Looking at the sectors that have been worst hit by the cost of living crisis, Bruce suggests a sector filter could be used to ‘read across’ where problems are yet to emerge. Companies covered BMS, CBOX and BGO.

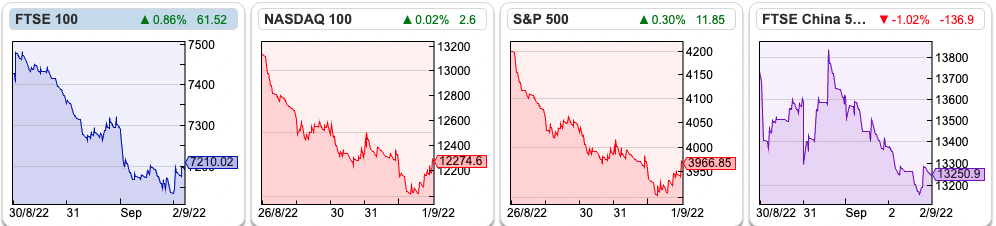

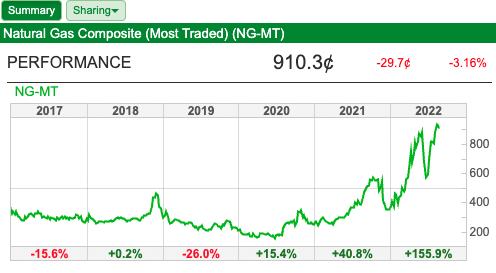

The FTSE 100 was down -3.5% last week to 7,210. The S&P500 was down -2.2% and the Nasdaq 100 down -2.6%. Commentators attribute that weakness to hawkish comments from Central Bankers at their Jackson Hole conference, which seems surprising given that most investors were already expecting hawkish comments. The US 10Y Government bond yield rose back to 3.24%, which is the same level as June this year when the S&P 500 was -8% lower than the current level. Oil was down -5% to $94 per barrel of Brent Crude. Using Brent Crude as a proxy for energy prices is a little misleading though, the Nymex Natural Gas contract (NG-MT on Sharepad) is up +156% to $910 since the start of the year.

The Resolution Foundation has published a briefing on the impact on UK households will struggle with rising energy prices and a suggested policy response. In case you don’t know it, the Resolution Foundation was set up by Sir Clive Cowdery, who made a fortune buying the closed life books from insurers and banks, then consolidating them into one vehicle (also called Resolution). He sold out in 2008, and nearly bought Bradford & Bingley which is when I first came across him. Instead of buying the failing buy-to-let lender or a trophy asset like a football team, he decided to spend some of his fortune on the Resolution Foundation, a think tank that he set up to raise the profile of low-to-middle income households. His thinking was that there are many charities focused on the very poorest in society, but the ‘working poor’ are the backbone of the country and don’t have much of a voice. In the past, I’ve found Resolution’s analysis more insightful than much of what investment bank research economists produce.

Many economists, including the IMF, argue that subsidising energy costs with price reductions is a bad idea because we should incentivise households to cut back on energy use. To some extent that’s true. The problem, as the Resolution Foundation pointed out, is that most people on low incomes rent their homes and rising energy costs don’t incentivise landlords to invest in energy efficiency, because the tenants pay the bills. The foundation also warns about ‘cliff edges’, where not qualifying means that households lose out on hundreds of pounds of support.

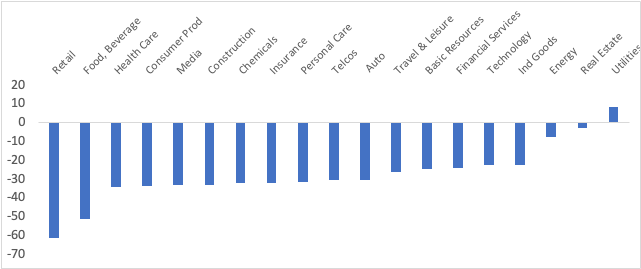

The AIM market off -29% YTD, is already reflecting some of that stress on households. Performance hides a wide dispersion among sectors, as the chart which I downloaded from Sharepad shows.

So far, the worst hit sectors have been Retail -61% YTD and Food &. Beverages -51% YTD (which contains VINO, HOTC and FEVR all down c. -70% YTD). Healthcare too has been hit by a sell-off this year – theoretically, healthcare should be recession proof but many companies in the sector are involved in drug discovery (for instance Open Orphan down -54% YTD) and had performed very strongly in 2020-2021. I am surprised at how well Travel & Leisure has held up, which I think reflects that 2020 and 2021 had seen a significant sell-off.

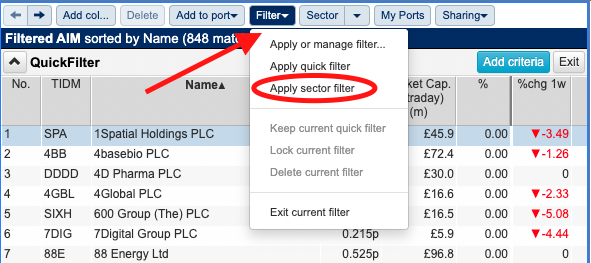

You can use Sharepad to see the AIM and FTSE 350 performance by sector. Then using the “Quick Filter” to see the best and worst performing stocks in each sector. This could be an interesting way to filter for oversold stocks and turnaround situations. Alternatively, the filter could be used to ‘read across’ from companies that have already warned in one sector to other companies in the same sector which could also disappoint.

A second thought about the coming winter is that we could see problems emerge with banks unsecured / credit card lending books. In 2002 Barclays held an analyst day in a fancy hotel near Tower Bridge. Somewhere I have a photo of me holding up the Premier League trophy which was on display because Barclaycard sponsored the football. The bank’s aim was to convince analysts and investors how sophisticated their Barclaycard systems and credit scorecards were. They also suggested that Barclaycard enjoyed an advantage versus US card companies like MBNA and Capital One, who at the time were entering the UK market. As a universal bank, Barclays claimed that having its own customers’ current account relationship meant that their credit card bad debts would be lower than the US card companies. Over the next couple of years, unemployment remained low and Central Banks cautiously raised interest rates.

You can probably guess what is coming next: by FY 2006, Barclaycard’s bad debts had quadrupled to £1.5bn, and were 70% of the group’s total bad debt charge, despite being less than 10% of the bank’s loan book. The same was true of Lloyds unsecured credit card book. This was an early warning sign that using computer models to make lending decisions based on extrapolating historic correlations was flawed. As banks made credit more easily available to borrowers, this invalidated their models based on backward-looking data. The same thing happened with subprime mortgages with the problems becoming obvious about 12-18 months later.

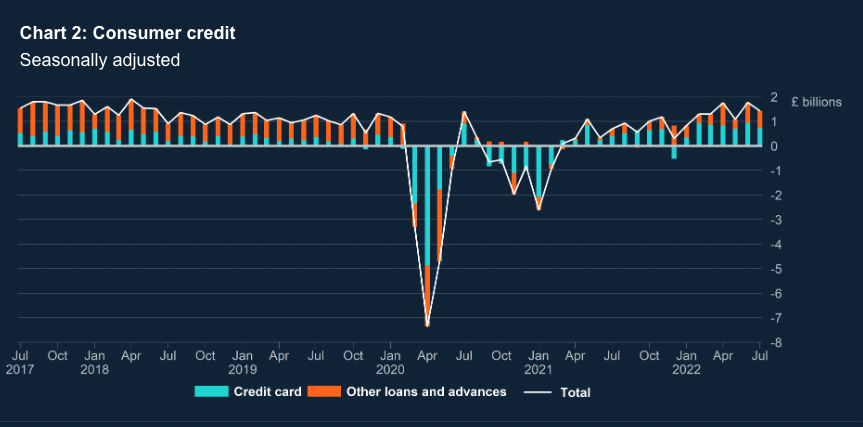

Last week the Bank of England released household borrowing data, showing credit card borrowing growing +13% annually, the highest annual rate since October 2005 (+13.7%) just when Barclaycard’s bad debts were ballooning. The chart below shows that during the pandemic borrowers paid down their credit cards, but are now borrowing more than before the pandemic to offset the rising cost of living. That seems fair enough to get through a couple of difficult months but could cause problems if energy prices continue to squeeze incomes. Barclays share price is off -12% YTD (the worst performance among UK clearing banks) and is trading at 0.4x net book value.

This week I look at Braemar Shipping’s recovery, Cake Box’s profit warning and Bango’s acquisition of NTT DoCoMo’s payments business.

Braemar Shipping Services FY Feb 2022

This shipping services company has released FY Feb 2022 results just before the 6 months mandatory reporting period cut off. Revenues from continuing operations were up +21% to £101m. They made two disposals during the year: a £5m gain on disposal from the sale of its investment in Cory Brothers Shipping and £4m gain selling AqualisBraemar (combined proceeds from both sales were £17m).

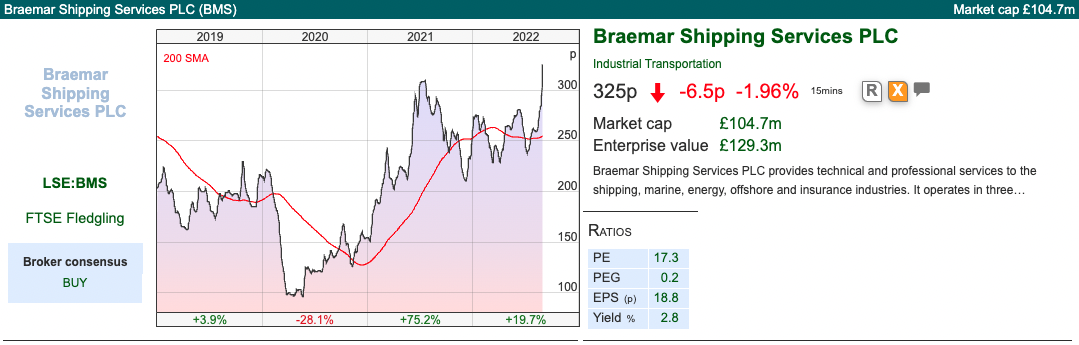

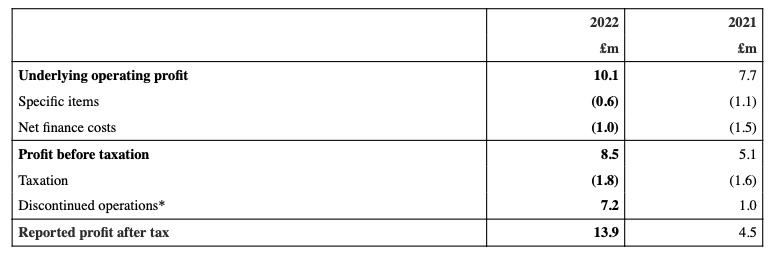

These are a very messy set of numbers, with various prior year corrections, including a correction saying that their Revolving Credit Facility (RCF) of £23m, which expires in September 2023, has been reclassified as a long-term debt. I’ve included the company’s own reconciliation of underlying operating PBT to reported profit.

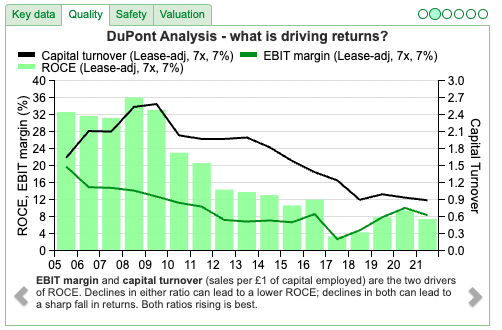

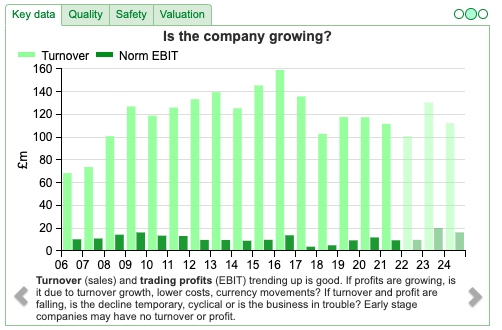

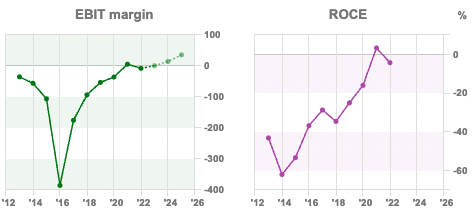

The balance sheet is rather weak, though shareholders’ equity stood at £75m, net tangible assets are minus £5m because they are carrying £80m of goodwill. There’s also a small pension deficit of £2m (present value of obligations: £15m, fair value of scheme assets: £13m). Sharepad shows that profitability (RoCE) has been in long term decline, driven by both falling capital turnover and EBIT margins.

The recent disposals have helped to support the balance sheet, with net bank debt (ie ex lease liabilities) falling to £2.8m versus £9m Feb 2021. As at 31 July 2022 the Group had net bank debt of £7m with available headroom in the RCF of £6m. The going concern statement says that the directors have discussed the extension of the RCF with the Group’s main bankers, HSBC, and have received acceptable indicative terms for such an extension. They also say that budgeted revenues could fall 41% from the base case assumptions to August 2023 for them to be in breach of their banking covenants. Given the strong start to this financial year (see outlook below) that seems a remote possibility.

Outlook: the company also released a separate RNS with a trading update for FY Feb 2023, where they say trading has been “exceptionally strong” for the first five months of this financial year. They now believe underlying operating PBT for FY Feb 2023F should be not less than £20m (doubling from FY 2022 £10.1m) and well ahead of the company’s previous expectations of £12m. They say around £5m of that comes from US dollar strength.

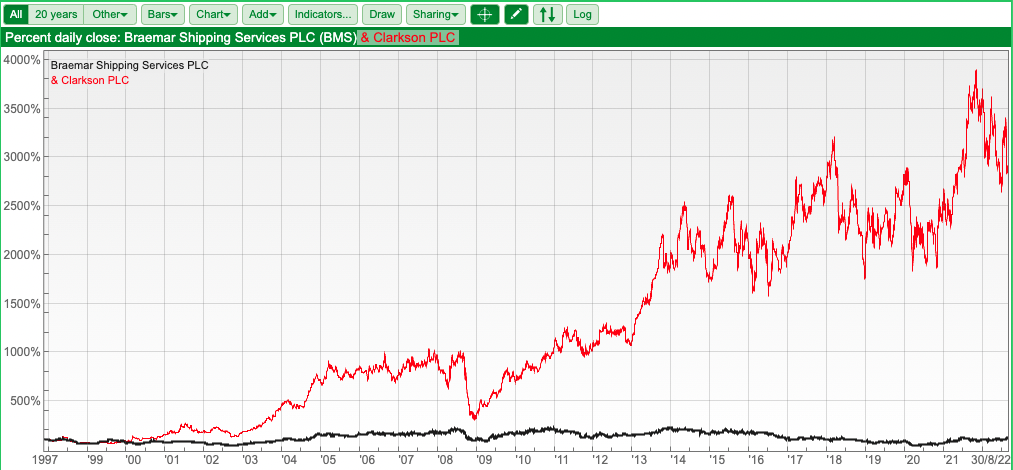

History: Braemar has been listed on the LSE since 1997, and I have never quite worked out why the performance has been so much worse than Clarkson (in red in the chart below), which is in the same sector. That is, Braemar’s underperformance makes sense in the light of revenue being the same level as 15 years ago as the chart shows.

However, over the same time frame, Clarkson has trebled revenue while also reporting better profitability (as measured by RoCE and CRoCI). Pre financial crisis (between 1998 to 2008) Braemar did have higher top-line growth (+30% Compound Annual Growth Rate) than Clarkson (+22% CAGR), but Clarkson focused on margins, growing PBT at a CAGR of +45%. I wrote a blog post in 2017, trying to see if there was any clue in either company’s management commentary. I’m also interested if others have thoughts about the divergence in performance, please do post in the Sharepad chat.

Valuation: Following the increase in forecasts, the shares are now trading on a PER 10x FY Feb 2024F and Feb 2025F. The dividend yield is above 4% for both those years too. However, the last 6 years RoCE has averaged below 7%, so it’s hard to justify a re-rating unless the profitability improves.

There’s also an 8p (or 18%) difference between FY Feb 2022 basic EPS of 45p and diluted EPS of 37p. That’s caused by all the incentive schemes: a Deferred Bonus Plan, a new Deferred Bonus Plan, Save as You Earn, Employee Share Ownership Plan, Restricted Share Plan and also an LTIP. Insiders seem to have found all sorts of interesting ways of rewarding themselves, despite the share price being below end 2004 levels.

Opinion: This looks like an interesting turnaround situation, but I would need to be persuaded that the fundamental problems had been fixed, rather than disaster averted by selling off valuable businesses and increased profits from dollar strength. Waiting 6 months before releasing FY results to Feb is not persuading me that the business has turned the corner.

Cake Box Profit warning

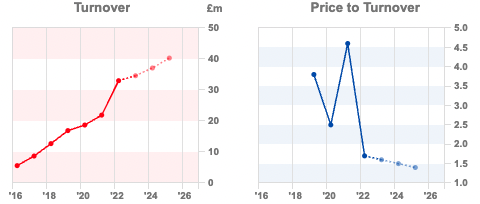

This egg-free cake franchise with a March year-end announced that they would be “significantly below” market expectations (without saying what those expectations were). Sharepad shows revenue FY Mar 2023F of £35m (implied +7% growth) and PBT £7.2m (implied +3.5% growth). The shares were off more than -45% on the morning of the RNS.

As a reminder, Maynard wrote about the company at the start of the year flagging some issues, when the share price was 330p. The auditor had resigned, but Maynard also pointed out some peculiar disclosure around payables and receivables, inconsistencies between the Annual Report and the RNS, plus some other bookkeeping curiosities. The Sharepad authors don’t set out to trash companies, but we are trying to highlight any inconsistencies that we come across. If you were invested in CBOX at the start of the year hopefully you read Maynard’s piece and decided to exit, rather than ‘shoot the messenger’.

The group has seen weaker than anticipated franchise sales, with like-for-like sales down -2.8% for the first 5 months of the company’s H1. For comparison, they reported like-for-like sales growth of +12% at the end of June, so that’s a considerable slowdown. The significance of like-for-like figures is that they adjust out stores that have opened within the last 12 months, which obviously flatter reported growth (CBOX opened 31 new stores FY Mar 2022, a +20% increase in their estate). The balance sheet is not financially distressed, they had £6.7m of cash at the end of August and still intend to pay a £2m dividend in September. We can be certain that the cash really is there because they appointed an interim CFO, David Forth, who would have phoned the bank on his first morning to confirm that the cash figure was correct.

Risk: I warned back in April that one risk that is specific to franchise business is “franchisee churn”. In their Admission Document, CBOX says that if franchisees fail then that could cause “damage to the Group’s brand, thereby potentially reducing the ability to sustain and/or grow revenues and which may have a detrimental effect upon the Group’s future trading performance and financial condition.” The former Domino’s Pizza management who are now running Franchise Brands are very clear that for a franchising operation to be sustainable, the formula has to work for franchisees.

To be clear, I haven’t heard of any problems with churn at Cake Box. However, if franchisees who have opened new stores in the last couple of years are struggling to make money, it won’t be immediately obvious, but eventually, the rate of new store openings will slow.

Back in June CBOX said: “for the coming year we have a target of another 24 new store openings and we will continue with kiosk development. This should bring us the 200th Cake Box store in the autumn of 2022, well in line with our stated ambition of having 250 stores.” Unlike their April trading update, there’s no mention of the number of stores or new openings in last week’s RNS. Study silence to learn the music.

Valuation: Following the sell-off from the start of the years the valuation ratios have de-rated significantly. The shares are now trading on 12x FY Mar 2024F and 11x FY Mar 2023F.

The Chief Executive, Sukh Chamdal bought 225K of shares at 122p following the profit warning which caused a post-warning bounce. He owns just over 10m shares, or 25% of the company. Institutional investors include Amati 9.7%, Ennismore 6.5% and AXA 5.2%. Note too that Sharepad is impressed by CBOX’s quality metrics.

Opinion: I’m encouraged by the Chief Executive buying but think we are a long way from the ‘cost of living’ pressure abating. I would wait 6 months and then revisit the investment case. Hopefully, Maynard’s diligence in January has saved some readers from making a mistake.

Bango acquisition

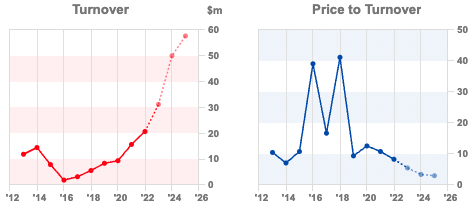

I noted a month ago that this loss-making Direct Carrier Billing (DCB) company was close to break even this year. Last week they announced the acquisition of Docomo Digital payments business from NTT Docomo (the largest mobile phone operator in Japan). The BGO share price rose +25% in response. They paid €4m, funded using existing Bango cash, which looks a good price, particularly as Docomo had a cash balance of €3m (so a net consideration of €1m).

The business being acquired lost €1.3m before tax FY Mar 2022. Korean NHN, which already owns 13.75% of Bango’s shares, has offered to lend Bango a $10m loan. There’s no plan to raise equity, according to management.

The RNS says that there’s likely to be a $30m-$35m restructuring charge this year, which seems rather high given the Docomo only had €11m of net assets at its March year-end—+++++++++++++++++-. They then expect synergies of $21m and a revenue contribution of $16m in FY 2023 (a 47% uplift to previous forecasts of $34m.)

Valuation: $50m of revenue in FY 2023 suggests that the shares are on 3.4x forecast revenue. I find the other numbers in the RNS rather strange though, expected synergies of $21m exceed revenue contribution of $16m. The huge $30m-$35m restructuring charge in comparison to the €1m net consideration to acquire the business looks rather odd too. Management said on the call that they would be writing down the value of previous investments in DoCoMo’s platform (everything would be shifted on to the BGO platform). That is no doubt true, but BGO are acquiring €11m of net assets by paying €4m (or €1m net of cash) so given they’re paying less than accounting book value, it’s hard to understand how they can write down $30-35m.

Perhaps some of the amount could be used to flatter profits in future years, by taking all the costs upfront then releasing provisions and reserves in future years? The RNS contains a comment from MP Kwasi Kwarteng, in charge of Business, Energy and Industrial Strategy. That’s presumably to reassure investors, but not something that I’ve seen before.

Opinion: I noted in August that Bango had a couple of decades of losses, but looked like it was about to make a sustainable profit. Given the size of the restructuring charge, the profits in FY 2023F seem even more likely, but that’s also more reason to pay close attention to the cashflow statement. There’s a half an hour presentation on IMC for more details, including Q&A, when management were asked about the synergies and restructuring charges.

Notes

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 05/09/22 |BMS, CBOX, BGO| Winter is coming

Looking at the sectors that have been worst hit by the cost of living crisis, Bruce suggests a sector filter could be used to ‘read across’ where problems are yet to emerge. Companies covered BMS, CBOX and BGO.

The FTSE 100 was down -3.5% last week to 7,210. The S&P500 was down -2.2% and the Nasdaq 100 down -2.6%. Commentators attribute that weakness to hawkish comments from Central Bankers at their Jackson Hole conference, which seems surprising given that most investors were already expecting hawkish comments. The US 10Y Government bond yield rose back to 3.24%, which is the same level as June this year when the S&P 500 was -8% lower than the current level. Oil was down -5% to $94 per barrel of Brent Crude. Using Brent Crude as a proxy for energy prices is a little misleading though, the Nymex Natural Gas contract (NG-MT on Sharepad) is up +156% to $910 since the start of the year.

The Resolution Foundation has published a briefing on the impact on UK households will struggle with rising energy prices and a suggested policy response. In case you don’t know it, the Resolution Foundation was set up by Sir Clive Cowdery, who made a fortune buying the closed life books from insurers and banks, then consolidating them into one vehicle (also called Resolution). He sold out in 2008, and nearly bought Bradford & Bingley which is when I first came across him. Instead of buying the failing buy-to-let lender or a trophy asset like a football team, he decided to spend some of his fortune on the Resolution Foundation, a think tank that he set up to raise the profile of low-to-middle income households. His thinking was that there are many charities focused on the very poorest in society, but the ‘working poor’ are the backbone of the country and don’t have much of a voice. In the past, I’ve found Resolution’s analysis more insightful than much of what investment bank research economists produce.

Many economists, including the IMF, argue that subsidising energy costs with price reductions is a bad idea because we should incentivise households to cut back on energy use. To some extent that’s true. The problem, as the Resolution Foundation pointed out, is that most people on low incomes rent their homes and rising energy costs don’t incentivise landlords to invest in energy efficiency, because the tenants pay the bills. The foundation also warns about ‘cliff edges’, where not qualifying means that households lose out on hundreds of pounds of support.

The AIM market off -29% YTD, is already reflecting some of that stress on households. Performance hides a wide dispersion among sectors, as the chart which I downloaded from Sharepad shows.

So far, the worst hit sectors have been Retail -61% YTD and Food &. Beverages -51% YTD (which contains VINO, HOTC and FEVR all down c. -70% YTD). Healthcare too has been hit by a sell-off this year – theoretically, healthcare should be recession proof but many companies in the sector are involved in drug discovery (for instance Open Orphan down -54% YTD) and had performed very strongly in 2020-2021. I am surprised at how well Travel & Leisure has held up, which I think reflects that 2020 and 2021 had seen a significant sell-off.

You can use Sharepad to see the AIM and FTSE 350 performance by sector. Then using the “Quick Filter” to see the best and worst performing stocks in each sector. This could be an interesting way to filter for oversold stocks and turnaround situations. Alternatively, the filter could be used to ‘read across’ from companies that have already warned in one sector to other companies in the same sector which could also disappoint.

A second thought about the coming winter is that we could see problems emerge with banks unsecured / credit card lending books. In 2002 Barclays held an analyst day in a fancy hotel near Tower Bridge. Somewhere I have a photo of me holding up the Premier League trophy which was on display because Barclaycard sponsored the football. The bank’s aim was to convince analysts and investors how sophisticated their Barclaycard systems and credit scorecards were. They also suggested that Barclaycard enjoyed an advantage versus US card companies like MBNA and Capital One, who at the time were entering the UK market. As a universal bank, Barclays claimed that having its own customers’ current account relationship meant that their credit card bad debts would be lower than the US card companies. Over the next couple of years, unemployment remained low and Central Banks cautiously raised interest rates.

You can probably guess what is coming next: by FY 2006, Barclaycard’s bad debts had quadrupled to £1.5bn, and were 70% of the group’s total bad debt charge, despite being less than 10% of the bank’s loan book. The same was true of Lloyds unsecured credit card book. This was an early warning sign that using computer models to make lending decisions based on extrapolating historic correlations was flawed. As banks made credit more easily available to borrowers, this invalidated their models based on backward-looking data. The same thing happened with subprime mortgages with the problems becoming obvious about 12-18 months later.

Last week the Bank of England released household borrowing data, showing credit card borrowing growing +13% annually, the highest annual rate since October 2005 (+13.7%) just when Barclaycard’s bad debts were ballooning. The chart below shows that during the pandemic borrowers paid down their credit cards, but are now borrowing more than before the pandemic to offset the rising cost of living. That seems fair enough to get through a couple of difficult months but could cause problems if energy prices continue to squeeze incomes. Barclays share price is off -12% YTD (the worst performance among UK clearing banks) and is trading at 0.4x net book value.

This week I look at Braemar Shipping’s recovery, Cake Box’s profit warning and Bango’s acquisition of NTT DoCoMo’s payments business.

Braemar Shipping Services FY Feb 2022

This shipping services company has released FY Feb 2022 results just before the 6 months mandatory reporting period cut off. Revenues from continuing operations were up +21% to £101m. They made two disposals during the year: a £5m gain on disposal from the sale of its investment in Cory Brothers Shipping and £4m gain selling AqualisBraemar (combined proceeds from both sales were £17m).

These are a very messy set of numbers, with various prior year corrections, including a correction saying that their Revolving Credit Facility (RCF) of £23m, which expires in September 2023, has been reclassified as a long-term debt. I’ve included the company’s own reconciliation of underlying operating PBT to reported profit.

The balance sheet is rather weak, though shareholders’ equity stood at £75m, net tangible assets are minus £5m because they are carrying £80m of goodwill. There’s also a small pension deficit of £2m (present value of obligations: £15m, fair value of scheme assets: £13m). Sharepad shows that profitability (RoCE) has been in long term decline, driven by both falling capital turnover and EBIT margins.

The recent disposals have helped to support the balance sheet, with net bank debt (ie ex lease liabilities) falling to £2.8m versus £9m Feb 2021. As at 31 July 2022 the Group had net bank debt of £7m with available headroom in the RCF of £6m. The going concern statement says that the directors have discussed the extension of the RCF with the Group’s main bankers, HSBC, and have received acceptable indicative terms for such an extension. They also say that budgeted revenues could fall 41% from the base case assumptions to August 2023 for them to be in breach of their banking covenants. Given the strong start to this financial year (see outlook below) that seems a remote possibility.

Outlook: the company also released a separate RNS with a trading update for FY Feb 2023, where they say trading has been “exceptionally strong” for the first five months of this financial year. They now believe underlying operating PBT for FY Feb 2023F should be not less than £20m (doubling from FY 2022 £10.1m) and well ahead of the company’s previous expectations of £12m. They say around £5m of that comes from US dollar strength.

History: Braemar has been listed on the LSE since 1997, and I have never quite worked out why the performance has been so much worse than Clarkson (in red in the chart below), which is in the same sector. That is, Braemar’s underperformance makes sense in the light of revenue being the same level as 15 years ago as the chart shows.

However, over the same time frame, Clarkson has trebled revenue while also reporting better profitability (as measured by RoCE and CRoCI). Pre financial crisis (between 1998 to 2008) Braemar did have higher top-line growth (+30% Compound Annual Growth Rate) than Clarkson (+22% CAGR), but Clarkson focused on margins, growing PBT at a CAGR of +45%. I wrote a blog post in 2017, trying to see if there was any clue in either company’s management commentary. I’m also interested if others have thoughts about the divergence in performance, please do post in the Sharepad chat.

Valuation: Following the increase in forecasts, the shares are now trading on a PER 10x FY Feb 2024F and Feb 2025F. The dividend yield is above 4% for both those years too. However, the last 6 years RoCE has averaged below 7%, so it’s hard to justify a re-rating unless the profitability improves.

There’s also an 8p (or 18%) difference between FY Feb 2022 basic EPS of 45p and diluted EPS of 37p. That’s caused by all the incentive schemes: a Deferred Bonus Plan, a new Deferred Bonus Plan, Save as You Earn, Employee Share Ownership Plan, Restricted Share Plan and also an LTIP. Insiders seem to have found all sorts of interesting ways of rewarding themselves, despite the share price being below end 2004 levels.

Opinion: This looks like an interesting turnaround situation, but I would need to be persuaded that the fundamental problems had been fixed, rather than disaster averted by selling off valuable businesses and increased profits from dollar strength. Waiting 6 months before releasing FY results to Feb is not persuading me that the business has turned the corner.

Cake Box Profit warning

This egg-free cake franchise with a March year-end announced that they would be “significantly below” market expectations (without saying what those expectations were). Sharepad shows revenue FY Mar 2023F of £35m (implied +7% growth) and PBT £7.2m (implied +3.5% growth). The shares were off more than -45% on the morning of the RNS.

As a reminder, Maynard wrote about the company at the start of the year flagging some issues, when the share price was 330p. The auditor had resigned, but Maynard also pointed out some peculiar disclosure around payables and receivables, inconsistencies between the Annual Report and the RNS, plus some other bookkeeping curiosities. The Sharepad authors don’t set out to trash companies, but we are trying to highlight any inconsistencies that we come across. If you were invested in CBOX at the start of the year hopefully you read Maynard’s piece and decided to exit, rather than ‘shoot the messenger’.

The group has seen weaker than anticipated franchise sales, with like-for-like sales down -2.8% for the first 5 months of the company’s H1. For comparison, they reported like-for-like sales growth of +12% at the end of June, so that’s a considerable slowdown. The significance of like-for-like figures is that they adjust out stores that have opened within the last 12 months, which obviously flatter reported growth (CBOX opened 31 new stores FY Mar 2022, a +20% increase in their estate). The balance sheet is not financially distressed, they had £6.7m of cash at the end of August and still intend to pay a £2m dividend in September. We can be certain that the cash really is there because they appointed an interim CFO, David Forth, who would have phoned the bank on his first morning to confirm that the cash figure was correct.

Risk: I warned back in April that one risk that is specific to franchise business is “franchisee churn”. In their Admission Document, CBOX says that if franchisees fail then that could cause “damage to the Group’s brand, thereby potentially reducing the ability to sustain and/or grow revenues and which may have a detrimental effect upon the Group’s future trading performance and financial condition.” The former Domino’s Pizza management who are now running Franchise Brands are very clear that for a franchising operation to be sustainable, the formula has to work for franchisees.

To be clear, I haven’t heard of any problems with churn at Cake Box. However, if franchisees who have opened new stores in the last couple of years are struggling to make money, it won’t be immediately obvious, but eventually, the rate of new store openings will slow.

Back in June CBOX said: “for the coming year we have a target of another 24 new store openings and we will continue with kiosk development. This should bring us the 200th Cake Box store in the autumn of 2022, well in line with our stated ambition of having 250 stores.” Unlike their April trading update, there’s no mention of the number of stores or new openings in last week’s RNS. Study silence to learn the music.

Valuation: Following the sell-off from the start of the years the valuation ratios have de-rated significantly. The shares are now trading on 12x FY Mar 2024F and 11x FY Mar 2023F.

The Chief Executive, Sukh Chamdal bought 225K of shares at 122p following the profit warning which caused a post-warning bounce. He owns just over 10m shares, or 25% of the company. Institutional investors include Amati 9.7%, Ennismore 6.5% and AXA 5.2%. Note too that Sharepad is impressed by CBOX’s quality metrics.

Opinion: I’m encouraged by the Chief Executive buying but think we are a long way from the ‘cost of living’ pressure abating. I would wait 6 months and then revisit the investment case. Hopefully, Maynard’s diligence in January has saved some readers from making a mistake.

Bango acquisition

I noted a month ago that this loss-making Direct Carrier Billing (DCB) company was close to break even this year. Last week they announced the acquisition of Docomo Digital payments business from NTT Docomo (the largest mobile phone operator in Japan). The BGO share price rose +25% in response. They paid €4m, funded using existing Bango cash, which looks a good price, particularly as Docomo had a cash balance of €3m (so a net consideration of €1m).

The business being acquired lost €1.3m before tax FY Mar 2022. Korean NHN, which already owns 13.75% of Bango’s shares, has offered to lend Bango a $10m loan. There’s no plan to raise equity, according to management.

The RNS says that there’s likely to be a $30m-$35m restructuring charge this year, which seems rather high given the Docomo only had €11m of net assets at its March year-end—+++++++++++++++++-. They then expect synergies of $21m and a revenue contribution of $16m in FY 2023 (a 47% uplift to previous forecasts of $34m.)

Valuation: $50m of revenue in FY 2023 suggests that the shares are on 3.4x forecast revenue. I find the other numbers in the RNS rather strange though, expected synergies of $21m exceed revenue contribution of $16m. The huge $30m-$35m restructuring charge in comparison to the €1m net consideration to acquire the business looks rather odd too. Management said on the call that they would be writing down the value of previous investments in DoCoMo’s platform (everything would be shifted on to the BGO platform). That is no doubt true, but BGO are acquiring €11m of net assets by paying €4m (or €1m net of cash) so given they’re paying less than accounting book value, it’s hard to understand how they can write down $30-35m.

Perhaps some of the amount could be used to flatter profits in future years, by taking all the costs upfront then releasing provisions and reserves in future years? The RNS contains a comment from MP Kwasi Kwarteng, in charge of Business, Energy and Industrial Strategy. That’s presumably to reassure investors, but not something that I’ve seen before.

Opinion: I noted in August that Bango had a couple of decades of losses, but looked like it was about to make a sustainable profit. Given the size of the restructuring charge, the profits in FY 2023F seem even more likely, but that’s also more reason to pay close attention to the cashflow statement. There’s a half an hour presentation on IMC for more details, including Q&A, when management were asked about the synergies and restructuring charges.

Notes

Bruce Packard

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.