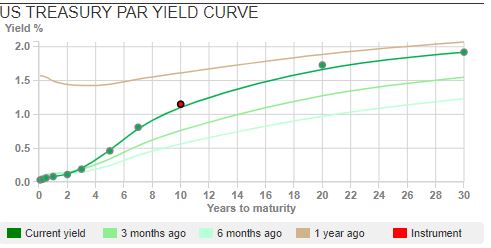

Moonpig IPO’ed last week at 350p, valuing the company at £1.2bn, and the shares rose +24% to 430p the following day. Meanwhile the FT reported that Elon Musk is expecting SpaceX to be valued at $60bn in a funding round later this month. Virgin Galactic is up +163% in the last 3 months. Valuations are literally going to the moon! The US 10 year Treasury bond yield rose above 1.15%, and the yield curve is at its steepest in 5 years. Steepness is an indication that growth and inflation expectations are rising, normally too a signal that banks should benefit.

The signs were there There is a fun interview on PI World with two fund managers, Tim Steer and Andy Brough on questionable accounting here. Tim published a great book on dubious accounting called The Signs were There, the whole interview is worth watching, but I’ve summarised a couple of points.

First, there is no single number that investors can point at and decide the management are overstating profits. Instead, his process is more like a jigsaw puzzle, comparing items in the balance sheet year on year, and looking how they compare to the figures in the p&l. Often companies try to shift costs that should be expensed through the p&l, to recording them on the balance sheet as an asset. Receivables and accruals are deferred income, and payables are deferred outgoings; if these two items are moving around in unexpected ways (for example growing much more quickly than sales) try to understand why.

Interpreting company accounts is more of an art than a science, though because sometimes costs really are investments, spending is creating a valuable asset (Netflix but also Games Workshop come to mind). So Tim suggests questioning whether the accounting judgements look “reasonable” or “aggressive”. If there’s something that you don’t like, it’s probably the tip of the iceberg.

Window Dressing In the interview Tim Steer and Andy Brough also discuss how companies are likely to “window dress” their FY 2020 accounts. Expect to see high year end cash balances, and also perhaps reduced year end bank debt versus average debt for the period. Often companies don’t give an average debt figure, but it’s worth asking the question, particularly if the company is recording high interest costs compared to the year end debt figure. Companies are likely to have other liabilities, such as deferred acquisition costs (earnouts), deferred rent, deferred VAT liabilities. We saw this with The Mission Group a couple of weeks ago.

Provisions We may also see large provisions taken by some companies who have the funds available to do this. Paradoxically large provisions often indicate a healthy balance sheet and resilient business model. From my own experience in 2008, banks that took provisions early and wrote down the value of their dodgy assets (eg HSBC, Goldman Sachs) tended to be rewarded with higher share prices. Banks that delayed making provisions (HBOS, RBOS, AIG, Lehman Brothers) because they lacked the balance sheet strength to take the pain early were (rightly) viewed with suspicion. Ironically PWC were auditors to both AIG and Goldmans, and in 2008 the auditor was happy to sign off on two vastly different valuations for the same financial instrument (a Credit Default Swap which Goldmans “marked to model” at a discount of 40%, but which AIG valued on their balance sheet with no discount). That defies common sense, the same instrument can’t be worth “X” on one balance sheet, but recorded at only “half X” on the other counterparty’s balance sheet. Last week Deutsche Bank’s reported a FY 2020 profit, for the first FY profit since 2014, which is worthy of at least one raised eyebrow.

KAPE This VPN cybersecurity company I covered a couple of weeks ago was discussed at the last Mello Event. Maynard has followed up and done some excellent work here on the “interesting” accounting choices that management have made. He shows that Kape is recording marketing costs as an asset on its balance sheet, and is not amortising over the same time period as the associated revenue relating to the commission. An excellent piece of digging, particularly as he points out that Kape’s affiliate marketing program offers up to 100% commissions to bloggers who generate new customers. That is, to acquire new customers Kape is paying up to 100% of the first year’s revenue out to influencers. No wonder Kape’s marketing cost is 44% of FY 2019 revenue.

It is just about possible that Kape’s high Customer Acquisition Cost (CAC) is locking in valuable long term customer relationships, but investors should be aware that accounting choices are flattering reported profits.

Mello Events Once again I’ll be speaking at David Stredder’s online “Mello Event” (Monday 8th Feb). The link and discount code for Sharepad / Sharescope readers gives you 50% off tickets for this and forthcoming MelloMondays (RRP £19.50, so £9.75 with the code).

https://buytickets.at/melloeventslimited/478820 Discount code : MMScope21

Creightons approach to InnovaDerma

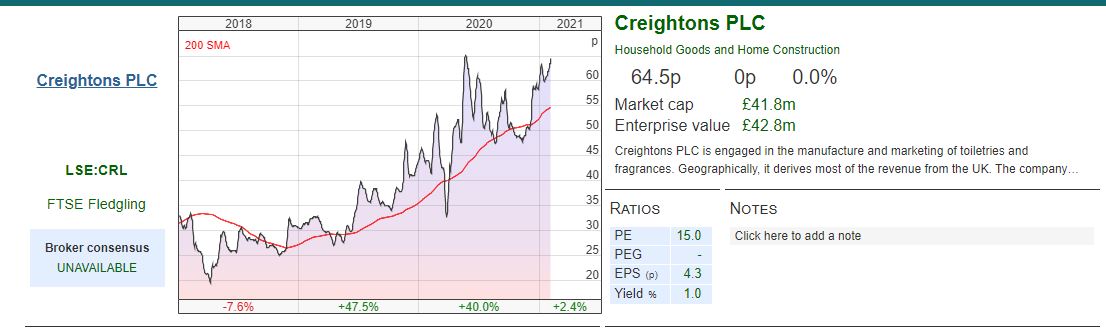

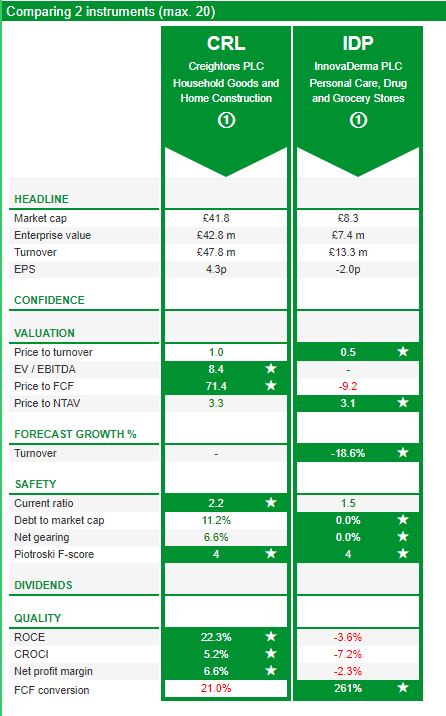

Creightons (£42m market cap) the personal grooming brands company announced that it made a preliminary approach to InnovaDerma (< £10m market cap), a loss-making haircair and anti-ageing products company. Creightons released some details of their approach, (2 Creightons shares for 3 InnovaDerma shares, a premium of just 3.5% to the target company’s share price at the start of this month.) InnovaDerma share price rose 15% on the morning of the announcement, Creightons was flat. Over the last 12 months InnovaDerma’s share price is down by a third, versus Creightons +61% over the same time period.

Takeover Panel Rules Lord Lee of Trafford spoke at Mello about a letter he has written to The Takeover Panel, because he believes that the current rules disadvantage individual shareholders. For a long time, he has been concerned at the failure of most Boards to alert shareholders to talks with a serious bidder. The current policy is to “say nothing” until a formal bid has been tabled, whereas it would obviously be to the advantage of shareholders to know that serious talks have been taking place, even if they subsequently don’t result in a formal bid. A Board of a company should instead make an earlier announcement, but with caveats such as “talks are at an early stage”, “no certainty that a formal bid will be made”. A link to his letter is here

I think that this Creighton’s InnovaDerma situation is an excellent case in point, so I look in detail at the situation below. If Creighton’s management had not made an announcement, InnovaDerma’s shareholders would not have known that an approach by another company had been made, while IDP shareholders were expected to invest new money in a loss making turnaround situation.

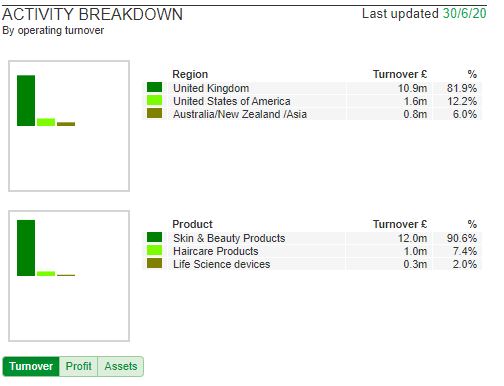

InnovaDerma The main operations are in the UK, but management operate from Melbourne while the auditor is on the other side of Australia (Perth, roughly the same distance as London to Moscow). Of the £13.3m revenue InnovaDerma reported for FY end June 2020, 6% came from Australia, 12% came from the USA and 82% came from the UK.

Shareholder register Presumably most of InnovaDerma’s external shareholders such as Edale 8%, Octopus 4.3% and Miton 4.1% would prefer the greater liquidity of holding shares in Creightons? The Directors might take a different view, and prefer to try to turn around a loss making sub £10m market cap company, particularly as the Chief Executive was only appointed late last year and a Non Exec Director who owns 15% of the shares has lent the company £0.5m last month.

Directors The Chief Exec, Blake Hughes was appointed in November last year and has spent most of his career in beauty and personal care sectors (Philip Kingsley, Murad, P&G, Elizabeth Arden, M&S). The Executive Chairman Joe Bayer resigned a couple of months ago, but the Board later agreed to dismiss him with immediate effect, and he has been replaced by Ross Andrews, an existing non Executive Director.

On 16th October last year the company announced that Mark Ward had built up a position of 1.8m shares, and would be made non Exec Director. He founded Hunter Macdonald, a digital transformation services company in 2013 and sold it to Scandinavian based Netcompany, now publicly listed on Nasdaq OMX (Nordic stock exchanged owned by Nasdaq). He began his career at PwC working in M&A and operations and spent c.13 years in senior operational director roles for Reckitt Benckiser, Verizon, BT and Friends Life. Later in October there was another RNS to say that his ownership had grown to more than 15% (2.2m shares).

Then on 11th January this year the company announced that Mark Ward had lent the company £0.5m as the company’s cash position was looking precarious. The interest rate on the loan is 5% above Libor and it is repayable in July 2021 (ie in 6 months). He can require that the loan be repaid early in the event the company raises more than £2m through debt or equity issuance. There is no mention of what happens if the company doesn’t pay back the loan (creditors fight it out presumably). I wonder if a conflict of interest will emerge between this one large shareholder / non Exec Director who is also a creditor and the other shareholders? Why wouldn’t their bank (Barclays) lend IDP any money? At June 2020 IDP had £1.2m of cash on balance sheet, and the Directors said that they had a reasonable expectation of meeting liabilities as they fell due in the foreseeable future.

Recent placing Last month InnovaDerma announced it intended to raise £4m at 35p per share in a placing to strengthen the balance sheet and fund losses (FinnCap their broker is forecasting FY June 2021 pre-tax loss of £0.9m v £0.4m FY June 2020). This placing was at 35p, a 29% discount to the market price of 49p on 19 January 2021 (the day before the placing announcement) and represents 47% of the enlarged equity. Management would also like to use the money to grow their Direct to Consumer (DTC) business. FinnCap says that DTC is currently 62% of revenues, although it’s not clear how profitable it is given that the group is loss making. The company says DTC is lower margin and ecommerce sales have also suffered from higher online advertising and customer acquisition costs.

Because the placing is so large relative to the current capital base, it has been split into two tranches: i) 2.9m shares raising c. £1m were admitted for trading on 26th January, ii) 8.35m shares conditional on a General Meeting and requires an FCA approved prospectus c £2.1m. There’s also an Open Offer of up to £0.5m. This second tranche of the placing will take a month or two to organise.

So it looks as though Creightons read the RNS on 20 January and approached the company a week later on the 26th January. InnovaDerma rejected the approach on 29th January, presumably after they were comfortable that the fund raise would go through. Creighton’s offer is just a 3.5% premium to the InnovaDerma market price of 42.5p on 1st Feb, but is 26% premium to placing price.

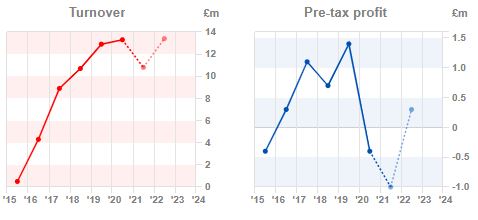

InnovaDerma Turnover and Profits (Losses)

Valuation The IDP trading update in January announced that the Board intended to make significant goodwill impairments (intangible assets were £7.8m June 2020, versus shareholders equity £10.3m and total assets of £14.2m). FinnCap has a target price of 90p, which implies an Enterprise Value of £22m, and an EV/Sales multiple of 1.6x – I don’t think anyone takes house broker target prices seriously. What we can say is that if management do turn things around the shares are undervalued, but the current price also factors in some risk of failure.

Opinion If I were a shareholder in IDP I would prefer giving some upside to Creightons shareholders, in exchange for reducing my risk. As it is, I’m a Creightons shareholder and I’m happy for CRL management to sound out the target’s shareholders and make another approach, perhaps at a 20-30% premium to the undisturbed price. If CRL do not make an offer, they also come out of the situation well showing both opportunism to make an approach and discipline to not over pay. If the InnovaDerma turnaround fails, Creightons are well positioned to make an offer for the brands to the insolvency practitioner. It was notable that when high street fashion retailers failed, the online retailers were most interested in the intangible assets (brands) rather than fixed assets or the property leases.

Under Takeover Panel rules, Creightons will have until 5pm on 2 March 2020 to announce a firm intention to make an offer for InnovaDerma. Creightons have a March year end, and have historically put out a trading update in May.

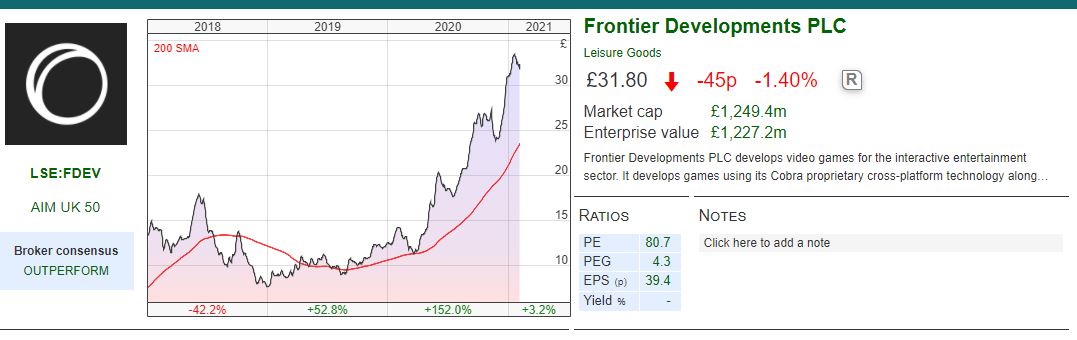

Frontier Developments H1 to November

This computer games maker (Elite, Planet Coaster, Jurassic World and Planet Zoo) put out H1 results for 6 months to 30 November. Revenue was up +15% to £36.9m (in line with previous guidance), gross profit margin was 71%. Statutory PBT was £6.5m +52% H1 on H1 19. The company had £34.9m of cash at the period end, down from £45.8m 31 May last year. The majority of that £11m fall in cash balances was down to the Employee Benefit Trust spending £10m to buy shares in order to satisfy future share option obligations.

Outlook statement Current guidance anticipates the successful release of Elite Dangerous: Odyssey, planned for release on PC before the end of this FY. In January management said that they expect to achieve £90-£95m of FY May 2021 revenue helped by a strong performance in December (which falls at the beginning of the company’s fiscal H2) and they reiterated this in last week’s RNS.

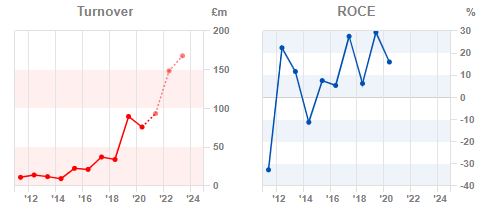

Opinion I’m a great admirer of this company and the Chief Executive David Braben (he also lead the charitable foundation responsible for the Raspberry Pi). However it looks to me like this is a QaaUP stock (Quality at an UNreasonable Price). The shares are trading on a PER of 80x. RoCE has been volatile (low 5.4% FY 16 high 29% FY 19) but averaged 15% over the last 6 years, which is good, but not spectacular. For comparison, Games Workshop, which I own, has averaged 74% RoCE, and trades on a PER ratio of <30x. Well done to holders of FDEV, the shares are up 1370% in the last 5 years, but I think I would be tempted to take some profits.

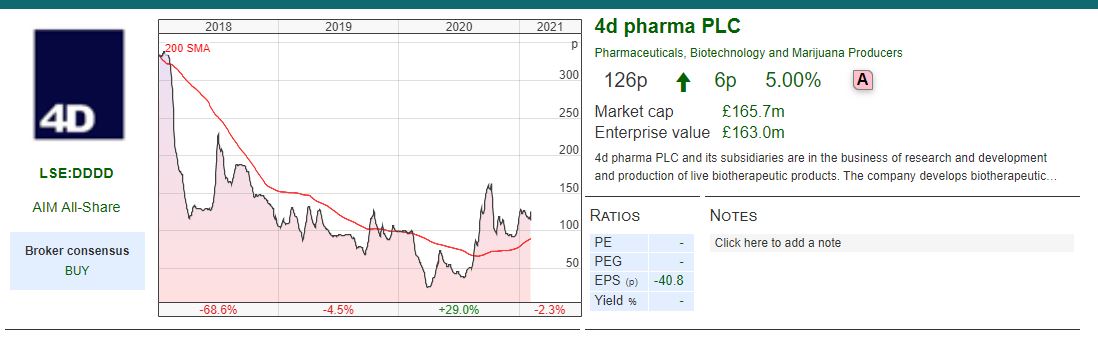

4D Pharma – Oncology Trial Update

This microbiome company developing Live Biotherapeutic Products (LBP) that a patient swallows and helps the body’s immune system to fight hard-to-treat cancers (pancreas, bladder, lung, kidney) announced an update on its trial. The company has less than £1m of revenue and has been losing roughly £40m a year, but has an ongoing trial of its LBP MRx0518 in combination with a drug called Keytruda (which suppresses the immune system).

The first part of the clinical trials was successful in May last year, showing that the treatment is safe. That trial only had 17 patients, the second part of the trial to assess clinical efficacy has an additional 24 patients.

The company had previously announced that tumour reductions had been observed in patients with kidney cancer (renal cell carcinoma RCC) and lung cancer (non small cell lung cancer NSCLC) and now last week’s statement says that there were also encouraging early signs for patients with bladder cancer.

I’m not an expert, but I think that there is very little “placebo effect” when treating cancer. Cancer can go into remission, but if patients are benefitting in clinical trials, it is likely to be caused by the pharma company’s product. Many trials have failed at phase II and phase III for diseases as diverse as Parkinson’s Disease, allergies, depression, IBS and other autoimmune diseases because the drug worked, but not significantly better than the placebo. I think that’s less of an issue for 4D, so the newsflow coming out from the company is positive.

4D pharma is planning to merge with a Nasdaq listed SPAC called Longevity Acquisition Corporation, which bulls suggest will drive the price higher as more optimistic US buyers put a higher valuation on the company. Highly speculative and outside my circle of competence, but I think it’s an interesting one to follow. The chart appears positive too, with the shares are trading above the 200 moving day average. I wrote up more detail on the company here.

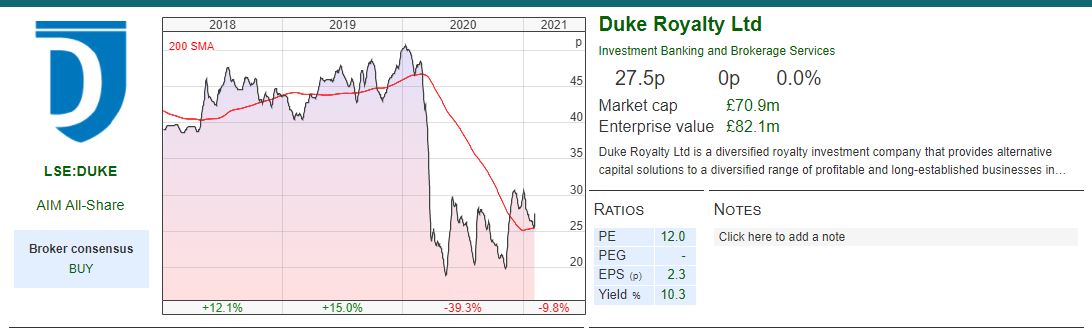

Duke Royalty – Trading Update Y/E 30 March

This royalty lender put out a trading statement saying that revenue for Q3, ex the disposal of Welltell (one of their portfolio companies which has been sold for £15m) would be £2.5m. They expect Q4 revenue to be £2.5m too, despite the sale of Welltell which generated £0.45m per quarter. So £5m for H2 to 30 March, v £3.6m H1 and a negative revenue figure in the same period last year.

Net debt currently stands at £5.6m, a substantial improvement on £15.5m net debt at the end of March last year. Of the £15m received from the sale of Welltell, £6.2m has already been lent out again in 3 follow on deals.

Broker forecasts Cenkos, their broker, is forecasting total income of £10.8m FY March 21F, though it’s not clear how they are treating the one off gain from the sale of Welltell. Cenkos is then forecasting that total income only grows 3% for the following 2 years, and adjusted EPS stays flat at 2.2p FY Mar 21F and 22F, before rising to 2.6p in FY Mar 23F. That puts the company on 10x PER March 23F. Cenkos is forecasting a dividend of 2.0p Mar 21F, growing to 2.2p Mar 23F, which is an eye catching 8% yield. I have pointed out previously that this is not a typical yield stock paying out excess capital, Duke has in the past needed capital raisings to fund growth. So management are paying out a dividend with one hand, but have a tendency to ask for capital back with the other hand.

Opinion Given that total income is a mixture of one of gains on sale, fair value adjustments, impairments and interest income it’s hard to understand the moving parts without seeing a full p&l, cashflow and balance sheet. But the RNS suggests at least things are going in the right direction. I think that miscellaneous financials (Equals, Cenkos, maybe even Funding Circle) could be a good way to play a recovery. Duke Royalty fits that profile too. I did cover the company in more detail here.

Bruce Packard

Twitter: @bruce_packard

Website: brucepackard.com

Notes

The author owns shares in Creightons

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 08/02/21 – The signs are here

Moonpig IPO’ed last week at 350p, valuing the company at £1.2bn, and the shares rose +24% to 430p the following day. Meanwhile the FT reported that Elon Musk is expecting SpaceX to be valued at $60bn in a funding round later this month. Virgin Galactic is up +163% in the last 3 months. Valuations are literally going to the moon! The US 10 year Treasury bond yield rose above 1.15%, and the yield curve is at its steepest in 5 years. Steepness is an indication that growth and inflation expectations are rising, normally too a signal that banks should benefit.

The signs were there There is a fun interview on PI World with two fund managers, Tim Steer and Andy Brough on questionable accounting here. Tim published a great book on dubious accounting called The Signs were There, the whole interview is worth watching, but I’ve summarised a couple of points.

First, there is no single number that investors can point at and decide the management are overstating profits. Instead, his process is more like a jigsaw puzzle, comparing items in the balance sheet year on year, and looking how they compare to the figures in the p&l. Often companies try to shift costs that should be expensed through the p&l, to recording them on the balance sheet as an asset. Receivables and accruals are deferred income, and payables are deferred outgoings; if these two items are moving around in unexpected ways (for example growing much more quickly than sales) try to understand why.

Interpreting company accounts is more of an art than a science, though because sometimes costs really are investments, spending is creating a valuable asset (Netflix but also Games Workshop come to mind). So Tim suggests questioning whether the accounting judgements look “reasonable” or “aggressive”. If there’s something that you don’t like, it’s probably the tip of the iceberg.

Window Dressing In the interview Tim Steer and Andy Brough also discuss how companies are likely to “window dress” their FY 2020 accounts. Expect to see high year end cash balances, and also perhaps reduced year end bank debt versus average debt for the period. Often companies don’t give an average debt figure, but it’s worth asking the question, particularly if the company is recording high interest costs compared to the year end debt figure. Companies are likely to have other liabilities, such as deferred acquisition costs (earnouts), deferred rent, deferred VAT liabilities. We saw this with The Mission Group a couple of weeks ago.

Provisions We may also see large provisions taken by some companies who have the funds available to do this. Paradoxically large provisions often indicate a healthy balance sheet and resilient business model. From my own experience in 2008, banks that took provisions early and wrote down the value of their dodgy assets (eg HSBC, Goldman Sachs) tended to be rewarded with higher share prices. Banks that delayed making provisions (HBOS, RBOS, AIG, Lehman Brothers) because they lacked the balance sheet strength to take the pain early were (rightly) viewed with suspicion. Ironically PWC were auditors to both AIG and Goldmans, and in 2008 the auditor was happy to sign off on two vastly different valuations for the same financial instrument (a Credit Default Swap which Goldmans “marked to model” at a discount of 40%, but which AIG valued on their balance sheet with no discount). That defies common sense, the same instrument can’t be worth “X” on one balance sheet, but recorded at only “half X” on the other counterparty’s balance sheet. Last week Deutsche Bank’s reported a FY 2020 profit, for the first FY profit since 2014, which is worthy of at least one raised eyebrow.

KAPE This VPN cybersecurity company I covered a couple of weeks ago was discussed at the last Mello Event. Maynard has followed up and done some excellent work here on the “interesting” accounting choices that management have made. He shows that Kape is recording marketing costs as an asset on its balance sheet, and is not amortising over the same time period as the associated revenue relating to the commission. An excellent piece of digging, particularly as he points out that Kape’s affiliate marketing program offers up to 100% commissions to bloggers who generate new customers. That is, to acquire new customers Kape is paying up to 100% of the first year’s revenue out to influencers. No wonder Kape’s marketing cost is 44% of FY 2019 revenue.

It is just about possible that Kape’s high Customer Acquisition Cost (CAC) is locking in valuable long term customer relationships, but investors should be aware that accounting choices are flattering reported profits.

Mello Events Once again I’ll be speaking at David Stredder’s online “Mello Event” (Monday 8th Feb). The link and discount code for Sharepad / Sharescope readers gives you 50% off tickets for this and forthcoming MelloMondays (RRP £19.50, so £9.75 with the code).

https://buytickets.at/melloeventslimited/478820 Discount code : MMScope21

Creightons approach to InnovaDerma

Creightons (£42m market cap) the personal grooming brands company announced that it made a preliminary approach to InnovaDerma (< £10m market cap), a loss-making haircair and anti-ageing products company. Creightons released some details of their approach, (2 Creightons shares for 3 InnovaDerma shares, a premium of just 3.5% to the target company’s share price at the start of this month.) InnovaDerma share price rose 15% on the morning of the announcement, Creightons was flat. Over the last 12 months InnovaDerma’s share price is down by a third, versus Creightons +61% over the same time period.

Takeover Panel Rules Lord Lee of Trafford spoke at Mello about a letter he has written to The Takeover Panel, because he believes that the current rules disadvantage individual shareholders. For a long time, he has been concerned at the failure of most Boards to alert shareholders to talks with a serious bidder. The current policy is to “say nothing” until a formal bid has been tabled, whereas it would obviously be to the advantage of shareholders to know that serious talks have been taking place, even if they subsequently don’t result in a formal bid. A Board of a company should instead make an earlier announcement, but with caveats such as “talks are at an early stage”, “no certainty that a formal bid will be made”. A link to his letter is here

I think that this Creighton’s InnovaDerma situation is an excellent case in point, so I look in detail at the situation below. If Creighton’s management had not made an announcement, InnovaDerma’s shareholders would not have known that an approach by another company had been made, while IDP shareholders were expected to invest new money in a loss making turnaround situation.

InnovaDerma The main operations are in the UK, but management operate from Melbourne while the auditor is on the other side of Australia (Perth, roughly the same distance as London to Moscow). Of the £13.3m revenue InnovaDerma reported for FY end June 2020, 6% came from Australia, 12% came from the USA and 82% came from the UK.

Shareholder register Presumably most of InnovaDerma’s external shareholders such as Edale 8%, Octopus 4.3% and Miton 4.1% would prefer the greater liquidity of holding shares in Creightons? The Directors might take a different view, and prefer to try to turn around a loss making sub £10m market cap company, particularly as the Chief Executive was only appointed late last year and a Non Exec Director who owns 15% of the shares has lent the company £0.5m last month.

Directors The Chief Exec, Blake Hughes was appointed in November last year and has spent most of his career in beauty and personal care sectors (Philip Kingsley, Murad, P&G, Elizabeth Arden, M&S). The Executive Chairman Joe Bayer resigned a couple of months ago, but the Board later agreed to dismiss him with immediate effect, and he has been replaced by Ross Andrews, an existing non Executive Director.

On 16th October last year the company announced that Mark Ward had built up a position of 1.8m shares, and would be made non Exec Director. He founded Hunter Macdonald, a digital transformation services company in 2013 and sold it to Scandinavian based Netcompany, now publicly listed on Nasdaq OMX (Nordic stock exchanged owned by Nasdaq). He began his career at PwC working in M&A and operations and spent c.13 years in senior operational director roles for Reckitt Benckiser, Verizon, BT and Friends Life. Later in October there was another RNS to say that his ownership had grown to more than 15% (2.2m shares).

Then on 11th January this year the company announced that Mark Ward had lent the company £0.5m as the company’s cash position was looking precarious. The interest rate on the loan is 5% above Libor and it is repayable in July 2021 (ie in 6 months). He can require that the loan be repaid early in the event the company raises more than £2m through debt or equity issuance. There is no mention of what happens if the company doesn’t pay back the loan (creditors fight it out presumably). I wonder if a conflict of interest will emerge between this one large shareholder / non Exec Director who is also a creditor and the other shareholders? Why wouldn’t their bank (Barclays) lend IDP any money? At June 2020 IDP had £1.2m of cash on balance sheet, and the Directors said that they had a reasonable expectation of meeting liabilities as they fell due in the foreseeable future.

Recent placing Last month InnovaDerma announced it intended to raise £4m at 35p per share in a placing to strengthen the balance sheet and fund losses (FinnCap their broker is forecasting FY June 2021 pre-tax loss of £0.9m v £0.4m FY June 2020). This placing was at 35p, a 29% discount to the market price of 49p on 19 January 2021 (the day before the placing announcement) and represents 47% of the enlarged equity. Management would also like to use the money to grow their Direct to Consumer (DTC) business. FinnCap says that DTC is currently 62% of revenues, although it’s not clear how profitable it is given that the group is loss making. The company says DTC is lower margin and ecommerce sales have also suffered from higher online advertising and customer acquisition costs.

Because the placing is so large relative to the current capital base, it has been split into two tranches: i) 2.9m shares raising c. £1m were admitted for trading on 26th January, ii) 8.35m shares conditional on a General Meeting and requires an FCA approved prospectus c £2.1m. There’s also an Open Offer of up to £0.5m. This second tranche of the placing will take a month or two to organise.

So it looks as though Creightons read the RNS on 20 January and approached the company a week later on the 26th January. InnovaDerma rejected the approach on 29th January, presumably after they were comfortable that the fund raise would go through. Creighton’s offer is just a 3.5% premium to the InnovaDerma market price of 42.5p on 1st Feb, but is 26% premium to placing price.

InnovaDerma Turnover and Profits (Losses)

Valuation The IDP trading update in January announced that the Board intended to make significant goodwill impairments (intangible assets were £7.8m June 2020, versus shareholders equity £10.3m and total assets of £14.2m). FinnCap has a target price of 90p, which implies an Enterprise Value of £22m, and an EV/Sales multiple of 1.6x – I don’t think anyone takes house broker target prices seriously. What we can say is that if management do turn things around the shares are undervalued, but the current price also factors in some risk of failure.

Opinion If I were a shareholder in IDP I would prefer giving some upside to Creightons shareholders, in exchange for reducing my risk. As it is, I’m a Creightons shareholder and I’m happy for CRL management to sound out the target’s shareholders and make another approach, perhaps at a 20-30% premium to the undisturbed price. If CRL do not make an offer, they also come out of the situation well showing both opportunism to make an approach and discipline to not over pay. If the InnovaDerma turnaround fails, Creightons are well positioned to make an offer for the brands to the insolvency practitioner. It was notable that when high street fashion retailers failed, the online retailers were most interested in the intangible assets (brands) rather than fixed assets or the property leases.

Under Takeover Panel rules, Creightons will have until 5pm on 2 March 2020 to announce a firm intention to make an offer for InnovaDerma. Creightons have a March year end, and have historically put out a trading update in May.

Frontier Developments H1 to November

This computer games maker (Elite, Planet Coaster, Jurassic World and Planet Zoo) put out H1 results for 6 months to 30 November. Revenue was up +15% to £36.9m (in line with previous guidance), gross profit margin was 71%. Statutory PBT was £6.5m +52% H1 on H1 19. The company had £34.9m of cash at the period end, down from £45.8m 31 May last year. The majority of that £11m fall in cash balances was down to the Employee Benefit Trust spending £10m to buy shares in order to satisfy future share option obligations.

Outlook statement Current guidance anticipates the successful release of Elite Dangerous: Odyssey, planned for release on PC before the end of this FY. In January management said that they expect to achieve £90-£95m of FY May 2021 revenue helped by a strong performance in December (which falls at the beginning of the company’s fiscal H2) and they reiterated this in last week’s RNS.

Opinion I’m a great admirer of this company and the Chief Executive David Braben (he also lead the charitable foundation responsible for the Raspberry Pi). However it looks to me like this is a QaaUP stock (Quality at an UNreasonable Price). The shares are trading on a PER of 80x. RoCE has been volatile (low 5.4% FY 16 high 29% FY 19) but averaged 15% over the last 6 years, which is good, but not spectacular. For comparison, Games Workshop, which I own, has averaged 74% RoCE, and trades on a PER ratio of <30x. Well done to holders of FDEV, the shares are up 1370% in the last 5 years, but I think I would be tempted to take some profits.

4D Pharma – Oncology Trial Update

This microbiome company developing Live Biotherapeutic Products (LBP) that a patient swallows and helps the body’s immune system to fight hard-to-treat cancers (pancreas, bladder, lung, kidney) announced an update on its trial. The company has less than £1m of revenue and has been losing roughly £40m a year, but has an ongoing trial of its LBP MRx0518 in combination with a drug called Keytruda (which suppresses the immune system).

The first part of the clinical trials was successful in May last year, showing that the treatment is safe. That trial only had 17 patients, the second part of the trial to assess clinical efficacy has an additional 24 patients.

The company had previously announced that tumour reductions had been observed in patients with kidney cancer (renal cell carcinoma RCC) and lung cancer (non small cell lung cancer NSCLC) and now last week’s statement says that there were also encouraging early signs for patients with bladder cancer.

I’m not an expert, but I think that there is very little “placebo effect” when treating cancer. Cancer can go into remission, but if patients are benefitting in clinical trials, it is likely to be caused by the pharma company’s product. Many trials have failed at phase II and phase III for diseases as diverse as Parkinson’s Disease, allergies, depression, IBS and other autoimmune diseases because the drug worked, but not significantly better than the placebo. I think that’s less of an issue for 4D, so the newsflow coming out from the company is positive.

4D pharma is planning to merge with a Nasdaq listed SPAC called Longevity Acquisition Corporation, which bulls suggest will drive the price higher as more optimistic US buyers put a higher valuation on the company. Highly speculative and outside my circle of competence, but I think it’s an interesting one to follow. The chart appears positive too, with the shares are trading above the 200 moving day average. I wrote up more detail on the company here.

Duke Royalty – Trading Update Y/E 30 March

This royalty lender put out a trading statement saying that revenue for Q3, ex the disposal of Welltell (one of their portfolio companies which has been sold for £15m) would be £2.5m. They expect Q4 revenue to be £2.5m too, despite the sale of Welltell which generated £0.45m per quarter. So £5m for H2 to 30 March, v £3.6m H1 and a negative revenue figure in the same period last year.

Net debt currently stands at £5.6m, a substantial improvement on £15.5m net debt at the end of March last year. Of the £15m received from the sale of Welltell, £6.2m has already been lent out again in 3 follow on deals.

Broker forecasts Cenkos, their broker, is forecasting total income of £10.8m FY March 21F, though it’s not clear how they are treating the one off gain from the sale of Welltell. Cenkos is then forecasting that total income only grows 3% for the following 2 years, and adjusted EPS stays flat at 2.2p FY Mar 21F and 22F, before rising to 2.6p in FY Mar 23F. That puts the company on 10x PER March 23F. Cenkos is forecasting a dividend of 2.0p Mar 21F, growing to 2.2p Mar 23F, which is an eye catching 8% yield. I have pointed out previously that this is not a typical yield stock paying out excess capital, Duke has in the past needed capital raisings to fund growth. So management are paying out a dividend with one hand, but have a tendency to ask for capital back with the other hand.

Opinion Given that total income is a mixture of one of gains on sale, fair value adjustments, impairments and interest income it’s hard to understand the moving parts without seeing a full p&l, cashflow and balance sheet. But the RNS suggests at least things are going in the right direction. I think that miscellaneous financials (Equals, Cenkos, maybe even Funding Circle) could be a good way to play a recovery. Duke Royalty fits that profile too. I did cover the company in more detail here.

Bruce Packard

Twitter: @bruce_packard

Website: brucepackard.com

Notes

The author owns shares in Creightons

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.