At midnight, on 1st January this year, the K.L.F. released their back catalogue of music (hits such as 3AM Eternal, Justified and Ancient, Last Train to Trancentral) on Spotify and uploaded their old videos to YouTube. This was their first activity as a band since 1992, when they announced they were leaving the music industry after having fired blanks from an automatic weapon at the audience at the BRITs and dumped a dead sheep with a sign attached saying “I died for you” at the entrance to the backstage party. They then left and withdrew their music back catalogue. The disbanded band then formed the K Foundation, where their first piece of art ‘Nailed to a Wall’ was £1m in £50 notes, nailed to a salvaged skirting board, which they framed and put a reserve price of £500K. The catalogue entry for the artwork stated:

“Over the years the face value will be eroded by inflation, while the artistic value will rise and rise. The precise point at which the artistic value will overtake the face value is unknown. Deconstruct the work now and you double your money. Hang it on a wall and watch the face value erode, the market value fluctuate, and the artistic value soar. The choice is yours.”

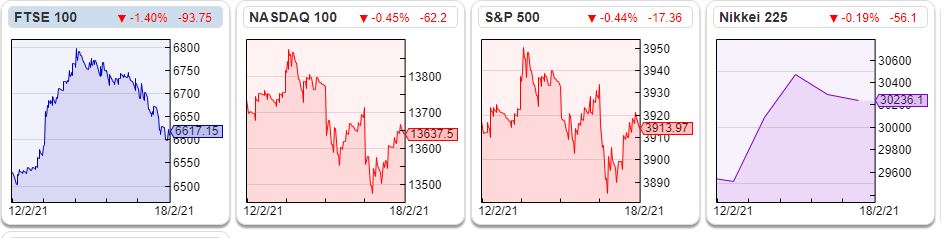

Inflation Most indicators from the bond markets, such as the US 10 year (which rose to 1.30% last week) and the UK spread between the 1y and 10y govt bond are now suggesting inflation will eat into the face value of financial assets. In the UK “real” interest rate (interest rates minus inflation) is minus 2%.

There is a simplistic formula which suggests negative real interest rates = good for equity markets, and bad for cash and bonds. Inflation is certainly bad news for bond holders, but I’m not convinced that it is bad news for cash or good news for equities.

Buffett is currently sitting on $140bn of cash and has underperformed the S&P500 by 37% over the last two years. Berkshire Hathaway’s performance has now lagged the S&P500 index over the past 5-, 10- and 15-year periods, according to data from S&P. The sage understands how inflation is eroding the face value of his cash, yet remarkably he preferred to sit out the market rally rather than risk overpaying for equities. To understand his thinking, we might look at a 1977 article he published ‘How Inflation Swindles the Equity Investor’, where he points out that company profits are reported after depreciation has been deducted, which “presumably will allow replacement of present productive capacity – if that plant and equipment can be purchased in the future at prices similar to their original cost.”

In an inflationary environment, the depreciation charge is understated (the cost of replacing a widget bashing machine rises with inflation) and therefore company profits and returns on capital are overstated. This can explain why, in the past, resources companies (oil&gas, but also mining) don’t necessarily benefit from commodity price inflation: companies have to spend money on equipment and assets, whose replacement cost may be rising faster than the price of whatever they are digging out of the ground. As investors reconsider their assumptions about future expenses, this leads to a de-rating.

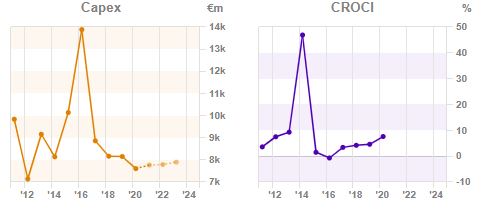

A similar process can happen without the economy reporting much inflation, rising costs with no pricing power to pass to the customer can be equally pernicious for investor returns. Vodafone’s share price fell 75% 2000-2 as investors saw that “free” cashflow was not really free at all, but would have to be ploughed back into the business (3G, 4G now 5G) just to stand still. The chart above shows Vodafone’s high capex and low Cash Return on Capital Invested.

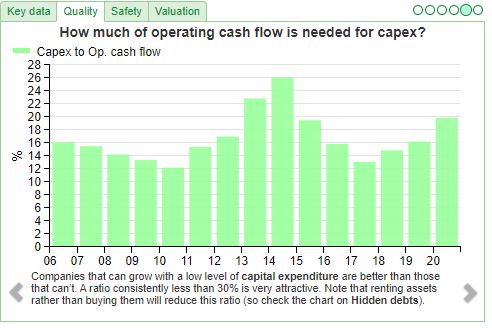

By contrast a company such as Diageo spends between 10-25% of operating cashflow on capex, as the chart on the next page shows. This should deliver better value for shareholders, as SharePad points out, a ratio below 30% is very attractive.

Does time also erode the value of intangible assets? The replacement cost of the KLF’s cash/art was £1m, but the market price was £0.5m, though over time the price of art can easily outpace inflation. Charles Saatchi sold The Physical Impossibility of Death in the Mind of Someone Living (also known as: the shark in formaldehyde) to Steve Cohen, the hedge fund billionaire for $8m, an excellent return on his invested capital (the original work cost Saatchi £50K). When Damian Hirst heard that the original shark was rotting, the artist offered to catch a new shark and preserve it with a better technique, for which Cohen paid Hirst an undisclosed sum to cover his costs, though Cohen was actually buying Hirst’s original artwork from Saatchi.

Companies have to spend money on marketing to maintain the value of intangible assets, even then brands can lose their appeal. Last year Diageo took an impairment charge of £1.3bn against brands, goodwill and other intangible assets. For context the group spent £1.8bn on marketing (3x the amount of capex of £620m) v PBT was £2bn the same year. My conclusion is that amounts recorded on company balance sheet show the limitations of accounting, we need to use our own judgement about the future costs and value trends. That Buffett is sitting on so much cash suggests that the value of companies’ intangible assets is now recognised and there are few obvious bargains.

This week I look at three companies: K3 Capital, a corporate finance and insolvency advisory firm, Marlowe, support services specialising in health and safety and Burford, the litigation funder. All three have substantial intangible assets on their balance sheet.

Once again I’ll be speaking at David Stredder’s online “Mello Event” (Monday 22nd Feb). The link and discount code for Sharepad / Sharescope readers gives you 50% off tickets for this and forthcoming MelloMondays (RRP £19.50, so £9.75 with the code).

https://buytickets.at/melloeventslimited/478820 Discount code : MMScope21

In the end, the KLF failed to find a buyer for their work of art at the reserve price of half a million pounds, or indeed an insurance company that would insure it. Instead they sailed to the Scottish Island of Jura, and in a quiet cottage filmed themselves burning a million pounds in the fireplace. When asked why they burnt a million pounds they struggled to give a reason.

Now that’s what I call impairment.

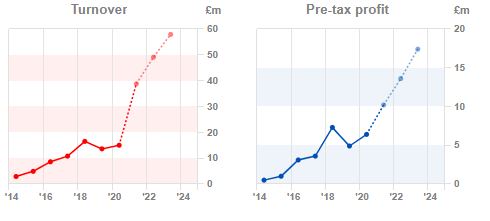

K3 Capital H1 results to 30 November

This acquisitive professional services firm (M&A, R&D tax credit advice, insolvency, forensic accounting, pension scheme advice) announced H1 results. In June last year the company raised £30m at 150p in a placing and then used the money to make a couple of acquisitions: i) Randd (R&D tax credit advice for £18m) and ii) Quantuma (restructuring and insolvency for £42m plus some shares issued in an earnout). This means the current year H1 revenue of £18m is not comparable with £8m H1 2020. The company hasn’t given an organic growth rate in their RNS, probably because excluding acquisitions, revenue fell 26% in their core “KBS” business to £5.9m v £8m last year.

History Listed on AIM in April 2017, raising £18m at 95p, valuing the company at £40m. Only £2m was raised to invest in the business, the rest was Anthony Ford, a founding shareholder selling due to health issues though he still owns 8%. John Rigby, the Chief Executive also sold some shares, but still owns 11%. The company’s history goes back to 1998, but only became K3 Capital in 2007. K3C specialises in the smaller end of the corporate finance market, and the company operates three brands based on size of the company that they are advising: i)the Knightsbridge brand targets companies with less than £1m enterprise value that don’t own freeholds, often pubs and restaurants, ii) the KBS Corporate brand serves businesses up to £10m, iii) KBS Corporate Finance £10-£200m which is still too small to be of much interest to stockbroking firms, let alone bulge bracket investment banks. Following the acquisitions, “core” KBS represents just 1/4 of annualised group revenue, with Quantuma 2/3 and Rannd 1/8.

As the company has grown by acquisition, there is currently £53m of intangible assets on the balance sheet, versus shareholders’ equity of £46m. So the business has negative tangible assets. That said, net cash from operations was £4.2m at H1 and they still ended the period with £10m of net cash on the balance sheet following the capital raising and acquisitions. There is no debt, but they do have an unused £10m facility as part of a flexible approach to funding acquisitions.

Outlook statement Management at first sounds upbeat: “KBS continues to see strong levels of performance, with January producing the highest profit month so far in FY21 and the pipeline remains strong, giving us confidence for the remainder of H2 and beyond”. But at the same time they express caution about Quantuma, the insolvency business which is 2/3 of revenue and is seeing significantly reduced activity because of the Government’s support of SMEs, which agrees with what Manolete warned about a couple of weeks ago.

Broker forecasts FinnCap their broker published a note, but left their forecasts unchanged: £37m of revenue FY 2021F to May, growing to £58m in two years time FY 2023F May. This give EPS of 12p FY 2021F, 16p and 21p in FY 2022F and 2023F respectively, putting the shares on 13x 2023F PER.

Ownership 53% of the shares are not in public hands, with the biggest insider shareholders Anthony Ford and John Rigby. The largest institutions are Miton, which owns 15%, Axa 5.5%, Schroders 3.8% and Hargreave Hale 3%.

Opinion Last year’s acquisitions, particularly Quantuma the insolvency business, were transformational. I think this business could be interesting long term, but I’m worried about the mixed messages coming from the outlook statement, and perhaps we could see a profit warning due to the insolvency waiver and Government support being extended? It is also worth noting that when you buy a people business, the assets walk out of the door every evening, and that is particularly true once earn-outs have expired.

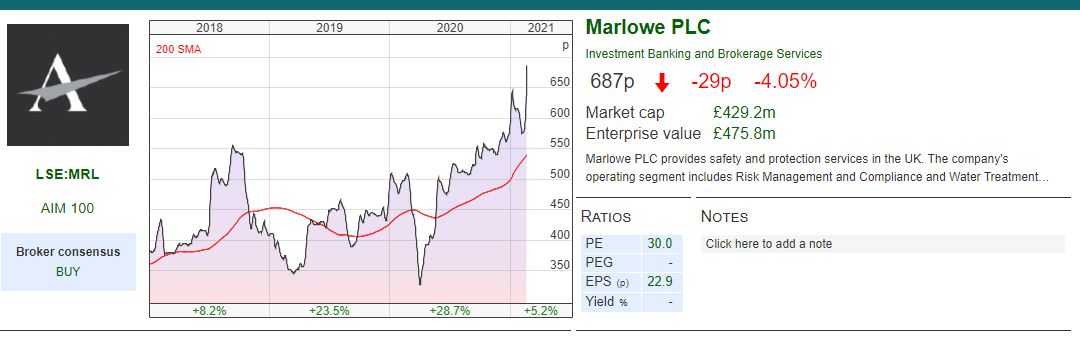

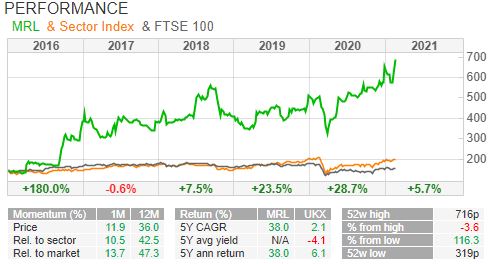

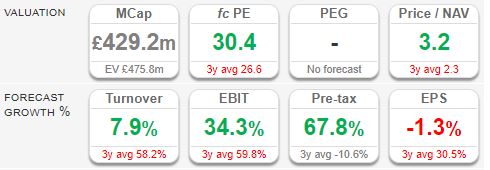

Marlowe H1 Trading Update / Capital Markets Day

This Lord Ashcroft support services company, with a 31 March Year End held a Capital Markets Day last week and announced a Trading Update. The Group set out its growth strategy with target revenue of c.£500 million and adjusted EBITDA of c.£100 million in 3 years. That compares to the current run-rate £245m revenue and adjusted EBITDA £37m. This is another company with negative tangible assets (intangible assets £146m v shareholders equity £138m) and £17m of net debt. Management also raised their EBITDA margin to 20% (previous target 15%, run rate 16%). Finally they announced that they will report as two divisional structures: i) Governance, Risk and Compliance (GRC) and ii) Testing Inspection and Certification (TIC).

History MHL listed in 2007 originally as an investment company by Lord Ashcroft, while Marlowe was incorporated in 2015 and reversed into MHL in 2016, at a price of 100p, raising £3m and valuing the company at £21m. At the same time as the listing the company acquired Swift, a fire safety and security systems business with £21m of revenue and £1.5m EBITDA, paying £13m total consideration. Since then Marlowe has made over 35 acquisitions and revenue was £185m FY2020 and PBT £0.5m. Management say that 78% of revenue is recurring, they operate in highly regulated markets and provide health and safety services such as water treatment and hygiene, fire safety and air quality testing that are non-discretionary.

In October management raised £30m at 547p to fund the acquisition of Ellis Whittam which specialises in outsourced Employment Law, HR and Health & Safety services. EW provides its services via a fixed-fee subscription model to over 3,300 organisations across the UK.

Ownership Around a third of the shares are not in public hands. Lord Ashcroft owns 22% of the shares, the Chief Executive Paul Dacre owns 6%. Danske Bank owns 5.6%, Canaccord WM 5.4% and Slater Investments owns 4.2%.

Broker forecasts Cenkos their broker is forecasting revenue of £238m FY March 2022F, which implies flat organic growth this year, accelerating to mid single digit for next year. For FY March 2022F the broker is now forecasting Adjusted EPS of 29p, which puts the shares on 24x the broker’s recently published numbers.

Opinion Often a Capital Markets Day can signal more future dilution for shareholders. The growth targets are ambitious, and it sounds like they may have more acquisitions in mind, despite having done two placings last year (£40m at 478p partly to buy Elogbooks for £14m in June, then £30m in October to buy Ellis Whittam for £59m enterprise value). Cenkos say that management are in discussions with 40+ potential targets. At the half year organic revenue declined 8% due to Covid-19 disruption, which suggests that revenues are not quite as resilient as management claim? I’m concerned about the low RoCE 7.6% and CRoCI of 6.6%, growth doesn’t create value for shareholders unless it is profitable growth. I’ll watch with interest, so not for me.

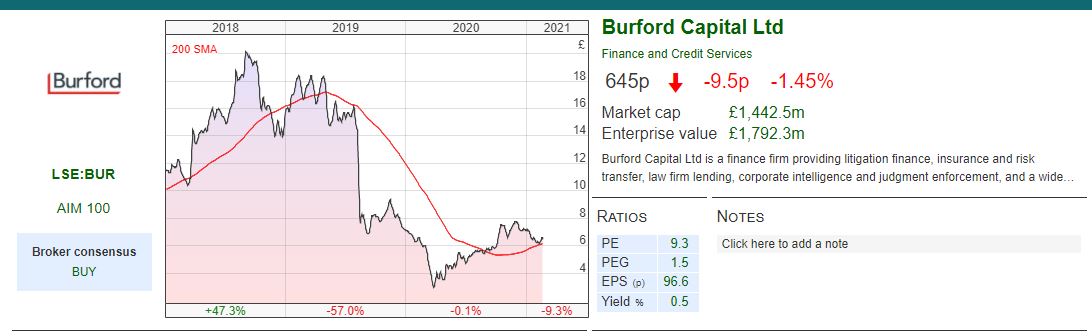

Burford Trading Update December Year End

The litigation funder released a detailed trading update, the company reports on a consolidated basis (including Third Party Funds) and on a Burford only basis. FY 2020 total income should be $345-355 million on a consolidated basis (2019: $366 million), $340-350 million Burford-only (2019: $357 million). In 2020, there were no fair value adjustments (neither up nor down) from the Petersen case against the Argentinian Govt, which is valued on their balance sheet at $773m. So excluding the Petersen fair value gain from 2019, 2020 total income rose by $170-$180 million, or by 95-101%, on a consolidated basis and by $175-$185 million, or by 104-109%, on a Burford-only basis.

Management expect to report Profit After Tax (consolidated and unadjusted Burford-only): $160-170m v (2019: $212m), in part due to a higher tax charge in 2020.

Cash figures look good. Burford only (which excludes TPFs) cash realisation was $325m, up +55% from 2019. This meant that the company ended the year with $336m of cash (+63% from Dec 2019, +24% from June 2020) on the balance sheet. They reported a ROIC of 92% on concluded cases (down from 97% H1 2020, but above the 88% FY 2019), and reinstated a dividend at the previous level of $c12.5.

Valuation I’m not really sure how to value Burford’s funds business, where they earn performance fees but only once the external investors have received back their capital. On page 41 of the H1 2020 accounts, management suggest they should receive at least $50m of performance fees, but for simplicity I will ignore the TPF business.

So $350m FY 2020 of Burford only revenue values the business at 6x FY2020 revenue. The company is trading on less than 13x FY 2020 PER, despite the higher tax charge flagged at the H1 results. Burford grew commitments significantly in 2017, so it is pleasing to see the cash realisations now beginning to come through. It takes, on average, over 2 years from deployments for Burford to recover money from settlements, and if the case goes to court and the judgement is in their favour it takes 3.5 years, on average. So it seems likely we will see PAT figure rise in the coming years. The 3 year average (2018-2020) PAT is $233m which puts the company on 9.5x PER (3 year average historic earnings). At H1 2020 net assets were $1.7bn versus a market cap of £1.6bn (ie 1.3x book) deducting $773m of Petersen, gives p/b of 2.2x, for a company generating 17% post tax RoE (also ex Petersen).

Opinion Cumulative Burford ROIC of 92% compares to LCM (which uses historic cost accounting) of 134%, and Manolete 187%, so although short sellers question the accounting, the ROIC is well below industry leading. The concern has been that the funder may have to raise new capital to cover operating costs and meet committed obligations. Burford’s new balance sheet commitments fell 37% in FY 2020 to $336m. Six months ago management blamed this on court closures in H1, rather than being capitally constrained. H2 2020 v H2 2019 commitments were down just 2%, to $279m which suggests that as court activity has switched online, deployments have once again recovered. The shares were up +7% following the announcement. I own this, and I think if management continue to win court cases and the cash continues to grow then gradually confidence will be restored.

Bruce Packard

Notes

The author owns shares in Burford

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary: 22/02/21 – All Aboard for Mu Mu Land

At midnight, on 1st January this year, the K.L.F. released their back catalogue of music (hits such as 3AM Eternal, Justified and Ancient, Last Train to Trancentral) on Spotify and uploaded their old videos to YouTube. This was their first activity as a band since 1992, when they announced they were leaving the music industry after having fired blanks from an automatic weapon at the audience at the BRITs and dumped a dead sheep with a sign attached saying “I died for you” at the entrance to the backstage party. They then left and withdrew their music back catalogue. The disbanded band then formed the K Foundation, where their first piece of art ‘Nailed to a Wall’ was £1m in £50 notes, nailed to a salvaged skirting board, which they framed and put a reserve price of £500K. The catalogue entry for the artwork stated:

“Over the years the face value will be eroded by inflation, while the artistic value will rise and rise. The precise point at which the artistic value will overtake the face value is unknown. Deconstruct the work now and you double your money. Hang it on a wall and watch the face value erode, the market value fluctuate, and the artistic value soar. The choice is yours.”

Inflation Most indicators from the bond markets, such as the US 10 year (which rose to 1.30% last week) and the UK spread between the 1y and 10y govt bond are now suggesting inflation will eat into the face value of financial assets. In the UK “real” interest rate (interest rates minus inflation) is minus 2%.

There is a simplistic formula which suggests negative real interest rates = good for equity markets, and bad for cash and bonds. Inflation is certainly bad news for bond holders, but I’m not convinced that it is bad news for cash or good news for equities.

Buffett is currently sitting on $140bn of cash and has underperformed the S&P500 by 37% over the last two years. Berkshire Hathaway’s performance has now lagged the S&P500 index over the past 5-, 10- and 15-year periods, according to data from S&P. The sage understands how inflation is eroding the face value of his cash, yet remarkably he preferred to sit out the market rally rather than risk overpaying for equities. To understand his thinking, we might look at a 1977 article he published ‘How Inflation Swindles the Equity Investor’, where he points out that company profits are reported after depreciation has been deducted, which “presumably will allow replacement of present productive capacity – if that plant and equipment can be purchased in the future at prices similar to their original cost.”

In an inflationary environment, the depreciation charge is understated (the cost of replacing a widget bashing machine rises with inflation) and therefore company profits and returns on capital are overstated. This can explain why, in the past, resources companies (oil&gas, but also mining) don’t necessarily benefit from commodity price inflation: companies have to spend money on equipment and assets, whose replacement cost may be rising faster than the price of whatever they are digging out of the ground. As investors reconsider their assumptions about future expenses, this leads to a de-rating.

A similar process can happen without the economy reporting much inflation, rising costs with no pricing power to pass to the customer can be equally pernicious for investor returns. Vodafone’s share price fell 75% 2000-2 as investors saw that “free” cashflow was not really free at all, but would have to be ploughed back into the business (3G, 4G now 5G) just to stand still. The chart above shows Vodafone’s high capex and low Cash Return on Capital Invested.

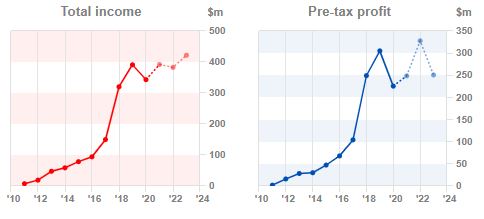

By contrast a company such as Diageo spends between 10-25% of operating cashflow on capex, as the chart on the next page shows. This should deliver better value for shareholders, as SharePad points out, a ratio below 30% is very attractive.

Does time also erode the value of intangible assets? The replacement cost of the KLF’s cash/art was £1m, but the market price was £0.5m, though over time the price of art can easily outpace inflation. Charles Saatchi sold The Physical Impossibility of Death in the Mind of Someone Living (also known as: the shark in formaldehyde) to Steve Cohen, the hedge fund billionaire for $8m, an excellent return on his invested capital (the original work cost Saatchi £50K). When Damian Hirst heard that the original shark was rotting, the artist offered to catch a new shark and preserve it with a better technique, for which Cohen paid Hirst an undisclosed sum to cover his costs, though Cohen was actually buying Hirst’s original artwork from Saatchi.

Companies have to spend money on marketing to maintain the value of intangible assets, even then brands can lose their appeal. Last year Diageo took an impairment charge of £1.3bn against brands, goodwill and other intangible assets. For context the group spent £1.8bn on marketing (3x the amount of capex of £620m) v PBT was £2bn the same year. My conclusion is that amounts recorded on company balance sheet show the limitations of accounting, we need to use our own judgement about the future costs and value trends. That Buffett is sitting on so much cash suggests that the value of companies’ intangible assets is now recognised and there are few obvious bargains.

This week I look at three companies: K3 Capital, a corporate finance and insolvency advisory firm, Marlowe, support services specialising in health and safety and Burford, the litigation funder. All three have substantial intangible assets on their balance sheet.

Once again I’ll be speaking at David Stredder’s online “Mello Event” (Monday 22nd Feb). The link and discount code for Sharepad / Sharescope readers gives you 50% off tickets for this and forthcoming MelloMondays (RRP £19.50, so £9.75 with the code).

https://buytickets.at/melloeventslimited/478820 Discount code : MMScope21

In the end, the KLF failed to find a buyer for their work of art at the reserve price of half a million pounds, or indeed an insurance company that would insure it. Instead they sailed to the Scottish Island of Jura, and in a quiet cottage filmed themselves burning a million pounds in the fireplace. When asked why they burnt a million pounds they struggled to give a reason.

Now that’s what I call impairment.

K3 Capital H1 results to 30 November

This acquisitive professional services firm (M&A, R&D tax credit advice, insolvency, forensic accounting, pension scheme advice) announced H1 results. In June last year the company raised £30m at 150p in a placing and then used the money to make a couple of acquisitions: i) Randd (R&D tax credit advice for £18m) and ii) Quantuma (restructuring and insolvency for £42m plus some shares issued in an earnout). This means the current year H1 revenue of £18m is not comparable with £8m H1 2020. The company hasn’t given an organic growth rate in their RNS, probably because excluding acquisitions, revenue fell 26% in their core “KBS” business to £5.9m v £8m last year.

History Listed on AIM in April 2017, raising £18m at 95p, valuing the company at £40m. Only £2m was raised to invest in the business, the rest was Anthony Ford, a founding shareholder selling due to health issues though he still owns 8%. John Rigby, the Chief Executive also sold some shares, but still owns 11%. The company’s history goes back to 1998, but only became K3 Capital in 2007. K3C specialises in the smaller end of the corporate finance market, and the company operates three brands based on size of the company that they are advising: i)the Knightsbridge brand targets companies with less than £1m enterprise value that don’t own freeholds, often pubs and restaurants, ii) the KBS Corporate brand serves businesses up to £10m, iii) KBS Corporate Finance £10-£200m which is still too small to be of much interest to stockbroking firms, let alone bulge bracket investment banks. Following the acquisitions, “core” KBS represents just 1/4 of annualised group revenue, with Quantuma 2/3 and Rannd 1/8.

As the company has grown by acquisition, there is currently £53m of intangible assets on the balance sheet, versus shareholders’ equity of £46m. So the business has negative tangible assets. That said, net cash from operations was £4.2m at H1 and they still ended the period with £10m of net cash on the balance sheet following the capital raising and acquisitions. There is no debt, but they do have an unused £10m facility as part of a flexible approach to funding acquisitions.

Outlook statement Management at first sounds upbeat: “KBS continues to see strong levels of performance, with January producing the highest profit month so far in FY21 and the pipeline remains strong, giving us confidence for the remainder of H2 and beyond”. But at the same time they express caution about Quantuma, the insolvency business which is 2/3 of revenue and is seeing significantly reduced activity because of the Government’s support of SMEs, which agrees with what Manolete warned about a couple of weeks ago.

Broker forecasts FinnCap their broker published a note, but left their forecasts unchanged: £37m of revenue FY 2021F to May, growing to £58m in two years time FY 2023F May. This give EPS of 12p FY 2021F, 16p and 21p in FY 2022F and 2023F respectively, putting the shares on 13x 2023F PER.

Ownership 53% of the shares are not in public hands, with the biggest insider shareholders Anthony Ford and John Rigby. The largest institutions are Miton, which owns 15%, Axa 5.5%, Schroders 3.8% and Hargreave Hale 3%.

Opinion Last year’s acquisitions, particularly Quantuma the insolvency business, were transformational. I think this business could be interesting long term, but I’m worried about the mixed messages coming from the outlook statement, and perhaps we could see a profit warning due to the insolvency waiver and Government support being extended? It is also worth noting that when you buy a people business, the assets walk out of the door every evening, and that is particularly true once earn-outs have expired.

Marlowe H1 Trading Update / Capital Markets Day

This Lord Ashcroft support services company, with a 31 March Year End held a Capital Markets Day last week and announced a Trading Update. The Group set out its growth strategy with target revenue of c.£500 million and adjusted EBITDA of c.£100 million in 3 years. That compares to the current run-rate £245m revenue and adjusted EBITDA £37m. This is another company with negative tangible assets (intangible assets £146m v shareholders equity £138m) and £17m of net debt. Management also raised their EBITDA margin to 20% (previous target 15%, run rate 16%). Finally they announced that they will report as two divisional structures: i) Governance, Risk and Compliance (GRC) and ii) Testing Inspection and Certification (TIC).

History MHL listed in 2007 originally as an investment company by Lord Ashcroft, while Marlowe was incorporated in 2015 and reversed into MHL in 2016, at a price of 100p, raising £3m and valuing the company at £21m. At the same time as the listing the company acquired Swift, a fire safety and security systems business with £21m of revenue and £1.5m EBITDA, paying £13m total consideration. Since then Marlowe has made over 35 acquisitions and revenue was £185m FY2020 and PBT £0.5m. Management say that 78% of revenue is recurring, they operate in highly regulated markets and provide health and safety services such as water treatment and hygiene, fire safety and air quality testing that are non-discretionary.

In October management raised £30m at 547p to fund the acquisition of Ellis Whittam which specialises in outsourced Employment Law, HR and Health & Safety services. EW provides its services via a fixed-fee subscription model to over 3,300 organisations across the UK.

Ownership Around a third of the shares are not in public hands. Lord Ashcroft owns 22% of the shares, the Chief Executive Paul Dacre owns 6%. Danske Bank owns 5.6%, Canaccord WM 5.4% and Slater Investments owns 4.2%.

Broker forecasts Cenkos their broker is forecasting revenue of £238m FY March 2022F, which implies flat organic growth this year, accelerating to mid single digit for next year. For FY March 2022F the broker is now forecasting Adjusted EPS of 29p, which puts the shares on 24x the broker’s recently published numbers.

Opinion Often a Capital Markets Day can signal more future dilution for shareholders. The growth targets are ambitious, and it sounds like they may have more acquisitions in mind, despite having done two placings last year (£40m at 478p partly to buy Elogbooks for £14m in June, then £30m in October to buy Ellis Whittam for £59m enterprise value). Cenkos say that management are in discussions with 40+ potential targets. At the half year organic revenue declined 8% due to Covid-19 disruption, which suggests that revenues are not quite as resilient as management claim? I’m concerned about the low RoCE 7.6% and CRoCI of 6.6%, growth doesn’t create value for shareholders unless it is profitable growth. I’ll watch with interest, so not for me.

Burford Trading Update December Year End

The litigation funder released a detailed trading update, the company reports on a consolidated basis (including Third Party Funds) and on a Burford only basis. FY 2020 total income should be $345-355 million on a consolidated basis (2019: $366 million), $340-350 million Burford-only (2019: $357 million). In 2020, there were no fair value adjustments (neither up nor down) from the Petersen case against the Argentinian Govt, which is valued on their balance sheet at $773m. So excluding the Petersen fair value gain from 2019, 2020 total income rose by $170-$180 million, or by 95-101%, on a consolidated basis and by $175-$185 million, or by 104-109%, on a Burford-only basis.

Management expect to report Profit After Tax (consolidated and unadjusted Burford-only): $160-170m v (2019: $212m), in part due to a higher tax charge in 2020.

Cash figures look good. Burford only (which excludes TPFs) cash realisation was $325m, up +55% from 2019. This meant that the company ended the year with $336m of cash (+63% from Dec 2019, +24% from June 2020) on the balance sheet. They reported a ROIC of 92% on concluded cases (down from 97% H1 2020, but above the 88% FY 2019), and reinstated a dividend at the previous level of $c12.5.

Valuation I’m not really sure how to value Burford’s funds business, where they earn performance fees but only once the external investors have received back their capital. On page 41 of the H1 2020 accounts, management suggest they should receive at least $50m of performance fees, but for simplicity I will ignore the TPF business.

So $350m FY 2020 of Burford only revenue values the business at 6x FY2020 revenue. The company is trading on less than 13x FY 2020 PER, despite the higher tax charge flagged at the H1 results. Burford grew commitments significantly in 2017, so it is pleasing to see the cash realisations now beginning to come through. It takes, on average, over 2 years from deployments for Burford to recover money from settlements, and if the case goes to court and the judgement is in their favour it takes 3.5 years, on average. So it seems likely we will see PAT figure rise in the coming years. The 3 year average (2018-2020) PAT is $233m which puts the company on 9.5x PER (3 year average historic earnings). At H1 2020 net assets were $1.7bn versus a market cap of £1.6bn (ie 1.3x book) deducting $773m of Petersen, gives p/b of 2.2x, for a company generating 17% post tax RoE (also ex Petersen).

Opinion Cumulative Burford ROIC of 92% compares to LCM (which uses historic cost accounting) of 134%, and Manolete 187%, so although short sellers question the accounting, the ROIC is well below industry leading. The concern has been that the funder may have to raise new capital to cover operating costs and meet committed obligations. Burford’s new balance sheet commitments fell 37% in FY 2020 to $336m. Six months ago management blamed this on court closures in H1, rather than being capitally constrained. H2 2020 v H2 2019 commitments were down just 2%, to $279m which suggests that as court activity has switched online, deployments have once again recovered. The shares were up +7% following the announcement. I own this, and I think if management continue to win court cases and the cash continues to grow then gradually confidence will be restored.

Bruce Packard

Notes

The author owns shares in Burford

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.