We are beginning to see companies operating in the “real” economy announce raised guidance. Somero (exceeding previous revenue guidance by +7%), but also Headlam (materially ahead), Acesso (comfortably ahead). Saga share price was also up +57% during the week.

The FTSE 100 is currently 6378, which is the same level as early March this year. The price of gold is beginning to fall at $1876.

Last week Novacyt, the best performing share on AIM in the last year (+7330%) released an R&D update. Bank of Georgia, the Tbilisi headquartered bank released Q3 results and held an investor day. Somero, the US based concrete screed business, also raised guidance for the FY 2020.

Novactyn R&D update

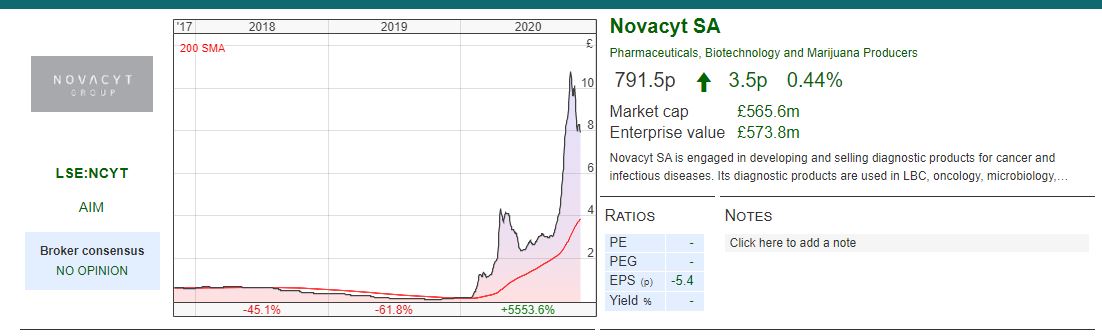

This health diagnostics company was founded in 2006 and is dual listed on AIM and the Euronext exchange in Paris. Novacyt has reported a 10x surge in revenues since they developed a test for the Covid-19 virus in January this year and released a R&D update at the start of last week suggesting even greater expansion in H2 and FY 2021.

History When it listed on AIM in 2017 the business was valued at £18m market cap, compared to £800m in October this year, before the Pfizer vaccine announcement. The original intention was to become a leader in developing new products for infectious diseases (including viruses) and oncology (cancer) diagnostic markets. Before the virus, revenue was growing at around 30% per annum, but the business was struggling for profitability, and looked like it could run out of cash unless it was supported with more money.

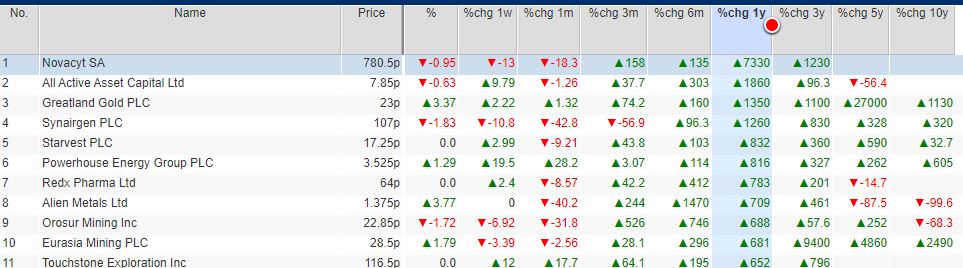

The company has been the best performing stock on AIM up 7330% in the last year (column with red dot). Perhaps surprisingly the only other stock that focuses on respiratory diseases is Synairgen, most of the remaining top 10 performers in the last 12 months have been speculative mining stocks. Well done to any reader who bought one or more of the stocks below.

qPCR diagnostic test In January Novacyt developed a Covid-19 test, currently used by the NHS. The Novacyt test, taken with a mouth or throat swab, is a quantitative polymerase chain reaction (qPCR) test designed to detect a specific sequence of genes known to exist only in the SARSCoV-2 responsible for the Covid-19 outbreak. The test can be done “at the point of need”, meaning that it doesn’t have to be sent away to a centralised lab, saving lots of time.

In October 2020, the company bought IT-IS International Ltd, the company that exclusively manufacturers Novacyt’s q16/q32 PCR molecular testing genesig® instruments. The price was an initial £10.1m with a further £1.2m earn out.

q16 is a smaller, portable qPCR instrument used in laboratories and the field. It costs around €5,000 per unit. The company’s admission document says it provides test results within 4 hours.

q32 is a larger real-time qPCR instrument, which provides customers with a faster and higher throughput solution and provides results within 60 minutes. It allows the analysis of up to 32 patient samples in tube or strip format, using fluorescence detection technologies. The list price is €13,500 per unit.

H1 results At the H1 20 results, released in September, the company reported revenues were up 10x from €7.2m in H1 2019, to €72m. The group reported gross margin of 83% for H1 2020, so much of the revenue increase dropped through to the bottom line. PBT was £40.2m versus a loss the previous year. The shares are up 10800% in the last year, but have sold off sharply in the last month, from when Pfizer announced a vaccine. As of end of June, book value was £59m and tangible book value was £40m (compared to a market cap of £565m).

Annualising the H1 revenue is likely to be too conservative, the company’s broker SP Angel points out that in September the company won a £250m contract to supply the Department of Health and Social Care (DHSC) with 300 qPCR diagnostic machines. The contract includes related kits and support services for hundreds of thousands of tests. The business model is similar to selling a printer at cost and making the margin on printer ink. There is a second phase to the contract, which the DHSC can still cancel, which would involve a further 700 qPCR diagnostic machines. Hence the broker is forecasting €288m of FY revenue (implying €216m in H2 alone) and €290m of revenue forecast in 2021.

Last week’s R&D update also confirmed effectiveness of the company’s Near Patient Test (NPT) with an interim report on a clinical trial run by Queen Mary University of London (QMUL). So far the trial analysed 4,000 samples from care home residents and staff, with 98% of the samples using Novacyt’s NPT system processed and reported in the same day. The clinical accuracy of Novacyt’s NPT system was found to have >99% clinical sensitivity and specificity when compared to a standard central laboratory system.

Antibody tests One limitation of all PCR tests is that they only diagnose an active infection, not if someone has previously had been infected and therefore may be immune from further infection. This requires an antibody test. Assuming that antibodies do prevent re-infection (that is, the virus doesn’t mutate fast enough to evade the body’s immune system) antibody tests are likely to be a key part of the strategy to contain the virus.

Novacyt expects to launch an antibody test in Q1 next year. They have manufacturing capacity to develop 3m antibody tests per month. Clearly antibody tests are controversial, because it is not clear if antibodies protect against re-infection. The Prime Minister has “tweeted” that he is self-isolating, despite having been hospitalised by the virus earlier in the year.

Competition and other risks According to the company’s broker SPAngel there are currently 207 PCR based Covid tests and 82 molecular based assays which have received US FDA Emergency Use Approval. Now that Novacyt has established itself it seems unlikely that Governments would risk switching to another testing company, unless there is an obvious reason for doing so.

One concern is that the virus will mutate, and the test may become ineffective against a new form. A second concern is that some markets (so far France and India) have demanded two-gene tests, rather than Novacyt’s single gene approach. In July Novacyt said that it expected to launch a two-gene test by September, but the R&D update last week was curiously silent on this.

An effective vaccine will eventually reduce the number of tests needed. However, it seems likely that testing will continue well into 2021.

LTIP from October 2017 paid in November 2020 The Novacyt share price fell 42% peak to trough following Pfizer’s vaccine announcement. Bulls of the shares pointed to the fact that Graham Mullis, CEO had stepped into the market and bought 60,875 shares at a price of £8.17 per share (£497,349) on 12 November. You can find this on SharePad’s DD tab.

I’m generally in favour of management owning equity in their own company. However the banks analyst in me remembers HBOS shares falling 20% one morning in early 2008, then rebounding when the bank’s employee pension scheme stepped into the market to support the share price.

Furthermore Novacyt management benefit from a LTIP that begins to pay out cash this month. The LTIP, established in 2017, gives participants a cash reward, with a calculation based on the share price. So the Chief Executive should receive around £9m cash (notional shares of 1.1m granted in 2017). Although he was buying half a million shares in the market, he was due to receive some of the £9m cash payout from the LTIP based on the share price this month. The way the LTIP was designed he will receive cash based on the share price, so he had a good reason to signal confidence when the share price was falling. Skin in the game. Indeed.

Valuation

Given the company’s revenue is likely to fall away rapidly at some point, perhaps as early as mid 2021, this would suggest valuing the company on a much lower level of revenues in perpetuity. Timing when the drop off comes is less significant than how far profits recede from their peak. The company’s broker SPAngel is paid to be optimistic, and they are forecasting revenues of €290m in 2020F and 2021F, but then falling 57% the following year followed by a further fall to €101m in 2023F.

Taking this 64€c EPS in 2023F and implies a 14x multiple for the current price of €8.70 or 790p.

The company should have substantial cash, possibly over €400m by year end 2022. The key will be what management choose to do with the cash: Return it to shareholders? Reinvest in further medical diagnostic technology? Or perhaps act as a consolidator to buy rival technologies? Perhaps a combination of all three?

This situation feels highly uncertain to me. From a tactical perspective, having missed out on the huge rise, I would be tempted to wait and see how much the shares sell off when revenue starts to fall. Clearly some investors are sitting on large gains. The shares are not expensive if the company can deliver on future earnings. But it feels like expectations may have run ahead of themselves and with an 18% fall in the last month, perhaps momentum has begun to turn.

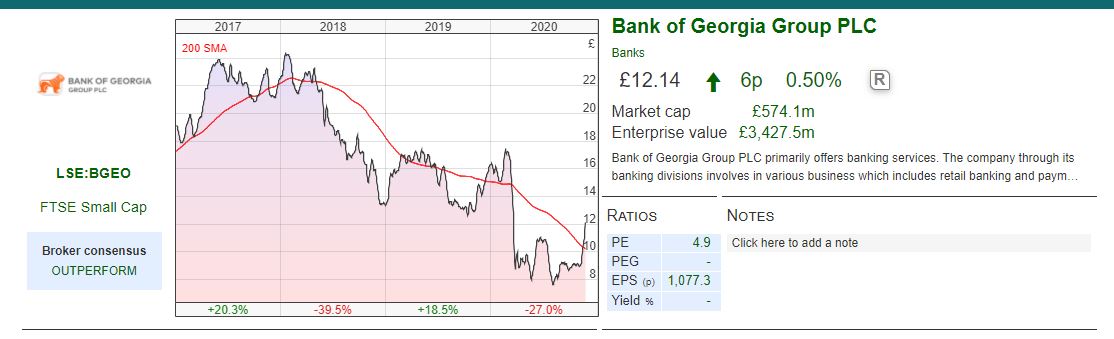

Bank of Georgia

Readers may be wondering how on earth a Tbilisi based bank came to be listed on the London Stock Exchange (on the premium section of the Main Market, not AIM). Well, it’s a fun story.

Readers may be wondering how on earth a Tbilisi based bank came to be listed on the London Stock Exchange (on the premium section of the Main Market, not AIM). Well, it’s a fun story.

From GDR to LSE

In 2005, the emerging markets desk at ING, where I worked, had structured a GDR (Global Depository Receipt) for the bank. I wasn’t involved, but followed progress out of curiosity (I spent my “gap year” heli-skiing in the Caucasus mountains). The GDR structure was rather unsatisfactory, although notionally listed in London, there was no liquidity in the GDR because ING had done a poor job at introducing the bank to London fund managers. ING had bought Charterhouse Securities at the peak of the internet bubble, then fired most of the staff when the downturn came. Sitting overseas in a nice glass office, ING management struggled to understand why, having fired most of the London staff, they had so few institutional relationships in the UK.

Russian invasion and financial crisis

After the financial crisis, which for the Georgians also included a Russian invasion of their country, BGEO’s management decided they needed more investor interest in their shares. I was now working at Seymour Pierce. Being familiar with both the bank and the country, I suggested that we become the bank’s corporate broker and went about introducing them to their current investor base. You can find lots more historic detail in my initial research piece here:

https://brucepackard.com/research/

Spin-off non-core activities In 2018 the bank did a spin-off of various non-core activities (an education business, a property construction business, insurance, health care businesses and even a vineyard and a brewery) which is now listed as Georgia Capital. Georgia Capital still owns just under 20% of Bank of Georgia shares outstanding.

Many of these businesses were acquired by the bank in 2008, during the financial crisis borrowers defaulted on loans and the bank was left with the underlying collateral assets. They also used to own a Ukrainian bank which they sold (even the Georgians had underestimated the level of corruption and difficulty of doing business in Ukraine), and a Belarussian bank, which they still own.

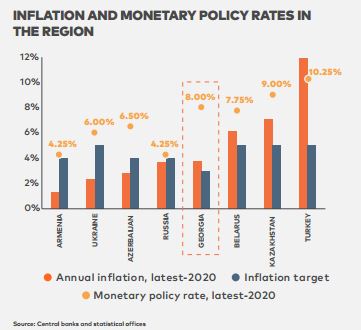

Central Bank interest rates are currently 8% in Georgia, and inflation is 4%.

Q3 Results to end of September Last week, the bank released Q3 results and an investor day updating on strategy. Q3 revenue held up well, down just 3% v Q3 19 and down 1.3% on a 9M v 9M 2019 basis in Georgia Lari terms. The bank conservatively took a large provision in Q1, only to find that Georgia Covid cases remained low through the first half of the year. Currently cases are rising and in terms of international comparison Georgia is currently between Italy and Poland in terms of cases per 100,000. The front end loading of the credit provision has meant that Q3 PBT is up 4% v Q3 last year, but down 57% on a 9M v 9M 2019 basis.

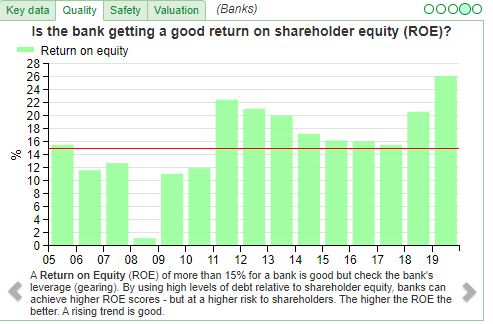

The bank has historically reported >20% RoE, but on a 9M basis this fell to 10% v 25% 9M 19. The bank’s cost/income ratio is 37%, with a medium term target of 35%.

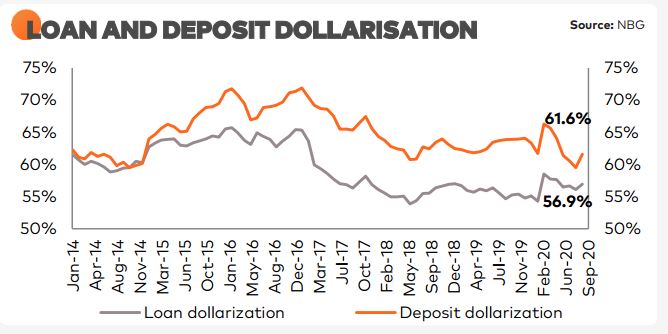

60% balance sheet US dollars Since the collapse of the Soviet Union, the Georgian Lari has a history of depreciation. Bank of Georgia has a 41% market share of retail customer deposits, and customers understandably prefer to keep some of their savings in US dollars. Currently 69% of the retail banks deposits are US dollars or other foreign currency (CHF or €uro). This compares to 46% of the retail loan book in foreign currency. 80% of the corporate loan book is also in US dollars, but of this around half is not exposed to currency risk, as the corporate earns income in US dollars. 75% of the loan book is backed by property collateral.

The bank has a 9.9% equity tier 1, which has trended down over the years. Management point out that on an IFRS basis their equity tier ratio would be over 3% stronger. Non Performing Loans (NPLs) are currently 3.8% of total loans, and these are covered by bad debt provisions that the bank has already taken through the p&l.

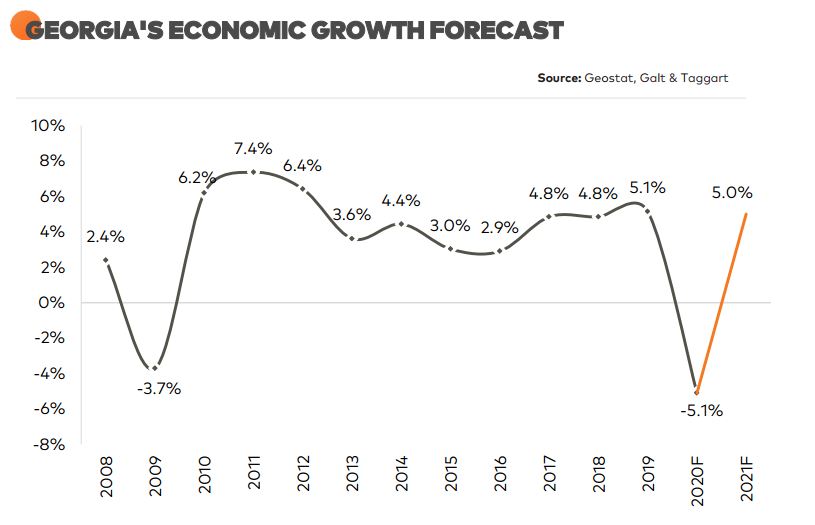

Economy The Georgian economy is reliant on both tourism (around 40% of goods and services, similar level to Croatia) and remittance flows: overseas workers sending cash back to their families in Georgia. Georgia closed its borders as the second wave of Covid cases hit, and Real GDP growth is forecast by the IMF to be down 5.0%, but recovering to 5% in 2021 and 6% in 2022.

Targets The bank targets:

- return on Equity in excess of 20% per annum;

- customer lending at c.15% per annum in Lari, with balanced growth in the retail and corporate and investment banking businesses;

- a dividend payout in the range of 25-40% of earnings, as soon as practicably possible.

I must admit I don’t really like banks with RoE or lending growth targets, from Northern Rock, Anglo Irish to Standard Chartered, I’ve seen it go wrong far too many times. That said, the bank’s balance sheet held up well in the past, not with some theoretical Central Bank stress test exercise, but with Russian tanks invading in 2008. One dreads to think what Royal Bank’s balance sheet would have looked like in 2008 if Putin had decided to invade Scotland.

Prospects I have held the shares since just after publishing my first report on the bank in October 2011.** My investment case was that banks with high market shares in small, fast growing markets do well. Particularly city states such as Singapore or Hong Kong, with open economies and British institutions. Georgia isn’t quite a city state like the above, but the country’s population size at 4.4m is comparable. Both Soc Gen and HSBC closed their operations in Georgia, because they were subscale in the country and unlike, say, Brazil, Indonesia or India the total size of the market was not compelling.

Risks Banks are compound interest machines, which also means that they are compound risk machines. A decade ago I pointed out that investors should begin to worry if either the bank, or country as a whole, catches “the Irish disease”. That is, after a decade of strong GDP per capita growth, a small group of inter-connected politicians, bankers and property speculators, with a shared admiration for race horses, start to believe that the rules of gravity don’t apply in their country. I still believe that is a risk that investors need to be alert to, but so far it hasn’t happened. The Central Bank emerged from the financial crisis with enhanced credibility, and capital ratios remain conservative.

Valuation Assuming 2022F to be a normal year, forecasts are for Georgian Lari 1272 EPS (Lari / GBP 4.36) implying 292p of EPS. That implies a PER of 2.8x for a bank with strong growth prospects, conservative balance sheet and RoE of over 20% in the last four years. If this was a tech company, I reckon investors would be willing to pay 35x future earnings for the profitability and growth. Instead, because BGEO is a bank, the shares are valued at less than 3x future earnings. I own the shares and expect that gap to close.

Somero Trading Statement to FY December

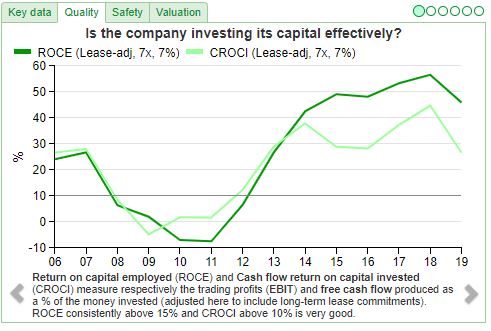

This US headquartered concrete screed business put out a trading statement raising revenue and profit expectations for FY to December. They had last updated the market in September, saying that FY revenue should exceed $75m, and this has now been raised to $80m. The cash position should also improve to approximately $26m v $21m previously guided. That $80m implies a fall of 15% versus peak cycle two years ago, when RoCE was 57%.

Although the company is global, the US is by far the largest market. That’s where the momentum seems to be coming from, despite the high Covid cases reported in the USA. Presumably construction work has not been as badly affected as anticipated.

I own the shares, and when I wrote about it in September pointed out that Somero should benefit from some of the trends that have lifted tech stocks like Amazon through the lockdowns because the screed is used to make sure that distribution centres have level floors. This is important to pile pallets high. Conversely Somero could also benefit from increased infrastructure spend if the US politicians are able to agree a stimulus package.

The company’s broker FinnCap updated forecasts show eps of 27c (21p) and dividend of 22c (or 17p) in 2020, which implies a PER of 13x and yield of 6.1%. The company is cyclical, but this year looks to be the trough in the cycle with growth returning in 2021.

Bruce Packard

Notes

The author owns shares in Bank of Georgia and Somero

* https://www.instagram.com/kaschk/

** BGEO is my largest position by cost. The value of my investment (which includes the CGEO spin-off) has doubled in a decade when banks have been rather poor investments. My mother also bought some BGEO shares, and recently increased her holding in October.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 23/11/20 – Expectations rising

We are beginning to see companies operating in the “real” economy announce raised guidance. Somero (exceeding previous revenue guidance by +7%), but also Headlam (materially ahead), Acesso (comfortably ahead). Saga share price was also up +57% during the week.

The FTSE 100 is currently 6378, which is the same level as early March this year. The price of gold is beginning to fall at $1876.

Last week Novacyt, the best performing share on AIM in the last year (+7330%) released an R&D update. Bank of Georgia, the Tbilisi headquartered bank released Q3 results and held an investor day. Somero, the US based concrete screed business, also raised guidance for the FY 2020.

Novactyn R&D update

This health diagnostics company was founded in 2006 and is dual listed on AIM and the Euronext exchange in Paris. Novacyt has reported a 10x surge in revenues since they developed a test for the Covid-19 virus in January this year and released a R&D update at the start of last week suggesting even greater expansion in H2 and FY 2021.

History When it listed on AIM in 2017 the business was valued at £18m market cap, compared to £800m in October this year, before the Pfizer vaccine announcement. The original intention was to become a leader in developing new products for infectious diseases (including viruses) and oncology (cancer) diagnostic markets. Before the virus, revenue was growing at around 30% per annum, but the business was struggling for profitability, and looked like it could run out of cash unless it was supported with more money.

The company has been the best performing stock on AIM up 7330% in the last year (column with red dot). Perhaps surprisingly the only other stock that focuses on respiratory diseases is Synairgen, most of the remaining top 10 performers in the last 12 months have been speculative mining stocks. Well done to any reader who bought one or more of the stocks below.

qPCR diagnostic test In January Novacyt developed a Covid-19 test, currently used by the NHS. The Novacyt test, taken with a mouth or throat swab, is a quantitative polymerase chain reaction (qPCR) test designed to detect a specific sequence of genes known to exist only in the SARSCoV-2 responsible for the Covid-19 outbreak. The test can be done “at the point of need”, meaning that it doesn’t have to be sent away to a centralised lab, saving lots of time.

In October 2020, the company bought IT-IS International Ltd, the company that exclusively manufacturers Novacyt’s q16/q32 PCR molecular testing genesig® instruments. The price was an initial £10.1m with a further £1.2m earn out.

q16 is a smaller, portable qPCR instrument used in laboratories and the field. It costs around €5,000 per unit. The company’s admission document says it provides test results within 4 hours.

q32 is a larger real-time qPCR instrument, which provides customers with a faster and higher throughput solution and provides results within 60 minutes. It allows the analysis of up to 32 patient samples in tube or strip format, using fluorescence detection technologies. The list price is €13,500 per unit.

H1 results At the H1 20 results, released in September, the company reported revenues were up 10x from €7.2m in H1 2019, to €72m. The group reported gross margin of 83% for H1 2020, so much of the revenue increase dropped through to the bottom line. PBT was £40.2m versus a loss the previous year. The shares are up 10800% in the last year, but have sold off sharply in the last month, from when Pfizer announced a vaccine. As of end of June, book value was £59m and tangible book value was £40m (compared to a market cap of £565m).

Annualising the H1 revenue is likely to be too conservative, the company’s broker SP Angel points out that in September the company won a £250m contract to supply the Department of Health and Social Care (DHSC) with 300 qPCR diagnostic machines. The contract includes related kits and support services for hundreds of thousands of tests. The business model is similar to selling a printer at cost and making the margin on printer ink. There is a second phase to the contract, which the DHSC can still cancel, which would involve a further 700 qPCR diagnostic machines. Hence the broker is forecasting €288m of FY revenue (implying €216m in H2 alone) and €290m of revenue forecast in 2021.

Last week’s R&D update also confirmed effectiveness of the company’s Near Patient Test (NPT) with an interim report on a clinical trial run by Queen Mary University of London (QMUL). So far the trial analysed 4,000 samples from care home residents and staff, with 98% of the samples using Novacyt’s NPT system processed and reported in the same day. The clinical accuracy of Novacyt’s NPT system was found to have >99% clinical sensitivity and specificity when compared to a standard central laboratory system.

Antibody tests One limitation of all PCR tests is that they only diagnose an active infection, not if someone has previously had been infected and therefore may be immune from further infection. This requires an antibody test. Assuming that antibodies do prevent re-infection (that is, the virus doesn’t mutate fast enough to evade the body’s immune system) antibody tests are likely to be a key part of the strategy to contain the virus.

Novacyt expects to launch an antibody test in Q1 next year. They have manufacturing capacity to develop 3m antibody tests per month. Clearly antibody tests are controversial, because it is not clear if antibodies protect against re-infection. The Prime Minister has “tweeted” that he is self-isolating, despite having been hospitalised by the virus earlier in the year.

Competition and other risks According to the company’s broker SPAngel there are currently 207 PCR based Covid tests and 82 molecular based assays which have received US FDA Emergency Use Approval. Now that Novacyt has established itself it seems unlikely that Governments would risk switching to another testing company, unless there is an obvious reason for doing so.

One concern is that the virus will mutate, and the test may become ineffective against a new form. A second concern is that some markets (so far France and India) have demanded two-gene tests, rather than Novacyt’s single gene approach. In July Novacyt said that it expected to launch a two-gene test by September, but the R&D update last week was curiously silent on this.

An effective vaccine will eventually reduce the number of tests needed. However, it seems likely that testing will continue well into 2021.

LTIP from October 2017 paid in November 2020 The Novacyt share price fell 42% peak to trough following Pfizer’s vaccine announcement. Bulls of the shares pointed to the fact that Graham Mullis, CEO had stepped into the market and bought 60,875 shares at a price of £8.17 per share (£497,349) on 12 November. You can find this on SharePad’s DD tab.

I’m generally in favour of management owning equity in their own company. However the banks analyst in me remembers HBOS shares falling 20% one morning in early 2008, then rebounding when the bank’s employee pension scheme stepped into the market to support the share price.

Furthermore Novacyt management benefit from a LTIP that begins to pay out cash this month. The LTIP, established in 2017, gives participants a cash reward, with a calculation based on the share price. So the Chief Executive should receive around £9m cash (notional shares of 1.1m granted in 2017). Although he was buying half a million shares in the market, he was due to receive some of the £9m cash payout from the LTIP based on the share price this month. The way the LTIP was designed he will receive cash based on the share price, so he had a good reason to signal confidence when the share price was falling. Skin in the game. Indeed.

Valuation

Given the company’s revenue is likely to fall away rapidly at some point, perhaps as early as mid 2021, this would suggest valuing the company on a much lower level of revenues in perpetuity. Timing when the drop off comes is less significant than how far profits recede from their peak. The company’s broker SPAngel is paid to be optimistic, and they are forecasting revenues of €290m in 2020F and 2021F, but then falling 57% the following year followed by a further fall to €101m in 2023F.

Taking this 64€c EPS in 2023F and implies a 14x multiple for the current price of €8.70 or 790p.

The company should have substantial cash, possibly over €400m by year end 2022. The key will be what management choose to do with the cash: Return it to shareholders? Reinvest in further medical diagnostic technology? Or perhaps act as a consolidator to buy rival technologies? Perhaps a combination of all three?

This situation feels highly uncertain to me. From a tactical perspective, having missed out on the huge rise, I would be tempted to wait and see how much the shares sell off when revenue starts to fall. Clearly some investors are sitting on large gains. The shares are not expensive if the company can deliver on future earnings. But it feels like expectations may have run ahead of themselves and with an 18% fall in the last month, perhaps momentum has begun to turn.

Bank of Georgia

From GDR to LSE

In 2005, the emerging markets desk at ING, where I worked, had structured a GDR (Global Depository Receipt) for the bank. I wasn’t involved, but followed progress out of curiosity (I spent my “gap year” heli-skiing in the Caucasus mountains). The GDR structure was rather unsatisfactory, although notionally listed in London, there was no liquidity in the GDR because ING had done a poor job at introducing the bank to London fund managers. ING had bought Charterhouse Securities at the peak of the internet bubble, then fired most of the staff when the downturn came. Sitting overseas in a nice glass office, ING management struggled to understand why, having fired most of the London staff, they had so few institutional relationships in the UK.

Russian invasion and financial crisis

After the financial crisis, which for the Georgians also included a Russian invasion of their country, BGEO’s management decided they needed more investor interest in their shares. I was now working at Seymour Pierce. Being familiar with both the bank and the country, I suggested that we become the bank’s corporate broker and went about introducing them to their current investor base. You can find lots more historic detail in my initial research piece here:

https://brucepackard.com/research/

Spin-off non-core activities In 2018 the bank did a spin-off of various non-core activities (an education business, a property construction business, insurance, health care businesses and even a vineyard and a brewery) which is now listed as Georgia Capital. Georgia Capital still owns just under 20% of Bank of Georgia shares outstanding.

Many of these businesses were acquired by the bank in 2008, during the financial crisis borrowers defaulted on loans and the bank was left with the underlying collateral assets. They also used to own a Ukrainian bank which they sold (even the Georgians had underestimated the level of corruption and difficulty of doing business in Ukraine), and a Belarussian bank, which they still own.

Central Bank interest rates are currently 8% in Georgia, and inflation is 4%.

Q3 Results to end of September Last week, the bank released Q3 results and an investor day updating on strategy. Q3 revenue held up well, down just 3% v Q3 19 and down 1.3% on a 9M v 9M 2019 basis in Georgia Lari terms. The bank conservatively took a large provision in Q1, only to find that Georgia Covid cases remained low through the first half of the year. Currently cases are rising and in terms of international comparison Georgia is currently between Italy and Poland in terms of cases per 100,000. The front end loading of the credit provision has meant that Q3 PBT is up 4% v Q3 last year, but down 57% on a 9M v 9M 2019 basis.

The bank has historically reported >20% RoE, but on a 9M basis this fell to 10% v 25% 9M 19. The bank’s cost/income ratio is 37%, with a medium term target of 35%.

60% balance sheet US dollars Since the collapse of the Soviet Union, the Georgian Lari has a history of depreciation. Bank of Georgia has a 41% market share of retail customer deposits, and customers understandably prefer to keep some of their savings in US dollars. Currently 69% of the retail banks deposits are US dollars or other foreign currency (CHF or €uro). This compares to 46% of the retail loan book in foreign currency. 80% of the corporate loan book is also in US dollars, but of this around half is not exposed to currency risk, as the corporate earns income in US dollars. 75% of the loan book is backed by property collateral.

The bank has a 9.9% equity tier 1, which has trended down over the years. Management point out that on an IFRS basis their equity tier ratio would be over 3% stronger. Non Performing Loans (NPLs) are currently 3.8% of total loans, and these are covered by bad debt provisions that the bank has already taken through the p&l.

Economy The Georgian economy is reliant on both tourism (around 40% of goods and services, similar level to Croatia) and remittance flows: overseas workers sending cash back to their families in Georgia. Georgia closed its borders as the second wave of Covid cases hit, and Real GDP growth is forecast by the IMF to be down 5.0%, but recovering to 5% in 2021 and 6% in 2022.

Targets The bank targets:

I must admit I don’t really like banks with RoE or lending growth targets, from Northern Rock, Anglo Irish to Standard Chartered, I’ve seen it go wrong far too many times. That said, the bank’s balance sheet held up well in the past, not with some theoretical Central Bank stress test exercise, but with Russian tanks invading in 2008. One dreads to think what Royal Bank’s balance sheet would have looked like in 2008 if Putin had decided to invade Scotland.

Prospects I have held the shares since just after publishing my first report on the bank in October 2011.** My investment case was that banks with high market shares in small, fast growing markets do well. Particularly city states such as Singapore or Hong Kong, with open economies and British institutions. Georgia isn’t quite a city state like the above, but the country’s population size at 4.4m is comparable. Both Soc Gen and HSBC closed their operations in Georgia, because they were subscale in the country and unlike, say, Brazil, Indonesia or India the total size of the market was not compelling.

Risks Banks are compound interest machines, which also means that they are compound risk machines. A decade ago I pointed out that investors should begin to worry if either the bank, or country as a whole, catches “the Irish disease”. That is, after a decade of strong GDP per capita growth, a small group of inter-connected politicians, bankers and property speculators, with a shared admiration for race horses, start to believe that the rules of gravity don’t apply in their country. I still believe that is a risk that investors need to be alert to, but so far it hasn’t happened. The Central Bank emerged from the financial crisis with enhanced credibility, and capital ratios remain conservative.

Valuation Assuming 2022F to be a normal year, forecasts are for Georgian Lari 1272 EPS (Lari / GBP 4.36) implying 292p of EPS. That implies a PER of 2.8x for a bank with strong growth prospects, conservative balance sheet and RoE of over 20% in the last four years. If this was a tech company, I reckon investors would be willing to pay 35x future earnings for the profitability and growth. Instead, because BGEO is a bank, the shares are valued at less than 3x future earnings. I own the shares and expect that gap to close.

Somero Trading Statement to FY December

This US headquartered concrete screed business put out a trading statement raising revenue and profit expectations for FY to December. They had last updated the market in September, saying that FY revenue should exceed $75m, and this has now been raised to $80m. The cash position should also improve to approximately $26m v $21m previously guided. That $80m implies a fall of 15% versus peak cycle two years ago, when RoCE was 57%.

Although the company is global, the US is by far the largest market. That’s where the momentum seems to be coming from, despite the high Covid cases reported in the USA. Presumably construction work has not been as badly affected as anticipated.

I own the shares, and when I wrote about it in September pointed out that Somero should benefit from some of the trends that have lifted tech stocks like Amazon through the lockdowns because the screed is used to make sure that distribution centres have level floors. This is important to pile pallets high. Conversely Somero could also benefit from increased infrastructure spend if the US politicians are able to agree a stimulus package.

The company’s broker FinnCap updated forecasts show eps of 27c (21p) and dividend of 22c (or 17p) in 2020, which implies a PER of 13x and yield of 6.1%. The company is cyclical, but this year looks to be the trough in the cycle with growth returning in 2021.

Bruce Packard

Notes

The author owns shares in Bank of Georgia and Somero

* https://www.instagram.com/kaschk/

** BGEO is my largest position by cost. The value of my investment (which includes the CGEO spin-off) has doubled in a decade when banks have been rather poor investments. My mother also bought some BGEO shares, and recently increased her holding in October.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.