While he is away skiing, Bruce asked ex-fund manager (with 16 years experience) and private Investor Jamie Ward to manage his weekly commentary this week. Jamie looks at the best things about being a private investor compared to being in the Square Mile as well as results from three companies that at some points in their existences have been labelled ‘quality’.

Equity markets rose sharply early in the week before reversing to finish modestly higher. Renishaw was best performing FTSE350 company after releasing a well-received update midweek (see below) whilst oil companies continue to outperform the broad market. Early in my career I heard several heuristics from various older market veterans. One that I always remembered is that you should ‘never invest in a company that changes its name’. Silly as it sounds, there have been plenty of examples where this advice proved useful. This week Meta, the eye-roll inducing new name for Facebook, badly disappointed markets when it released figures that showed Daily Average Users fell for the first time in its history and a warning about the threat to advertising revenues from other platforms like TikTok. The shares fell more than a quarter and with it broke a record; that of the most market capitalisation lost in one day by any business ever at close to $250b. Mark Zuckerberg alone personally saw his paper net worth decline $31b – poor dear.

It is not a secret that compounding holds the key to successful investing and many of the best investors are particularly adept at spotting businesses with decades of growth ahead of them. A former colleague and I invested our fund in a similar manner, or at least attempted to. We used to refer to this as ‘quality’ investing i.e. neither growth nor value but perhaps sharing elements with both. In later years, however, we began to drop the ‘quality’ moniker because it had begun to take a definition that we weren’t particularly keen on. Ultimately, quality became a style factor much like the aforementioned value and growth labels. As is often the case, much of the blame can be squared at the Square Mile (The City) in this regard. Over the last twenty years or so, and particularly since the 2008 financial crisis, passive investing has come to the fore – passive is a misnomer for what should properly be called rules-based investing. In order to profit from this trend, financial institutions have become adept at building products that capitalise on this or that style factor.

Paradoxically then, you can now buy any number of exchanged traded funds (ETFs) for which the rules that govern their management is based on quality. Paradoxical because, definitionally, it cannot be possible to boil down qualitative factors (like management skill etc) to quantitative terms. The Square Mile’s response is to make up their own terms to define what it means to be quality – all of which are necessarily quantitative in nature. Typically, these include factors such as return on capital employed to be greater than some arbitrary number; revenue growing sequentially for a similarly arbitrary number of years; and cash conversion over circa 90%. Doubtless these rules filter down to some superb businesses but what of the investment outcomes? There’s more to investing than identifying businesses with the widest moats.

There is a number of companies that would often fall foul of these quantitative measures of quality but, despite this, have yielded investors phenomenal returns over decades. The common denominator is not some quantitative financial metric but rather managerial competence. Frequently, these turn out to be family businesses or ones for which the management team are lifers with considerable amounts of their own fortune tied up in the success; examples include James Halstead and MS International. Often, they operate in unsexy areas with marginal returns on capital but management dedicated tight cost controls such as Breedon/Sigma Roc and Alliance Pharma. Sometimes they can be innovative, forward looking, well-invested companies but once again, they are stewarded by capable managers such as Goodwin and Avingtrans. Ultimately, the defining factor I look for in potential equity investments is management. Management with skill, management who care about capital preservation as well as appreciation and management with skin in the game.

It is the case that many of these businesses will find their way on to quality ETFs but that is putting the cart before the horse. There is no shortcut for finding exceptionally stewarded enterprises. ETF providers don’t like this fact because it cannot be systematised, packaged and sold back to you. It is worth being flexible and open-minded about what it means to be a quality investment, which is one that has the capacity to be become consistently more valuable year after year. Recently, Joel Greenblatt (he of the Little Book That Beats the Market https://www.amazon.co.uk/Little-Still-Market-Books-Profits/dp/0470624159) made a similar point about value investing https://www.youtube.com/watch?v=1F9BY7sT4CY stating that simple quantified measures of value don’t necessarily correlate to what is cheap and that there are ample opportunities to buy cheap companies that look expensive on these simple measures. Just because High Finance says something is the case, does not necessarily make it true. One of the best things about being a private investor is the ability to look at businesses in a way that doesn’t conform to arbitrary meanings for words like ‘growth’, ‘value’ or ‘quality’.

This week we look at results from three companies that at some points in their existences have been labelled ‘quality’.

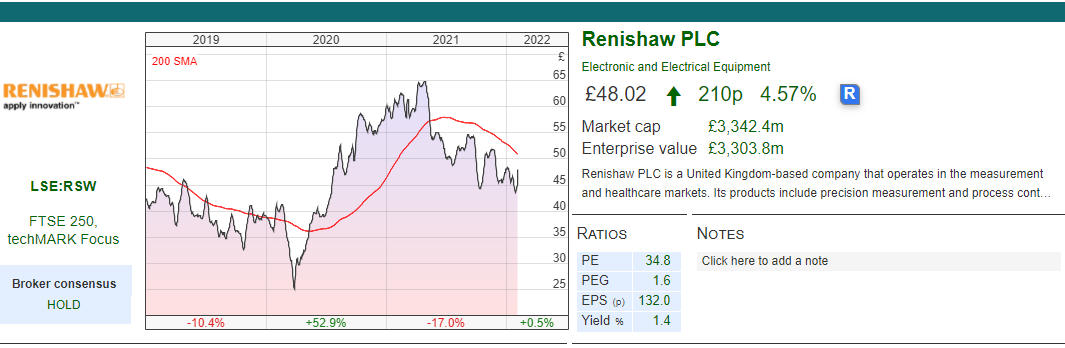

Renishaw December Interim Results

Renishaw announced its interim results for the six months to the end of December 2021. It provides products that aid in precision. Originally founded as a maker of touch probes, former CEO and current Executive Chairman Sir David McMurtry has long fostered a culture of entrepreneurialism and innovation. This has seen the company create world-leading products in all manner of fields for which extremely high levels of precision are required from additive manufacturing in aerospace to neurological products.

Revenue in the period rose 27% to reach a new record for a six-month period. Despite its quality, Renishaw is not immune to economics, which means that the revenue can be a fairly volatile number. Coupling this with the inherent operational gearing and earnings are anything but predictable. Thus, the rise in revenue caused a near doubling of adjusted profits before tax as return on revenue increased by 900bps.

Renishaw is, and always has been, very conservatively managed from a balance sheet perspective – wise considering its exposure to economic cycles. As such, despite a cash outflow from the payment of the full year dividend of almost £38m, net cash increased modestly and represents c. 6.5% of the total market capitalisation.

History:

Renishaw was founded in 1973 by Sir David McMurtry. Whilst working for Rolls-Royce, he developed a touch probe to aid in inspection of the Olympus engines; this invention formed the basis of the business. The company was further developed through a commitment to research and development (R&D) that can see as much as 18% of revenues spent on R&D projects. This level of investment is admirable in a public company and perhaps rarely possible unless management have effective control over the business (Sir David along with deputy Chairman John Deer own in excess of 50% of the equity outstanding). One can imagine a parallel universe in which a Renishaw without such a large management ownership could resort to gutting the R&D budget to boost apparent profitability.

This independence in business practice, which has seen the company frequently considered anti-City (no bad thing in my experience) has manifested in some truly unique characteristics. For example, in the mid-1980s, the company was unhappy with the amount being spent on third party travel agencies and management felt it could do the job better. This manifested into the award-winning Wotton Travel Ltd https://www.wtlholidays.com/en/welcome-to-wotton-travel–20795, a high street travel agency with a shop on the High Street of Wotton under Edge – close to Renishaw’s headquarters.

In 2021, Sir David and Mr Deer who are both in their 80s, announced their intention to sell Renishaw. This saw the share price climb as high as £69, breaching a market capitalisation of £5bn in the process and taking the valuation metrics to hitherto unknown levels for the company. At its peak the share traded at 10x sales and 50x EBITDA. Sir David apparently placed a number of restrictions on a takeover however. These were thought to be related to the commitment to R&D expenditure and employment in the UK. Frankly this is admirable but the market seems tired of waiting for a potential buyer and so the shares have drifted back to pre-sale announcement levels.

Ownership

Sir David owns 36.2%, Mr Deer 16.6% with Standard Life, Blackrock, Capital Research and Baillie Gifford owning 5% a piece. An unwillingness to engage much with institutions means that, considering its size, success and history, it has never attracted a great deal of institutional money.

Valuation

Valuation is tricky; optically we can see that the PE is 29x and price to sales is c. 6x. However, recall the degree of R&D expenditure. Were the company buying its innovation through acquisitions, the company would look much the same but with a much larger balance sheet coupled with higher accounting profitability. If we treat R&D as investment instead of expense, EPS could be perhaps a third larger, thus lowering the PE ratio to 21x.

Opinion

Renishaw is a fascinating company; one can easily spend half an hour watching demonstrations of its many products on its YouTube page https://www.youtube.com/c/renishaw/videos. In many ways it is sad that the company may be taken over at some point as it is rare to find a UK listed business with such a long-term focus and commitment to innovation and excellence. Nevertheless, should a bid be forthcoming, holders will doubtless benefit. If no bid ever appears, the history, innovative culture and balance sheet should provide comfort.

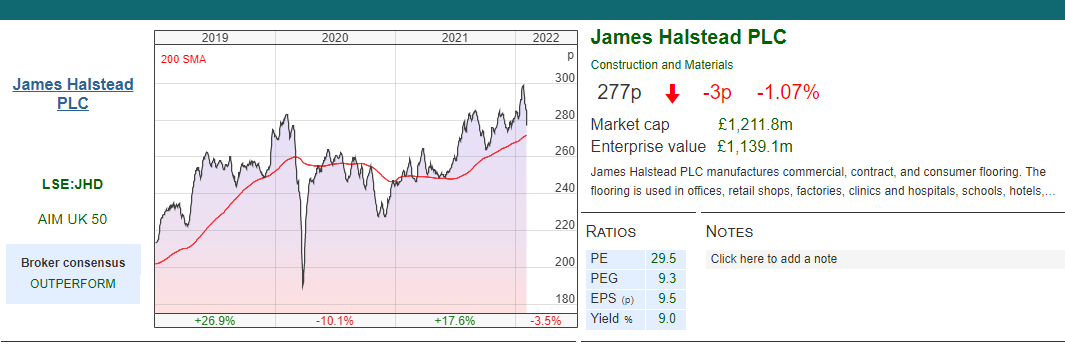

James Halstead Half Year December Trading Update

James Halstead released a trading update for the half year to the end of December. Business appears to be going well but inflation is unhelpful in the short run for James Halstead. Raw material availability is restricted and has been for most of the COVID-19 era. James Halstead is rather conservatively managed and, as such, it is fairing better than most through canny buying of materials. Further, as a UK manufacturer that sells almost two thirds outside the UK, it is affected by elevated shipping costs that we’ve seen in recent months. Management indicate that this will negatively affect margins in the short term but is confident it will pass along price rises accordingly as the price rises catch up with cost rises. Overall, management are confident for the future.

History

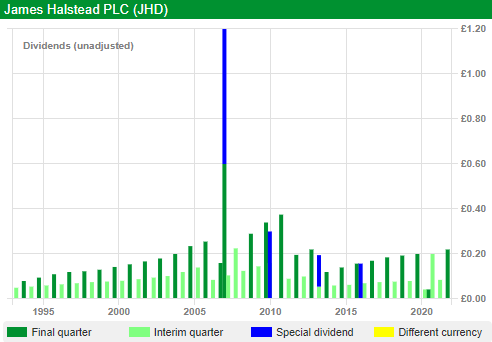

James Halstead makes commercial flooring from its factories near Manchester and in Teesside and distributes its products globally. It provides flooring to a huge array of applications from cruise ships, to sports stadia. It was founded in 1915 with the move towards PVC flooring beginning in the 1930s before listing in 1948. The company has been ran by Halsteads its entire history, with the current CEO, Mark Halstead, being the fifth generation. Such is the importance of the business to the family that there are large houses adjacent to the Greater Manchester factory where the CEO purportedly resides.

Today it is AIM listed having moved from the main market shortly following the creation of the alternative investment market in the mid-90s. It has been a consistent business throughout its AIM-listed period and as such, is a perennial mainstay of inheritance tax portfolios. Two expansion investments occurred in the aftermath as the management took advantage of the distressed market to buy a distribution centre in Oldham, followed by a new factory in Teesside. This was made possible by a super strong balance sheet that rarely sees cash go below at least a full year’s worth of EBITDA and for which cash makes up more than half of the shareholder equity. Much of the sell-side would consider this balance sheet inefficient given the sheer quantity of unproductive cash but historically it has proved a timely benefit by allowing the company to invest when there’s blood on the streets.

Last year the company distributed a Bonus Issue of one new share for every share held. An odd sort of a structure that effectively amounted to a convoluted two for one split.

Ownership

Many of the largest shareholders share the founder’s surname – that is to say it is still a family ran business with a descendent as CEO. No institutions hold more than 3% of the company though, as previously mentioned, the shares are very popular amongst inheritance tax portfolio providers. Additionally, the company has ran an employee share scheme since 1980 providing an unquantified, but likely meaningful, amount of employee ownership.

Valuation

One of the problems of successful AIM companies is their popularity amongst inheritance tax portfolio providers. This provides a near passive, value-agnostic bid for shares given the scarcity of quality businesses that qualify for these types of portfolio. Consequently, James Halstead has always appeared to be expensive. Consequently, the shares trade at c. 27x PE ratio for relatively meagre growth. Nevertheless, the company has delivered a remarkable dividend record and currently yields 2.9%.

Opinion

For the last 25 years, James Halstead has been the classic get rich slowly story. However, the current CEO is 64 and, whilst there is little indication of him stepping down, there is also little indication of a succession either. There has an almost Victorian feel about its operations whereby the business is not just a local business and employer but actually integral to its community. Whether this is sustainable forever is uncertain but for now, the company is extremely well managed, well financed and attractive in any broad based sell-offs.

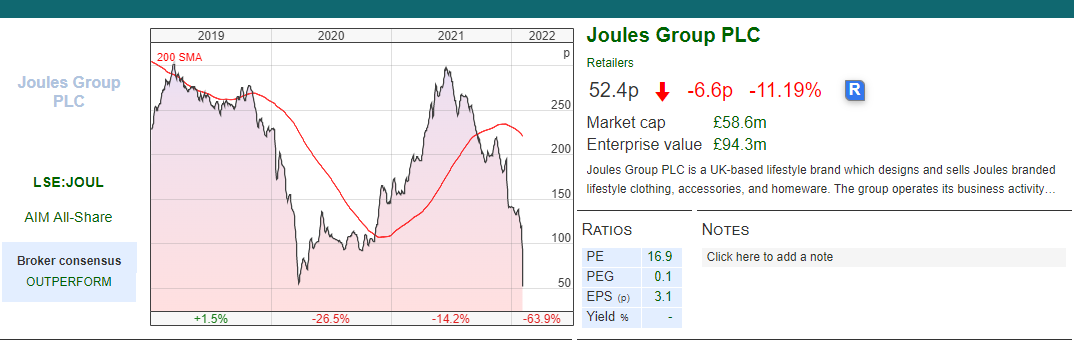

Joules Trading Update & Update on Interim Results

Joules’s February 1st update would have made pretty miserable reading for holders. The company had already disappointed in December with a statement that stated the company was struggling to fulfil order, particularly online orders. This is a problem that can snowball in the run up to Christmas as apparel is much more valuable before Dec 25th than after it. At first blush the update in February looks reassuring with a great deal of further growth coming through, however the problems in distribution aren’t fixed and costs here are double internal budgets. The board announced a number of actions to address these problems though many appear rather desperate including; marketing expense constraints (in a business where brand is key); stock liquidations (implying cash flow difficulty?); and price increases (fine but will the consumer pay up?)

It concludes however with a phrase that will guarantee an awful day for the shares,

‘The Group is in the process of finalising its Interim Results, including completing its going concern analysis, reflecting the impact of trading performance up to the end of January.’

The fact that ‘going concern’ needs to be questioned is alarming itself and calls into the question its viability.

History

Joules was founded in the late 80s as an outdoors clothing company specialising in mid-market fashion-led country clothing. The business as it now came around in the early 2000s following the opening of the first shop in Market Harborough, with a wholesale and mail order business alongside. Over the next decade and a half, the stores were successfully rolled out, focusing on wealthy market towns. In 2016, the company was listed on AIM to further accelerate the expansion. However, this expansion has yielded nothing but pain for shareholders with the shares currently sitting barely a quarter of the list price.

Ownership

Tom Joules, the founder owns 21% and several institutions own meaningful positions indicating some success at building an institutional following. The remainder of the board hold fairly paltry amounts.

Valuation

If the company can get through its growth indigestion, it is entirely feasible that the share may prove cheap here with the shares trading at just 5x 2019 earnings with an apparent long runway for growth. Nevertheless, mere questions of going concern mean that the downside is significant. As it stands Joules is only for the brave. Perhaps we will see a rights issue in time that will provide a surer footing, but this is unlikely to be pleasant for existing holders.

Opinion

Good businesses manage through crises and emerge stronger (see James Halstead, which is battling its own issues), poor businesses are cut down. Most of Joules’s problems appear to stem from distribution, albeit a stronger balance sheet would be nice. Interestingly, the management make reference more than once that the distribution is done by a third party as if passing some of the blame. This might be justified and it should be noted that the third party in question is Clipper Logistics https://www.clippergroup.co.uk/clipper-announces-new-contract-win-with-joules/. Clipper’s next update will make for interesting reading.

Jamie Ward

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Hi Jamie, Thank you for your comments on quality.

It reminds me of the books by Robert Pirsig ‘Zen and the art of Motorcycle maintenance’ in which he comes to the same conclusion about quality. In his second book ‘Lila’ he divides quality into passive quality as the boundary of knowledge and evolution that must be challenged by dynamic quality in order to move the state of evolution forward.

What do you say?

Thanks Colin,

That’s an interesting comment, thank you for the book references, I will check them out.

Jamie

I reserve judgement on the companies, but the article was extremely high quality. Thank you. More from this contributor please.

That’s very kind of you to say

Your blog has piqued a lot of real interest. I can see why since you have done such a good job of making it interesting. I appreciate your efforts very much.

online casino ph