Bruce suggests that the rate of change of investors’ expectations is more important than expectations themselves. Companies covered SRC, and expensive but becoming more reasonably priced FEVR and ITM.

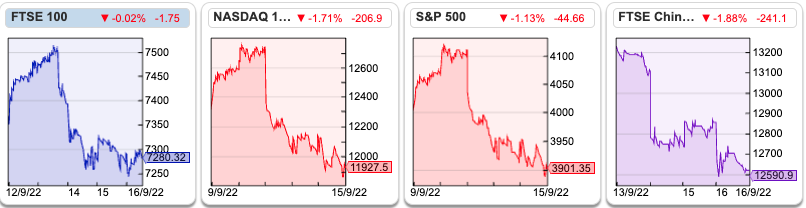

The FTSE 100 was down -1% to 7280 last week. The Nasdaq100 and S&P500 sold off more steeply down -5.25% and -4.1% respectively. The UK 10Y Govt bond yield was 3.15% (v 2.12% a month ago) and the US 10Y Govt bond yield rose to 3.46% (v 2.84% a month ago). Brent crude was down -2% to $90 per barrel, while Natural Gas (NG-MT) rose +4%.

Last week I went to see a Yann Tiersen concert, who wrote the soundtrack to films Amelie and Goodbye Lenin. His new album, called 11 5 18 2 5 18 is, let’s say, pushing the boundaries between music and noise. I enjoyed it, but many of the audience walked out and someone even shouted abuse. I would imagine that if you’d paid €50 for a ticket and expected the Amelie soundtrack you would have been disappointed versus your expectations. But I think the problem was with the audience’s expectations. Music is, after all, a combination of predictable repetition and subverting expectations.

The sell-off in US markets last week was due to an inflation report, suggesting that the Fed could raise rates faster than previously expected. The odd thing is that professional investors’ expectations were already very bearish – as revealed by the Bank of America global fund manager survey. BoA’s August survey showed that 68% of fund managers are already expecting a US recession, that level is the highest since May 2020, when Covid-19 was at its worst. The same survey showed fund managers’ cash balances were the highest since October 2011. So it’s odd that a negative economic report could cause a sell-off in markets when sentiment was already negative. I think that the likely cause is the deterioration seems to be accelerating (ie the rate of change or second derivative.)

One of the interesting characteristics of the stock market’s sell-off this year has been high-quality but expensive companies warning on gross margin (Treatt and Fevertree spring to mind) and low-quality companies like NatWest and Lloyds raising margin and RoE guidance. It looks like expectations at the start of the year were too low for unloved ‘value’ stocks like banks, and were too high for the likes of FEVR, HOTC and TET. I think this has been a problem with market expectations (and valuations), rather than that high-quality companies have suddenly become rubbish. If your time horizon is shorter, I think it could be worth looking at banks as a trade though, because they seem to be enjoying a favourable tail wind.

This week I look at SigmaRoc, which despite (or perhaps because of) the rapid growth has a value rating, plus two GaaUP (Growth at an Unreasonable Price) shares FEVR and ITM. They are both down c. -70% YTD, but I’m not convinced either represents a bargain yet.

SigmaRoc H1 to June

This acquisitive concrete company, that focuses on acquiring local quarries for local markets, has had a difficult 2022, with the share price down -52% YTD. It seems likely that construction projects are slowing in the UK and Europe as bond yields rise, plus energy costs are not helpful. The company also mentions a 4-month strike at one of their pulp and paper customers (UPM in Finland) and a separate unexpected plant shutdown at a different customer (SSAB). Given that backdrop, I was surprised at the revenue growth and how upbeat management sounded in last week’s RNS.

Revenues were up +192% to £247m and statutory PBT more than doubled to £14m for H1 to June. They’ve grown by acquisitions, so the company also give a +17% proforma revenue growth number. The company’s preferred measure, underlying PBT was up more than 3x to £29m. Cash was up +133% to £46m, as they raised £255m at 85p per share last year. I’ve calculated net debt of £217m, though the company doesn’t give that figure themselves.

They do report borrowings of £263m in note 13. In July last year, they agreed a Syndicated Senior Credit Facility of £305m with Santander and other major banks. This facility is floating rate, (interest charged is between 1.85% and 3.85% above SONIA, the replacement for Libor). That means SigmaRoc is exposed to Central Banks increasing the pace of rising interest rates. Shareholders equity is £441m, but of that intangible assets are £355m, meaning net debt of £217m compares to tangible assets of £86m. The other aspect to note is that trade and other payables are £120m versus receivables of £94m, so small movements in those large numbers could be negative for working capital. There’s also £8.5m of deferred consideration for Johnston Quarry Group (acquired Feb 2022).

Looking at the Annual report reveals the covenants on the debt are i) interest cover ratio set at a minimum of 4.5 times EBITDA; and ii) ─a maximum adjusted leverage ratio, which is the ratio of total net debt, including further borrowings such as deferred consideration, to adjusted EBITDA, of 3.5x in 2021. Interest costs were £6.7m in H1 according to cashflow statement, annualising that suggests £13m or 7x just reported annualised EBITDA of £96m. Or looking at the second condition of the covenant, EBITDA could fall by a third before the company would be in breach of its banking covenant. That seems satisfactory, as long as conditions don’t deteriorate further.

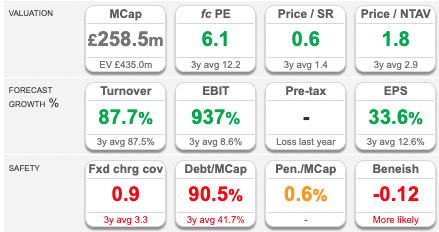

Sharepad’s ‘safety’ indicators are red, and also the low forecast PE and Price/Sales ratio indicate caution.

Background: Quarrying and concrete, though essential to modern construction, is very energy intensive and has a poor environmental reputation. According to this FT article, 10bn tonnes of the stuff is produced a year, global concrete industry revenues will reach $1trillion, the bulk of which will be in China I think. For every tonne of cement produced a tonne of Co2 is also released.

The company is keen to appeal to ESG investors, so there’s some interesting detail about ‘nappy enhanced asphalt’. In West Wales they have trialled used nappies as a road construction material, with the idea that fibres from the nappies improve binding of bitumen with aggregate, resulting in a more durable road surface which is expected to remain in situ for up to 20 years while also providing reduced road noise. So far, the trial was on just 2.4KM of road, but this does sound like a management team that is thinking creatively. They also launched the Greenbloc brand last year, the UK’s first Cement Free Ultra-low Carbon Concrete Building Block, and means significant reduction in CO2 of 77% per block. They have targets in their ESG report to be free of fossil fuels by 2032 and achieve net zero by 2040.

Outlook: Trading in H2 has started well, with management saying that the company “dealt with various supply chain and inflationary headwinds in H1 2022 and has continued to do so into H2 2022, with particular focus on energy costs and continuous operational improvement initiatives.”

Below the line items: PBT was £13m, but there was also a large currency gain of £11.3m and cashflow hedges of £11.7m, both those items were positive, meaning that total comprehensive income was £36.4m. Looking at note 16 ‘fair value of financial assets and liabilities’ it looks like those gains come from buying protection from rising electricity costs and currency risk. However, I’m concerned that the items could have been negative if they’d been the wrong side of their hedges, which would have wiped out profits.

Ownership: Blackrock owns 12% of the shares, but have been reducing their position recently according to SharePad. The next largest shareholder is Rettig Group, who received equity in return for selling NordKalk a Nordic region limestone quarry business to SigmaRoc for €470m last year.

Joint Venture: On the same day as the H1 RNS, they put out a separate announcement saying they would create a JV with ArcelorMittal, one of the biggest steel companies in the world. They have agreed to create a new company, to make ‘net zero’ lime, which is used in steel production. The JV aims to make 900,000 tons a year, near Dunkirk where ArcelorMittal has steel works. Both sides will take a 47.5% ownership stake in the JV, which SigmaRoc says will cost €20m for their equity contribution.

Valuation: The shares are trading on 6x this year and next year’s forecast earnings. EV/EBITDA is below 5x and the price to sales is below 1. So this is a value stock, despite the fast pace of growth. I noted above Sharepad’s ‘safety’ indicators are red, and the low returns and margins on the ‘quality’ tab also suggests caution.

Opinion: I feel rather nervous about the acquisition-led growth at a time of rising energy prices and rising interest rates. This business may need to rely on government subsidising energy costs over the winter. However, I think it’s worth following because at some point it could be a very attractive opportunity, I’m a big fan of learning about ‘unsexy’ areas of the market, like concrete. In the decade following the financial crisis Breedon, which also makes construction materials, was an 8x bagger.

Fevertree Drinks H1 to June

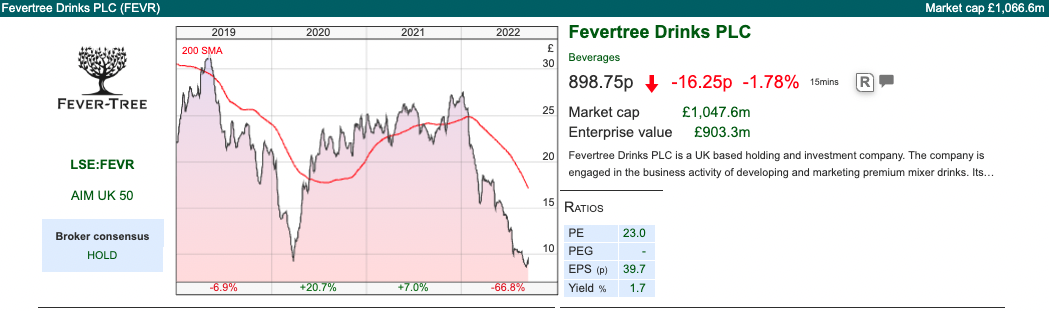

I’ve been thinking that the current sell-off could be an opportunity to take positions in companies that were previously ‘Growth at an UNreasonable Price’ (GaaUP). Hotel Chocolat down -73% YTD and Treatt down -52% YTD are a couple of candidates, but Fevertree down -67% YTD strikes me as another.

Last week Fevertree reported revenue growth +14% year-on-year to £161m for H1 to June. They reiterated their FY revenue guidance of FY £355m-£365m. Helpfully the company provides a full breakdown of analyst consensus on their website. PBT of £17.6m was down +30% on H1 last year, as the business was hit by margin pressure (gross margin fell to 37% v 44% H1 June 2021). Cash was also down -25% to £100m, in part reflecting a £50m special dividend paid during the period, but also worth noting that cashflow from operating activities was negative £4m in H1 this year (v positive £4m H1 last year). It does look like there is considerable seasonality in cashflows (H2 last year was £43m positive).

Margin discussion: Management suggest the reasons for gross margin decline were: i) underlying inflationary cost of ingredients and logistics ii) having to ship product across the Atlantic until East Coast production has increased to support US revenue growth (currently +11% H1 v H1 last year). Interestingly Hotel Chocolat said in July it would reverse course on US expansion, and no longer offer direct-to-consumer sales. I think a good deal of the ‘froth’ in both share prices was driven by hopes that their products would do well expanding into the US.

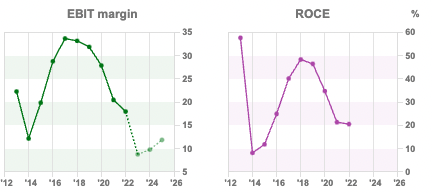

Guidance is for a FY 2022F gross margin of 33%-35%, which implies a further decline in H2. However, management have held guidance steady since their update in mid-July, which implies that the situation is not getting any worse. SharePad shows that FEVR’s EBIT margin has been declining since 2017, but is forecast to recover from 2023F onwards.

History: The business was founded by Charles Rolls and Tim Warrillow (I used to play cricket with the latter) in late 2003 with the aim of developing premium natural mixers using the highest quality ingredients. The insight was there were plenty of premium gin brands, yet three-quarters of a g&t is the tonic, and Schweppes served in slightly naff plastic bottles hadn’t invested in their brand. Early backers were the Fleming family and Lloyds Development Capital (Lloyd’s bank private equity arm). In 2005, the Fever-Tree brand was launched (nb the brand is Fever-Tree, but the company is Fevertree Drinks – I’m not sure why). The Group’s first product, Indian Tonic Water, sold at Selfridges and Waitrose.

Fevertee IPO’ed in November 2014, at 134p raising just £3m and selling shareholders receiving £90m. That gave the company a market cap of £154m. It was a ‘rara avis’,* an AIM IPO that increased by 30x in the five years directly from its first day of trading. In 2018 there was bid speculation that Pepsi would make an offer. Subsequently there were a couple of profit warnings late 2019, and early 2020 before the pandemic hit as management cut revenue guidance. The shares fell 75% peak to trough between 2018 and the pandemic low in March 2020. FEVR then staged a recovery, and participated in the ‘vaccine rally’ yet management then started warning on costs and pressure on the gross margin.

Ownership: Lindsell Train are the largest shareholder with 11% of the shares, Fundsmith also owns 5%. These two fund managers (Nick Train, Terry Smith) both have excellent long-term track records, as ‘buy and hold’ investors. Coincidentally both studied history at university, and there’s an idea that historians make good fund managers because an underappreciated skill which history teaches is how to build and analyse narratives. The two co-founders Charles Rolls and Tim Warrilow still own 7.1% and 4.8% respectively.

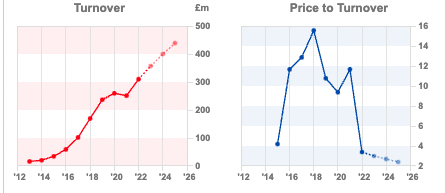

Valuation: FEVR is trading on 35x FY Dec 2023F, dropping to 27x FY Dec 2024F. That equates to a price to sales of 2.4x in two year’s time, compared to a historic level of 16x sales in 2018. That’s looking more reasonable now that gravity has re-asserted itself, but I still wouldn’t say that the shares represent a bargain.

Opinion: There’s something odd going on when a company trading on above 35x forecast price/earnings reports ‘in-line’ guidance and the shares rise +12% on the morning of the RNS. Normally you would expect 35x earnings to reflect high expectations, and an ‘in-line’ RNS might dent that rating. My conclusion is that the almost £40 per share price peak in 2018 was bonkers; whether the shares are good value at 898p is harder to say.

ITM Power FY to April

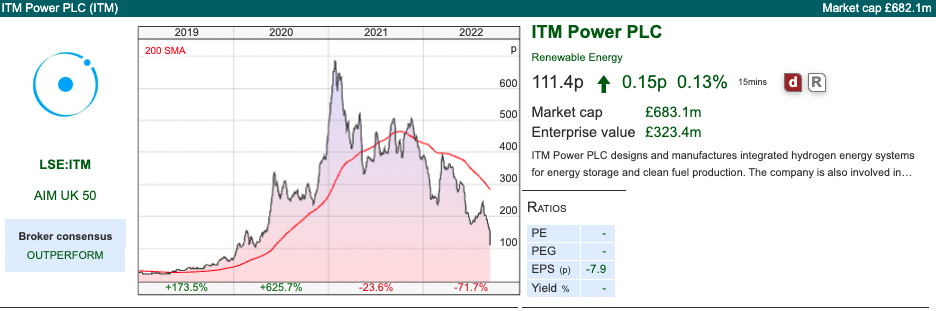

Staying with the theme of ‘Growth at an UNreasonable Price’, if Fevertree Drinks had a bonkers valuation at its peak, then ITM Power above 700p at the beginning of last year, was bonkers squared. The shares are now down -84% from that peak. This clearly isn’t for everyone, but I feel hydrogen energy and fuel cells is a sector worth following; there could be opportunities worth researching further. Please beware of the hype and unrealistic expectations though.

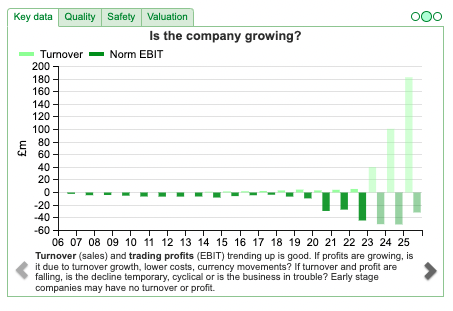

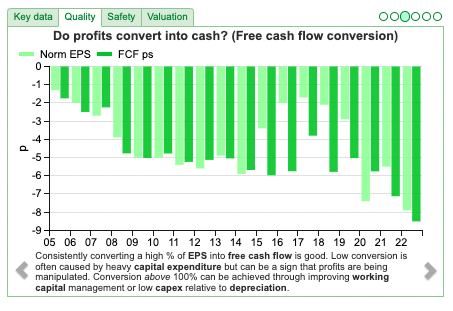

ITM Power is a ‘green’ hydrogen company, announced FY to April results. Green hydrogen means energy comes from renewable sources, in contrast to brown hydrogen, which comes from coal. There’s a National Grid explainer on all the other colours that hydrogen comes in. Given that revenues were just £5.6m, +30% from the previous FY, management seem to have taken a very long time to add up the numbers. Pre-tax loss was £47m for the period, though ITM had a cash balance at the April year end of £366m. That means although they burned through £53m of cash last year, they are not under any immediate pressure, having raised £250m in Nov 2021 at 400p per share, when market conditions were more favourable.

Activities: ITM Power makes hydrogen energy equipment for grid balancing, energy storage and hydrogen production. They also operate the world’s largest electrolyser factory at Bessemer Park, Sheffield. They’ve been listed on AIM since 2004. Although the investment case in hydrogen is unproven, ITM have managed to raise money from industry players including £38m from Linde (market cap $142m, one of the largest gas suppliers in the world) in 2019 and £30m from Snam (market cap €15.6bn, an Italian energy infrastructure company). In October 2021, ITM and Linde announced the deployment of a 100MW electrolyser at Shell’s Rhineland refinery.

Chief Executive: The company announced last week that Graham Cooley, the Chief Executive for the last 13 years would step down. No successor has been appointed. This is probably related to a number of delays, for instance in Leuna, Germany which was the JV with Linde and a cancelled second electrolyser factory in the UK (previously announced to be built at Aviation Park, near Manchester). The delays have been caused by supply chain difficulties and rising costs. ITM also needs governments to make final investment decisions (FIDs) and management point out that there have been decisions have been delayed around subsidies and incentive schemes. Last week Tesla announced a delay to its German factory expansion, so this may be a common theme from supply chain disruption. There’s an InvestorMeetCompany presentation, followed by a Q&A session.

Forecasts: Current year guidance is for cash burn of £110-£135m and revenue guidance is £23-28m. The company said that they are fully funded to get to their 5 GigaWatt aspiration, however, they are reliant on government grants (ie if Governments are less generous funding green energy transition projects, there could be a problem).

Longer term, the Chief Exec was asked when he expected to be profitable, he referred people to broker research notes. Having been a corporate broker, I know forecasts don’t magically appear in analysts’ Excel spreadsheets, there is a significant amount of company influence. If he doesn’t want to help retail investors with the investment case in his company, there are plenty of other management teams that will be more helpful.

Valuation: On a price to FY Apr 2023F revenue, the shares are on 25x revenue. That seems hard to justify when the company has disappointed and continues to burn cash.

Opinion: A number of hydrogen stocks that did very well during the pandemic are now confronting reality (AFC and Powerhouse Energy both down -65% YTD, Ceres Power down -49% YTD). I do hope though the AIM market can be a source of equity funding for successful hydrogen energy companies over the next 5 years. Fevertree has been a great investment for half a decade following their IPO, but premium tonic water is not changing the world for the better in the way these green energy companies could be. Hopefully, some hydrogen stocks manage to repay investors’ faith with decent long-term returns.

Notes

* From Juvenal‘s Satires VI: rara avis in terris nigroque simillima cygno (“a rare bird in the lands, and very like a black swan“)

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 20/09/22 |SRC, FEVER, ITM| The second derivative of expectations

Bruce suggests that the rate of change of investors’ expectations is more important than expectations themselves. Companies covered SRC, and expensive but becoming more reasonably priced FEVR and ITM.

The FTSE 100 was down -1% to 7280 last week. The Nasdaq100 and S&P500 sold off more steeply down -5.25% and -4.1% respectively. The UK 10Y Govt bond yield was 3.15% (v 2.12% a month ago) and the US 10Y Govt bond yield rose to 3.46% (v 2.84% a month ago). Brent crude was down -2% to $90 per barrel, while Natural Gas (NG-MT) rose +4%.

Last week I went to see a Yann Tiersen concert, who wrote the soundtrack to films Amelie and Goodbye Lenin. His new album, called 11 5 18 2 5 18 is, let’s say, pushing the boundaries between music and noise. I enjoyed it, but many of the audience walked out and someone even shouted abuse. I would imagine that if you’d paid €50 for a ticket and expected the Amelie soundtrack you would have been disappointed versus your expectations. But I think the problem was with the audience’s expectations. Music is, after all, a combination of predictable repetition and subverting expectations.

The sell-off in US markets last week was due to an inflation report, suggesting that the Fed could raise rates faster than previously expected. The odd thing is that professional investors’ expectations were already very bearish – as revealed by the Bank of America global fund manager survey. BoA’s August survey showed that 68% of fund managers are already expecting a US recession, that level is the highest since May 2020, when Covid-19 was at its worst. The same survey showed fund managers’ cash balances were the highest since October 2011. So it’s odd that a negative economic report could cause a sell-off in markets when sentiment was already negative. I think that the likely cause is the deterioration seems to be accelerating (ie the rate of change or second derivative.)

One of the interesting characteristics of the stock market’s sell-off this year has been high-quality but expensive companies warning on gross margin (Treatt and Fevertree spring to mind) and low-quality companies like NatWest and Lloyds raising margin and RoE guidance. It looks like expectations at the start of the year were too low for unloved ‘value’ stocks like banks, and were too high for the likes of FEVR, HOTC and TET. I think this has been a problem with market expectations (and valuations), rather than that high-quality companies have suddenly become rubbish. If your time horizon is shorter, I think it could be worth looking at banks as a trade though, because they seem to be enjoying a favourable tail wind.

This week I look at SigmaRoc, which despite (or perhaps because of) the rapid growth has a value rating, plus two GaaUP (Growth at an Unreasonable Price) shares FEVR and ITM. They are both down c. -70% YTD, but I’m not convinced either represents a bargain yet.

SigmaRoc H1 to June

This acquisitive concrete company, that focuses on acquiring local quarries for local markets, has had a difficult 2022, with the share price down -52% YTD. It seems likely that construction projects are slowing in the UK and Europe as bond yields rise, plus energy costs are not helpful. The company also mentions a 4-month strike at one of their pulp and paper customers (UPM in Finland) and a separate unexpected plant shutdown at a different customer (SSAB). Given that backdrop, I was surprised at the revenue growth and how upbeat management sounded in last week’s RNS.

Revenues were up +192% to £247m and statutory PBT more than doubled to £14m for H1 to June. They’ve grown by acquisitions, so the company also give a +17% proforma revenue growth number. The company’s preferred measure, underlying PBT was up more than 3x to £29m. Cash was up +133% to £46m, as they raised £255m at 85p per share last year. I’ve calculated net debt of £217m, though the company doesn’t give that figure themselves.

They do report borrowings of £263m in note 13. In July last year, they agreed a Syndicated Senior Credit Facility of £305m with Santander and other major banks. This facility is floating rate, (interest charged is between 1.85% and 3.85% above SONIA, the replacement for Libor). That means SigmaRoc is exposed to Central Banks increasing the pace of rising interest rates. Shareholders equity is £441m, but of that intangible assets are £355m, meaning net debt of £217m compares to tangible assets of £86m. The other aspect to note is that trade and other payables are £120m versus receivables of £94m, so small movements in those large numbers could be negative for working capital. There’s also £8.5m of deferred consideration for Johnston Quarry Group (acquired Feb 2022).

Looking at the Annual report reveals the covenants on the debt are i) interest cover ratio set at a minimum of 4.5 times EBITDA; and ii) ─a maximum adjusted leverage ratio, which is the ratio of total net debt, including further borrowings such as deferred consideration, to adjusted EBITDA, of 3.5x in 2021. Interest costs were £6.7m in H1 according to cashflow statement, annualising that suggests £13m or 7x just reported annualised EBITDA of £96m. Or looking at the second condition of the covenant, EBITDA could fall by a third before the company would be in breach of its banking covenant. That seems satisfactory, as long as conditions don’t deteriorate further.

Sharepad’s ‘safety’ indicators are red, and also the low forecast PE and Price/Sales ratio indicate caution.

Background: Quarrying and concrete, though essential to modern construction, is very energy intensive and has a poor environmental reputation. According to this FT article, 10bn tonnes of the stuff is produced a year, global concrete industry revenues will reach $1trillion, the bulk of which will be in China I think. For every tonne of cement produced a tonne of Co2 is also released.

The company is keen to appeal to ESG investors, so there’s some interesting detail about ‘nappy enhanced asphalt’. In West Wales they have trialled used nappies as a road construction material, with the idea that fibres from the nappies improve binding of bitumen with aggregate, resulting in a more durable road surface which is expected to remain in situ for up to 20 years while also providing reduced road noise. So far, the trial was on just 2.4KM of road, but this does sound like a management team that is thinking creatively. They also launched the Greenbloc brand last year, the UK’s first Cement Free Ultra-low Carbon Concrete Building Block, and means significant reduction in CO2 of 77% per block. They have targets in their ESG report to be free of fossil fuels by 2032 and achieve net zero by 2040.

Outlook: Trading in H2 has started well, with management saying that the company “dealt with various supply chain and inflationary headwinds in H1 2022 and has continued to do so into H2 2022, with particular focus on energy costs and continuous operational improvement initiatives.”

Below the line items: PBT was £13m, but there was also a large currency gain of £11.3m and cashflow hedges of £11.7m, both those items were positive, meaning that total comprehensive income was £36.4m. Looking at note 16 ‘fair value of financial assets and liabilities’ it looks like those gains come from buying protection from rising electricity costs and currency risk. However, I’m concerned that the items could have been negative if they’d been the wrong side of their hedges, which would have wiped out profits.

Ownership: Blackrock owns 12% of the shares, but have been reducing their position recently according to SharePad. The next largest shareholder is Rettig Group, who received equity in return for selling NordKalk a Nordic region limestone quarry business to SigmaRoc for €470m last year.

Joint Venture: On the same day as the H1 RNS, they put out a separate announcement saying they would create a JV with ArcelorMittal, one of the biggest steel companies in the world. They have agreed to create a new company, to make ‘net zero’ lime, which is used in steel production. The JV aims to make 900,000 tons a year, near Dunkirk where ArcelorMittal has steel works. Both sides will take a 47.5% ownership stake in the JV, which SigmaRoc says will cost €20m for their equity contribution.

Valuation: The shares are trading on 6x this year and next year’s forecast earnings. EV/EBITDA is below 5x and the price to sales is below 1. So this is a value stock, despite the fast pace of growth. I noted above Sharepad’s ‘safety’ indicators are red, and the low returns and margins on the ‘quality’ tab also suggests caution.

Opinion: I feel rather nervous about the acquisition-led growth at a time of rising energy prices and rising interest rates. This business may need to rely on government subsidising energy costs over the winter. However, I think it’s worth following because at some point it could be a very attractive opportunity, I’m a big fan of learning about ‘unsexy’ areas of the market, like concrete. In the decade following the financial crisis Breedon, which also makes construction materials, was an 8x bagger.

Fevertree Drinks H1 to June

I’ve been thinking that the current sell-off could be an opportunity to take positions in companies that were previously ‘Growth at an UNreasonable Price’ (GaaUP). Hotel Chocolat down -73% YTD and Treatt down -52% YTD are a couple of candidates, but Fevertree down -67% YTD strikes me as another.

Last week Fevertree reported revenue growth +14% year-on-year to £161m for H1 to June. They reiterated their FY revenue guidance of FY £355m-£365m. Helpfully the company provides a full breakdown of analyst consensus on their website. PBT of £17.6m was down +30% on H1 last year, as the business was hit by margin pressure (gross margin fell to 37% v 44% H1 June 2021). Cash was also down -25% to £100m, in part reflecting a £50m special dividend paid during the period, but also worth noting that cashflow from operating activities was negative £4m in H1 this year (v positive £4m H1 last year). It does look like there is considerable seasonality in cashflows (H2 last year was £43m positive).

Margin discussion: Management suggest the reasons for gross margin decline were: i) underlying inflationary cost of ingredients and logistics ii) having to ship product across the Atlantic until East Coast production has increased to support US revenue growth (currently +11% H1 v H1 last year). Interestingly Hotel Chocolat said in July it would reverse course on US expansion, and no longer offer direct-to-consumer sales. I think a good deal of the ‘froth’ in both share prices was driven by hopes that their products would do well expanding into the US.

Guidance is for a FY 2022F gross margin of 33%-35%, which implies a further decline in H2. However, management have held guidance steady since their update in mid-July, which implies that the situation is not getting any worse. SharePad shows that FEVR’s EBIT margin has been declining since 2017, but is forecast to recover from 2023F onwards.

History: The business was founded by Charles Rolls and Tim Warrillow (I used to play cricket with the latter) in late 2003 with the aim of developing premium natural mixers using the highest quality ingredients. The insight was there were plenty of premium gin brands, yet three-quarters of a g&t is the tonic, and Schweppes served in slightly naff plastic bottles hadn’t invested in their brand. Early backers were the Fleming family and Lloyds Development Capital (Lloyd’s bank private equity arm). In 2005, the Fever-Tree brand was launched (nb the brand is Fever-Tree, but the company is Fevertree Drinks – I’m not sure why). The Group’s first product, Indian Tonic Water, sold at Selfridges and Waitrose.

Fevertee IPO’ed in November 2014, at 134p raising just £3m and selling shareholders receiving £90m. That gave the company a market cap of £154m. It was a ‘rara avis’,* an AIM IPO that increased by 30x in the five years directly from its first day of trading. In 2018 there was bid speculation that Pepsi would make an offer. Subsequently there were a couple of profit warnings late 2019, and early 2020 before the pandemic hit as management cut revenue guidance. The shares fell 75% peak to trough between 2018 and the pandemic low in March 2020. FEVR then staged a recovery, and participated in the ‘vaccine rally’ yet management then started warning on costs and pressure on the gross margin.

Ownership: Lindsell Train are the largest shareholder with 11% of the shares, Fundsmith also owns 5%. These two fund managers (Nick Train, Terry Smith) both have excellent long-term track records, as ‘buy and hold’ investors. Coincidentally both studied history at university, and there’s an idea that historians make good fund managers because an underappreciated skill which history teaches is how to build and analyse narratives. The two co-founders Charles Rolls and Tim Warrilow still own 7.1% and 4.8% respectively.

Valuation: FEVR is trading on 35x FY Dec 2023F, dropping to 27x FY Dec 2024F. That equates to a price to sales of 2.4x in two year’s time, compared to a historic level of 16x sales in 2018. That’s looking more reasonable now that gravity has re-asserted itself, but I still wouldn’t say that the shares represent a bargain.

Opinion: There’s something odd going on when a company trading on above 35x forecast price/earnings reports ‘in-line’ guidance and the shares rise +12% on the morning of the RNS. Normally you would expect 35x earnings to reflect high expectations, and an ‘in-line’ RNS might dent that rating. My conclusion is that the almost £40 per share price peak in 2018 was bonkers; whether the shares are good value at 898p is harder to say.

ITM Power FY to April

Staying with the theme of ‘Growth at an UNreasonable Price’, if Fevertree Drinks had a bonkers valuation at its peak, then ITM Power above 700p at the beginning of last year, was bonkers squared. The shares are now down -84% from that peak. This clearly isn’t for everyone, but I feel hydrogen energy and fuel cells is a sector worth following; there could be opportunities worth researching further. Please beware of the hype and unrealistic expectations though.

ITM Power is a ‘green’ hydrogen company, announced FY to April results. Green hydrogen means energy comes from renewable sources, in contrast to brown hydrogen, which comes from coal. There’s a National Grid explainer on all the other colours that hydrogen comes in. Given that revenues were just £5.6m, +30% from the previous FY, management seem to have taken a very long time to add up the numbers. Pre-tax loss was £47m for the period, though ITM had a cash balance at the April year end of £366m. That means although they burned through £53m of cash last year, they are not under any immediate pressure, having raised £250m in Nov 2021 at 400p per share, when market conditions were more favourable.

Activities: ITM Power makes hydrogen energy equipment for grid balancing, energy storage and hydrogen production. They also operate the world’s largest electrolyser factory at Bessemer Park, Sheffield. They’ve been listed on AIM since 2004. Although the investment case in hydrogen is unproven, ITM have managed to raise money from industry players including £38m from Linde (market cap $142m, one of the largest gas suppliers in the world) in 2019 and £30m from Snam (market cap €15.6bn, an Italian energy infrastructure company). In October 2021, ITM and Linde announced the deployment of a 100MW electrolyser at Shell’s Rhineland refinery.

Chief Executive: The company announced last week that Graham Cooley, the Chief Executive for the last 13 years would step down. No successor has been appointed. This is probably related to a number of delays, for instance in Leuna, Germany which was the JV with Linde and a cancelled second electrolyser factory in the UK (previously announced to be built at Aviation Park, near Manchester). The delays have been caused by supply chain difficulties and rising costs. ITM also needs governments to make final investment decisions (FIDs) and management point out that there have been decisions have been delayed around subsidies and incentive schemes. Last week Tesla announced a delay to its German factory expansion, so this may be a common theme from supply chain disruption. There’s an InvestorMeetCompany presentation, followed by a Q&A session.

Forecasts: Current year guidance is for cash burn of £110-£135m and revenue guidance is £23-28m. The company said that they are fully funded to get to their 5 GigaWatt aspiration, however, they are reliant on government grants (ie if Governments are less generous funding green energy transition projects, there could be a problem).

Longer term, the Chief Exec was asked when he expected to be profitable, he referred people to broker research notes. Having been a corporate broker, I know forecasts don’t magically appear in analysts’ Excel spreadsheets, there is a significant amount of company influence. If he doesn’t want to help retail investors with the investment case in his company, there are plenty of other management teams that will be more helpful.

Valuation: On a price to FY Apr 2023F revenue, the shares are on 25x revenue. That seems hard to justify when the company has disappointed and continues to burn cash.

Opinion: A number of hydrogen stocks that did very well during the pandemic are now confronting reality (AFC and Powerhouse Energy both down -65% YTD, Ceres Power down -49% YTD). I do hope though the AIM market can be a source of equity funding for successful hydrogen energy companies over the next 5 years. Fevertree has been a great investment for half a decade following their IPO, but premium tonic water is not changing the world for the better in the way these green energy companies could be. Hopefully, some hydrogen stocks manage to repay investors’ faith with decent long-term returns.

Notes

* From Juvenal‘s Satires VI: rara avis in terris nigroque simillima cygno (“a rare bird in the lands, and very like a black swan“)

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.