Mining shares continued to enjoy a good rebound on the FTSE 100 at 7076, with Fresnillo +10%, Rio Tinto +6.6%, POLY +6.5% and Anglo American +6.4% the best performing stocks last week. Never mind about Rhodium, instead Copper and Iron Ore hit record highs, having doubled from March lows last year, which shows that the “real” economy is recovering well, and as yet Central Banks seem unconcerned by inflationary pressure. Gold at $1782 per ounce is still down -6% since the start of the year. The Nasdaq 100 continued to trend lower -2.4% to 13,614. The US 10Y bond yield has consolidated at 1.59%.

If you’re reading this on 10th May, then Mello Monday is this evening. It looks like an interesting line-up with Leon Boros, interviewing Kieran Maguire on the business of football. Even if you’re not interested in football as a spectator sport, I think the business of sport is fascinating. It defies generalisation, because most clubs lose money (the value is captured by the star players, like stockbroking used to be!) yet Manchester United was a multi-bagger and Nick Train points out that when the club first listed on the LSE in 1991 it was valued at just £20m. A beautiful game indeed, though more recent performance on the NYSE stock exchange since listing at $14 per share in 2012 has been disappointing. See chart below:

It’s possible to see in football trends played out from the economy more generally, as the competing interests of club owners (shareholders), managers, players (staff), fans (consumers) reflect broader trends, winning and losing from globalisation and the outsized rewards of success on a level playing field. Certainly the botched “superleague” appears to be an attempt by wealthy owners to insulate themselves from the financial consequences of losing important games, helped by a pliant US investment bank (JP Morgan). Yet the risk that global superstars can be humbled by minnows is what provides the interest in football; fans don’t want to watch if the game is not played on a level playing field.

I worked at Seymour Pierce, when the Chairman Keith Harris was famous for being the corporate finance adviser to football clubs. He was responsible for listing many clubs on AIM, then when after a few years AIM shareholders became less receptive to investing in football teams, Keith somehow seemed able to keep finding billionaires (Chelsea/Roman Abramovich, Newcastle/Mike Ashley, Man City/ former Prime Minister of Thailand Thaksin Shinawatra and Aston Villa/Randy Lerner as well as, errr, Lawrence Bassini/Watford) who were keen to buy clubs. The office was full of framed football shirts on display from football deals that Keith had done. Seymour Pierce even ended up owning Birmingham City for 6 weeks, after Carsen Yeung failed to pay us our fee and the High Court awarded us the football club until we were paid. I kept volunteering to play at the weekend, but somehow was never selected.

Later both Yeung and Vladimir Antonov (who Seymour Pierce helped buy Portsmouth FC) were jailed for money laundering. A long way from “jumpers for goalposts”. With the sad demise of Seymour Pierce, Keith has now moved on to esports, with Semper Fortis which raised £2.6m on Aquis Exchange. They are looking to sign Man Utd’s Harry Maguire to promote the venture.

This week I’ve focused on a couple of defensively positioned stocks: Frenkel Topping and Andrews Sykes. I also look at Somero, which released a positive trading update last week, where the Chairman is 86 years old, young compared to Andrews Sykes’s Chair who is 101 years young.

Rather than trying to time the market by switching into cash, probably it is worth thinking about portfolio composition. With interest rates so low switching out of more speculative positions into boring, but resilient, dividend paying stocks seems like a better alternative to cashing out completely.

Somero Trading Update for FY Dec 2021

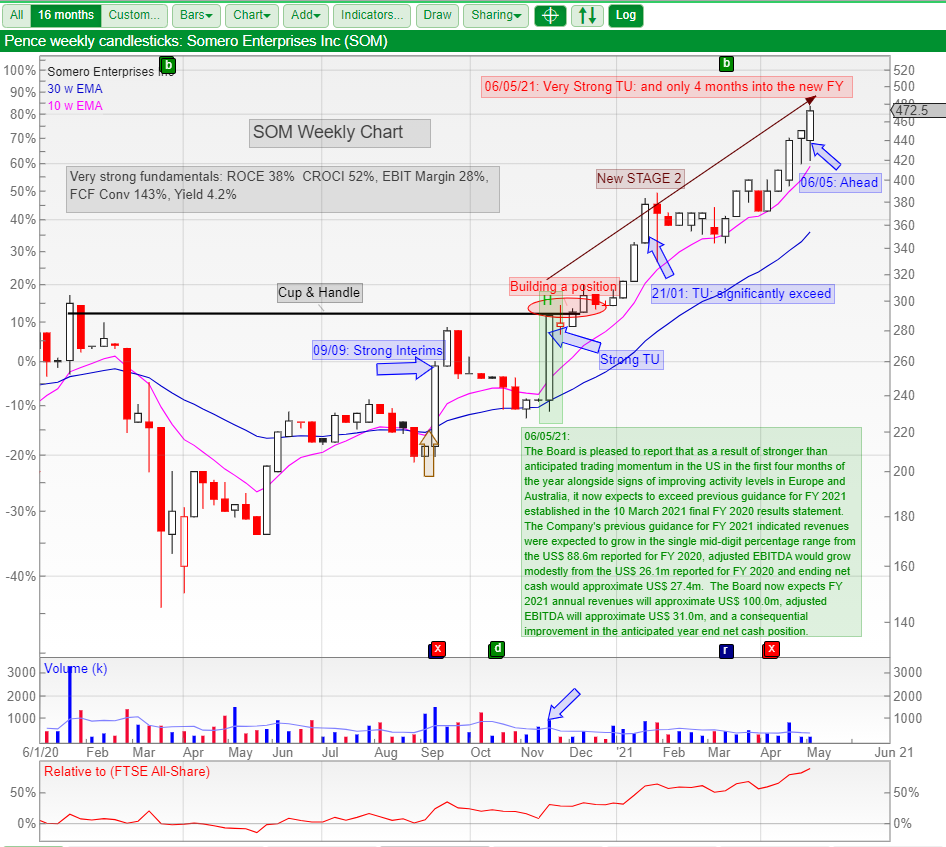

This US headquartered concrete screed company with a December year end put out a positive trading update, saying that it now expects to exceed FY 2021 guidance. Previous guidance was mid-single digit percentage revenue growth, but management now expects $100m of revenue growth (implying +13%) and adjusted EBITDA $31m (implying +19% v previous “grow modestly” guidance).

I like the way this company communicates, setting out what the old and the new expectations are, relative to FY2020 reported numbers. The RNS also explains where they are ahead (in the US, their main market and to a lesser extent Europe). The impression that management convey is that they are shareholder friendly. Other companies should understand if they don’t write their RNS announcements like this, then it harms their investment case; investors prefer to invest with management who communicate well.

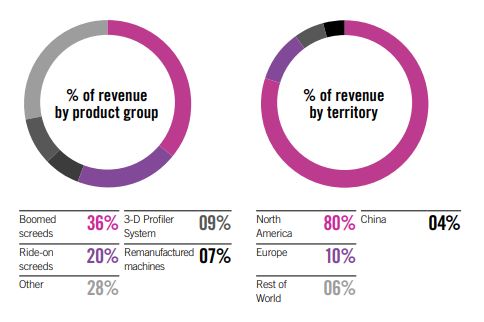

The US market is 80% of revenue and trading reflects an active market and healthy sales across the Company’s product portfolio with particularly good performance in the boomed screed category (36% of revenue) driven by demand for new warehousing required to keep pace with the growth in e-commerce operations. I’ve mentioned before that this company seems a good way to play the secondary effects of retail moving online, because their screed machines help keep concrete floors flat.

Despite the lingering effects of COVID-19 restrictions, early positive 2021 performance in Europe and Australia supports the expectation for meaningful contributions to growth from both regions in 2021. China is 4% of revenue, and the story has been for several years that if the company can grow in the Chinese market, then it has huge potential. So far though results have been underwhelming, but the potential remains. The US and Europe were just 3% and 5% of global cement consumption according to sources cited in the company’s Annual Report, whereas China is 55%.

Management also point to new products that they have launched last year (with exciting names like the SRS-4, the Broom+CureTM and the SkyScreed® 36) which they believe should contribute meaningfully to growth in 2021.

Management The Non Exec Chairman, Lawrence Horsch is 86 years old and still going strong. Jack Cooney is 74 years old, and has been Chief Executive since 1997. I think in a cyclical industry like construction it is reassuring to have management who have experienced a few ups and downs. The company has an unusual remuneration policy, salary for the Chief Exec is $502K, with bonus opportunity 0-100% depending on whether targets are hit. But there have been two successive 10 year plans, with no performance criteria attached, where management are awarded 10% of the company (ie 1% dilution each year) over the 10 year period. So far it seems to be working, though I’m also not sure that it qualifies as best practice rewarding management equity just for doing their job? Executive remuneration in the US does seem excessive and so I think UK shareholders are probably wise to accept that this company operates in the US where cultural norms about executive remuneration are far more generous. It’s hard to fault management on their track record of Return on Capital Employed.

I’m not really one for the dark arts of charting, but I know many readers are, and SharePad certainly has many “bells and whistles” that I’m not using, so I thought I’d share (with his permission) this beautifully annotated chart from SharePad user Stock Whittler. I think it means he likes the stocks.

Ownership Unicorn Asst Mgt own 10%, Canaccord 9.6%, Close Brothers Asset Mgt 7.9%. So institutional ownership is not as high as I would expect, Canaccord and Close being private client brokers. Artemis and Jupiter both own less than 4%.

Broker forecasts FinnCap, their broker, have raised the FY2021F EPS by +15% to 39.9c$. They have also raised 2022F EPS 9% to 42.9c$. This stock is cyclical, but when things are going well it tends to throw off cash. FinnCap have kept this year’s DPS unchanged at 27.9$c, but raised 2022F DPS by +14% to 27.9$c. That suggests a PE of 15x 2022F and a dividend yield of 4.3% 2022F. The company also has a $1m share buyback program this year, to mitigate dilution from equity issuance related to the management incentives I wrote about above.

Opinion I’m glad that I overcame my reluctance to invest in US headquartered stocks listed on AIM, because this share is up around 3.5x since I bought it. It’s interesting how the story about geographical expansion outside the US hasn’t really played out (yet) but the shares have still managed to “multi bag”. In some ways the mirror image of Tristel, which I looked at last week, a dominant share of its UK market but has failed to gain traction in the US for its product, but whose share price is up +379% in the last 5 years.

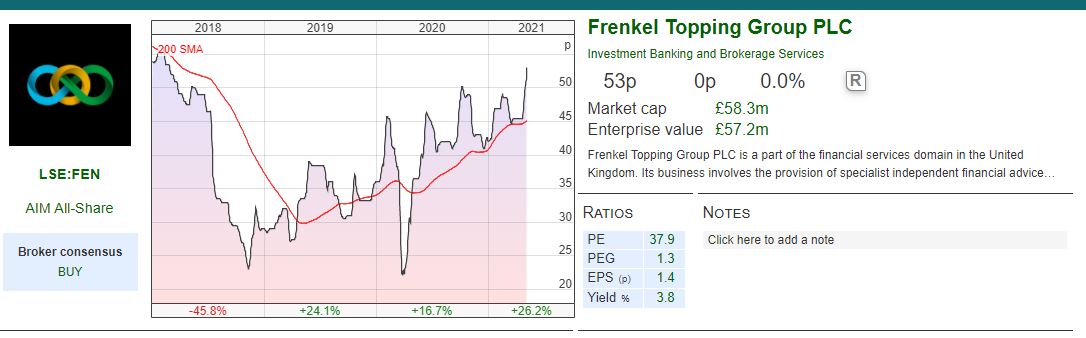

Frenkel Topping FY Dec 2020

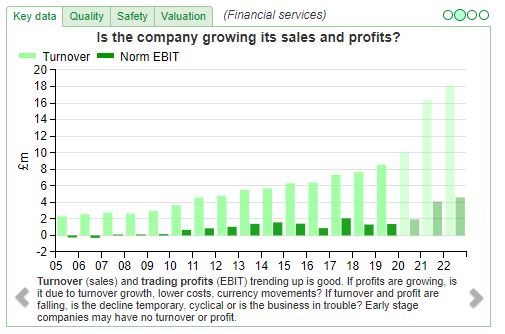

This specialist financial services firm reported revenue +19% to £10.2m and PBT +25% to £1.5m. Following a capital raise of £12m last year, they finished 2020 with £12m of net cash on their balance sheet. Assets under Management (AuM) +13% to £1.01bn, and 71% of revenue is recurring.

Frenkel Topping was founded in 1980 by two accountants, Michael Topping and John Frenkel, who have long since departed. The company floated on AIM in 2004, but annoyingly the link to their Admission Document doesn’t work on their website. I think that this is a legal requirement under AIM Rule 26, so hopefully the company fixes the link soon. The company specialises in advice and wealth management services to people who have been involved in accidents, or otherwise received substantial court awards. They also act as expert witnesses, giving guidance on future costs of living expenses which also serves as a good introduction to clients. Given the nature of their clients, ”those in vulnerable circumstances”, the advice they provide is specialised, as well as requiring empathy.

AuM has grown from £666m in 2015 to just over £1bn today. The history of the company has been haphazard. In 2015 Michael Spencer of ICAP and Jason Granite bought 17% of the shares and the latter became Chairman. I can’t imagine of a corporate culture further from ICAP than Frenkel Topping, so I think the changes in ownership tried to embed resulted in advisers leaving because there was a clash. A reminder that this is a people business, and the assets cannot only walk out the door but also set up in competition. The shake up did not have the desired effect: at 53p the shares are currently still trading the level they were at the end of 2015. In April 2017 the company announced a strategic review and a formal sales process, which failed to find a buyer.

Then in September last year they made a bid for National Accident Help Line (NAHL, current mkt cap £22m) after acquiring 6% of NAHL’s shares and receiving written confirmation that Harwood Capital which owned 13% of NAHL’s shares would be supportive. In the end the bid was unsuccessful.

Outlook First quarter of 2021 has been “robust”; management say that they have outperformed internal targets for AuM mandates won. Current trading is in line with expectations (though they don’t say what those expectations are).

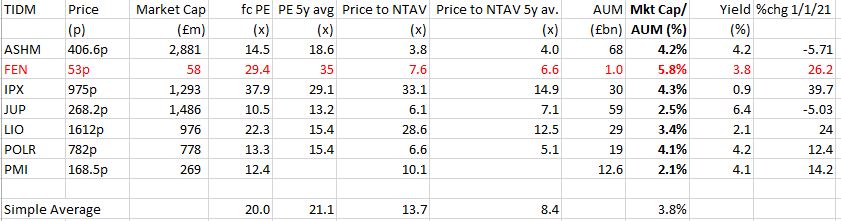

Broker forecasts FinnCap, their broker, hasn’t increased their FY 2021F, but raised FY 2022F PBT by 4% to £5.1m. They also introduce 2023F, giving EPS of 3.8p in 2022F and 4.6p in 2023F. This means that though the stock looks expensive on 29x forecast earnings, the PER falls to 11.5x 2023F. The Market Cap/AuM of 5.8% does look expensive relative to peers.

Shareholders Michael Spencer and Jason Granite no longer own disclosable stakes. SharePad shows that Christopher Mills / Harwood Capital owns 22% of the company. Hargreave Hale 8%, Gresham House 5.7% and Miton 5.4%. 49.8% of shares are not in public hands.

Opinion This looks an interesting company, operating in an attractive niche. If anything the ROCE at 11% seems a little low and the Market Cap/AuM seems rather expensive (I use 4% as a rule of thumb). Markets have been strong in the last 5 years, but unlike other asset managers Frenkel Topping don’t seem to have benefitted, probably because the nature of their clients means that they need to keep their clients in more defensively positioned portfolios.

Andrews Sykes FY Dec 2020

This equipment hire (pumps, portable heating, air conditioning, drying and ventilation) business founded in 1857 reported revenues down -13% to £67.3m and PBT down -15% to £15.8m. Jeremy highlighted it in his final SharePad weekly as a “last forever stock”, because of the attractively high ROCE, which has ranged from 25%-35% over the last 5 years. The company paid £19m in dividends last year (consisting of 10.5p Final and an Interim of 11.9p and a Special dividend of 23.7p making 46p in total dividends) but cashflow was strong enough to support the payout and the group had net cash of £7.7m at the end of December.

Earlier this year Paul Wood, the Managing Director, died aged 58. He had joined from school, and worked for the company his whole life. He’s been replaced by Carl Webb, an internal appointment who has been MD of the UK business for 15 years. The non-Exec Chairman Jacques-Gaston Murray is 101 years old.

Pension surplus The Group does have a pension scheme, and is paying in £1.3m this year and next to support the scheme. However, the scheme is in surplus. The full Annual Report is not yet available, but I went back to see how large the scheme was in the 2019 Annual Report. The scheme had £44m of assets vs £42m of obligations, so it seems unlikely that this will be a major drag on future profitability.

Forecasts Altium are the company’s NOMAD. But rather than tell their broker some forecast numbers, management have simply stated that they believe 2021F revenue should be “comparable but above” 2020, and 2021F operating profit should be “comparable to” 2020, which would imply EPS of 30.1p in line with 2020. Which puts the stock on 18x, which seems good value for a stock with temporarily depressed earnings with such an enviable long term track record.

Ownership 86% of the Shares are held by EOI Sykes Sarl, which is incorporated in Luxembourg. The ultimate holding company is the Tristar Corporation, incorporated in the Republic of Panama. The Tristar Corporation is held jointly, in equal proportions, by the Ariane Trust and the Eden Trust. I’m not sure why there is this convoluted holding structure, ultimately these Trusts are controlled by Non-Exec Chairman Jacques Gaston Murray and his son Vice Chairman Jean Jacques Murray, who acquired a controlling interest in 1994.

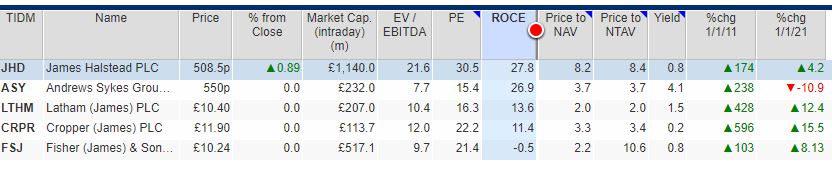

Opinion I rather like this unusual company, with a Chairman over 100 years old (the nonagenarians running Berkshire Hathaway don’t seem to have been impeded by age too much). A couple of weeks ago I suggested that an investor would have done reasonably well over the last 10 years buying a 100-year-old company with “James” in the title (Cropper, Fisher, Halstead, Latham). I’ve now added Andrews Sykes for diversification, sorted on the ROCE column.

The one reason I wouldn’t take a position is that the stock has an absurd bid – offer spread, of 500p – 600p, which is ridiculous for a £250m market cap stock. You could drive a coach, horses and highwayman through that spread, rather than market making it should be classified as daylight robbery. I have put a limit order in at the mid-point of the spread to see if I can get filled, but so far it’s been there a few days and I haven’t managed to trade.

Bruce Packard

Notes

The author owns shares in Somero

Got some thoughts on this week’s commentary? We’d love to hear from you! Share them in the comments section below.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

For a decade SOMERO has had very good cash generation and declining borrowing.

In early June 2022, SharePad’s singe-page summary shows a change from net assets of $40m in 2022 to $60m net borrowing in 2024.

What explains the $100mln flip?

You there, this is really good post here. Thanks for taking the time to post such valuable information.

okbet online casino