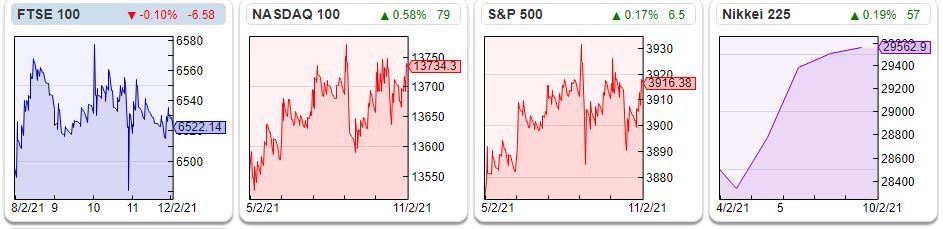

Last week Bloomberg reported that junk bond yields in the US fell below 4% the lowest level ever recorded and down from 11.5% peak yield in March last year. This is the opposite direction to the yield on the “risk free rate” of US 10y bond (hitting 1.18% last week) which has been steadily rising over the last 6 months. These contrasting trends in fixed income suggest that debt investors are beginning to fear wealth erosion from inflation in “risk free” assets more than default risk from highly leveraged companies.

Junk bonds have benefitted from a rising oil price $58 per barrel (WTI), up 66% since the start of November. Many US energy (including shale gas) companies used the junk bond market to finance their operations.

Companies are responding to the rising junk bond market by issuing more junk debt, year-to-date US volume stands at about $60 billion, which is a record amount. In the UK, Mohsin and Zuber Issa’s deal (backed by TDR Capital, a Private Equity firm) to buy Asda from Wal-Mart for £6.5bn will be funded by the junk bond market and sale and leaseback deals. Wal-Mart has always struck me as a well-run company with a strong management team, Jeff Bezos lured many employees from the retailer, such as Rick Dalzell, to manage Amazon. So it’s not clear what expertise the Issas and TDR bring to the business that Wal-Mart doesn’t have, other than a talent for financial structures.

The current buoyancy bodes well for UK banks that still have a high yield fixed income business (Barclays). A sanguine attitude is good for equity markets too, though how long the sentiment lasts is another question entirely.

Private Equity bids Last week saw a couple of P.E. approaches for financial administration platforms (Equiniti, plus the recommended cash offer for Nucleus). Jason Streets at Hardman’s* has suggested that the potential future size of the UK investment platforms market is £2.5 trillion, while he calculated the 2020 size was £717bn. Of that £717bn, £104bn Assets under Administration (AuA) is Hargreaves Lansdown, £62.5bn is AJ Bell. JC Flowers (Private Equity) owns Interactive Investors which charges customers a flat fee, rather than a percentage, has £36bn.

Presumably the attraction of the financial platform sector for P.E. buyers is operational, as well as financial gearing. That is platform costs stay relatively fixed, but revenue can increase, generating substantial profit growth in a consolidating industry.

I think that P.E.’s use of leverage to amplify returns and reduce tax is well understood. Marc Rubinstein at Net Interest points out another advantage that P.E. enjoys, which is less discussed: that managers are in control of when to buy and when to sell. Very often the greatest inflows signal the peak of exuberance in markets, but P.E. funds don’t tend to deploy all of their money as soon as they’ve raised, but instead can diversify over time by deploying their capital more slowly. So if Neil Woodford had been managing a P.E. fund, he wouldn’t have had to immediately invest the huge inflows he enjoyed, followed by even larger outflows which meant he was a forced seller and we’d probably all still think that he was a genius.

P.E. firms can wait, then make a bid where sentiment is depressed (perhaps following a couple of profit warnings) and make a bid at a 30-40% premium, the listed company’s management are under pressure to recommend the bid. Yet we know that in turnaround situations companies can increase in value 4-5x, perhaps even more. Shareholders may want to think twice about whether to accept bids from P.E. firms, even if the premium appears generous.

A good example of exit timing is Boots (the chemist) which was bought by KKR in 2007 (bad time to buy) and just about struggled through the financial crisis; in 2011 (bad time to sell) it was valued at 1.0x cost on KKR’s books. But KKR didn’t have to sell— investors in KKR’s fund were locked in for 10 years and there was plenty of time to run on the clock. KKR finally sold Boots in 2014 with a return of 4.0x (good time to sell).

As P.E. can pick their timing when to sell, I’m also extremely wary of any IPOs from P.E. firms, frequently the company being IPO’ed has suffered from lack of investment and the sellers attempt to achieve the highest possible sales price, timed to perfection. Then 18-24 months later the company warns that profits are on an unsustainable path and the share price collapses. This keeps happening, I’m confused why institutional fund managers keep falling for the same trick, time after time.

It seems likely to me that rather than management skill, P.E. returns come from i) excessive use of leverage which amplifies returns but also reduces tax paid and increases risk ii) buying cheap companies from public markets at favourable times iii) selling the same companies back to public markets at an inflated price a few years later. None of those 3 points seem to me to be “socially useful”.

Companies covered Aside from Equiniti and Nucleus, I also look at SDI Group, which reported a very impressive trading update. As “Rhomboid” on Twitter points out, SDI have disintermediated the whole of the broker industry at one stroke, with management saying what they think they’ll earn over the next couple of years. I think it’s very positive that SDI Group feel confident enough to do this.

Equiniti approach

Sky News reported last Tuesday that a US technology-focused private equity investor, has tabled a 170p-a-share bid for Equiniti (the administration platform and share registrar) 40% higher than the share price when the story leaked.** The shares jumped to 174p in intraday trading +50% in response, before falling back to 145p at the end of the week. “City sources” (that is, PR representatives who have been encouraged by the bidder to leak the story to journalists) said the proposal was the latest in a string of offers that had been made by Siris for Equiniti in recent months – none of which had yet been publicly disclosed to the stock market.

Equiniti is not an administration platform for individuals like Hargreaves Lansdown or AJ Bell. Instead it wins contracts to administer final salary pension schemes for the likes of the NHS, Bank of England, the Civil Service, British Airways, BAE and Shell. The economics should be similar though, with fixed costs and variable revenue. Unfortunately for Equiniti the operational leverage worked the wrong way, with revenues declining in all three divisions on a fixed cost base. In the past management haven’t been able to explain what has gone wrong and why. For instance they say that the EQ Digital division, which the company unhelpfully describes as “complex or regulated activities to help organisations manage their interactions with customers, citizens and employees” (could be anything?) saw revenue fall 15% H1, which the company blamed on clients closing sites and deferring projects (presumably because of Covid-19, companies are cutting back on their complex and regulated activity?) I find the communication style of this company is dreadful, management can’t describe clearly what they do, what has gone wrong or how they are going to fix things. Hopefully that will be the first issue the new Chief Executive resolves.

History This share registrar company, which serves 70 of the FTSE 100 companies, was spun out from Lloyds Bank in 2007 to Private Equity, who then listed it in October 2015, raising £315m at 165p, valuing the company at £495m market cap. It was a premium listing on the main market of the LSE (ie not AIM). Advent the P.E. firm retained around a 30% stake.

By 2017 Advent sold down their stake and Woodford was the largest shareholder owning over 10% when Equiniti did a rights issue, raising £118m at 190p to buy Wells Fargo’s Shareowner Services business (WFSS) for $227m or £176m. Wells Fargo is the US West Coast bank which Buffett owned a chunk of, but had got itself into trouble for overly aggressively cross-selling financial products to customers. The disposal looked like an opportunistic geographic expansion by Equiniti management buying from a distressed seller at the time. WFSS provides share registration, corporate actions, and investment plan services to approximately 1,200 public and private US companies, with approximately 5 million shareholder records processed in the US. Following the acquisition Equiniti has total intangible assets of £830m (goodwill £538m, software £103m, acquisition related intangibles £188m) versus shareholders equity £540m, so the company has negative tangible assets. There’s also a pension deficit of £34m (obligations £97m, plan assets £63m).

Theoretically Equiniti’s administrative services should be recession proof, management claim that 70% of revenue is non-discretionary, long term contracts. In practice the group reported revenues down 12% H1 2020 to £243m v H1 2019, and the company fell into a pretax loss of £0.7m H1 2020, down from £12m H1 2019. Net debt was £355m, 77% of the market cap and 3.0x EBITDA (covenant attached to the committed facility is net debt/underlying EBITDA excluding finance lease liability should be no more than 4.0x in 2020). I don’t think that net debt figure includes VAT deferrals, which were £9m at the H1. The company blames revenue disappointment on corporate dividends being passed by companies, which has reduced income earned on reinvestment plans. Management also say Central Bank’s interest rates cuts caused lower profits, which seems an odd claim for a company with a highly indebted balance sheet. At H1 management put the total impact of Covid as a £25m reduction in EBITDA for the first six months of 2020. EBITDA was £128m FY 2019.

Then in November the company put out further guidance, suggesting FY 2020 revenue would be £480-£490m (down 9% v FY 2019). A new Chief Exec has been appointed to replace Guy Wakeley who stepped down with immediate effect on 5th January. The company is currently being run by a non-executive director, Cheryl Millington, who is interim chief executive until the new Chief Exec, Paul Lynam (ex Secure Trust Bank Chief Exec) joins in March this year. Philip Yea, ex Diageo Finance Director and 3i Chief Exec is the company’s Chairman.

In January Equiniti did announce that it was in talks to sell SelfTrade, their direct-to-consumer customer business. But no mention of the approach from Private Equity.

Valuation The level of indebtedness and the revenue disappointment meant that the share price halved last year. Assuming that the company’s problems are temporary, and that earnings can recover back to 2019 levels (18p of EPS) the company is trading on 9x historic PER.

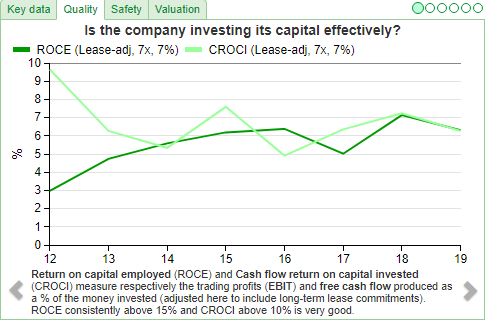

When I discussed this stock with Andrew at Fundhunter a few months ago, neither of us could work out why the revenue had disappointed so much. Even before the Covid pandemic hit, the financials the company reported were not particularly attractive, though we wondered whether the low CroCI (6.4%, 3 year avg 6.0%) and Returns on Capital Employed (7% or below since it listed in 2015) could be improved by a strong management team.

So it could be that the Board are right to reject an approach at this stage of the turnaround, with a new Chief Executive set to arrive in March. Even so, I think shareholders would have liked to have been informed with an RNS.

Opinion Again Lord Lee of Trafford’s letter to the Takeover Panel seems relevant. The failure of Equiniti’s Board to alert shareholders to talks with a serious bidder while the indebted company has been issuing profit warnings is within the rules. Yet it would obviously be to the advantage of shareholders to know that serious talks have been taking place, even if they subsequently don’t result in a formal bid. A Board of a company should instead make an earlier announcement, but with caveats such as “talks are at an early stage”, “no certainty that a formal bid will be made”. A link to his letter is here.

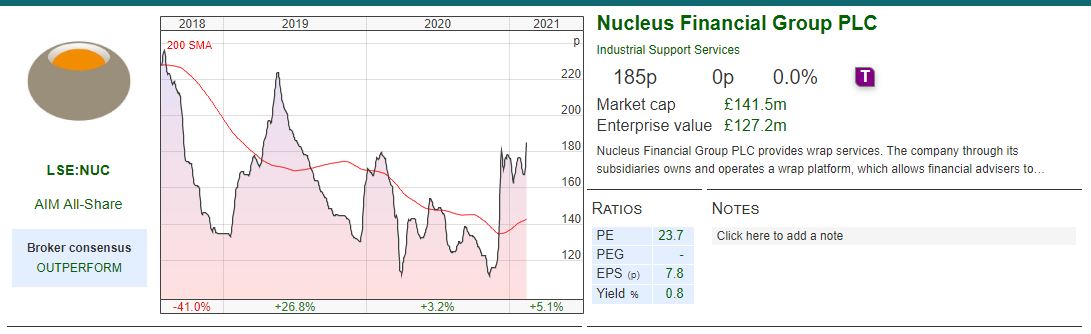

James Hay recommended bid for Nucleus Financial

AIM listed Nucleus (market cap £130m) the investment platform provider founded in 2006 has recommended an offer from James Hay Ltd, the unlisted retirement planning partnership and Epiris LLP (Private Equity). Nucleus holds c. £17 billion of Assets under Administration (AuA) on its platform for over 100K end customers, though the users are actually 1,400 IFAs and their firms. The merger, via Scheme of Arrangement, will create a pension platform with around £45bn AUA. That compares to Hargreaves Lansdown £104bn AuA and £62.5bn AuA for AJ Bell. In 2020 the investment platform market size was £717bn, but Jason Streets reckons it could grow to £2.5 trillion as more investors switch to holding their investments on platforms.

AIM listed Nucleus (market cap £130m) the investment platform provider founded in 2006 has recommended an offer from James Hay Ltd, the unlisted retirement planning partnership and Epiris LLP (Private Equity). Nucleus holds c. £17 billion of Assets under Administration (AuA) on its platform for over 100K end customers, though the users are actually 1,400 IFAs and their firms. The merger, via Scheme of Arrangement, will create a pension platform with around £45bn AUA. That compares to Hargreaves Lansdown £104bn AuA and £62.5bn AuA for AJ Bell. In 2020 the investment platform market size was £717bn, but Jason Streets reckons it could grow to £2.5 trillion as more investors switch to holding their investments on platforms.

There were originally at least three potential bidders for the company, Aquiline Capital Partners, Integrafin Holdings (£1.8bn market cap investment administration platform) and the successful Epiris/James Hay bid. The company first made an announcement because the story leaked to the press. Sanlam, the South African insurance and investment group owned 52% of Nucleus and encouraged the Board to engage with bidders.

The bid values Nucleus at £140m a 42% premium to the undisturbed Nucleus share price of 132p on 1st Dec which was the day before the offer period. That equates to 7x tangible book and 24x PER. Nucleus is smaller and more profitable than Equiniti, but presumably the operational gearing is also the attraction.

Opinion As an investor it is worth thinking about what type of companies and what sectors P.E. bidders are keen on and why. Much as I dislike P.E. firms, most are not “dumb money”. Private Equity buyers tend to bid for businesses with resilient cashflows, because it allows the bidders to use cheap debt to amplify returns. The strategy is not without risk, as the example of Carnival, Saga, and AA shows, many businesses that were thought to be “recession proof” have turned out not to be “pandemic proof”. It also looks like P.E. believe that there are significant gains to be made through consolidating investment platforms, keeping the fixed costs low while enjoying significant revenue growth.

SDI Group Trading Update Y/E 30 April

This scientific instrument maker put out a trading update for its H2, saying that despite most of their businesses being negatively affected by Covid-19, their ATIK Camera division has been winning significant one off contracts because their products are used in “real time” PCR DNA amplifiers (used to detect the virus). Management did caution that delivery was scheduled for close to the 30 April year end, so perhaps there could be timing issues around revenue recognition (current year, or if there are delays next year)? They also said these contracts were “one-off” in nature, so we will see tough comparatives in a couple of years’ time.

This scientific instrument maker put out a trading update for its H2, saying that despite most of their businesses being negatively affected by Covid-19, their ATIK Camera division has been winning significant one off contracts because their products are used in “real time” PCR DNA amplifiers (used to detect the virus). Management did caution that delivery was scheduled for close to the 30 April year end, so perhaps there could be timing issues around revenue recognition (current year, or if there are delays next year)? They also said these contracts were “one-off” in nature, so we will see tough comparatives in a couple of years’ time.

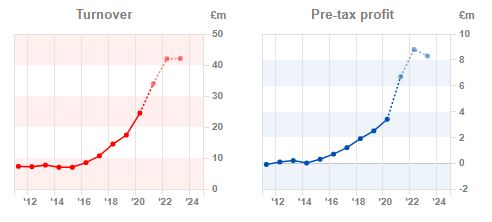

Impressively management believe that they’ll beat expectations for the FY ending this April, but also said that they expect to “substantially exceed the market’s sales and profit expectations for the year ending 30 April 2022” and put in this very helpful table in the RNS.

| £m |

FY 30 April 2020A |

FY 30 April 2021F |

FY 30 April 2022F |

| Revenue |

24.5 |

34.0 |

42.0 |

| Adjusted PBT |

4.4 |

6.7 |

8.7 |

I find it noteworthy how good quality companies are able to communicate clearly with investors, whereas troubled companies often prefer obfuscation.

Broker forecasts Unsurprisingly FinnCap, their house broker, raised SDI sales forecasts by 4% for FY 2021F and 18% FY 2022F. This results in EPS raised by 23% to 5.5p for FY 2021F and 48% to 7.1p FY 2022F. The broker is also expecting the company to report net debt of £3.7m for 30 April 2021F, but net cash of £3.3m April 2022F. This puts the stock on 3.7x 2022F sales and 22x 2022F PER.

Richard has written a very good piece on “roll ups” here. He points out that SDI was not a roll up until it changed strategy five or six years ago. It is the youngest to follow the likes of Judges Scientific, Diploma, and Halma in acquiring scientific and technical businesses. In the early stages of its strategy it has been a issuer of shares (rather than using debt and paying cash) which is a divergence from the blue print. SDI’s acquisition spending has tended to exceed free cashflow, with free cashflow then rising in the following years. Shareholders who believed in management have been well rewarded, the shares are up 1170% in the last 5 years.

Bruce Packard

Twitter: @bruce_packard

Website: brucepackard.com

Notes

The author owns shares in SDI

*https://www.hardmanandco.com/wp-content/uploads/2020/05/Hardman-Research-Platform-Potential-May-2020.pdf

**https://news.sky.com/story/equiniti-draws-600m-takeover-interest-from-us-buyout-firm-siris-12212757

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 15/02/21 – Getting high on junk bonds

Last week Bloomberg reported that junk bond yields in the US fell below 4% the lowest level ever recorded and down from 11.5% peak yield in March last year. This is the opposite direction to the yield on the “risk free rate” of US 10y bond (hitting 1.18% last week) which has been steadily rising over the last 6 months. These contrasting trends in fixed income suggest that debt investors are beginning to fear wealth erosion from inflation in “risk free” assets more than default risk from highly leveraged companies.

Junk bonds have benefitted from a rising oil price $58 per barrel (WTI), up 66% since the start of November. Many US energy (including shale gas) companies used the junk bond market to finance their operations.

Companies are responding to the rising junk bond market by issuing more junk debt, year-to-date US volume stands at about $60 billion, which is a record amount. In the UK, Mohsin and Zuber Issa’s deal (backed by TDR Capital, a Private Equity firm) to buy Asda from Wal-Mart for £6.5bn will be funded by the junk bond market and sale and leaseback deals. Wal-Mart has always struck me as a well-run company with a strong management team, Jeff Bezos lured many employees from the retailer, such as Rick Dalzell, to manage Amazon. So it’s not clear what expertise the Issas and TDR bring to the business that Wal-Mart doesn’t have, other than a talent for financial structures.

The current buoyancy bodes well for UK banks that still have a high yield fixed income business (Barclays). A sanguine attitude is good for equity markets too, though how long the sentiment lasts is another question entirely.

Private Equity bids Last week saw a couple of P.E. approaches for financial administration platforms (Equiniti, plus the recommended cash offer for Nucleus). Jason Streets at Hardman’s* has suggested that the potential future size of the UK investment platforms market is £2.5 trillion, while he calculated the 2020 size was £717bn. Of that £717bn, £104bn Assets under Administration (AuA) is Hargreaves Lansdown, £62.5bn is AJ Bell. JC Flowers (Private Equity) owns Interactive Investors which charges customers a flat fee, rather than a percentage, has £36bn.

Presumably the attraction of the financial platform sector for P.E. buyers is operational, as well as financial gearing. That is platform costs stay relatively fixed, but revenue can increase, generating substantial profit growth in a consolidating industry.

I think that P.E.’s use of leverage to amplify returns and reduce tax is well understood. Marc Rubinstein at Net Interest points out another advantage that P.E. enjoys, which is less discussed: that managers are in control of when to buy and when to sell. Very often the greatest inflows signal the peak of exuberance in markets, but P.E. funds don’t tend to deploy all of their money as soon as they’ve raised, but instead can diversify over time by deploying their capital more slowly. So if Neil Woodford had been managing a P.E. fund, he wouldn’t have had to immediately invest the huge inflows he enjoyed, followed by even larger outflows which meant he was a forced seller and we’d probably all still think that he was a genius.

P.E. firms can wait, then make a bid where sentiment is depressed (perhaps following a couple of profit warnings) and make a bid at a 30-40% premium, the listed company’s management are under pressure to recommend the bid. Yet we know that in turnaround situations companies can increase in value 4-5x, perhaps even more. Shareholders may want to think twice about whether to accept bids from P.E. firms, even if the premium appears generous.

A good example of exit timing is Boots (the chemist) which was bought by KKR in 2007 (bad time to buy) and just about struggled through the financial crisis; in 2011 (bad time to sell) it was valued at 1.0x cost on KKR’s books. But KKR didn’t have to sell— investors in KKR’s fund were locked in for 10 years and there was plenty of time to run on the clock. KKR finally sold Boots in 2014 with a return of 4.0x (good time to sell).

As P.E. can pick their timing when to sell, I’m also extremely wary of any IPOs from P.E. firms, frequently the company being IPO’ed has suffered from lack of investment and the sellers attempt to achieve the highest possible sales price, timed to perfection. Then 18-24 months later the company warns that profits are on an unsustainable path and the share price collapses. This keeps happening, I’m confused why institutional fund managers keep falling for the same trick, time after time.

It seems likely to me that rather than management skill, P.E. returns come from i) excessive use of leverage which amplifies returns but also reduces tax paid and increases risk ii) buying cheap companies from public markets at favourable times iii) selling the same companies back to public markets at an inflated price a few years later. None of those 3 points seem to me to be “socially useful”.

Companies covered Aside from Equiniti and Nucleus, I also look at SDI Group, which reported a very impressive trading update. As “Rhomboid” on Twitter points out, SDI have disintermediated the whole of the broker industry at one stroke, with management saying what they think they’ll earn over the next couple of years. I think it’s very positive that SDI Group feel confident enough to do this.

Equiniti approach

Sky News reported last Tuesday that a US technology-focused private equity investor, has tabled a 170p-a-share bid for Equiniti (the administration platform and share registrar) 40% higher than the share price when the story leaked.** The shares jumped to 174p in intraday trading +50% in response, before falling back to 145p at the end of the week. “City sources” (that is, PR representatives who have been encouraged by the bidder to leak the story to journalists) said the proposal was the latest in a string of offers that had been made by Siris for Equiniti in recent months – none of which had yet been publicly disclosed to the stock market.

Equiniti is not an administration platform for individuals like Hargreaves Lansdown or AJ Bell. Instead it wins contracts to administer final salary pension schemes for the likes of the NHS, Bank of England, the Civil Service, British Airways, BAE and Shell. The economics should be similar though, with fixed costs and variable revenue. Unfortunately for Equiniti the operational leverage worked the wrong way, with revenues declining in all three divisions on a fixed cost base. In the past management haven’t been able to explain what has gone wrong and why. For instance they say that the EQ Digital division, which the company unhelpfully describes as “complex or regulated activities to help organisations manage their interactions with customers, citizens and employees” (could be anything?) saw revenue fall 15% H1, which the company blamed on clients closing sites and deferring projects (presumably because of Covid-19, companies are cutting back on their complex and regulated activity?) I find the communication style of this company is dreadful, management can’t describe clearly what they do, what has gone wrong or how they are going to fix things. Hopefully that will be the first issue the new Chief Executive resolves.

History This share registrar company, which serves 70 of the FTSE 100 companies, was spun out from Lloyds Bank in 2007 to Private Equity, who then listed it in October 2015, raising £315m at 165p, valuing the company at £495m market cap. It was a premium listing on the main market of the LSE (ie not AIM). Advent the P.E. firm retained around a 30% stake.

By 2017 Advent sold down their stake and Woodford was the largest shareholder owning over 10% when Equiniti did a rights issue, raising £118m at 190p to buy Wells Fargo’s Shareowner Services business (WFSS) for $227m or £176m. Wells Fargo is the US West Coast bank which Buffett owned a chunk of, but had got itself into trouble for overly aggressively cross-selling financial products to customers. The disposal looked like an opportunistic geographic expansion by Equiniti management buying from a distressed seller at the time. WFSS provides share registration, corporate actions, and investment plan services to approximately 1,200 public and private US companies, with approximately 5 million shareholder records processed in the US. Following the acquisition Equiniti has total intangible assets of £830m (goodwill £538m, software £103m, acquisition related intangibles £188m) versus shareholders equity £540m, so the company has negative tangible assets. There’s also a pension deficit of £34m (obligations £97m, plan assets £63m).

Theoretically Equiniti’s administrative services should be recession proof, management claim that 70% of revenue is non-discretionary, long term contracts. In practice the group reported revenues down 12% H1 2020 to £243m v H1 2019, and the company fell into a pretax loss of £0.7m H1 2020, down from £12m H1 2019. Net debt was £355m, 77% of the market cap and 3.0x EBITDA (covenant attached to the committed facility is net debt/underlying EBITDA excluding finance lease liability should be no more than 4.0x in 2020). I don’t think that net debt figure includes VAT deferrals, which were £9m at the H1. The company blames revenue disappointment on corporate dividends being passed by companies, which has reduced income earned on reinvestment plans. Management also say Central Bank’s interest rates cuts caused lower profits, which seems an odd claim for a company with a highly indebted balance sheet. At H1 management put the total impact of Covid as a £25m reduction in EBITDA for the first six months of 2020. EBITDA was £128m FY 2019.

Then in November the company put out further guidance, suggesting FY 2020 revenue would be £480-£490m (down 9% v FY 2019). A new Chief Exec has been appointed to replace Guy Wakeley who stepped down with immediate effect on 5th January. The company is currently being run by a non-executive director, Cheryl Millington, who is interim chief executive until the new Chief Exec, Paul Lynam (ex Secure Trust Bank Chief Exec) joins in March this year. Philip Yea, ex Diageo Finance Director and 3i Chief Exec is the company’s Chairman.

In January Equiniti did announce that it was in talks to sell SelfTrade, their direct-to-consumer customer business. But no mention of the approach from Private Equity.

Valuation The level of indebtedness and the revenue disappointment meant that the share price halved last year. Assuming that the company’s problems are temporary, and that earnings can recover back to 2019 levels (18p of EPS) the company is trading on 9x historic PER.

When I discussed this stock with Andrew at Fundhunter a few months ago, neither of us could work out why the revenue had disappointed so much. Even before the Covid pandemic hit, the financials the company reported were not particularly attractive, though we wondered whether the low CroCI (6.4%, 3 year avg 6.0%) and Returns on Capital Employed (7% or below since it listed in 2015) could be improved by a strong management team.

So it could be that the Board are right to reject an approach at this stage of the turnaround, with a new Chief Executive set to arrive in March. Even so, I think shareholders would have liked to have been informed with an RNS.

Opinion Again Lord Lee of Trafford’s letter to the Takeover Panel seems relevant. The failure of Equiniti’s Board to alert shareholders to talks with a serious bidder while the indebted company has been issuing profit warnings is within the rules. Yet it would obviously be to the advantage of shareholders to know that serious talks have been taking place, even if they subsequently don’t result in a formal bid. A Board of a company should instead make an earlier announcement, but with caveats such as “talks are at an early stage”, “no certainty that a formal bid will be made”. A link to his letter is here.

James Hay recommended bid for Nucleus Financial

There were originally at least three potential bidders for the company, Aquiline Capital Partners, Integrafin Holdings (£1.8bn market cap investment administration platform) and the successful Epiris/James Hay bid. The company first made an announcement because the story leaked to the press. Sanlam, the South African insurance and investment group owned 52% of Nucleus and encouraged the Board to engage with bidders.

The bid values Nucleus at £140m a 42% premium to the undisturbed Nucleus share price of 132p on 1st Dec which was the day before the offer period. That equates to 7x tangible book and 24x PER. Nucleus is smaller and more profitable than Equiniti, but presumably the operational gearing is also the attraction.

Opinion As an investor it is worth thinking about what type of companies and what sectors P.E. bidders are keen on and why. Much as I dislike P.E. firms, most are not “dumb money”. Private Equity buyers tend to bid for businesses with resilient cashflows, because it allows the bidders to use cheap debt to amplify returns. The strategy is not without risk, as the example of Carnival, Saga, and AA shows, many businesses that were thought to be “recession proof” have turned out not to be “pandemic proof”. It also looks like P.E. believe that there are significant gains to be made through consolidating investment platforms, keeping the fixed costs low while enjoying significant revenue growth.

SDI Group Trading Update Y/E 30 April

Impressively management believe that they’ll beat expectations for the FY ending this April, but also said that they expect to “substantially exceed the market’s sales and profit expectations for the year ending 30 April 2022” and put in this very helpful table in the RNS.

I find it noteworthy how good quality companies are able to communicate clearly with investors, whereas troubled companies often prefer obfuscation.

Broker forecasts Unsurprisingly FinnCap, their house broker, raised SDI sales forecasts by 4% for FY 2021F and 18% FY 2022F. This results in EPS raised by 23% to 5.5p for FY 2021F and 48% to 7.1p FY 2022F. The broker is also expecting the company to report net debt of £3.7m for 30 April 2021F, but net cash of £3.3m April 2022F. This puts the stock on 3.7x 2022F sales and 22x 2022F PER.

Richard has written a very good piece on “roll ups” here. He points out that SDI was not a roll up until it changed strategy five or six years ago. It is the youngest to follow the likes of Judges Scientific, Diploma, and Halma in acquiring scientific and technical businesses. In the early stages of its strategy it has been a issuer of shares (rather than using debt and paying cash) which is a divergence from the blue print. SDI’s acquisition spending has tended to exceed free cashflow, with free cashflow then rising in the following years. Shareholders who believed in management have been well rewarded, the shares are up 1170% in the last 5 years.

Bruce Packard

Twitter: @bruce_packard

Website: brucepackard.com

Notes

The author owns shares in SDI

*https://www.hardmanandco.com/wp-content/uploads/2020/05/Hardman-Research-Platform-Potential-May-2020.pdf

**https://news.sky.com/story/equiniti-draws-600m-takeover-interest-from-us-buyout-firm-siris-12212757

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.