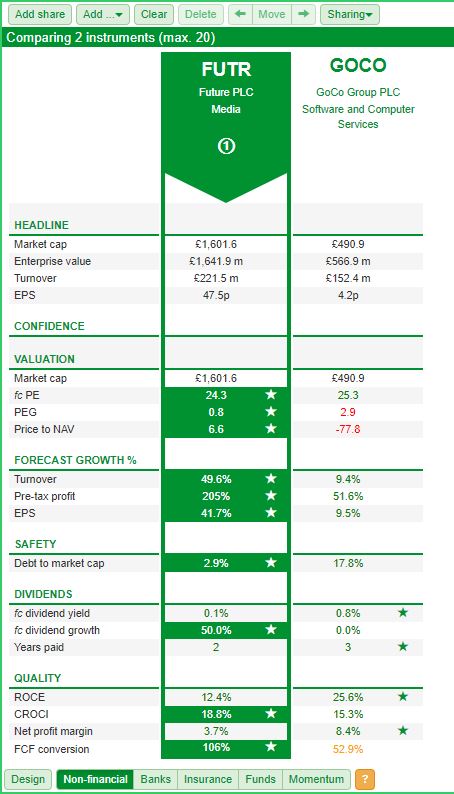

Rationale for the deal: Cost synergies are just £10m, so instead this deal is about revenue growth. Future talk about expanding through “complimentary adjacencies”. They believe that their content drives “intent to purchase” and therefore they can monetise advertising more effectively. That is, customers read product reviews and retailers are prepared to pay more for advertising on Future’s websites, because their readers are likely to buy stuff. It is a sophisticated form of affiliate marketing.** Future has software called “Hawk” which helps customers search for best price for a specific product (examples given by management are make and model of laptops, headphones, coffee machines). GoCompare’s platform allows customers to compare prices of services (broadband, utility bills, home insurance) and advertise on Future’s websites like realhomes.com. Future’s Chief Executive Zillah Byng-Thorne certainly knows the company she is buying well, because she’s Non Executive Director and Chair of the Audit and Risk Committee of GoCompare (hat tip “@Rhomboid” on Twitter). At the bottom of this article I’ve used SharePad’s “compare” tool to show the relative size and valuation metrics of the two companies.

Future has made 7 acquisitions since January 2019 the four most significant were

- TI Media total consideration £140m, 8m of shares issued (share price £12.75)

- Barcroft total consideration of £23.4m of which 40% share 686K of shares issued with a value of £9.1m (share price £13.22)

- MoNa Mobile Nations £90m total consideration 600K of shares

- SmartBrief up to £50m total consideration 1m shares.

Almost £600m price looks expensive, given that GoCompare consensus is for £27m profit in 2021. Even adding the £10m of annual synergies, that makes a Return on Investment of below 7%. When a buyer funds it purchase with its own paper, it can signal management believe their own “currency” is overvalued. The most memorable example of this was Vodafone paying £101bn for Mannesman in late 1999. Vodafone hugely overpaid, though they did so with their own overvalued paper, not cash.

I’m wary. For investors keen on the business model, they could buy Moneysupermarket which reports RoCE of 49% according to SharePad, and trades on 19x earnings.

Funding Circle Trading Update

Like Bank of Georgia last week, this is another financial company that I followed closely when I was working at Seymour Pierce, hoping that I could bring them to market. Unlike Bank of Georgia, I failed and instead discovered that Funding Circle could raise money far more easily by staying private and attracting VC funding than by coming to AIM. There are huge pools of money looking to back loss making unlisted businesses, because somehow asset allocators believe that unlisted companies make more attractive investments. In reality, these unlisted businesses are the same ones that would otherwise be listing on the stock market. Instead businesses are delaying their IPOs, even then, many are still loss making when they do decide to float.

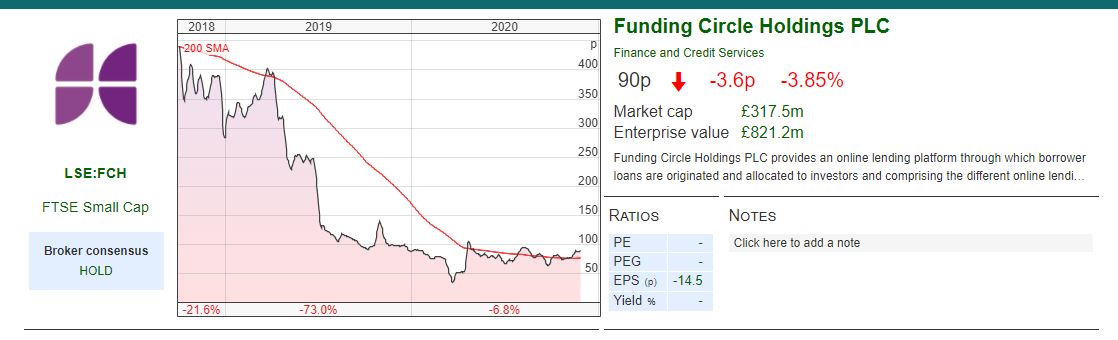

In 2018, Funding Circle did eventually IPO, at the wrong price (430p implying £1.5bn market cap) and the shares fell 90% within 18 months. Now I think that it is worth re-visiting and asking whether FC is fundamentally a flawed business that always loses money or if the IPO price was wildly over optimistic, and at the current price the investment case begins to make sense.

History Funding Circle was founded in 2010 by Samir Desai, James Meekings and Andrew Mullinger. The idea was to become a technology platform so “investors” (NB FC returns are not guaranteed, so customers can not be called “savers”) could earn superior risk adjusted returns than keeping money on deposit in a high street bank. They believed SMEs were being poorly served by banks after the financial crisis, so targeted small businesses as borrowers. Funding Circle started by not taking credit risk, but instead merely charging a fee for being the intermediary between a borrower SME and an “investor” lender.

However, FC found that “peer to peer” wasn’t really working for them, it was too hard to scale so many small investors, instead packaging up loans and selling them to institutions was more effective. “P2P” transformed to “marketplace lending”. This in turn meant that the business went from pure intermediation with no credit risk to warehousing loans that they intended to sell. In H1 2020 they took a negative £96.1m fair value adjustment through the p&l for these loans in their “warehouse”.*** Maybe a significant amount of this £96.1m fair value charge could reverse in H2 because credit markets have responded exuberantly to the vaccine news? For instance Carnival has issued an unsecured bond and Peru has borrowed in US dollars for a century at 2.55% (are these the same investors who lent Argentina money a couple of years ago on similar terms???).

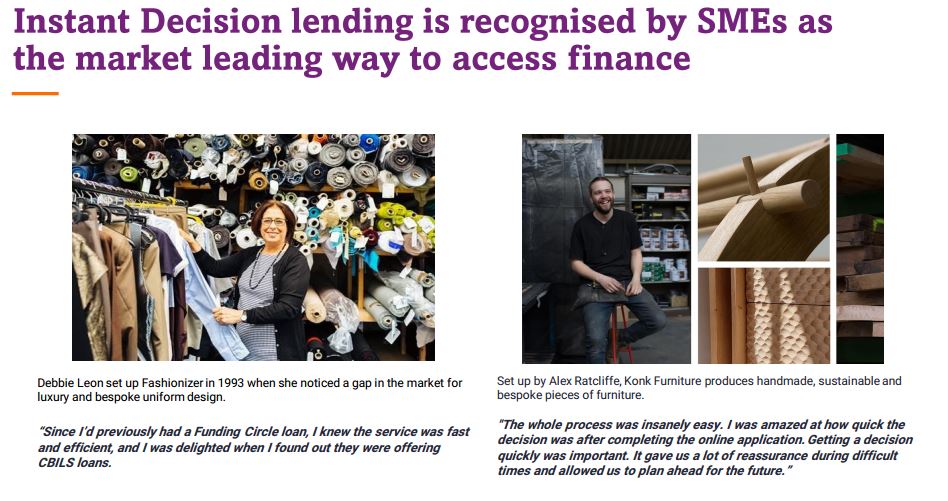

In finance there is always a risk of “adverse selection”: the borrowers who are the worst credit risk are the most likely to be rejected by a bank and find their way to Funding Circle. In response, FC point out that speed of application process and decision time attracts borrowers. They claim a 6 minute average application time and once submitted an instant decision is normally made. Banks often take weeks before they decide to lend to an SME.

Source: Funding Circle presentation

Claimed network effects In the IPO document management claimed network effects, accumulating more data that has improved credit scoring, higher acceptance rates and better pricing for borrowers. They said: “every additional retail Investor that joins the platform renders it more valuable for existing and prospective Investors”. That platform word again, it occurs 424 times in their IPO document! I think that claim is debatable. It is not the same economics as increasing returns that you see in true “network effect” businesses (like Google, Facebook but also the London Stock Exchange). Certainly Funding Circle’s and Lending Club’s 90% share price declines post IPO reveal little evidence of network effects.

Before the pandemic, the company was spending over 40% of its revenue on marketing. For comparison that is higher than Bank of Georgia’s entire operating cost base (their cost income ratio is below 40%). Perhaps FC’s cost advantage from not having physical branches is illusory, because they have to spend significantly more money on advertising to attract customers?

Trading update Last week Funding Circle said their H2 had started well and they would be “materially ahead” of previous guidance. Total income in the first 4 months of H2 was up 38% v the same period in H2 last year. This was driven by the UK were total income was up 67% year on year. The company is now guiding that FY total income should be up 20% v 2019. At the H1 results Funding Circle reported a loss of £115m. The business had £131m of cash, versus total assets of £1.01bn, and net assets of £217m.

As businesses come out of “lockdown” they may well require more working capital to expand, it is a matter of fine judgement whether lending more money to a business struggling for cashflow is value creating.

Verdict In theory SME lending should be a target for “FinTech” disruption. Lending money is a commodity business, so returns ought to accrue to the lowest cost and most efficient competitor. That should be Funding Circle or similar, though at the moment their customer acquisition cost is too high. The question in my mind, is whether marketing spend declines as revenue grows, allowing the business to generate decent returns on capital. As I noted above, this is the same conundrum as for airbnb.

So I wouldn’t dismiss this business. It hit 25p in mid March, and has bounced strongly, 90p is the 200 MACD so if it can sustain a level above that line it would also be positive. Meanwhile Bank of Georgia generates a RoE of 20%

Codemasters H1 results to September

Codemasters the car racing game specialist released their H1 results to end of September. This may be their last set of results, because on the 10th Nov announced the Board recommended to sell the company to Take-Two Interactive Software.

Codemasters the car racing game specialist released their H1 results to end of September. This may be their last set of results, because on the 10th Nov announced the Board recommended to sell the company to Take-Two Interactive Software.

H1 revenues of £80.5m, roughly double the £39.8m reported in H1 last year. Net cash was £50.1m at the end of September v £24.6m same period in 2019. The above figures are in line with the trading update the company announced on 7th October, though the gross margin now reported by the company is 88.9%, lower than the 92.9% originally stated back in October by the company. This discrepancy is due to licence costs not being included in the margin disclosed on 7 October, according to management.

Statutory PBT was £20.5m, v 10.6m H1 last year. Management say that H2 has begun well, highlighting DiRT 5 which was released earlier in November and CARS GO scheduled to be released in H2. With such a positive outlook it’s hard to see why management might be so keen to recommend Take-Two’s offer.

The reason given, despite the mere 11% premium to the company’s share price was: “The Board believes that Codemasters will benefit by leveraging Take-Two’s global distribution and marketing infrastructure, and its core operating expertise in live operations, analytics, product development, and brand and performance marketing.”

This seems an odd claim given that 73% of CDM’s total sales are already digital. In a digital world, the amount of investment has a weak relationship with success, because feedback loops positively reinforce a successful product. Films like Reservoir Dogs or El Mariachi (budget $7,000) can be hugely successful despite their low budgets and little marketing. I’m unconvinced that the costs are going to accelerate, unless the company sees some sort of existential threat from new technology (maybe virtual reality?)

Last year Frank Sagnier, the Chief Executive of Codemasters earned £985K, of which £363K was basic salary. He also owns 3.2m of the ordinary shares, worth just under £16m at the current bid price. Though he could sell his shares in the market, it’s unlikely he could do so at the undisturbed price. With £16m on the table, perhaps his interests are not completely aligned with those of his fellow shareholders?

That said, given the violent sell off in “expensive quality” since Pfizer announced they had a credible vaccine, perhaps shareholders should think twice before voting against the bid.

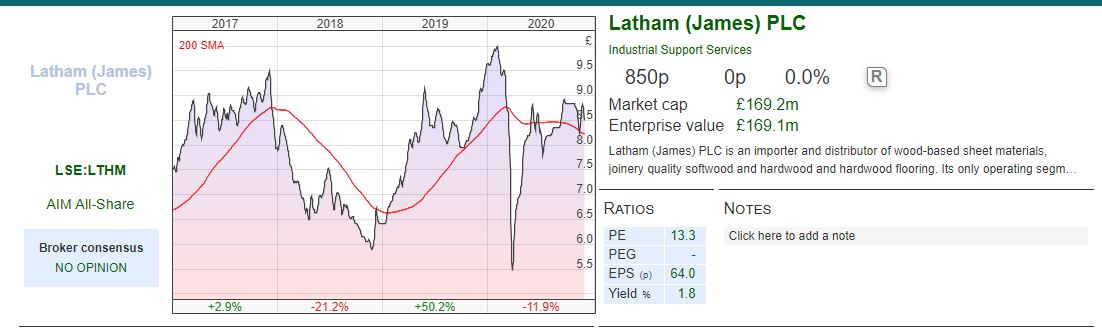

James Latham H1 results to September

Covered recently here by Richard https://knowledge.sharescope.co.uk/2020/08/19/a-safety-first-stock/

An interesting investment case, suggesting that company could report higher cashflow if management were prepared to undermine a competitive “moat”: holding large amounts of timber stock. But they don’t sacrifice the long term on the altar of short term higher cashflow because they are family owned and chaired by Nick Latham who has been at the company 28 years and on the Board 13 years.

Results H1 revenues were down 15% to £107m (v down 20% mentioned in their Trading Update in early September) so the second quarter has been much more positive than the first. H1 statutory PBT down 24% to £6.5m v £8.5m last year.

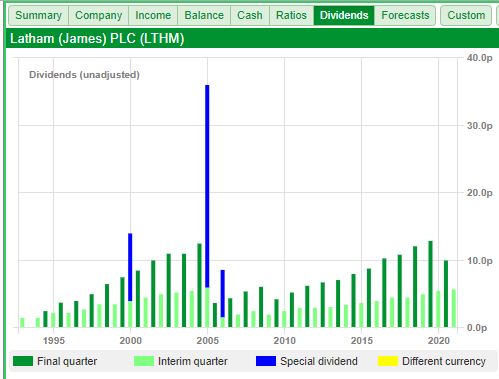

The company says Q2’s trends have continued to improve into H2, although we now have a second wave / lockdown I doubt that the strong start to H2 is sustainable. The Board has declared an increased interim dividend of 5.7p per Ordinary Share (2019: 5.5p). I’ve shown Sharepad’s long term dividend history going back to 1995 of this company on the next page. The company has increased levels of inventory to prepare for any BREXIT disruption.

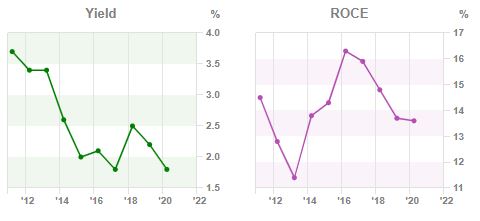

Verdict I agree with Richard, James Latham looks like a quality, long term business. There don’t seem to be any broker forecasts, but the shares are trading on 13x historic earnings. Returns have been falling in recent years, and I wonder if they will suffer further from commodity price inflation. But with RoCE at 13.6%, James Latham still ranks in the top 20% of the market by RoCE (264 of 1297) according to SharePad. The chart shows the share price does sometimes sell off hard, so you may be able to time your entry level.

Bruce Packard

Notes

*See https://www.businesstimes.com.sg/garage/news/for-airbnb-employees-dream-turns-into-disillusionment and also a very good write up on the airbnb IPO by this blogger. https://valueandopportunity.com/2020/11/24/travel-series-airbnb-baller-ipo-or-desperate-hail-mary-including-a-3-5-bn-usd-accounting-time-bomb/#more-37971

**Normally affiliate marketing website are rather amateurish. They review say “top 10 dating websites” or “best CFD trading apps” and then earn money on click-through rates to the sites they are promoting. There is an incentive to drive traffic to the sites that pay the highest commission, so there’s often a conflict of interest. Future plc seems much more sophisticated than that. Nevertheless at its heart there does seem to be a blurring of the boundaries between editorial content and advertising, which is strongly frowned upon by print media journalists.

***This is the metaphor the company uses. A SME loan warehouse is a curious image. I have pictures of a Segro estate in Slough, stacked full to the ceiling with pallets of SME loans gradually gathering dust.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 30/11/20 – The platform bandwagon rolls on

FTSE weakened slightly to 6300 in the second half of last week, but the bounce of former “Covid losers” continued with Rolls Royce, Glencore, Shell and BP all up 8% in the last 5 days. Nasdaq continued to rise to 12152 and Tesla’s value exceeded half a trillion dollars.

airbnb IPO

Last week airbnb filed its 349 page S-1 document in preparation for an IPO. I couldn’t face reading it, but out of curiosity did a CTRL+F search for the word “platform” which appears 512 times in the document. Though the company has been operating for 13 years, it failed to make a post-tax profit in either 2018 or 2019. This year the business has suffered badly because of Covid 19, so it seems an odd time for a loss-making travel company to IPO. There are some stories that employees have become frustrated with being paid in “Restricted Stock Units”.* In the S1 document airbnb puts the size of these RSUs at $3.5bn, which presumably would have made the loss-making company’s p&l look even less attractive. In May this year the company made redundant a quarter of its staff.

airbnb spends around a third of its revenue on marketing. Whether you like the business rather depends on if you think this expense is building a valuable long term brand with loyal customers, or burning money. Is the platform finding that attracting new customers is too expensive? Or do existing customers stay on the platform and eventually pay back the company’s investment in their acquisition costs?

Put another way: who are airbnb’s competitors? Physical hotels? Or Booking.com? Or Google? The latter has its own travel offering, but is also a major beneficiary of airbnb’s marketing dollars. Platforms are supposed to enjoy network effects and deliver a virtuous circle of increasing returns. Yet neither airbnb nor Funding Circle, which updated the market last week and also claims to be a platform, can deliver profitable growth. Wouldn’t it be fun if we are seeing a massive transfer of value from “dumb” VC money backing unlisted businesses who are burning money on marketing into the pockets of investors in listed companies with genuine network effects (Google, Facebook, maybe even Future)?

Future claims to be a platform leveraging data and insights. They reported strong FY results last week. At the same time their shares dropped almost 20% as they announced an agreed bid of £600m for GoCompare. I also add a couple of brief comments on James Latham and Codemasters both reported H1 results to 30th September.

Future FY results to 30 Sept and acquisition

This acquisitive media company put out FY results and announced a recommended offer for GoCompare, the price comparison website spun out of esure, itself an HBOS spin-off. The latter’s shareholders receive 0.052497 of Future shares, plus 33p of cash. This valued GoCo’s shares at 136p (a 24% premium to the previous day’s closing price) or £594m. GoCo’s shareholders would own 19% of the enlarged group.

GoCompare’s share price jumped to 134p on the open, before selling off to 118p. Future’s shares were down just under 20%, despite reporting strong results.

Platform model Yes another company that has jumped on the platform bandwagon! Their tagline is “a global platform for specialist media driven by technology, leveraging our data and insight”. 30% of revenue comes from specialist print magazine titles that the company owns (Guitar Player, FourFourTwo, Music Week, What Hifi? etc) which are in secular decline, but still generate cash. The company has been buying titles and migrating content online (they say they are experts at writing content that ranks high on SEO). Future then earn revenue from faster growing segments: eCommerce, events and digital advertising which are 70% of revenue. The example they give is “What Hifi?” which they converted from a UK magazine to website content which would also appeal to US audiences. They then generate revenue from advertising “click-throughs”. Their titles already reach one in three people in the US and UK (282m online pairs of eyeballs). This strategy seems to be working, with gross profit margins improving and Return on Capital Employed rising steadily from -16% FY 2014 to +12% 2020.

Results Future reported FY 2020 revenue of £340m +53%, and statutory PBT of £52m +309%. The Group acquired TI Media in April 2020 and Barcroft Studios in November 2019, so excluding acquisitions organic revenue growth was a less exciting +6%. The outlook statement says that FY2021 has started well, positive trends seen in FY 2020 expected to continue in FY2021.

Year end cash was £19.3m, up £14m during the year. As an aside, I find this company’s own published cashflow statement rather odd. Normally cash flow statements start with profits at the top and show adjustments that they make to arrive at “cashflows from operation activities”. Future’s cashflow statement begins with “cashflow from operating activities”. Fortunately Sharepad’s “cash” tab on Financials does a reconciliation.

Given that revenue in Newstrade revenues fell 47% organically this year, I wonder what assumptions go into the company’s £32m depreciation and amortisation charge. Tangible assets are just £21m. Print media titles certainly seem to be a depreciating asset, so I wonder if some of the £494m of intangible assets on the balance sheet could be impaired. The company paid less than £8m of tax on £52m of statutory PBT, which the company attributes to tax deductible exceptional items and a fair value gain on contingent consideration for SmartBrief. I’ve never before come across changes in consideration paid for previous acquisitions as a way of juicing statutory profits.

Covid impact: The company estimates the impact of retail closures meant they lost around £20m of magazine sales. They also had to cancel 27 physical events, which last year made £8.9m of revenue. They hosted 32 virtual events, which made £1.4m of revenue, but presumably cost significantly less than the physical events to host.

Rationale for the deal: Cost synergies are just £10m, so instead this deal is about revenue growth. Future talk about expanding through “complimentary adjacencies”. They believe that their content drives “intent to purchase” and therefore they can monetise advertising more effectively. That is, customers read product reviews and retailers are prepared to pay more for advertising on Future’s websites, because their readers are likely to buy stuff. It is a sophisticated form of affiliate marketing.** Future has software called “Hawk” which helps customers search for best price for a specific product (examples given by management are make and model of laptops, headphones, coffee machines). GoCompare’s platform allows customers to compare prices of services (broadband, utility bills, home insurance) and advertise on Future’s websites like realhomes.com. Future’s Chief Executive Zillah Byng-Thorne certainly knows the company she is buying well, because she’s Non Executive Director and Chair of the Audit and Risk Committee of GoCompare (hat tip “@Rhomboid” on Twitter). At the bottom of this article I’ve used SharePad’s “compare” tool to show the relative size and valuation metrics of the two companies.

Future has made 7 acquisitions since January 2019 the four most significant were

Almost £600m price looks expensive, given that GoCompare consensus is for £27m profit in 2021. Even adding the £10m of annual synergies, that makes a Return on Investment of below 7%. When a buyer funds it purchase with its own paper, it can signal management believe their own “currency” is overvalued. The most memorable example of this was Vodafone paying £101bn for Mannesman in late 1999. Vodafone hugely overpaid, though they did so with their own overvalued paper, not cash.

I’m wary. For investors keen on the business model, they could buy Moneysupermarket which reports RoCE of 49% according to SharePad, and trades on 19x earnings.

Funding Circle Trading Update

Like Bank of Georgia last week, this is another financial company that I followed closely when I was working at Seymour Pierce, hoping that I could bring them to market. Unlike Bank of Georgia, I failed and instead discovered that Funding Circle could raise money far more easily by staying private and attracting VC funding than by coming to AIM. There are huge pools of money looking to back loss making unlisted businesses, because somehow asset allocators believe that unlisted companies make more attractive investments. In reality, these unlisted businesses are the same ones that would otherwise be listing on the stock market. Instead businesses are delaying their IPOs, even then, many are still loss making when they do decide to float.

In 2018, Funding Circle did eventually IPO, at the wrong price (430p implying £1.5bn market cap) and the shares fell 90% within 18 months. Now I think that it is worth re-visiting and asking whether FC is fundamentally a flawed business that always loses money or if the IPO price was wildly over optimistic, and at the current price the investment case begins to make sense.

History Funding Circle was founded in 2010 by Samir Desai, James Meekings and Andrew Mullinger. The idea was to become a technology platform so “investors” (NB FC returns are not guaranteed, so customers can not be called “savers”) could earn superior risk adjusted returns than keeping money on deposit in a high street bank. They believed SMEs were being poorly served by banks after the financial crisis, so targeted small businesses as borrowers. Funding Circle started by not taking credit risk, but instead merely charging a fee for being the intermediary between a borrower SME and an “investor” lender.

However, FC found that “peer to peer” wasn’t really working for them, it was too hard to scale so many small investors, instead packaging up loans and selling them to institutions was more effective. “P2P” transformed to “marketplace lending”. This in turn meant that the business went from pure intermediation with no credit risk to warehousing loans that they intended to sell. In H1 2020 they took a negative £96.1m fair value adjustment through the p&l for these loans in their “warehouse”.*** Maybe a significant amount of this £96.1m fair value charge could reverse in H2 because credit markets have responded exuberantly to the vaccine news? For instance Carnival has issued an unsecured bond and Peru has borrowed in US dollars for a century at 2.55% (are these the same investors who lent Argentina money a couple of years ago on similar terms???).

In finance there is always a risk of “adverse selection”: the borrowers who are the worst credit risk are the most likely to be rejected by a bank and find their way to Funding Circle. In response, FC point out that speed of application process and decision time attracts borrowers. They claim a 6 minute average application time and once submitted an instant decision is normally made. Banks often take weeks before they decide to lend to an SME.

Source: Funding Circle presentation

Claimed network effects In the IPO document management claimed network effects, accumulating more data that has improved credit scoring, higher acceptance rates and better pricing for borrowers. They said: “every additional retail Investor that joins the platform renders it more valuable for existing and prospective Investors”. That platform word again, it occurs 424 times in their IPO document! I think that claim is debatable. It is not the same economics as increasing returns that you see in true “network effect” businesses (like Google, Facebook but also the London Stock Exchange). Certainly Funding Circle’s and Lending Club’s 90% share price declines post IPO reveal little evidence of network effects.

Before the pandemic, the company was spending over 40% of its revenue on marketing. For comparison that is higher than Bank of Georgia’s entire operating cost base (their cost income ratio is below 40%). Perhaps FC’s cost advantage from not having physical branches is illusory, because they have to spend significantly more money on advertising to attract customers?

Trading update Last week Funding Circle said their H2 had started well and they would be “materially ahead” of previous guidance. Total income in the first 4 months of H2 was up 38% v the same period in H2 last year. This was driven by the UK were total income was up 67% year on year. The company is now guiding that FY total income should be up 20% v 2019. At the H1 results Funding Circle reported a loss of £115m. The business had £131m of cash, versus total assets of £1.01bn, and net assets of £217m.

As businesses come out of “lockdown” they may well require more working capital to expand, it is a matter of fine judgement whether lending more money to a business struggling for cashflow is value creating.

Verdict In theory SME lending should be a target for “FinTech” disruption. Lending money is a commodity business, so returns ought to accrue to the lowest cost and most efficient competitor. That should be Funding Circle or similar, though at the moment their customer acquisition cost is too high. The question in my mind, is whether marketing spend declines as revenue grows, allowing the business to generate decent returns on capital. As I noted above, this is the same conundrum as for airbnb.

So I wouldn’t dismiss this business. It hit 25p in mid March, and has bounced strongly, 90p is the 200 MACD so if it can sustain a level above that line it would also be positive. Meanwhile Bank of Georgia generates a RoE of 20%

Codemasters H1 results to September

H1 revenues of £80.5m, roughly double the £39.8m reported in H1 last year. Net cash was £50.1m at the end of September v £24.6m same period in 2019. The above figures are in line with the trading update the company announced on 7th October, though the gross margin now reported by the company is 88.9%, lower than the 92.9% originally stated back in October by the company. This discrepancy is due to licence costs not being included in the margin disclosed on 7 October, according to management.

Statutory PBT was £20.5m, v 10.6m H1 last year. Management say that H2 has begun well, highlighting DiRT 5 which was released earlier in November and CARS GO scheduled to be released in H2. With such a positive outlook it’s hard to see why management might be so keen to recommend Take-Two’s offer.

The reason given, despite the mere 11% premium to the company’s share price was: “The Board believes that Codemasters will benefit by leveraging Take-Two’s global distribution and marketing infrastructure, and its core operating expertise in live operations, analytics, product development, and brand and performance marketing.”

This seems an odd claim given that 73% of CDM’s total sales are already digital. In a digital world, the amount of investment has a weak relationship with success, because feedback loops positively reinforce a successful product. Films like Reservoir Dogs or El Mariachi (budget $7,000) can be hugely successful despite their low budgets and little marketing. I’m unconvinced that the costs are going to accelerate, unless the company sees some sort of existential threat from new technology (maybe virtual reality?)

Last year Frank Sagnier, the Chief Executive of Codemasters earned £985K, of which £363K was basic salary. He also owns 3.2m of the ordinary shares, worth just under £16m at the current bid price. Though he could sell his shares in the market, it’s unlikely he could do so at the undisturbed price. With £16m on the table, perhaps his interests are not completely aligned with those of his fellow shareholders?

That said, given the violent sell off in “expensive quality” since Pfizer announced they had a credible vaccine, perhaps shareholders should think twice before voting against the bid.

James Latham H1 results to September

Covered recently here by Richard https://knowledge.sharescope.co.uk/2020/08/19/a-safety-first-stock/

An interesting investment case, suggesting that company could report higher cashflow if management were prepared to undermine a competitive “moat”: holding large amounts of timber stock. But they don’t sacrifice the long term on the altar of short term higher cashflow because they are family owned and chaired by Nick Latham who has been at the company 28 years and on the Board 13 years.

Results H1 revenues were down 15% to £107m (v down 20% mentioned in their Trading Update in early September) so the second quarter has been much more positive than the first. H1 statutory PBT down 24% to £6.5m v £8.5m last year.

The company says Q2’s trends have continued to improve into H2, although we now have a second wave / lockdown I doubt that the strong start to H2 is sustainable. The Board has declared an increased interim dividend of 5.7p per Ordinary Share (2019: 5.5p). I’ve shown Sharepad’s long term dividend history going back to 1995 of this company on the next page. The company has increased levels of inventory to prepare for any BREXIT disruption.

Verdict I agree with Richard, James Latham looks like a quality, long term business. There don’t seem to be any broker forecasts, but the shares are trading on 13x historic earnings. Returns have been falling in recent years, and I wonder if they will suffer further from commodity price inflation. But with RoCE at 13.6%, James Latham still ranks in the top 20% of the market by RoCE (264 of 1297) according to SharePad. The chart shows the share price does sometimes sell off hard, so you may be able to time your entry level.

Bruce Packard

Notes

*See https://www.businesstimes.com.sg/garage/news/for-airbnb-employees-dream-turns-into-disillusionment and also a very good write up on the airbnb IPO by this blogger. https://valueandopportunity.com/2020/11/24/travel-series-airbnb-baller-ipo-or-desperate-hail-mary-including-a-3-5-bn-usd-accounting-time-bomb/#more-37971

**Normally affiliate marketing website are rather amateurish. They review say “top 10 dating websites” or “best CFD trading apps” and then earn money on click-through rates to the sites they are promoting. There is an incentive to drive traffic to the sites that pay the highest commission, so there’s often a conflict of interest. Future plc seems much more sophisticated than that. Nevertheless at its heart there does seem to be a blurring of the boundaries between editorial content and advertising, which is strongly frowned upon by print media journalists.

***This is the metaphor the company uses. A SME loan warehouse is a curious image. I have pictures of a Segro estate in Slough, stacked full to the ceiling with pallets of SME loans gradually gathering dust.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.