Two very different US financial personalities believe that US interest rates are rising too fast. No doubt bankers and fund managers are talking their own book, but that doesn’t mean they’re wrong. Stocks covered AT., BDEV, DARK

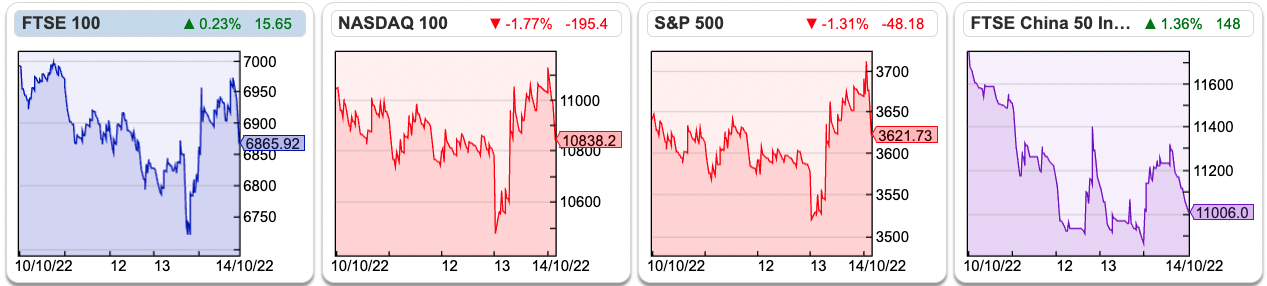

The FTSE 100 failed to consolidate above 7,000 and was down -3.8% last week. The Nasdaq100 was down -1.7% with much of the selling coming on Friday afternoon. Much of the selling came on Friday afternoon. The US 10Y bond yield was 3.98% versus 3.0% a month ago. The UK 10Y gilt yield (Sharepad ticker UKTSY10) fell back below 4% early last week, helped by the Bank of England’s temporary support measures, then rose to above 4.2% after the Prime Minister sacked the Chancellor. Politics in the UK remain “entertaining”.

Last week two very different finance personalities suggested that the Fed was raising interest rates too aggressively. The first was Jamie Dimon of JP Morgan, who said in an interview with CNBC that the US economy was in good shape at the moment and household balance sheets are strong but he’s much more cautious about the future, suggesting a recession in 6-9 months time. JP Morgan released Q3 results, with Q3 revenues growing +10% but net income down -17%, driven by a $1.5bn charge for bad debts. Investment banking revenues at the bank were down -43%.

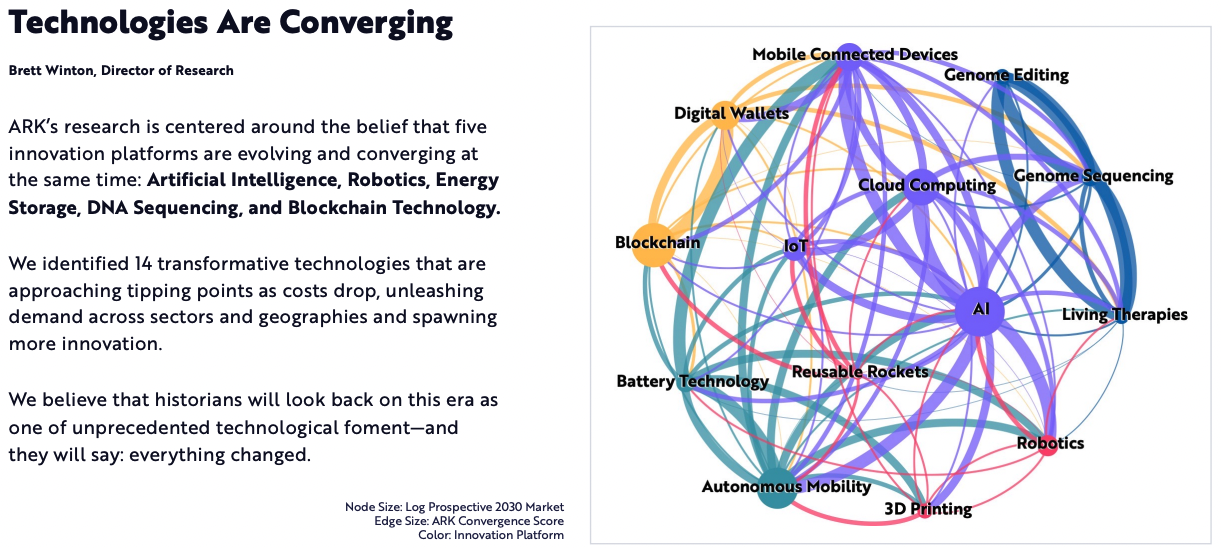

The second was Cathie Wood, of ARK ETF, who wrote an open letter to the Fed saying that the US Central Bank was making a ‘policy error’ and she believes deflation is a much greater threat than inflation. She points out that US retailers like Walmart and Target have increased inventories by c. +30%, whereas sales are growing at single-digit rates. The risk is that retailers either have to write off inventory or slash prices in the coming months.

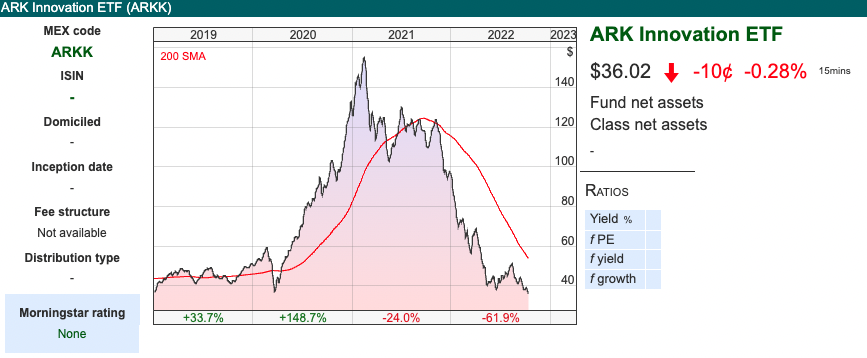

On the subject of slashed prices, below is the Sharepad chart showing her ARKK ETF is down -62% YTD, juxtaposed with a graphic from the fund manager’s ‘Big Ideas’ presentation which shows the 14 transformative technologies they’re backing to change the world.

Some of her top 10 largest holdings are Zoom -60% YTD, Tesla -37% YTD, and UiPath -73% YTD. With that kind of performance, reusable rocket technology probably would come in useful.

13 minutes into her ‘Gilt Trip – In the know with Cathie’ update, she claims that if rates had risen to 8% the UK banking system would have collapsed. This doesn’t make much sense to me, because fixed-income gilts make up around 2% of bank total assets. Lloyds hit a 52-week low of 39p last week before recovering. The bank has just £17bn fixed-interest government bonds. That might sound like a large number but compares to £76bn of cash on the balance sheet and total assets of £886bn in June. It’s possible that banks have dangerous undisclosed derivative positions, she claims that lenders problems would be caused by pension funds unable margin calls. In any case, we will find out more in the last week of October when UK banks are scheduled to release Q3 updates.

This week I look at Ashtead Technology Holdings, a recent IPO that provides rental equipment to both the offshore oil & gas sector and wind farms. Plus housebuilder Barratt Developments and cybersecurity firm Darktrace.

At the moment it feels like written commentary can go out of date very quickly as markets move around so much. I’ve discussed with the management at Sharepad and will switch to shorter but more timely pieces 2x a week. This is an experiment, so we’d welcome your feedback. marketing@sharescope.co.uk

Ashtead Technology Holdings Trading Update FY Dec

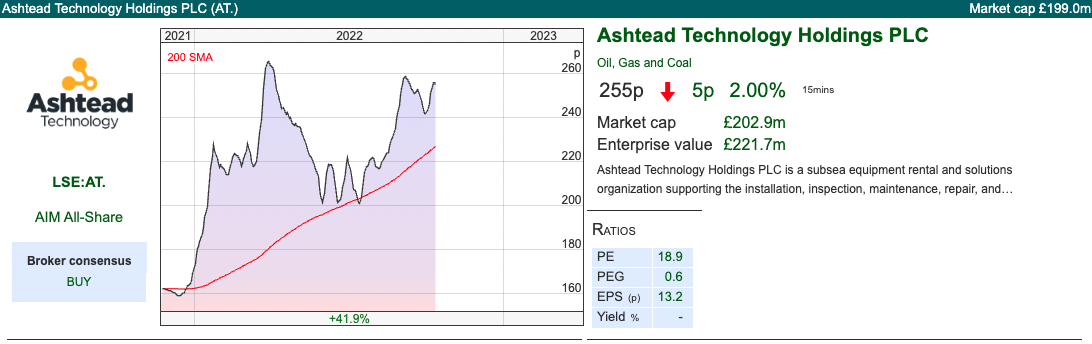

A positive update from this offshore and subsea energy equipment rental company which came to market in November last year. Last week’s brief RNS said that they now expect to ‘materially outperform’ FY Dec 2022F expectations (without saying what those expectations are).

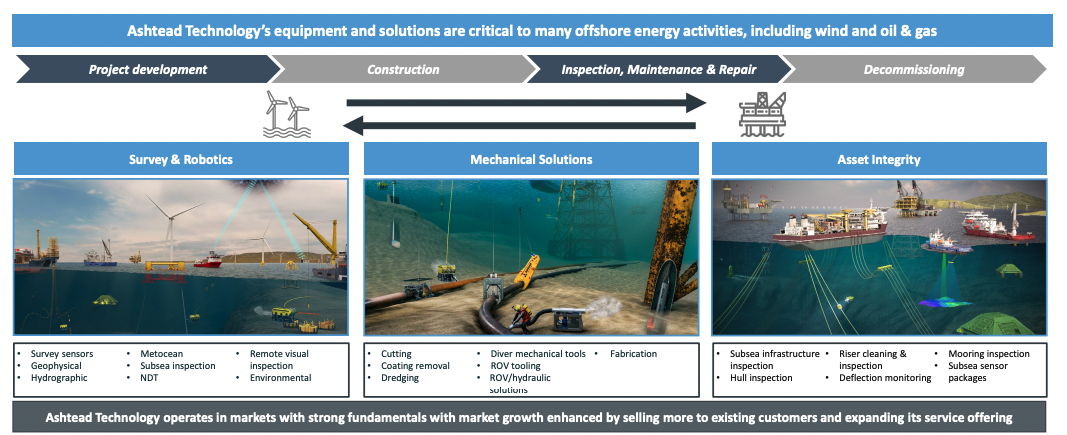

A month ago the company reported encouraging H1 results to June with revenue growth of +28.5% to £31.7m and a gross profit margin of 73%. Renewables now represent 30% of revenue with the other 70% offshore oil & gas. Net debt was £21m and they are targeting it to be 1x EBITDA by December. I’ve taken this slide from their InvestorMeetCompany presentation last month, which shows their activities across the life cycle of offshore energy activities.

History: The company was founded in 1985, then in 1993 was acquired by Ashtead Group (ticker AHT), the £19bn FTSE 100 company, that does equipment hire and derives most of its earnings from the USA with the Sunbelt Rentals brand. Ashtead Technology (ticker AT.) which at the time was focused on equipment hire for the oil & gas industry, was then sold to Private Equity (Phoenix Equity Partners) in 2008. The PE firm hired the current CEO Alan Pirie, who sold its onshore North American oil & gas division in 2013 and refocused the business on offshore energy. Phoenix then sold the business to Buckthorn Partners and Arab Petroleum Investments in 2016. They then made 5 acquisitions, around subsea equipment, robotics and increased capabilities in serving offshore wind farms.

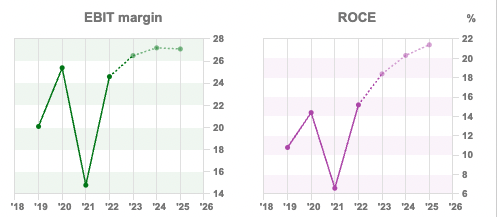

AT. came to market in November last year at 162p, raising £12m of new money and £36m for selling shareholders (Buckthorn Partners LLP, Arab Petroleum Investments, registered in Saudi Arabia, plus the CEO Alan Pirie and other management). Historically AT.’s customers spent money on significant equipment fleets, however, that is capitally intensive. As companies prioritise free cash flow and reducing CAPEX, they’ve been willing to outsource their specialist equipment requirements to companies like Ashtead Technology Holdings. There is some concentration risk, with their top 10 customers generating around 50% of revenue, but they’ve worked with 8 of those largest 10 customers for the last decade. The one concern I have is that AT.’s RoCE 3-year average of 10.6% is just above the cost of capital and CRoCI is currently 2.2%. SharePad shows current forecasts of >20% RoCE in a couple of years time.

The Admission Document says the total addressable market is expected to grow at an aggregate CAGR of +11% from 2020 to 2025 to reach a value in excess of $2 billion. Within this, offshore wind is expected to grow by a CAGR of +19% to $777m, decommissioning by +12% to $200m, and oil and gas Inspection Maintenance Repair (IMR) by +7% to $1bn.

On admission to AIM the market cap was £129m and surprisingly for a company listed by Private Equity has done well in the 12 months since coming to market. Buckthorn held 58% before the IPO and sold down to 35% and API Corp held 35% and sold down to 21%. Sharepad’s “DD tab” shows that they haven’t sold down any more shares since last November. Possibly the fact that the two largest selling shareholders still own 56% of the company may explain why the IPO wasn’t overpriced and hasn’t warned within 12 months of listing on AIM? Institutional buyers included FMR IM 7.9%, Chelverton AM 4.7%, Schroders 4.1%, Jupiter 3.9%.

Valuation: The shares are trading on 12.6x Dec 2023F and 11.8x Dec 2024F, with RoCE forecast to be greater than 20% in both of those forecast years. It does strike me that this could be cyclical, if there’s a global recession and the oil price collapses as it did in mid-2008 then those forecasts could be too optimistic.

Opinion: The renewables sector is obviously enjoying a favourable tailwind. I own shares in a couple of equipment hire businesses already, Andrews Sykes (air conditioning, pumps, boilers etc) and Capital Drilling (rents out drilling rigs to African gold mines). The economics ought to be attractive if done well because rather than price alone, reputation for service quality and reliability ought to drive returns. ASY reports a 3-year average RoCE of 27%, CAPD 3 yr RoCE 16.7%. If you are trying to fix some problem on the seabed, are you going to choose the cheapest equipment rental or the one with whom you have worked with before and has a good reputation? On my watch list, but I prefer to wait a couple of years following an IPO before investing.

Barratt Developments H1 Trading Update

Given that many mortgage deals have been pulled by banks recently, I thought it would be interesting to look at what housebuilders are saying. Financial markets are pricing in 2-year fixed mortgage deals repricing upwards to 6%, and the FT says that more than 2m UK households will have to remortgage at higher rates in the next two years. It seems likely if house prices fall, that will also affect the price of new build homes.

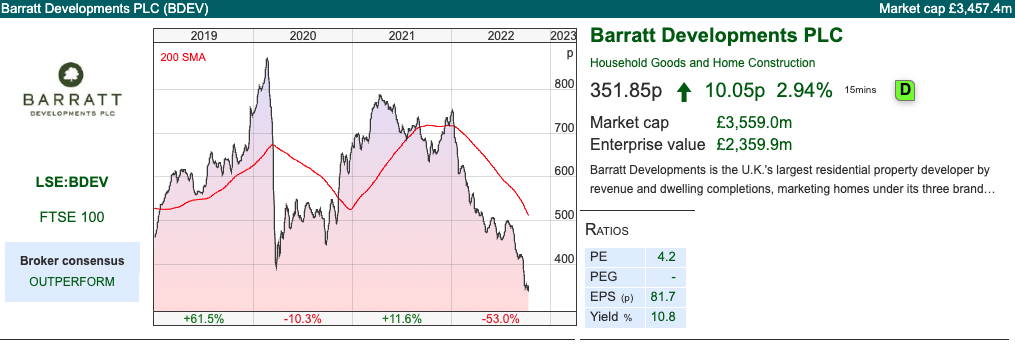

BDEV has a June year-end and last week released a trading update for July to 9th October. Management says that they are currently on track to deliver adj PBT of £972m FY Jun 2023, but note that the outlook for the year is less certain and the housing market is more challenging. They announced a £200m share buyback a month ago, and so far have bought 10.645 million shares for cancellation at a cost of £40m. So the average price they’ve paid is 375p, above the current market price of 351p.

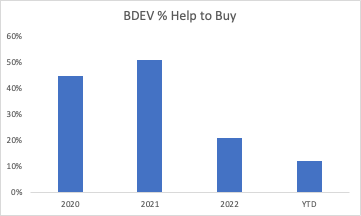

Help to Buy, the unpopular policy introduced in 2013 on which the government spent £29bn is coming to an end. HtB has fallen from over half of private reservations a couple of years ago to 12% at Barratt currently. At the time George Osborne, then Chancellor, claimed it would help First Time Buyers, in reality, it has operated as a subsidy to property developers who have benefited from the uplift in house prices and captured it as profit.

In response to rising interest rates, BDEV are being “increasingly selective” in bidding for land, they apply hurdle rates of 23% gross margin and 25% ROCE. That means net land approvals will be significantly lower than the 19K new plots costing £1.4bn in FY22, which in turn will help preserve cash. At the June year end, BDEV reported £1.14bn of net cash, that’s a third of the market cap of £3.55bn. Last week’s trading statement doesn’t give a net cash figure, and given how cash fluctuates through the financial year (it was £735m in April) I think there’s a good case for them disclosing an average rather than just a year-end figure.

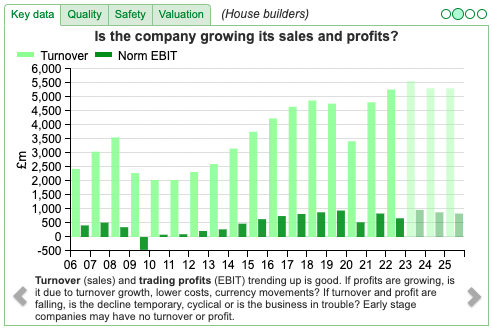

Valuation: The shares are trading on 5.3x Jun 2024F. However, a rule of thumb with cyclical stocks is to avoid them when they appear good value on a low PER because the markets are pricing in that the denominator ‘E’ of the P/E ratio is unsustainable. The chart above gives an idea of how cyclical Barratt is.

In the year following the financial crisis revenue fell -36% and Barratt reported a £679m loss. Then at the start of the pandemic revenue fell by -28% and profits halved. Thus, it is often better to wait until earnings have been slashed, in which case the P/E looks more expensive, but the earnings are achievable.

Opinion: I’ve used Sharepad’s “quick sector filter” to show the indiscriminate YTD share price sell-off in the housebuilding sector and the low valuation ratios across the board. That could be suggesting that the bad news is in the price. However, housebuilders have benefitted from government support, as the conventional wisdom is that a political party can’t win an election if house prices are falling. Recent turmoil in the gilts market means that the UK Government can no longer borrow cheaply to spend billions on propping up the housing market. One to keep an eye on, but it feels too early to call the turn.

Darktrace Q1 Trading Update

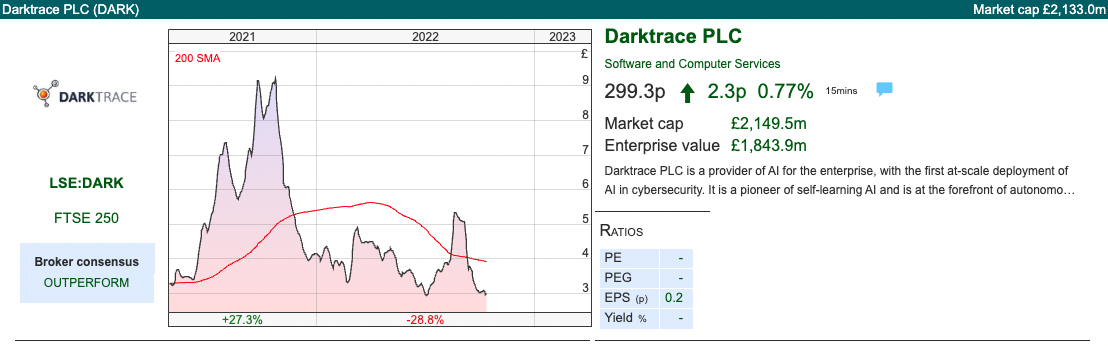

This cybersecurity company with a June year end put out a trading update for Q1 to September. They had received an approach from Private Equity firm Thoma Bravo, who then decided not to make an offer and the shares fell -30% at the beginning of September. Thoma Bravo didn’t say why they had decided to walk away. They are one of the largest investors in cyber security companies: their website lists 26 firms including McAfee, Sophos and Sailpoint (they paid $6.9bn for the latter earlier this year). Here’s a link to Orlando Bravo’s interview, where he explains that he specialises in buying unprofitable technology companies.

Given Darktrace’s associations with Mike Lynch (former CEO of Autonomy, currently fighting an extradition process to the USA) investor nervousness is understandable. Mike Lynch and his wife Angela Bacares still own 12.2% of Darktrace. Shadowfall, Matt Earl’s short-selling fund, which was also negative on Wirecard, have been critical of Darktrace too.

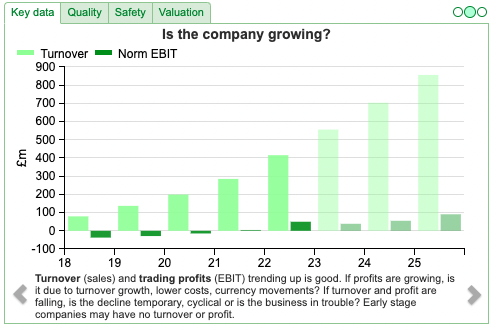

With that background in mind, the financial track record looks OK and last week’s RNS was re-assuring. Revenue for Q1 FY 2023 was $126m, up +37% versus the same quarter last year. They say that the recent strong dollar / weak pound has not had much effect, because most revenue has been invoiced prior to, or early in the summer. However, a strong dollar is likely to be a headwind in Q2. The explanation seems correct to me, but I do wonder how price sensitives corporates are about Darktrace’s product. If Heinz baked beans become more expensive, consumers might switch to supermarkets’ own brand, but are large corporates really that sensitive to forex movements for cyber security costs?

Outlook: They reiterate FY Jun 2023F guidance: revenue is expected to grow between +30% and +33%, with an H2 weighting of 53-54% (raised by 1 percentage point).

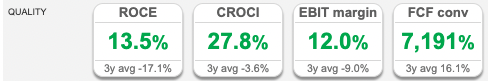

Valuation: The shares are trading on a pricey PER of 77x Jun 2023F dropping to 54x Jun 2024F. Despite being a software company DARK’s margins are not particularly high, so on a price/sales ratio of 3x Jun 2024F, they look more reasonably priced.

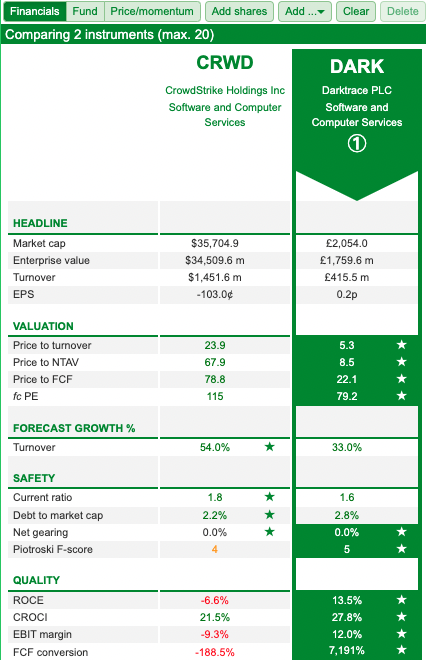

Opinion: Cybersecurity ought to be ‘defensive’ in the sense that it’s an essential spend, not something like marketing, consultancy or CAPEX which all can be slashed in a downturn to reduce costs and improve cash flow. It’s also possible to make large returns in the sector, Nasdaq listed Crowdstrike (market cap $35bn) increased in value 9x over the pandemic. More recently CRWD is off -25% YTD, so not immune to the tech sell-off.

I’ve used Sharepad (below) to compare DARK with CRWD, and on most measures, the UK company comes out ahead. I think this a sector where some technical expertise would be very useful, and it’s outside my circle of competence so I will avoid.

NB – graphic on next page

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 17/10/22 |AT., BDEV, DARK|Raising rates into a recession

Two very different US financial personalities believe that US interest rates are rising too fast. No doubt bankers and fund managers are talking their own book, but that doesn’t mean they’re wrong. Stocks covered AT., BDEV, DARK

The FTSE 100 failed to consolidate above 7,000 and was down -3.8% last week. The Nasdaq100 was down -1.7% with much of the selling coming on Friday afternoon. Much of the selling came on Friday afternoon. The US 10Y bond yield was 3.98% versus 3.0% a month ago. The UK 10Y gilt yield (Sharepad ticker UKTSY10) fell back below 4% early last week, helped by the Bank of England’s temporary support measures, then rose to above 4.2% after the Prime Minister sacked the Chancellor. Politics in the UK remain “entertaining”.

Last week two very different finance personalities suggested that the Fed was raising interest rates too aggressively. The first was Jamie Dimon of JP Morgan, who said in an interview with CNBC that the US economy was in good shape at the moment and household balance sheets are strong but he’s much more cautious about the future, suggesting a recession in 6-9 months time. JP Morgan released Q3 results, with Q3 revenues growing +10% but net income down -17%, driven by a $1.5bn charge for bad debts. Investment banking revenues at the bank were down -43%.

The second was Cathie Wood, of ARK ETF, who wrote an open letter to the Fed saying that the US Central Bank was making a ‘policy error’ and she believes deflation is a much greater threat than inflation. She points out that US retailers like Walmart and Target have increased inventories by c. +30%, whereas sales are growing at single-digit rates. The risk is that retailers either have to write off inventory or slash prices in the coming months.

On the subject of slashed prices, below is the Sharepad chart showing her ARKK ETF is down -62% YTD, juxtaposed with a graphic from the fund manager’s ‘Big Ideas’ presentation which shows the 14 transformative technologies they’re backing to change the world.

Some of her top 10 largest holdings are Zoom -60% YTD, Tesla -37% YTD, and UiPath -73% YTD. With that kind of performance, reusable rocket technology probably would come in useful.

13 minutes into her ‘Gilt Trip – In the know with Cathie’ update, she claims that if rates had risen to 8% the UK banking system would have collapsed. This doesn’t make much sense to me, because fixed-income gilts make up around 2% of bank total assets. Lloyds hit a 52-week low of 39p last week before recovering. The bank has just £17bn fixed-interest government bonds. That might sound like a large number but compares to £76bn of cash on the balance sheet and total assets of £886bn in June. It’s possible that banks have dangerous undisclosed derivative positions, she claims that lenders problems would be caused by pension funds unable margin calls. In any case, we will find out more in the last week of October when UK banks are scheduled to release Q3 updates.

This week I look at Ashtead Technology Holdings, a recent IPO that provides rental equipment to both the offshore oil & gas sector and wind farms. Plus housebuilder Barratt Developments and cybersecurity firm Darktrace.

At the moment it feels like written commentary can go out of date very quickly as markets move around so much. I’ve discussed with the management at Sharepad and will switch to shorter but more timely pieces 2x a week. This is an experiment, so we’d welcome your feedback. marketing@sharescope.co.uk

Ashtead Technology Holdings Trading Update FY Dec

A positive update from this offshore and subsea energy equipment rental company which came to market in November last year. Last week’s brief RNS said that they now expect to ‘materially outperform’ FY Dec 2022F expectations (without saying what those expectations are).

A month ago the company reported encouraging H1 results to June with revenue growth of +28.5% to £31.7m and a gross profit margin of 73%. Renewables now represent 30% of revenue with the other 70% offshore oil & gas. Net debt was £21m and they are targeting it to be 1x EBITDA by December. I’ve taken this slide from their InvestorMeetCompany presentation last month, which shows their activities across the life cycle of offshore energy activities.

History: The company was founded in 1985, then in 1993 was acquired by Ashtead Group (ticker AHT), the £19bn FTSE 100 company, that does equipment hire and derives most of its earnings from the USA with the Sunbelt Rentals brand. Ashtead Technology (ticker AT.) which at the time was focused on equipment hire for the oil & gas industry, was then sold to Private Equity (Phoenix Equity Partners) in 2008. The PE firm hired the current CEO Alan Pirie, who sold its onshore North American oil & gas division in 2013 and refocused the business on offshore energy. Phoenix then sold the business to Buckthorn Partners and Arab Petroleum Investments in 2016. They then made 5 acquisitions, around subsea equipment, robotics and increased capabilities in serving offshore wind farms.

AT. came to market in November last year at 162p, raising £12m of new money and £36m for selling shareholders (Buckthorn Partners LLP, Arab Petroleum Investments, registered in Saudi Arabia, plus the CEO Alan Pirie and other management). Historically AT.’s customers spent money on significant equipment fleets, however, that is capitally intensive. As companies prioritise free cash flow and reducing CAPEX, they’ve been willing to outsource their specialist equipment requirements to companies like Ashtead Technology Holdings. There is some concentration risk, with their top 10 customers generating around 50% of revenue, but they’ve worked with 8 of those largest 10 customers for the last decade. The one concern I have is that AT.’s RoCE 3-year average of 10.6% is just above the cost of capital and CRoCI is currently 2.2%. SharePad shows current forecasts of >20% RoCE in a couple of years time.

The Admission Document says the total addressable market is expected to grow at an aggregate CAGR of +11% from 2020 to 2025 to reach a value in excess of $2 billion. Within this, offshore wind is expected to grow by a CAGR of +19% to $777m, decommissioning by +12% to $200m, and oil and gas Inspection Maintenance Repair (IMR) by +7% to $1bn.

On admission to AIM the market cap was £129m and surprisingly for a company listed by Private Equity has done well in the 12 months since coming to market. Buckthorn held 58% before the IPO and sold down to 35% and API Corp held 35% and sold down to 21%. Sharepad’s “DD tab” shows that they haven’t sold down any more shares since last November. Possibly the fact that the two largest selling shareholders still own 56% of the company may explain why the IPO wasn’t overpriced and hasn’t warned within 12 months of listing on AIM? Institutional buyers included FMR IM 7.9%, Chelverton AM 4.7%, Schroders 4.1%, Jupiter 3.9%.

Valuation: The shares are trading on 12.6x Dec 2023F and 11.8x Dec 2024F, with RoCE forecast to be greater than 20% in both of those forecast years. It does strike me that this could be cyclical, if there’s a global recession and the oil price collapses as it did in mid-2008 then those forecasts could be too optimistic.

Opinion: The renewables sector is obviously enjoying a favourable tailwind. I own shares in a couple of equipment hire businesses already, Andrews Sykes (air conditioning, pumps, boilers etc) and Capital Drilling (rents out drilling rigs to African gold mines). The economics ought to be attractive if done well because rather than price alone, reputation for service quality and reliability ought to drive returns. ASY reports a 3-year average RoCE of 27%, CAPD 3 yr RoCE 16.7%. If you are trying to fix some problem on the seabed, are you going to choose the cheapest equipment rental or the one with whom you have worked with before and has a good reputation? On my watch list, but I prefer to wait a couple of years following an IPO before investing.

Barratt Developments H1 Trading Update

Given that many mortgage deals have been pulled by banks recently, I thought it would be interesting to look at what housebuilders are saying. Financial markets are pricing in 2-year fixed mortgage deals repricing upwards to 6%, and the FT says that more than 2m UK households will have to remortgage at higher rates in the next two years. It seems likely if house prices fall, that will also affect the price of new build homes.

BDEV has a June year-end and last week released a trading update for July to 9th October. Management says that they are currently on track to deliver adj PBT of £972m FY Jun 2023, but note that the outlook for the year is less certain and the housing market is more challenging. They announced a £200m share buyback a month ago, and so far have bought 10.645 million shares for cancellation at a cost of £40m. So the average price they’ve paid is 375p, above the current market price of 351p.

Help to Buy, the unpopular policy introduced in 2013 on which the government spent £29bn is coming to an end. HtB has fallen from over half of private reservations a couple of years ago to 12% at Barratt currently. At the time George Osborne, then Chancellor, claimed it would help First Time Buyers, in reality, it has operated as a subsidy to property developers who have benefited from the uplift in house prices and captured it as profit.

In response to rising interest rates, BDEV are being “increasingly selective” in bidding for land, they apply hurdle rates of 23% gross margin and 25% ROCE. That means net land approvals will be significantly lower than the 19K new plots costing £1.4bn in FY22, which in turn will help preserve cash. At the June year end, BDEV reported £1.14bn of net cash, that’s a third of the market cap of £3.55bn. Last week’s trading statement doesn’t give a net cash figure, and given how cash fluctuates through the financial year (it was £735m in April) I think there’s a good case for them disclosing an average rather than just a year-end figure.

Valuation: The shares are trading on 5.3x Jun 2024F. However, a rule of thumb with cyclical stocks is to avoid them when they appear good value on a low PER because the markets are pricing in that the denominator ‘E’ of the P/E ratio is unsustainable. The chart above gives an idea of how cyclical Barratt is.

In the year following the financial crisis revenue fell -36% and Barratt reported a £679m loss. Then at the start of the pandemic revenue fell by -28% and profits halved. Thus, it is often better to wait until earnings have been slashed, in which case the P/E looks more expensive, but the earnings are achievable.

Opinion: I’ve used Sharepad’s “quick sector filter” to show the indiscriminate YTD share price sell-off in the housebuilding sector and the low valuation ratios across the board. That could be suggesting that the bad news is in the price. However, housebuilders have benefitted from government support, as the conventional wisdom is that a political party can’t win an election if house prices are falling. Recent turmoil in the gilts market means that the UK Government can no longer borrow cheaply to spend billions on propping up the housing market. One to keep an eye on, but it feels too early to call the turn.

Darktrace Q1 Trading Update

This cybersecurity company with a June year end put out a trading update for Q1 to September. They had received an approach from Private Equity firm Thoma Bravo, who then decided not to make an offer and the shares fell -30% at the beginning of September. Thoma Bravo didn’t say why they had decided to walk away. They are one of the largest investors in cyber security companies: their website lists 26 firms including McAfee, Sophos and Sailpoint (they paid $6.9bn for the latter earlier this year). Here’s a link to Orlando Bravo’s interview, where he explains that he specialises in buying unprofitable technology companies.

Given Darktrace’s associations with Mike Lynch (former CEO of Autonomy, currently fighting an extradition process to the USA) investor nervousness is understandable. Mike Lynch and his wife Angela Bacares still own 12.2% of Darktrace. Shadowfall, Matt Earl’s short-selling fund, which was also negative on Wirecard, have been critical of Darktrace too.

With that background in mind, the financial track record looks OK and last week’s RNS was re-assuring. Revenue for Q1 FY 2023 was $126m, up +37% versus the same quarter last year. They say that the recent strong dollar / weak pound has not had much effect, because most revenue has been invoiced prior to, or early in the summer. However, a strong dollar is likely to be a headwind in Q2. The explanation seems correct to me, but I do wonder how price sensitives corporates are about Darktrace’s product. If Heinz baked beans become more expensive, consumers might switch to supermarkets’ own brand, but are large corporates really that sensitive to forex movements for cyber security costs?

Outlook: They reiterate FY Jun 2023F guidance: revenue is expected to grow between +30% and +33%, with an H2 weighting of 53-54% (raised by 1 percentage point).

Valuation: The shares are trading on a pricey PER of 77x Jun 2023F dropping to 54x Jun 2024F. Despite being a software company DARK’s margins are not particularly high, so on a price/sales ratio of 3x Jun 2024F, they look more reasonably priced.

Opinion: Cybersecurity ought to be ‘defensive’ in the sense that it’s an essential spend, not something like marketing, consultancy or CAPEX which all can be slashed in a downturn to reduce costs and improve cash flow. It’s also possible to make large returns in the sector, Nasdaq listed Crowdstrike (market cap $35bn) increased in value 9x over the pandemic. More recently CRWD is off -25% YTD, so not immune to the tech sell-off.

I’ve used Sharepad (below) to compare DARK with CRWD, and on most measures, the UK company comes out ahead. I think this a sector where some technical expertise would be very useful, and it’s outside my circle of competence so I will avoid.

NB – graphic on next page

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.