Bruce looks at how successful formulas, if copied without thought, can become lazy thinking. He looks at a profit warnings from last week LUCE and RCH. Plus a couple of acquisitive “roll-ups” which the auditors delayed signing off the results: SFOR and LTG.

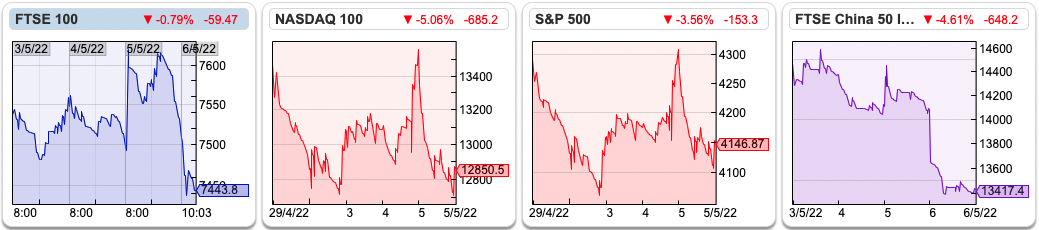

The FTSE was down -0.9% at to 7,443 last week. The US markets were very volatile, with the S&P seeing it’s biggest gain in 2 years in response to the Fed “only” raising interest rates by 50bp, before falling back very sharply down -3.3% in the last 5 days. The Nasdaq 100 was down -4.5% in the last 5 days. The US Govt 10Y bond yield touched just over 3% on Bank Holiday Monday, when UK markets were closed, then falling back mid week, then rising back to consolidate above 3%. Brent crude also rose to $110 per barrel and is now up +42% since the start of the year.

There were a couple of disappointing updates from retailers, Boo Hoo, Quiz and Joules. I think the idea that just because a retailer sells online, it is somehow immune to pressure on consumers’ disposable income has proved flawed. We’ve now seen that although online is less exposed to “shrinkage” (that is customers shoplifting), customers sending back clothes is equally hard to deal with and also negative for margins. Cost savings on physical stores and leases is offset by investment needed in warehouses and distribution centres. Next, which has revenue of £4.6bn or c 2.5x size of Boo Hoo, did manage to deliver an inline update, but even so the shares are down -25% since the start of the year.

A related trend that we could see in the coming months is that consumer subscription businesses, that until now have been seen as higher quality recurring revenue, may also struggle. In normal times, assuming that subscriptions will renew year after year is a solid assumption, but if inflation is putting pressure on household incomes, then that could be flawed thinking. Successful investing is not about what works in normal times. Instead, it’s worth thinking about what can go wrong when conditions are not normal and making sure that we don’t lose too much money in any downturn.

A programmer friend shared this funny Bloomberg article about “Blands”. Most have single syllable names like Hum, Quip, Burst, Brüush, Gleem and Shyn, and are trying to do subscription businesses for toothbrushing, shaving, vitamin supplements, coffee, healthy snacks, house plants or CBD infused fizzy drinks. Chamath Palihapitiya, the former Facebook executive and until recently SPAC promoter, has suggested that Venture Capital has become lazy and formulaic: “The VC community is an increasingly predictable and lookalike bunch that just seems to follow each other around from one trivial idea to another.”

I do think that there is a tendency in finance to keep iterating on what works…until it no longer works. “Repeat what works” is not a bad rule of thumb. The trouble is that blindly copying past success can lead to lazy, formulaic thinking rather than trying to imagine how different the world could look in a couple of years’ time. Before the financial crisis, everyone assumed that Returns on Equity (between 20-35% for the banking industry) couldn’t fall below banks’ Cost of Equity (around 9%). Analysts unthinkingly plugged these assumptions into Excel to derive valuations and target prices. I think the formulas in Excel blinded the whole industry of analysts to the steady rise in wholesale funding and credit risks. The next crisis won’t be around subprime CDO’s or SIV-lites, but I would imagine that areas that attracted a lot of capital, digital advertising, edtech, subscription based business models could all see a reassessment of assumptions.

Last week there seemed to be a high number of profit warnings. Not just from the retailers already mentioned but also Luceco and Reach, which I cover below. There were also a couple of acquisitive companies with delayed results, Learning Technologies and S4 Capital. One business not seeing any pressure is SDI, the scientific instruments company. They have an April FY 2022 year end and expect results to be “materially ahead” of expectations and jumping +15% to 173p on Friday morning.

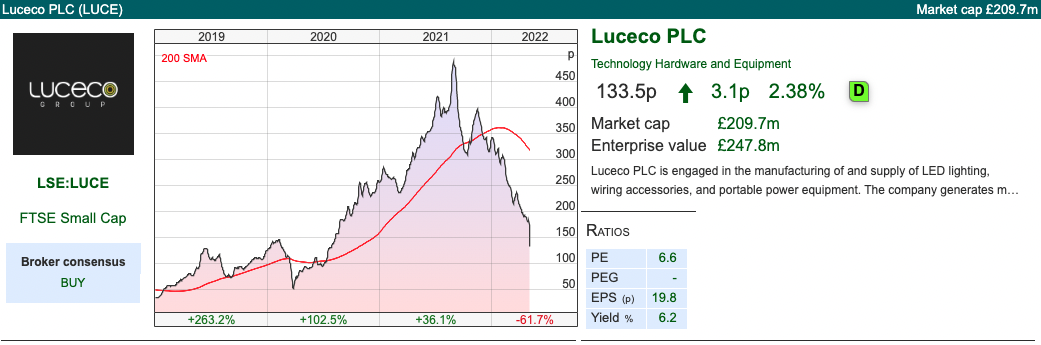

Luceco Q1 update / profit warning

This electrical products (LEDs, wiring accessories and portable power) manufacturer with a factory c. 150KM outside Shanghai announced a profit warning. Their Q1 to end of March has finished and they already expect a 15% shortfall in revenue versus FY Dec 2022F expectations. That implies a -8% fall in revenue versus last year (£228m), versus previous expectations of a +7% rise. The short fall in profits is expected to be £10m (translating as a -25% hit to previous expectations). The forecast decrease in sales has been caused by customers (ie retailers) overstocking their supply chains in 2021, and a slowdown in DIY activity particularly hurting LUCE’s higher margin wiring accessories business.

In terms of inflation and the supply chain, the company is still targeting a gross margin of 37% in the second half of this year, implying that they can pass on input costs to their customers. The company’s Chinese factory has seen no Covid cases (and their suppliers performance) has not been “materially” impacted. As the chart shows, the price over the last few months had been very weak, having started the year at 350p. However, that didn’t prevent the shares selling off a further -25% on the morning of the warning.

Richard wrote up the strengths and weaknesses of Luceco a few weeks ago here.

History: The company IPO’ed in October 2016. As LUCE joined the Premium listing section of the LSE, rather than AIM they are not subject to rule 26, and hence have removed their prospectus from their website. No doubt company management would argue that the document is no longer relevant – but I think that’s for shareholders to decide. Voluntary disclosure is a fascinating topic: what companies choose to reveal, and what they then decide to withdraw. Removing your listing prospectus is not a good look, in my view.

The company came to market at 150p in October 2016, the share price peaked at over 250p a year later. There then followed a series of profit warnings, driven by poor financial controls which meant that the company had not noticed pressure on gross margin. which took the shares all the way down to below 50p at the start of 2019. I also note that in the Dec 2017 profit warning, management suggested they were still likely to achieve next year’s (2018) revenue forecasts, which they subsequently revised 3 months later in March 2018. It’s understandable that investors are wary. Management remain confident that they can pass on cost inflation as now they have better financial controls, so LUCE shouldn’t see the gross margin hit that they saw 4 years ago. Reality may turn out to be more difficult.

Valuations: The shares do not look expensive on conventional valuation ratios like Price/Earnings 8.4x or Price/Sales 0.9x. However, the momentum and current newsflow is against the stock at the moment, for instance although the factory 150KM from Shanghai hasn’t yet seen any Covid cases, we know how rapidly the virus can spread and how damaging China’s Zero Covid policy is.

Opinion: I nearly bought this at 50p a couple of years ago. I reckoned that the share price might bounce, but that this was a business without much of a “moat” and I was less than impressed by the way management communicated with investors. That might present an opportunity in future if we see “revulsion” levels like we did a couple of years ago. For now, I will avoid for now though.

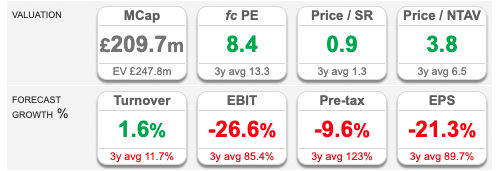

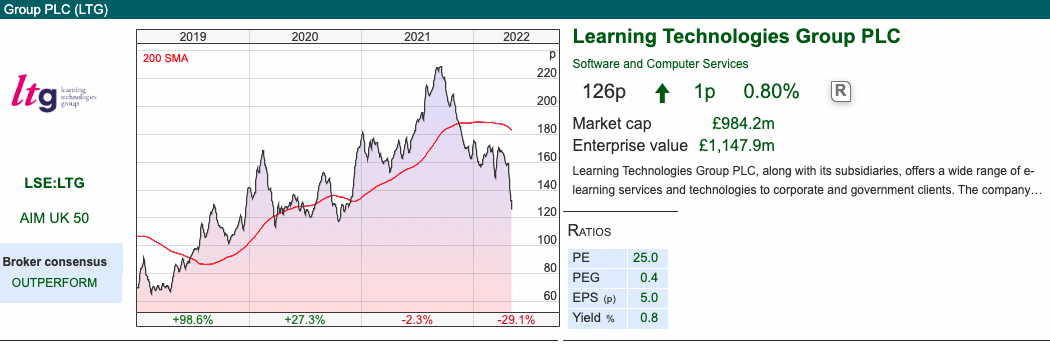

Learning Technologies

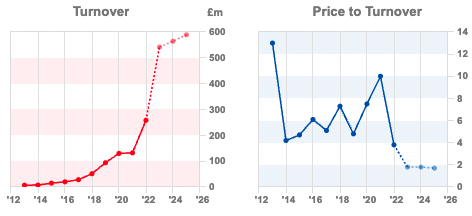

This corporate “ed-tech” company announced delayed FY Dec 2021 results, with organic revenue +8%. The delay to the RNS was announced at the end of last month, and the shares dropped -16% on that announcement, and haven’t yet recovered to the previous level 157p. Half way through last year they bought a business in the US, so statutory revenue was much stronger +95% to £258m than the +8% organic figure. Statutory PBT was down -31% to £9.3m and there’s around £45m of adjusting items between that and the company preferred measure of adjusted EBIT £55m. Net debt was £141m versus £70m of net cash at the end of 2020.

The RNS has been finessed somewhat, for instance removing the percentage decline in PBT and leaving out the 2020 cash figure from the text. These are minor issues, but it does suggest to me that management are “keeping up appearances”, particularly as the FY results have taken until May to be released and they didn’t manage to have the Annual Report available on their website. Management blamed the delayed accounts on a “presentational adjustment” to the 2020 balance sheet, in the trade receivables item. The restatement now reduces Dec 2020 receivables by £6m to £27m, and in the cash flow statement decreases both receivables and payables by £6m. There’s no change to the year end cash figure though.

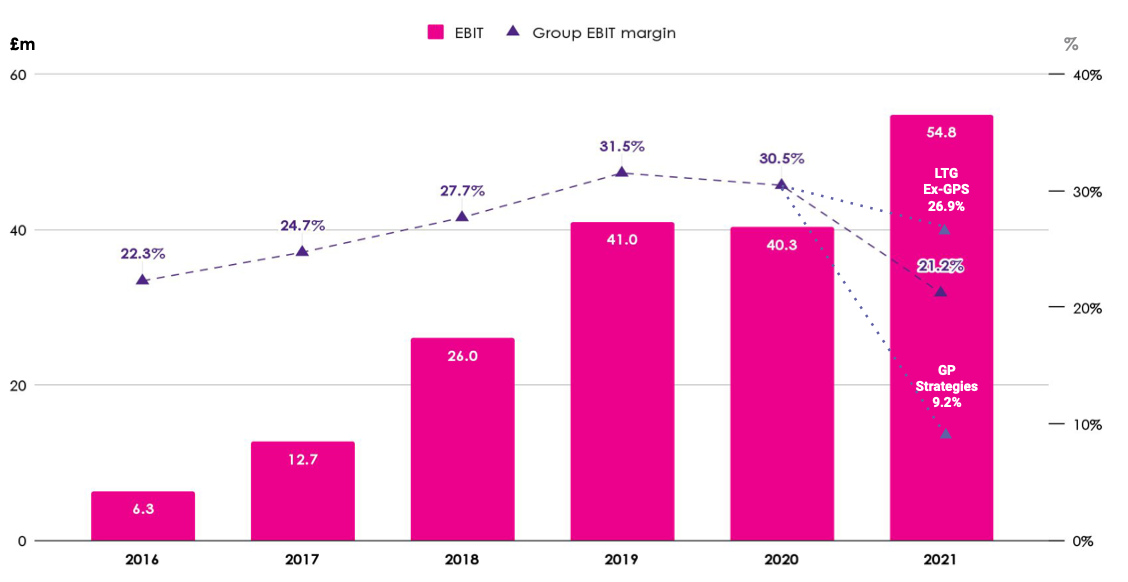

In July last year they announced the acquisition of New York listed GP Strategies for £284m in cash. This was partly funded with a placing at 192p which raised £85m. GP Strategies is a workforce training company which serves a quarter of the Fortune 500 across a wide array of sectors: automotive, financial services, technology, defence and government customers. 75% of revenue is from customers of more than 10 years standing. The price LTG paid represents 0.8x GP’s forecast FY 2021F revenues at the time ($499m) and 12x EV/adjusted EBITDA – they didn’t publish a post tax profit forecast in the acquisition announcement. In 2021 they also made some smaller acquisitions: Reflektive (($14m price, c. 1x revenue), Bridge ($48m price, c. 2.3x revenue) and PDT (£20m price, c. 4x revenue). In total they’ve made 17 acquisitions over the last 10 years.

Outlook: Q1 was in line with management expectations. Management have increased their margin guidance for GP Strategies to 12% FY 2022F (versus 9.2% FY 2021). LTG’s group EBIT margin was lower than anticipated at 21.2% (or 26.9% ex GP Strategies). Historically they have reported EBIT margins of around 30%. I think the best way to show all the moving parts is slide 11 from the company’s presentation.

History: This share has been a very strong performer over the last decade. The shares listed on AIM in 2013 at 9p or £15m market cap via a reverse takeover of Epic, the market cap has now risen to over £1bn. Epic Group was established in 1986 and specialised in e-learning. The Admission Doc lists Deloitte, easyJet, H&M, Lloyds, Pearson and the UK civil service as clients. At the time Epic Group was profitable, but had less than £10m of revenue. Following a number of acquisitions, there’s now £546m of intangible assets on the balance sheet versus shareholders equity of £371m, so net tangible assets are negative £175m. Inevitably they describe their balance sheet as strong – with £141m of net debt, and negative tangible book value, I’m not sure what a weak balance sheet would look like!

That said, 75% of revenue is SaaS or long term contracts and LTG did generate £38m of cash from operating activities. Within the cashflow statement it’s worth noting that in 2021 trade receivables increased 4.6x to £122m and other receivables were up 3.6x to £15m in 2021. As they develop software internally for clients, there’s a c. £8m per annum development that spend doesn’t appear in cash from operating activities and instead goes through cash from investing.

Ownership: The Chairman Andrew Brode (also Exec Chair of RWS) owns 15% and Chief Exec Jonathan Satchell owns 9%. They’ve both been running Epic, which became LTG since before the IPO, and have known each other since 1986. Sharepad shows that in June last year the CEO sold £3.6m worth of shares at 170p. Institutional ownership: Liontrust 12%, BlackRock 6.8%, Octopus 4.7%, and Jupiter 3.9%.

Valuation: Acquisitive companies are tricky to value, because there are so many moving parts. They may be buying growth to substitute for weak growth in existing businesses. I note that PeopleFluent, which they paid $150m (£107m) for in April 2018 is now seeing falling revenue. The shares are trading on 13x 2024F PER or 1.7x 2024F revenue, which is well below the historic level though that may reflect that growth in the core business is struggling?

The shares are down -29% since the start of the year and have roughly halved since their peak in September 2021. This doesn’t feel like the sort of market to own an acquisitive tech company. So I reckon there’s a fair chance that if you do like the story it will be possible to buy it cheaper in 6-12 months time.

Chief Exec’s thoughts: There’s a fascinating podcast interview posted earlier this year with Jonathan Satchell the Chief Exec. He talks a lot of sense about using virtual reality to help learning. There are many scenarios where the technology is gratuitous, and if anything complicates the learning experience. However, he highlights an example where virtual reality could be useful is helping simulate dangerous situations and train in a realistic (but safe) environment: for instance an explosion in an underground mine.

From a financial perspective the CEO is a great admirer of how Sir Martin Sorrell built WPP through acquisitions. They like the model of brands with a separate p&l, though admit that WPP rather lost the plot in recent years as it failed to adapt to the rise of “ad-tech”. It sounds like the LTG CEO is trying to learn the lessons, both positive and negative from WPP. He comes across as very impressive, as you would expect for a company that is up 14x since the IPO. I look at S4 Capital results later in this weekly.

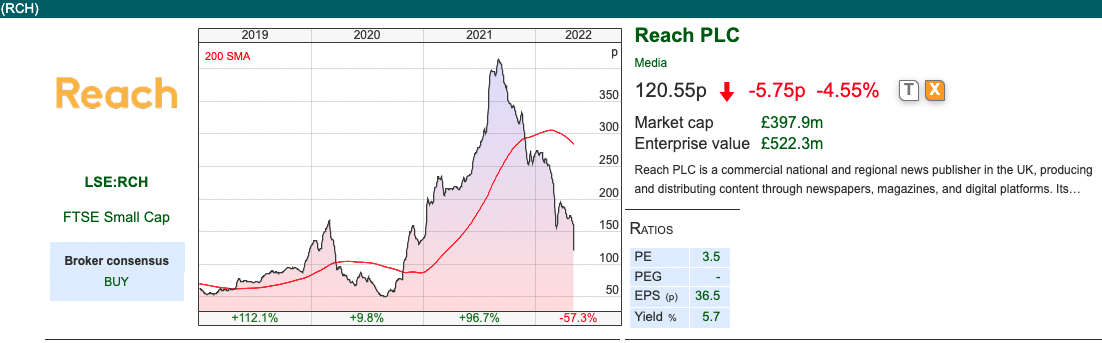

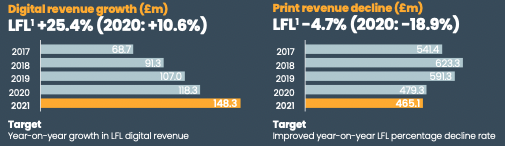

Reach profit warning

There was a profit warning from Reach, the newspaper company (Daily Mirror, Sunday Mirror, Sunday People, Daily Express, Sunday Express, Daily Star, Daily Record, amongst others) due to reduced advertising spend. Digital advertising revenue is c. 25% of group in 2021 (up from 15% pre-pandemic in 2019). So the RNS last week has reversed the company’s target and historic trend of growing proportion of digital revenue, as the chart from the Annual Report shows. This could be significant as marketing and advertising budgets could be coming under pressure across a wide variety of consumer facing sectors.

Aside from advertising spend disappointing, Reach has also seen rising operating costs, particularly the impact of newsprint increases, that will now exceed their previous expectations. So revenue under pressure and costs rising doesn’t feel like a good combination. The shares were down -19% on the morning of the RNS.

Outlook: Reach still anticipate broadly flat revenue (ie slightly down) for the year, but with higher newsprint circulation and lower digital advertising revenue. They say that they are taking actions to mitigate the rising newsprint costs on profits, but I’m assuming that there is an impact on profits otherwise they wouldn’t have mentioned the rising cost.

Background: They own over 130 national and local papers, reaching 80% of the UK online population. This stock was an unlikely “reflation trade” winner, rising from below 50p in September 2020 to a peak of 420p September 2021. Since then the shares have been on a relentless decline back to the current share price of 120p. Looking at Sharepad’s financial’s tab suggests that this is not a business I would be interested in. Single digit RoCE and CROCI and poor FCF conversion.

There’s also a large (IAS) pension deficit of £154m, consisting of £2.8bn of pension obligations and £2.6bn of plan assets. In other words, the gross liabilities are 5.6x the company’s market cap. The last triennial valuation was Dec 2019. The company has failed to provide a more recent update. The triennial valuation was done by actuaries who I thought inputted their assumptions and management had much less ability to influence the valuation than the accounting (IAS 19) deficit. I think until the triennial valuation is published, there’s a risk of a negative surprise. They key audit matter in the 2021 Annual Report says:

“We noted that the group’s actuaries updated the benchmark used to determine the discount rate in FY20. The change increased volatility in the discount rate, which moved from the middle of our independently derived range at FY19 to the optimistic end at FY20; however, at FY21 the discount rates have on average returned to around the middle of the range.”

It’s possible that rising bond yields will be good for companies with large pension obligations, because a higher discount rate reduces future liabilities. To some extent that’s already happened with the Reach IAS 19 deficit reducing from £314m in 2020 as the company’s assumed discount rate rose from 1.49% to 1.83% FY 2021. I’ve mentioned this in relation to De La Rue in the past.

Read across: The valuation multiples of 3.8 P/E and Price/Sales 0.7x look like a real bargain, but I think this is a declining industry and in my view could be a “value trap”. If you can trade this, then you’ll do well because the share price is very volatile.

I think the read across to declining digital advertising spend is more significant. Tremor (-18% YTD), and US competitors like The Trade Desk (-40% YTD) and Digital Turbine (-49% YTD) are very “marmite” stocks, dividing opinion among well informed investors. I think that the outlook for these stocks is negative, and the downside is greater than bulls are expecting. I look at SFOR Capital (-46% YTD) delayed results below.

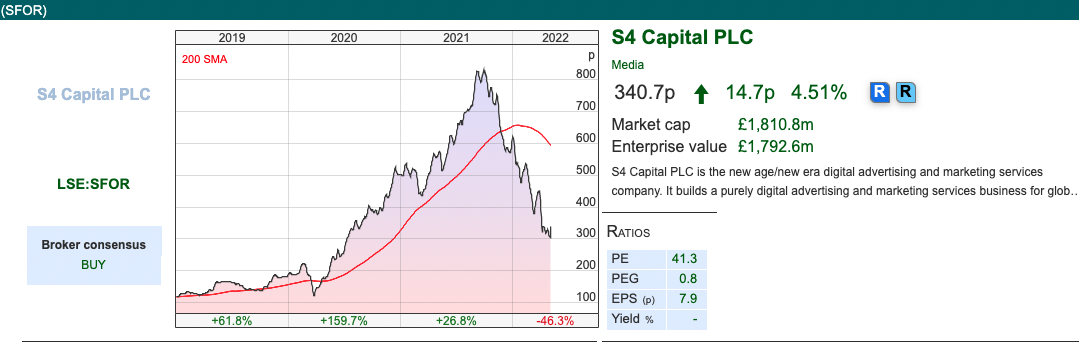

S4 Capital FY Dec (delayed) Results

Sir Martin Sorrell’s adtech roll-up announced delayed and unaudited FY results. The results are preliminary, therefore unaudited, but PwC have consented for them to be released, and the Annual Report will be published 14th May (as originally scheduled). In mid January, there was a FY “in line” trading statement, scheduling the FY results for 18th March. Since then there have been a couple of delays, and the shares responded +4.5% on the morning, probably as a relief that the auditors hadn’t discovered a financial blackhole.

Revenue doubled to £687m (ahead of Sharepad’s consensus forecast of £654m) and operational EBITDA was £101m (slightly below Sharepad’s consensus forecast of £104m). These are not an easy set of results to interpret because of all the acquisitions and the mouthful of reported/like-for-like/proforma/H1 v H2 comparisons. For instance, one of the bulletpoints on the first page is:

- Operational EBITDA margin 18.0%, down 3.0 percentage points on 2020 reported, like-for-like down 5.1 percentage points, pro-forma down 4.6 percentage points driven by investment in major new “whopper******” clients, new areas of organic growth and the Group’s management infrastructure. Operational EBITDA margin improved from 14.5% in the first half to 20.6% in the second half.

If you like statutory numbers, the Loss Before Tax was £57m.

Balance sheet: The 2020 balance sheet has been restated in this set of results. So as a cross check I went back and compared the numbers reported last year to last week’s 2020 figures. Reassuringly there were some minor changes (current lease liabilities in 2020 had been restated by a couple of million and so had contingent consideration) but nothing that looked untoward. 2021 shows £980m of intangible assets, versus shareholder’s equity of £801m, so net tangible book value is negative. Year end net debt was £18m but on a monthly basis this year it has ranged between £30-£70m. There’s also £55m of cash contigent consideration due this year, not included in net debt. Again, this is not a strong balance sheet, though the company generated £33m of free cashflow (or £67m before working capital changes).

Valuation: The shares are trading on 13.5x forecast 2023F or 1.4x price to sales the same year. That’s not demanding, but may also mean that the acquisition currency that Sir Martin uses to do deals (ie SFOR’s shares) is less attractive than in the past. The valuation compares to 10x 2023F PER for Sir Martin’s old business, WPP.

Option: I will wait for the full Annual Report to be released, and cast a keen eye over the “key audit matters” section and also the notes to the accounts on contingent consideration. The shares are off -46% YTD, despite the results being inline with expectations. I think that reflects the broad sell of in ad-tech. Similar to Learning Technologies, this could be a good business to own at the right price but I don’t feel very confident that now is the right time to buy.

Bruce Packard

Notes

The author owns shares in SDI

In your Weekly Market Commentary 09/05/22 this:

“The shares are down -29% since the start of the year and have roughly halved since their peak in September 2022.”

needs correcting, as we haven’t got to that point in time yet 😉

Regards

Steve

Thank you Steve. As fast as the year is flying by we thankfully haven’t got to September quite yet! That has now been corrected.

Your blog has piqued a lot of real interest. I can see why since you have done such a good job of making it interesting. I appreciate your efforts very much.

okbet online casino