“Until the day when God shall deign to reveal the future to man, all human wisdom is summed up in these two words… wait and hope.” – The Count of Monte Cristo

The FTSE 100 finished the year at 6460, down 14% from 7585 this time last year. There were some odd movements in share prices on AIM in the last 10 trading days of the year, with Powerhouse Energy, EQTEC, AFC Energy and Ilika all more than doubling.

So much for Efficient Markets!

No forecasts

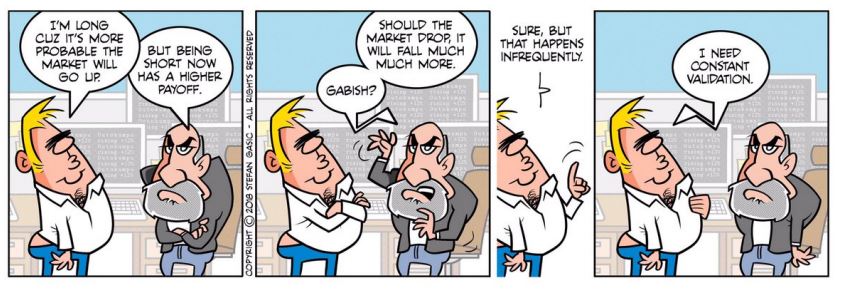

This time of year it is traditional for pundits to make forecasts about the year ahead. I’m currently reading NN Taleb’s latest book, where he argues (belligerently) that focusing on asymmetric payoffs is far more important than forecasting events.* Much of the maths contradicts what I had to memorise in order to pass the CFA exams. At the time I was troubled by the assumptions about applying Gaussian distributions to financial data, however the refrain from our tutor was “Do you want to pass the exam or not?” I did. But I felt that the CFA was more like memorising a doctrinal catechism than true education.

Instead basic numeracy and thinking for yourself are better skills for investors. For instance, the UK vaccinated 137,897 people in the first week of the rollout**, which sounds a large number. But simple arithmetic reveals at that rate it will take 3.5 years to vaccinate the 25m inhabitants of the UK the Government plans to offer a vaccine to. Wait and Hope.

Taleb has updated ideas from philosophers like Hume, Popper and Russell and applied them to financial markets. But it occurred to me that the same themes had also been explored in great literature. I emailed Taleb to suggest that Edmond Dantes, is an anti-fragile character and The Count of Monte Cristo portrays ideas which Taleb expounds with mathematical functions, notwithstanding the occasional cartoon.

Source: The Consequence of Fat Tails, Nassim N Taleb. Credit Stefan Gasic.

He agreed and replied that he would re-read the book.

2020 will be remembered for the ‘Black Swan’ pandemic, an infrequent event with serious consequences. Yet Black Swans come in two forms

- harmful (e.g. unexpected pandemic)

- beneficial (unexpected gains).

We should protect ourselves from the first type, what Taleb calls the Turkey Problem: many positive validations, followed by one big blow up. The flipside is to try to benefit from the occasional Inverse Turkey: years of disappointment, followed by an unexpected blockbuster hit. Edmond Dantes, falsely imprisoned for years in the Chateau d’If before discovering the treasure on Monte Cristo, embodies that thought.

This week, I look at two ‘wait and hope’ stocks: Ilika and DDDD which are up 105% and 37% in the last 10 trading days. I do NOT expect them to do well in 2021. I’ve written about them because I find their story engaging.

I wish readers a prosperous New Year and hope 2021 delivers a few “inverse turkeys”.

Ilika

This solid state battery technology company put out a statement on the 29th Dec saying that they were aware of the sudden share price spike to 270p (up from below £1 on 21st December) but nothing had changed that they were aware of. The company has two main products i) Stereax miniature solid state batteries ii) Goliath solid state batteries for use in Electric Vehicles (EVs).

This solid state battery technology company put out a statement on the 29th Dec saying that they were aware of the sudden share price spike to 270p (up from below £1 on 21st December) but nothing had changed that they were aware of. The company has two main products i) Stereax miniature solid state batteries ii) Goliath solid state batteries for use in Electric Vehicles (EVs).

In the RNS on 29th Dec the company reiterated guidance set out in the announcements dated 11 and 24 November 2020. The statement said the current year was “broadly inline” with revenue of £1.3m for H1 to 31 October (v H1 2019 £1.5m) hindered by a 3-month shutdown of their manufacturing facilities between March and June 2020. The company expects to report a loss in H1 of £1.0m (H1 2019 also a £1.0m loss). Following a capital raising of £20m in April 2020, Ilika has £12.4m of cash at the 31 October.

The FY 2022 (that is, year ending April 2022) expectations were not changed in the RNS.

In November the company said that they would do their own manufacturing for Stereax miniature batteries in the UK, rather than a licensing model similar to Arm Holdings, the former FTSE 100 listed semi conductor company bought by Softbank in 2016 for £24bn. This was a change of tack, as previously they had suggested that they preferred the “capital light” licensing approach, and had good insight into implementing it because Monika Biddulp, ex IP Products Group at Arm is a non Exec on Ilika’s board. However, because of the problems with international travel it made more sense from a risk management and speed to market perspective to keep manufacturing in-house than outsource to an overseas manufacturer. The decision will also mean that the company should generate a better operating margin as volume increases. The negative is that they’ll likely require more capital than a 3rd party licensing agreement would have done. I wonder if we will see similar decisions by larger companies who have now become acutely aware of their supply chain vulnerabilities after the Covid 19.

The company expects to be profitable in FY 2023 (that is, year ending April 2023) and see a 70x increase in Stereax production capacity. Reported FY 2020A revenue from Stereax was £367K, so a 70x increase would imply revenue of £28m in FY 2023. However, when asked about this in a Share Soc investor presentation Graeme Purdy, the Chief Exec said that around half of the benefit from economies of scale would be passed on to the end customer. Thus revenues of circa £15m and gross margin of 40% is a more realistic estimate from the 70x increase mentioned on page 12 of the company’s most recent placing document. That leaves the company trading on 19x forecast revenue. Pricey.

The company’s second product is Goliath, a larger battery that can be used in EVs and is at an earlier stage of development than Stereax. As solid state batteries can run at higher temperatures (up to 150 degrees Celsius v 60 degrees Celsius for standard Lithium Ion batteries) and there is no risk of them exploding, it means that EVs don’t need a cooling system with a heat exchanger, unlike the Tesla / Panasonic 2170 battery cells. The Goliath batteries should also charge 6x faster meaning EVs could charge in 10 minutes vs an hour, according to management.

The company has £5.1m of UK Government funding for the “Faraday Battery Challenge”. It plans to open a pre-pilot facility within 9 months. Scale up will take a couple of years, and manufacturing is likely to require JVs with automotive partners. McLaren, the Formula 1 racing team, Jaguar Landrover and Honda are mentioned as current partners. The placing document from April this year suggests most of the funds raised will go to supporting Stereax, it seems likely to me that Goliath will require more funding. The company points to Quantumscape a $41bn (yes, $41bn!) SPAC that is up 475% in 3 months as a key competitor in the EV battery arena.

History: Ilika was founded in 2004 in order to commercialise materials technology from University of Southampton. Graeme Purdy the Chief Executive has headed the company from the start. It listed on AIM in 2010 raising £4m at 51p, valuing the company at £19m following the placing.

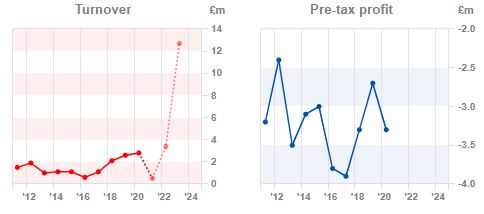

The company has had a good story to tell investors for many years, but as is almost always the case, commercialisation has taken longer than initially planned. SharePad users should be aware that the £2.8m of historic revenue FY to April 2020 includes £2.5m of grant income. Non grant revenue was just £367K. Despite grant income representing a larger percentage of revenue, the company has failed to make a profit in the last 10 years. So, management have had to raise capital from investors and shares outstanding has risen from £37m in 2010 to 137m following the most recent capital raising in April 2020.

Shareholders: As of October 2020 a Private Client Wealth Manager GPIM I’ve never heard of before is the largest shareholder with 10%, Janus Henderson owns 9.6%, Parkwalk Advisors 8.8%, Herald 5.8%, Schroders 5.6% Baillie Gifford 5.2%

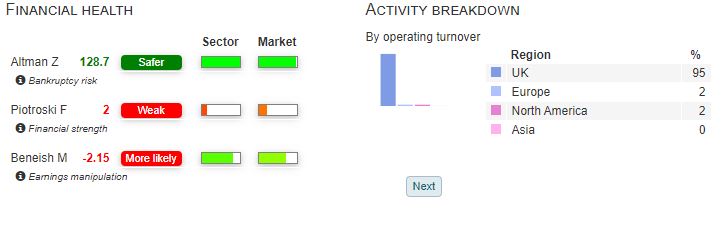

Verdict: This is undoubtedly a “story stock”, currently trading on 19x forecast revenues and 1000x FY 2020A historic revenues. For context I sold Keyword Studios on 8x revenues, thinking that it was expensive. Altman Z score is favourable as the company has £12.4m of cash following the last capital raising, though the Piotroski F score is weak because the company has taken so long to generate significant revenue.

I can understand investors who compare the company to ARM Holdings, so it is conceivable that in 5-10 years the company is worth considerably more than its current valuation.

The company has an April year end, and will report H1 results to 31 October 2020 on 14 January 2021. There will be a presentation by management on investormeetcompany

If you’re a ShareSoc member, see also https://www.sharesoc.org/events/sharesoc-webinar-with-ilika-ika-12-november-2020/

4D Pharma

This Neil Woodford backed company was founded and listed on AIM in February 2014 at 100p, raising £17m and valuing the company at £37m. Management intended to commercialise recent advances in live biotherapeutics, or gut bacteria and their influence on both the immune system and the nervous system.

Gut bacteria are critical to the proper development and function of the human immune system and the importance of the microbiota as a contributing factor in the development of inflammatory and autoimmune diseases is now well recognised, according to the listing document. I came across the company after reading a book on the microbiome*** which the author wrote after catching a tropical disease and being prescribed antibiotics which had all sorts of unpleasant side effects. 4D Pharma’s Live Biotherapeutic products (LBPs) are an orally delivered single strains of bacteria that are naturally found in the healthy human gut.

4D has a product in phase I and II clinical trials (evaluating safety and preliminary efficacy) of MRx0518, which it hopes can be used to treat cancer. It is delivered as an oral capsule and stimulates the body’s immune system, directing it to produce cytokines and immune cells that are known to attack tumours. It is currently being evaluated in clinical trials in cancer patients and has achieved a Disease Control Rate (DCR) of 42%, though the sample was small: 12 patients with kidney cancer.

The company also has a product Blautix for Irritable Bowel Syndrome (IBS) which has completed a successful Phase II trial. Academic research suggests that IBS patients have a different microbiome compared to healthy people. Blautix has shown a statistically significant response rate in Phase II trials (353 patients), when compared to patients receiving a placebo. Interestingly the placebo also produced a positive effect (response rate 40%) but Blautix response rate was higher at 55%.

They are also working with the Michael J Fox Foundation looking at the treatment of Parkinson’s disease. A further avenue is immunomodulatory anti-inflammatory treatment (MRx-4DP0004) to prevent Covid 19 progressing for patients who are already hospitalised with the disease.

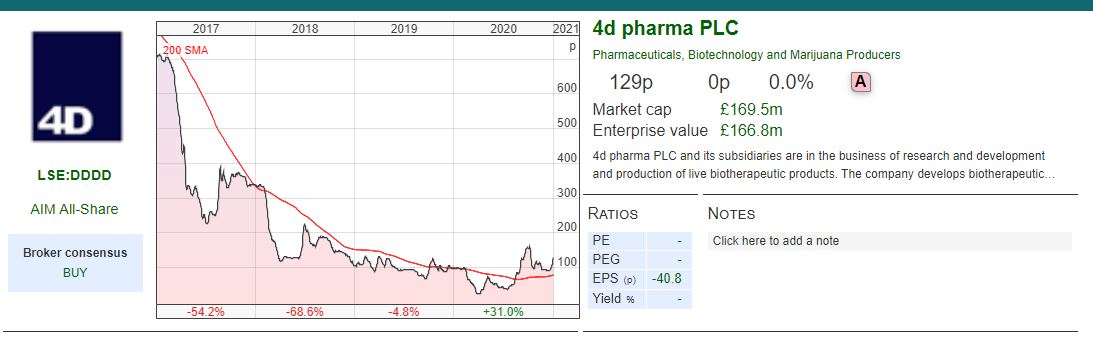

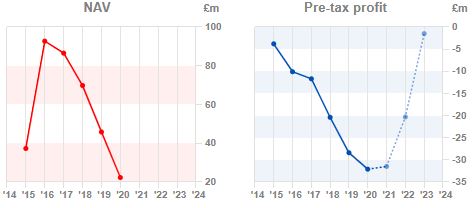

History: A year after listing the shares had 10 bagged to over £10. By the end of 2015 Woodford owned 24% of the ordinary shares and well respected Lansdowne Partners owned 7%. However since then revenue has taken longer than anticipated and cumulative losses of over £100m have dwarfed net assets of £31m at the H1 30th June. Deducting intangible assets from net assets gives tangible book value of just £17m. The shares fell to a low of 25p in April 2020.

Then on 22 October 2020 4D pharma plc announced it would merge with a Nasdaq listed SPAC Longevity Acquisition Corp (LOAC), which also meant that they would be dual listed with ADRs on Nasdaq (ticker LBPS), which could attract more US investor interest. The AIM ticker of DDDD and listing remains unchanged and the shares finish the year at 129p. LOAC had $14.6m of cash reserves, and these funds will be available to the combined group meaning that the company can continue operating until Q3 2021 without having to come back to shareholders and ask for more money. Plus there is another $23m possible from the sale of warrants in the SPAC.

Management The Non Exec Chairman, Axel Glasmacher was head of clinical R&D Haematology Oncology at Celgene, a pharma company acquired by Bristol Myers Squibb for $74bn. The Chief Executive and co-founder is Duncan Peyton and has a background in investing in bioscience (Aquarius Equity) and is qualified as a corporate lawyer. His base salary is £100K a year and he owns 6.4% of the ordinary shares. Other Directors own around 10% and Merck own 5.8% of the shares. Richard Griffiths who I used to work with at Evolution Group owns 3.7%.

Verdict I don’t have the credentials to know how likely the treatments are to succeed. But some of my background reading suggests that the microbiome is a promising area. I intend to follow the company with interest. Most loss making stocks of this type fail to make a return, so I have low expectations. However, if 4D does work, it is likely to generate significant asymmetric gains.

Wait and hope.

Bruce Packard

Notes

The author’s mother owns shares in Ilika.

*The Consequences of Fat Tails NN Taleb

**https://www.bbc.com/news/health-55332242

***10% Human: How Your Body’s Microbes Hold the Key to Health and Happiness A Cohen

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 04/01/21 – Wait and Hope

“Until the day when God shall deign to reveal the future to man, all human wisdom is summed up in these two words… wait and hope.” – The Count of Monte Cristo

The FTSE 100 finished the year at 6460, down 14% from 7585 this time last year. There were some odd movements in share prices on AIM in the last 10 trading days of the year, with Powerhouse Energy, EQTEC, AFC Energy and Ilika all more than doubling.

So much for Efficient Markets!

No forecasts

This time of year it is traditional for pundits to make forecasts about the year ahead. I’m currently reading NN Taleb’s latest book, where he argues (belligerently) that focusing on asymmetric payoffs is far more important than forecasting events.* Much of the maths contradicts what I had to memorise in order to pass the CFA exams. At the time I was troubled by the assumptions about applying Gaussian distributions to financial data, however the refrain from our tutor was “Do you want to pass the exam or not?” I did. But I felt that the CFA was more like memorising a doctrinal catechism than true education.

Instead basic numeracy and thinking for yourself are better skills for investors. For instance, the UK vaccinated 137,897 people in the first week of the rollout**, which sounds a large number. But simple arithmetic reveals at that rate it will take 3.5 years to vaccinate the 25m inhabitants of the UK the Government plans to offer a vaccine to. Wait and Hope.

Taleb has updated ideas from philosophers like Hume, Popper and Russell and applied them to financial markets. But it occurred to me that the same themes had also been explored in great literature. I emailed Taleb to suggest that Edmond Dantes, is an anti-fragile character and The Count of Monte Cristo portrays ideas which Taleb expounds with mathematical functions, notwithstanding the occasional cartoon.

Source: The Consequence of Fat Tails, Nassim N Taleb. Credit Stefan Gasic.

He agreed and replied that he would re-read the book.

2020 will be remembered for the ‘Black Swan’ pandemic, an infrequent event with serious consequences. Yet Black Swans come in two forms

We should protect ourselves from the first type, what Taleb calls the Turkey Problem: many positive validations, followed by one big blow up. The flipside is to try to benefit from the occasional Inverse Turkey: years of disappointment, followed by an unexpected blockbuster hit. Edmond Dantes, falsely imprisoned for years in the Chateau d’If before discovering the treasure on Monte Cristo, embodies that thought.

This week, I look at two ‘wait and hope’ stocks: Ilika and DDDD which are up 105% and 37% in the last 10 trading days. I do NOT expect them to do well in 2021. I’ve written about them because I find their story engaging.

I wish readers a prosperous New Year and hope 2021 delivers a few “inverse turkeys”.

Ilika

In the RNS on 29th Dec the company reiterated guidance set out in the announcements dated 11 and 24 November 2020. The statement said the current year was “broadly inline” with revenue of £1.3m for H1 to 31 October (v H1 2019 £1.5m) hindered by a 3-month shutdown of their manufacturing facilities between March and June 2020. The company expects to report a loss in H1 of £1.0m (H1 2019 also a £1.0m loss). Following a capital raising of £20m in April 2020, Ilika has £12.4m of cash at the 31 October.

The FY 2022 (that is, year ending April 2022) expectations were not changed in the RNS.

In November the company said that they would do their own manufacturing for Stereax miniature batteries in the UK, rather than a licensing model similar to Arm Holdings, the former FTSE 100 listed semi conductor company bought by Softbank in 2016 for £24bn. This was a change of tack, as previously they had suggested that they preferred the “capital light” licensing approach, and had good insight into implementing it because Monika Biddulp, ex IP Products Group at Arm is a non Exec on Ilika’s board. However, because of the problems with international travel it made more sense from a risk management and speed to market perspective to keep manufacturing in-house than outsource to an overseas manufacturer. The decision will also mean that the company should generate a better operating margin as volume increases. The negative is that they’ll likely require more capital than a 3rd party licensing agreement would have done. I wonder if we will see similar decisions by larger companies who have now become acutely aware of their supply chain vulnerabilities after the Covid 19.

The company expects to be profitable in FY 2023 (that is, year ending April 2023) and see a 70x increase in Stereax production capacity. Reported FY 2020A revenue from Stereax was £367K, so a 70x increase would imply revenue of £28m in FY 2023. However, when asked about this in a Share Soc investor presentation Graeme Purdy, the Chief Exec said that around half of the benefit from economies of scale would be passed on to the end customer. Thus revenues of circa £15m and gross margin of 40% is a more realistic estimate from the 70x increase mentioned on page 12 of the company’s most recent placing document. That leaves the company trading on 19x forecast revenue. Pricey.

The company’s second product is Goliath, a larger battery that can be used in EVs and is at an earlier stage of development than Stereax. As solid state batteries can run at higher temperatures (up to 150 degrees Celsius v 60 degrees Celsius for standard Lithium Ion batteries) and there is no risk of them exploding, it means that EVs don’t need a cooling system with a heat exchanger, unlike the Tesla / Panasonic 2170 battery cells. The Goliath batteries should also charge 6x faster meaning EVs could charge in 10 minutes vs an hour, according to management.

The company has £5.1m of UK Government funding for the “Faraday Battery Challenge”. It plans to open a pre-pilot facility within 9 months. Scale up will take a couple of years, and manufacturing is likely to require JVs with automotive partners. McLaren, the Formula 1 racing team, Jaguar Landrover and Honda are mentioned as current partners. The placing document from April this year suggests most of the funds raised will go to supporting Stereax, it seems likely to me that Goliath will require more funding. The company points to Quantumscape a $41bn (yes, $41bn!) SPAC that is up 475% in 3 months as a key competitor in the EV battery arena.

History: Ilika was founded in 2004 in order to commercialise materials technology from University of Southampton. Graeme Purdy the Chief Executive has headed the company from the start. It listed on AIM in 2010 raising £4m at 51p, valuing the company at £19m following the placing.

The company has had a good story to tell investors for many years, but as is almost always the case, commercialisation has taken longer than initially planned. SharePad users should be aware that the £2.8m of historic revenue FY to April 2020 includes £2.5m of grant income. Non grant revenue was just £367K. Despite grant income representing a larger percentage of revenue, the company has failed to make a profit in the last 10 years. So, management have had to raise capital from investors and shares outstanding has risen from £37m in 2010 to 137m following the most recent capital raising in April 2020.

Shareholders: As of October 2020 a Private Client Wealth Manager GPIM I’ve never heard of before is the largest shareholder with 10%, Janus Henderson owns 9.6%, Parkwalk Advisors 8.8%, Herald 5.8%, Schroders 5.6% Baillie Gifford 5.2%

Verdict: This is undoubtedly a “story stock”, currently trading on 19x forecast revenues and 1000x FY 2020A historic revenues. For context I sold Keyword Studios on 8x revenues, thinking that it was expensive. Altman Z score is favourable as the company has £12.4m of cash following the last capital raising, though the Piotroski F score is weak because the company has taken so long to generate significant revenue.

I can understand investors who compare the company to ARM Holdings, so it is conceivable that in 5-10 years the company is worth considerably more than its current valuation.

The company has an April year end, and will report H1 results to 31 October 2020 on 14 January 2021. There will be a presentation by management on investormeetcompany

If you’re a ShareSoc member, see also https://www.sharesoc.org/events/sharesoc-webinar-with-ilika-ika-12-november-2020/

4D Pharma

This Neil Woodford backed company was founded and listed on AIM in February 2014 at 100p, raising £17m and valuing the company at £37m. Management intended to commercialise recent advances in live biotherapeutics, or gut bacteria and their influence on both the immune system and the nervous system.

Gut bacteria are critical to the proper development and function of the human immune system and the importance of the microbiota as a contributing factor in the development of inflammatory and autoimmune diseases is now well recognised, according to the listing document. I came across the company after reading a book on the microbiome*** which the author wrote after catching a tropical disease and being prescribed antibiotics which had all sorts of unpleasant side effects. 4D Pharma’s Live Biotherapeutic products (LBPs) are an orally delivered single strains of bacteria that are naturally found in the healthy human gut.

4D has a product in phase I and II clinical trials (evaluating safety and preliminary efficacy) of MRx0518, which it hopes can be used to treat cancer. It is delivered as an oral capsule and stimulates the body’s immune system, directing it to produce cytokines and immune cells that are known to attack tumours. It is currently being evaluated in clinical trials in cancer patients and has achieved a Disease Control Rate (DCR) of 42%, though the sample was small: 12 patients with kidney cancer.

The company also has a product Blautix for Irritable Bowel Syndrome (IBS) which has completed a successful Phase II trial. Academic research suggests that IBS patients have a different microbiome compared to healthy people. Blautix has shown a statistically significant response rate in Phase II trials (353 patients), when compared to patients receiving a placebo. Interestingly the placebo also produced a positive effect (response rate 40%) but Blautix response rate was higher at 55%.

They are also working with the Michael J Fox Foundation looking at the treatment of Parkinson’s disease. A further avenue is immunomodulatory anti-inflammatory treatment (MRx-4DP0004) to prevent Covid 19 progressing for patients who are already hospitalised with the disease.

History: A year after listing the shares had 10 bagged to over £10. By the end of 2015 Woodford owned 24% of the ordinary shares and well respected Lansdowne Partners owned 7%. However since then revenue has taken longer than anticipated and cumulative losses of over £100m have dwarfed net assets of £31m at the H1 30th June. Deducting intangible assets from net assets gives tangible book value of just £17m. The shares fell to a low of 25p in April 2020.

Then on 22 October 2020 4D pharma plc announced it would merge with a Nasdaq listed SPAC Longevity Acquisition Corp (LOAC), which also meant that they would be dual listed with ADRs on Nasdaq (ticker LBPS), which could attract more US investor interest. The AIM ticker of DDDD and listing remains unchanged and the shares finish the year at 129p. LOAC had $14.6m of cash reserves, and these funds will be available to the combined group meaning that the company can continue operating until Q3 2021 without having to come back to shareholders and ask for more money. Plus there is another $23m possible from the sale of warrants in the SPAC.

Management The Non Exec Chairman, Axel Glasmacher was head of clinical R&D Haematology Oncology at Celgene, a pharma company acquired by Bristol Myers Squibb for $74bn. The Chief Executive and co-founder is Duncan Peyton and has a background in investing in bioscience (Aquarius Equity) and is qualified as a corporate lawyer. His base salary is £100K a year and he owns 6.4% of the ordinary shares. Other Directors own around 10% and Merck own 5.8% of the shares. Richard Griffiths who I used to work with at Evolution Group owns 3.7%.

Verdict I don’t have the credentials to know how likely the treatments are to succeed. But some of my background reading suggests that the microbiome is a promising area. I intend to follow the company with interest. Most loss making stocks of this type fail to make a return, so I have low expectations. However, if 4D does work, it is likely to generate significant asymmetric gains.

Wait and hope.

Bruce Packard

Notes

The author’s mother owns shares in Ilika.

*The Consequences of Fat Tails NN Taleb

**https://www.bbc.com/news/health-55332242

***10% Human: How Your Body’s Microbes Hold the Key to Health and Happiness A Cohen

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.