Bruce suggests that government debt to GDP ratios should include unfunded pension liabilities, and some of the issues from the Eurozone crisis a decade ago remain unresolved. Companies covered JDG, GAW and BOKU.

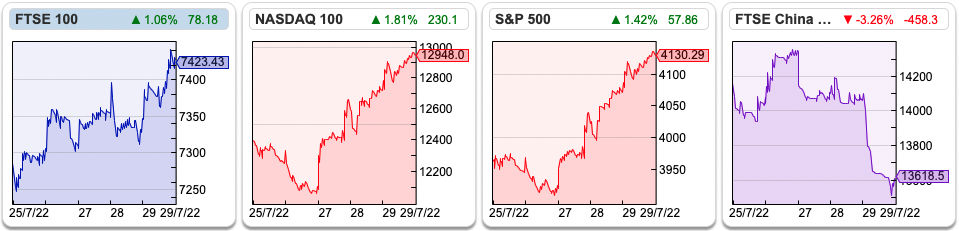

The FTSE 100 finished the week at 7,423 up +2.0%. The Nasdaq 100 was up +4.5% and the S&P500 +4.3% with July being their best month since 2020. The spread between the German and Italian 10-year bond widened to 2.3%.

Last week also marked the 10-year anniversary since Mario Draghi made his “whatever it takes” comment, that held the Eurozone together. Fast forward 10 years and the Prime Minister of Italy has resigned, the same Mario Draghi. Investors are again questioning what Eurozone imbalances mean for financial markets. The ECB has introduced Transmission Protection Instruments, intending to prevent bond yields in the more indebted Mediterranean economies rising to unsustainable levels. The aim is to avoid disorderly markets, but I have commented before that Central Banks have a habit of planting the seeds of future crises with their resolution of previous ones.

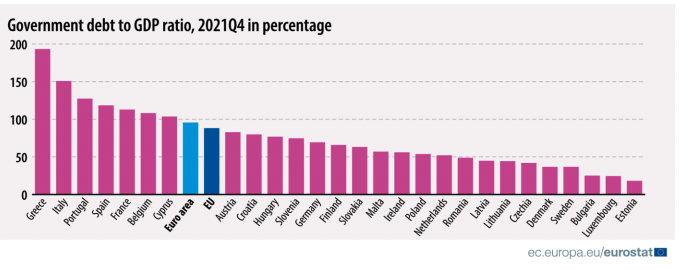

Italian Govt debt /GDP is currently c. 151%, the second highest in the Eurozone after Greece. For context, the UK is 103%, in line with the Euro area average. Worth noting too that the original entry criteria for joining the Eurozone was 60% of GDP maximum level.

As always, the headline comparisons can be misleading. An actuary friend of mine suggests that we should include unfunded pension liabilities in the calculation, which would make all countries look much worse. At the time he published the analysis in 2008, UK public debt was 49% of GDP, but including pension liabilities, it would rise to 270% of GDP. The only similar analysis I have seen for Eurozone countries is this BIS paper, which suggests that assuming a 3% discount rate, Italia’s pension obligations are a further 182% of GDP (or 332% in total). Germany’s unfunded pension liabilities are actually higher: 228% of GDP (or 297% in total).

Arguably all this is known about and well understood by government bond markets. Unfunded government pension obligations have been talked about for decades (I first came across them in Religious Studies A level in the 1990s as an example of a modern ethical issue that the Bible or other religious texts gave no guidance on). The same actuary friend who wrote the Institute of Economic Affairs discussion paper above also introduced me to Findhorn Foundation, an eco-village established in Scotland in the 1960s, which had experienced a financial crisis over how the community coped with ageing. The answer was that there were no easy answers; one key insight though was to recognise the situation as it is, not pretend we are in a world where the problem doesn’t exist. That’s probably relevant to investing too.

This week I look at Judges Scientific and Games Workshop, two long-term quality compounders. Plus Boku, the Direct Carrier Billing company, which is now seeing an opportunity in eWallets.

Judges Scientific H1 June Trading Update

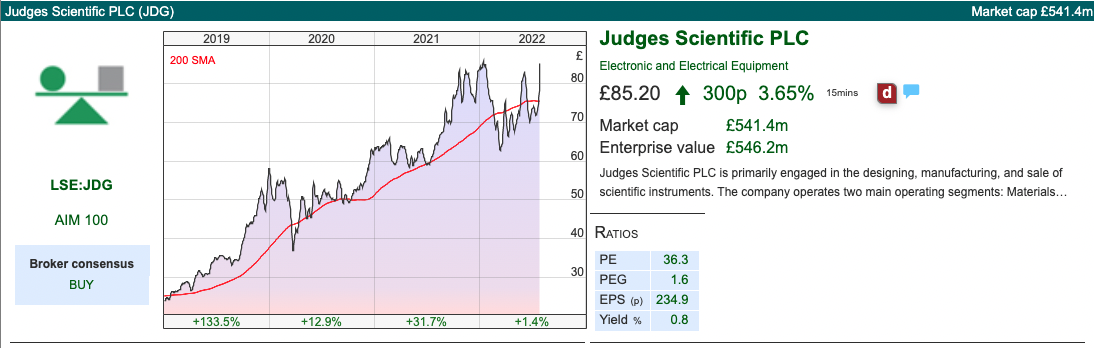

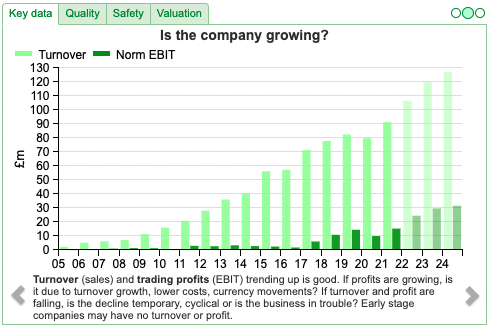

This acquisitive scientific instruments company announced a trading update for the six months to June. They warn of challenging market conditions but currently expect to meet FY Dec 2022F expectations (without saying what those expectations are). The long-term track record of revenue and profit growth is very impressive.

Organic sales in the first half were up +7% y-o-y. They talk about ongoing supply chain issues but now also face recruitment difficulties and problems from colleagues having to isolate. The last point is an interesting one, a friend who is a partner at a law firm was knocked out with covid for 2 weeks a couple of months ago. The thought occurred to me that she probably charges her time at close to £1000 an hour, so even without lockdowns employees could be less productive and the pandemic is likely still having disruptive effects on businesses.

JDG don’t give any PBT guidance or a period-end cash figure. Net cash ex IFRS 16 lease liabilities was £1.4m at the end of December. Since then they’ve bought Geotek in May, which makes high-resolution geological instruments, for £80m total consideration, funded with a new £100m facility from the banks. Based on last year’s numbers, the multiple they’ve paid is well above JDG 6x EBIT multiple that they specify in their Annual Report as an acquisition criteria because last year revenue was £7.3m and EBIT £1.5m. That was severely impacted by the pandemic though. The business has a 3-year average EBIT of £6.3m, so does fit the criteria when also adjusted for £12m of cash Geotek holds and deducting the £35m earnout from £80m total consideration. The £35m earn-out is payable if EBIT is above £6.4m and capped at £11.4m. So, assuming the maximum earn-out is achieved and they end up paying £80m, they would have paid less than 6x EBIT too. Reading the background on Geotek’s divisions, it sounds like many of their geological core measuring instruments are used in the oil & gas and mining industries, which have not seen much investment over the last few years but could be a growth area in future.

Worth noting too, that the deal was introduced by one of the non-Execs, and he has earned 1% of the enterprise value as commission. The fee is payable in proportion to the total consideration, so £450K now and up to £350K if the earn-out is achieved in 2023. He’s taking half of the fee in shares. JDG has reported this as a related party transaction, but it seems very sensible to have well non Execs to introduce deals, rather than pay a corporate finance advisor who would charge a higher fee.

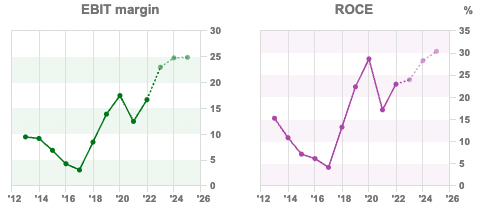

Valuation: 3-year avg RoCE is 23% and 3-year EBIT margin is 17%. The shares are trading on PER 26x FY Dec 2023F and 25x PER Dec 2024F.

Opinion: Like SDI which I wrote about last week, JDG has an impressive track record of ‘buying and build’, it has been a ‘ten bagger’ over the last decade. I don’t own it and feel like I have missed out. David Cicurel, the Chief Executive who owns 11%, is now 73 years old so there is some question of how long he wants to keep going and what the company’s succession planning is. The bear case is that eventually, JDG will blunder into a large deal, buying the scientific instrument maker equivalent of ABN Amro. I think that’s unlikely though.

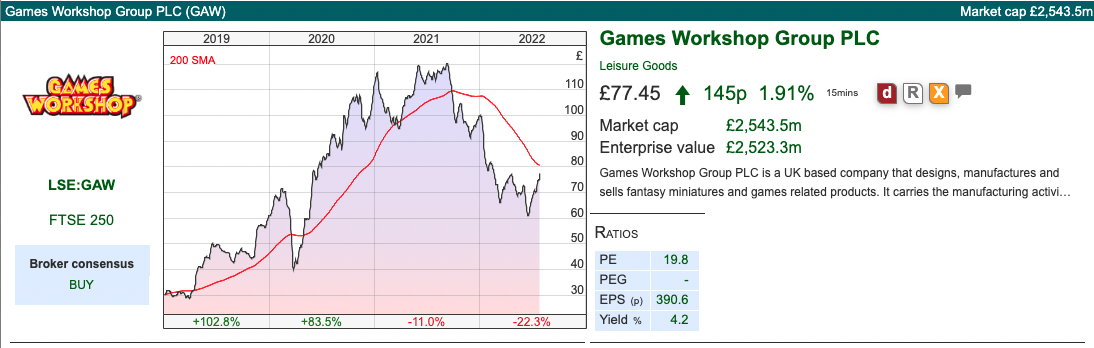

Games Workshop FY May Results

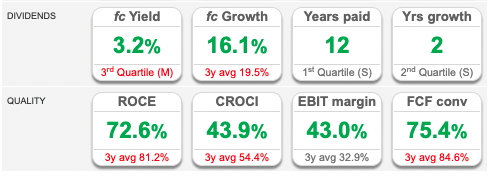

This fantasy miniatures company, that makes Warhammer and similar games announced revenue +13% on a constant currency basis. On a statutory basis revenue was £415m and PBT +3% to £157m. That’s 8% ahead of expectations on the revenue line but held back by rising costs. Those included £9.2m additional freight costs, £3.4m costs into Europe (mainly Brexit) and £2.5m additional staff cost. The largest item though was a £10.6m charge to inventory provisions. Together they caused 5.6% decline in the ‘core’ gross margin, the business ex royalty income payments. They’ve raised prices by c. 5%, but absorbed some of the cost pressure themselves meaning that core gross margin was 67.1% FY May 2022.

Licensing revenue from royalty income increased by +75% to £28m, split 83% PC and console games, 7% mobile and 10% other. They recognise this income upfront but receive cash over a number of years. Also affecting cashflow was £6m increase in VAT receivables. There’s an £11m VAT receivable with the French tax authorities who charge VAT on entry and then ask Games Workshop to submit a reclaim.

The declared dividend was flat at £77m, or 235p. The company has a policy of returning surplus cash to shareholders, in practice that means almost all of the closing net cash position of £71m is paid out to shareholders. Management prudently likes to hold 3 months’ worth of working capital and half a year’s worth of tax payments.

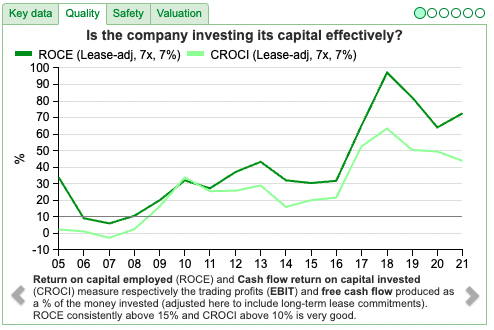

Valuation: RoCE fell from the exceptionally high 185% reported last year to 118%. NB Games Workshop calculate Capital Employed at £111m, which excludes cash of £70m and also licensing receivables, provisions, and hence is a lower number than Sharepad’s (meaning GAW calculated RoCE is higher than Sharepad’s). The shares are trading on a PER 19x FY May 2023F and FY May 2024F. Richard wrote up the company in detail last September.

Opinion: Games Workshop has a history of high profitability, but hard to forecast revenue growth. Revenue was flat between 2010-2016. In the subsequent 6 years to these results revenue is up 3.5x and PBT up 9x. It’s entirely possible we have a couple of years of lacklustre revenues and profits, but I’ve held it for a decade and don’t intend to sell unless it looks like management have lost the plot. Looking at the chart, when it seems that the company is ‘ex-growth’ that can be a good time to buy the shares.

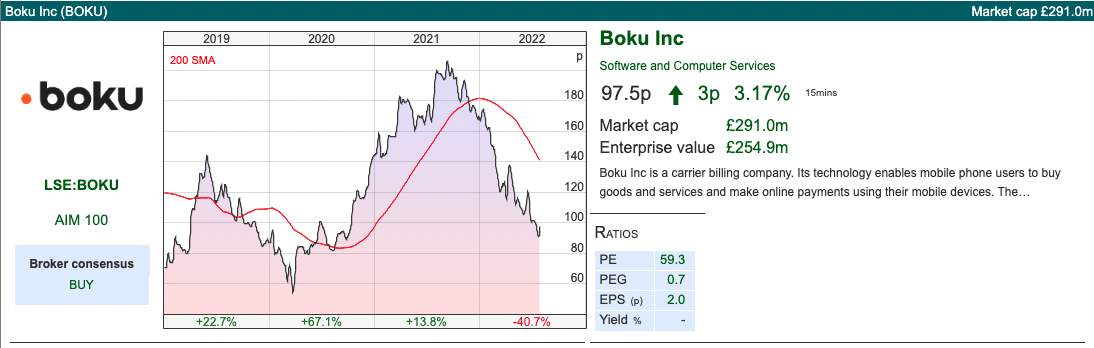

Boku H1 June Trading Update

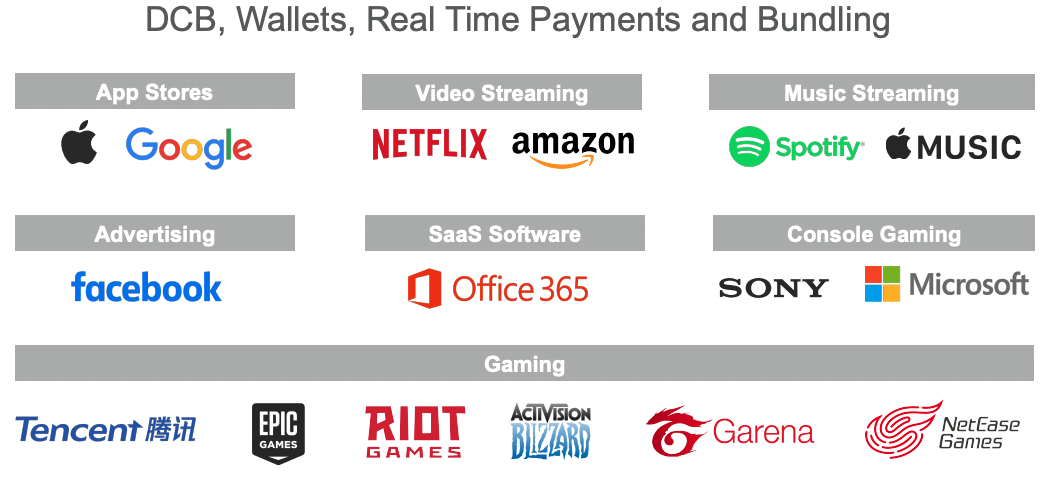

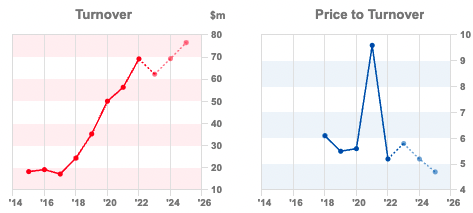

Boku, the Direct Carrier Billing (DCB) software company, that allows users to buy items with their mobile phones and add the charge to their monthly bill, announced a H1 trading update. Revenues for H1 Jun 2022 were $30m, down $0.4m on H1 last year. They are suffering from a strong dollar as a reporting currency, and say on a constant currency basis revenue growth would have been +7% (still down sharply on the +21% organic revenue growth achieved H1 v H1 the previous year). Revenue growth has also lagged the growth in Monthly Active Users (MAU) +22%, without management providing an explanation, though see my discussion on strategy below.

In February this year they sold their digital identity division to Twilio for a maximum consideration of $32m, so strictly speaking revenue was down -12%, unadjusted for the disposal. I’m not saying that this is the correct figure to focus on, but when companies make acquisitions they often highlight the headline growth number, not the organic growth which adjusts out the acquisition. The rest of the commentary excludes the Identity division results.

They’ve recognised a profit on disposal of $24m, and excluding that PBT was $5.5m v $1.9m H1 last year. NB, they’d already written down $21m of goodwill impairment on the Identity business (Danal, acquired 1st Jan 2019) so that profit on disposal is not as impressive as it would first appear. Group cash was $68m, up from $38m June last year. They mention Netflix, Meta, Apple, Amazon, Spotify, Samsung, Sky and EA Games as clients in the RNS, and a few more in their FY presentation slide pack below.

Strategy: I described Boku as a DCB company in the first paragraph because that was its background. The company explains in the Annual Report though that the majority of people who buy online entertainment products are not going to charge the payment through their phone bill. DCB as a payment method has a natural ceiling of about 15%, with the other 85% paid for by other means. Thus they expanded into digital identity, which didn’t really work (but wasn’t a disaster either). They are now targeting eWallets, particularly in non-European and North American regions, where cards are not the online payment method of choice. They’ve invested in their Mobile-First Payment Network (M1ST) and have more than 1.1m MAUs of eWallets and Real-Time Payments increased eight times to over 2.1m in June 2022 compared to the same period in 2021. This side of the business will also require investment though – hence they sold the identity business to Twilio. They are now also competing with large payment processors like Worldpay, Adyen along with specialists like dLocal and Rapyd, so success is not a given.

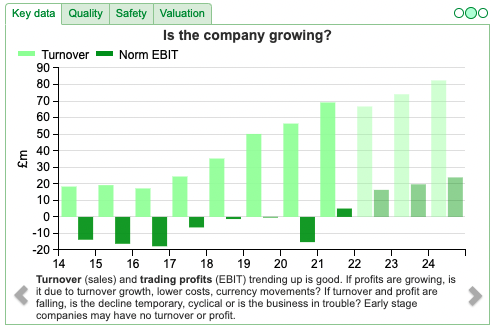

Below is the historic track record, showing losses eventually turning to profits as revenue growth has been achieved.

Valuation: The shares are on a PER 28x FY Dec 2023F, falling to 22x FY Dec 2024F. That looks on the expensive side, but the cash is now 18% of the market cap. The rating does assume forecasts of +11% revenue growth and +22% PBT growth can be achieved, which the +7% constant currency achieved in last week’s RNS casts some doubt on. The shares have traded as high as 10x revenue in the past, but I would not pay anything close to that valuation.

Opinion: The shares are off 53% from their high in H2 last year. Although it has fallen a long way, I can see this continuing to decline in this type of market unless management can deliver +10% revenue growth and operational gearing.

The DCB niche makes sense to me: I can understand why the likes of Netflix or Spotify prefer to deal with one global DCB company than a Hodge podge of payments companies in 100 different countries. However, from here DCB revenue growth is limited. The company has explained why it expanded into eWallets, an exciting but unproven adjacent sector. The fact that they now have $60m of cash suggests that although DCB is profitable, the group may see a few years of losses as it chases the eWallet opportunity. That’s not in their brokers forecasts though.

Notes

The author owns shares in Games Workshop

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.