In the early days of a new Democrat presidency, the President’s campaign manager observed that: “I used to think if there was reincarnation, I wanted to come back as the President or the Pope or a 0.400 baseball hitter. But now I want to come back as the bond market. You can intimidate anybody.”

The remark was by James Carville, Bill Clinton’s campaign manager. The context was a 1992 speech by Clinton, where he suggested that he would reduce the federal deficit, and in response bond prices rose (yields fell). We are now in the early days of another Democrat President, but how times have changed. The new President is asking Congress for a $1.9 trillion stimulus package, following on from the $900bn agreed last month and $3 trillion since the start of the pandemic, which will significantly increase the budget deficit.

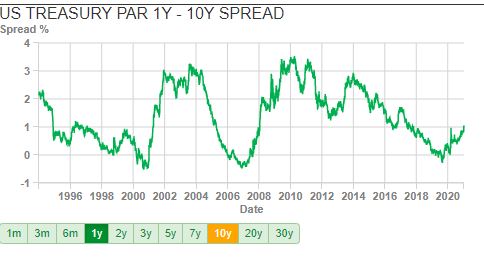

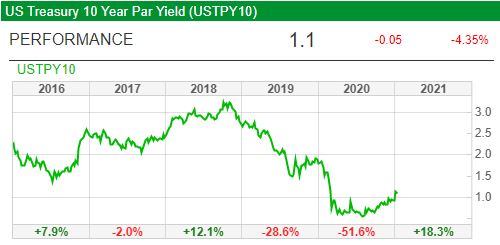

At the start of the pandemic investors rushed to buy US Government bonds, for their “safe haven” status. More recently the focus on an increasing deficit has caused a significant rise in yields (fall in prices) in the US bond market, the 10y yield is up 50% in the last 3 months to 1.1%. SharePad shows the spread between the 1 year and the 10 year bond is the widest it has been since the start of 2018, that is, the yield curve is steepening.

This to be welcomed as a sign that the US economy will recover in 2021. Unlike in the early 1990’s bond vigilantes (bond markets policing political spending) have not intimidated anyone, except Recep Erdogan. At the end of 2020, the Turkish Central Bank had to raise interest rates to 17%. The Lira has plunged and the country looks in crisis.

Bond proxies

Inflation expectations rising strongly would be bad for corporate and government bond prices; relatively equity markets should do better. But questions remain how the “bond proxy” equities will perform. Bond proxies have stable cashflows and their prices have risen as long bond yields have fallen over the last 20 years.

No one quite seems to agree which equities are bond proxies though: utility companies like National Grid? Property REITs? Housebuilders? Or consumer staples like Unilever and Diageo? US tech stocks? Private Equity owned stocks?

I looked at the best performing companies in the FTSE 100 over the last 20 years, a period when bonds and bond proxies have done well. Flutter Entertainment +7200%, JD Sports +6240%, Ashtead +3020% so there doesn’t look to be a common theme. I don’t think anyone would claim Tesla is a bond proxy, but that has been the best performing stock in the US.

That said, I can see the argument for Amazon as a bond proxy. Stable cashflows, and perhaps the internet retailer lacks pricing power, so may suffer in a reflationary environment because the vast stock of goods it holds will erode in value if its inventory turn is not fast enough. More broadly tech companies may not have the pricing power than many seem to assume. We’ve seen customers defect from WhatsApp to competitors, caused by a mere change in terms and conditions and a Tweet from Elon Musk. I’m not sure how easy it would be for Spotify or Netflix to raise prices without customers cancelling their subscriptions.

People do agree on what isn’t a bond proxy: banks, oil and mining companies are all inversely correlated with bond prices (they have struggled while bond prices rose over the last 2 decades). Most AIM stocks are in this category too. In the last 6 months, AIM has been one of the best performing markets up +34%, versus Nasdaq +26%, S&P +20%. Risk on.

This week there have been many companies reporting trading updates. It’s not possible to focus on every company that reports, so I have chosen a mix of recovery plays (Hostelworld, Churchill China, Franchise Brands) and Covid winners/safe havens (Wey Education, Games Workshop).

Hostelworld Trading Update

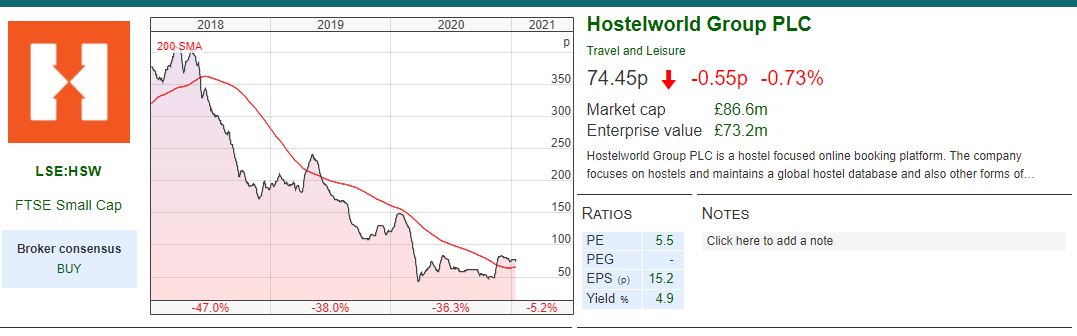

This Online Travel Agent (OTA) put out a trading update saying that FY 2020 bookings were down 78-80% compared to FY 2019. This was inline with previous guidance in October. Clearly the last quarter of 2020 has been more difficult, and the first half of 2021 is likely to be too.

The group had €18.2m of net cash at the end of December, down €10.9m in H2. Cash liabilities due in H1 2021 are €7m, and current liabilities are €21m implying that 2x more liabilities fall due in H2. Management are in discussion with lenders about a new €30m debt facility, with a maturity of 5 years and costing a low to mid-teens interest rate. I wonder if a condition of this new facility might be another equity capital raising?

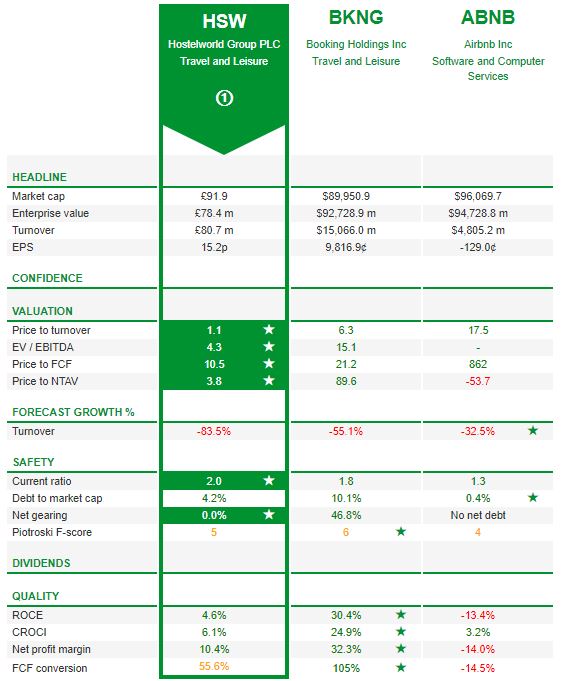

History This dual listed stock (Premium listing on LSE and Irish Stock Exchange) came to market at 185p per share in October 2015. It was founded in 1999, and offers travellers an online platform for budget accommodation. Similar to booking.com, but for hostels. Pre IPO the revenue growth was impressive, growing to €83.5m in 2015, from zero sixteen years earlier. However since the IPO revenue has been flat (€80.9m FY 2019) I think because booking.com has expanded its offering from hotels to budget accommodation? Probably AirBNB has had some impact too? More broadly Hostelworld faces competition from Google and hostel chains like St Christopher’s who have a direct booking service on their website, and encourage their customers to book direct and cut out the middleman (Hostelworld). The competitive landscape explains why RoCE has been below 10% for the last few years.

However, if Hostelworld can establish a “platform” where travellers arrange their trips and achieve “lock in”, then the company has significant operational leverage. This explains the high valuation (c. $90bn each) that investors are putting on both booking.com and Airbnb, despite the pandemic.

HSW did an equity placing in June, raising £14m gross at a discount of 7% to the then price of 77p. Then in September the company announced that the Chief Financial Officer who had only been in the position since 2018, would leave for a new job. Clearly this would not have been helpful when it came to negotiating more support from lenders.

Opinion I timed my purchase of this stock very badly in Q4 2019, the shares are down 41% since 1 Jan 2020. Then in the last 3 months the shares have participated in the “vaccine rally” +40%. If I traded frequently I might look to sell, hoping to buy back the shares more cheaply in a couple of months. However I deliberately try to keep my number of transactions down, so I will do nothing. The shares are trading on 1x FY 2019 revenue and 6x FY 2019 PER, and I think there’s a good probability that the company makes it through the next few months and recovers strongly.

Churchill China Trading Update

This ceramics (or as they say on their website: “total table top solutions”) company supplies hotels and restaurants. They put out an update for FY 2020 (December year end) saying that they traded profitably through H2, despite the tightening of Covid restrictions at the end of last year. Q1 will be difficult for the same reason, but after that they expect improved conditions for 2021. Results will be announced in April 2021.

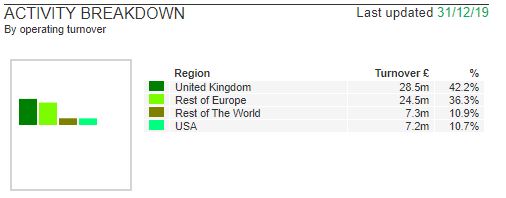

Around 42% of sales are to the UK, and 58% exports (of which Europe is the largest market at 36% of turnover). Management say that their preparations for BREXIT are in place, and the company probably benefits from the trade deal that was struck at the 11th hour.

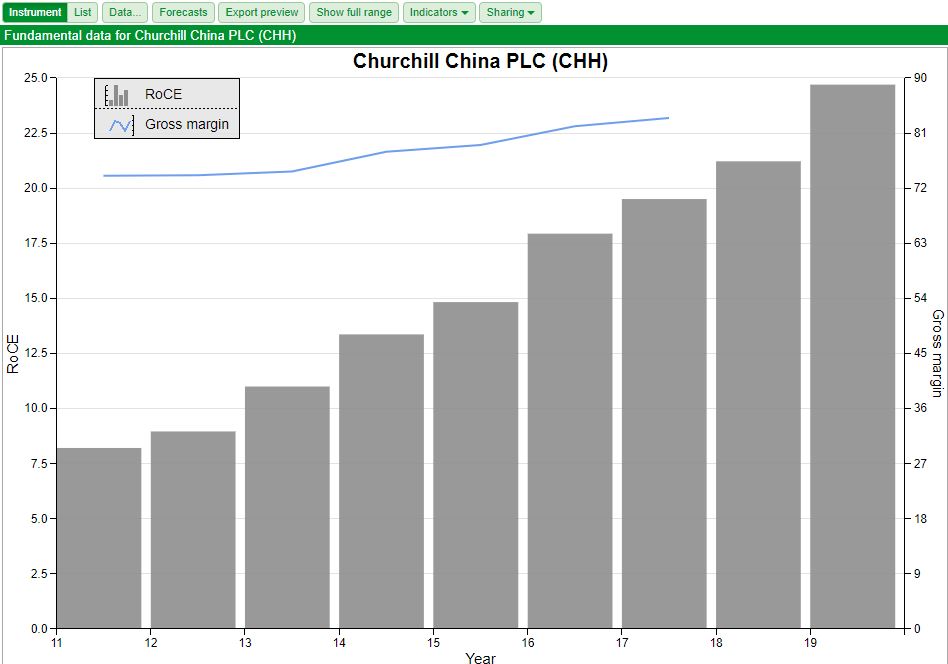

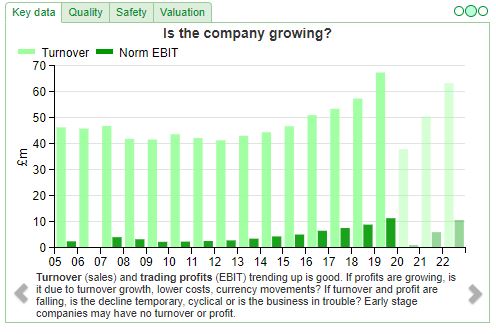

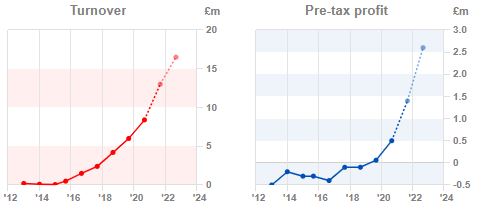

History The company goes back to 1795, and listed on the London Stock Exchange (not AIM) in 1994. Since 2015 revenue has grown at 10% CAGR to FY 19 £67.5m and PBT has more than doubled over the same period to £11m FY 19. Up until 2020 RoCE has been steadily rising over the last 10 years to 25% FY 2019, helped by a gross margin of around 80%. The shares are down 35% versus a year ago, but on a ten year view they are up from below £3 to a peak of £20 before selling off sharply due to Covid.

They had net cash on their balance sheet of £16m at 30th June, though management believe it is too early to declare a dividend at this stage. This company should survive though I think I’d prefer to wait and see if further short term bad news causes the price to fall further before buying.

Opinion This looks like a quality company that you can “buy and hold” forever. The shares are trading on 16x PER 2019, it will probably take a couple of years for profits to recover back to £6.6m that they reported that year, as cash starved restaurants and hotels are unlikely to prioritise replacing their tableware. But the company’s long term history and cash on balance sheet gives comfort that the business will eventually recover.

Games Workshop

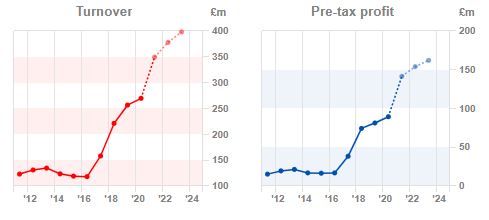

The company announced H1 results to November with Revenue £186.8 +27% and PBT £91.6m +57% on a constant currency basis. Previous guidance announced in December was for sales of £185m and PBT of “not less than” £90m, so these numbers were in line. This is an impressive performance, given that the majority of the company’s 529 retail stores have been restricted or closed because of Covid. Online sales were up +87%, and at £46m, now represent a quarter of group sales. The Chief Exec admits in the commentary that online is not as great as they would like it to be. That said, the total amount of online sales is understated, because the company only reports sales through its own online stores in the “Online” category, in reality independent retailers who sell the product also have websites, but this is reported in “Trade” +33% (56% of group revenue).

Dividend declared in 2020 was 80p, versus 100p the year before. Cash on balance sheet was £96.5m at the end of November, an increase of £43.5m on the previous 6 months. Staff and customers are thanked in the outlook statement, and the Chief Exec talks about the biggest risk is that senior management become complacent. No comment on expectations for 2021, except that they have internal plans, and they will keep investors updated with regular RNS. Sales in December were “broadly in line” – which may translate as slightly disappointing, given the tightening of Covid restrictions and a tough comparison to December last year?

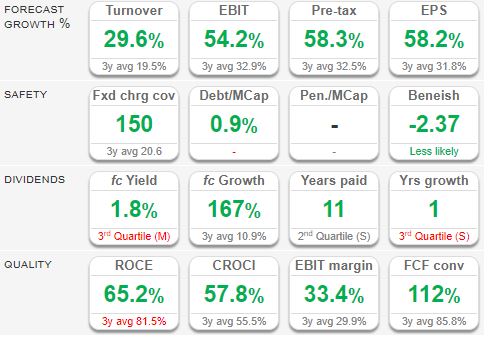

Opinion More of the same from a well-regarded company. I’m a long term holder, and there’s nothing in this statement to make me feel uneasy. The SharePad summary tab shows impressive RoCE of 65.2% and 57.8% CRoCI.

Such quality comes at a price, over 50x PER. The shares were down 7% on the day of the results, despite the numbers being in line with guidance, which probably reflects the high level of expectations that some investors have. That said, the company could have beaten PBT guidance by 6%, but chose not to, instead spending £5m on a well-deserved staff bonus. As a shareholder I’m thoroughly behind that decision.

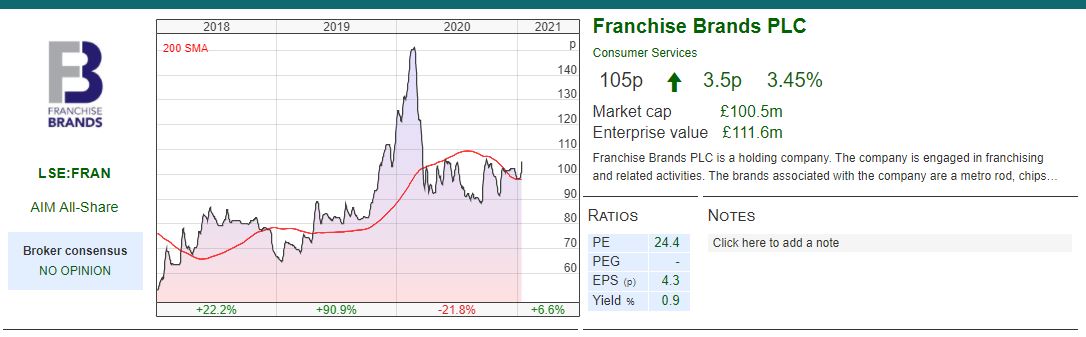

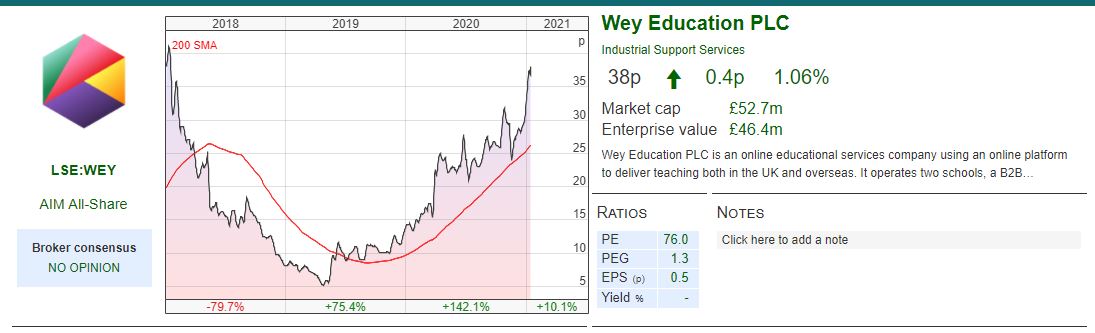

Franchise Brands Trading Update

The company announced in a trading update for FY 2020 (December year end) that they expect revenue, adjusted EBITDA and adjusted EPS to be ahead of consensus expectations (Revenue £48.6m, Adjusted EBITDA £6.1m, Adjusted EPS 3.9p). The company did a placing last April at 90p raising £13.6m net. Last week’s RNS says that they finished the year with £13.2m of gross cash, although I think a net cash figure would have been more useful, which stood at £2.6m at June, including capitalised leases.

History The company was founded in 2008 by Stephen Hemsley and Nigel Wray, who both did well from Dominos Pizza and hence have a deep knowledge of the franchise sector. Unusually this company has two Admission Documents, from 2016 and 2017. In August 2016 they raised £3.5m at 33p valuing the company at £15.5m. At the time their brands were ChipsAway (paintwork scratches, minor dents in cars), Ovenclean and MyHome (residential cleaning). Then in April 2017, they raised a further £20m at 67p, valuing the company at £52m, in order to buy Metro Rod, a leading provider of drain clearance and maintenance services. Since then they have added to these franchises with Willow Pumps (installation and maintenance of pump stations), Barking Mad (dog sitting) and The Handyman Van (home and property maintenance).

B2B and B2C: The company splits its operations into 2 divisions i) B2B division (some of which is direct labour, rather than franchise): Metro Rod, Metro Plumb, and Willow Pumps 84% of Adjusted EBITDA and ii) B2C ChipsAway, Ovenclean, Barking Mad 32% of Adjusted EBITDA. The percentages do not sum to 100%, because the company deducts £451K of overheads from Adjusted EBITDA of £2.8m at H1 2020. In the B2C divisions franchisees pay a fixed monthly fee, in the B2B divisions franchisees pay a turnover related fee.

Ownership The business was co-founded by Nigel Wray, who is a non Exec Director and owns 23%, he has been very successful with Domino’s Pizza and various other investments. He is co-owner of Saracens Rugby Club but has recently resigned as Chairman.* One of his least successful investments was Seymour Pierce, the stockbroker where I used to work.

Stephen Hemsley is the Executive Chairman, and also co-founded the business. He was Non Executive Chairman of Domino’s Pizza for 21 years, where he oversaw the growth in market cap from £25m to £1.5bn. He also owns 23% of the shares. Given the insiders own more than half of the company, there is a lack of free float, but Gresham House 5.7% and Hargreave Hale 4.2% still own disclosable stakes.

Forecasts The company’s broker Allenby Capital tweaked up their forecasts marginally on the RNS. In 2021F they are forecasting revenue of £58m, adjusted PBT of £5.8m and EPS of 4.8p, putting the shares on 22x PER 2021F. The broker is also going for a steep hike in the dividend to 1.4p v 0.9p in 2020F.

Opinion Whenever I have looked at this company in the past, I’ve liked the story, but the shares were too expensive. The shares are down 15% in the last year, so I’m following it closely.

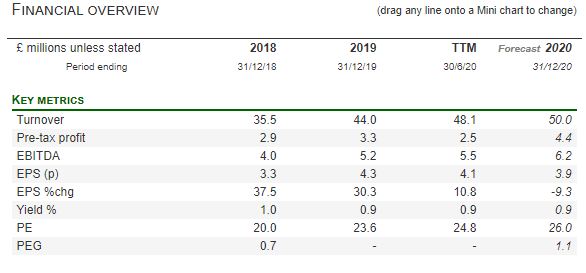

Wey Education H1 Trading Update

This online school with an August year end, said that the first 4 months of their financial year had started well, and they were ahead of expectations (without telling us what those expectations were and only that they were “significantly” ahead.)

They also say that Wey will begin charging VAT to UK customers, following a group structure and tax review. The reason given is to allow the company to recover VAT expenses and ensure that InterHigh (roughly 2/3 of revenue the online, fee paying school) would be able to distribute profits. They will smooth the transition for existing customers, rather than hike fees 20% immediately.

Forecasts WH Ireland raised their FY2021 revenue forecast by a whopping 23% to £13m, and PBT up 10% as the company will likely increase marketing expense. The broker is forecasting EPS of 0.81p and 1.40p in 2021F and 2022F respectively. The current price puts the shares on 27x PER 2022F. There is still no dividend forecast, but WH Ireland forecast net cash to rise above £10m in 2022F.

Opinion Public schools like Eton, Winchester and Charterhouse have “non-profit” status, which means that though their fees are £40K a year, parents do not pay VAT on the education services they provide. Though Wey charges a fraction of traditional public schools (roughly £3K a year) it is clearly in business to generate a profit. To compete on a level playing field they had set up a legal structure with InterHigh Ltd as non profit, which then paid money to Wey for educational services. It seems likely that the VAT man has raised his eyebrows at this structure.

I follow this investor’s blog and he has been consistently insightful on the company. He flagged the VAT issue, and also regulatory risk in general, in June last year in this post. In the past he has expressed scepticism towards the Chairman Barry Whipp. Dressing the announcement up as a voluntary decision to charge VAT to recover tax on expenditure (unlikely given that Wey’s largest cost is staff, which wouldn’t qualify) could be an example of the Chairman’s unconvincing communication style with investors.

That said, I like the company, and continue to hold it in my portfolio.

Bruce Packard

Notes

Bruce owns shares in Games Workshop, Hostelworld and Wey Education

* https://www.theguardian.com/sport/2020/jan/02/time-for-a-fresh-start-nigel-wray-retires-as-saracens-chairman

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 18/01/21 – Reincarnation as the bond market

In the early days of a new Democrat presidency, the President’s campaign manager observed that: “I used to think if there was reincarnation, I wanted to come back as the President or the Pope or a 0.400 baseball hitter. But now I want to come back as the bond market. You can intimidate anybody.”

The remark was by James Carville, Bill Clinton’s campaign manager. The context was a 1992 speech by Clinton, where he suggested that he would reduce the federal deficit, and in response bond prices rose (yields fell). We are now in the early days of another Democrat President, but how times have changed. The new President is asking Congress for a $1.9 trillion stimulus package, following on from the $900bn agreed last month and $3 trillion since the start of the pandemic, which will significantly increase the budget deficit.

At the start of the pandemic investors rushed to buy US Government bonds, for their “safe haven” status. More recently the focus on an increasing deficit has caused a significant rise in yields (fall in prices) in the US bond market, the 10y yield is up 50% in the last 3 months to 1.1%. SharePad shows the spread between the 1 year and the 10 year bond is the widest it has been since the start of 2018, that is, the yield curve is steepening.

This to be welcomed as a sign that the US economy will recover in 2021. Unlike in the early 1990’s bond vigilantes (bond markets policing political spending) have not intimidated anyone, except Recep Erdogan. At the end of 2020, the Turkish Central Bank had to raise interest rates to 17%. The Lira has plunged and the country looks in crisis.

Bond proxies

Inflation expectations rising strongly would be bad for corporate and government bond prices; relatively equity markets should do better. But questions remain how the “bond proxy” equities will perform. Bond proxies have stable cashflows and their prices have risen as long bond yields have fallen over the last 20 years.

No one quite seems to agree which equities are bond proxies though: utility companies like National Grid? Property REITs? Housebuilders? Or consumer staples like Unilever and Diageo? US tech stocks? Private Equity owned stocks?

I looked at the best performing companies in the FTSE 100 over the last 20 years, a period when bonds and bond proxies have done well. Flutter Entertainment +7200%, JD Sports +6240%, Ashtead +3020% so there doesn’t look to be a common theme. I don’t think anyone would claim Tesla is a bond proxy, but that has been the best performing stock in the US.

That said, I can see the argument for Amazon as a bond proxy. Stable cashflows, and perhaps the internet retailer lacks pricing power, so may suffer in a reflationary environment because the vast stock of goods it holds will erode in value if its inventory turn is not fast enough. More broadly tech companies may not have the pricing power than many seem to assume. We’ve seen customers defect from WhatsApp to competitors, caused by a mere change in terms and conditions and a Tweet from Elon Musk. I’m not sure how easy it would be for Spotify or Netflix to raise prices without customers cancelling their subscriptions.

People do agree on what isn’t a bond proxy: banks, oil and mining companies are all inversely correlated with bond prices (they have struggled while bond prices rose over the last 2 decades). Most AIM stocks are in this category too. In the last 6 months, AIM has been one of the best performing markets up +34%, versus Nasdaq +26%, S&P +20%. Risk on.

This week there have been many companies reporting trading updates. It’s not possible to focus on every company that reports, so I have chosen a mix of recovery plays (Hostelworld, Churchill China, Franchise Brands) and Covid winners/safe havens (Wey Education, Games Workshop).

Hostelworld Trading Update

This Online Travel Agent (OTA) put out a trading update saying that FY 2020 bookings were down 78-80% compared to FY 2019. This was inline with previous guidance in October. Clearly the last quarter of 2020 has been more difficult, and the first half of 2021 is likely to be too.

The group had €18.2m of net cash at the end of December, down €10.9m in H2. Cash liabilities due in H1 2021 are €7m, and current liabilities are €21m implying that 2x more liabilities fall due in H2. Management are in discussion with lenders about a new €30m debt facility, with a maturity of 5 years and costing a low to mid-teens interest rate. I wonder if a condition of this new facility might be another equity capital raising?

History This dual listed stock (Premium listing on LSE and Irish Stock Exchange) came to market at 185p per share in October 2015. It was founded in 1999, and offers travellers an online platform for budget accommodation. Similar to booking.com, but for hostels. Pre IPO the revenue growth was impressive, growing to €83.5m in 2015, from zero sixteen years earlier. However since the IPO revenue has been flat (€80.9m FY 2019) I think because booking.com has expanded its offering from hotels to budget accommodation? Probably AirBNB has had some impact too? More broadly Hostelworld faces competition from Google and hostel chains like St Christopher’s who have a direct booking service on their website, and encourage their customers to book direct and cut out the middleman (Hostelworld). The competitive landscape explains why RoCE has been below 10% for the last few years.

However, if Hostelworld can establish a “platform” where travellers arrange their trips and achieve “lock in”, then the company has significant operational leverage. This explains the high valuation (c. $90bn each) that investors are putting on both booking.com and Airbnb, despite the pandemic.

HSW did an equity placing in June, raising £14m gross at a discount of 7% to the then price of 77p. Then in September the company announced that the Chief Financial Officer who had only been in the position since 2018, would leave for a new job. Clearly this would not have been helpful when it came to negotiating more support from lenders.

Opinion I timed my purchase of this stock very badly in Q4 2019, the shares are down 41% since 1 Jan 2020. Then in the last 3 months the shares have participated in the “vaccine rally” +40%. If I traded frequently I might look to sell, hoping to buy back the shares more cheaply in a couple of months. However I deliberately try to keep my number of transactions down, so I will do nothing. The shares are trading on 1x FY 2019 revenue and 6x FY 2019 PER, and I think there’s a good probability that the company makes it through the next few months and recovers strongly.

Churchill China Trading Update

This ceramics (or as they say on their website: “total table top solutions”) company supplies hotels and restaurants. They put out an update for FY 2020 (December year end) saying that they traded profitably through H2, despite the tightening of Covid restrictions at the end of last year. Q1 will be difficult for the same reason, but after that they expect improved conditions for 2021. Results will be announced in April 2021.

Around 42% of sales are to the UK, and 58% exports (of which Europe is the largest market at 36% of turnover). Management say that their preparations for BREXIT are in place, and the company probably benefits from the trade deal that was struck at the 11th hour.

History The company goes back to 1795, and listed on the London Stock Exchange (not AIM) in 1994. Since 2015 revenue has grown at 10% CAGR to FY 19 £67.5m and PBT has more than doubled over the same period to £11m FY 19. Up until 2020 RoCE has been steadily rising over the last 10 years to 25% FY 2019, helped by a gross margin of around 80%. The shares are down 35% versus a year ago, but on a ten year view they are up from below £3 to a peak of £20 before selling off sharply due to Covid.

They had net cash on their balance sheet of £16m at 30th June, though management believe it is too early to declare a dividend at this stage. This company should survive though I think I’d prefer to wait and see if further short term bad news causes the price to fall further before buying.

Opinion This looks like a quality company that you can “buy and hold” forever. The shares are trading on 16x PER 2019, it will probably take a couple of years for profits to recover back to £6.6m that they reported that year, as cash starved restaurants and hotels are unlikely to prioritise replacing their tableware. But the company’s long term history and cash on balance sheet gives comfort that the business will eventually recover.

Games Workshop

The company announced H1 results to November with Revenue £186.8 +27% and PBT £91.6m +57% on a constant currency basis. Previous guidance announced in December was for sales of £185m and PBT of “not less than” £90m, so these numbers were in line. This is an impressive performance, given that the majority of the company’s 529 retail stores have been restricted or closed because of Covid. Online sales were up +87%, and at £46m, now represent a quarter of group sales. The Chief Exec admits in the commentary that online is not as great as they would like it to be. That said, the total amount of online sales is understated, because the company only reports sales through its own online stores in the “Online” category, in reality independent retailers who sell the product also have websites, but this is reported in “Trade” +33% (56% of group revenue).

Dividend declared in 2020 was 80p, versus 100p the year before. Cash on balance sheet was £96.5m at the end of November, an increase of £43.5m on the previous 6 months. Staff and customers are thanked in the outlook statement, and the Chief Exec talks about the biggest risk is that senior management become complacent. No comment on expectations for 2021, except that they have internal plans, and they will keep investors updated with regular RNS. Sales in December were “broadly in line” – which may translate as slightly disappointing, given the tightening of Covid restrictions and a tough comparison to December last year?

Opinion More of the same from a well-regarded company. I’m a long term holder, and there’s nothing in this statement to make me feel uneasy. The SharePad summary tab shows impressive RoCE of 65.2% and 57.8% CRoCI.

Such quality comes at a price, over 50x PER. The shares were down 7% on the day of the results, despite the numbers being in line with guidance, which probably reflects the high level of expectations that some investors have. That said, the company could have beaten PBT guidance by 6%, but chose not to, instead spending £5m on a well-deserved staff bonus. As a shareholder I’m thoroughly behind that decision.

Franchise Brands Trading Update

The company announced in a trading update for FY 2020 (December year end) that they expect revenue, adjusted EBITDA and adjusted EPS to be ahead of consensus expectations (Revenue £48.6m, Adjusted EBITDA £6.1m, Adjusted EPS 3.9p). The company did a placing last April at 90p raising £13.6m net. Last week’s RNS says that they finished the year with £13.2m of gross cash, although I think a net cash figure would have been more useful, which stood at £2.6m at June, including capitalised leases.

History The company was founded in 2008 by Stephen Hemsley and Nigel Wray, who both did well from Dominos Pizza and hence have a deep knowledge of the franchise sector. Unusually this company has two Admission Documents, from 2016 and 2017. In August 2016 they raised £3.5m at 33p valuing the company at £15.5m. At the time their brands were ChipsAway (paintwork scratches, minor dents in cars), Ovenclean and MyHome (residential cleaning). Then in April 2017, they raised a further £20m at 67p, valuing the company at £52m, in order to buy Metro Rod, a leading provider of drain clearance and maintenance services. Since then they have added to these franchises with Willow Pumps (installation and maintenance of pump stations), Barking Mad (dog sitting) and The Handyman Van (home and property maintenance).

B2B and B2C: The company splits its operations into 2 divisions i) B2B division (some of which is direct labour, rather than franchise): Metro Rod, Metro Plumb, and Willow Pumps 84% of Adjusted EBITDA and ii) B2C ChipsAway, Ovenclean, Barking Mad 32% of Adjusted EBITDA. The percentages do not sum to 100%, because the company deducts £451K of overheads from Adjusted EBITDA of £2.8m at H1 2020. In the B2C divisions franchisees pay a fixed monthly fee, in the B2B divisions franchisees pay a turnover related fee.

Ownership The business was co-founded by Nigel Wray, who is a non Exec Director and owns 23%, he has been very successful with Domino’s Pizza and various other investments. He is co-owner of Saracens Rugby Club but has recently resigned as Chairman.* One of his least successful investments was Seymour Pierce, the stockbroker where I used to work.

Stephen Hemsley is the Executive Chairman, and also co-founded the business. He was Non Executive Chairman of Domino’s Pizza for 21 years, where he oversaw the growth in market cap from £25m to £1.5bn. He also owns 23% of the shares. Given the insiders own more than half of the company, there is a lack of free float, but Gresham House 5.7% and Hargreave Hale 4.2% still own disclosable stakes.

Forecasts The company’s broker Allenby Capital tweaked up their forecasts marginally on the RNS. In 2021F they are forecasting revenue of £58m, adjusted PBT of £5.8m and EPS of 4.8p, putting the shares on 22x PER 2021F. The broker is also going for a steep hike in the dividend to 1.4p v 0.9p in 2020F.

Opinion Whenever I have looked at this company in the past, I’ve liked the story, but the shares were too expensive. The shares are down 15% in the last year, so I’m following it closely.

Wey Education H1 Trading Update

This online school with an August year end, said that the first 4 months of their financial year had started well, and they were ahead of expectations (without telling us what those expectations were and only that they were “significantly” ahead.)

They also say that Wey will begin charging VAT to UK customers, following a group structure and tax review. The reason given is to allow the company to recover VAT expenses and ensure that InterHigh (roughly 2/3 of revenue the online, fee paying school) would be able to distribute profits. They will smooth the transition for existing customers, rather than hike fees 20% immediately.

Forecasts WH Ireland raised their FY2021 revenue forecast by a whopping 23% to £13m, and PBT up 10% as the company will likely increase marketing expense. The broker is forecasting EPS of 0.81p and 1.40p in 2021F and 2022F respectively. The current price puts the shares on 27x PER 2022F. There is still no dividend forecast, but WH Ireland forecast net cash to rise above £10m in 2022F.

Opinion Public schools like Eton, Winchester and Charterhouse have “non-profit” status, which means that though their fees are £40K a year, parents do not pay VAT on the education services they provide. Though Wey charges a fraction of traditional public schools (roughly £3K a year) it is clearly in business to generate a profit. To compete on a level playing field they had set up a legal structure with InterHigh Ltd as non profit, which then paid money to Wey for educational services. It seems likely that the VAT man has raised his eyebrows at this structure.

I follow this investor’s blog and he has been consistently insightful on the company. He flagged the VAT issue, and also regulatory risk in general, in June last year in this post. In the past he has expressed scepticism towards the Chairman Barry Whipp. Dressing the announcement up as a voluntary decision to charge VAT to recover tax on expenditure (unlikely given that Wey’s largest cost is staff, which wouldn’t qualify) could be an example of the Chairman’s unconvincing communication style with investors.

That said, I like the company, and continue to hold it in my portfolio.

Bruce Packard

Notes

Bruce owns shares in Games Workshop, Hostelworld and Wey Education

* https://www.theguardian.com/sport/2020/jan/02/time-for-a-fresh-start-nigel-wray-retires-as-saracens-chairman

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.