After a strong November and start of December the FTSE 100 was largely unchanged this week at 6566.

More broadly, the signs of a cyclical recovery are evident: oil price rose through $50 a barrel and copper and other industrial commodities have also been strong. Airbnb IPO’ed with the shares closing on their first day of trading at $144.71, up from $68 at the open, and three times the $44-$50 range the company gave last week. This values the company at $86bn.

CGT fears: Both SDI Group and Solid State management mentioned on calls following results this week that talk of increased Capital Gains Tax has meant founders of unlisted companies are becoming more open to conversations about selling their businesses, before any tax rises come into effect.

The Office of Tax Simplification has suggested that the gap between CGT and Income Tax causes perverse behaviour as individuals try to classify income as gains. The report also said that “in the tax year 2017-18, around 50,000 people reported net gains just below the threshold. If the government’s policy is that the Annual Exempt Amount is intended mainly to operate as an administrative de minimis, it should consider reducing its level.” This doesn’t sound like simplification, this sounds like more work and higher taxes for people who will have to declare gains on their tax return! 265K UK individuals paid £8.3bn of CGT v £55bn of gains declared (net of losses). This compares to 31m individuals who paid £180bn of income tax.

Aside from founders looking to sell their businesses, fear of tax rises could cause a supply demand imbalance in the Buy-To-Let property market. Currently we are seeing a very buoyant property market in anticipation of another tax: stamp duty being reinstated in March next year. The housing market outlook for later in 2021 is more clouded. Persimmon, Berkeley and Barratt Developments all fell more than 10% last week.

The German word for tax is “Steuer” which also means steer, as in steering a vehicle. The implication is that tax can be used to steer behaviour (R&D tax credits, or pension savings are positive examples). However, more negatively, UK Governments have tended to use tax as a PR exercise, for example announcing a 10p band of income tax that made everyone’s life more complicated. The stockmarket has enjoyed a strong run in the last 9 months so I wouldn’t be surprised to see some people locking in their gains. Naturally you should seek out professional tax advice if you are unsure about your personal situation.

Companies covered this week are ULS Technology (H1 to end Sept), the online mortgage conveyancing platform, Solid State (H1 to end Sept), which makes rugged computers, IMImobile which received a cash bid from Cisco Systems and a brief comment on the well loved Games Workshop (H1 Trading Update, H1 to end November).

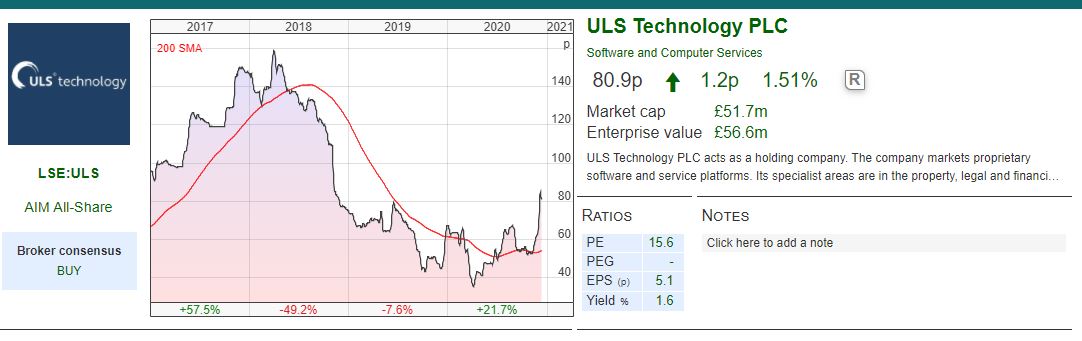

ULS Technology H1 to 30 September

Revenue fell by 31% to £10.06m (H1 2019: £14.55m) for this online conveyancing company. Statutory PBT was £69K, both numbers were in line with previous guidance from the company’s trading update in October. Earlier this month, the company announced the sale of a subsidiary, Conveyancing Alliance Ltd (CAL) for £27.3m in cash. After repaying debt, they will be left with around £25m of cash to invest in their “Digital Move” platform.

The number of property transactions are currently above pre-Covid levels, and the lag between instruction and completion means that this will benefit numbers in the company’s H2. Excluding the impact of the disposal, the Chairman sounds confident about the coming months, as there will be a rush for people to complete before the stamp duty deadline in March. The p&l will be affected by the sale of CAL £8.9m of revenue and £2.4m of PBT in FY to March 2020, so despite the supportive property market there will be an inevitable hit to Group earnings.

Outlook: Longer term perhaps first time buyers could return, as banks have begun to offer higher loan-to-value mortgages. I’m more bearish on UK house prices than most people, but it’s important to remember that transactions, rather than house prices per se, drive the profits of intermediaries like ULS. ULS has calculate that they have less than 3% market share of the total UK conveyancing market, which creates an opportunity as the company has plenty of room to grow faster than the market as a whole.

I listened in to the analyst call because I was curious about how management would spend their windfall. I didn’t learn much, the Chairman is reluctant to update the market for their plans before the new Chief Executive, Jesper With-Fogstrup, joins in early 2021. It does sound like there had been a disagreement over strategy, with the new Chief Executive having better digital experience and also a new Chief Technology Officer. The Chairman did signal that there could be potential acquisitions, and said it was too early to talk about returning capital to shareholders.

One risk with the disposal is that the company is now even more reliant on Lloyds Banking Group. ULS has lost significant contracts in the past, which has reduced revenue and profits. In the most recent Annual Report the loss of this Lloyds contract is listed as the number 1 key risk, as it is worth just under 30% of gross profit. I estimate following the sale of CAL that Lloyds rises to 40% of gross profit, and presumably a higher percentage of Group revenue. Management expect to sign up more lenders to their platform and are hoping that the increase in revenue results in less concentration of this one key contract.

Aside from the obvious risk of losing revenue if Lloyds end the contract, I also wonder if a more understated risk is that Lloyds are able to use their dominant position to extract value from ULS (ie they drive a hard bargain because they know ULS relies on them?) Other “network effects” businesses have enjoyed outsized gains because of the advantages of having once been owned by customers (Visa, Rightmove, London Stock Exchange). The ownership of those businesses was fragmented, whereas Lloyds (through their Private Equity arm) previously owned 47% when ULS listed on AIM in 2014, but they have sold off their stake.

Kestrel Partners, the specialist software investor owns over a quarter of the shares, they have had notable successes in the past (eg GB Group the identity management software which increased in value 24x for them). Oliver Scott, one of Kestrel’s founders, joined ULS Technology’s Board early in the year. NB Sharepad reports Kestrel/Oliver Scott’s holding twice, though this is clearly duplicating the same stake. A quick view of Kestrel’s website suggests that they will be supportive of ULS’s vision that consumers “will use this platform to arrange the finance necessary to complete their house purchase, obtain the legal support needed to complete the transaction and select the insurance, utilities and other providers of services they need to run their home.”

ULS revenue per transaction is £361** which is low relative to other costs when buying a house. Ultimately the home buyer pays this cost, although as ULS earns money for property searches, the charge is usually paid by the solicitor, who then re-charges their client. Management have a vision of using their technology to reduce friction in the house buying and mortgage process. But this will involve persuading vested interests (estate agents, lenders, conveyancers) to use their platform, which might mean the participants lose the customer relationship and become “commoditised”. Historically lawyers have done better than bankers at not letting the transparency that technology brings disintermediate their business.

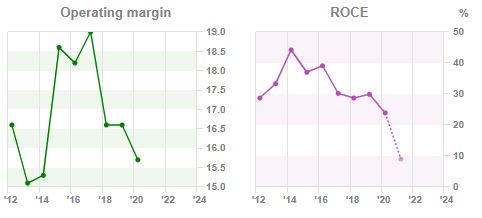

Both operating margins and RoCE have been falling in recent years. This is the opposite of what you’d expect with a true network effects business, which should grow PBT faster than revenue, as a relatively fixed cost base supports more volume. This is not just an observation about the financials. A platform business normally implies that both sides develop in synch (buyers want to be where sellers are and vice versa, or I want to be on the same social media site as my friends). DigitalMove is already being offered to conveyancers for free, perhaps one way to incentivise take up could be to offer them equity in the platform in the same way that Aquis Exchange announced a market maker incentive scheme?

Presumably the -11% negative share price reaction on the results day was due to the lack of a clear plan for how management would spend their windfall gains. I own the shares, though I will wait to hear what the new Chief Executive thinks before thinking about buying more.

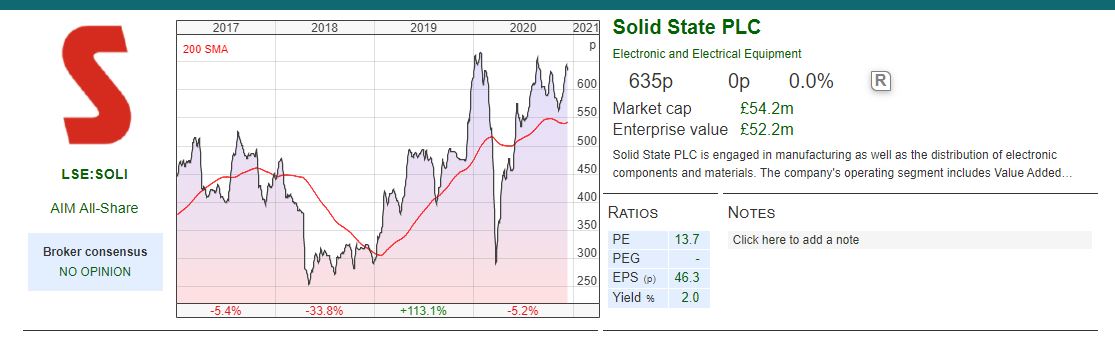

Solid State H1 to 30 September

Solid State, the manufacturer of “rugged” computers, power, communications and electronics announced H1 revenue down 1.5% to £33.1m for H1 to September. Statutory PBT was up 2% to £2.37m, as management reacted to the pandemic by trimming costs and improving operating profit margin by 20bp to 7.3%. The group had net cash of £4.0m at the end of September. This looks like a good result given that some of the company’s products are used in aerospace and the oil & gas industry, both of which were badly hit by the pandemic and saw capex reduced.

FinnCap is the broker and is now forecasting EPS of 43.1 for the FY ending March 2021, and a flat dividend of 12.5p. That puts the shares on 15x March 2021F PER and 2% yield. Outlook statement sounds rather vague talking about cross-division collaboration (I rather hoped that was already happening!) and being well placed to deliver both organic growth and international sales. The open order book stood at £33.6m as of 30 November (down from £38m October 2019).

If we are in a cyclical recovery then I’m expecting orders to pick up and Solid State could benefit from the uptrend. I listened in to the call on Investor Meets Company and management pointed to increased UK Defence spending, as well as Medical and Transport equipment as being likely areas of growth. “GreenTech” is a further area of expansion, they have been awarded an Innovate UK grant to develop their 48v battery modules – targeting fossil fuel replacement in powertrain applications.

The company is looking at acquisitions, and suggested that flagged rise in CGT could lead to founders to sell in anticipation of tax rises. Management cautioned that there is still large amounts of Private Equity money keen to buy businesses that Solid State would also be looking at.

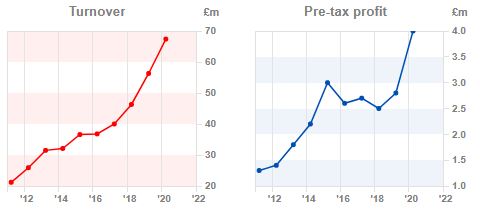

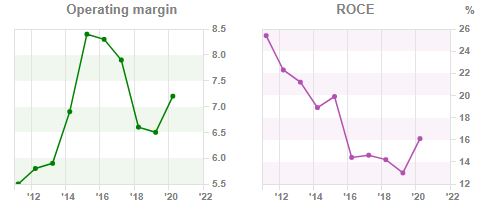

I rather like this company’s strategy tagline, it clearly expresses its positioning: “we do the difficult things that smaller companies can’t do, and that larger manufacturers don’t want to do.” Turnover has grown by CAGR of 16% in the last 4 years to £67.4m FY March 2020, but PBT has lagged the growth 11% CAGR over the same time period to £4m. So the impressive top-line growth hasn’t translated into higher operating margins or increasing RoCE, which is rather disappointing.

Management were asked about this on the call. If their technology is as impressive as they claim, and their niche is profitable then investors should expect Solid State to achieve higher Group margins (perhaps double digit?) and improved Return on Capital Employed. SharePad shows that despite the topline growth achieve, the PER ratio has declined as margins have fallen. I’m hoping that margin expansion and improving returns will become an area of focus for them in future.

IMImobile cash bid from Cisco Systems

Last week Cisco offered 595p in cash, a 48% premium to buy IMImobile. The bid values IMImobile at 1.8x March 2022F revenues and 38x 2022F PER. The IMImobile board has recommended the offer, which makes sense given that the premium is generous and the bid is in cash. The directors who hold 13% of the shares have offered their shares, even in the event of a higher offer. In total Cisco has received undertakings from shareholders in favour of 31%, plus other shareholders have agreed a non-binding letter of intent bring the total to 55% in favour of the deal. The deal is structured as a Scheme of Arrangement, meaning 75% of the votes need to approve, but it looks like this will happen in my view.

The Chief Executive will continue to earn his current base salary of £300K, but will receive a cash payment of $3m from Cisco payable in instalments over the next 3 years. Similarly the Finance Director will receive his base salary of £200K and receive $1.5m in instalments over the next 3 years. Nice work if you can get it.

History IMImobile was founded in 2000 and listed on AIM in 2014 with a placing at 120p, raising £30m and valuing the company at £57m. The company has software that helps businesses (Barclays, O2, BT, Lloyds Bank are given as examples) communicate with their customers. I have seen management present in the past, and have never been quite clear in my head how clever the technology is and whether the company has a “moat”.

Revenue has climbed from £43m FY March 2014 to £171m a CAGR of 25%. Despite reporting a gross margin of 46%, the company has struggled to grow profits and RoCE has averaged 5.5% in the last 3 years according to Sharepad, which rather supports my scepticism. An attractive gross margin can signal that the business is scaleable, because indirect costs (admin, overheads, rent etc) ought to become a smaller percentage of revenues as the business grows. This hasn’t happened with IMImobile, but Cisco paying 38x 2022F earnings can presumably see something valuable that I can’t.

Well done to holders, and also Liontrust 18.7%, Octopus 13.5% Hargreave Hale 9.7% who all hold substantial stakes.

Games Workshop H1 to 29 November Trading Update

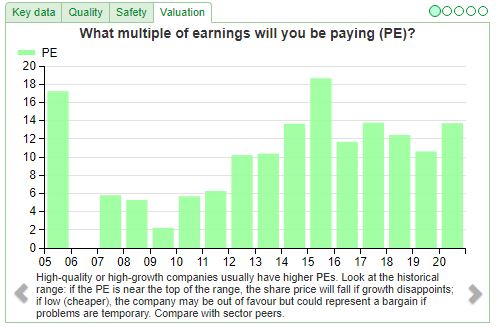

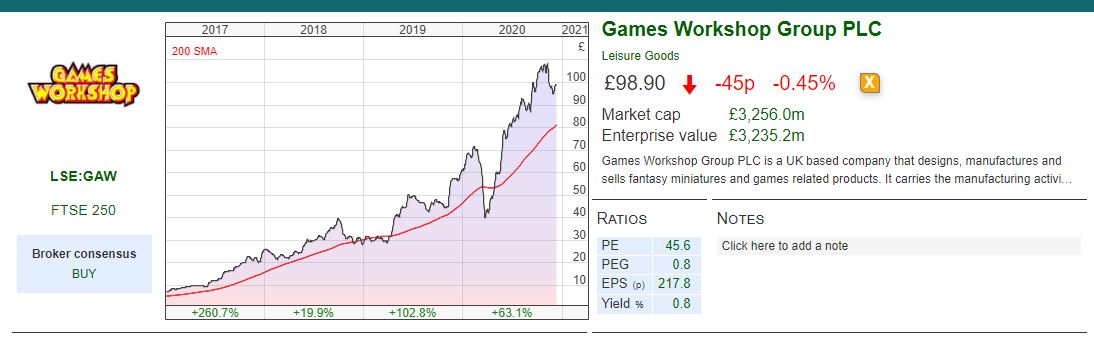

Games Workshop put out a trading update saying sales were up 25% to £185m (2019 148m) and PBT +53% to “not less than” £90m (2019 £59m) for their H1 to end of November. There was also a 60p interim dividend declared, Edison the “paid for” research house is forecasting an annual dividend of 200p for the current FY ending in May 2021. Edison are now forecasting current year PBT of £140m (FY May 2021F) and £157m next year (FY May 2022F) which gives EPS of 342p this financial year and EPS of 381p FY May 2022F, suggesting 26x PER.

Both Maynard and Richard have covered the company’s long history in detail. Richard’s article is here and Maynard’s is here. Maynard bought the shares at £8 in the late 1990s, and sold most of them in 2003 after meeting management. I bought at 639p in 2013 and Richard also bought the shares more recently… we both have held on (sorry Maynard!). The lesson I take from this is that even an exceptional company can appear mediocre in the absence of revenue growth. SharePad shows the company’s long term financial history: in 2004 reported sales were £152m and PBT £20m. Twelve years later, in 2016, sales had actually fallen to £118m and PBT was £17m. But performance has really improved in the last 3 years, as revenue and profit growth have accelerated. Unlike IMImobile above, incremental annual sales of £152m for GAW has translated into an increase in PBT of £72m for FY 2020**

The financials are impressive. But growth I think also benefits players, for example more people knowing the rules, attending events and playing against each other, whether in person or more recently online. The Warhammer 40K trailer has been watched almost 3 million times on YouTube, so I think you can make the case that this company enjoys network effects. Ironically, though Games Workshop in their annual report they do not use the language of “platforms”, “fly wheels” or “virtuous circle”.

Hence, I’m not worried if we see sales plateau again, management have been able to invest well to eventually generate growth. I hold the shares for 2 reasons: i) when sales growth occurs, it results in significant profit growth ii) I enjoy reading the management commentary and appreciate the clear thinking that management communicate to investors. Both of these attractions seem hard for other companies to replicate. The company should announce its H1 results on 12 January.

Bruce Packard

Notes

The author owns shares in ULS Technology, Solid State and Games Workshop

*ULS reports transactions of 27,866 and H1 to September 20 of £10.6m.

** See table below for increase in Games Workshop Sales and PBT

I prefer backgammon to chess. I’ve discovered during lockdown my friends like either chess or poker, which to me is rather annoying. The network effects of board games are real.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 14/12/20 – Taxes steering behaviour?

After a strong November and start of December the FTSE 100 was largely unchanged this week at 6566.

More broadly, the signs of a cyclical recovery are evident: oil price rose through $50 a barrel and copper and other industrial commodities have also been strong. Airbnb IPO’ed with the shares closing on their first day of trading at $144.71, up from $68 at the open, and three times the $44-$50 range the company gave last week. This values the company at $86bn.

CGT fears: Both SDI Group and Solid State management mentioned on calls following results this week that talk of increased Capital Gains Tax has meant founders of unlisted companies are becoming more open to conversations about selling their businesses, before any tax rises come into effect.

The Office of Tax Simplification has suggested that the gap between CGT and Income Tax causes perverse behaviour as individuals try to classify income as gains. The report also said that “in the tax year 2017-18, around 50,000 people reported net gains just below the threshold. If the government’s policy is that the Annual Exempt Amount is intended mainly to operate as an administrative de minimis, it should consider reducing its level.” This doesn’t sound like simplification, this sounds like more work and higher taxes for people who will have to declare gains on their tax return! 265K UK individuals paid £8.3bn of CGT v £55bn of gains declared (net of losses). This compares to 31m individuals who paid £180bn of income tax.

Aside from founders looking to sell their businesses, fear of tax rises could cause a supply demand imbalance in the Buy-To-Let property market. Currently we are seeing a very buoyant property market in anticipation of another tax: stamp duty being reinstated in March next year. The housing market outlook for later in 2021 is more clouded. Persimmon, Berkeley and Barratt Developments all fell more than 10% last week.

The German word for tax is “Steuer” which also means steer, as in steering a vehicle. The implication is that tax can be used to steer behaviour (R&D tax credits, or pension savings are positive examples). However, more negatively, UK Governments have tended to use tax as a PR exercise, for example announcing a 10p band of income tax that made everyone’s life more complicated. The stockmarket has enjoyed a strong run in the last 9 months so I wouldn’t be surprised to see some people locking in their gains. Naturally you should seek out professional tax advice if you are unsure about your personal situation.

Companies covered this week are ULS Technology (H1 to end Sept), the online mortgage conveyancing platform, Solid State (H1 to end Sept), which makes rugged computers, IMImobile which received a cash bid from Cisco Systems and a brief comment on the well loved Games Workshop (H1 Trading Update, H1 to end November).

ULS Technology H1 to 30 September

Revenue fell by 31% to £10.06m (H1 2019: £14.55m) for this online conveyancing company. Statutory PBT was £69K, both numbers were in line with previous guidance from the company’s trading update in October. Earlier this month, the company announced the sale of a subsidiary, Conveyancing Alliance Ltd (CAL) for £27.3m in cash. After repaying debt, they will be left with around £25m of cash to invest in their “Digital Move” platform.

The number of property transactions are currently above pre-Covid levels, and the lag between instruction and completion means that this will benefit numbers in the company’s H2. Excluding the impact of the disposal, the Chairman sounds confident about the coming months, as there will be a rush for people to complete before the stamp duty deadline in March. The p&l will be affected by the sale of CAL £8.9m of revenue and £2.4m of PBT in FY to March 2020, so despite the supportive property market there will be an inevitable hit to Group earnings.

Outlook: Longer term perhaps first time buyers could return, as banks have begun to offer higher loan-to-value mortgages. I’m more bearish on UK house prices than most people, but it’s important to remember that transactions, rather than house prices per se, drive the profits of intermediaries like ULS. ULS has calculate that they have less than 3% market share of the total UK conveyancing market, which creates an opportunity as the company has plenty of room to grow faster than the market as a whole.

I listened in to the analyst call because I was curious about how management would spend their windfall. I didn’t learn much, the Chairman is reluctant to update the market for their plans before the new Chief Executive, Jesper With-Fogstrup, joins in early 2021. It does sound like there had been a disagreement over strategy, with the new Chief Executive having better digital experience and also a new Chief Technology Officer. The Chairman did signal that there could be potential acquisitions, and said it was too early to talk about returning capital to shareholders.

One risk with the disposal is that the company is now even more reliant on Lloyds Banking Group. ULS has lost significant contracts in the past, which has reduced revenue and profits. In the most recent Annual Report the loss of this Lloyds contract is listed as the number 1 key risk, as it is worth just under 30% of gross profit. I estimate following the sale of CAL that Lloyds rises to 40% of gross profit, and presumably a higher percentage of Group revenue. Management expect to sign up more lenders to their platform and are hoping that the increase in revenue results in less concentration of this one key contract.

Aside from the obvious risk of losing revenue if Lloyds end the contract, I also wonder if a more understated risk is that Lloyds are able to use their dominant position to extract value from ULS (ie they drive a hard bargain because they know ULS relies on them?) Other “network effects” businesses have enjoyed outsized gains because of the advantages of having once been owned by customers (Visa, Rightmove, London Stock Exchange). The ownership of those businesses was fragmented, whereas Lloyds (through their Private Equity arm) previously owned 47% when ULS listed on AIM in 2014, but they have sold off their stake.

Kestrel Partners, the specialist software investor owns over a quarter of the shares, they have had notable successes in the past (eg GB Group the identity management software which increased in value 24x for them). Oliver Scott, one of Kestrel’s founders, joined ULS Technology’s Board early in the year. NB Sharepad reports Kestrel/Oliver Scott’s holding twice, though this is clearly duplicating the same stake. A quick view of Kestrel’s website suggests that they will be supportive of ULS’s vision that consumers “will use this platform to arrange the finance necessary to complete their house purchase, obtain the legal support needed to complete the transaction and select the insurance, utilities and other providers of services they need to run their home.”

ULS revenue per transaction is £361** which is low relative to other costs when buying a house. Ultimately the home buyer pays this cost, although as ULS earns money for property searches, the charge is usually paid by the solicitor, who then re-charges their client. Management have a vision of using their technology to reduce friction in the house buying and mortgage process. But this will involve persuading vested interests (estate agents, lenders, conveyancers) to use their platform, which might mean the participants lose the customer relationship and become “commoditised”. Historically lawyers have done better than bankers at not letting the transparency that technology brings disintermediate their business.

Both operating margins and RoCE have been falling in recent years. This is the opposite of what you’d expect with a true network effects business, which should grow PBT faster than revenue, as a relatively fixed cost base supports more volume. This is not just an observation about the financials. A platform business normally implies that both sides develop in synch (buyers want to be where sellers are and vice versa, or I want to be on the same social media site as my friends). DigitalMove is already being offered to conveyancers for free, perhaps one way to incentivise take up could be to offer them equity in the platform in the same way that Aquis Exchange announced a market maker incentive scheme?

Presumably the -11% negative share price reaction on the results day was due to the lack of a clear plan for how management would spend their windfall gains. I own the shares, though I will wait to hear what the new Chief Executive thinks before thinking about buying more.

Solid State H1 to 30 September

Solid State, the manufacturer of “rugged” computers, power, communications and electronics announced H1 revenue down 1.5% to £33.1m for H1 to September. Statutory PBT was up 2% to £2.37m, as management reacted to the pandemic by trimming costs and improving operating profit margin by 20bp to 7.3%. The group had net cash of £4.0m at the end of September. This looks like a good result given that some of the company’s products are used in aerospace and the oil & gas industry, both of which were badly hit by the pandemic and saw capex reduced.

FinnCap is the broker and is now forecasting EPS of 43.1 for the FY ending March 2021, and a flat dividend of 12.5p. That puts the shares on 15x March 2021F PER and 2% yield. Outlook statement sounds rather vague talking about cross-division collaboration (I rather hoped that was already happening!) and being well placed to deliver both organic growth and international sales. The open order book stood at £33.6m as of 30 November (down from £38m October 2019).

If we are in a cyclical recovery then I’m expecting orders to pick up and Solid State could benefit from the uptrend. I listened in to the call on Investor Meets Company and management pointed to increased UK Defence spending, as well as Medical and Transport equipment as being likely areas of growth. “GreenTech” is a further area of expansion, they have been awarded an Innovate UK grant to develop their 48v battery modules – targeting fossil fuel replacement in powertrain applications.

The company is looking at acquisitions, and suggested that flagged rise in CGT could lead to founders to sell in anticipation of tax rises. Management cautioned that there is still large amounts of Private Equity money keen to buy businesses that Solid State would also be looking at.

I rather like this company’s strategy tagline, it clearly expresses its positioning: “we do the difficult things that smaller companies can’t do, and that larger manufacturers don’t want to do.” Turnover has grown by CAGR of 16% in the last 4 years to £67.4m FY March 2020, but PBT has lagged the growth 11% CAGR over the same time period to £4m. So the impressive top-line growth hasn’t translated into higher operating margins or increasing RoCE, which is rather disappointing.

Management were asked about this on the call. If their technology is as impressive as they claim, and their niche is profitable then investors should expect Solid State to achieve higher Group margins (perhaps double digit?) and improved Return on Capital Employed. SharePad shows that despite the topline growth achieve, the PER ratio has declined as margins have fallen. I’m hoping that margin expansion and improving returns will become an area of focus for them in future.

IMImobile cash bid from Cisco Systems

Last week Cisco offered 595p in cash, a 48% premium to buy IMImobile. The bid values IMImobile at 1.8x March 2022F revenues and 38x 2022F PER. The IMImobile board has recommended the offer, which makes sense given that the premium is generous and the bid is in cash. The directors who hold 13% of the shares have offered their shares, even in the event of a higher offer. In total Cisco has received undertakings from shareholders in favour of 31%, plus other shareholders have agreed a non-binding letter of intent bring the total to 55% in favour of the deal. The deal is structured as a Scheme of Arrangement, meaning 75% of the votes need to approve, but it looks like this will happen in my view.

The Chief Executive will continue to earn his current base salary of £300K, but will receive a cash payment of $3m from Cisco payable in instalments over the next 3 years. Similarly the Finance Director will receive his base salary of £200K and receive $1.5m in instalments over the next 3 years. Nice work if you can get it.

History IMImobile was founded in 2000 and listed on AIM in 2014 with a placing at 120p, raising £30m and valuing the company at £57m. The company has software that helps businesses (Barclays, O2, BT, Lloyds Bank are given as examples) communicate with their customers. I have seen management present in the past, and have never been quite clear in my head how clever the technology is and whether the company has a “moat”.

Revenue has climbed from £43m FY March 2014 to £171m a CAGR of 25%. Despite reporting a gross margin of 46%, the company has struggled to grow profits and RoCE has averaged 5.5% in the last 3 years according to Sharepad, which rather supports my scepticism. An attractive gross margin can signal that the business is scaleable, because indirect costs (admin, overheads, rent etc) ought to become a smaller percentage of revenues as the business grows. This hasn’t happened with IMImobile, but Cisco paying 38x 2022F earnings can presumably see something valuable that I can’t.

Well done to holders, and also Liontrust 18.7%, Octopus 13.5% Hargreave Hale 9.7% who all hold substantial stakes.

Games Workshop H1 to 29 November Trading Update

Games Workshop put out a trading update saying sales were up 25% to £185m (2019 148m) and PBT +53% to “not less than” £90m (2019 £59m) for their H1 to end of November. There was also a 60p interim dividend declared, Edison the “paid for” research house is forecasting an annual dividend of 200p for the current FY ending in May 2021. Edison are now forecasting current year PBT of £140m (FY May 2021F) and £157m next year (FY May 2022F) which gives EPS of 342p this financial year and EPS of 381p FY May 2022F, suggesting 26x PER.

Both Maynard and Richard have covered the company’s long history in detail. Richard’s article is here and Maynard’s is here. Maynard bought the shares at £8 in the late 1990s, and sold most of them in 2003 after meeting management. I bought at 639p in 2013 and Richard also bought the shares more recently… we both have held on (sorry Maynard!). The lesson I take from this is that even an exceptional company can appear mediocre in the absence of revenue growth. SharePad shows the company’s long term financial history: in 2004 reported sales were £152m and PBT £20m. Twelve years later, in 2016, sales had actually fallen to £118m and PBT was £17m. But performance has really improved in the last 3 years, as revenue and profit growth have accelerated. Unlike IMImobile above, incremental annual sales of £152m for GAW has translated into an increase in PBT of £72m for FY 2020**

The financials are impressive. But growth I think also benefits players, for example more people knowing the rules, attending events and playing against each other, whether in person or more recently online. The Warhammer 40K trailer has been watched almost 3 million times on YouTube, so I think you can make the case that this company enjoys network effects. Ironically, though Games Workshop in their annual report they do not use the language of “platforms”, “fly wheels” or “virtuous circle”.

Hence, I’m not worried if we see sales plateau again, management have been able to invest well to eventually generate growth. I hold the shares for 2 reasons: i) when sales growth occurs, it results in significant profit growth ii) I enjoy reading the management commentary and appreciate the clear thinking that management communicate to investors. Both of these attractions seem hard for other companies to replicate. The company should announce its H1 results on 12 January.

Bruce Packard

Notes

The author owns shares in ULS Technology, Solid State and Games Workshop

*ULS reports transactions of 27,866 and H1 to September 20 of £10.6m.

** See table below for increase in Games Workshop Sales and PBT

I prefer backgammon to chess. I’ve discovered during lockdown my friends like either chess or poker, which to me is rather annoying. The network effects of board games are real.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.