Bruce suggests that strong equity markets may be reflecting asset class rotation out of government bonds, rather than optimism about the situation in Ukraine. Companies covered this week SPSY, FNTL, JDG

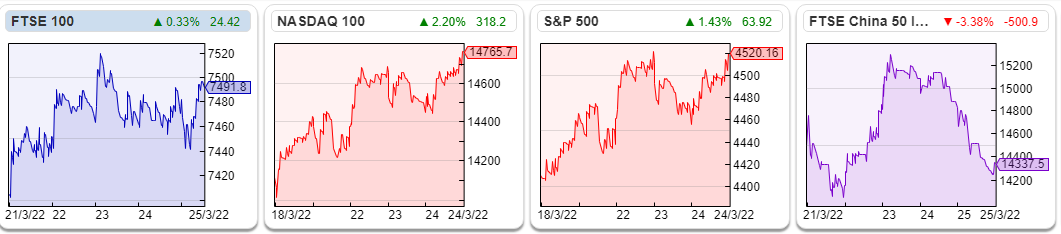

The FTSE was up less than 1% to 7,492 last week. The Nasdaq100 and S&P500 were up +2.4% and 1.3% respectively. US Government bonds continued to sell off steeply: the 10Y yield rose above 2.3% and the two-year US bond yield now implies that there are seven more hikes to come from the Fed this year. Brent crude is now up +48% since the start of this year to $115 per barrel.

The FTSE was up less than 1% to 7,492 last week. The Nasdaq100 and S&P500 were up +2.4% and 1.3% respectively. US Government bonds continued to sell off steeply: the 10Y yield rose above 2.3% and the two-year US bond yield now implies that there are seven more hikes to come from the Fed this year. Brent crude is now up +48% since the start of this year to $115 per barrel.

The war in Ukraine drags on. I’ve reassessed my cash weighting following strong equity market performance. Rather than discounting a quick resolution of the conflict, it could be that equities are benefiting from asset class rotation out of government bonds? Plus foreign investors selling out of China? The FTSE China 50 index is down -30% in the last 12 months. I’ve gone back and looked at my copy of Expected Returns, which shows that historically rising inflation is negative for equities (real returns) but even more negative for bond returns. Traditionally the businesses that tend to do well in inflationary times are those with brands and “competitive moats” (Unilever down -23% YTD and Diageo +33% YTD for example). I am wondering if telecoms like Vodafone might also benefit, they can probably raise prices for broadband and mobile phone subscriptions, which are now seen as essential compared to the 1990’s when we last had inflation. Banks like Lloyds and Barclays also have high levels of recurring revenues and should benefit from rising interest rates – as long as we avoid rising unemployment and stagflation.

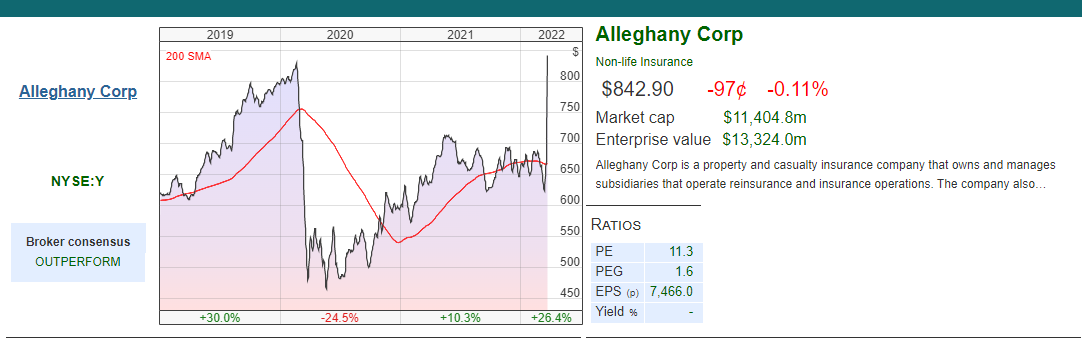

Berkshire Hathaway, which owns a portfolio of “inflation proof” businesses with pricing power, also has cash worth 19% of its market cap. Last week BRK paid $12bn for a US conglomerate called Alleghany. Presumably rising inflation and the threat of war are not too serious for Buffett’s investment case on the former railway company turned insurance conglomerate. Reading up on the history of the company, it did fail in the Great Depression. Alleghany was then acquired out of bankruptcy by a railway magnate called Robert Wright Young who used it to pursue a vendetta against J.P. Morgan. Through many twists and turns the company eventually ended up as an insurance conglomerate.

I wonder if the same fate is in store for some of the high profile telecoms companies at the moment? Railways were the telecoms companies of their day, with high fixed costs funded by banks and bond holders but uncertain revenue to follow. I keep meaning to read Sandy Nairn’s book, which he wrote 20 years ago after the internet bubble burst: Engines That Move Markets: Technology Investing from Railroads to the Internet and Beyond.

I wonder if the same fate is in store for some of the high profile telecoms companies at the moment? Railways were the telecoms companies of their day, with high fixed costs funded by banks and bond holders but uncertain revenue to follow. I keep meaning to read Sandy Nairn’s book, which he wrote 20 years ago after the internet bubble burst: Engines That Move Markets: Technology Investing from Railroads to the Internet and Beyond.

Games Workshop announced an “in line” trading update for FY May 2022F last week, the shares rising +7% in response. The shares have fallen -40% from their peak in September last year, without warning on profits. SharePad reveals GAW’s 2022F or 2023F EPS expectations have hardly changed over the last 6 months. Instead it seems that the engine driving the share price is expectations of expectations (ie anticipating results above or below forecasts.) I continue to hold through thick and thin.

4D Pharma was up +25% last week, following positive results in their renal cell carcinoma trial (difficult to treat cancer of the kidney) meeting the “primary efficacy endpoint” – which is a complicated way of saying that their treatment seems to work, I think. The company has a drug MRx0518 which is given to patients in combination with Keytruda (a cancer drug that’s already been approved and widely used). DDDD’s drug alters the microbiome in patients guts, which helps the immune system fight off cancer. I’ve followed it with interest though I am very far from being an expert. Well done to Donald Pond, who has been highlighting the potential of the company on Twitter for a while. Worth noting though that DDDD haven’t yet reported FY Dec 2021 results. In the 6 months to June 2021 they reported an operating loss of $56m (v cash of $21m at the period end), so will almost certainly need to raise more money from investors.

Mello is on Monday 28th – David Stredder has Poolbeg Pharma presenting, which was created from the assets of Open Orphan. He also has Fintel (support services for IFAs) that had FY Dec results that I cover below. The third company is musicMagpie (refurbished consumer electronics) which I haven’t looked at before because it came to market in April last year.

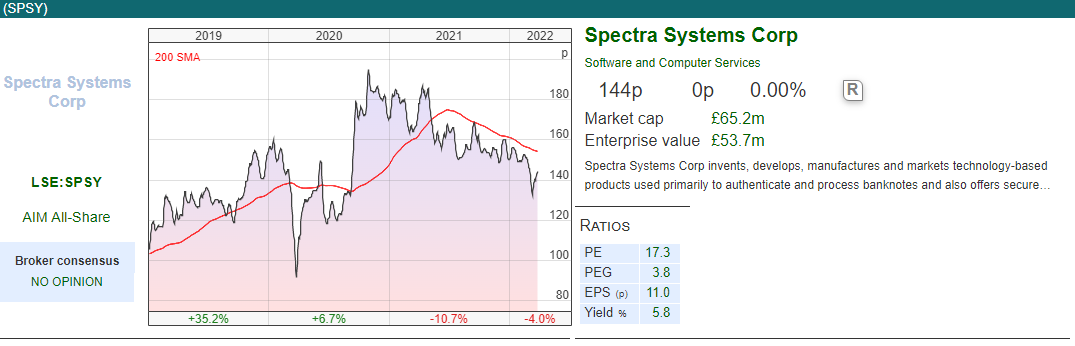

Aside from Fintel results, this week I also look at Spectra Systems the US headquartered bank note authentication company and Judges Scientific.

Spectra Systems FY Dec 2021

Strong results from this US based, bank note authentication company, with revenues +13% to $16.6m and statutory PBT +10% to $5.9m. They have $16.8m of cash on their balance sheet, +19% on the previous year.

Strong results from this US based, bank note authentication company, with revenues +13% to $16.6m and statutory PBT +10% to $5.9m. They have $16.8m of cash on their balance sheet, +19% on the previous year.

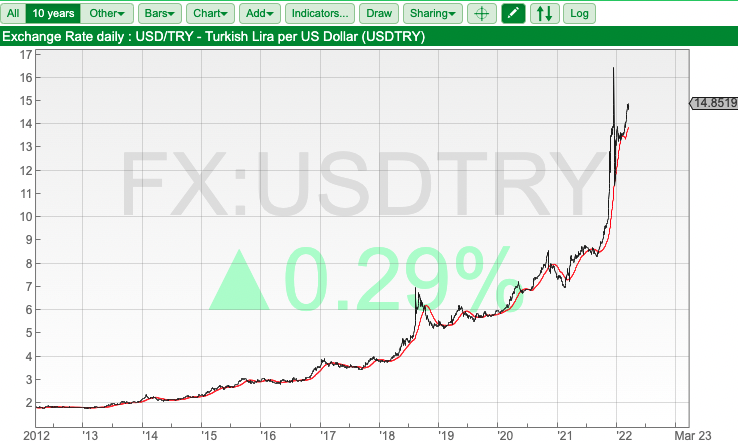

The pandemic has accelerated the decline in physical cash payments, however SPSY should be able to cope for a couple of reasons. They have a patented Banknote Disinfection System, which they have introduced and received interest from one Asian Central Bank. The second reason is that the company point out that while most currencies are seeing decreased everyday usage, for reserve currencies like the Dollar, Euro and Swiss Franc the use of physical reserve currencies is actually increasing. That is driven by people living in countries where GDP per capita is less than $10,000 who tend to save by keeping physical USD or similar outside their own country’s banking system. As an example, think about someone living in Turkey, they could save in a Turkish bank, but keeping physical US Dollars (or similar) under the mattress at home has been the better option. SharePad shows that 10 years ago a US dollar was worth 1.8 Turkish Lira, whereas now a dollar is worth c. 15 Turkish Lira.

Allenby Capital, SPSY’s broker point out that: “This is placing a greater demand for larger denomination notes and associated advanced security features to guard against counterfeiting. As such, we are entering a ‘less cash’ rather than ‘cashless’ future where cash represents one of several coexisting options. This is reflected in the investments that central banks are making in new generations of banknotes and the associated security measures, including the standardisation of sensors and new sorters for the next thirty or more years. Spectra is heavily involved in these projects.”

Outlook: There are some large numbers in SPSY’s outlook statement. They expect sensor sales c. $50m from 2024-2026, plus a 10 year service agreement worth over $8m. That translates into Allenby’s FY Dec 2025F revenue forecast of $29m +56% from the prior year and +78% v 2021 revenue of $16.6m just reported.

That’s likely to change the shape of the SPSY p&l, the current gross margin fell from 69% to 63% FY Dec 2021. According to Allenby’s note, Spectra currently derives c. $1 in revenue for every 1,000 notes printed. With the supply of the polymer substrate as well as the covert materials, management expects revenue of in excess of $20 per 1,000 notes printed. Although the gross margin for polymer substrates is lower (c. 15% to 20% versus >85% for covert materials), the potential gross profit is considerably greater. On the basis of two billion notes per annum, this would result in $6m to $8m in incremental gross profit. Allenby are forecasting statutory PBT of $10.5m in 2025F and EPS of $c18, which is assuming a gross margin of 54% 2024F.

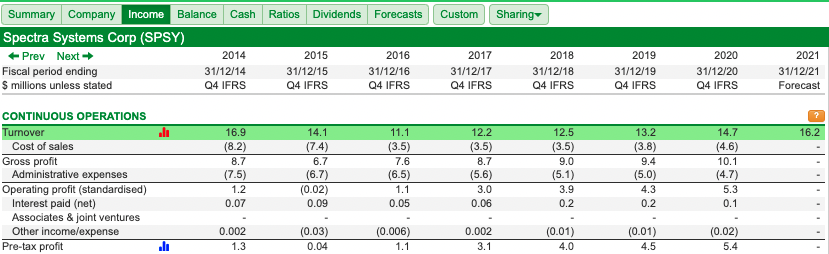

Valuation: Allenby’s $29m 2025F revenue forecat implies a price/sales of 3x and PER 2025F of 11x. However, it is definitely worth pondering if 2025F is a sustainable level of revenue. Using Sharepad to look at the company’s historic financials, we can see that SPSY achieved $16.9m of revenues in 2014, followed by 2 years of falling revenues and that level has not yet been surpassed ($16.6m revenues just reported in 2021).

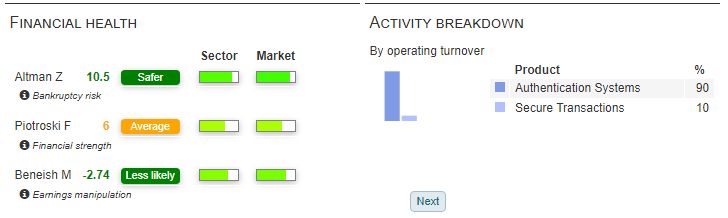

Low tax rate: Some extra caution is needed with US stocks listed in London because the US has well functioning stock markets, it’s worth understanding why a US company is listed in London when higher valuations can be achieved on Nasdaq than on AIM. SharePad shows that historically there’s been a low tax rate (less than 10%). In last year’s Annual Report they attribute this to ”$8.6m in federal net operating loss carryforwards to offset future income reported on the respective tax returns.” SPSY has not reported a loss since 2013 and the deferred tax asset on the balance sheet was $1m Dec 2021 (down from $1.4m 2020), versus a tax charge of $878K (a 2.9x increase versus the previous year) so I wonder how sustainable that low tax charge is. Sharepad’s Beneish M score of -2.74 and other financial health indicators (Altman Z and Piotroski F) are positive though.

Low tax rate: Some extra caution is needed with US stocks listed in London because the US has well functioning stock markets, it’s worth understanding why a US company is listed in London when higher valuations can be achieved on Nasdaq than on AIM. SharePad shows that historically there’s been a low tax rate (less than 10%). In last year’s Annual Report they attribute this to ”$8.6m in federal net operating loss carryforwards to offset future income reported on the respective tax returns.” SPSY has not reported a loss since 2013 and the deferred tax asset on the balance sheet was $1m Dec 2021 (down from $1.4m 2020), versus a tax charge of $878K (a 2.9x increase versus the previous year) so I wonder how sustainable that low tax charge is. Sharepad’s Beneish M score of -2.74 and other financial health indicators (Altman Z and Piotroski F) are positive though.

Opinion: Some US stocks listed in London have done very well (Somero up 37x and Water Intelligence up 25x in the last decade spring to mind.) The key is to understand what a “normal” year looks like for SPSY, and use that to derive a valuation.

Fintel FY Dec 2021

This data and support services business that used to be called SimplyBiz, is presenting at Mello on Monday night. They define themselves as a “FinTech”, though I think I would describe what they do as rather less exciting: compliance and regulatory support to IFAs. They have an unusual joint Chief Executive (Matt Timmins and Neil Stevens) structure. I’ve seen that before, but normally the arrangement doesn’t last long (for example Argentex). For Fintel though it does seem to have worked, with the two bosses working alongside each other running the company since 2010.

This data and support services business that used to be called SimplyBiz, is presenting at Mello on Monday night. They define themselves as a “FinTech”, though I think I would describe what they do as rather less exciting: compliance and regulatory support to IFAs. They have an unusual joint Chief Executive (Matt Timmins and Neil Stevens) structure. I’ve seen that before, but normally the arrangement doesn’t last long (for example Argentex). For Fintel though it does seem to have worked, with the two bosses working alongside each other running the company since 2010.

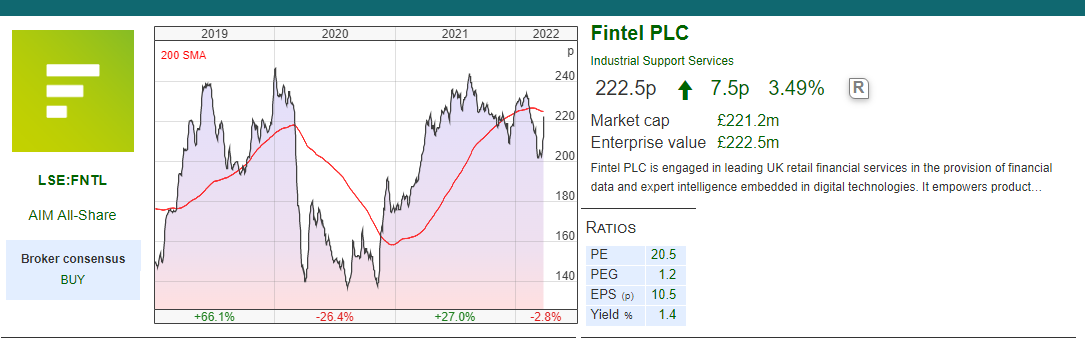

Fintel reported revenue +5% to £64m and statutory PBT +95% to £19.9m. That was helped by the gain on sale of a subsidiary and a second sale of a business, which together contributed £7.8m to statutory profits. On an adjusted basis PBT was up +5% to £15.9m. The disposals meant that net debt has gone from £19m at the end of 2020 to £2.6m of net cash at the end of December 2021.

History: The Group was founded in 2002, to help IFAs adapt to changing regulations. For instance in 2004 mortgage regulation, in 2011 FG11/05 Assessing Investment Suitability, the 2013 Retail Distribution Review in 2013, another Mortgage Market Review in 2014 and MiFID II in 2018.

In March 2018 they IPO’ed as Simply Biz at 170p per share, with the selling shareholders receiving £34m and raising £30m of new money for the company. This valued the business at £130m market cap on admission. They changed their name to FinTel early last year.

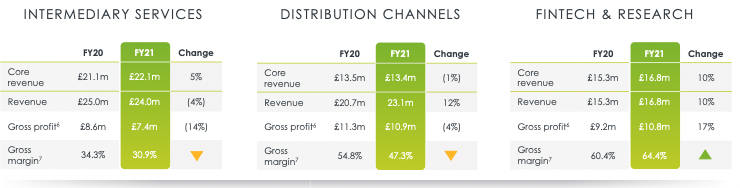

The group has 3 divisions, with very different margins and growth rates, as the graphic from the company’s analyst pack on the next page shows. Core revenue is excluding the effects of disposals. Intermediary services which is 35% of revenue, is the original business which provides support to thousands of IFAs, Wealth Managers and Mortgage Brokers. The Distribution Channels business, where core revenue fell 1%, helps financial institutions (Life & Pension companies, Fund Management companies and Banks) to push their products. The fastest growing (revenue +10%) and highest margin (gross margin 60%) is the smaller “FinTech” business, which provides Defaqto star ratings on thousands of financial products. I wonder if there’s a conflict of interest between the last two divisions, the equivalent of Fintel “marking it’s own homework”?

Outlook: Management have set out a medium-term objective for core business revenue growth at 5-7% annually during the period 2021 to 2024 (versus +9% ex disposals in 2021). They have excluded a couple of non core activities (panel management and surveying) which saw a strong recovery from Covid restrictions being lifted. They say that 2022 has started positively, but decline to put any numbers on that statement.

Valuation: 66% of the revenue is recurring, as the company has subscription agreements with intermediaries. The shares are trading on 17.1x 2023F falling to 16.2x 2024F. That seems about right for a business growing in single digits and reporting profitability in the low teens, albeit with strong free cash flow and recurring revenues.

Opinion: This looks a sensible investment case, though hardly an exciting FinTech like Wise or Revolut. I think the questions I would ask management would be around the growth potential and need to reinvest (they mention an ERP system implementation in the commentary). There’s so much excellent information available online, that I do wonder if there’s a long term need for face to face meetings with IFA’s and for them to shrink in number. So far that hasn’t seemed to have happened – partly because there’s another trend for increasingly complicated regulation, the burden of which benefits Fintel’s business model.

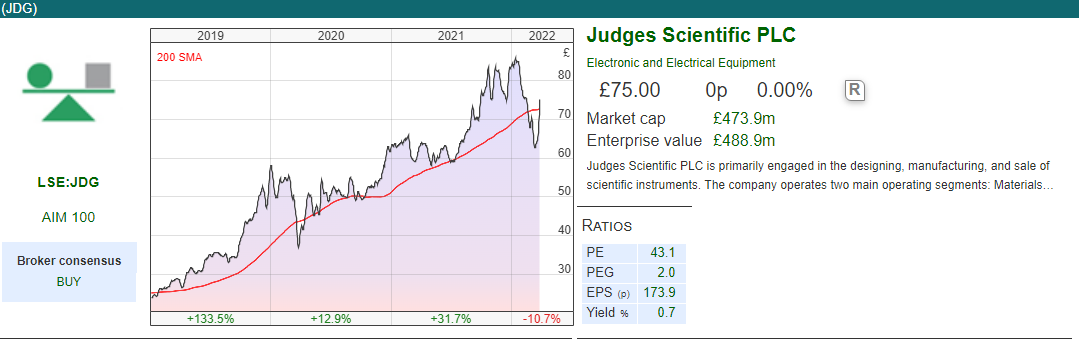

Judges Scientific FY Dec 2021

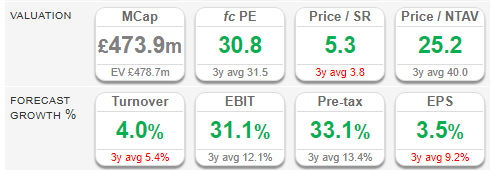

Judges Scientific continues to go from strength to strength. Last week they reported organic revenue was +10%, or +14% including acquisitions to £91m. Statutory PBT was up +49% to £15m. I had worried that the company might struggle with academic conferences moving online, which makes it hard for their salesmen to showcase the scientific instruments that they make. They have bought 19 businesses over the years, and acquisitive groups can unravel when conditions become more difficult. But the order book was +25% compared to 2020, and up +8.5% versus 2019 before the pandemic. Adjusted net cash was £1.4m up from £5.7m net debt the previous year. I appreciate the voluntary disclosure where that net cash figure is ex IFRS lease liabilities (which makes sense) but does include sums still due for recent acquisitions (which makes even more sense).

Judges Scientific continues to go from strength to strength. Last week they reported organic revenue was +10%, or +14% including acquisitions to £91m. Statutory PBT was up +49% to £15m. I had worried that the company might struggle with academic conferences moving online, which makes it hard for their salesmen to showcase the scientific instruments that they make. They have bought 19 businesses over the years, and acquisitive groups can unravel when conditions become more difficult. But the order book was +25% compared to 2020, and up +8.5% versus 2019 before the pandemic. Adjusted net cash was £1.4m up from £5.7m net debt the previous year. I appreciate the voluntary disclosure where that net cash figure is ex IFRS lease liabilities (which makes sense) but does include sums still due for recent acquisitions (which makes even more sense).

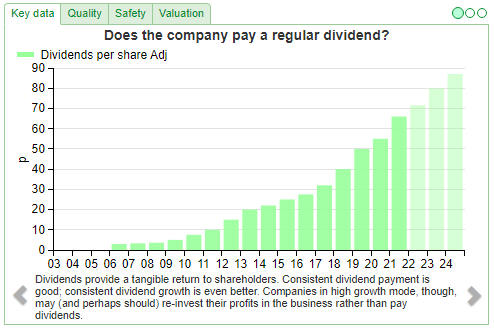

The dividend per share is 66p, which compares to the share price of 100p in 2005, when Judges did a placing to reverse into Fire Testing Technology. So a 75x share price increase since then. Dividends have compounded at +22% CAGR since then, and the Chairman points out that cumulative dividend distribution is almost 6x that original 100p share price. A fantastic achievement that deserves our admiration (mixed with feelings of regret for not buying the shares.)

Valuation: The shares are trading on 31x 2023F and 29x 2024F. Price to Sales is just over 5x, while forecast suggest continued progress even without further acquisitions. Judges agreed last year a £60m banking facility with Lloyds, which indicates that management believe they can continue the policy to selectively acquire businesses that generate sustainable profits and cash. Sounds simple doesn’t it?

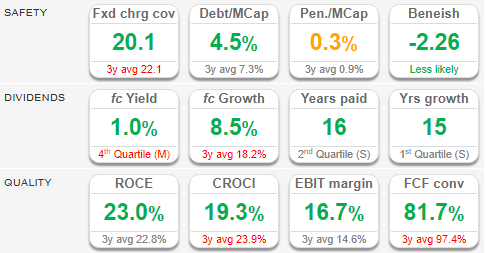

Opinion: With the benefit of hindsight the beginning of the pandemic was an opportunity to buy this quality business. The shares have doubled since their April 2020 low. The one cloud on the horizon is we could see a change of management soon, because David Cicurel is in his mid 70s. However, even if the Chief Exec decides not to copy the example of that other conglomerate in Omaha, whose nonagenarian Chairman and Vice Chairman show no signs of stepping down, I would imagine that he’s not unaware of his age and the board would have put succession plans in place. In the meantime Sharepad shows the excellent Safety, Dividends and Quality metrics for the company.

Bruce Packard

brucepackard.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 28/03/22 | SPSY, FNTL, JDG | Engines that move markets

Bruce suggests that strong equity markets may be reflecting asset class rotation out of government bonds, rather than optimism about the situation in Ukraine. Companies covered this week SPSY, FNTL, JDG

The war in Ukraine drags on. I’ve reassessed my cash weighting following strong equity market performance. Rather than discounting a quick resolution of the conflict, it could be that equities are benefiting from asset class rotation out of government bonds? Plus foreign investors selling out of China? The FTSE China 50 index is down -30% in the last 12 months. I’ve gone back and looked at my copy of Expected Returns, which shows that historically rising inflation is negative for equities (real returns) but even more negative for bond returns. Traditionally the businesses that tend to do well in inflationary times are those with brands and “competitive moats” (Unilever down -23% YTD and Diageo +33% YTD for example). I am wondering if telecoms like Vodafone might also benefit, they can probably raise prices for broadband and mobile phone subscriptions, which are now seen as essential compared to the 1990’s when we last had inflation. Banks like Lloyds and Barclays also have high levels of recurring revenues and should benefit from rising interest rates – as long as we avoid rising unemployment and stagflation.

Berkshire Hathaway, which owns a portfolio of “inflation proof” businesses with pricing power, also has cash worth 19% of its market cap. Last week BRK paid $12bn for a US conglomerate called Alleghany. Presumably rising inflation and the threat of war are not too serious for Buffett’s investment case on the former railway company turned insurance conglomerate. Reading up on the history of the company, it did fail in the Great Depression. Alleghany was then acquired out of bankruptcy by a railway magnate called Robert Wright Young who used it to pursue a vendetta against J.P. Morgan. Through many twists and turns the company eventually ended up as an insurance conglomerate.

Games Workshop announced an “in line” trading update for FY May 2022F last week, the shares rising +7% in response. The shares have fallen -40% from their peak in September last year, without warning on profits. SharePad reveals GAW’s 2022F or 2023F EPS expectations have hardly changed over the last 6 months. Instead it seems that the engine driving the share price is expectations of expectations (ie anticipating results above or below forecasts.) I continue to hold through thick and thin.

4D Pharma was up +25% last week, following positive results in their renal cell carcinoma trial (difficult to treat cancer of the kidney) meeting the “primary efficacy endpoint” – which is a complicated way of saying that their treatment seems to work, I think. The company has a drug MRx0518 which is given to patients in combination with Keytruda (a cancer drug that’s already been approved and widely used). DDDD’s drug alters the microbiome in patients guts, which helps the immune system fight off cancer. I’ve followed it with interest though I am very far from being an expert. Well done to Donald Pond, who has been highlighting the potential of the company on Twitter for a while. Worth noting though that DDDD haven’t yet reported FY Dec 2021 results. In the 6 months to June 2021 they reported an operating loss of $56m (v cash of $21m at the period end), so will almost certainly need to raise more money from investors.

Mello is on Monday 28th – David Stredder has Poolbeg Pharma presenting, which was created from the assets of Open Orphan. He also has Fintel (support services for IFAs) that had FY Dec results that I cover below. The third company is musicMagpie (refurbished consumer electronics) which I haven’t looked at before because it came to market in April last year.

Aside from Fintel results, this week I also look at Spectra Systems the US headquartered bank note authentication company and Judges Scientific.

Spectra Systems FY Dec 2021

The pandemic has accelerated the decline in physical cash payments, however SPSY should be able to cope for a couple of reasons. They have a patented Banknote Disinfection System, which they have introduced and received interest from one Asian Central Bank. The second reason is that the company point out that while most currencies are seeing decreased everyday usage, for reserve currencies like the Dollar, Euro and Swiss Franc the use of physical reserve currencies is actually increasing. That is driven by people living in countries where GDP per capita is less than $10,000 who tend to save by keeping physical USD or similar outside their own country’s banking system. As an example, think about someone living in Turkey, they could save in a Turkish bank, but keeping physical US Dollars (or similar) under the mattress at home has been the better option. SharePad shows that 10 years ago a US dollar was worth 1.8 Turkish Lira, whereas now a dollar is worth c. 15 Turkish Lira.

Allenby Capital, SPSY’s broker point out that: “This is placing a greater demand for larger denomination notes and associated advanced security features to guard against counterfeiting. As such, we are entering a ‘less cash’ rather than ‘cashless’ future where cash represents one of several coexisting options. This is reflected in the investments that central banks are making in new generations of banknotes and the associated security measures, including the standardisation of sensors and new sorters for the next thirty or more years. Spectra is heavily involved in these projects.”

Outlook: There are some large numbers in SPSY’s outlook statement. They expect sensor sales c. $50m from 2024-2026, plus a 10 year service agreement worth over $8m. That translates into Allenby’s FY Dec 2025F revenue forecast of $29m +56% from the prior year and +78% v 2021 revenue of $16.6m just reported.

That’s likely to change the shape of the SPSY p&l, the current gross margin fell from 69% to 63% FY Dec 2021. According to Allenby’s note, Spectra currently derives c. $1 in revenue for every 1,000 notes printed. With the supply of the polymer substrate as well as the covert materials, management expects revenue of in excess of $20 per 1,000 notes printed. Although the gross margin for polymer substrates is lower (c. 15% to 20% versus >85% for covert materials), the potential gross profit is considerably greater. On the basis of two billion notes per annum, this would result in $6m to $8m in incremental gross profit. Allenby are forecasting statutory PBT of $10.5m in 2025F and EPS of $c18, which is assuming a gross margin of 54% 2024F.

Valuation: Allenby’s $29m 2025F revenue forecat implies a price/sales of 3x and PER 2025F of 11x. However, it is definitely worth pondering if 2025F is a sustainable level of revenue. Using Sharepad to look at the company’s historic financials, we can see that SPSY achieved $16.9m of revenues in 2014, followed by 2 years of falling revenues and that level has not yet been surpassed ($16.6m revenues just reported in 2021).

Opinion: Some US stocks listed in London have done very well (Somero up 37x and Water Intelligence up 25x in the last decade spring to mind.) The key is to understand what a “normal” year looks like for SPSY, and use that to derive a valuation.

Fintel FY Dec 2021

Fintel reported revenue +5% to £64m and statutory PBT +95% to £19.9m. That was helped by the gain on sale of a subsidiary and a second sale of a business, which together contributed £7.8m to statutory profits. On an adjusted basis PBT was up +5% to £15.9m. The disposals meant that net debt has gone from £19m at the end of 2020 to £2.6m of net cash at the end of December 2021.

History: The Group was founded in 2002, to help IFAs adapt to changing regulations. For instance in 2004 mortgage regulation, in 2011 FG11/05 Assessing Investment Suitability, the 2013 Retail Distribution Review in 2013, another Mortgage Market Review in 2014 and MiFID II in 2018.

In March 2018 they IPO’ed as Simply Biz at 170p per share, with the selling shareholders receiving £34m and raising £30m of new money for the company. This valued the business at £130m market cap on admission. They changed their name to FinTel early last year.

The group has 3 divisions, with very different margins and growth rates, as the graphic from the company’s analyst pack on the next page shows. Core revenue is excluding the effects of disposals. Intermediary services which is 35% of revenue, is the original business which provides support to thousands of IFAs, Wealth Managers and Mortgage Brokers. The Distribution Channels business, where core revenue fell 1%, helps financial institutions (Life & Pension companies, Fund Management companies and Banks) to push their products. The fastest growing (revenue +10%) and highest margin (gross margin 60%) is the smaller “FinTech” business, which provides Defaqto star ratings on thousands of financial products. I wonder if there’s a conflict of interest between the last two divisions, the equivalent of Fintel “marking it’s own homework”?

Outlook: Management have set out a medium-term objective for core business revenue growth at 5-7% annually during the period 2021 to 2024 (versus +9% ex disposals in 2021). They have excluded a couple of non core activities (panel management and surveying) which saw a strong recovery from Covid restrictions being lifted. They say that 2022 has started positively, but decline to put any numbers on that statement.

Valuation: 66% of the revenue is recurring, as the company has subscription agreements with intermediaries. The shares are trading on 17.1x 2023F falling to 16.2x 2024F. That seems about right for a business growing in single digits and reporting profitability in the low teens, albeit with strong free cash flow and recurring revenues.

Opinion: This looks a sensible investment case, though hardly an exciting FinTech like Wise or Revolut. I think the questions I would ask management would be around the growth potential and need to reinvest (they mention an ERP system implementation in the commentary). There’s so much excellent information available online, that I do wonder if there’s a long term need for face to face meetings with IFA’s and for them to shrink in number. So far that hasn’t seemed to have happened – partly because there’s another trend for increasingly complicated regulation, the burden of which benefits Fintel’s business model.

Judges Scientific FY Dec 2021

The dividend per share is 66p, which compares to the share price of 100p in 2005, when Judges did a placing to reverse into Fire Testing Technology. So a 75x share price increase since then. Dividends have compounded at +22% CAGR since then, and the Chairman points out that cumulative dividend distribution is almost 6x that original 100p share price. A fantastic achievement that deserves our admiration (mixed with feelings of regret for not buying the shares.)

Valuation: The shares are trading on 31x 2023F and 29x 2024F. Price to Sales is just over 5x, while forecast suggest continued progress even without further acquisitions. Judges agreed last year a £60m banking facility with Lloyds, which indicates that management believe they can continue the policy to selectively acquire businesses that generate sustainable profits and cash. Sounds simple doesn’t it?

Opinion: With the benefit of hindsight the beginning of the pandemic was an opportunity to buy this quality business. The shares have doubled since their April 2020 low. The one cloud on the horizon is we could see a change of management soon, because David Cicurel is in his mid 70s. However, even if the Chief Exec decides not to copy the example of that other conglomerate in Omaha, whose nonagenarian Chairman and Vice Chairman show no signs of stepping down, I would imagine that he’s not unaware of his age and the board would have put succession plans in place. In the meantime Sharepad shows the excellent Safety, Dividends and Quality metrics for the company.

Bruce Packard

brucepackard.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.