The FTSE 100 started the year strongly +6% during the week to 6857. Both the S&P 500 +1.3% to 3804 Nasdaq +1.4% to 13068 were more subdued, though largely unaffected by events in Washington.

10 years ago when I was in Tbilisi, I remember a US dignitary explaining to the Georgians that the point of democracy is not whether philosopher kings, military generals, billionaire businessmen, lawyers, actors, journalists or even choirboys turned bank robbers (Stalin) make the best leaders. The point of democracy is that every 5 years the people vote, and if the people decide someone else would make a better leader, there is a peaceful transition of power. The Georgians were sceptical, but a decade later, their democracy seems to be functioning well.

Sadly, the transition of power has not been smooth in the USA. In response to the President’s inflammatory remarks, Twitter has suspended Donald Trump’s account.

I’ve been dismissive of Twitter in the past, the shares have been a poor investment, falling by around two thirds since the IPO price. But like many other tech stocks it enjoyed a good 2020, and the shares are up 63% since 1/1/2020. Twitter’s influence on politics is undeniable, but the site’s role in by-passing gatekeepers in other areas is less commented upon.

I recommend this interesting interview between Jim O’Shaugnessy (an early quant) and Alex Danco, who works at Shopify. They talk about how Twitter is removing traditional “gatekeeper” roles from the media, finance, recruitment and academia. For instance, Twitter is the real LinkedIn. I don’t know of anybody who has found a job or recruited someone via LinkedIn, but I do know several (including myself) who have found work via Twitter. Similarly Twitter is giving PhDs and PostDoc students the ability to talk about the science they’re doing without having to go through the prestigious “gatekeeper” journals like Nature or Cell. The quality of financial insight on Twitter is surprisingly good too, probably due to the lack of legal and compliance gatekeepers.

Reader suggestions from Twitter

So I have asked three of the people I follow on Twitter for stock ideas for 2021.

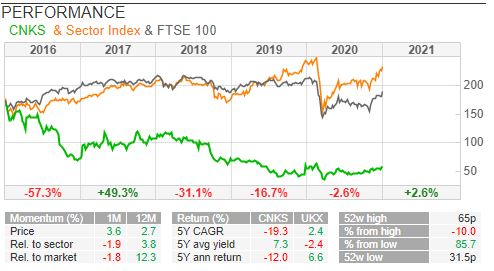

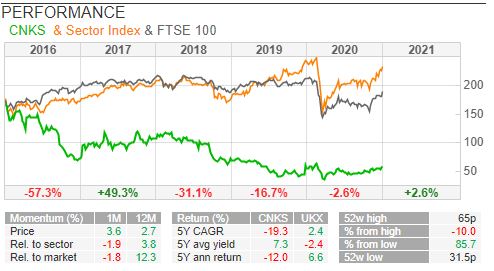

First Carcosa whose portfolio was up +49.8% in 2020. I haven’t independently verified that, but he seems like a sensible chap, and I’m open minded about using other investors’ suggestions as a starting point for my own research on SharePad. Similarly I’d be worried if readers were blindly following what I write, the point of this weekly is to showcase the features and benefits of using Sharepad to do your own research. He went for Cenkos, so I write about the below.

Traditionally UK brokers like Cenkos were the “gatekeepers” who decided which small companies had access to public markets like AIM. Cenkos’ Admission Document talks about a “selective approach to taking on new clients and transactions.” More realistically now, no corporate financier can afford to turn away business, so it is the fund managers who are the gatekeepers and decide which companies can come to market. In the large cap area professional gatekeepers have done a poor job, tolerating over-indebted Private Equity owned businesses (AA and Saga spring to mind) and letting through outright frauds like NMC Health.

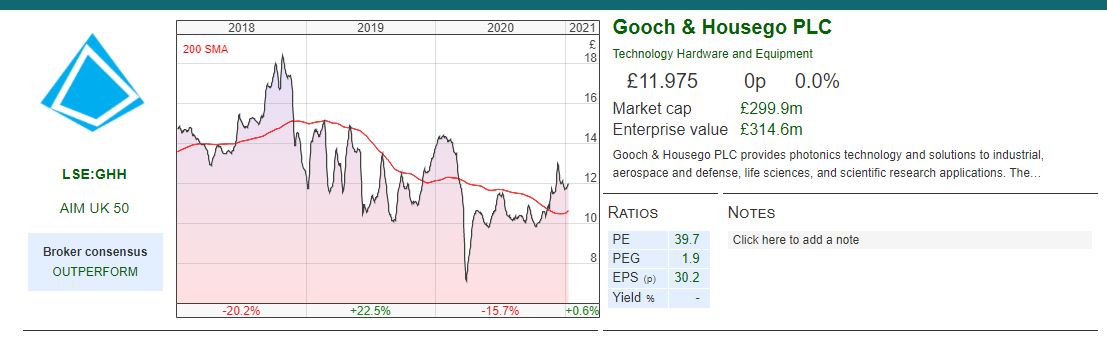

Also via Twitter, Andrew at Fund Hunter whose model portfolio was up +38% in 2020 sent me some good suggestions. IFAs have acted as gatekeepers to investment funds, but in the past they have tended to push the product which paid the adviser the highest commission. There’s been a lack of quality independent analysis, and Andrew’s site is an excellent resource if you want to invest in funds rather than individual stocks. I picked Gooch & Housego from his shortlist because it is a multi-bagger that has struggled in the last 2 years. The shares rose from a trough of 30p in mid 2008 to almost £19 a decade later. I’m curious what has gone well, and what has gone badly. Twitter may be disrupting recruitment, but sadly remuneration reports have yet to be disrupted by technology.

Finally Glasshalfull who has said that he was up +83% in 2020, and achieved an even more impressive +44% CAGR over the last 10 years. Again, I haven’t verified those performance statistics, but it seems weird to make up some huge gain just to impress random people on Twitter. He is still positive on Equals Group, the international payments group for SMEs which reported a Trading Update last week, despite it being his worst performer in 2020. So I write about that company too.

Cenkos

History: Named after a racehorse and founded by Andy Stewart (of Collins Stewart) Cenkos listed on AIM at 140p placing at valuing the company at £102m in 2006. The financial crisis was difficult to navigate, but the years following have been even harder for UK brokers. I worked at Seymour Pierce, which eventually failed. The problem was that Government support for the banks meant that no capacity was taken out of equities stockbroking. This coupled with the relentless shift from active institutional fund managers to quant and passive funds meant that there was the same number of people trying to eat a shrinking pie of profit.

At Seymour Pierce it was particularly annoying to have our junior staff poached by loss making Royal Bank of Scotland who offered them salaries 3x higher than we could pay. That was not a level playing field, indeed we were paying tax to the UK Government who were using the money to support a failed bank who was a direct competitor. RBS did eventually close down their equities business, which had been losing hundreds of millions of pounds a year, but it was very hard for independent brokers to compete against other banks with implicit Government support. Then came MIFID II which again favoured large global banks rather than smaller UK brokers.

My experience of Cenkos from friends that have worked there was that the broker was well run. However there is only so much that management can do in the face of such an unfavourable operating environment and the shares briefly troughed at below 30p in the March 2020 sell off.

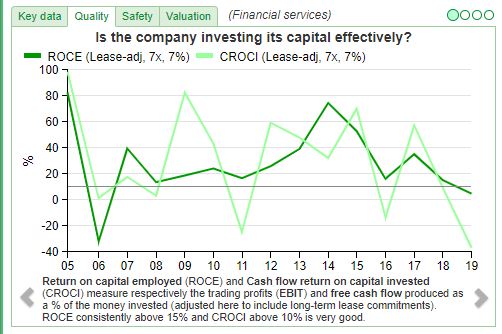

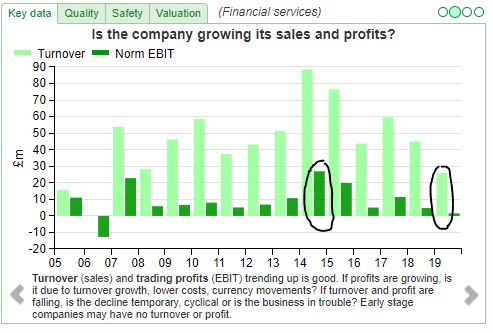

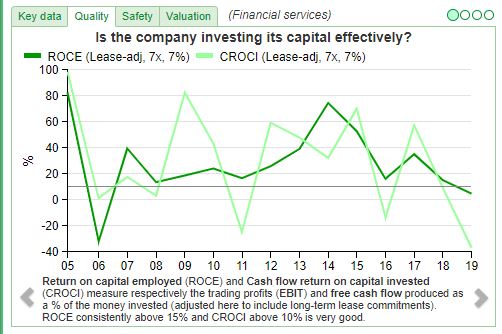

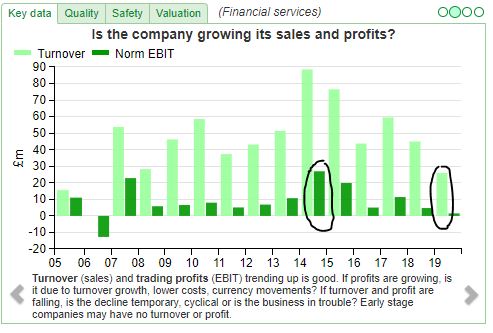

SharePad’s “Quality” tab shows the volatile operating history, with RoCE varying between negative and +80%. The company’s best year was 2014, with sales of £88.5m and PBT of £27m. This compares to £26m sales and £140K of PBT in 2019 (ie times were tough even before Covid-19 hit in 2020). Or put another way, in a good year Cenkos profit exceed their total sales in a bad year. See circled bars in the bar chart.

Edison the paid for research house is not publishing forecasts, even for 2020. Cenkos management took until 2nd October to release their H1 results to end of June.

H1 results: Revenue was up +22% in H1 to £12.9m helped by corporate finance fees +48% to £9.2m as companies sought to raise equity funding both to weather the Covid storm but also to take advantage of growth opportunities. Group PBT was £0.8m v a small loss in H1 19. The company had £22.4m of cash on the balance sheet at the end of June – they could have told investors how much cash they had at the end of September, but chose not to. The company has 97 Nomad / corporate broking clients, down from 100 at December 2019. They make markets in 185 stocks, but kept the trading book flat within capital limits meaning that they didn’t lose money on their market making in H1.

Headcount was reduced to 89 at June 20 (down from 95 Dec 19). The company expects more of the savings of staff reductions to be seen in H2. On the outlook for H2 (bear in mind the RNS was 2nd October) they say H2 “has begun with energy and purpose at Cenkos, despite the ongoing macro challenges presented by the ongoing coronavirus” and make reference to several equity fundraisings for their clients. The company paid a 1p interim dividend.

Last month the company announced that Jim Durkin the Chief Executive who returned to lead the business 2019 would step down and Julian Morse, an internal appointment would become Chief Executive.

Remuneration: Like football clubs, corporate finance has often been a sector where most of the value accrues to the “star players”, rather than the owners. Cenkos has a profit sharing model, in an attempt to align employee bonuses with external shareholders’ interests. The model works by business unit, and is based on a percentage of revenues after direct costs have been deducted. This means that even during the financial crisis when revenue fell 47% to £28m FY 2008, the company still reported a £5.1m PBT.

Opinion: Similar to Duke Royalty, I can see that this could be an interesting way to play the recovery and the shares could bounce very strongly in 2021. However, I’m less enthusiastic about the long term prospects of the business. The shares look a “deep value” type of investment, but with no tangible assets except the £22m cash (v £34m market cap) on the balance sheet. That is, the company’s other assets are its reputation, relationships and the staff who walk out the door every evening, who are occasionally bid away to competitors with deeper pockets.

I feel sad that UK brokers have been through such hard times; in my experience smaller companies do receive a better service from them than large global banks. Policy makers seem unconcerned with the demise of the stockbroker and no wealthy pop stars will write songs lamenting their passing, as Sting did for Northern coal miners in the 1980s (We Worked the Black Seam Together)

Gooch & Housego

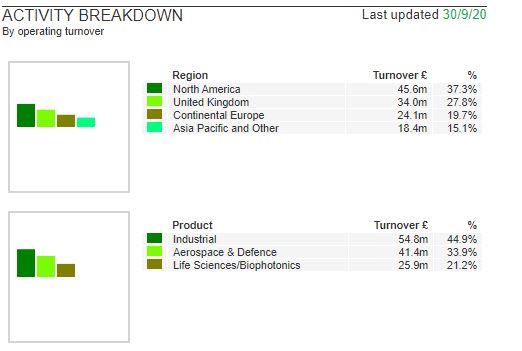

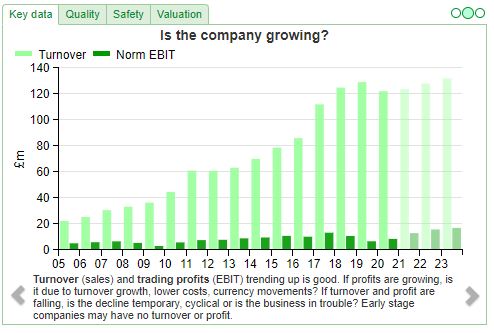

History In 1997 this precision instruments company listed on AIM at 105p, raising £1.5m and valuing the entire company at £18m. The corporate history goes back much further to 1946 when Archie Gooch and Leslie Housego established a manufacturing partnership in Illminster Somerset, to make optical components and crystals. The company’s photonic products are used in aerospace & defence, industrial and life science research sectors. The company has 8 manufacturing sites, mostly in the UK and USA. Revenue was just £6.7m and PBT £1.6m in 1997, so the company has a long term track record of growth over the recent decades. The company has grown the top line every year since 2002, aside from last year and 2012 when revenue was flat at £61m.

Results G&H has a September year end and reported its most recent results in December 2020. Revenue was down 5.5% to £122m, and adjusted PBT was down 35% to £9.8m. Statutory PBT was down 9.4% to £5.4m, the adjustments for non underlying items were site closure costs of £2.6m, acquisition and amortisation charges £2.7m and a £1.2m benefit from a favourable court case that went their way. Net debt ex IFRS 16 was £6.5m. The company paid a final dividend of 7.2p for the previous year, but passed the interim dividend earlier in 2020 and have not proposed a final dividend.

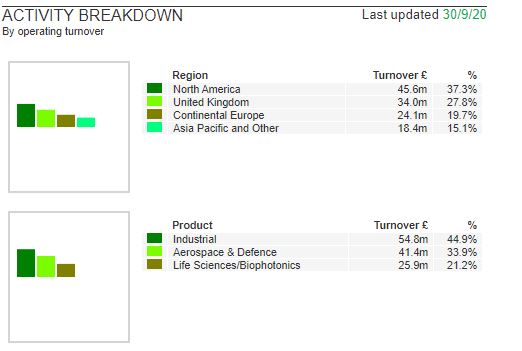

Around 2/3 of the Group’s revenue is in US dollars, and 1/3 in GBP. The company splits revenue into 3 segments, with the first two (Industrial -10%, Aerospace & Defence -6%) making up 80% of revenue suffering a year on year decline:

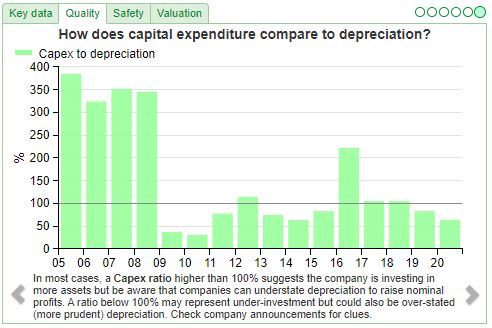

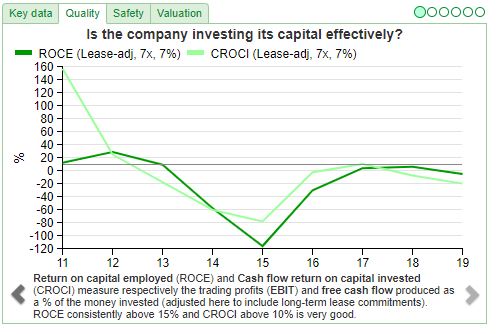

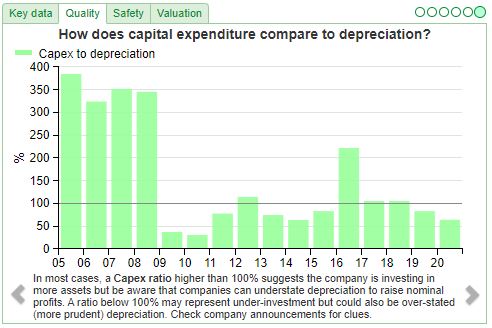

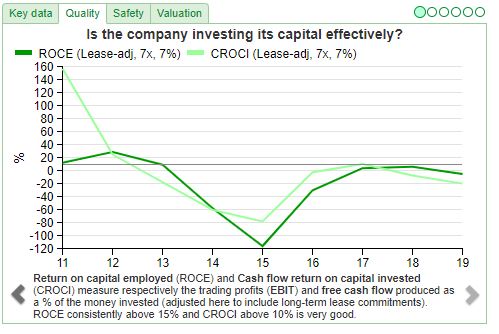

The smallest segment (Life Sciences/Biophotonics) was up 7.6% because some of their components are used in respirators. The group spent £7.9m, or 6.5% of revenue on R&D, all of which is expensed through the p&l. Over the years G&H has grown by acquisition, so there is £55m of intangible assets on the balance sheet, versus net assets of £113m. Capex has tended to be below depreciation, and the ratio has reduced significantly from the years before the financial crisis when it averaged around 350%.

Remuneration The Chief Executive Mark Webster was paid £350K basic, and CFO Chris Jewell £259K. The Board employed remuneration consultants to come up with an incentive scheme. However all the awards are now under water and in addition targets have not been achieved for the last two years. The Board has decided that they can’t afford to lose senior executives and they need to compensate Executive Directors for the loss in value of LTIP awards to make sure that they are retained and motivated (because obviously £350K a year basic is not very motivational, are these guys Premier League footballers?) Readers can guess what is coming next: the Board has consulted with major shareholders and is going to reprice its options scheme and hopes to receive support for this at the AGM on 24th February.

The AGM won’t take place in person, but shareholders are invited to send questions to agm@gandh.com and responses will be published on the Company’s website.

As you can tell I’m against companies repricing their incentives schemes. The pandemic probably does mean that it would be harder to hire external talent, but why doesn’t the company have internal succession planning in place? I also wonder how hard the large shareholders pushed back against this.

Institutions The company’s shares are well owned by a variety of high quality institutions: Octopus owns 13.4%, Invesco 9.7%, Investec 7.5%, Standard Life 7.2%, Blackrock 6.2%.

Opinion: The shares look expensive on 40x 2020 FY reported earnings. In some ways this reminds me of PZ Cussons, a quality long term compounder that has had a difficult few years. I’m sceptical of management who need to be remunerated with re-priced options or other incentive schemes, so I will avoid unless the remuneration policy is voted down at the AGM and the Chief Exec resigns in a huff.

EQUALS FY 2020 Trading Update

This payments group put out a trading statement on 6 January for FY to December 2020. FY revenue is expected to be £30m, beating market expectations by £1m but still down 6% versus FY 2019. Adjusted EBITDA is expected to be £1m (v expectations of £0.55m) down from £9.1m FY 19. Cash on balance sheet at the end of December was £8m, and this excluded a £2m drawdown of the Government’s CBILS scheme. No mention of statutory PBT. The shares rose 19% on the day of the RNS, Cenkos their broker, increased their 2020F to reflect the positive trading update, but did not raise their forecasts for 2021F or 2022F.

History: Cenkos listed this payments business, originally called FAIRFX at 45p, valuing the company at £31m in 2014. It had been operating in the UK since 2007, offering low cost currency transactions for personal and SME business customers. Revenue grew from £5.5m FY 2014, to £30.9m FY 2019, a CAGR of 41%. The share price peaked at 150p at the end of September 2018.

Despite the impressive top line growth, Equals has struggled to report a positive PBT (most recently an £8m pre-tax loss in FY 19) so at the current size there doesn’t seem to be much operational gearing. As an aside, this £8m pre-tax loss does not appear in the Financial Summary at the front of the FY19 Annual Report, instead management choose to emphasize Adjusted EBITDA of £9.1m then jumping straight to an after tax loss of £5.4m. The company also received £3.5m of R&D tax credits in 2019, and capitalised £8.3m of expenses, without which reported losses in the p&l would have been higher.

In order to fund the ongoing losses management raised £16m in 2019.

They also had a relationship with a Wirecard subsidiary. However, it looks like “ringfencing” worked as it was supposed to and despite the failure of Wirecard AG last year, customer funds were protected.

Although the company rebranded in 2019 to “EQUALS” in order to de-emphasize their forex business in favour of SME expense management system, there has still been an impact from Covid. Travel related revenue (bureau de change and retail pre-paid cards) has been badly hit by the virus, down 87% on the comparative period in 2019. To put this into context, travel represented 29% of revenue in 2019 but fell to just 4% of revenue to end of June 2020.

Cenkos are forecasting £32m and £38m of sales in 2021F and 2022F, with the company still expected to be loss making in FY 2021F, but reporting a £1.5m PBT in 2022F or 1.1p EPS 2022F. This puts the shares on 1.5x sales and 29x PER 2022F. Equals expect to report FY audited figures in April.

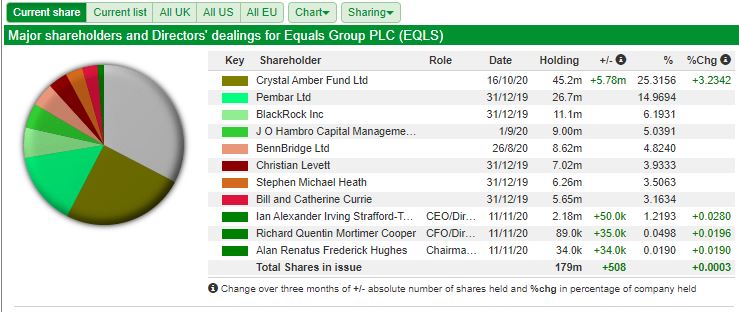

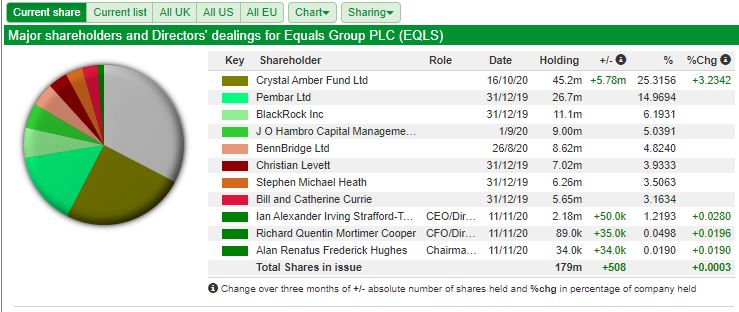

Shareholder register: Looking at the shareholder register, Crystal Amber, the activist hedge fund own 25%, along with BlackRock 6% and JO Hambro 5%. Pembar Ltd which holds 15% is an Ashley Levett British Virgin Islands vehicle. He’s a former copper trader, who used to own Richmond Rugby Club.*

Opinion: This is my favourite of the three suggestions that have come from twitter users. Though still loss making this year, the reported gross profit margin 66% implies that we should see operational gearing in the coming years if revenue grows as forecast.

My concern is that Equals may not be competing against clunky old banks who gouge their SME customers with expensive products and bad service. Instead Equals could be competing against other sexy FinTechs like Revolut, Monzo, Starling or TransferWise. The latter was last valued at $5bn,** and backed by deep pocketed investors such as US hedge funds plus Baillie Gifford and Fidelity. TransferWise last reported revenue was over £300m and PBT was £20m. That said, Equals is definitely worth following, particularly if you take the “@glasshalfull” view.

Bruce Packard

Notes

* https://www.independent.co.uk/sport/rugby-union-richmond-adjust-to-poorer-life-after-levett-1078947.html But see also https://en.wikipedia.org/wiki/Sumitomo_copper_affair

**TransferWise valued at $5bn https://www.ft.com/content/dcc92f78-47b4-41bd-bac4-5eec036623bc

11 January 2020

Gatekeepers

The FTSE 100 started the year strongly +6% during the week to 6857. Both the S&P 500 +1.3% to 3804 Nasdaq +1.4% to 13068 were more subdued, though largely unaffected by events in Washington.

10 years ago when I was in Tbilisi, I remember a US dignitary explaining to the Georgians that the point of democracy is not whether philosopher kings, military generals, billionaire businessmen, lawyers, actors, journalists or even choirboys turned bank robbers (Stalin) make the best leaders. The point of democracy is that every 5 years the people vote, and if the people decide someone else would make a better leader, there is a peaceful transition of power. The Georgians were sceptical, but a decade later, their democracy seems to be functioning well.

Sadly, the transition of power has not been smooth in the USA. In response to the President’s inflammatory remarks, Twitter has suspended Donald Trump’s account.

I’ve been dismissive of Twitter in the past, the shares have been a poor investment, falling by around two thirds since the IPO price. But like many other tech stocks it enjoyed a good 2020, and the shares are up 63% since 1/1/2020. Twitter’s influence on politics is undeniable, but the site’s role in by-passing gatekeepers in other areas is less commented upon.

I recommend this interesting interview between Jim O’Shaugnessy (an early quant) and Alex Danco, who works at Shopify. They talk about how Twitter is removing traditional “gatekeeper” roles from the media, finance, recruitment and academia. For instance, Twitter is the real LinkedIn. I don’t know of anybody who has found a job or recruited someone via LinkedIn, but I do know several (including myself) who have found work via Twitter. Similarly Twitter is giving PhDs and PostDoc students the ability to talk about the science they’re doing without having to go through the prestigious “gatekeeper” journals like Nature or Cell. The quality of financial insight on Twitter is surprisingly good too, probably due to the lack of legal and compliance gatekeepers.

Reader suggestions from Twitter

So I have asked three of the people I follow on Twitter for stock ideas for 2021.

First Carcosa whose portfolio was up +49.8% in 2020. I haven’t independently verified that, but he seems like a sensible chap, and I’m open minded about using other investors’ suggestions as a starting point for my own research on SharePad. Similarly I’d be worried if readers were blindly following what I write, the point of this weekly is to showcase the features and benefits of using Sharepad to do your own research. He went for Cenkos, so I write about the below.

Traditionally UK brokers like Cenkos were the “gatekeepers” who decided which small companies had access to public markets like AIM. Cenkos’ Admission Document talks about a “selective approach to taking on new clients and transactions.” More realistically now, no corporate financier can afford to turn away business, so it is the fund managers who are the gatekeepers and decide which companies can come to market. In the large cap area professional gatekeepers have done a poor job, tolerating over-indebted Private Equity owned businesses (AA and Saga spring to mind) and letting through outright frauds like NMC Health.

Also via Twitter, Andrew at Fund Hunter whose model portfolio was up +38% in 2020 sent me some good suggestions. IFAs have acted as gatekeepers to investment funds, but in the past they have tended to push the product which paid the adviser the highest commission. There’s been a lack of quality independent analysis, and Andrew’s site is an excellent resource if you want to invest in funds rather than individual stocks. I picked Gooch & Housego from his shortlist because it is a multi-bagger that has struggled in the last 2 years. The shares rose from a trough of 30p in mid 2008 to almost £19 a decade later. I’m curious what has gone well, and what has gone badly. Twitter may be disrupting recruitment, but sadly remuneration reports have yet to be disrupted by technology.

Finally Glasshalfull who has said that he was up +83% in 2020, and achieved an even more impressive +44% CAGR over the last 10 years. Again, I haven’t verified those performance statistics, but it seems weird to make up some huge gain just to impress random people on Twitter. He is still positive on Equals Group, the international payments group for SMEs which reported a Trading Update last week, despite it being his worst performer in 2020. So I write about that company too.

Cenkos

History: Named after a racehorse and founded by Andy Stewart (of Collins Stewart) Cenkos listed on AIM at 140p placing at valuing the company at £102m in 2006. The financial crisis was difficult to navigate, but the years following have been even harder for UK brokers. I worked at Seymour Pierce, which eventually failed. The problem was that Government support for the banks meant that no capacity was taken out of equities stockbroking. This coupled with the relentless shift from active institutional fund managers to quant and passive funds meant that there was the same number of people trying to eat a shrinking pie of profit.

At Seymour Pierce it was particularly annoying to have our junior staff poached by loss making Royal Bank of Scotland who offered them salaries 3x higher than we could pay. That was not a level playing field, indeed we were paying tax to the UK Government who were using the money to support a failed bank who was a direct competitor. RBS did eventually close down their equities business, which had been losing hundreds of millions of pounds a year, but it was very hard for independent brokers to compete against other banks with implicit Government support. Then came MIFID II which again favoured large global banks rather than smaller UK brokers.

My experience of Cenkos from friends that have worked there was that the broker was well run. However there is only so much that management can do in the face of such an unfavourable operating environment and the shares briefly troughed at below 30p in the March 2020 sell off.

SharePad’s “Quality” tab shows the volatile operating history, with RoCE varying between negative and +80%. The company’s best year was 2014, with sales of £88.5m and PBT of £27m. This compares to £26m sales and £140K of PBT in 2019 (ie times were tough even before Covid-19 hit in 2020). Or put another way, in a good year Cenkos profit exceed their total sales in a bad year. See circled bars in the bar chart.

Edison the paid for research house is not publishing forecasts, even for 2020. Cenkos management took until 2nd October to release their H1 results to end of June.

H1 results: Revenue was up +22% in H1 to £12.9m helped by corporate finance fees +48% to £9.2m as companies sought to raise equity funding both to weather the Covid storm but also to take advantage of growth opportunities. Group PBT was £0.8m v a small loss in H1 19. The company had £22.4m of cash on the balance sheet at the end of June – they could have told investors how much cash they had at the end of September, but chose not to. The company has 97 Nomad / corporate broking clients, down from 100 at December 2019. They make markets in 185 stocks, but kept the trading book flat within capital limits meaning that they didn’t lose money on their market making in H1.

Headcount was reduced to 89 at June 20 (down from 95 Dec 19). The company expects more of the savings of staff reductions to be seen in H2. On the outlook for H2 (bear in mind the RNS was 2nd October) they say H2 “has begun with energy and purpose at Cenkos, despite the ongoing macro challenges presented by the ongoing coronavirus” and make reference to several equity fundraisings for their clients. The company paid a 1p interim dividend.

Last month the company announced that Jim Durkin the Chief Executive who returned to lead the business 2019 would step down and Julian Morse, an internal appointment would become Chief Executive.

Remuneration: Like football clubs, corporate finance has often been a sector where most of the value accrues to the “star players”, rather than the owners. Cenkos has a profit sharing model, in an attempt to align employee bonuses with external shareholders’ interests. The model works by business unit, and is based on a percentage of revenues after direct costs have been deducted. This means that even during the financial crisis when revenue fell 47% to £28m FY 2008, the company still reported a £5.1m PBT.

Opinion: Similar to Duke Royalty, I can see that this could be an interesting way to play the recovery and the shares could bounce very strongly in 2021. However, I’m less enthusiastic about the long term prospects of the business. The shares look a “deep value” type of investment, but with no tangible assets except the £22m cash (v £34m market cap) on the balance sheet. That is, the company’s other assets are its reputation, relationships and the staff who walk out the door every evening, who are occasionally bid away to competitors with deeper pockets.

I feel sad that UK brokers have been through such hard times; in my experience smaller companies do receive a better service from them than large global banks. Policy makers seem unconcerned with the demise of the stockbroker and no wealthy pop stars will write songs lamenting their passing, as Sting did for Northern coal miners in the 1980s (We Worked the Black Seam Together)

Gooch & Housego

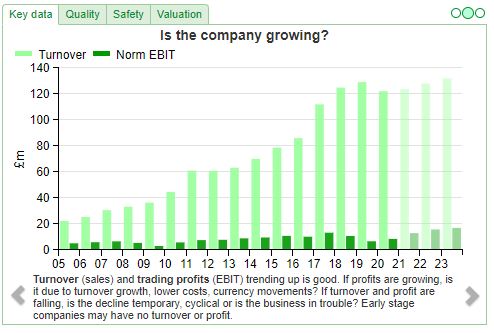

History In 1997 this precision instruments company listed on AIM at 105p, raising £1.5m and valuing the entire company at £18m. The corporate history goes back much further to 1946 when Archie Gooch and Leslie Housego established a manufacturing partnership in Illminster Somerset, to make optical components and crystals. The company’s photonic products are used in aerospace & defence, industrial and life science research sectors. The company has 8 manufacturing sites, mostly in the UK and USA. Revenue was just £6.7m and PBT £1.6m in 1997, so the company has a long term track record of growth over the recent decades. The company has grown the top line every year since 2002, aside from last year and 2012 when revenue was flat at £61m.

Results G&H has a September year end and reported its most recent results in December 2020. Revenue was down 5.5% to £122m, and adjusted PBT was down 35% to £9.8m. Statutory PBT was down 9.4% to £5.4m, the adjustments for non underlying items were site closure costs of £2.6m, acquisition and amortisation charges £2.7m and a £1.2m benefit from a favourable court case that went their way. Net debt ex IFRS 16 was £6.5m. The company paid a final dividend of 7.2p for the previous year, but passed the interim dividend earlier in 2020 and have not proposed a final dividend.

Around 2/3 of the Group’s revenue is in US dollars, and 1/3 in GBP. The company splits revenue into 3 segments, with the first two (Industrial -10%, Aerospace & Defence -6%) making up 80% of revenue suffering a year on year decline:

The smallest segment (Life Sciences/Biophotonics) was up 7.6% because some of their components are used in respirators. The group spent £7.9m, or 6.5% of revenue on R&D, all of which is expensed through the p&l. Over the years G&H has grown by acquisition, so there is £55m of intangible assets on the balance sheet, versus net assets of £113m. Capex has tended to be below depreciation, and the ratio has reduced significantly from the years before the financial crisis when it averaged around 350%.

Remuneration The Chief Executive Mark Webster was paid £350K basic, and CFO Chris Jewell £259K. The Board employed remuneration consultants to come up with an incentive scheme. However all the awards are now under water and in addition targets have not been achieved for the last two years. The Board has decided that they can’t afford to lose senior executives and they need to compensate Executive Directors for the loss in value of LTIP awards to make sure that they are retained and motivated (because obviously £350K a year basic is not very motivational, are these guys Premier League footballers?) Readers can guess what is coming next: the Board has consulted with major shareholders and is going to reprice its options scheme and hopes to receive support for this at the AGM on 24th February.

The AGM won’t take place in person, but shareholders are invited to send questions to agm@gandh.com and responses will be published on the Company’s website.

As you can tell I’m against companies repricing their incentives schemes. The pandemic probably does mean that it would be harder to hire external talent, but why doesn’t the company have internal succession planning in place? I also wonder how hard the large shareholders pushed back against this.

Institutions The company’s shares are well owned by a variety of high quality institutions: Octopus owns 13.4%, Invesco 9.7%, Investec 7.5%, Standard Life 7.2%, Blackrock 6.2%.

Opinion: The shares look expensive on 40x 2020 FY reported earnings. In some ways this reminds me of PZ Cussons, a quality long term compounder that has had a difficult few years. I’m sceptical of management who need to be remunerated with re-priced options or other incentive schemes, so I will avoid unless the remuneration policy is voted down at the AGM and the Chief Exec resigns in a huff.

EQUALS FY 2020 Trading Update

This payments group put out a trading statement on 6 January for FY to December 2020. FY revenue is expected to be £30m, beating market expectations by £1m but still down 6% versus FY 2019. Adjusted EBITDA is expected to be £1m (v expectations of £0.55m) down from £9.1m FY 19. Cash on balance sheet at the end of December was £8m, and this excluded a £2m drawdown of the Government’s CBILS scheme. No mention of statutory PBT. The shares rose 19% on the day of the RNS, Cenkos their broker, increased their 2020F to reflect the positive trading update, but did not raise their forecasts for 2021F or 2022F.

History: Cenkos listed this payments business, originally called FAIRFX at 45p, valuing the company at £31m in 2014. It had been operating in the UK since 2007, offering low cost currency transactions for personal and SME business customers. Revenue grew from £5.5m FY 2014, to £30.9m FY 2019, a CAGR of 41%. The share price peaked at 150p at the end of September 2018.

Despite the impressive top line growth, Equals has struggled to report a positive PBT (most recently an £8m pre-tax loss in FY 19) so at the current size there doesn’t seem to be much operational gearing. As an aside, this £8m pre-tax loss does not appear in the Financial Summary at the front of the FY19 Annual Report, instead management choose to emphasize Adjusted EBITDA of £9.1m then jumping straight to an after tax loss of £5.4m. The company also received £3.5m of R&D tax credits in 2019, and capitalised £8.3m of expenses, without which reported losses in the p&l would have been higher.

In order to fund the ongoing losses management raised £16m in 2019.

They also had a relationship with a Wirecard subsidiary. However, it looks like “ringfencing” worked as it was supposed to and despite the failure of Wirecard AG last year, customer funds were protected.

Although the company rebranded in 2019 to “EQUALS” in order to de-emphasize their forex business in favour of SME expense management system, there has still been an impact from Covid. Travel related revenue (bureau de change and retail pre-paid cards) has been badly hit by the virus, down 87% on the comparative period in 2019. To put this into context, travel represented 29% of revenue in 2019 but fell to just 4% of revenue to end of June 2020.

Cenkos are forecasting £32m and £38m of sales in 2021F and 2022F, with the company still expected to be loss making in FY 2021F, but reporting a £1.5m PBT in 2022F or 1.1p EPS 2022F. This puts the shares on 1.5x sales and 29x PER 2022F. Equals expect to report FY audited figures in April.

Shareholder register: Looking at the shareholder register, Crystal Amber, the activist hedge fund own 25%, along with BlackRock 6% and JO Hambro 5%. Pembar Ltd which holds 15% is an Ashley Levett British Virgin Islands vehicle. He’s a former copper trader, who used to own Richmond Rugby Club.*

Opinion: This is my favourite of the three suggestions that have come from twitter users. Though still loss making this year, the reported gross profit margin 66% implies that we should see operational gearing in the coming years if revenue grows as forecast.

My concern is that Equals may not be competing against clunky old banks who gouge their SME customers with expensive products and bad service. Instead Equals could be competing against other sexy FinTechs like Revolut, Monzo, Starling or TransferWise. The latter was last valued at $5bn,** and backed by deep pocketed investors such as US hedge funds plus Baillie Gifford and Fidelity. TransferWise last reported revenue was over £300m and PBT was £20m. That said, Equals is definitely worth following, particularly if you take the “@glasshalfull” view.

Notes

* https://www.independent.co.uk/sport/rugby-union-richmond-adjust-to-poorer-life-after-levett-1078947.html But see also https://en.wikipedia.org/wiki/Sumitomo_copper_affair

**TransferWise valued at $5bn https://www.ft.com/content/dcc92f78-47b4-41bd-bac4-5eec036623bc

Weekly Commentary: 11/01/21 – Gatekeepers

The FTSE 100 started the year strongly +6% during the week to 6857. Both the S&P 500 +1.3% to 3804 Nasdaq +1.4% to 13068 were more subdued, though largely unaffected by events in Washington.

10 years ago when I was in Tbilisi, I remember a US dignitary explaining to the Georgians that the point of democracy is not whether philosopher kings, military generals, billionaire businessmen, lawyers, actors, journalists or even choirboys turned bank robbers (Stalin) make the best leaders. The point of democracy is that every 5 years the people vote, and if the people decide someone else would make a better leader, there is a peaceful transition of power. The Georgians were sceptical, but a decade later, their democracy seems to be functioning well.

Sadly, the transition of power has not been smooth in the USA. In response to the President’s inflammatory remarks, Twitter has suspended Donald Trump’s account.

I’ve been dismissive of Twitter in the past, the shares have been a poor investment, falling by around two thirds since the IPO price. But like many other tech stocks it enjoyed a good 2020, and the shares are up 63% since 1/1/2020. Twitter’s influence on politics is undeniable, but the site’s role in by-passing gatekeepers in other areas is less commented upon.

I recommend this interesting interview between Jim O’Shaugnessy (an early quant) and Alex Danco, who works at Shopify. They talk about how Twitter is removing traditional “gatekeeper” roles from the media, finance, recruitment and academia. For instance, Twitter is the real LinkedIn. I don’t know of anybody who has found a job or recruited someone via LinkedIn, but I do know several (including myself) who have found work via Twitter. Similarly Twitter is giving PhDs and PostDoc students the ability to talk about the science they’re doing without having to go through the prestigious “gatekeeper” journals like Nature or Cell. The quality of financial insight on Twitter is surprisingly good too, probably due to the lack of legal and compliance gatekeepers.

Reader suggestions from Twitter

So I have asked three of the people I follow on Twitter for stock ideas for 2021.

First Carcosa whose portfolio was up +49.8% in 2020. I haven’t independently verified that, but he seems like a sensible chap, and I’m open minded about using other investors’ suggestions as a starting point for my own research on SharePad. Similarly I’d be worried if readers were blindly following what I write, the point of this weekly is to showcase the features and benefits of using Sharepad to do your own research. He went for Cenkos, so I write about the below.

Traditionally UK brokers like Cenkos were the “gatekeepers” who decided which small companies had access to public markets like AIM. Cenkos’ Admission Document talks about a “selective approach to taking on new clients and transactions.” More realistically now, no corporate financier can afford to turn away business, so it is the fund managers who are the gatekeepers and decide which companies can come to market. In the large cap area professional gatekeepers have done a poor job, tolerating over-indebted Private Equity owned businesses (AA and Saga spring to mind) and letting through outright frauds like NMC Health.

Also via Twitter, Andrew at Fund Hunter whose model portfolio was up +38% in 2020 sent me some good suggestions. IFAs have acted as gatekeepers to investment funds, but in the past they have tended to push the product which paid the adviser the highest commission. There’s been a lack of quality independent analysis, and Andrew’s site is an excellent resource if you want to invest in funds rather than individual stocks. I picked Gooch & Housego from his shortlist because it is a multi-bagger that has struggled in the last 2 years. The shares rose from a trough of 30p in mid 2008 to almost £19 a decade later. I’m curious what has gone well, and what has gone badly. Twitter may be disrupting recruitment, but sadly remuneration reports have yet to be disrupted by technology.

Finally Glasshalfull who has said that he was up +83% in 2020, and achieved an even more impressive +44% CAGR over the last 10 years. Again, I haven’t verified those performance statistics, but it seems weird to make up some huge gain just to impress random people on Twitter. He is still positive on Equals Group, the international payments group for SMEs which reported a Trading Update last week, despite it being his worst performer in 2020. So I write about that company too.

Cenkos

History: Named after a racehorse and founded by Andy Stewart (of Collins Stewart) Cenkos listed on AIM at 140p placing at valuing the company at £102m in 2006. The financial crisis was difficult to navigate, but the years following have been even harder for UK brokers. I worked at Seymour Pierce, which eventually failed. The problem was that Government support for the banks meant that no capacity was taken out of equities stockbroking. This coupled with the relentless shift from active institutional fund managers to quant and passive funds meant that there was the same number of people trying to eat a shrinking pie of profit.

At Seymour Pierce it was particularly annoying to have our junior staff poached by loss making Royal Bank of Scotland who offered them salaries 3x higher than we could pay. That was not a level playing field, indeed we were paying tax to the UK Government who were using the money to support a failed bank who was a direct competitor. RBS did eventually close down their equities business, which had been losing hundreds of millions of pounds a year, but it was very hard for independent brokers to compete against other banks with implicit Government support. Then came MIFID II which again favoured large global banks rather than smaller UK brokers.

My experience of Cenkos from friends that have worked there was that the broker was well run. However there is only so much that management can do in the face of such an unfavourable operating environment and the shares briefly troughed at below 30p in the March 2020 sell off.

SharePad’s “Quality” tab shows the volatile operating history, with RoCE varying between negative and +80%. The company’s best year was 2014, with sales of £88.5m and PBT of £27m. This compares to £26m sales and £140K of PBT in 2019 (ie times were tough even before Covid-19 hit in 2020). Or put another way, in a good year Cenkos profit exceed their total sales in a bad year. See circled bars in the bar chart.

Edison the paid for research house is not publishing forecasts, even for 2020. Cenkos management took until 2nd October to release their H1 results to end of June.

H1 results: Revenue was up +22% in H1 to £12.9m helped by corporate finance fees +48% to £9.2m as companies sought to raise equity funding both to weather the Covid storm but also to take advantage of growth opportunities. Group PBT was £0.8m v a small loss in H1 19. The company had £22.4m of cash on the balance sheet at the end of June – they could have told investors how much cash they had at the end of September, but chose not to. The company has 97 Nomad / corporate broking clients, down from 100 at December 2019. They make markets in 185 stocks, but kept the trading book flat within capital limits meaning that they didn’t lose money on their market making in H1.

Headcount was reduced to 89 at June 20 (down from 95 Dec 19). The company expects more of the savings of staff reductions to be seen in H2. On the outlook for H2 (bear in mind the RNS was 2nd October) they say H2 “has begun with energy and purpose at Cenkos, despite the ongoing macro challenges presented by the ongoing coronavirus” and make reference to several equity fundraisings for their clients. The company paid a 1p interim dividend.

Last month the company announced that Jim Durkin the Chief Executive who returned to lead the business 2019 would step down and Julian Morse, an internal appointment would become Chief Executive.

Remuneration: Like football clubs, corporate finance has often been a sector where most of the value accrues to the “star players”, rather than the owners. Cenkos has a profit sharing model, in an attempt to align employee bonuses with external shareholders’ interests. The model works by business unit, and is based on a percentage of revenues after direct costs have been deducted. This means that even during the financial crisis when revenue fell 47% to £28m FY 2008, the company still reported a £5.1m PBT.

Opinion: Similar to Duke Royalty, I can see that this could be an interesting way to play the recovery and the shares could bounce very strongly in 2021. However, I’m less enthusiastic about the long term prospects of the business. The shares look a “deep value” type of investment, but with no tangible assets except the £22m cash (v £34m market cap) on the balance sheet. That is, the company’s other assets are its reputation, relationships and the staff who walk out the door every evening, who are occasionally bid away to competitors with deeper pockets.

I feel sad that UK brokers have been through such hard times; in my experience smaller companies do receive a better service from them than large global banks. Policy makers seem unconcerned with the demise of the stockbroker and no wealthy pop stars will write songs lamenting their passing, as Sting did for Northern coal miners in the 1980s (We Worked the Black Seam Together)

Gooch & Housego

History In 1997 this precision instruments company listed on AIM at 105p, raising £1.5m and valuing the entire company at £18m. The corporate history goes back much further to 1946 when Archie Gooch and Leslie Housego established a manufacturing partnership in Illminster Somerset, to make optical components and crystals. The company’s photonic products are used in aerospace & defence, industrial and life science research sectors. The company has 8 manufacturing sites, mostly in the UK and USA. Revenue was just £6.7m and PBT £1.6m in 1997, so the company has a long term track record of growth over the recent decades. The company has grown the top line every year since 2002, aside from last year and 2012 when revenue was flat at £61m.

Results G&H has a September year end and reported its most recent results in December 2020. Revenue was down 5.5% to £122m, and adjusted PBT was down 35% to £9.8m. Statutory PBT was down 9.4% to £5.4m, the adjustments for non underlying items were site closure costs of £2.6m, acquisition and amortisation charges £2.7m and a £1.2m benefit from a favourable court case that went their way. Net debt ex IFRS 16 was £6.5m. The company paid a final dividend of 7.2p for the previous year, but passed the interim dividend earlier in 2020 and have not proposed a final dividend.

Around 2/3 of the Group’s revenue is in US dollars, and 1/3 in GBP. The company splits revenue into 3 segments, with the first two (Industrial -10%, Aerospace & Defence -6%) making up 80% of revenue suffering a year on year decline:

The smallest segment (Life Sciences/Biophotonics) was up 7.6% because some of their components are used in respirators. The group spent £7.9m, or 6.5% of revenue on R&D, all of which is expensed through the p&l. Over the years G&H has grown by acquisition, so there is £55m of intangible assets on the balance sheet, versus net assets of £113m. Capex has tended to be below depreciation, and the ratio has reduced significantly from the years before the financial crisis when it averaged around 350%.

Remuneration The Chief Executive Mark Webster was paid £350K basic, and CFO Chris Jewell £259K. The Board employed remuneration consultants to come up with an incentive scheme. However all the awards are now under water and in addition targets have not been achieved for the last two years. The Board has decided that they can’t afford to lose senior executives and they need to compensate Executive Directors for the loss in value of LTIP awards to make sure that they are retained and motivated (because obviously £350K a year basic is not very motivational, are these guys Premier League footballers?) Readers can guess what is coming next: the Board has consulted with major shareholders and is going to reprice its options scheme and hopes to receive support for this at the AGM on 24th February.

The AGM won’t take place in person, but shareholders are invited to send questions to agm@gandh.com and responses will be published on the Company’s website.

As you can tell I’m against companies repricing their incentives schemes. The pandemic probably does mean that it would be harder to hire external talent, but why doesn’t the company have internal succession planning in place? I also wonder how hard the large shareholders pushed back against this.

Institutions The company’s shares are well owned by a variety of high quality institutions: Octopus owns 13.4%, Invesco 9.7%, Investec 7.5%, Standard Life 7.2%, Blackrock 6.2%.

Opinion: The shares look expensive on 40x 2020 FY reported earnings. In some ways this reminds me of PZ Cussons, a quality long term compounder that has had a difficult few years. I’m sceptical of management who need to be remunerated with re-priced options or other incentive schemes, so I will avoid unless the remuneration policy is voted down at the AGM and the Chief Exec resigns in a huff.

EQUALS FY 2020 Trading Update

This payments group put out a trading statement on 6 January for FY to December 2020. FY revenue is expected to be £30m, beating market expectations by £1m but still down 6% versus FY 2019. Adjusted EBITDA is expected to be £1m (v expectations of £0.55m) down from £9.1m FY 19. Cash on balance sheet at the end of December was £8m, and this excluded a £2m drawdown of the Government’s CBILS scheme. No mention of statutory PBT. The shares rose 19% on the day of the RNS, Cenkos their broker, increased their 2020F to reflect the positive trading update, but did not raise their forecasts for 2021F or 2022F.

History: Cenkos listed this payments business, originally called FAIRFX at 45p, valuing the company at £31m in 2014. It had been operating in the UK since 2007, offering low cost currency transactions for personal and SME business customers. Revenue grew from £5.5m FY 2014, to £30.9m FY 2019, a CAGR of 41%. The share price peaked at 150p at the end of September 2018.

Despite the impressive top line growth, Equals has struggled to report a positive PBT (most recently an £8m pre-tax loss in FY 19) so at the current size there doesn’t seem to be much operational gearing. As an aside, this £8m pre-tax loss does not appear in the Financial Summary at the front of the FY19 Annual Report, instead management choose to emphasize Adjusted EBITDA of £9.1m then jumping straight to an after tax loss of £5.4m. The company also received £3.5m of R&D tax credits in 2019, and capitalised £8.3m of expenses, without which reported losses in the p&l would have been higher.

In order to fund the ongoing losses management raised £16m in 2019.

They also had a relationship with a Wirecard subsidiary. However, it looks like “ringfencing” worked as it was supposed to and despite the failure of Wirecard AG last year, customer funds were protected.

Although the company rebranded in 2019 to “EQUALS” in order to de-emphasize their forex business in favour of SME expense management system, there has still been an impact from Covid. Travel related revenue (bureau de change and retail pre-paid cards) has been badly hit by the virus, down 87% on the comparative period in 2019. To put this into context, travel represented 29% of revenue in 2019 but fell to just 4% of revenue to end of June 2020.

Cenkos are forecasting £32m and £38m of sales in 2021F and 2022F, with the company still expected to be loss making in FY 2021F, but reporting a £1.5m PBT in 2022F or 1.1p EPS 2022F. This puts the shares on 1.5x sales and 29x PER 2022F. Equals expect to report FY audited figures in April.

Shareholder register: Looking at the shareholder register, Crystal Amber, the activist hedge fund own 25%, along with BlackRock 6% and JO Hambro 5%. Pembar Ltd which holds 15% is an Ashley Levett British Virgin Islands vehicle. He’s a former copper trader, who used to own Richmond Rugby Club.*

Opinion: This is my favourite of the three suggestions that have come from twitter users. Though still loss making this year, the reported gross profit margin 66% implies that we should see operational gearing in the coming years if revenue grows as forecast.

My concern is that Equals may not be competing against clunky old banks who gouge their SME customers with expensive products and bad service. Instead Equals could be competing against other sexy FinTechs like Revolut, Monzo, Starling or TransferWise. The latter was last valued at $5bn,** and backed by deep pocketed investors such as US hedge funds plus Baillie Gifford and Fidelity. TransferWise last reported revenue was over £300m and PBT was £20m. That said, Equals is definitely worth following, particularly if you take the “@glasshalfull” view.

Bruce Packard

Notes

* https://www.independent.co.uk/sport/rugby-union-richmond-adjust-to-poorer-life-after-levett-1078947.html But see also https://en.wikipedia.org/wiki/Sumitomo_copper_affair

**TransferWise valued at $5bn https://www.ft.com/content/dcc92f78-47b4-41bd-bac4-5eec036623bc

11 January 2020

Gatekeepers

The FTSE 100 started the year strongly +6% during the week to 6857. Both the S&P 500 +1.3% to 3804 Nasdaq +1.4% to 13068 were more subdued, though largely unaffected by events in Washington.

10 years ago when I was in Tbilisi, I remember a US dignitary explaining to the Georgians that the point of democracy is not whether philosopher kings, military generals, billionaire businessmen, lawyers, actors, journalists or even choirboys turned bank robbers (Stalin) make the best leaders. The point of democracy is that every 5 years the people vote, and if the people decide someone else would make a better leader, there is a peaceful transition of power. The Georgians were sceptical, but a decade later, their democracy seems to be functioning well.

Sadly, the transition of power has not been smooth in the USA. In response to the President’s inflammatory remarks, Twitter has suspended Donald Trump’s account.

I’ve been dismissive of Twitter in the past, the shares have been a poor investment, falling by around two thirds since the IPO price. But like many other tech stocks it enjoyed a good 2020, and the shares are up 63% since 1/1/2020. Twitter’s influence on politics is undeniable, but the site’s role in by-passing gatekeepers in other areas is less commented upon.

I recommend this interesting interview between Jim O’Shaugnessy (an early quant) and Alex Danco, who works at Shopify. They talk about how Twitter is removing traditional “gatekeeper” roles from the media, finance, recruitment and academia. For instance, Twitter is the real LinkedIn. I don’t know of anybody who has found a job or recruited someone via LinkedIn, but I do know several (including myself) who have found work via Twitter. Similarly Twitter is giving PhDs and PostDoc students the ability to talk about the science they’re doing without having to go through the prestigious “gatekeeper” journals like Nature or Cell. The quality of financial insight on Twitter is surprisingly good too, probably due to the lack of legal and compliance gatekeepers.

Reader suggestions from Twitter

So I have asked three of the people I follow on Twitter for stock ideas for 2021.

First Carcosa whose portfolio was up +49.8% in 2020. I haven’t independently verified that, but he seems like a sensible chap, and I’m open minded about using other investors’ suggestions as a starting point for my own research on SharePad. Similarly I’d be worried if readers were blindly following what I write, the point of this weekly is to showcase the features and benefits of using Sharepad to do your own research. He went for Cenkos, so I write about the below.

Traditionally UK brokers like Cenkos were the “gatekeepers” who decided which small companies had access to public markets like AIM. Cenkos’ Admission Document talks about a “selective approach to taking on new clients and transactions.” More realistically now, no corporate financier can afford to turn away business, so it is the fund managers who are the gatekeepers and decide which companies can come to market. In the large cap area professional gatekeepers have done a poor job, tolerating over-indebted Private Equity owned businesses (AA and Saga spring to mind) and letting through outright frauds like NMC Health.

Also via Twitter, Andrew at Fund Hunter whose model portfolio was up +38% in 2020 sent me some good suggestions. IFAs have acted as gatekeepers to investment funds, but in the past they have tended to push the product which paid the adviser the highest commission. There’s been a lack of quality independent analysis, and Andrew’s site is an excellent resource if you want to invest in funds rather than individual stocks. I picked Gooch & Housego from his shortlist because it is a multi-bagger that has struggled in the last 2 years. The shares rose from a trough of 30p in mid 2008 to almost £19 a decade later. I’m curious what has gone well, and what has gone badly. Twitter may be disrupting recruitment, but sadly remuneration reports have yet to be disrupted by technology.

Finally Glasshalfull who has said that he was up +83% in 2020, and achieved an even more impressive +44% CAGR over the last 10 years. Again, I haven’t verified those performance statistics, but it seems weird to make up some huge gain just to impress random people on Twitter. He is still positive on Equals Group, the international payments group for SMEs which reported a Trading Update last week, despite it being his worst performer in 2020. So I write about that company too.

Cenkos

History: Named after a racehorse and founded by Andy Stewart (of Collins Stewart) Cenkos listed on AIM at 140p placing at valuing the company at £102m in 2006. The financial crisis was difficult to navigate, but the years following have been even harder for UK brokers. I worked at Seymour Pierce, which eventually failed. The problem was that Government support for the banks meant that no capacity was taken out of equities stockbroking. This coupled with the relentless shift from active institutional fund managers to quant and passive funds meant that there was the same number of people trying to eat a shrinking pie of profit.

At Seymour Pierce it was particularly annoying to have our junior staff poached by loss making Royal Bank of Scotland who offered them salaries 3x higher than we could pay. That was not a level playing field, indeed we were paying tax to the UK Government who were using the money to support a failed bank who was a direct competitor. RBS did eventually close down their equities business, which had been losing hundreds of millions of pounds a year, but it was very hard for independent brokers to compete against other banks with implicit Government support. Then came MIFID II which again favoured large global banks rather than smaller UK brokers.

My experience of Cenkos from friends that have worked there was that the broker was well run. However there is only so much that management can do in the face of such an unfavourable operating environment and the shares briefly troughed at below 30p in the March 2020 sell off.

SharePad’s “Quality” tab shows the volatile operating history, with RoCE varying between negative and +80%. The company’s best year was 2014, with sales of £88.5m and PBT of £27m. This compares to £26m sales and £140K of PBT in 2019 (ie times were tough even before Covid-19 hit in 2020). Or put another way, in a good year Cenkos profit exceed their total sales in a bad year. See circled bars in the bar chart.

Edison the paid for research house is not publishing forecasts, even for 2020. Cenkos management took until 2nd October to release their H1 results to end of June.

H1 results: Revenue was up +22% in H1 to £12.9m helped by corporate finance fees +48% to £9.2m as companies sought to raise equity funding both to weather the Covid storm but also to take advantage of growth opportunities. Group PBT was £0.8m v a small loss in H1 19. The company had £22.4m of cash on the balance sheet at the end of June – they could have told investors how much cash they had at the end of September, but chose not to. The company has 97 Nomad / corporate broking clients, down from 100 at December 2019. They make markets in 185 stocks, but kept the trading book flat within capital limits meaning that they didn’t lose money on their market making in H1.

Headcount was reduced to 89 at June 20 (down from 95 Dec 19). The company expects more of the savings of staff reductions to be seen in H2. On the outlook for H2 (bear in mind the RNS was 2nd October) they say H2 “has begun with energy and purpose at Cenkos, despite the ongoing macro challenges presented by the ongoing coronavirus” and make reference to several equity fundraisings for their clients. The company paid a 1p interim dividend.

Last month the company announced that Jim Durkin the Chief Executive who returned to lead the business 2019 would step down and Julian Morse, an internal appointment would become Chief Executive.

Remuneration: Like football clubs, corporate finance has often been a sector where most of the value accrues to the “star players”, rather than the owners. Cenkos has a profit sharing model, in an attempt to align employee bonuses with external shareholders’ interests. The model works by business unit, and is based on a percentage of revenues after direct costs have been deducted. This means that even during the financial crisis when revenue fell 47% to £28m FY 2008, the company still reported a £5.1m PBT.

Opinion: Similar to Duke Royalty, I can see that this could be an interesting way to play the recovery and the shares could bounce very strongly in 2021. However, I’m less enthusiastic about the long term prospects of the business. The shares look a “deep value” type of investment, but with no tangible assets except the £22m cash (v £34m market cap) on the balance sheet. That is, the company’s other assets are its reputation, relationships and the staff who walk out the door every evening, who are occasionally bid away to competitors with deeper pockets.

I feel sad that UK brokers have been through such hard times; in my experience smaller companies do receive a better service from them than large global banks. Policy makers seem unconcerned with the demise of the stockbroker and no wealthy pop stars will write songs lamenting their passing, as Sting did for Northern coal miners in the 1980s (We Worked the Black Seam Together)

Gooch & Housego

History In 1997 this precision instruments company listed on AIM at 105p, raising £1.5m and valuing the entire company at £18m. The corporate history goes back much further to 1946 when Archie Gooch and Leslie Housego established a manufacturing partnership in Illminster Somerset, to make optical components and crystals. The company’s photonic products are used in aerospace & defence, industrial and life science research sectors. The company has 8 manufacturing sites, mostly in the UK and USA. Revenue was just £6.7m and PBT £1.6m in 1997, so the company has a long term track record of growth over the recent decades. The company has grown the top line every year since 2002, aside from last year and 2012 when revenue was flat at £61m.

Results G&H has a September year end and reported its most recent results in December 2020. Revenue was down 5.5% to £122m, and adjusted PBT was down 35% to £9.8m. Statutory PBT was down 9.4% to £5.4m, the adjustments for non underlying items were site closure costs of £2.6m, acquisition and amortisation charges £2.7m and a £1.2m benefit from a favourable court case that went their way. Net debt ex IFRS 16 was £6.5m. The company paid a final dividend of 7.2p for the previous year, but passed the interim dividend earlier in 2020 and have not proposed a final dividend.

Around 2/3 of the Group’s revenue is in US dollars, and 1/3 in GBP. The company splits revenue into 3 segments, with the first two (Industrial -10%, Aerospace & Defence -6%) making up 80% of revenue suffering a year on year decline:

The smallest segment (Life Sciences/Biophotonics) was up 7.6% because some of their components are used in respirators. The group spent £7.9m, or 6.5% of revenue on R&D, all of which is expensed through the p&l. Over the years G&H has grown by acquisition, so there is £55m of intangible assets on the balance sheet, versus net assets of £113m. Capex has tended to be below depreciation, and the ratio has reduced significantly from the years before the financial crisis when it averaged around 350%.

Remuneration The Chief Executive Mark Webster was paid £350K basic, and CFO Chris Jewell £259K. The Board employed remuneration consultants to come up with an incentive scheme. However all the awards are now under water and in addition targets have not been achieved for the last two years. The Board has decided that they can’t afford to lose senior executives and they need to compensate Executive Directors for the loss in value of LTIP awards to make sure that they are retained and motivated (because obviously £350K a year basic is not very motivational, are these guys Premier League footballers?) Readers can guess what is coming next: the Board has consulted with major shareholders and is going to reprice its options scheme and hopes to receive support for this at the AGM on 24th February.

The AGM won’t take place in person, but shareholders are invited to send questions to agm@gandh.com and responses will be published on the Company’s website.

As you can tell I’m against companies repricing their incentives schemes. The pandemic probably does mean that it would be harder to hire external talent, but why doesn’t the company have internal succession planning in place? I also wonder how hard the large shareholders pushed back against this.

Institutions The company’s shares are well owned by a variety of high quality institutions: Octopus owns 13.4%, Invesco 9.7%, Investec 7.5%, Standard Life 7.2%, Blackrock 6.2%.

Opinion: The shares look expensive on 40x 2020 FY reported earnings. In some ways this reminds me of PZ Cussons, a quality long term compounder that has had a difficult few years. I’m sceptical of management who need to be remunerated with re-priced options or other incentive schemes, so I will avoid unless the remuneration policy is voted down at the AGM and the Chief Exec resigns in a huff.

EQUALS FY 2020 Trading Update

This payments group put out a trading statement on 6 January for FY to December 2020. FY revenue is expected to be £30m, beating market expectations by £1m but still down 6% versus FY 2019. Adjusted EBITDA is expected to be £1m (v expectations of £0.55m) down from £9.1m FY 19. Cash on balance sheet at the end of December was £8m, and this excluded a £2m drawdown of the Government’s CBILS scheme. No mention of statutory PBT. The shares rose 19% on the day of the RNS, Cenkos their broker, increased their 2020F to reflect the positive trading update, but did not raise their forecasts for 2021F or 2022F.

History: Cenkos listed this payments business, originally called FAIRFX at 45p, valuing the company at £31m in 2014. It had been operating in the UK since 2007, offering low cost currency transactions for personal and SME business customers. Revenue grew from £5.5m FY 2014, to £30.9m FY 2019, a CAGR of 41%. The share price peaked at 150p at the end of September 2018.

Despite the impressive top line growth, Equals has struggled to report a positive PBT (most recently an £8m pre-tax loss in FY 19) so at the current size there doesn’t seem to be much operational gearing. As an aside, this £8m pre-tax loss does not appear in the Financial Summary at the front of the FY19 Annual Report, instead management choose to emphasize Adjusted EBITDA of £9.1m then jumping straight to an after tax loss of £5.4m. The company also received £3.5m of R&D tax credits in 2019, and capitalised £8.3m of expenses, without which reported losses in the p&l would have been higher.

In order to fund the ongoing losses management raised £16m in 2019.

They also had a relationship with a Wirecard subsidiary. However, it looks like “ringfencing” worked as it was supposed to and despite the failure of Wirecard AG last year, customer funds were protected.

Although the company rebranded in 2019 to “EQUALS” in order to de-emphasize their forex business in favour of SME expense management system, there has still been an impact from Covid. Travel related revenue (bureau de change and retail pre-paid cards) has been badly hit by the virus, down 87% on the comparative period in 2019. To put this into context, travel represented 29% of revenue in 2019 but fell to just 4% of revenue to end of June 2020.

Cenkos are forecasting £32m and £38m of sales in 2021F and 2022F, with the company still expected to be loss making in FY 2021F, but reporting a £1.5m PBT in 2022F or 1.1p EPS 2022F. This puts the shares on 1.5x sales and 29x PER 2022F. Equals expect to report FY audited figures in April.

Shareholder register: Looking at the shareholder register, Crystal Amber, the activist hedge fund own 25%, along with BlackRock 6% and JO Hambro 5%. Pembar Ltd which holds 15% is an Ashley Levett British Virgin Islands vehicle. He’s a former copper trader, who used to own Richmond Rugby Club.*

Opinion: This is my favourite of the three suggestions that have come from twitter users. Though still loss making this year, the reported gross profit margin 66% implies that we should see operational gearing in the coming years if revenue grows as forecast.

My concern is that Equals may not be competing against clunky old banks who gouge their SME customers with expensive products and bad service. Instead Equals could be competing against other sexy FinTechs like Revolut, Monzo, Starling or TransferWise. The latter was last valued at $5bn,** and backed by deep pocketed investors such as US hedge funds plus Baillie Gifford and Fidelity. TransferWise last reported revenue was over £300m and PBT was £20m. That said, Equals is definitely worth following, particularly if you take the “@glasshalfull” view.

Notes

* https://www.independent.co.uk/sport/rugby-union-richmond-adjust-to-poorer-life-after-levett-1078947.html But see also https://en.wikipedia.org/wiki/Sumitomo_copper_affair

**TransferWise valued at $5bn https://www.ft.com/content/dcc92f78-47b4-41bd-bac4-5eec036623bc