Bruce sees more trouble on the horizon for the retail sector, fearing heavy discounting of unsold inventory later this year. Stocks covered SHOE, WISE and a post-mortem on DDDD.

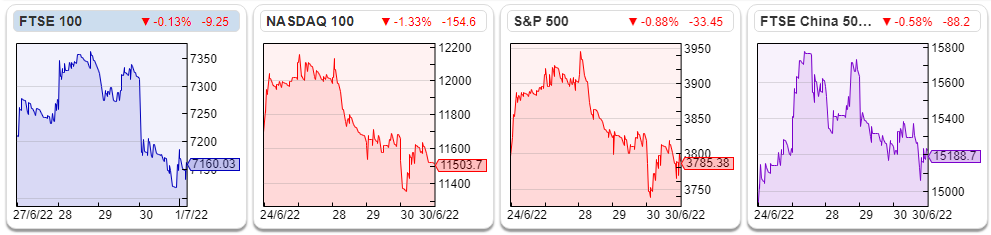

The FTSE 100 was down -0.6% last week to 7,160. The Nasdaq100 and S&P500 fell -1.66% and -0.27% respectively. The US 10Y Government bond fell back below 3% and the price of a barrel of oil (Brent Crude, most traded contract) rose +5% to $112 per barrel.

In H1 we saw a big divergence between AIM, which was down -27% in H1 versus the FTSE 100 which was flat, helped by a weighting towards larger, less speculative companies. My portfolio hasn’t been immune to the sell-off, and I’m down c. -27% for H1. Although it’s a larger paper loss, it’s unleveraged and I’m not worried. That percentage doesn’t include my significant cash position, which I’m cautiously putting to work. Most recently I bought some more Ocean Wilsons, the Brazilian ports business which I first bought in 2016.

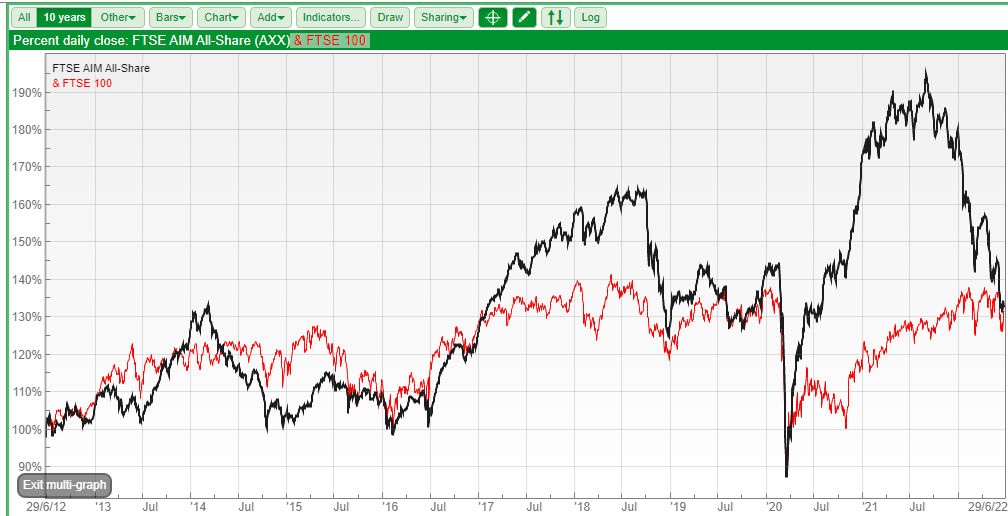

Using Sharepad’s ‘multi-graph’ feature I was surprised to see that over a 10-year time horizon AIM had not outperformed the FTSE 100. As a reminder, CTRL+‘left click’ on the items that you would like to graph. Then ‘right click’ to bring up the menu, and scroll down to ‘multi-graph selected shares’. The option says ‘shares’ but the feature also works for comparing different stockmarket indices (FTSE 100 in red, AIM in black).

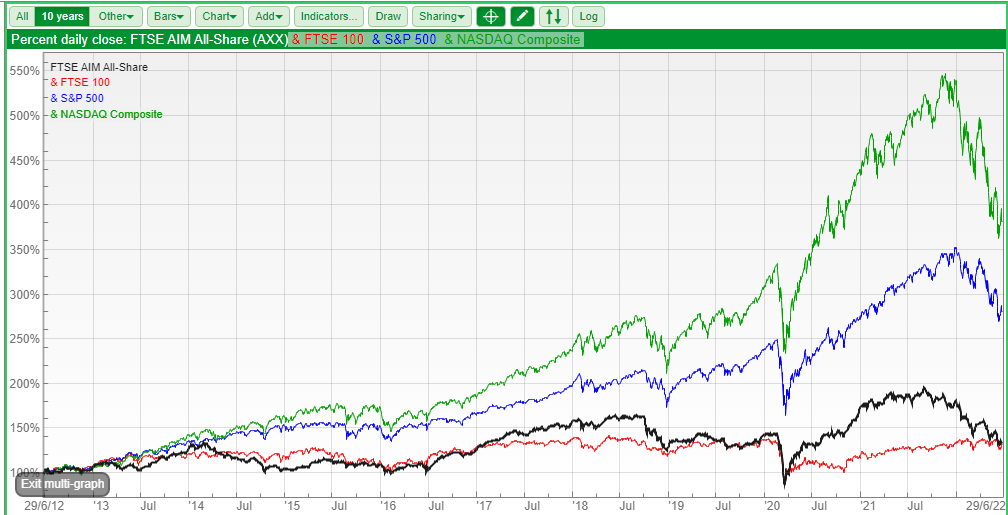

Both UK indices have done much worse than the S&P500 (blue line) and Nasdaq Composite (green line). I would have expected an index with smaller market cap stocks to outperform a large-cap index over 10 years. One of the few strategies to make sense to me is the ‘small cap’ effect, which suggests that smaller companies have more potential to grow than larger companies.

Antti Ilmanen’s analysis of Expected Returns going back to 1926 supports this. He says that ‘small-cap value’ does better than ‘small-cap growth’ – and ‘small cap’ tends do better than ‘large cap’ through the cycle. The exception is small risky companies that resemble ‘lottery tickets’ which investors systematically overestimate the chance of a successful outcome (see my comments on 4D Pharma below). Those effects were consistent for 1990-2009, but he also back-tested the data to 1926-2009. Perhaps another reminder that the last decade has been unusual and that past performance can’t be extrapolated into the future unthinkingly.

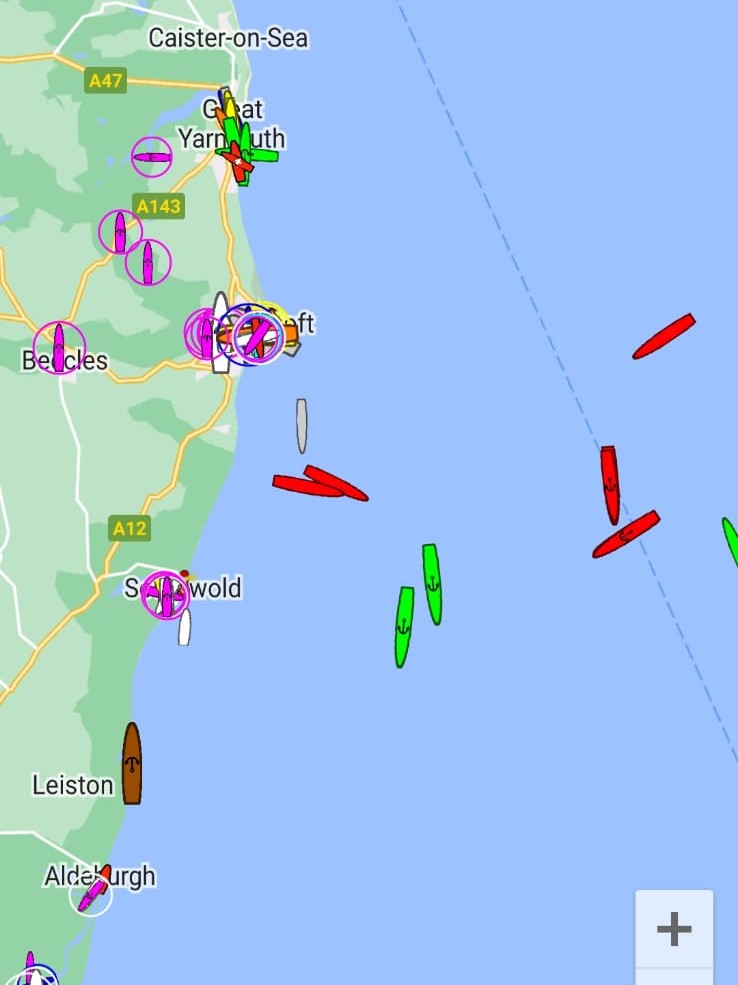

Last week I went swimming in the North Sea off the coast of Southwold, and while being slapped around by the waves I noticed a couple of container ships on the horizon. They are the green icons on the map.

This seems odd and rarely happens according to the city analyst friend I was swimming with who has a second home there. More often there are oil tankers moored on the horizon when the oil market is in contango (futures price higher than spot price). But contango for consumer goods is a bizarre concept. Given the elevated freight costs, I would be surprised if the ships were sitting off the coast with empty shipping containers. Surely they could be chartered out at a profitable rate?

I think that the most likely explanation is that the container ships could be being used as short-term, offshore warehouses. Most retailers rely on inventory turn, they want to sell as much and as soon as possible, and given the recent supply chain bottlenecks, they may have overordered.

In May UK consumer confidence dropped to it’s lowest level since the mid-1970s, so it does seem plausible that companies might have imported too much relative to consumers willingness to spend. That in turn would hit corporate margins as companies decide to offer discounts later in the year, I think? I’m interested to hear your thoughts, so do post in the chat any theories that you might have.

Of course, many retailers have had a torrid H1. Boohoo down -55% YTD, ASOS -64% YTD Joules -75% YTD. Even MKS -40% YTD and NXT -27% YTD are having a bad start to the year. The same is true in Europe, with Berlin headquarters Zalando putting out a nasty profit warning cutting FY estimates by 90% at the end of June, and now down -63% YTD.

There could be more bad news to come through if they are left with too much inventory. So I would wait until year-on-year comparisons have turned positive before deciding that all the bad news for retailers is ‘in the price’.

The one company that seems to be bucking the trend is SHOE +61% YTD, which I look at briefly below. I’m cautious about SHOE given what is happening to the rest of the retail sector. This week I also look at Wise results and think about implications for the likes of Equals, and Argentex which reports on Wednesday. Plus a post mortem on 4D Pharma, which has run out of cash despite raising $40m by reversing into a SPAC in H1 last year.

Wise FY March 2022 Results

This foreign exchange FinTech, which direct listed on the LSE last July. reported revenue rising +33% to £560m, for FG Mar 2022. Statutory PBT ex listing costs was up +14% to £51.5m, though I do notice a £17m fair value loss taken ‘below the line’ in other comprehensive income, with very little explanation. The notes just say that Wise sold £147m of fair value assets before maturity. Their assets are short duration, but with short rates rising rapidly in H1 it could be that they haven’t managed this book very well.

This foreign exchange FinTech, which direct listed on the LSE last July. reported revenue rising +33% to £560m, for FG Mar 2022. Statutory PBT ex listing costs was up +14% to £51.5m, though I do notice a £17m fair value loss taken ‘below the line’ in other comprehensive income, with very little explanation. The notes just say that Wise sold £147m of fair value assets before maturity. Their assets are short duration, but with short rates rising rapidly in H1 it could be that they haven’t managed this book very well.

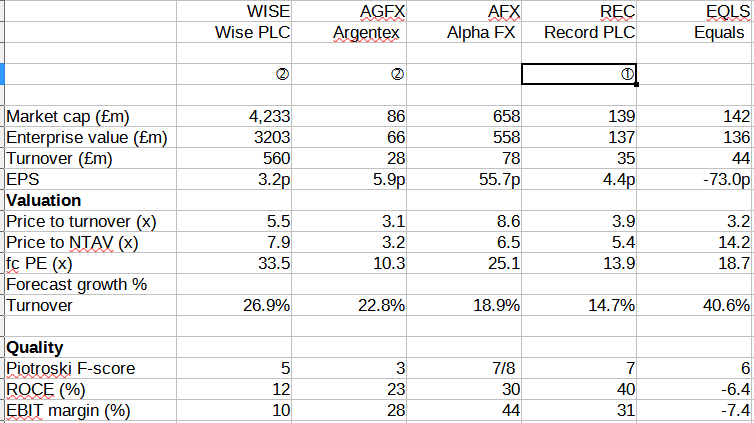

The gross profit margin increased from 62% to 64%. The group had £358m of cash (up from £286m Mar 2021) at the end of March. To be clear, that’s separate from customer balances, which are much larger at £5.7bn, but the latter obviously doesn’t belong to shareholders. When Sharepad calculates cashflow measures like CRoCI, FCF or cash conversion, the system has difficulty with how all of the forex currency shops like Wise, Argentex, Record and Equals etc disclose cash, so I have removed those items from the company comparison below.

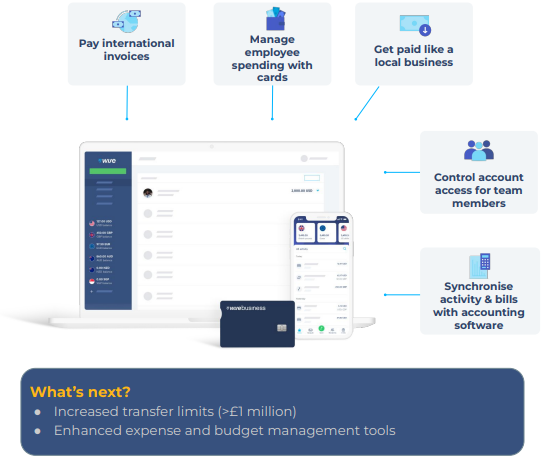

Opportunity and threat: WISE say that the personal forex market is $2 trillion by volume and for SMEs, the figure is $9 trillion. So their market share is less than 4% for the former and less than 1% for the latter. They say that a typical personal customer sends £8K abroad, from which they make revenue of £62. That compares to a typical business customer who transfers £48K and from which they make £309 of revenue. That’s not really the same market as Equals or Argentex, whose customers make much larger transfers, but it’s worth bearing in mind that Wise might look to expand into the higher value segments. Indeed, they’re already increasing the maximum transfer limit to over £1m.

Outlook: WISE expect revenue growth of between 30-35% FY Mar 2023F, slowing to 20% CAGR medium term. Management do suggest that although the model has operational gearing, relatively fixed costs with the ability to grow revenues, they will share the benefits of this with customers to create a ‘moat’. That’s similar thinking to Amazon.com, and very alien to financial services where the prevalent strategy among banks is to try to gouge customers, and report a high RoE which allows management to justify paying themselves large bonuses.

Co-founders: The FCA also launched an investigation in Kristo Kaarmann’s tax affairs, after HMRC included him on a list of individuals who had received a penalty for default. The other co-founder Taavet Hinrikus’ sold 11m A class shares last year and also pledged up to 40m shares (worth £120m at today’s price) in return for a loan from Goldman Sachs. The proceeds would then be invested in the next generation of global technology companies coming from Europe. Following the direct listing in July last year, there was a lock-up agreement, but it was only for 180 days. In any case, the condition was only that the sellers would seek prior written consent from the investment banks before selling and pledging shares was excluded from the lock-up.

Ownership: There’s a dual-class share structure, with the co-founders maintaining control through B shares which carry 9x as many votes. Baillie Gifford owns 23% of the shares, then some other venture capitalists including Andreesen Horrowitz own around 30% in total. It’s not clear how long these VC’s are planning to hold the shares for, so this does strike me as an overhang.

Valuation: WISE shares are trading on 5.5x historic sales, though that ratio drops to 3.5x FY Mar 2024F. The PER ratio is 26x Mar 2024F. For comparison, Argentex, which reports Wed 6th July is forecast to grow revenues +23% FY March 2022F, and trades on 3.1x historic sales and below 7x PER 2024F.

Opinion: Despite not doing too much wrong, WISE shares are down -61% YTD. That suggests to me that they were priced too aggressively when it came to market (over 10x sales, valuing the company at almost £9bn). The shares now look more reasonable (5.5x sales, £4.2bn market cap), though the chart remains in a downtrend so I will wait at least another 6 months (ie until H1 next year).

I have been building a position in the much smaller Argentex (which reports on Wednesday 6th) in the last few months, so I’m hoping that market conditions have been favourable to all forex companies and that WISE is not growing by taking market share from smaller competitors. Below is a table downloaded from Sharepad’s ‘Compare’ feature, which picks out Record, which I wrote about last week as having the most positives.

Shoe Zone FY Oct 2022 Trading Update

This footwear retailer that has 500 shops across the UK announced that they now expect adjusted PBT for FY Oct 2022F, to be not less than £8.5m. That follows H1 to 2nd April which saw revenue +73% to £40m and PBT of £3.1m (implying £5.2m H2). The company had £13.9m at the end of H1. Last week’s RNS was only a couple of lines long, so it would be interesting to know why SHOE seems able to go against the trend other retailers are reporting.

This footwear retailer that has 500 shops across the UK announced that they now expect adjusted PBT for FY Oct 2022F, to be not less than £8.5m. That follows H1 to 2nd April which saw revenue +73% to £40m and PBT of £3.1m (implying £5.2m H2). The company had £13.9m at the end of H1. Last week’s RNS was only a couple of lines long, so it would be interesting to know why SHOE seems able to go against the trend other retailers are reporting.

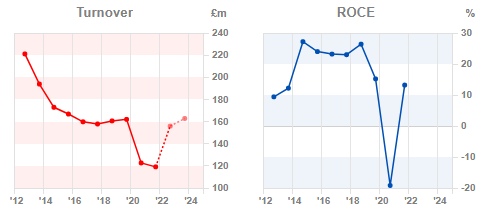

Valuation: The shares are trading on a PER 8x Mar 2023F dropping to 7x Mar 2024F. Revenue looks like it has been trending down even before the pandemic, which was obviously negative. That said, I’m impressed that SHOE can report historic RoCE above 20% when revenue has been under pressure, which implies that if they can stabilise the business then there is a reasonable ‘moat’ (which is unusual for a retailer).

Opinion: Following a difficult 2019 and 2020, this company looks like it has turned the corner. My view is that there could be more bad news to come from retail, so would avoid the sector for now though.

4D Pharma shares suspended

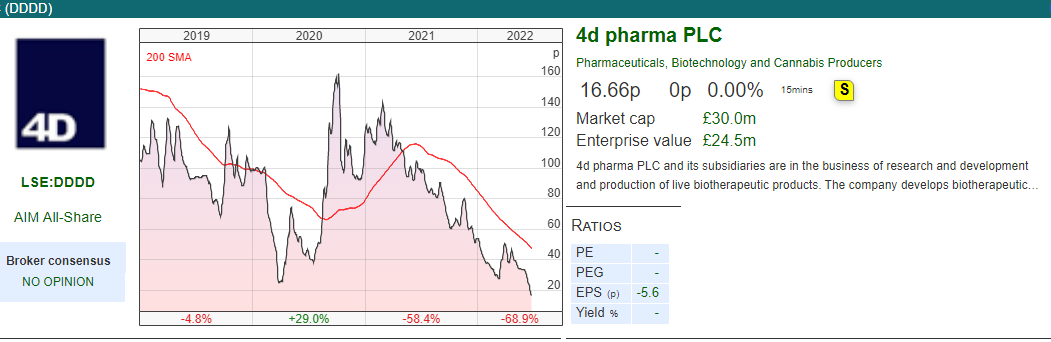

18.27 on Friday (24th June) night, too late for last week’s note, 4D Pharma, the microbiome company put out a statement explaining why trading in their shares had been suspended. I think it’s worth having a post mortem on this one, to see if there’s anything to be learnt.

18.27 on Friday (24th June) night, too late for last week’s note, 4D Pharma, the microbiome company put out a statement explaining why trading in their shares had been suspended. I think it’s worth having a post mortem on this one, to see if there’s anything to be learnt.

Oxford Finance LLP had requested an immediate repayment of a $12.5m loan, following an investor presentation on InvestorMeetCompany last week. That was despite DDDD reporting £15.5m of cash on their balance sheet at the December year end. Management said in the ‘going concern’ statement in April that they had enough cash to fund the business until Q4 this year. What seems extraordinary is that they received $40m in H1 last year from the SPAC merger and concurrent capital raising saying that they were in a “very strong financial position to execute across our robust pipeline”.

I would imagine that US investors in the SPAC called Longevity Acquisition Corp (Nasdaq ticker LBPS) are rather unhappy, seeing the business fail within 15 months of the deal’s completion. There’s an old rule of thumb to avoid banks or hedge funds with ‘Long Term’ in the name (LTCM, but also Long Term Credit Bank which was nationalised by the Japanese Govt in the 1990s). We should now extend this heuristic from ‘Long Term’ to also avoiding any investment with ‘Longevity’ in its name, I think.

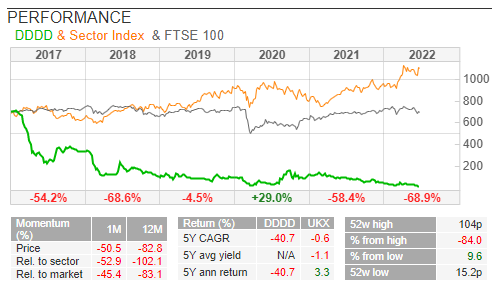

I bought a small position in DDDD a couple of months ago, after the shares had fallen 95% from their high in 2016. DDDD put out a positive phase II trial announcement (which saw the shares almost double to c. 55p) before falling back. I was aware of the risks but thought it might be worth taking a small speculative position. This now looks like it could be a zero though. With the benefit of hindsight, they have spread themselves too thinly, funding trials to investigate how improving the microbiome of patients might improve Irritable Bowel Syndrome, Asthma, Crohn’s disease, Parkinson’s Disease, Renal Cancer and patients hospitalised with Covid.

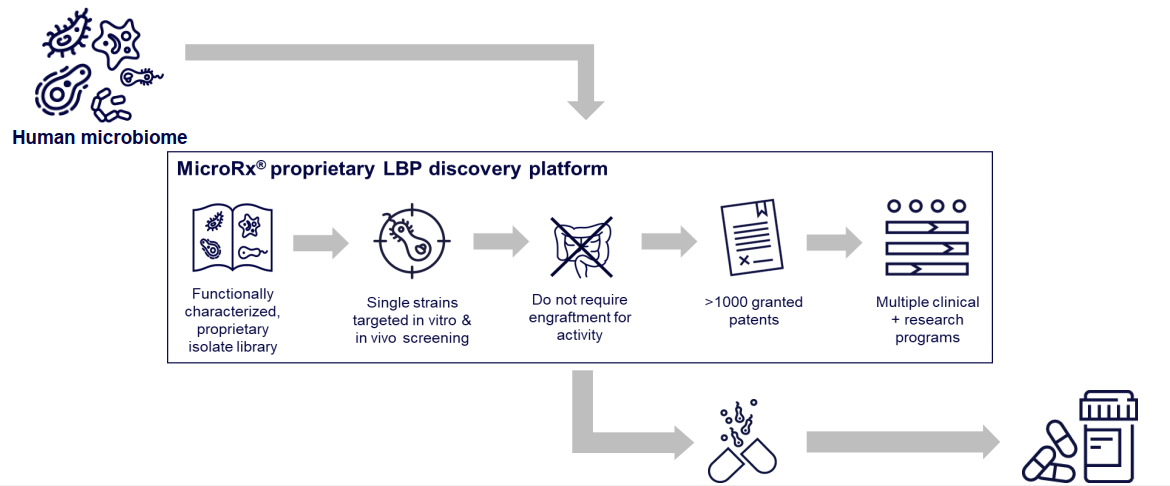

The original story was around using Blautix®, a Live Biotherapeutic Product (LBP) to help patients with IBS. That trial failed more than a year ago because although DDDD’s treatment was safe and effective, it was not a statistically significant improvement on the placebo. That’s similar to Circassian (another Woodford backed biotech) that had treatment for cat allergies that worked but was not significantly better than the placebo effect.

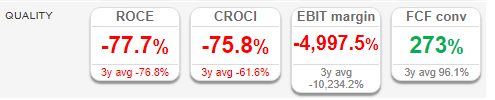

DDDD has spent over £180m of shareholders’ cash since 2014, which goes to show that in some sectors there isn’t any relationship between invested capital and future returns. The company was not generating any revenue, so Sharepad’s quality metrics show that DDDD track record didn’t give much confidence. I’m not sure why FCF conv is positive, because the company relied on having to raise money from investors, but the FCF could be the effect of R&D grants.

The other thing I should have checked more carefully was the terms of the Oxford Finance loan agreed in July last year. 4D Pharma had a facility to borrow up to $30m, including the initial drawdown of the first tranche for $12.5 million. The 2 other tranches were dependent on DDDD achieving milestones, presumably positive trial results. This was an interest-only loan at Libor + 8.15%, with the principal repayable either September next year, or the following year, again dependent on the milestones being achieved. That seems like an expensive way to borrow, especially given how frothy debt markets were a year ago. The loan included a covenant that required DDDD to keep at least $7.5m cash balance, if the Group did not raise $45m before 1 April 2022.

Ownership: The shares were not well owned by institutions. Hargreaves Lansdown and Interactive Investors (both retail investors platforms) owned 14% and 7% of the stock respectively. Pharmaceutical company Merck with whom they had a partnership owned 4.6%, Fidelity 4%. I can remember at a Mello event last year Andy Brough at Schroders said he sold out at a much higher price. Woodford held 24% of the shares in 2015, but the position sold when his fund was wound up a couple of years ago. Sharepad doesn’t show any director sales ahead of the bad news.

Opinion: It looks like institutions were unwilling to back management, and retail investors preferred to sell too. It’s not clear to me how management could claim that they were funded through to Q4, and yet they failed before the end of June. I’m wondering if ‘loan to own’ was the plan all along from Oxford Finance?

Kevin Taylor gave a talk at Mello suggesting that loss-making companies will find H2 a much harder environment to raise money from investors. If readers do have any companies with weak balance sheets and/or losing money, then it’s worth revisiting the investment case. Also, beware of any company claiming “very strong financial position” that isn’t matched by reality – often management thinks that they can make qualitative statements in their commentary, even if it isn’t supported by the numbers. That can be a ‘red flag’ in itself. At least I got the position sizing right on this one, and it will be one of my smallest losses ever.

Perhaps the lesson is: avoid investing even small amounts in loss-making speculative ‘lottery ticket’ style pay-offs; you can make far higher returns from larger positions in profitable, dividend paying companies. To be honest though – I knew that already! Similar to that other timeless piece of advice ‘never let anyone pressure you into signing a contract that you don’t understand’ – but that’s a story for another time.

Notes

The author owns shares in 4D Pharma and Argentex

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 04/07/22|SHOE, WISE, DDDD |Containership contango

Bruce sees more trouble on the horizon for the retail sector, fearing heavy discounting of unsold inventory later this year. Stocks covered SHOE, WISE and a post-mortem on DDDD.

The FTSE 100 was down -0.6% last week to 7,160. The Nasdaq100 and S&P500 fell -1.66% and -0.27% respectively. The US 10Y Government bond fell back below 3% and the price of a barrel of oil (Brent Crude, most traded contract) rose +5% to $112 per barrel.

In H1 we saw a big divergence between AIM, which was down -27% in H1 versus the FTSE 100 which was flat, helped by a weighting towards larger, less speculative companies. My portfolio hasn’t been immune to the sell-off, and I’m down c. -27% for H1. Although it’s a larger paper loss, it’s unleveraged and I’m not worried. That percentage doesn’t include my significant cash position, which I’m cautiously putting to work. Most recently I bought some more Ocean Wilsons, the Brazilian ports business which I first bought in 2016.

Using Sharepad’s ‘multi-graph’ feature I was surprised to see that over a 10-year time horizon AIM had not outperformed the FTSE 100. As a reminder, CTRL+‘left click’ on the items that you would like to graph. Then ‘right click’ to bring up the menu, and scroll down to ‘multi-graph selected shares’. The option says ‘shares’ but the feature also works for comparing different stockmarket indices (FTSE 100 in red, AIM in black).

Both UK indices have done much worse than the S&P500 (blue line) and Nasdaq Composite (green line). I would have expected an index with smaller market cap stocks to outperform a large-cap index over 10 years. One of the few strategies to make sense to me is the ‘small cap’ effect, which suggests that smaller companies have more potential to grow than larger companies.

Antti Ilmanen’s analysis of Expected Returns going back to 1926 supports this. He says that ‘small-cap value’ does better than ‘small-cap growth’ – and ‘small cap’ tends do better than ‘large cap’ through the cycle. The exception is small risky companies that resemble ‘lottery tickets’ which investors systematically overestimate the chance of a successful outcome (see my comments on 4D Pharma below). Those effects were consistent for 1990-2009, but he also back-tested the data to 1926-2009. Perhaps another reminder that the last decade has been unusual and that past performance can’t be extrapolated into the future unthinkingly.

Last week I went swimming in the North Sea off the coast of Southwold, and while being slapped around by the waves I noticed a couple of container ships on the horizon. They are the green icons on the map.

This seems odd and rarely happens according to the city analyst friend I was swimming with who has a second home there. More often there are oil tankers moored on the horizon when the oil market is in contango (futures price higher than spot price). But contango for consumer goods is a bizarre concept. Given the elevated freight costs, I would be surprised if the ships were sitting off the coast with empty shipping containers. Surely they could be chartered out at a profitable rate?

I think that the most likely explanation is that the container ships could be being used as short-term, offshore warehouses. Most retailers rely on inventory turn, they want to sell as much and as soon as possible, and given the recent supply chain bottlenecks, they may have overordered.

In May UK consumer confidence dropped to it’s lowest level since the mid-1970s, so it does seem plausible that companies might have imported too much relative to consumers willingness to spend. That in turn would hit corporate margins as companies decide to offer discounts later in the year, I think? I’m interested to hear your thoughts, so do post in the chat any theories that you might have.

Of course, many retailers have had a torrid H1. Boohoo down -55% YTD, ASOS -64% YTD Joules -75% YTD. Even MKS -40% YTD and NXT -27% YTD are having a bad start to the year. The same is true in Europe, with Berlin headquarters Zalando putting out a nasty profit warning cutting FY estimates by 90% at the end of June, and now down -63% YTD.

There could be more bad news to come through if they are left with too much inventory. So I would wait until year-on-year comparisons have turned positive before deciding that all the bad news for retailers is ‘in the price’.

The one company that seems to be bucking the trend is SHOE +61% YTD, which I look at briefly below. I’m cautious about SHOE given what is happening to the rest of the retail sector. This week I also look at Wise results and think about implications for the likes of Equals, and Argentex which reports on Wednesday. Plus a post mortem on 4D Pharma, which has run out of cash despite raising $40m by reversing into a SPAC in H1 last year.

Wise FY March 2022 Results

The gross profit margin increased from 62% to 64%. The group had £358m of cash (up from £286m Mar 2021) at the end of March. To be clear, that’s separate from customer balances, which are much larger at £5.7bn, but the latter obviously doesn’t belong to shareholders. When Sharepad calculates cashflow measures like CRoCI, FCF or cash conversion, the system has difficulty with how all of the forex currency shops like Wise, Argentex, Record and Equals etc disclose cash, so I have removed those items from the company comparison below.

Opportunity and threat: WISE say that the personal forex market is $2 trillion by volume and for SMEs, the figure is $9 trillion. So their market share is less than 4% for the former and less than 1% for the latter. They say that a typical personal customer sends £8K abroad, from which they make revenue of £62. That compares to a typical business customer who transfers £48K and from which they make £309 of revenue. That’s not really the same market as Equals or Argentex, whose customers make much larger transfers, but it’s worth bearing in mind that Wise might look to expand into the higher value segments. Indeed, they’re already increasing the maximum transfer limit to over £1m.

Outlook: WISE expect revenue growth of between 30-35% FY Mar 2023F, slowing to 20% CAGR medium term. Management do suggest that although the model has operational gearing, relatively fixed costs with the ability to grow revenues, they will share the benefits of this with customers to create a ‘moat’. That’s similar thinking to Amazon.com, and very alien to financial services where the prevalent strategy among banks is to try to gouge customers, and report a high RoE which allows management to justify paying themselves large bonuses.

Co-founders: The FCA also launched an investigation in Kristo Kaarmann’s tax affairs, after HMRC included him on a list of individuals who had received a penalty for default. The other co-founder Taavet Hinrikus’ sold 11m A class shares last year and also pledged up to 40m shares (worth £120m at today’s price) in return for a loan from Goldman Sachs. The proceeds would then be invested in the next generation of global technology companies coming from Europe. Following the direct listing in July last year, there was a lock-up agreement, but it was only for 180 days. In any case, the condition was only that the sellers would seek prior written consent from the investment banks before selling and pledging shares was excluded from the lock-up.

Ownership: There’s a dual-class share structure, with the co-founders maintaining control through B shares which carry 9x as many votes. Baillie Gifford owns 23% of the shares, then some other venture capitalists including Andreesen Horrowitz own around 30% in total. It’s not clear how long these VC’s are planning to hold the shares for, so this does strike me as an overhang.

Valuation: WISE shares are trading on 5.5x historic sales, though that ratio drops to 3.5x FY Mar 2024F. The PER ratio is 26x Mar 2024F. For comparison, Argentex, which reports Wed 6th July is forecast to grow revenues +23% FY March 2022F, and trades on 3.1x historic sales and below 7x PER 2024F.

Opinion: Despite not doing too much wrong, WISE shares are down -61% YTD. That suggests to me that they were priced too aggressively when it came to market (over 10x sales, valuing the company at almost £9bn). The shares now look more reasonable (5.5x sales, £4.2bn market cap), though the chart remains in a downtrend so I will wait at least another 6 months (ie until H1 next year).

I have been building a position in the much smaller Argentex (which reports on Wednesday 6th) in the last few months, so I’m hoping that market conditions have been favourable to all forex companies and that WISE is not growing by taking market share from smaller competitors. Below is a table downloaded from Sharepad’s ‘Compare’ feature, which picks out Record, which I wrote about last week as having the most positives.

Shoe Zone FY Oct 2022 Trading Update

Valuation: The shares are trading on a PER 8x Mar 2023F dropping to 7x Mar 2024F. Revenue looks like it has been trending down even before the pandemic, which was obviously negative. That said, I’m impressed that SHOE can report historic RoCE above 20% when revenue has been under pressure, which implies that if they can stabilise the business then there is a reasonable ‘moat’ (which is unusual for a retailer).

Opinion: Following a difficult 2019 and 2020, this company looks like it has turned the corner. My view is that there could be more bad news to come from retail, so would avoid the sector for now though.

4D Pharma shares suspended

Oxford Finance LLP had requested an immediate repayment of a $12.5m loan, following an investor presentation on InvestorMeetCompany last week. That was despite DDDD reporting £15.5m of cash on their balance sheet at the December year end. Management said in the ‘going concern’ statement in April that they had enough cash to fund the business until Q4 this year. What seems extraordinary is that they received $40m in H1 last year from the SPAC merger and concurrent capital raising saying that they were in a “very strong financial position to execute across our robust pipeline”.

I would imagine that US investors in the SPAC called Longevity Acquisition Corp (Nasdaq ticker LBPS) are rather unhappy, seeing the business fail within 15 months of the deal’s completion. There’s an old rule of thumb to avoid banks or hedge funds with ‘Long Term’ in the name (LTCM, but also Long Term Credit Bank which was nationalised by the Japanese Govt in the 1990s). We should now extend this heuristic from ‘Long Term’ to also avoiding any investment with ‘Longevity’ in its name, I think.

I bought a small position in DDDD a couple of months ago, after the shares had fallen 95% from their high in 2016. DDDD put out a positive phase II trial announcement (which saw the shares almost double to c. 55p) before falling back. I was aware of the risks but thought it might be worth taking a small speculative position. This now looks like it could be a zero though. With the benefit of hindsight, they have spread themselves too thinly, funding trials to investigate how improving the microbiome of patients might improve Irritable Bowel Syndrome, Asthma, Crohn’s disease, Parkinson’s Disease, Renal Cancer and patients hospitalised with Covid.

The original story was around using Blautix®, a Live Biotherapeutic Product (LBP) to help patients with IBS. That trial failed more than a year ago because although DDDD’s treatment was safe and effective, it was not a statistically significant improvement on the placebo. That’s similar to Circassian (another Woodford backed biotech) that had treatment for cat allergies that worked but was not significantly better than the placebo effect.

DDDD has spent over £180m of shareholders’ cash since 2014, which goes to show that in some sectors there isn’t any relationship between invested capital and future returns. The company was not generating any revenue, so Sharepad’s quality metrics show that DDDD track record didn’t give much confidence. I’m not sure why FCF conv is positive, because the company relied on having to raise money from investors, but the FCF could be the effect of R&D grants.

The other thing I should have checked more carefully was the terms of the Oxford Finance loan agreed in July last year. 4D Pharma had a facility to borrow up to $30m, including the initial drawdown of the first tranche for $12.5 million. The 2 other tranches were dependent on DDDD achieving milestones, presumably positive trial results. This was an interest-only loan at Libor + 8.15%, with the principal repayable either September next year, or the following year, again dependent on the milestones being achieved. That seems like an expensive way to borrow, especially given how frothy debt markets were a year ago. The loan included a covenant that required DDDD to keep at least $7.5m cash balance, if the Group did not raise $45m before 1 April 2022.

Ownership: The shares were not well owned by institutions. Hargreaves Lansdown and Interactive Investors (both retail investors platforms) owned 14% and 7% of the stock respectively. Pharmaceutical company Merck with whom they had a partnership owned 4.6%, Fidelity 4%. I can remember at a Mello event last year Andy Brough at Schroders said he sold out at a much higher price. Woodford held 24% of the shares in 2015, but the position sold when his fund was wound up a couple of years ago. Sharepad doesn’t show any director sales ahead of the bad news.

Opinion: It looks like institutions were unwilling to back management, and retail investors preferred to sell too. It’s not clear to me how management could claim that they were funded through to Q4, and yet they failed before the end of June. I’m wondering if ‘loan to own’ was the plan all along from Oxford Finance?

Kevin Taylor gave a talk at Mello suggesting that loss-making companies will find H2 a much harder environment to raise money from investors. If readers do have any companies with weak balance sheets and/or losing money, then it’s worth revisiting the investment case. Also, beware of any company claiming “very strong financial position” that isn’t matched by reality – often management thinks that they can make qualitative statements in their commentary, even if it isn’t supported by the numbers. That can be a ‘red flag’ in itself. At least I got the position sizing right on this one, and it will be one of my smallest losses ever.

Perhaps the lesson is: avoid investing even small amounts in loss-making speculative ‘lottery ticket’ style pay-offs; you can make far higher returns from larger positions in profitable, dividend paying companies. To be honest though – I knew that already! Similar to that other timeless piece of advice ‘never let anyone pressure you into signing a contract that you don’t understand’ – but that’s a story for another time.

Notes

The author owns shares in 4D Pharma and Argentex

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.