The FTSE 100 had a volatile week, rallying, selling off then recovering to 7,040 last Friday. The Nasdaq100 was down -4% and S&P500 -3.3% last week. US 10y Govt bond yield continued to trend upwards to 1.55% versus a low of 1.19% at the start of August. The UK 10y bond yield is up even more sharply than the US, from below 60bp at the start of August to 0.99%. That would normally signal “risk on”, with allocations shifting more to junk bonds and value stocks outperforming the quality and tech stocks that have relied on a low discount rate to justify their valuations. Cathy Wood’s ARKK ETF continued to see outflows and is down -14% in the last 3 months. The VIX volatility Index remained above 20 (chart below).

Despite the volatile conditions Oxford Nanopore’s IPO was a success. The IPO was priced at 425p, giving ONT a market cap of £3.4bn IP Group, but the shares were up +42% on the morning. IP Group owned a 14.4% stake last valued £359 at the end of June (implying a pre IPO valuation of £2.5bn for ONT) but sold £150m at the offer price of 425p to Oracle, the US database company. IP Group is up +18% in the last 3 months.

Boots on the ground Last week I met up with a former British Army Officer friend, who has first-hand knowledge about what happened with the Afghanistan evacuation. He told me that in August, when the Taliban were outside Kabul, the journalists who lived in the city were confident that the attacking force were not going to march in and immediately start chopping off Westerners’ heads. They were happy to stay put. But the newspaper bosses in New York, London etc were more cautious and couldn’t live with the risk of being wrong, so they ordered all journalists to leave.

Within 48 hours it was clear that the local view was correct, and the journalists were ordered back in – which was logistically far more difficult because there weren’t any flights, so they had to go in over the land borders and drive through the hinterlands, with a greater degree of risk. The risk aversion was understandable but I questioned the point of having local knowledge, if management in head office were going to ignore the perspective of those closest to the action. Donald Trump has made a name for himself, undermining the credibility of the “Mainstream Media”, but it’s funny that the people running newspapers and TV channels don’t have much confidence in what their own journalists are reporting either.

The story reminded me of the financial crisis, when the people at the top of banks took too long to realise how serious the contagion from subprime lending would be. HSBC warned on profits at the start of 2007, but through most of that year there was a bidding war for ABN Amro, the Dutch investment bank with a suspect balance sheet. Eventually the Royal Bank-led consortium beat Barclays, and the deal completed in September 2007. Even after Northern Rock had failed, the stock market peaked in October 2007. It took more than a year from the first “canary in the coal mine” until the extent of the credit contagion to be understood. Right up until September 2008, Fred Goodwin was claiming with a straight face that Royal Bank was facing a liquidity problem, not a solvency problem.

The people I worked with at the time who had the best perspective on the banking crisis were on the Japan desk. They had seen the banking crisis of the late 1990s involving Long Term Credit Bank, the Hokkaido Takushoku affair, etc. They had no inside information, they weren’t at all close to management of UK or US banks, and I had to teach them the correct banking terminology like tier 1 ratio, risk weighted assets, Available For Sale securities and Level III assets. But their ignorance of the terminology was compensated for by their experience of similar events a decade before and half a world away. Their distance provided better insight than people who had only covered US or UK banks for decades. I read Gillian Tett’s book Saving the Sun to help understand what happened in Japan, and emailed her a talk I’d given on the cultural theory of risk and financial crises. This was 10 years ago, but in her reply she told me that the Chinese authorities had spent considerable time studying the Japanese credit bubble, so that they could avoid the same mistakes. We shall see how that plays out in the coming months I think.

Below I look at Elixirr, a management consultancy that has been a “Covid winner”, growing organic revenues +45% H1 vs H1 last year. I’ll also look at HeiQ’s profit warning, Seeen a Patrick De Souza (Water Intelligence Executive Chairman) venture and the “last forever” Andrews Sykes H1 results.

Elixirr H1 June 2021

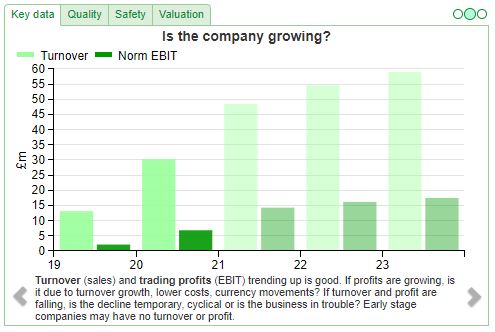

This management consultancy firm, founded in 2009, reported strong H1 to June 2021 results. Organic revenue growth was up +45%, and including acquisitions up +77% to £24m. PBT increased 2.5x to £6.4m. At the end of June they had net cash of £21m. That’s an impressive performance given that Management Consulting Group (the old Proudfoot’s business) delisted last year, their business model relied on flying internationally to be physically present on clients’ sites. Elixirr doesn’t appear to need the same “boots on the ground” physical presence, with organic revenue growth doing so well despite the difficulty travelling in H1 this year.

This management consultancy firm, founded in 2009, reported strong H1 to June 2021 results. Organic revenue growth was up +45%, and including acquisitions up +77% to £24m. PBT increased 2.5x to £6.4m. At the end of June they had net cash of £21m. That’s an impressive performance given that Management Consulting Group (the old Proudfoot’s business) delisted last year, their business model relied on flying internationally to be physically present on clients’ sites. Elixirr doesn’t appear to need the same “boots on the ground” physical presence, with organic revenue growth doing so well despite the difficulty travelling in H1 this year.

History Originally called, Elix-IRR, the company was founded by 4 ex-Accenture management consultants: Stephen Newton, current Chief Exec, Graham Busby current CFO, Andy Curtis, Mark Goodyear and one lawyer Ian Ferguson, current General Counsel. The Non Exec Chairman is Gavin Patterson, ex Chief Exec of BT, who left under a cloud following an accounting scandal in the telco group’s Italian operations. It’s a recent flotation; Elixirr listed on AIM in July last year with a placing at 217p, raising £25m and valuing the company at £98m market cap.

The original idea was to be a challenger brand to McKinsey, Boston Consulting Group, Bain and Accenture. The Admission Document says that clients typically come to Elixirr when they face a problem they are unsure how to solve internally, for example, technological disruption in their industry. A significant proportion of Elixirr’s revenue has come from financial services; 10 years ago this was 90% but had shrunk to roughly half by the time of the AIM listing.

In 2017 they acquired Den Creative, a design agency and subsequently revenues are up +700% since then by cross selling services to Elixirr’s existing clients. That’s an impressive performance, but bear in mind Den was bought for just £245K cash consideration (net assets below £10k), so it was likely growing from a low base. More recently, they’ve bought a couple of small businesses: Coast Digital (Oct 2020, £5m total consideration) and Retearn (April 2021, £7m total consideration) which they say are performing well.

Financials Aside from the £56.8m of intangible assets on the balance sheet (so net tangible book value is £23m) there’s also an unusual item “loans to shareholders” £7.2m. The Annual Report says these interest free loans are to senior employees of the group, in order for them to buy shares in the company. “Loans were advanced by Founders and Directors who financed 50% of the loan by the Company to non-Founder shareholders for their acquisition of shares in the Company.” That’s normal for a private partnership, where partners are expected to borrow money to buy into their share of the partnership, but unusual for a publicly listed company. I think it indicates that the business is likely dependent on some key “rainmakers” who need to be incentivised not to leave.

Ownership Stephen Newton, the current Chief Exec, owns 31% of the shares and the other 4 founders own 15.37% between them. In terms of institutions, Slater owns 9.5%, Chelverton AM 4.9%, Gresham House 4.1%.

Forecasts The RNS says that FY2021F revenue should now be £47m-£50m (previous range £44-47m) with an Adjusted EBITDA margin in the 30-32% range (previously 29%). FinnCap, their broker, is expecting £59m FY 2023F revenue and 25p adj EPS. That puts the shares on 5.2x 2023F revenue and 26x 2023F PER.

Opinion Although the numbers look good, this isn’t for me. I used to work in management consulting before joining CSFB, and it doesn’t strike me as an industry with attractive economics for shareholders through the cycle. In good times the finances look reasonable, but in bad times these are hard businesses to keep people from leaving, then when conditions improve setting up in competition. It’s also not clear to me what these chaps are doing, that can’t be copied by larger competitors like McKinsey or Accenture.

The other problem with management consultancies is, if they do a good job, they have no recurring revenue. David Clayton, who used to head the equity research technology team at CSFB has written about this here. This market is rewarding the likes of GB Group, Craneware, D4T4, Aptitude etc on 5-15x revenues because recurring revenues from SaaS (Software as a Service) model are perceived as more valuable than revenues that rely on winning new business each time a project comes to an end. So, to me at least, Elixirr’s > 5x 2023F revenue valuation makes little sense.

HeiQ H1 June 2021

The Swiss headquartered textiles and materials company, that sells chemicals and consumer goods, announced H1 revenue down -14% to $25.8m. Gross profit margin fell -7% to 50%, due to higher freight, raw materials and price pressure so statutory PBT was down a whopping -68% to $3.4m. This clearly caught out investors because the shares fell -24% on the morning of the results.

Looking through the “News” tab on SharePad shows plenty of RNS’s about partnerships, contract wins and small acquisitions but no trading update warning that the market’s expectations were too high. This seems barely credible, management must have known in the first half that growth was stalling, yet they were happy for Progressive Research to publish an initiation note on 20th May with 2021F FY revenue growth of +19% and adjusted PBT growth of +8%. Management then waited until the end of September to inform the market that these forecasts were too optimistic. Bad numbers really do take longer to add up apparently.

I’ve previously expressed some scepticism towards HeiQ, in May and in December last year when it floated.

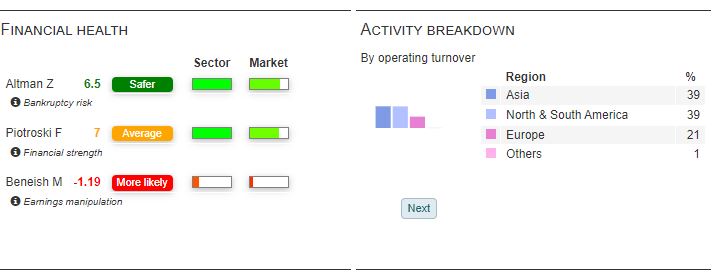

Balance sheet Adding to my concerns, there were also some rather odd-looking movements in inventories and receivables on the face of the balance sheet. Inventory quadrupled in the 12 months to December 2020 to $13.2m, then in H1 this year fell back -6% to $12.5m. Trade receivables on the other hand were up +46% in the 12 months to December 2020, then increased +24% in H1 this year. When different line items on the balance sheet are trending in different directions it’s also a sign that the accounting is not straightforward. For me, this has too many red flags so I’m not going to dig any deeper, SharePad flags that HeiQ does not do well on Quality metrics with negative CROCI and FCF conversion.

I also note that the Beneish-M “earnings manipulation” score is flashing red.

Ownership The largest institutional holders are Amati with 8.9% and Miton with 5.2%. Fidelity own 4.1%. There’s plenty of skin in the game for management; Carlo Centonze, the Chief Exec owns 16.1% (including Cortegrande AG a company he is sole director of) and Murray Height, so-called Chief Science Officer, owns 6.1%.

Valuation Even after last week’s fall, the shares trade on 34x historic earnings of $4.9m (£3.6m). Progressive published another note following the RNS which forecasts FY2021F revenue flat at $51m and Adj EPS at 2c. Forecasts for 2023F imply a strong recovery in the revenue growth trend to $70m and EPS of 6.9c (5.1p), implying a PER 2023F PER of 18x.

Opinion I’m reluctant to trust management who communicate with investors in this fashion. It’s not clear to me why a Swiss firm has come to list in London, the Admission Document says that they are not eligible for a Premium Listing on the LSE, but doesn’t explain why. The shares tick many boxes, anti-viral fabric technology, sustainability but even after the recent fall the valuation does not seem particularly compelling to me.

Andrews Sykes H1 2021

This high quality, but very illiquid company was suggested by Jeremy in his final weekly for SharePad in August 2020, as a “last forever” stock. He wrote that “I would like to find a stock that in 10 years’ time I can be remembered warmly for” and if the share price does well perhaps someone could buy him a pint.

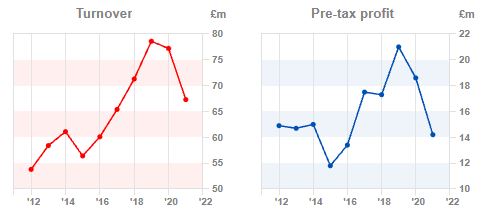

ASY announced H1 revenue +7% to £35.7m and statutory PBT +4.5% to £7.6m. Unusually for a hire business they have no bank debt and net cash of £24m at June (flat vs Dec 2020) and also a pension surplus of £3.6m which shows how conservatively the business is run.

The main businesses in Europe and UK showed growing revenue vs H1 last year. However that’s not particularly useful, as both this year and last year saw considerable disruption from Covid 19. For instance in the Air Conditioning and Refrigeration division revenue is still down by more than a third versus H1 2019. That said from a group perspective the most recent half’s revenue vs H1 2019 was +2% and statutory PBT was +12% ahead, which seems like an encouraging performance.

Outlook The outlook statement mentions Khanaseb, the UAE-based business still experiencing reduced demand compared to historic levels, but the UK and Europe improving. Management have no forecasts in the market, because they don’t wish to pay a broker to publish forecast. Disregard for “norms” can often be a good sign that management are prepared to plough their own furrow, focusing on the business and indifferent to investor perceptions.

Ownership The reason the stock is so illiquid is that 86% is held in EOI Sykes Sarl, a Luxembourg holding company for the Murray family. Jacques Gaston (Tony) Murray, a 101 year old French born businessman who fought in WWII for the Free French before transferring to the RAF flying 38 missions, is Chairman of the Group. I notice from the Annual Report that he retired by rotation, but being eligible, successfully stood for re-election at the June 2021 AGM. Last forever indeed.

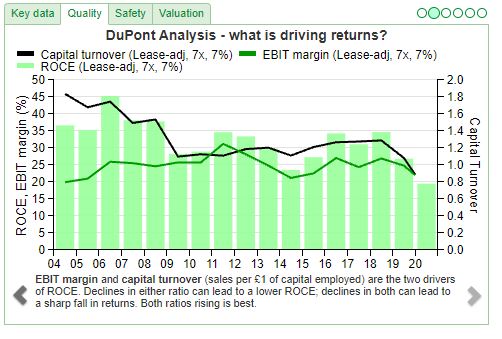

Opinion This is an example of a high Return on Capital business (SharePad shows 29% 5 year average) but that’s struggling to grow the top line. The shares are currently trading on 3.8x book value, which implies that profits are sustainable, but that growth is likely to be low single digits. I think that’s probably fair, except to notice as a “buy and hold” stock a target price in 12 months misses the point. The way the company is run, it’s likely to compound away and return excess cash for as long as the younger generation don’t mess things up.

I already own the shares and bought some more on the morning of the results. The one quibble I have is the absurdly wide bid-offer spreads (I was quoted 490p-570p, the sort of thing you’d expect to see in airport foreign exchange kiosks.)

Seeen

This loss-making but fast-growing California-based media company reported revenue +39% to $5.2m. The H1 loss reduced to -$1.54m, and I’m assuming that they could turn profitable if that level of top line growth is maintained. That assumption might be incorrect, because they report a gross margin of 11%, which seems very low for a media / technology platform. The group had $3.9m of cash, so it might need to raise more money; cash used in operating activities was $0.6m and there’s also $0.76m of purchased intangibles (under cash used in investing activities) in the cashflow statement.

The company is not very good at explaining what it does. It owns GTChannel, a network of YouTube creators and a catalogue of content plus Tagasauris, a human-assisted computing technology company. I think what that means is that they label images so that they appear in Google searches. Seeen have posted examples of their work on Twitter, but I should also note that they have just 25 followers, so they don’t have much of a following in the social media world. For contrast, Mambu an obscure, unlisted banking SaaS company that I only know about because I played beach volleyball with the founder, has almost 3,000 followers.

Chairman’s track record The reason SEEN caught my attention is that the Chairman is Patrick De Souza, who is also Executive Chairman of Water Intelligence, the US water leak detection business. WATR is valued at 47x EV/EBITDA or 91x PER and the shares are up +1410% in the last 5 years, through buying back existing franchises. WATR has performed so well despite being a plumbing business, which ought to be rather dull. The Chairman clearly knows how to spot an opportunity and has now become involved in this small, fast-growing venture. Seeen also has the same auditors (Crowe LLP) as Water Intelligence. Patrick De Souza owns 10.9% of the shares and Water Intelligence owns a further 7.7%.

Management The Chief Exec is Todd Carter, who has a technical background (co-authored AXS File Concatenation Protocol), the CFO, Adrian Hargrave is ex-Water Intelligence. Aside from that, Jake Desjarlais head of Multi Channel Network (MCN) was involved with Machinima, a gaming-focused MCN that sold to Warner Bros for $100 million.

History The company listed on AIM in 2017 as an investment vehicle, but then became Blockchain Worldwide Plc, intending to make acquisitions in the blockchain / cryptocurrency space before changing tack once again. In September 2019 it bought Entertainment AI (EAI) for £12m, a Los Angeles based media company aiming to be part of the Third Wave of media distribution (that is people watching videos on their phones – wave one being broadcast, wave two being cable TV.) At the end of last year EAI then changed its name to Seeen. The share price has been volatile, doubling in the last 12 months but also down -24% from its high earlier this year.

Outlook The outlook statement begins with the cliché that data is the oil on which machine learning and the digital economy runs. It all sounds very upbeat, but there’s no guidance to help us judge whether the revenue growth is sustainable or when it will start to turn a profit. Net cash fell to $3.3m by the end of August, so they’re still losing money. Looking at least year’s revenue split, there was a heavy H2 weighting.

Valuation With a market cap of £19m, the shares are currently trading on 2.5x historic revenue, which seems reasonable for a company that does have some hope of breaking even. It’s speculative, they could need to raise more money and it’s not clear why any company so close to Silicon Valley needs to come to AIM to find investors, but there could be something here so worth following to see how they progress.

Bruce Packard

brucepackard.com

Notes

The author owns shares in Andrews Sykes

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary 04/10/21: Distance and Perspective

The FTSE 100 had a volatile week, rallying, selling off then recovering to 7,040 last Friday. The Nasdaq100 was down -4% and S&P500 -3.3% last week. US 10y Govt bond yield continued to trend upwards to 1.55% versus a low of 1.19% at the start of August. The UK 10y bond yield is up even more sharply than the US, from below 60bp at the start of August to 0.99%. That would normally signal “risk on”, with allocations shifting more to junk bonds and value stocks outperforming the quality and tech stocks that have relied on a low discount rate to justify their valuations. Cathy Wood’s ARKK ETF continued to see outflows and is down -14% in the last 3 months. The VIX volatility Index remained above 20 (chart below).

Despite the volatile conditions Oxford Nanopore’s IPO was a success. The IPO was priced at 425p, giving ONT a market cap of £3.4bn IP Group, but the shares were up +42% on the morning. IP Group owned a 14.4% stake last valued £359 at the end of June (implying a pre IPO valuation of £2.5bn for ONT) but sold £150m at the offer price of 425p to Oracle, the US database company. IP Group is up +18% in the last 3 months.

Boots on the ground Last week I met up with a former British Army Officer friend, who has first-hand knowledge about what happened with the Afghanistan evacuation. He told me that in August, when the Taliban were outside Kabul, the journalists who lived in the city were confident that the attacking force were not going to march in and immediately start chopping off Westerners’ heads. They were happy to stay put. But the newspaper bosses in New York, London etc were more cautious and couldn’t live with the risk of being wrong, so they ordered all journalists to leave.

Within 48 hours it was clear that the local view was correct, and the journalists were ordered back in – which was logistically far more difficult because there weren’t any flights, so they had to go in over the land borders and drive through the hinterlands, with a greater degree of risk. The risk aversion was understandable but I questioned the point of having local knowledge, if management in head office were going to ignore the perspective of those closest to the action. Donald Trump has made a name for himself, undermining the credibility of the “Mainstream Media”, but it’s funny that the people running newspapers and TV channels don’t have much confidence in what their own journalists are reporting either.

The story reminded me of the financial crisis, when the people at the top of banks took too long to realise how serious the contagion from subprime lending would be. HSBC warned on profits at the start of 2007, but through most of that year there was a bidding war for ABN Amro, the Dutch investment bank with a suspect balance sheet. Eventually the Royal Bank-led consortium beat Barclays, and the deal completed in September 2007. Even after Northern Rock had failed, the stock market peaked in October 2007. It took more than a year from the first “canary in the coal mine” until the extent of the credit contagion to be understood. Right up until September 2008, Fred Goodwin was claiming with a straight face that Royal Bank was facing a liquidity problem, not a solvency problem.

The people I worked with at the time who had the best perspective on the banking crisis were on the Japan desk. They had seen the banking crisis of the late 1990s involving Long Term Credit Bank, the Hokkaido Takushoku affair, etc. They had no inside information, they weren’t at all close to management of UK or US banks, and I had to teach them the correct banking terminology like tier 1 ratio, risk weighted assets, Available For Sale securities and Level III assets. But their ignorance of the terminology was compensated for by their experience of similar events a decade before and half a world away. Their distance provided better insight than people who had only covered US or UK banks for decades. I read Gillian Tett’s book Saving the Sun to help understand what happened in Japan, and emailed her a talk I’d given on the cultural theory of risk and financial crises. This was 10 years ago, but in her reply she told me that the Chinese authorities had spent considerable time studying the Japanese credit bubble, so that they could avoid the same mistakes. We shall see how that plays out in the coming months I think.

Below I look at Elixirr, a management consultancy that has been a “Covid winner”, growing organic revenues +45% H1 vs H1 last year. I’ll also look at HeiQ’s profit warning, Seeen a Patrick De Souza (Water Intelligence Executive Chairman) venture and the “last forever” Andrews Sykes H1 results.

Elixirr H1 June 2021

History Originally called, Elix-IRR, the company was founded by 4 ex-Accenture management consultants: Stephen Newton, current Chief Exec, Graham Busby current CFO, Andy Curtis, Mark Goodyear and one lawyer Ian Ferguson, current General Counsel. The Non Exec Chairman is Gavin Patterson, ex Chief Exec of BT, who left under a cloud following an accounting scandal in the telco group’s Italian operations. It’s a recent flotation; Elixirr listed on AIM in July last year with a placing at 217p, raising £25m and valuing the company at £98m market cap.

The original idea was to be a challenger brand to McKinsey, Boston Consulting Group, Bain and Accenture. The Admission Document says that clients typically come to Elixirr when they face a problem they are unsure how to solve internally, for example, technological disruption in their industry. A significant proportion of Elixirr’s revenue has come from financial services; 10 years ago this was 90% but had shrunk to roughly half by the time of the AIM listing.

In 2017 they acquired Den Creative, a design agency and subsequently revenues are up +700% since then by cross selling services to Elixirr’s existing clients. That’s an impressive performance, but bear in mind Den was bought for just £245K cash consideration (net assets below £10k), so it was likely growing from a low base. More recently, they’ve bought a couple of small businesses: Coast Digital (Oct 2020, £5m total consideration) and Retearn (April 2021, £7m total consideration) which they say are performing well.

Financials Aside from the £56.8m of intangible assets on the balance sheet (so net tangible book value is £23m) there’s also an unusual item “loans to shareholders” £7.2m. The Annual Report says these interest free loans are to senior employees of the group, in order for them to buy shares in the company. “Loans were advanced by Founders and Directors who financed 50% of the loan by the Company to non-Founder shareholders for their acquisition of shares in the Company.” That’s normal for a private partnership, where partners are expected to borrow money to buy into their share of the partnership, but unusual for a publicly listed company. I think it indicates that the business is likely dependent on some key “rainmakers” who need to be incentivised not to leave.

Ownership Stephen Newton, the current Chief Exec, owns 31% of the shares and the other 4 founders own 15.37% between them. In terms of institutions, Slater owns 9.5%, Chelverton AM 4.9%, Gresham House 4.1%.

Forecasts The RNS says that FY2021F revenue should now be £47m-£50m (previous range £44-47m) with an Adjusted EBITDA margin in the 30-32% range (previously 29%). FinnCap, their broker, is expecting £59m FY 2023F revenue and 25p adj EPS. That puts the shares on 5.2x 2023F revenue and 26x 2023F PER.

Opinion Although the numbers look good, this isn’t for me. I used to work in management consulting before joining CSFB, and it doesn’t strike me as an industry with attractive economics for shareholders through the cycle. In good times the finances look reasonable, but in bad times these are hard businesses to keep people from leaving, then when conditions improve setting up in competition. It’s also not clear to me what these chaps are doing, that can’t be copied by larger competitors like McKinsey or Accenture.

The other problem with management consultancies is, if they do a good job, they have no recurring revenue. David Clayton, who used to head the equity research technology team at CSFB has written about this here. This market is rewarding the likes of GB Group, Craneware, D4T4, Aptitude etc on 5-15x revenues because recurring revenues from SaaS (Software as a Service) model are perceived as more valuable than revenues that rely on winning new business each time a project comes to an end. So, to me at least, Elixirr’s > 5x 2023F revenue valuation makes little sense.

HeiQ H1 June 2021

The Swiss headquartered textiles and materials company, that sells chemicals and consumer goods, announced H1 revenue down -14% to $25.8m. Gross profit margin fell -7% to 50%, due to higher freight, raw materials and price pressure so statutory PBT was down a whopping -68% to $3.4m. This clearly caught out investors because the shares fell -24% on the morning of the results.

Looking through the “News” tab on SharePad shows plenty of RNS’s about partnerships, contract wins and small acquisitions but no trading update warning that the market’s expectations were too high. This seems barely credible, management must have known in the first half that growth was stalling, yet they were happy for Progressive Research to publish an initiation note on 20th May with 2021F FY revenue growth of +19% and adjusted PBT growth of +8%. Management then waited until the end of September to inform the market that these forecasts were too optimistic. Bad numbers really do take longer to add up apparently.

I’ve previously expressed some scepticism towards HeiQ, in May and in December last year when it floated.

Balance sheet Adding to my concerns, there were also some rather odd-looking movements in inventories and receivables on the face of the balance sheet. Inventory quadrupled in the 12 months to December 2020 to $13.2m, then in H1 this year fell back -6% to $12.5m. Trade receivables on the other hand were up +46% in the 12 months to December 2020, then increased +24% in H1 this year. When different line items on the balance sheet are trending in different directions it’s also a sign that the accounting is not straightforward. For me, this has too many red flags so I’m not going to dig any deeper, SharePad flags that HeiQ does not do well on Quality metrics with negative CROCI and FCF conversion.

I also note that the Beneish-M “earnings manipulation” score is flashing red.

Ownership The largest institutional holders are Amati with 8.9% and Miton with 5.2%. Fidelity own 4.1%. There’s plenty of skin in the game for management; Carlo Centonze, the Chief Exec owns 16.1% (including Cortegrande AG a company he is sole director of) and Murray Height, so-called Chief Science Officer, owns 6.1%.

Valuation Even after last week’s fall, the shares trade on 34x historic earnings of $4.9m (£3.6m). Progressive published another note following the RNS which forecasts FY2021F revenue flat at $51m and Adj EPS at 2c. Forecasts for 2023F imply a strong recovery in the revenue growth trend to $70m and EPS of 6.9c (5.1p), implying a PER 2023F PER of 18x.

Opinion I’m reluctant to trust management who communicate with investors in this fashion. It’s not clear to me why a Swiss firm has come to list in London, the Admission Document says that they are not eligible for a Premium Listing on the LSE, but doesn’t explain why. The shares tick many boxes, anti-viral fabric technology, sustainability but even after the recent fall the valuation does not seem particularly compelling to me.

Andrews Sykes H1 2021

This high quality, but very illiquid company was suggested by Jeremy in his final weekly for SharePad in August 2020, as a “last forever” stock. He wrote that “I would like to find a stock that in 10 years’ time I can be remembered warmly for” and if the share price does well perhaps someone could buy him a pint.

ASY announced H1 revenue +7% to £35.7m and statutory PBT +4.5% to £7.6m. Unusually for a hire business they have no bank debt and net cash of £24m at June (flat vs Dec 2020) and also a pension surplus of £3.6m which shows how conservatively the business is run.

The main businesses in Europe and UK showed growing revenue vs H1 last year. However that’s not particularly useful, as both this year and last year saw considerable disruption from Covid 19. For instance in the Air Conditioning and Refrigeration division revenue is still down by more than a third versus H1 2019. That said from a group perspective the most recent half’s revenue vs H1 2019 was +2% and statutory PBT was +12% ahead, which seems like an encouraging performance.

Outlook The outlook statement mentions Khanaseb, the UAE-based business still experiencing reduced demand compared to historic levels, but the UK and Europe improving. Management have no forecasts in the market, because they don’t wish to pay a broker to publish forecast. Disregard for “norms” can often be a good sign that management are prepared to plough their own furrow, focusing on the business and indifferent to investor perceptions.

Ownership The reason the stock is so illiquid is that 86% is held in EOI Sykes Sarl, a Luxembourg holding company for the Murray family. Jacques Gaston (Tony) Murray, a 101 year old French born businessman who fought in WWII for the Free French before transferring to the RAF flying 38 missions, is Chairman of the Group. I notice from the Annual Report that he retired by rotation, but being eligible, successfully stood for re-election at the June 2021 AGM. Last forever indeed.

Opinion This is an example of a high Return on Capital business (SharePad shows 29% 5 year average) but that’s struggling to grow the top line. The shares are currently trading on 3.8x book value, which implies that profits are sustainable, but that growth is likely to be low single digits. I think that’s probably fair, except to notice as a “buy and hold” stock a target price in 12 months misses the point. The way the company is run, it’s likely to compound away and return excess cash for as long as the younger generation don’t mess things up.

I already own the shares and bought some more on the morning of the results. The one quibble I have is the absurdly wide bid-offer spreads (I was quoted 490p-570p, the sort of thing you’d expect to see in airport foreign exchange kiosks.)

Seeen

This loss-making but fast-growing California-based media company reported revenue +39% to $5.2m. The H1 loss reduced to -$1.54m, and I’m assuming that they could turn profitable if that level of top line growth is maintained. That assumption might be incorrect, because they report a gross margin of 11%, which seems very low for a media / technology platform. The group had $3.9m of cash, so it might need to raise more money; cash used in operating activities was $0.6m and there’s also $0.76m of purchased intangibles (under cash used in investing activities) in the cashflow statement.

The company is not very good at explaining what it does. It owns GTChannel, a network of YouTube creators and a catalogue of content plus Tagasauris, a human-assisted computing technology company. I think what that means is that they label images so that they appear in Google searches. Seeen have posted examples of their work on Twitter, but I should also note that they have just 25 followers, so they don’t have much of a following in the social media world. For contrast, Mambu an obscure, unlisted banking SaaS company that I only know about because I played beach volleyball with the founder, has almost 3,000 followers.

Chairman’s track record The reason SEEN caught my attention is that the Chairman is Patrick De Souza, who is also Executive Chairman of Water Intelligence, the US water leak detection business. WATR is valued at 47x EV/EBITDA or 91x PER and the shares are up +1410% in the last 5 years, through buying back existing franchises. WATR has performed so well despite being a plumbing business, which ought to be rather dull. The Chairman clearly knows how to spot an opportunity and has now become involved in this small, fast-growing venture. Seeen also has the same auditors (Crowe LLP) as Water Intelligence. Patrick De Souza owns 10.9% of the shares and Water Intelligence owns a further 7.7%.

Management The Chief Exec is Todd Carter, who has a technical background (co-authored AXS File Concatenation Protocol), the CFO, Adrian Hargrave is ex-Water Intelligence. Aside from that, Jake Desjarlais head of Multi Channel Network (MCN) was involved with Machinima, a gaming-focused MCN that sold to Warner Bros for $100 million.

History The company listed on AIM in 2017 as an investment vehicle, but then became Blockchain Worldwide Plc, intending to make acquisitions in the blockchain / cryptocurrency space before changing tack once again. In September 2019 it bought Entertainment AI (EAI) for £12m, a Los Angeles based media company aiming to be part of the Third Wave of media distribution (that is people watching videos on their phones – wave one being broadcast, wave two being cable TV.) At the end of last year EAI then changed its name to Seeen. The share price has been volatile, doubling in the last 12 months but also down -24% from its high earlier this year.

Outlook The outlook statement begins with the cliché that data is the oil on which machine learning and the digital economy runs. It all sounds very upbeat, but there’s no guidance to help us judge whether the revenue growth is sustainable or when it will start to turn a profit. Net cash fell to $3.3m by the end of August, so they’re still losing money. Looking at least year’s revenue split, there was a heavy H2 weighting.

Valuation With a market cap of £19m, the shares are currently trading on 2.5x historic revenue, which seems reasonable for a company that does have some hope of breaking even. It’s speculative, they could need to raise more money and it’s not clear why any company so close to Silicon Valley needs to come to AIM to find investors, but there could be something here so worth following to see how they progress.

Bruce Packard

brucepackard.com

Notes

The author owns shares in Andrews Sykes

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.