The FTSE 100 closed around 6,487 to 24 December down -15% from the start of the year. From a peak of 7670 in mid-January the index fell by -35% to a low of 4998 at the end of March before recovering +30%. A reminder of the importance of pound cost averaging, because a -30% drop, followed by a +30% rise doesn’t get you back to the figure you started with.

The best performing FTSE 100 companies this year were Scottish Mortgage Investment Trust +104%, which now has a market cap of £17.1bn, followed by Fresnillo +78%, Ocado +75%, Pershing Square +65%, and Flutter +65%. The outperformance of technology companies is unsurprising, but unlike the late 1990s natural resources stocks and industrial commodities like copper have also done well.

The worst performing companies were IAG (the old British Airways) -61%, Rolls Royce -51%, BP -44%, Shell -42%, Lloyds -41%. Airlines, oil companies and banks are obviously harmed by the economic damaged caused by lockdowns, how permanent the damage remains to be seen.

US markets fared better this year with the S&P up +15% and the Nasdaq composite up +42% (best performers: Tesla, Moderna, Zoom all of which have questionable profitability).

Interviews: Closer to home there are some interviews on piworld.co.uk with people talking about their performance this year, so I do the same below. It’s interesting that the “professionals” like Stephen English and Richard Leonard who manage other people’s money have underperformed the “amateurs” who manager their own money, like Leon Boros for example. I think that this is a great argument for using SharePad to education yourself, and do your own research and investing.

I am listen to an account of the Everest 1953 *expedition on audiobook. All of the climbers had to be “amateurs” with occupations like doctor, statistician, British Army officer or university student; anyone earning a living as a professional mountain guide was not selected. This seems in opposition to modern values, “amateur” is often meant as an insult. Yet I think perhaps we have lost something to be admired in the “amateurs”, who have achieved much over the centuries.**

Earlier this year the ONS published its Ownership of UK quoted shares data report, showing that back in 1963, the man in the street owned 54% of all the shares in issue on the London stock market. Since then the stock market has become dominated by institutional investors, and the amateurs’ direct holdings have declined to a low of 10% in 2012. But since 2012 the trend has begun to recover, and individuals now constitute 13.5% helped by tools like SharePad. I very much enjoyed the musings of this anonymous professional fund manager, explaining the advantages that amateurs enjoy relative to professionals. Amateurs who know what they’re doing outperform the professionals on a regular basis.

My portfolio performance: This year I sold nothing, and I bought shares in only 3 companies, 2 of which I already own (Ocean Wilsons, ULS Technology) and one I didn’t (Arcontech). This activity was less than 2.5% of my portfolio.

13/23 of the stocks I own finished down this year. Worst performers were Vianet (-58% this year) Georgia Capital (-45%) Hostelworld (-42%) MS International (-35%) and Quarto (-32%) though these 5 stocks are less than 5% of my total portfolio (ex Georgia Capital less than 2%). If I’d re-balanced my portfolio at the start of the year so that each company was 1/23 of my portfolio, then I would have been up 5%. But because I didn’t rebalance and I’ve owned companies like Sylvania Platinum(+109% this year), Games Workshop(+81%), Impax AM(+74%) and SDI Group(+44%) for years, the power of compounding means that my top 4 holdings have grown to become roughly two thirds of my entire portfolio. So I ended the year up 29% to 24 Dec 2020.

Looking forward many commentators are anticipating inflation. No one seems to think that interest rates will also rise though. A reflationary environment may be more helpful to banks which have had 20 terrible years of underperformance. Perhaps though it could be better to buy either i) oil and other commodities or ii) brands with pricing power like Unilever and Reckitt & Benckiser? The latter are both trading on less than 20x earnings, which surprised me. I came across a presentation by Ash Park / Kingsway Capital saying that since 1977 a portfolio of global consumer staples had never lost money in any 5 year period. Past performance should not be extrapolated into the future uncritically, but investors probably do make consistent mistakes. For example overvaluing speculative mining stocks, and systematically underestimating the power of compounding in companies like Unilever.**

As the week around Christmas has been quiet I spent time listening to company presentations on Investor Meets Company. Below I cover HeiQ which came to the market earlier in December and have a clever process to make fabrics anti-viral. Then Duke Royalty which is a lender that looks well set to benefit if there is an economic recovery next year.

HeiQ

This is an innovative textile firm that is reversing into a cash shell: Auctus Growth. Previously Auctus was a Richard Lockwood vehicle, a fund manager who specialised in natural resources stocks. He had good performance prior to the financial crisis, and timed his market exit, selling to hedge fund CQS in 2007 right at the top of the “super-cycle”. But since then he has invested in commodity stocks anticipating inflation which hasn’t worked out over the last 10 years. When I last met him in 2015 I suggested that Unilever shares were a lower risk hedge against inflation. Afterwards the only feedback I heard was that he thought my haircut was untidy. That was probably good advice, professional fund managers make an awful lot of money by appearing smart, but in fact being lucky.

Earlier this month HeiQ then reversed into Auctus Growth. HeiQ was founded in 2005 (the idea came to the founder on a hike) and is headquartered in Zurich, with manufacturing facilities in Switzerland, USA and Australia. They also have 5 wholly owned subsidiaries and a further subsidiary is planned for China, though oddly they don’t appear to do any manufacturing there, presumably China would be a cheaper location than Switzerland.

The company has clever chemistry which allows them to treat fabrics to make them breathable and filter out particles. HeiQ’s technology is used by over 300 of the world’s functional lifestyle brands across the clothes (including underwear), medical and home textile markets. The textiles can have a cooling, warming, breathable, masks odours, repel oil and insects, antiviral, antibacterial and antifungal effect.

They also make HeiQ Viroblock, which is added to fabric during the final stage of the textile manufacturing process and is enjoying rapid product revenue growth in the global fight against Covid-19.

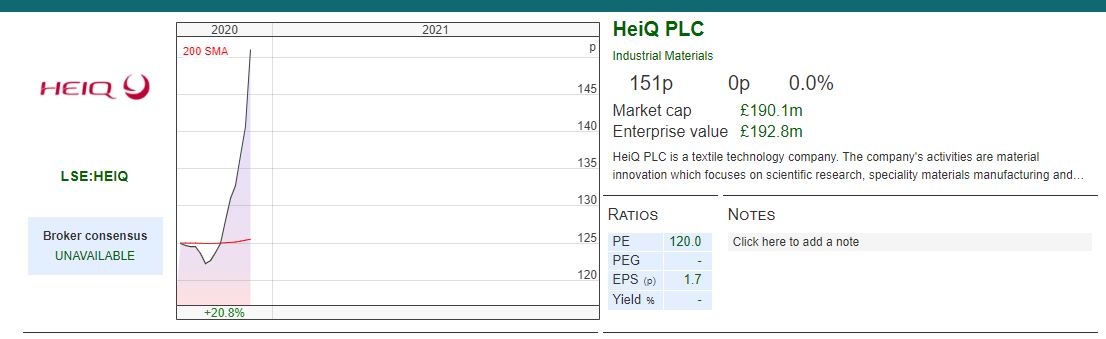

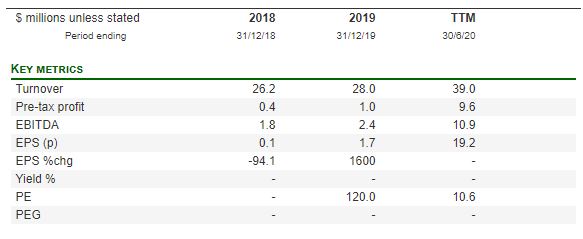

Following a placing at 112p, raising £19m and re-admission to the market Carlo Centonze and a company he controls now owns 11%, Amati Global owns 9%, Miton 5% and Fidelity 4%. The use of the funds are to “strengthen regulatory portfolio” £3m, direct to consumer marketing £4m, geographical expansion £3m, expand sales channels £2m, GrapheneX pilot production project £4.1m and to build a medical business unit £3m. The shares have seen strong interest up since it came to market earlier this month, and now trading at 151p.

There is a 1 hour presentation and Q&A session on https://www.investormeetcompany.com/ The first question asked is: why did management choose to list in London, rather than Zurich, given that’s where the company’s headquarters are? The Chief Executive’s answer was unconvincing, first making a rather weak BREXIT joke, and then claiming that Hong Kong was their first choice (rejected because of too much instability), Nasdaq was their second choice (rejected because of too many links to China), Zurich and London were their next choices. But they chose London because there aren’t many tech companies in Switzerland. I’m not at all convinced by this answer.

A scan of the Admission Document reveals that the Company is not currently eligible for a Premium Listing under Chapter 6 of the LSE’s Listing Rules. Unhelpfully the Admission Document doesn’t specify the rule in Chapter 6 which makes it ineligible. This is a company in lots of exciting themes, sustainability, clean-tech, anti-virus but deliberate obfuscation makes me uncomfortable. I’m avoiding till I understand it better.

Duke Royalty

Earlier in December Duke Royalty, the alternative finance company, reported H1 results to 30 September. They also have a presentation on investormeetcompany. Then just before Christmas they announced that they’d received £15m of cash (after exit fees) from Welltell, a Dublin based telecoms and network specialist. WellTell was the largest investment in their portfolio (most recently valued at £13.2m) and the sale results in an IRR of 27%.

Proceeds from this exit will leave Duke with net cash (versus net debt of £14m at the end of September) and means that they have £30m available for new deployments in 2021. Management say that they have several new and follow-on investment opportunities currently at a late stage of due diligence.

By coincidence the history of Duke Royalty is also a reverse takeover from another Richard Lockwood vehicle Praeton Resources originally set up to invest in mining assets in 2012, which also experienced disappointing performance. Lockie really should have just given up investing in speculative mining stocks and simply bought shares in Unilever.

After the market cap of Praeton fell below £5m in 2015 shareholders voted to amend the investing policy to royalty finance. The company changed its name to Duke Royalty, raised £15m (83% of the enlarged share capital) and was readmitted to AIM with new management in March 2016 beginning trading at 40p, valuing the company at £18m market cap.

Royalty Finance: This form of lending is better known in North America, where the sector is worth around £45bn. It began as an alternative source of finance for mining and energy companies, but later it was used in the pharmaceutical sector during the 1990s before expanding in the mid-2000s into a number of other sectors such as the restaurants. Royalty finance is seen as an alternative to debt, but because payouts are calculated relative to revenue growth, it allows lenders to benefit from some of the upside in sectors where returns are kurtotic (ie asymmetric returns). That said Duke Royalty management avoid riskier sectors like natural resources, biotech and start-ups in general. The company puts up this comparison in their slide deck:

Duke lends money with a term of between 25 and 40 years (or occasionally a perpetual term). In the first year, the borrower pays Duke a monthly distribution (typically equal to 12-15% per annum of the financing amount). From the second year onwards, the monthly distribution Duke receives is linked to the year on year growth in the revenue of the borrowing company, but collared at 6% per year of the total increase or decrease in revenue over the prior year. That is when things are going well the distribution is adjusted up in line with revenue growth (but capped at 6% maximum), but in bad years when revenue falls, the cash Duke receives is adjusted down (but can’t be reduced by more than 6%). See an illustrative example from Admission Document, including a year (Year 4) when revenue falls.

The company has 258m shares in issue up from 45m when it became Duke Royalty in 2017. So the business is paying a dividend out to shareholders with one hand, but with the other hand management has come back to investors four times to ask for more money to finance opportunities. Management are very clear that this is the strategy, there is no deception. But investors should be aware that the company is not a typical “yield stock” paying out excess capital, it requires capital raisings to fund growth.

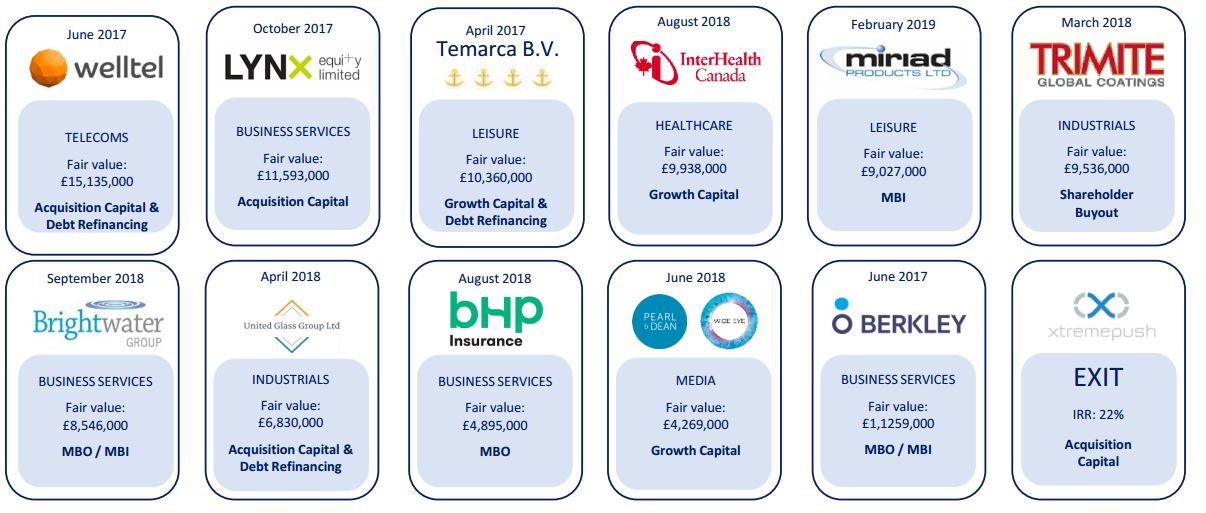

The company puts up a slide of the companies that they lend to:

The Chief Executive earns a basic salary of £200K, and total compensation of £590K in FY to 31 March 2020. There is an LTIP which vests after 3 years, half of which is based on Total Shareholder Return (TSR) and half is based on Total Cash Available for Distribution (TCAD). This seems fair enough, in October 2019, management were granted awards with a fair value of £871K. Aside from the LTIP there is also a share option scheme, which seems unnecessary (unless you are management benefiting from it).

Results: Duke announced H1 results on 9th December, of the 12 companies they’ve lent money to, they have forbearance agreements with 5. In 3 of those 5 distressed situations Duke elected to convert to equity, only 1 of the company’s is still in forbearance, though it’s unclear if further Covid lockdowns will mean this number rises.

On the positive side in their results they announced their first successful exit (XtremePush) a Dublin based B2B platform with an IRR of 22% and resumed their quarterly dividend which had been suspended in June. Duke will pay 0.5p per share in Q3 FY 21 (that is Oct-Dec this calendar year). Outlook statement says that they’re currently looking at 14 opportunities with potential investment of £65m. Management are keen to emphasize their operational gearing, mean that as the business grows costs should remain relatively flat.

The shares are down 40% this year, and at 30p are trading below their listing price. But current forecasts are implying that this may be a good way to play the recovery. It looks like lockdowns restrictions will do more damage over the next few months while we wait for the vaccine to control the spread of the disease, so timing is important.

Merry Christmas and a prosperous New Year.

Bruce Packard

Notes

*Everest 1953: The Epic Story of the First Ascent by Mick Conefrey

** Naturally many first mountaineering first ascents have been made by amateurs. But there are examples from mathematics and science: from Rev Thomas Bayes and Rene Descartes through to relativity being worked out in the Swiss patent office. When Albert Einstein became a professional academic, his productivity dwindled. The gentleman amateur has had a long innings in philosophy all the way back to Thales of Miletus. See A History of Western Philosophy by Bertrand Russell

***Some investors like Buffett, Munger, Nick Train and Terry Smith have eventually figured it out. Who was first to figure it out is a close run thing between Buffett who bought See’s Candy for 3x book (something he’d never done before) in January 1972 and my mother whose largest holding has been Unilever since the early 1970s (she has the share certificates, but can’t find the contract note with the exact date).

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 29/12/20 – Amateurs

The FTSE 100 closed around 6,487 to 24 December down -15% from the start of the year. From a peak of 7670 in mid-January the index fell by -35% to a low of 4998 at the end of March before recovering +30%. A reminder of the importance of pound cost averaging, because a -30% drop, followed by a +30% rise doesn’t get you back to the figure you started with.

The best performing FTSE 100 companies this year were Scottish Mortgage Investment Trust +104%, which now has a market cap of £17.1bn, followed by Fresnillo +78%, Ocado +75%, Pershing Square +65%, and Flutter +65%. The outperformance of technology companies is unsurprising, but unlike the late 1990s natural resources stocks and industrial commodities like copper have also done well.

The worst performing companies were IAG (the old British Airways) -61%, Rolls Royce -51%, BP -44%, Shell -42%, Lloyds -41%. Airlines, oil companies and banks are obviously harmed by the economic damaged caused by lockdowns, how permanent the damage remains to be seen.

US markets fared better this year with the S&P up +15% and the Nasdaq composite up +42% (best performers: Tesla, Moderna, Zoom all of which have questionable profitability).

Interviews: Closer to home there are some interviews on piworld.co.uk with people talking about their performance this year, so I do the same below. It’s interesting that the “professionals” like Stephen English and Richard Leonard who manage other people’s money have underperformed the “amateurs” who manager their own money, like Leon Boros for example. I think that this is a great argument for using SharePad to education yourself, and do your own research and investing.

I am listen to an account of the Everest 1953 *expedition on audiobook. All of the climbers had to be “amateurs” with occupations like doctor, statistician, British Army officer or university student; anyone earning a living as a professional mountain guide was not selected. This seems in opposition to modern values, “amateur” is often meant as an insult. Yet I think perhaps we have lost something to be admired in the “amateurs”, who have achieved much over the centuries.**

Earlier this year the ONS published its Ownership of UK quoted shares data report, showing that back in 1963, the man in the street owned 54% of all the shares in issue on the London stock market. Since then the stock market has become dominated by institutional investors, and the amateurs’ direct holdings have declined to a low of 10% in 2012. But since 2012 the trend has begun to recover, and individuals now constitute 13.5% helped by tools like SharePad. I very much enjoyed the musings of this anonymous professional fund manager, explaining the advantages that amateurs enjoy relative to professionals. Amateurs who know what they’re doing outperform the professionals on a regular basis.

My portfolio performance: This year I sold nothing, and I bought shares in only 3 companies, 2 of which I already own (Ocean Wilsons, ULS Technology) and one I didn’t (Arcontech). This activity was less than 2.5% of my portfolio.

13/23 of the stocks I own finished down this year. Worst performers were Vianet (-58% this year) Georgia Capital (-45%) Hostelworld (-42%) MS International (-35%) and Quarto (-32%) though these 5 stocks are less than 5% of my total portfolio (ex Georgia Capital less than 2%). If I’d re-balanced my portfolio at the start of the year so that each company was 1/23 of my portfolio, then I would have been up 5%. But because I didn’t rebalance and I’ve owned companies like Sylvania Platinum(+109% this year), Games Workshop(+81%), Impax AM(+74%) and SDI Group(+44%) for years, the power of compounding means that my top 4 holdings have grown to become roughly two thirds of my entire portfolio. So I ended the year up 29% to 24 Dec 2020.

Looking forward many commentators are anticipating inflation. No one seems to think that interest rates will also rise though. A reflationary environment may be more helpful to banks which have had 20 terrible years of underperformance. Perhaps though it could be better to buy either i) oil and other commodities or ii) brands with pricing power like Unilever and Reckitt & Benckiser? The latter are both trading on less than 20x earnings, which surprised me. I came across a presentation by Ash Park / Kingsway Capital saying that since 1977 a portfolio of global consumer staples had never lost money in any 5 year period. Past performance should not be extrapolated into the future uncritically, but investors probably do make consistent mistakes. For example overvaluing speculative mining stocks, and systematically underestimating the power of compounding in companies like Unilever.**

As the week around Christmas has been quiet I spent time listening to company presentations on Investor Meets Company. Below I cover HeiQ which came to the market earlier in December and have a clever process to make fabrics anti-viral. Then Duke Royalty which is a lender that looks well set to benefit if there is an economic recovery next year.

HeiQ

This is an innovative textile firm that is reversing into a cash shell: Auctus Growth. Previously Auctus was a Richard Lockwood vehicle, a fund manager who specialised in natural resources stocks. He had good performance prior to the financial crisis, and timed his market exit, selling to hedge fund CQS in 2007 right at the top of the “super-cycle”. But since then he has invested in commodity stocks anticipating inflation which hasn’t worked out over the last 10 years. When I last met him in 2015 I suggested that Unilever shares were a lower risk hedge against inflation. Afterwards the only feedback I heard was that he thought my haircut was untidy. That was probably good advice, professional fund managers make an awful lot of money by appearing smart, but in fact being lucky.

Earlier this month HeiQ then reversed into Auctus Growth. HeiQ was founded in 2005 (the idea came to the founder on a hike) and is headquartered in Zurich, with manufacturing facilities in Switzerland, USA and Australia. They also have 5 wholly owned subsidiaries and a further subsidiary is planned for China, though oddly they don’t appear to do any manufacturing there, presumably China would be a cheaper location than Switzerland.

The company has clever chemistry which allows them to treat fabrics to make them breathable and filter out particles. HeiQ’s technology is used by over 300 of the world’s functional lifestyle brands across the clothes (including underwear), medical and home textile markets. The textiles can have a cooling, warming, breathable, masks odours, repel oil and insects, antiviral, antibacterial and antifungal effect.

They also make HeiQ Viroblock, which is added to fabric during the final stage of the textile manufacturing process and is enjoying rapid product revenue growth in the global fight against Covid-19.

Following a placing at 112p, raising £19m and re-admission to the market Carlo Centonze and a company he controls now owns 11%, Amati Global owns 9%, Miton 5% and Fidelity 4%. The use of the funds are to “strengthen regulatory portfolio” £3m, direct to consumer marketing £4m, geographical expansion £3m, expand sales channels £2m, GrapheneX pilot production project £4.1m and to build a medical business unit £3m. The shares have seen strong interest up since it came to market earlier this month, and now trading at 151p.

There is a 1 hour presentation and Q&A session on https://www.investormeetcompany.com/ The first question asked is: why did management choose to list in London, rather than Zurich, given that’s where the company’s headquarters are? The Chief Executive’s answer was unconvincing, first making a rather weak BREXIT joke, and then claiming that Hong Kong was their first choice (rejected because of too much instability), Nasdaq was their second choice (rejected because of too many links to China), Zurich and London were their next choices. But they chose London because there aren’t many tech companies in Switzerland. I’m not at all convinced by this answer.

A scan of the Admission Document reveals that the Company is not currently eligible for a Premium Listing under Chapter 6 of the LSE’s Listing Rules. Unhelpfully the Admission Document doesn’t specify the rule in Chapter 6 which makes it ineligible. This is a company in lots of exciting themes, sustainability, clean-tech, anti-virus but deliberate obfuscation makes me uncomfortable. I’m avoiding till I understand it better.

Duke Royalty

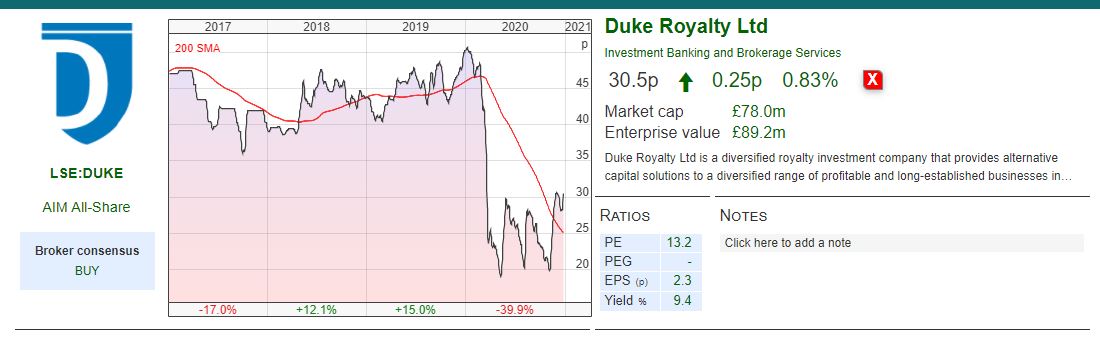

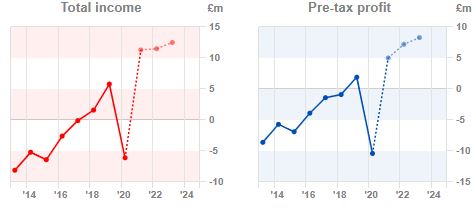

Earlier in December Duke Royalty, the alternative finance company, reported H1 results to 30 September. They also have a presentation on investormeetcompany. Then just before Christmas they announced that they’d received £15m of cash (after exit fees) from Welltell, a Dublin based telecoms and network specialist. WellTell was the largest investment in their portfolio (most recently valued at £13.2m) and the sale results in an IRR of 27%.

Proceeds from this exit will leave Duke with net cash (versus net debt of £14m at the end of September) and means that they have £30m available for new deployments in 2021. Management say that they have several new and follow-on investment opportunities currently at a late stage of due diligence.

By coincidence the history of Duke Royalty is also a reverse takeover from another Richard Lockwood vehicle Praeton Resources originally set up to invest in mining assets in 2012, which also experienced disappointing performance. Lockie really should have just given up investing in speculative mining stocks and simply bought shares in Unilever.

After the market cap of Praeton fell below £5m in 2015 shareholders voted to amend the investing policy to royalty finance. The company changed its name to Duke Royalty, raised £15m (83% of the enlarged share capital) and was readmitted to AIM with new management in March 2016 beginning trading at 40p, valuing the company at £18m market cap.

Royalty Finance: This form of lending is better known in North America, where the sector is worth around £45bn. It began as an alternative source of finance for mining and energy companies, but later it was used in the pharmaceutical sector during the 1990s before expanding in the mid-2000s into a number of other sectors such as the restaurants. Royalty finance is seen as an alternative to debt, but because payouts are calculated relative to revenue growth, it allows lenders to benefit from some of the upside in sectors where returns are kurtotic (ie asymmetric returns). That said Duke Royalty management avoid riskier sectors like natural resources, biotech and start-ups in general. The company puts up this comparison in their slide deck:

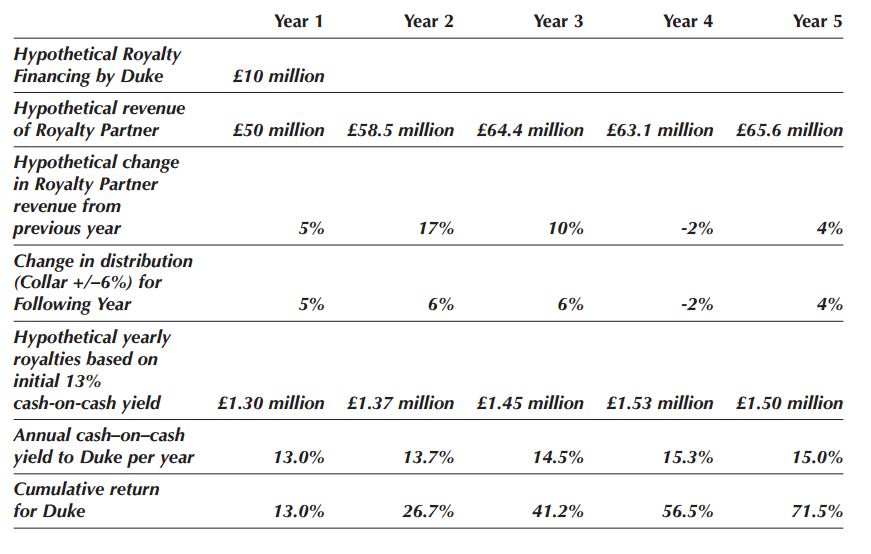

Duke lends money with a term of between 25 and 40 years (or occasionally a perpetual term). In the first year, the borrower pays Duke a monthly distribution (typically equal to 12-15% per annum of the financing amount). From the second year onwards, the monthly distribution Duke receives is linked to the year on year growth in the revenue of the borrowing company, but collared at 6% per year of the total increase or decrease in revenue over the prior year. That is when things are going well the distribution is adjusted up in line with revenue growth (but capped at 6% maximum), but in bad years when revenue falls, the cash Duke receives is adjusted down (but can’t be reduced by more than 6%). See an illustrative example from Admission Document, including a year (Year 4) when revenue falls.

The company has 258m shares in issue up from 45m when it became Duke Royalty in 2017. So the business is paying a dividend out to shareholders with one hand, but with the other hand management has come back to investors four times to ask for more money to finance opportunities. Management are very clear that this is the strategy, there is no deception. But investors should be aware that the company is not a typical “yield stock” paying out excess capital, it requires capital raisings to fund growth.

The company puts up a slide of the companies that they lend to:

The Chief Executive earns a basic salary of £200K, and total compensation of £590K in FY to 31 March 2020. There is an LTIP which vests after 3 years, half of which is based on Total Shareholder Return (TSR) and half is based on Total Cash Available for Distribution (TCAD). This seems fair enough, in October 2019, management were granted awards with a fair value of £871K. Aside from the LTIP there is also a share option scheme, which seems unnecessary (unless you are management benefiting from it).

Results: Duke announced H1 results on 9th December, of the 12 companies they’ve lent money to, they have forbearance agreements with 5. In 3 of those 5 distressed situations Duke elected to convert to equity, only 1 of the company’s is still in forbearance, though it’s unclear if further Covid lockdowns will mean this number rises.

On the positive side in their results they announced their first successful exit (XtremePush) a Dublin based B2B platform with an IRR of 22% and resumed their quarterly dividend which had been suspended in June. Duke will pay 0.5p per share in Q3 FY 21 (that is Oct-Dec this calendar year). Outlook statement says that they’re currently looking at 14 opportunities with potential investment of £65m. Management are keen to emphasize their operational gearing, mean that as the business grows costs should remain relatively flat.

The shares are down 40% this year, and at 30p are trading below their listing price. But current forecasts are implying that this may be a good way to play the recovery. It looks like lockdowns restrictions will do more damage over the next few months while we wait for the vaccine to control the spread of the disease, so timing is important.

Merry Christmas and a prosperous New Year.

Bruce Packard

Notes

*Everest 1953: The Epic Story of the First Ascent by Mick Conefrey

** Naturally many first mountaineering first ascents have been made by amateurs. But there are examples from mathematics and science: from Rev Thomas Bayes and Rene Descartes through to relativity being worked out in the Swiss patent office. When Albert Einstein became a professional academic, his productivity dwindled. The gentleman amateur has had a long innings in philosophy all the way back to Thales of Miletus. See A History of Western Philosophy by Bertrand Russell

***Some investors like Buffett, Munger, Nick Train and Terry Smith have eventually figured it out. Who was first to figure it out is a close run thing between Buffett who bought See’s Candy for 3x book (something he’d never done before) in January 1972 and my mother whose largest holding has been Unilever since the early 1970s (she has the share certificates, but can’t find the contract note with the exact date).

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.