Bruce considers whether profit warnings in the insurance and adtech signal that too much capital has been chasing too few opportunities. Sophisticated data models are no replacement for management turning cautious at the top of the cycle. Stocks covered SDI, RBGP and HOTC profit warning.

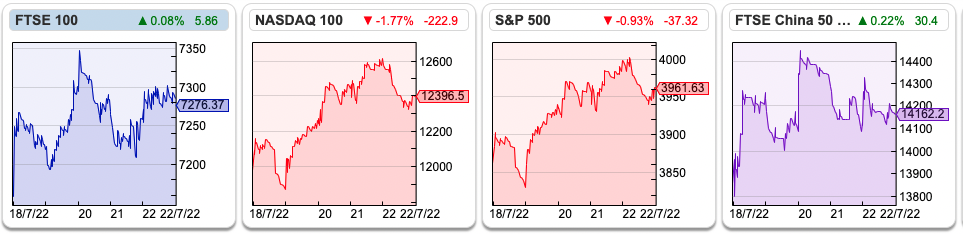

The FTSE 100 recovered +1.6% last week to 7,276. Markets in the US were also strong, with the Nasdaq100 +3.5% and the S&P500 +2.6%. The US 10-year Govt bond yield, which peaked at 3.44% in the middle of June, has now fallen to 2.78%. The price of Brent Crude rose +2.7% to $104 per barrel.

Last week I wrote about how higher inflation has affected brands, such as Fevertree and Creightons which I imagine most investors were assuming were relatively immune from higher fuel prices. Now I’ve come across this post by a German blogger, on how inflation has been a surprising negative for the general insurance (specifically car insurance) sector.

Until recently, the heuristic has been that the current environment ought to be favourable for general insurance companies. With Direct Line down -28% and Admiral down -45% YTD, this now looks like an expensive mistake.

A journey back to 1967 Nebraska may help explain what I think has happened. Following his acquisition of Berkshire Hathaway, one of Buffett’s first acquisitions was to buy general insurer National Indemnity. The auto insurance company was founded in the 1940s with the then revolutionary idea that high-risk businesses (such as taxi drivers, hire cars and long-haul trucks) should not be rejected out of hand. Instead, with a large enough sample, it should be possible for insurance companies to price this risk, and generate a return on capital. It’s a similar idea to credit card economics, the risk of default and fraud is higher, but the high-interest rates charged to credit card borrowers should (in theory) offset the higher expected losses.

In the early 1970s, the insurance sector enjoyed large underwriting profits. The economics did not go unnoticed and competition became keener, followed by a difficult time in the mid-1970s because of claims inflation. National Indemnity, no doubt encouraged by the Sage to be cautious, had anticipated the problems and was prepared to lose market share and even see revenue fall. That meant Berkshire’s business was well placed when underwriting became more rational later in the decade. It strikes me that there’s a lesson in second-order thinking here.

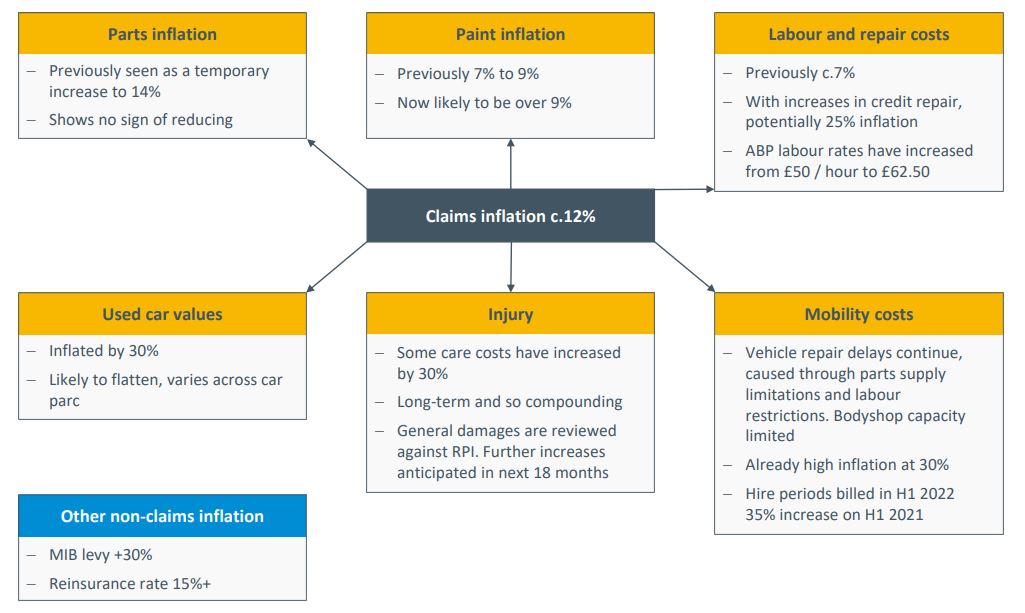

Investors have been wrongfooted by Sabre Insurance’s warning earlier this month, with the shares down -49% following their profit warning. Early in the pandemic motor accidents fell as people were driving their cars less. It now looks as if we’re returning to a ‘normal’ level of car accidents, but the cost of claims (car parts, paint, labour and used car values) has risen faster than models assumed. For people seriously injured in accidents, the cost of care has risen +30%.

The lesson to me is that we spend too much brainpower thinking about inflation or deflation, perhaps because it is easy for newspapers to write about. Instead, we should be thinking about the capital cycle and competition – there are no Central Bank meetings to discuss these subjects and data is not compiled and released monthly in the same way as CPI or interest rates. I think though, competition and capital cycle are more important than interest rates or inflation.

One early indicator of the capital cycle before the financial crisis was large losses on credit cards in 2005-6. All sorts of sophisticated data analytics, scorecards, PhDs in mathematics, and data mining correlations had been applied to credit card lending – yet in the end, losses mounted because too much money was chasing too few credit-worthy borrowers, and lenders weren’t prepared to step back and lose market share to competitors. When HSBC bought Household International for $14bn, The Banker magazine described it as HSBC’s ‘killer move’. That’s an apt description, but not in the way the magazine intended – the deal was a disaster.

Fast forward to more recent experience and there’s been an abundance of capital chasing returns, often justified by ‘machine learning’, ‘digital transformation’ and ‘data analytics’. Last week S4 Capital, Sir Martin Sorrell’s digital advertising firm lowered adj EBITDA guidance by around 25% to £120m and the share price fell -44% on the day. The sophisticated algos that target advertising are not immune from the capital cycle after all. Similarly, the FT reported last week that FinTech’s recently listed in the US have fallen by 50% or more this year, a cumulative market capitalisation decline of $156bn. If each FinTech is measured from its peak, the decline is $460bn. This suggests we are about to learn the same lesson: sophisticated data crunching only works if the models identify when conditions are frothy and management are prepared to take a step back from the pursuit growth at all costs.

This week I look at RBG’s H1 trading update, and question if the outlook is too sanguine. Hotel Chocolate, another brand, that has had a profit warning (caused more by botched international expansion than inflation I think). Plus SDI, which continues to deliver organic and acquisition-related growth.

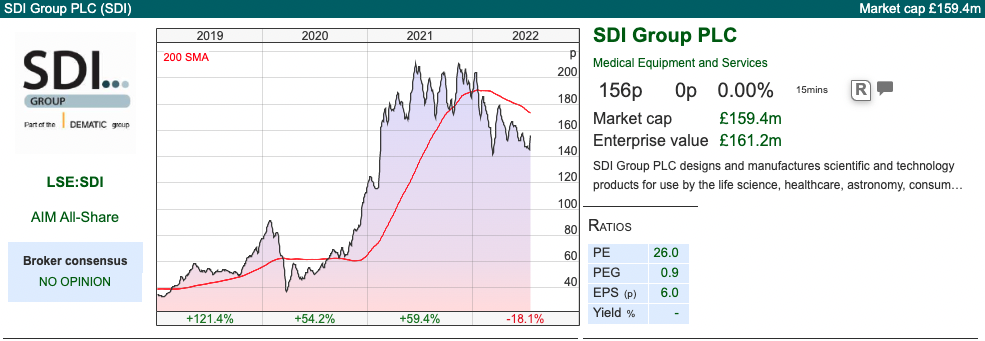

SDI FY April Results

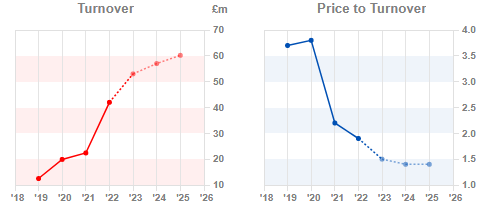

This fast-growing ‘buy and build’ scientific instruments company reported +21.6% organic revenue growth, or +42% to £49.7m including the latest 2 acquisitions in the period. Adj PBT looks to be 12% ahead (£10.5m May trading update) versus £11.8m in last week’s RNS. That’s +60% growth on the previous year. Net cash was £1.1m at the end of April.

Last year’s acquisitions (£5.5m total consideration for SVS in January, and £8.5m for Safelab Systems in March) were mainly funded from cash flow, with the exception of £200K of shares issued to Safelab. SVS specialises in Physical Vapour Deposition (PVD) systems for coating semiconductor wafers. Safe lab makes fume cupboards, and there’s some potential synergies with Monmouth Scientific which SDI bought in Dec 2020. In the future, it looks like management will use debt to fund acquisitions, as they have agreed to a £20m revolving loan facility, plus an additional £10m (accordion option at the discretion of HSBC).

Outlook: Over the pandemic, SDI has enjoyed strong demand in their Atik cameras division, because these are used in PCR testing equipment for Covid. Originally they expected this to be a one-off benefit, but sales have held up and are now expected to continue at least for the first half of FY Apr 2023. Prudently they are assuming this will normalise at some point, though they don’t quantify the likely drop in revenues. Organic growth from other portfolio companies averaged +9%.

Ken Ford, the Chairman says that he expects adj PBT of not less than £11m in FY April 2023F. FinnCap, their broker, are forecasting flat EPS of 8.7p FY Apr 2023F, growing to 8.9p FY Apr 2024F. Progressive Research have also published forecasts which are 9% higher than FinnCap’s.

Valuation: The shares are trading on 18x FinnCap FY Apr 2023F and Apr 2024F. That looks reasonable value if management can continue to execute.

Opinion: The shares are down -25% since their peak in November last year. That seems to be driven by the sell-off in quality, and growth stocks – operationally and strategically SDI continues to perform extremely well. Given the exceptionally high level of growth since the start of the pandemic, flat EPS for the next couple of years is impressive. If I have a concern, it’s that deals look like they will be larger and funded with debt. That’s not without risk, but so far management have demonstrated an enviable track record of buying companies and growing the underlying business. I own the shares.

RBG Holdings H1 June Trading Update

This legal and corporate finance business put out a trading statement for H1 to June, saying that it was in line with FY Dec 2022F market expectations of £56.2m revenues and Adj PBT of £13.1m. That implies +19% revenue growth and +30% growth in adj PBT. Net debt at the end of H1 was £17.2 million, up from £10m H1.

The original Rosenblatt business is strong in ‘contentious’ legal matters – where the fees tend to be higher for dispute resolution. Since the IPO in May 2018, they’ve made a couple of transformational acquisitions and doubled revenue. In 2021 they bought of Memery Crystal (which tends to focus on non-contentious legal services) for £29m (£12m in cash, £11.7m in shares, £5.6m deferred consideration). Other divisions are LionFish (litigation finance) and Convex Capital (corporate finance) which completed 14 deals last year and generated £9.4m of revenue. That should mean that revenue is better diversified, but the negative is that investors find it harder to understand all the moving parts.

Last week’s statement says that Memery Crystal is performing well, with the EBITDA margin improving by 10% to 27%. They expect EBITDA margin of RBGLS (which includes both Memery Crystal and Rosenblatt divisions) to improve to 35% over the medium term. That’s positive because RBGLS is c. 80% of group revenue. One thing that isn’t clear – because we don’t have much of a track record – is how Memery Crystal will perform through a recession though.

Convex Capital (c. 20% of group revenue FY 2021) corporate finance deals are down -16% to £4.2m H1 v H1 last year. Management says they have a strong pipeline of 20 deals (same number as the pipeline back in March). I’m rather sceptical that all these deals in the pipeline will be complete, given market conditions. I find that their statement “it is the Board’s expectation that the current macro-economic environment will support the ongoing fundamentals that drive M&A” surprising. To me, the current environment of more difficult debt markets and falling equity values means that deal flow could dry up (as it did at the beginning of the pandemic).

LionFish, the third-party litigation funder, has only had one case settled so far. They’ve committed £11m to 12 cases. RBGLS has also funded 13 disputes, so 24 active cases across both divisions. There’s no way of knowing how good these portfolios of cases will turn out to be, but Rosenblatt’s background in dispute resolution presumably does mean that they ought to generate their aspiration of c. 2x committed capital.

Rewards: At the last set of results management announced an Executive Incentive Plan (EIP) and Growth Share Scheme (GSS). The EIP runs to Dec 2026, and if the share price increases to 198p (+10% CAGR from 123p at the start of this year) the Chief Exec and Finance Director receive 8% of the value created. In absolute terms, I think that means (c. £100m increase in market cap x 8% = c. £8m) split with 50% going to Nicola Foulson (Chief Exec), 45% Robert Parker (CFO) and 5% Roma Marlin (HR Director). The CFO has also been awarded 1m nil cost options, with no further conditions other than he remains employed at RBGP. There will also be two GSS, for employees at Convex Capital and RBGLS. Progressive Research has published a 27-page note.

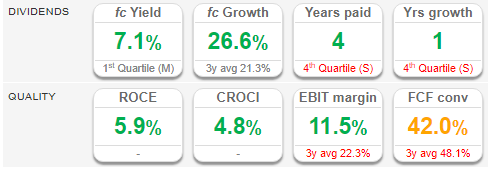

Valuation: On Progressive’s numbers PER ratio of 9.3x FY Dec 2023F and 7.2x Dec 2024F. The dividend yield is an eye-catching 7.1%. However, I can’t see this trading at much of a premium, because the RoCE is below 6%. The Growth Share Scheme is likely to act as a drag on the share price, similar to listed brokers who rewarded their staff in shares, there’s likely to be continual selling. For instance, in early June insiders sold 2m shares at a price of £1. I bought The Mission Group (marketing) almost a decade ago, and despite revenue growing c. +7% CAGR, the share price never re-rated from mid-single digit PER, for similar reasons I think.

Opinion: These numbers look good, but the low rating suggests that there is some doubt about how the business performs in a downturn. Disputes may well rise following a recession, but there will be a lag before cash flow arrives. We saw that with MANO through the pandemic, I think I would avoid RBGP for now.

Hotel Chocolate FY June Trading Update

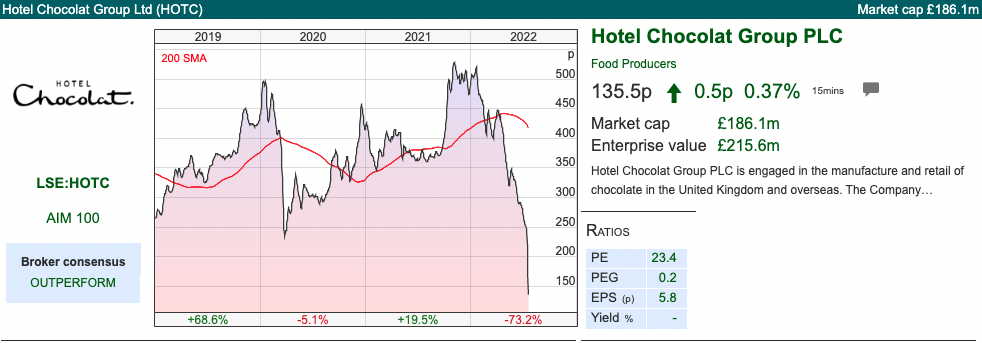

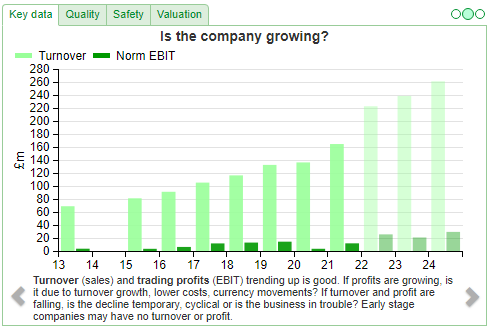

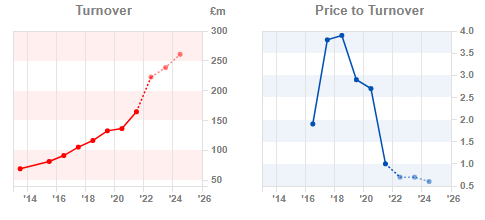

This premium brand chocolate company announced FY revenues +37% to £226m in a trading update. The increase was +70% compared to FY 2019 which was unaffected by the pandemic and was 5% above market expectations, underlying PBT was in line with consensus of £22m too, doubling from last year.

Cash: At the end of December they had net cash of £54m, in last week’s statement they say that ‘cash on hand’ (which they don’t define) has fallen to £17m. I think they mean ‘net cash’, but they don’t say that. I wonder if the subtle change of phrase signals something, perhaps with lease obligations, which companies often exclude from net debt / net cash? The company paid £11m of rent last year but has written down ‘right of use’ lease assets by £5.7m over the past couple of years as they have renegotiated with landlords. Some of that impairment is their St Lucia estate where they grow cacao, have a hotel and a visitor centre.

The shares responded by falling -46% on the morning of the RNS. The damage has been done by a £3m impairment charge for closing stores in the USA, plus an impairment charge of £23m due to poor credit quality of loans made to their Japanese joint venture (31 stores). The company raised £40m in July last year at 355p, with the proceeds used to fund an increase in sales capacity and future growth.

With the retreat from international expansion, sales growth and profit margins (60% gross margin H1 to Dec) are likely to be lower over the next couple of years. NB management said ‘sales growth’ in the RNS, implying that they don’t expect sales to fall in absolute terms. The USA will close the 4 physical stores, and be an online-only business. They are now talking about an EBITDA margin of c. 20% in FY June 2025.

Richard wrote about HOTC here. One positive is that the business is still run by its co-founder, Angus Thirlwell. Another co-founder, Peter Harris, is also a co-director. Both of them own 27.1% according to the website. I queried this with Sharepad support because for some reason the DD tab seems to think they are no longer shareholders. The reason is probably that the co-founders transferred their ownership of the shares from their names into Trusts earlier in the year.

Valuation: Liberum have nudged down their revenue forecasts for FY Jun 2023F by -4% to £236m and -12% to £254m FY Jun 2024F. However adj EPS is slashed by -60% to 5.6p FY Jun 2023F and -34% to 12p FY Jun 2024F. That means the shares are trading on 24x PER FY Jun 2023F, dropping to 11x PER FY Jun F2024. So despite the steep fall, the shares don’t strike me as an obvious bargain yet.

Opinion: One thing to bear in mind is that HOTC started life as a subscription business in the 1990s, and only opened their first physical store in 2004. That means that closing the stores in the USA and retreating from Japan is not necessarily as negative as might be first imagined. The brand is achieving “very strong” growth in the UK, so they believe that they don’t need to allocate capital to international expansion as the UK market can be a lot bigger than they thought a year ago. I’ve had my eye on HOTC for a while, the valuation is not compelling yet but it is now on my radar screen.

Notes

The author owns shares in SDI Group

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 25/07/22| SDI, RBGP, HOTC | The capital cycle

Bruce considers whether profit warnings in the insurance and adtech signal that too much capital has been chasing too few opportunities. Sophisticated data models are no replacement for management turning cautious at the top of the cycle. Stocks covered SDI, RBGP and HOTC profit warning.

The FTSE 100 recovered +1.6% last week to 7,276. Markets in the US were also strong, with the Nasdaq100 +3.5% and the S&P500 +2.6%. The US 10-year Govt bond yield, which peaked at 3.44% in the middle of June, has now fallen to 2.78%. The price of Brent Crude rose +2.7% to $104 per barrel.

Last week I wrote about how higher inflation has affected brands, such as Fevertree and Creightons which I imagine most investors were assuming were relatively immune from higher fuel prices. Now I’ve come across this post by a German blogger, on how inflation has been a surprising negative for the general insurance (specifically car insurance) sector.

Until recently, the heuristic has been that the current environment ought to be favourable for general insurance companies. With Direct Line down -28% and Admiral down -45% YTD, this now looks like an expensive mistake.

A journey back to 1967 Nebraska may help explain what I think has happened. Following his acquisition of Berkshire Hathaway, one of Buffett’s first acquisitions was to buy general insurer National Indemnity. The auto insurance company was founded in the 1940s with the then revolutionary idea that high-risk businesses (such as taxi drivers, hire cars and long-haul trucks) should not be rejected out of hand. Instead, with a large enough sample, it should be possible for insurance companies to price this risk, and generate a return on capital. It’s a similar idea to credit card economics, the risk of default and fraud is higher, but the high-interest rates charged to credit card borrowers should (in theory) offset the higher expected losses.

In the early 1970s, the insurance sector enjoyed large underwriting profits. The economics did not go unnoticed and competition became keener, followed by a difficult time in the mid-1970s because of claims inflation. National Indemnity, no doubt encouraged by the Sage to be cautious, had anticipated the problems and was prepared to lose market share and even see revenue fall. That meant Berkshire’s business was well placed when underwriting became more rational later in the decade. It strikes me that there’s a lesson in second-order thinking here.

Investors have been wrongfooted by Sabre Insurance’s warning earlier this month, with the shares down -49% following their profit warning. Early in the pandemic motor accidents fell as people were driving their cars less. It now looks as if we’re returning to a ‘normal’ level of car accidents, but the cost of claims (car parts, paint, labour and used car values) has risen faster than models assumed. For people seriously injured in accidents, the cost of care has risen +30%.

The lesson to me is that we spend too much brainpower thinking about inflation or deflation, perhaps because it is easy for newspapers to write about. Instead, we should be thinking about the capital cycle and competition – there are no Central Bank meetings to discuss these subjects and data is not compiled and released monthly in the same way as CPI or interest rates. I think though, competition and capital cycle are more important than interest rates or inflation.

One early indicator of the capital cycle before the financial crisis was large losses on credit cards in 2005-6. All sorts of sophisticated data analytics, scorecards, PhDs in mathematics, and data mining correlations had been applied to credit card lending – yet in the end, losses mounted because too much money was chasing too few credit-worthy borrowers, and lenders weren’t prepared to step back and lose market share to competitors. When HSBC bought Household International for $14bn, The Banker magazine described it as HSBC’s ‘killer move’. That’s an apt description, but not in the way the magazine intended – the deal was a disaster.

Fast forward to more recent experience and there’s been an abundance of capital chasing returns, often justified by ‘machine learning’, ‘digital transformation’ and ‘data analytics’. Last week S4 Capital, Sir Martin Sorrell’s digital advertising firm lowered adj EBITDA guidance by around 25% to £120m and the share price fell -44% on the day. The sophisticated algos that target advertising are not immune from the capital cycle after all. Similarly, the FT reported last week that FinTech’s recently listed in the US have fallen by 50% or more this year, a cumulative market capitalisation decline of $156bn. If each FinTech is measured from its peak, the decline is $460bn. This suggests we are about to learn the same lesson: sophisticated data crunching only works if the models identify when conditions are frothy and management are prepared to take a step back from the pursuit growth at all costs.

This week I look at RBG’s H1 trading update, and question if the outlook is too sanguine. Hotel Chocolate, another brand, that has had a profit warning (caused more by botched international expansion than inflation I think). Plus SDI, which continues to deliver organic and acquisition-related growth.

SDI FY April Results

This fast-growing ‘buy and build’ scientific instruments company reported +21.6% organic revenue growth, or +42% to £49.7m including the latest 2 acquisitions in the period. Adj PBT looks to be 12% ahead (£10.5m May trading update) versus £11.8m in last week’s RNS. That’s +60% growth on the previous year. Net cash was £1.1m at the end of April.

Last year’s acquisitions (£5.5m total consideration for SVS in January, and £8.5m for Safelab Systems in March) were mainly funded from cash flow, with the exception of £200K of shares issued to Safelab. SVS specialises in Physical Vapour Deposition (PVD) systems for coating semiconductor wafers. Safe lab makes fume cupboards, and there’s some potential synergies with Monmouth Scientific which SDI bought in Dec 2020. In the future, it looks like management will use debt to fund acquisitions, as they have agreed to a £20m revolving loan facility, plus an additional £10m (accordion option at the discretion of HSBC).

Outlook: Over the pandemic, SDI has enjoyed strong demand in their Atik cameras division, because these are used in PCR testing equipment for Covid. Originally they expected this to be a one-off benefit, but sales have held up and are now expected to continue at least for the first half of FY Apr 2023. Prudently they are assuming this will normalise at some point, though they don’t quantify the likely drop in revenues. Organic growth from other portfolio companies averaged +9%.

Ken Ford, the Chairman says that he expects adj PBT of not less than £11m in FY April 2023F. FinnCap, their broker, are forecasting flat EPS of 8.7p FY Apr 2023F, growing to 8.9p FY Apr 2024F. Progressive Research have also published forecasts which are 9% higher than FinnCap’s.

Valuation: The shares are trading on 18x FinnCap FY Apr 2023F and Apr 2024F. That looks reasonable value if management can continue to execute.

Opinion: The shares are down -25% since their peak in November last year. That seems to be driven by the sell-off in quality, and growth stocks – operationally and strategically SDI continues to perform extremely well. Given the exceptionally high level of growth since the start of the pandemic, flat EPS for the next couple of years is impressive. If I have a concern, it’s that deals look like they will be larger and funded with debt. That’s not without risk, but so far management have demonstrated an enviable track record of buying companies and growing the underlying business. I own the shares.

RBG Holdings H1 June Trading Update

This legal and corporate finance business put out a trading statement for H1 to June, saying that it was in line with FY Dec 2022F market expectations of £56.2m revenues and Adj PBT of £13.1m. That implies +19% revenue growth and +30% growth in adj PBT. Net debt at the end of H1 was £17.2 million, up from £10m H1.

The original Rosenblatt business is strong in ‘contentious’ legal matters – where the fees tend to be higher for dispute resolution. Since the IPO in May 2018, they’ve made a couple of transformational acquisitions and doubled revenue. In 2021 they bought of Memery Crystal (which tends to focus on non-contentious legal services) for £29m (£12m in cash, £11.7m in shares, £5.6m deferred consideration). Other divisions are LionFish (litigation finance) and Convex Capital (corporate finance) which completed 14 deals last year and generated £9.4m of revenue. That should mean that revenue is better diversified, but the negative is that investors find it harder to understand all the moving parts.

Last week’s statement says that Memery Crystal is performing well, with the EBITDA margin improving by 10% to 27%. They expect EBITDA margin of RBGLS (which includes both Memery Crystal and Rosenblatt divisions) to improve to 35% over the medium term. That’s positive because RBGLS is c. 80% of group revenue. One thing that isn’t clear – because we don’t have much of a track record – is how Memery Crystal will perform through a recession though.

Convex Capital (c. 20% of group revenue FY 2021) corporate finance deals are down -16% to £4.2m H1 v H1 last year. Management says they have a strong pipeline of 20 deals (same number as the pipeline back in March). I’m rather sceptical that all these deals in the pipeline will be complete, given market conditions. I find that their statement “it is the Board’s expectation that the current macro-economic environment will support the ongoing fundamentals that drive M&A” surprising. To me, the current environment of more difficult debt markets and falling equity values means that deal flow could dry up (as it did at the beginning of the pandemic).

LionFish, the third-party litigation funder, has only had one case settled so far. They’ve committed £11m to 12 cases. RBGLS has also funded 13 disputes, so 24 active cases across both divisions. There’s no way of knowing how good these portfolios of cases will turn out to be, but Rosenblatt’s background in dispute resolution presumably does mean that they ought to generate their aspiration of c. 2x committed capital.

Rewards: At the last set of results management announced an Executive Incentive Plan (EIP) and Growth Share Scheme (GSS). The EIP runs to Dec 2026, and if the share price increases to 198p (+10% CAGR from 123p at the start of this year) the Chief Exec and Finance Director receive 8% of the value created. In absolute terms, I think that means (c. £100m increase in market cap x 8% = c. £8m) split with 50% going to Nicola Foulson (Chief Exec), 45% Robert Parker (CFO) and 5% Roma Marlin (HR Director). The CFO has also been awarded 1m nil cost options, with no further conditions other than he remains employed at RBGP. There will also be two GSS, for employees at Convex Capital and RBGLS. Progressive Research has published a 27-page note.

Valuation: On Progressive’s numbers PER ratio of 9.3x FY Dec 2023F and 7.2x Dec 2024F. The dividend yield is an eye-catching 7.1%. However, I can’t see this trading at much of a premium, because the RoCE is below 6%. The Growth Share Scheme is likely to act as a drag on the share price, similar to listed brokers who rewarded their staff in shares, there’s likely to be continual selling. For instance, in early June insiders sold 2m shares at a price of £1. I bought The Mission Group (marketing) almost a decade ago, and despite revenue growing c. +7% CAGR, the share price never re-rated from mid-single digit PER, for similar reasons I think.

Opinion: These numbers look good, but the low rating suggests that there is some doubt about how the business performs in a downturn. Disputes may well rise following a recession, but there will be a lag before cash flow arrives. We saw that with MANO through the pandemic, I think I would avoid RBGP for now.

Hotel Chocolate FY June Trading Update

This premium brand chocolate company announced FY revenues +37% to £226m in a trading update. The increase was +70% compared to FY 2019 which was unaffected by the pandemic and was 5% above market expectations, underlying PBT was in line with consensus of £22m too, doubling from last year.

Cash: At the end of December they had net cash of £54m, in last week’s statement they say that ‘cash on hand’ (which they don’t define) has fallen to £17m. I think they mean ‘net cash’, but they don’t say that. I wonder if the subtle change of phrase signals something, perhaps with lease obligations, which companies often exclude from net debt / net cash? The company paid £11m of rent last year but has written down ‘right of use’ lease assets by £5.7m over the past couple of years as they have renegotiated with landlords. Some of that impairment is their St Lucia estate where they grow cacao, have a hotel and a visitor centre.

The shares responded by falling -46% on the morning of the RNS. The damage has been done by a £3m impairment charge for closing stores in the USA, plus an impairment charge of £23m due to poor credit quality of loans made to their Japanese joint venture (31 stores). The company raised £40m in July last year at 355p, with the proceeds used to fund an increase in sales capacity and future growth.

With the retreat from international expansion, sales growth and profit margins (60% gross margin H1 to Dec) are likely to be lower over the next couple of years. NB management said ‘sales growth’ in the RNS, implying that they don’t expect sales to fall in absolute terms. The USA will close the 4 physical stores, and be an online-only business. They are now talking about an EBITDA margin of c. 20% in FY June 2025.

Richard wrote about HOTC here. One positive is that the business is still run by its co-founder, Angus Thirlwell. Another co-founder, Peter Harris, is also a co-director. Both of them own 27.1% according to the website. I queried this with Sharepad support because for some reason the DD tab seems to think they are no longer shareholders. The reason is probably that the co-founders transferred their ownership of the shares from their names into Trusts earlier in the year.

Valuation: Liberum have nudged down their revenue forecasts for FY Jun 2023F by -4% to £236m and -12% to £254m FY Jun 2024F. However adj EPS is slashed by -60% to 5.6p FY Jun 2023F and -34% to 12p FY Jun 2024F. That means the shares are trading on 24x PER FY Jun 2023F, dropping to 11x PER FY Jun F2024. So despite the steep fall, the shares don’t strike me as an obvious bargain yet.

Opinion: One thing to bear in mind is that HOTC started life as a subscription business in the 1990s, and only opened their first physical store in 2004. That means that closing the stores in the USA and retreating from Japan is not necessarily as negative as might be first imagined. The brand is achieving “very strong” growth in the UK, so they believe that they don’t need to allocate capital to international expansion as the UK market can be a lot bigger than they thought a year ago. I’ve had my eye on HOTC for a while, the valuation is not compelling yet but it is now on my radar screen.

Notes

The author owns shares in SDI Group

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.