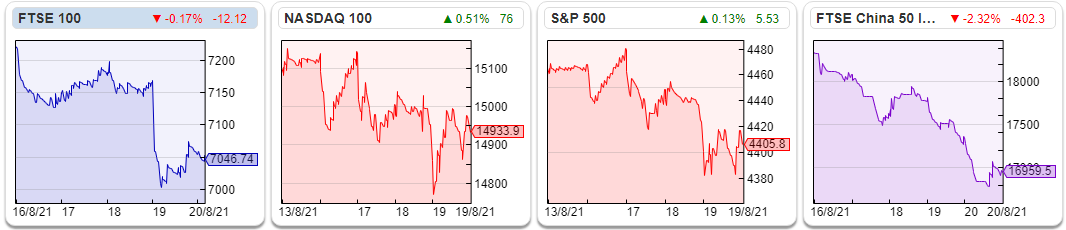

The FTSE 100 fell 2.5% last week and remains at the level it was in early May, at 7,048. The China 50 Index was down even more sharply 7.6% to 16,959. Alibaba fell 15% last week, and Tencent was also down 11%. The damage is being done by new data privacy laws that Beijing will implement later this year. More broadly economic data coming from China such as retail sales and industrial production has disappointed recently, plus there are concerns that the country won’t be able to contain the spread of the Delta variant of the virus.

Ajmal Ahmady, the (former) Governor of the Central Bank of Afghanistan said that the Taliban have been asking his staff at the Central Banks about the location of $9.5bn of reserves. Given Afghanistan’s large current account deficit, the Central Bank was reliant on US flights of physical bank notes arriving every few weeks. But the most recent flight scheduled two weekends ago was cancelled. The remainder of the Central Bank assets are held (electronically) at the US Federal Reserves and Bank of International Settlements (BIS). It’s likely the money will now be frozen, and the Taliban won’t be able to get their hands on it.

23rd of August is the 27-year anniversary since the KLF burnt a million pounds in cash. The former band filmed themselves burning bank notes in the early hours of the morning of the 23rd in an abandoned boat house on the Scottish island of Jura. They then spent several months showing the film to audiences, explaining that they didn’t really know why they burnt the money, but that it felt like the right thing to do and asking people for their thoughts. Most of these people, who would never have a million pounds, felt really rather angry and called the KLF names, such as attention-seeking gits.

So the KLF decided at a Little Chef restaurant near Aviemore to stop showing people the film and stop talking about burning a million pounds. They then drafted a contract to not mention the subject for 23 years. Never people to do things the easy way, the duo wanted to write and sign the contract on a van their friend Gimpo (a Falkland Islands veteran, who had briefly considered murdering the two and running off with the money) had borrowed from a friend and push the contract/van into the sea. Understandably Gimpo got nervous about the van he had borrowed, so drove off back to London and left the KLF stranded. They then wrote their contract on the windscreen of a hire car (a Nissan Bluebird), and drove it off a cliff into the crashing Atlantic waves at Cape Wrath, north west tip of Scotland.

Their self-imposed contractual silence on the matter ended on the 23rd August 2017 with the Welcome To The Dark Ages event in Liverpool.

I’m not suggesting that the KLF predicted Non Fungible Tokens (NFTs) or Central Bank Digital Currencies (CBDC). But I do think that they were decades ahead of their time as artists who played with ideas of “value”, “originality”, “creativity and destruction” and the zero marginal cost of information in a digital age. They also were first class at using the media to alter perceptions about themselves.

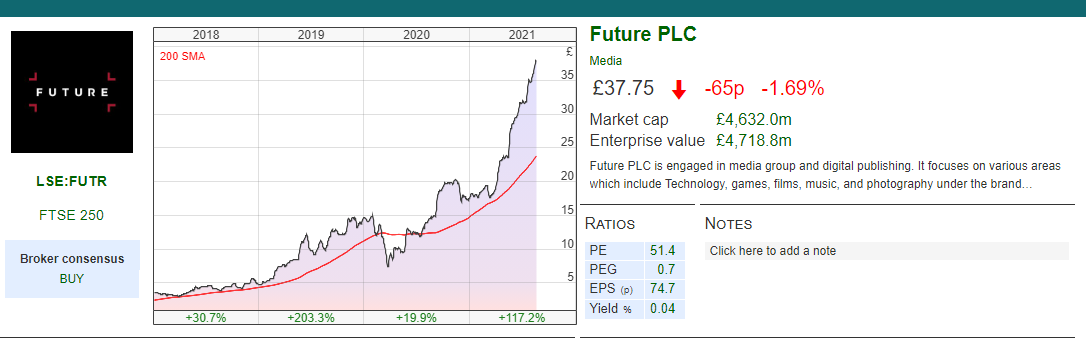

This week I look at Future, the digital publisher and advertising business, which has bought Dennis, the owner of titles like MoneyWeek. Plus Bank of Georgia strong H1 results, and an update from Novacyt, the volatile PCR testing company.

Future buys Dennis

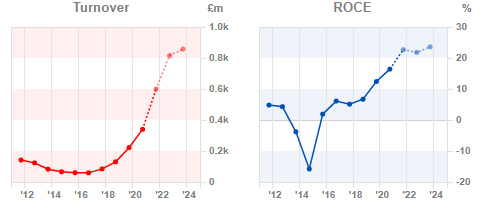

Future, the acquisitive media company, announced that they’d bought Dennis, which owns MoneyWeek and other specialist titles*, from Exponent Private Equity LLP for £300m. Future’s strategy is to buy subscription magazines and migrate them on to its digital platform. The fall in subscriptions (declining at around 15% per annum at the most recent H1 results) is offset by increased growth in advertising (rising +30% and affiliate marketing +56% growth at the most recent H1 results).

Dennis reported revenues of £105m, +12% on the previous year and adjusted EBITDA of £20m (no profit figure is given). 75% of Dennis’ revenues come from subscription (the rest coming from advertising). 56% of revenue comes from the US. The £300m purchase price is being funded by Future with debt. FUTR increased their debt facility to £600m in July.

Current trading A month ago FUTR released a trading update where they said FY profitability was expected to be “materially ahead of current market expectations”. At the most recent set of results (H1 to 31 March) organic revenue growth was +21%.

However the group is executing a roll up strategy, acquiring businesses and integrating them on to the FUTR platform. They bought TI Media in April last year, the publisher of Horse & Hound and Country Life, CinemaBlend in October last year, a TV and film company, Mozo and Go Compare, in February 2021, both price comparison websites. So including acquisitions H1 revenue was up +89% to £273m.

H1 PBT doubled to £56.9m and cash from operations was £85.9m. The predictable cash generative nature of the subscriptions business is presumably the reason banks feel comfortable lending money to fund the acquisitions. Net debt was £243m at the end of March versus negative net tangible book value (ie shareholders equity £819m less goodwill and other intangible assets £1.2bn) of £354m.

Forecasts SharePad shows strong top line growth is forecast to continue +36% in 2022F before slowing to +5% in 2023F. This gives an EPS in 2022F of 145p and 158p in 2023F, putting the shares on 26x 2022F PER and 24x 2023F PER. That’s not particularly expensive, though it is worth bearing in mind the risks of one, or more, bad deals.

Opinion Future is up +3,240% in the last 5 years so the strategy is clearly working. I’m not particularly interested in investing now given the strong historic performance, but do think that the business is an interesting case study. Normally I’d be very wary of management using debt to finance the acquisition of intangible assets, particularly when subscriptions from print media have been in decline. But the migration to online advertising and affiliate marketing has worked so far, and the acquisition of price comparison website Go Compare suggests the group is broadening out its offering.

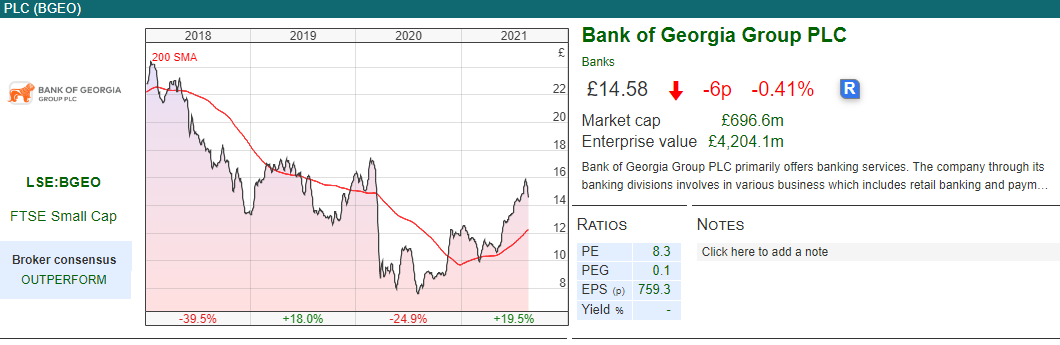

Bank of Georgia H1 results to June

Bank of Georgia, the Tbilisi headquartered bank, announced H1 results with revenue up +24% H1 vs H1 2020 to GEL 638m and PBT up 37x to GEL 375m. That profit increase is not meaningful, as H1 profits were suppressed last year, as the bank took a GEL 400m general provision in March 2020 in anticipation of Expected Credit Losses (ECL) caused by bad debts from the pandemic.

Importantly this year’s H1 profits were not flattered by releasing any of that provision, merely that the charge was not repeated this year. The Net Interest Margin was steady at 4.6% (actually rising slightly 20bp Q2 vs Q1 this year). The bank’s core equity tier 1 ratio was a comfortable 12.5% at the end of June this year, up from 9.9% 12 months ago.

Market share and returns The Bank has 38% market share in loans to individuals and 40% market share of individuals’ deposits. The bank also has 35% market share of remittance inflows from the 1.3m Georgians living abroad and sending money home. This suggests to me that the c. 20% Return on Equity reported for 4 years pre pandemic is sustainable (vs just reported Q2 2021 RoE, 29% which is likely peak profitability) and the bank is likely to achieve similar levels of returns in the next few years.

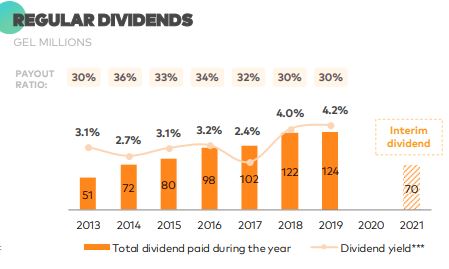

Management also announced a GEL 1.48p interim dividend (or 35p) and the bank is targeting a payout ratio of 25-40%. Historically the payout ratio has been roughly a third, or GEL 124m (£29m) FY 2019.

Forecasts BGEO is forecast to achieve GEL 1550 (360p) per share in 2023F, putting the shares on a meagre 4x PER ratio. That clearly is discounting much bad news

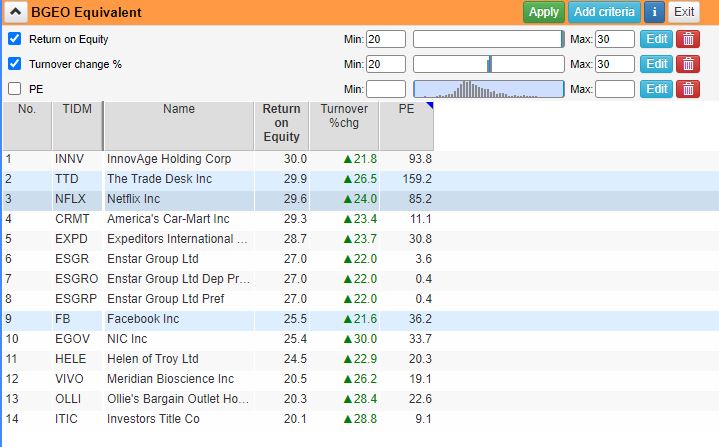

Opinion Banks are compounding machines, both of risk and returns. Following the financial crisis, investors have rightly focused far more on the former. However, I’ve used SharePad’s screening tools to look at what valuation companies with 20-30% RoE, and growing revenue at 20-30% per annum trade on Nasdaq. Facebook trades on 36x, Netflix 85x and The Trade Desk 159x.

Banks have very different balance sheets to tech companies and I’m not suggesting that BGEO should trade on 159x like adtech company The Trade Desk, but the example does reveal how perceptions drive valuation more than accounting numbers. When I started as a financial analyst, tech stocks high returns were widely thought to be higher risk of being disrupted by other tech stocks (as happened to the likes of Netscape, Yahoo, IBM, Hewlett Packard and even the Intel Microsoft duopoly). Whereas UK banks’ Return on Equity of 20-35% were thought to be sustainable, because of the competitive “moats” that suppressed competition between banks. Indeed the Labour Government even commissioned The Cruickshank Report in 1998 to look at remedies to the “complex monopoly”, lack of new entrants and competition in UK banking.

So I’m not sure that it’s correct to dismiss BGEO, just because it is a bank. I’ve owned the shares for a decade, and am still waiting for a change of perception and re-rating.

Novacyt H1 Update

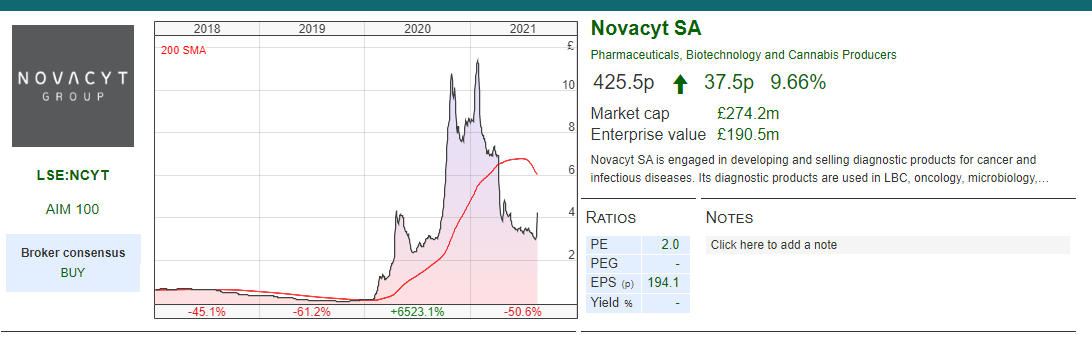

This volatile PCR testing company, which is in dispute with its largest customer the Department of Health and Social Care (DHSC) announced H1 revenue +50% H1 vs H1 last year to £95m. DHSC revenue was up +121% to £41m. The company had already announced that £41m of DHSC sales are in dispute. Excluding that, non DHSC revenue was up +20% to £54m. The company has a two year agreement with the World Health Organisation, but is also expanding rapidly into private testing. The shares responded by rising +43% last week in response to the RNS.

This volatile PCR testing company, which is in dispute with its largest customer the Department of Health and Social Care (DHSC) announced H1 revenue +50% H1 vs H1 last year to £95m. DHSC revenue was up +121% to £41m. The company had already announced that £41m of DHSC sales are in dispute. Excluding that, non DHSC revenue was up +20% to £54m. The company has a two year agreement with the World Health Organisation, but is also expanding rapidly into private testing. The shares responded by rising +43% last week in response to the RNS.

Departing Chief Exec LTIP Graham Mullis, the Chief Executive announced on 29 July that he would step down, having been CEO since 2014 and before that Lab21 which was acquired Novacyt, to be replaced by David Allmond. In 2020 Mullis earned £8.8m, of which £8.2m was a vesting 2017 LTIP award that was settled in cash using a “Phantom Award” based on the closing share price of £10 per share on 1st November 2020. He received a third in 2020, plus a third this year, and a third in 2022. I wonder if he’ll be looking to buy a new house in the same area as the BOTB management after their share sales.

The condition for receiving the LTIP award was that the Novacyt share price exceeded €0.66 per share, being the Placing Price upon admission to AIM. Clearly with the share price at around £10 this was easily achieved. But given the share price collapse since then, I think shareholders might legitimately question whether the remuneration committee did a good job at aligning management incentives with shareholders. I also remember last November several Novacyt fans on Twitter making much of the fact that Mullis was buying 60,875 shares in the market, without pointing out that he was to receive over £8m in cash from the LTIP.

New Chief Exec The new Chief Exec joins from Amryt Pharma, which specialises in rare and orphan (meaning so rare that drug specifically developed to treat the disease are unlikely to be commercially viable) diseases.

Outlook Novacyt management reiterated revenue guidance of £100 million for the Full Year, excluding DHSC revenues. This is supported by strong growth in private testing as travel re-opens but testing is still required. It’s become obvious that the vaccine reduces hospitalisations, but hasn’t been able to halt the spread of the disease, so we now have an endemic virus that will require testing, rather than any chance of eradicating the virus completely. I listened in to the conference call, management wouldn’t answer any questions on the nature of the contract dispute with the DHSC, which is understandable but leaves investors in the dark. They pointed to a much smaller contract with the DHSC which could be worth £4.7m (though no minimum purchase commitment) as a sign that they still have a relationship with their largest customer.

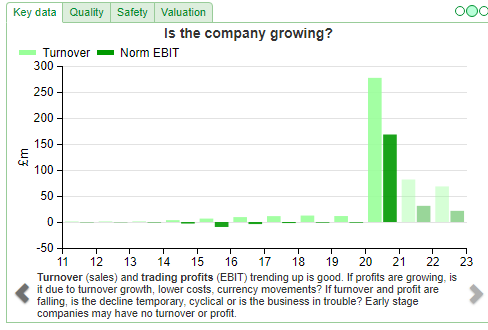

The chart below demonstrates graphically just how exceptional 2020 was for Novacyt.

Forecasts Management also said on the conference call that their working assumption was that tests reduce by half each year into the future. They pointed out that this didn’t necessarily mean that revenue would halve each year, as they planned to release new products, win market share and target new customers (eg private testing market). Management said it was too early to give guidance for 2022F or 2023F.

Hence, although SharePad shows forecasts of 2022F of 41p declining to 31p 2023F (implying an undemanding PER of 10x next year, and 14x the year after) I think we should treat these with particular caution. The variance in outcomes is huge.

Opinion These shares had a fantastic 2020, one of the top performing shares of the year and topping out at around £12. But this year they’re down 50% YTD, as the company announced that it was in dispute with the DHSC. The outlook is particularly hard to judge, so I wonder if a new Chief Exec arriving could manage down expectations for next year and the year after? This one goes in my “too hard” pile, but worth keeping an eye on.

Bruce Packard

Notes

The author owns shares in Bank of Georgia

*A full list of titles being acquired by Future are: The Week UK / The Week US, The Week Junior UK / The Week Junior US, MoneyWeek, Kiplinger, Science & Nature, IT Pro, Computer Active, PC Pro, Minecraft World, and Coach.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Always interesting