Bruce discusses the concept of “edge” – now that we all have access to the same information, how can anyone enjoy an advantage? Companies covered this week ZOO, SWG, SMV.

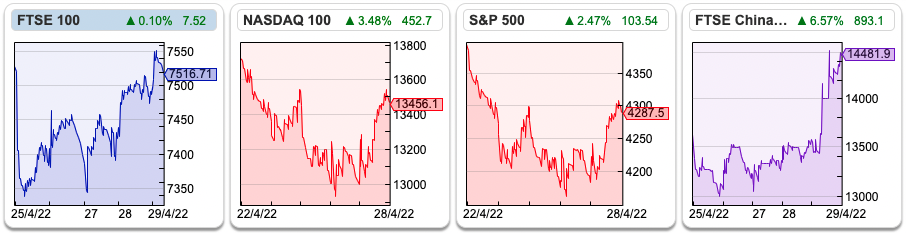

The FTSE 100 was flat at 7,516 over the last week. The Nasdaq100 and S&P500 were down -2% and -2.4% over the same time period. The FTSE China 50 was up +5.7% which was rather surprising given the flawed Covid Zero strategy, but I think driven by Renminbi currency devaluation of -4.2%. The last time this happened in 2015 Brent crude fell below $30 per barrel. So perhaps a demand shock from a slowing China could offset rising energy costs from Russian sanctions? The US 10Y government bond yield fell back a couple of basis points to 2.82% and Brent crude was steady at $105 per barrel.

Edge: Last week on Mello I pitched TP ICAP, which I had written up on Sharepad earlier here. Someone from the audience asked “what is your edge?” – meaning that TP ICAP is worth over a billion pounds, how can anyone possibly know anything price sensitive about a £1bn company. That’s a hard question to answer, I obviously don’t have price sensitive inside information. Now that amateur investors have powerful tools like Sharepad (vs a Bloomberg terminal which costs 50x more for similar functionality) how can anyone claim to have an advantage?

Yet, I have plenty of experience of looking at £10bn or even £100bn market cap banks and being i) in a minority of one ii) correct.

Perhaps a personal anecdote from 20 years ago will help. My first job in the city was working for the banks’ team at Credit Suisse, typing numbers into excel, creating powerpoint slides, digging information from Central Bank websites etc. After a year, the team I worked for were headhunted by another bank, and as I had only a year’s worth of experience, I wasn’t offered a job working with them at their new bank. So I was left behind at CSFB, in charge of publishing equity research on UK banks 2001-2002. At the time UK banks like HSBC, Lloyds and Royal Bank were some of the biggest in the world. I had studied Theology at Durham University, failed the first level of the CFA, hadn’t met any fund management clients and had a single year of experience…How could I have an “edge” in banking? As it turned out, one thing I got right and almost everyone else got wrong was Abbey National.

Abbey was a dull, former building society and the shares looked cheap on most valuation measures. I didn’t understand what their wholesale banking division did, though it had grown very fast and it seemed to create profits from thin air. Many of my competitors thought they knew they had an edge: Abbey was “Not Complicated Just Cheap” – the title of one of my rival’s research notes. As it turned out, Abbey was funding short term in interbank markets then investing in assets of dubious quality: bonds of Enron and other TMT bubble debt, aircraft leasing etc. My edge was admitting what I didn’t know.

A couple of years (and more than a couple of Abbey profit warnings) later, an article appeared in the Sunday Times that US value investors were concerned that Abbey’s new management, who were trying to turn the business around, had rejected a bid from Santander without consulting shareholders. Having been fired by CSFB and replace by my more high profile rival who got Abbey so wrong, I was working for ING, the Dutch bank. It made sense to me for Santander to buy Abbey (because the reduced risk weighting on mortgages under the new Basel II regulations was advantageous to banks with large mortgage books). So I published a research note and upgraded Abbey to “buy”. Again, no one else thought this and I even had a French fund management client scream at me that I had “no credibility”. I think she was annoyed that my edge was reading the newspaper. Abbey was later bought by Santander.

Luck, perhaps? Another example: before the financial crisis I was bearish on UK mortgage banks, and as the crisis got going I was negative on both Northern Rock and Bradford & Bingley. Halfway through 2008, after Royal Bank and HBOS had been forced by the Bank of England to raise equity, but their credit spreads were still indicating trouble, I published a note saying that the UK banks could end up being nationalised. Paul Mason at the BBC rather liked this, but I don’t think that the UK banking regulators were thrilled. This all seems rather obvious, except no one else thought so. The concept of “edge” implies some arcane knowledge, which I think doesn’t exist.

Investing is an infinite jigsaw puzzle with no edges. So I encourage readers to enjoy putting pieces of the puzzle together. True, underappreciated companies can often be found below the £1bn market cap level. But Sharepad can help you with your own investing whatever the size of the company if you’re prepared to do your own thinking. I hope you use the tool to enjoy the psychic and financial rewards of being proved right (without being shouted at by a French fund manager). TP ICAP seems an interesting story, about the ebb and flow between transactions on exchanges and OTC markets – but I have no special knowledge, no edge. Let’s see how it looks in one or two years from now. This week I look at Zoo Digital, the media company that does localisation services for streaming company’s. Plus Smoove (online conveyancing that used to be called ULS Technology) and IT services company Shearwater (cyber security).

Zoo Digital FY March Trading Update

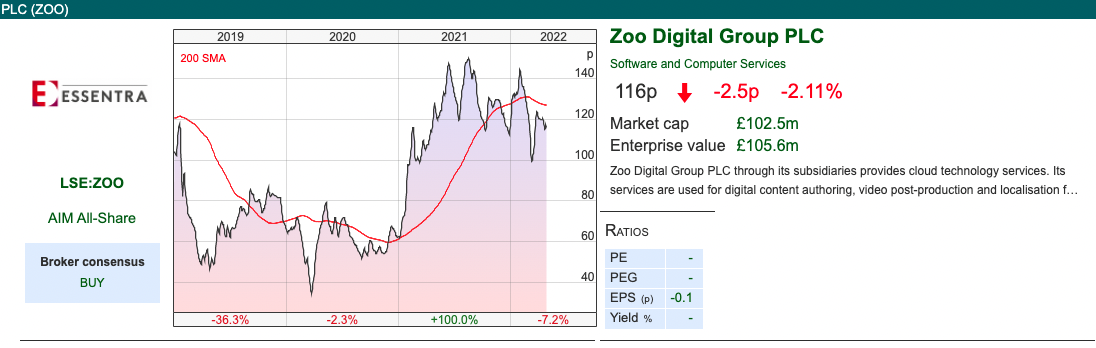

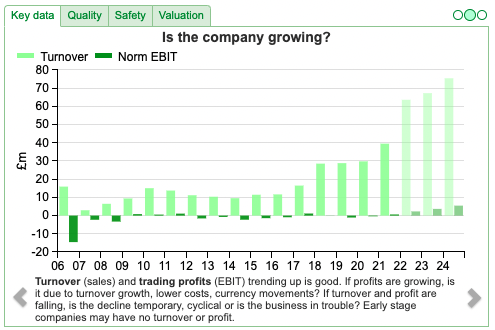

This fast growing media services company (they specialise in localising content for Hollywood studios and streaming companies). Since 2018 Zoo has been Netflix’s Preferred Fulfilment Partner. ZOO had already released an update at the end of March saying that they expected revenues to be at least $65m and adj EBITDA at least $6.5m for FY Mar 2022F. There’s a significant difference between the adjusted EBITDA figure and Progressive’s forecast of $2.1m for reported PBT. At least the business is profitable though, which it hasn’t been for the last two years.

It looks like Zoo management were keen to tell investors that the problems with Netflix subscriber growth has yet to impact them. ZOO’s FY March has finished strongly, because they’re now saying revenue of approximately $70m and adj EBITDA of $8m (implying c. +77% increase for both item v FY March 2021). Net cash was $5.4m versus $2.9m the previous March year end.

Progressive, their research publisher, has suggested the challenges around subscriber growth at Netflix could actually prove to be positive for ZOO. They make the case that this will lead to increased spend by streaming companies on content and localisation. ZOO’s customers are all the main streaming companies, not just NFLX. Paid for research exists to put the positive spin on events; so I’d treat their argument with caution – but wouldn’t dismiss it entirely. Interestingly Progressive haven’t raised their FY March 2023F or FY March 2024F estimates to reflect their own optimism.

Outlook: Netflix may continue to spend on content, but it’s pretty clear the rest of the entertainment industry is having second thoughts. David Zaslav of Warner Bros Discovery (recently created when AT&T decided to sell Warner Media to Discovery Channel) has said he will not overspend to drive subscriber growth. Meanwhile his Finance Director said that previous management at Warner Media had $40bn of revenue and virtually no free cash flow.

History: ZOO has been listed since 2001, when it reversed into a shell. At the time ZOO had revenues of less than £100K. Over the last 20 years the company has grown revenue to $70m FY March 2022F, but despite impressive revenue progression has struggled to report profits.

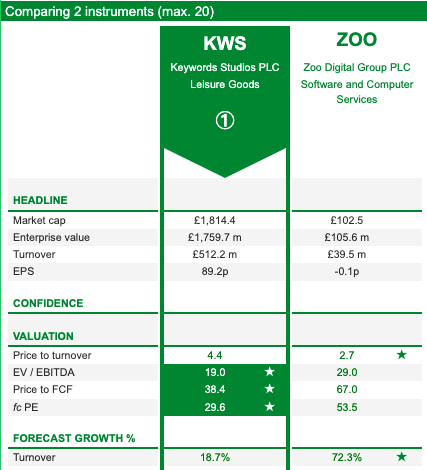

Comparison with Keyword Studios: The other company that I can think of in this area is Keywords Studios, which does localisation of content for computer games.

Keyword’s offering has broadened out, to include art work, quality assurance, game testing and similar services having grown by making small acquisitions. KWS has been a strong performer, up around 17x in the last 10 years – so localisation services might sound like a low value added service but it seems to be an attractive niche for investors. So far, there’s been no evidence of economies of scale at the moment for ZOO, but I wonder if we’re reaching a point (over $50m of revenues) where we might see the benefits of scale?

Valuation: ZOO shares are trading on 43x PER FY March 2023F, falling to 27x PER the following year. However, that’s because the company is just beginning to turn a profit. On a price to sales ratio 2.7x looks more reasonable.

Opinion: This is a tricky one. Hopefully you can see there are good reasons for believing that Zoo may start to enjoy operational gearing and the benefits of scale. But on the downside it looks like entertainment studios will be spending less on content. I think that the outlook statement in the next set of results on 6 July will make interesting reading – until then I will “sit on my hands”.

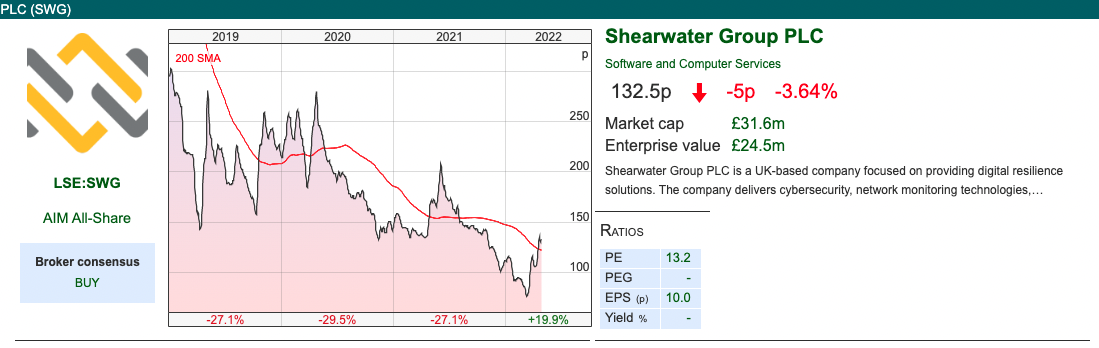

Shearwater FY March Trading Update

This IT services and cybersecurity firm announced a strong H2, with FY revenue now expected to be +12% to £35.5m. The group expects to report adj EBITDA of £4.2m slightly ahead of their research provider’s forecast (Progressive adj EBITDA £4.1m). I’m not sure what message company managements think they are sending by putting adj EBITDA rather than profit guidance in their trading statements – but to me this is an immediate signal to use Sharepad to check the track record for (lack of) profits!

History: The company has been listed on AIM for 20 years, originally as Aurum Mining Plc. The gold mining and legacy assets became a cash shell, and there was a transformative deal, in 2017 when they acquired SecurEnvoy a multifactor authentication software company (similar to Intercede) for £20m in 2017. A string of deals rapidly followed, culminating in a cyber security company: Brookcourt which they bought for £30m in H2 2018. They changed their name in H2 2018 to Shearwater, raising £16m and valuing the company at £69m market cap. So we can ignore pre 2017 numbers, but since then the company has failed to report a profit until last year (and then it was just £33K). Progressive suggest that the performance has been held back as management were integrating the acquired businesses into a cohesive whole, then followed by delays resulting from Covid putting further expansion on the backburner. The research provider’s forecasts suggest that the company has now turned the corner and adj PBT is expected to grow to £3.2m FY 2023F. The Chief Executive was replaced 2019, and the new Chief Exec Philip Higgins comes from the Brookwater acquisition – he looks like he has the right background to turn things around.

Ownership: Schroders own 13.1%, followed by Secarma Ltd, which was the previous owner of Pentest (a penetration testing company acquired in April 2019 for equity). Management own considerable stakes, including the Chief Exec Philip Higgins 9.3% and Chairman David Williams 6.8%.

Valuation: The shares are trading on 9x Progressive March 2023F earnings, which looks very good value if momentum can be maintained. The shares have bounced +82% from the end of February, at a time when the rest of the market has been very week. That’s a very strong reaction without a trading update. The company has announced 3 contract wins in that period, the most significant of which was a RNS on 13th April suggesting a contract worth up to £21m (£13m over 3 years, with the option to extend a further £8m).

Opinion: Looks interesting. Someone mentioned this at Mello a year ago, as an example of a good turnaround story that was just beginning to turn. As it happens the shares continue to sell off until this February and are now back to where they were a year ago. Certainly seems worthy of further research.

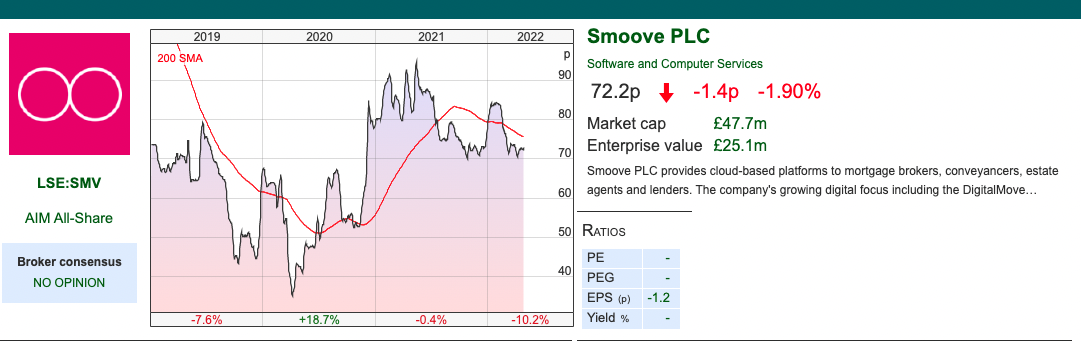

Smoove FY March Trading Update

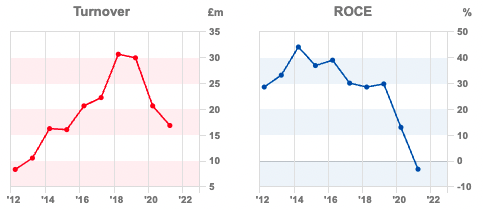

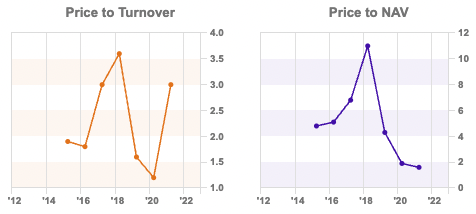

This digital conveyancing firm that used to be called ULS Technology announced a FY trading update with revenues +12% to £19m. That implies a -14% fall H2 v H1 – maybe some of that decline is seasonality between each half but the trading update doesn’t say so. Cash is £20m or 43% of market cap, after they sold a business Conveyancing Alliance Limited (CAL) for £27.3m back in November 2020. Cash has fallen by £4m over the last 12 months, which implies the business has been loss making. Looking at my notes from last year, management were reluctant to give financial guidance – suggesting that in the near term there was considerable downside risk. Longer term, talked about a £1.6bn opportunity – in terms of the market size of conveyancing in the UK.

With the £20m of cash they can fund 5 years of losses at the current rate, and management see a substantial opportunity to profit from all the frictional costs around home buying and conveyancing. Whether they can execute I think is still open to question.

The company’s flagship product is DigitalMove, a secure platform for managing the workflow between lawyers and home buyers with electronic ID verification and digital signatures. Management say that starter packs are being completed and returned to solicitors around 60% more rapidly than using physical paper based systems. I had noted in the past that the product didn’t seem to be catching on as fast as expected – in total 75,000 cases have been completed. The platform has now been up and running for a couple of years and that translates to 15,000 in H2 down from 20,000 cases in H1. So they’re going backwards. There are some negative TrustPilot reviews for DigitalMove.

Outlook: The UK housing market has been very strong due to support measures like the stamp duty holidays – which have now come to an end. The outlook statement says that they continue to see strong trading for eConveyancer. Lower down it says that DigitalMove has been absorbed into the eConveyancer “flagship brand” – reading between the lines suggests that the DigitalMove product has been a disappointment. eConveyancer relies on winning contracts from mortgage brokers and lenders, and stumbled a couple of years ago when they lost some big contracts. Smoove management talk about the launch of a new product Smoove Start, but don’t explain what this is. In all the near term, the outlook doesn’t sound very exciting to me.

Valuation: There are no forecasts in the market, so the shares are trading 2.5x Mar 2022F revenue. However, if we deduct the cash from the market cap, that falls to 1.4x. Between 2012 and 2019 the company was growing revenue and reporting RoCE in the high 20% (peak 44% in 2015). Yet it seems to have lost its way.

Opinion: This story strikes me as being about the cash and the longer term potential. I do think that there are plenty of “pain points” around home buying and remortgaging that could be ripe for digital disruption. So far, the company seems to be making heavy weather of this. Given the large amount of cash, management have time on their side to eventually make things work though. I own the shares, I’m less than excited about the near term, but the cash sitting on its balance sheet suggests the share price will be supported if there’s another downward lurch in markets – so I’m not planning to sell.

Bruce Packard

Notes

The author owns shares in Smoove

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

This is really a nice and informative, containing all information and also has a great impact on the new technology. Thanks for sharing it,

okbet online casino login