Bruce looks at WISE and AFX, currency traders that are benefiting from the market volatility and rising interest rates. He compares their investment case to the UK banks reporting this week.

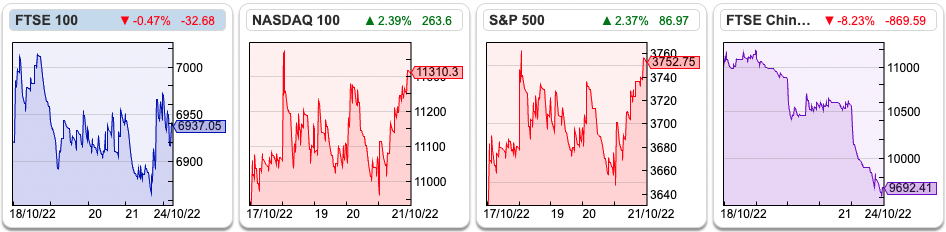

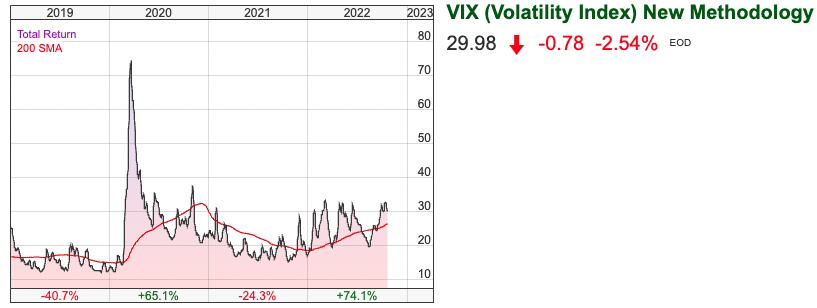

Despite all the volatility of the last week, the FTSE 100 was actually flat at 6,937 over the last 5 days. The Nasdaq100 and S&P500 were up +2.2% and +2.3% respectively. Chinese markets continue to be weak, with the FTSE China 50 Index the worst-performing major indices down -41% YTD (for comparison AIM is down -36% YTD). The Hong Kong-based Hang Seng Index is now at levels seen just before the 1997 Asian crisis. The VIX volatility index on Monday did however fall below 30 for the first time since the start of October.

Last week, the pound strengthened and gilt yields fell (ie prices rose) as an initial reaction to the Prime Minister resigning. However, gilts sold off and yields rose 22bp to 4.06% as it became unclear if a new Prime Minister would stick with Chancellor Jeremy Hunt’s fiscal plans. The pound also weakened against the dollar at the end of last week.

Then at the start of this week, the pound rose to 1.13 to the dollar and the gilt yield fell back to 3.9%, as it became clear that Rishi Sunak’s leadership would not be contested by Boris. For comparison, the UK 10Y government bond yield is now trading at 4.24%, and US debt govt debt/GDP is 121%. The Japanese 10Y bond yield is still below 25bp, despite Japan’s debt to GDP being double the US levels, though the Yen has slid past 150 to the dollar in response.

I think that most of this gilt market volatility is noise. Effectively, whoever is running the country there is now a ceiling on how much the UK government can borrow: financial markets are unlikely to let the UK’s Govt debt rise much above the level of GDP (both are £2.4 trillion, roughly the same level).

It feels like written commentary can go out of date very quickly as markets move around so much. I’ve discussed with the management at Sharepad and will switch to shorter but more timely pieces 2x a week. This is an experiment, so we’d welcome your feedback: marketing@sharescope.co.uk

Below I look at a couple of the currency trading firms Alpha FX and Wise which have both enjoyed a tailwind from the market conditions.

Finally, I wanted to flag that there will be a physical event of Mello taking place next month: MelloLondon will take place on the 16th & 17th of November at the Clayton Hotel & Conference Centre in Chiswick. It’s good to meet fellow investors face-to-face and perhaps this session will prove therapeutic as we share disaster stories about some of the year’s worst performers but also feel inspired by getting some calls right.

Alpha FX Q3 update

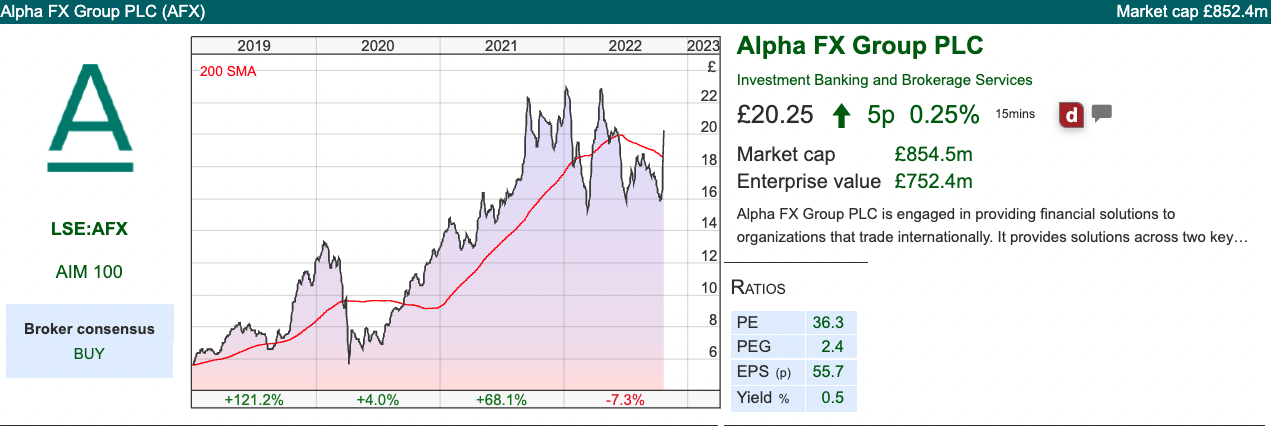

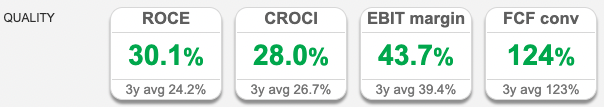

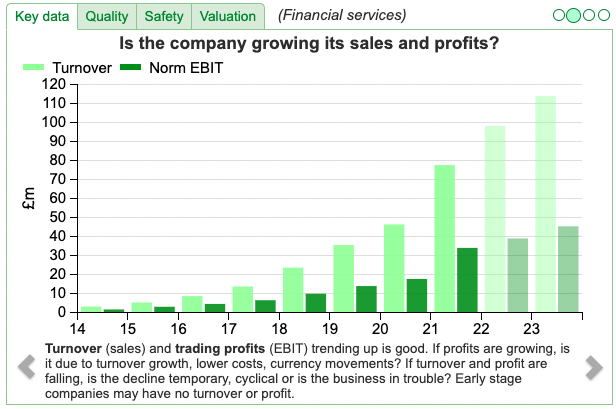

Alpha FX (AFX, not to be confused with AFMC) announced a trading update for FY Dec. Like Argentex which I covered a couple of weeks ago, they are benefiting from currency market volatility, but also from rising interest rates in their Alternative Banking division. As a reminder, AFX has two divisions i) Risk Management 70% of revenue, growing revenue at +35%, provides spot and forward hedging ii) Alternative Banking Solutions 30% of revenue, growing revenues at +47% at H1. This is smaller, more frequent transfers, such as paying invoices. I last wrote about AFX H1 results, which were released in early September here, with revenue up +35% to £46m and reported PBT was up +16% to £18m. SharePad shows the quality metrics for the business are impressive.

One concern that I flagged with all the forex currency firms was that recent market volatility has merely transferred revenue from the future to the present quarter, and we could see the sector hit the doldrums in H1 2023. AFX management specifically denies this, saying in last week’s RNS that: “the recent volatility has not brought forward any material revenues and trading has followed a consistent pattern of growth to the prior year. This is because our ethos is to encourage clients to adopt a formalised and structured approach to currency risk management, rather than hedging disproportionately and speculatively in response to isolated macro-conditions.”

The implication is that, unlike (say) IG Index, CMC, and Plus500 (perhaps even interdealer broker TP ICAP), there is a fundamental business purpose to the currency market activity, and this should result in more stable, higher-quality revenue growth. Given their track record (share price +313% in the last 5 years, revenues and profits up by more than 9x) I will give AFX management the benefit of the doubt on this.

In the past management of large banks have said that their forex dealing profits are to facilitate client activity; later it turned out that client activity is leveraged hedge funds and so the dealing profits weren’t sustainable. Just one example of bank management saying something that is technically correct, but utterly misleading. UK banks are reporting this week, so it will be interesting to see how they are doing in the current conditions, but I would treat their outlook statements with caution.

Although these currency trading firms have less credit risk than lenders like Lloyds or NatWest, they do provide credit facilities and in the more challenging environment expect client defaults to increase. For instance, if they are a counterparty to retailers, I could imagine that risk has increased versus a year ago. They respond that credit losses from failing corporates are factored into their expectations and are part of the business model. There’s less risk than committed credit facilities because they can refuse to trade with a client that looks like it might be in trouble. To date, they say that there has been no significant change in client default rates compared to their original expectations set at the start of the year. That does mean that we might see higher default rates in 2023F though.

Benefits from rising interest rates: The other benefit that AFX is enjoying comes from the ‘float’ of customers’ balances in their Alternative Banking Solutions division. This interest is being generated against sterling, euro, and dollar-denominated client funds that are held overnight and off-balance sheet as part of the Group’s safeguarding arrangements for its Alternative Banking division. This additional interest income is expected to contribute circa £6m between the end of August and December 2022 and therefore result in profits for the year being materially ahead of expectations. They don’t give consensus, but Sharepad shows PBT Dec of 2022F £39m, so a 15% uplift. However, that’s for just 5 months of the year, annualising £6m (5/12) gives £14m or a 31% uplift to Dec 2023F PBT. That’s not baked in, management say that could vary according to three key variables: 1.) the size of customer balances 2.) currency mix, and 3.) the interest rate environment.

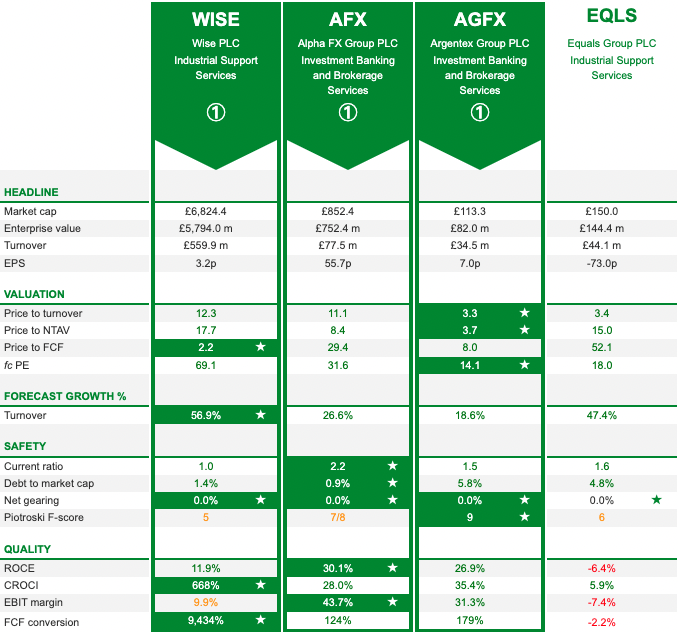

Opinion: I like AFX, but the valuation seems full at above 11x revenue. That’s slightly below WISE, which also reported an update last week, but a significant premium to both AGFX and EQLS that are on 3.3x revenue. There is an argument to suggest that this is a scale business and the larger players will beat the smaller, in the same way that Amazon can create a virtuous circle feedback loop, winning by sharing the benefits of scale with customers. That could explain why WISE, the largest currency trader is also the least profitable in terms of RoCE and EBIT margins. I look at their results below.

Wise Q2 update

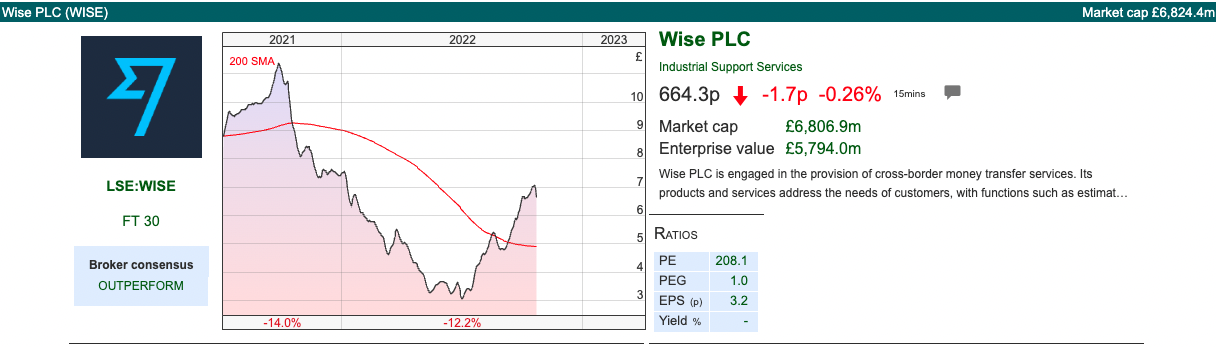

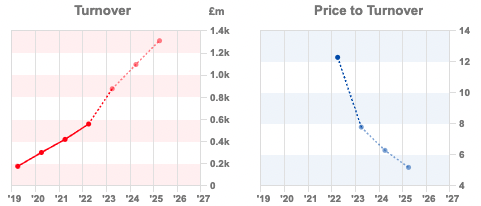

Wise, which has a March year-end, also reported a strong Q2 (ie July-Sept), with revenue growing +59%, and total income, which includes interest from customer balances +73% to £229m. We can do a similar exercise for Wise as AFX, and annualise the £17.5m of net interest income, to give £70m (or £53m for the last three quarters of FY March 2023) so a 6% benefit from rising interest rates as a percentage of forecast revenue. Importantly there should be very little cost associated with this extra income, so it drops straight through to profit, meaning an increase of +45% in profits for FY Mar 2023F, or 42% of FY Mar 2024F. That’s assuming that all of the benefit goes to shareholders though, Wise management have explicitly stated that they are following the Costco / Amazon model of sharing the benefits of scale with customers. Current forecasts are for WISE to double revenue in 2 years, from £560m FY Mar 2022A to £1.2bn FY Mar 2024F. Thus the WISE expensive price/turnover multiple does halve to 6x 2024F.

There’s some talk that now might be the time to buy UK banks, for instance, this piece from a former competitor of mine: Tom Rayner. I must admit that I have dabbled with this idea too. The problem with the ‘buy UK banks, because rising interest rates will increase net interest margin’ argument, is that, if interest rates rise too fast there will be bad debts from credit risk. The UK bank sector has gone ex-growth, in part because of FinTech and new entrants are picking off the more profitable parts of the banking business model, like forex transfers. Lloyds revenue, at £39bn is the same level as 2012, Barclays revenue is down by a third versus a decade ago.

A second risk is from a political perspective, banks are unpopular, so an easy target for the government that is seeing its borrowing costs rise to target for a windfall tax. It’s all rather uncertain because a windfall tax would also mean the government would struggle to sell its 48% stake in NatWest, left over from the credit crisis when it paid £45.5bn to rescue the bank. *

It seems to me that these forex currency traders which hold lots of cash can demonstrate revenue growth and benefit from client activity are a better way to play the rising interest rate theme. Wise and AFX are perhaps too richly valued, but I think either EQLS or AGFX could be worth holding as a source of uncorrelated returns. I own AGFX, but please don’t follow me blindly, SharePad is a great tool for helping you to do research and supporting your own thinking.

Notes

The author owns shares in AGFX

*This was structured as 58% of the ordinary shares, but a further tranche of B shares that were later converted to ordinary shares. NatWest’s investor relations website has the detailed history.

On government debt/ GDP comparisons, there seem to be all sorts of figures floating around on the internet. I’ve used Office of National Statistics in the UK, and St Louis Fed in the USA as my source. The OECD has this comparison graph, with completely different numbers! I’ve heard the 90-100% figure quoted for the UK several times, so I’ve gone with that.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

Bi-Weekly Market Commentary Part 1| 25/10/22 |AFX, WISE| Volatility subsides

Bruce looks at WISE and AFX, currency traders that are benefiting from the market volatility and rising interest rates. He compares their investment case to the UK banks reporting this week.

Despite all the volatility of the last week, the FTSE 100 was actually flat at 6,937 over the last 5 days. The Nasdaq100 and S&P500 were up +2.2% and +2.3% respectively. Chinese markets continue to be weak, with the FTSE China 50 Index the worst-performing major indices down -41% YTD (for comparison AIM is down -36% YTD). The Hong Kong-based Hang Seng Index is now at levels seen just before the 1997 Asian crisis. The VIX volatility index on Monday did however fall below 30 for the first time since the start of October.

Last week, the pound strengthened and gilt yields fell (ie prices rose) as an initial reaction to the Prime Minister resigning. However, gilts sold off and yields rose 22bp to 4.06% as it became unclear if a new Prime Minister would stick with Chancellor Jeremy Hunt’s fiscal plans. The pound also weakened against the dollar at the end of last week.

Then at the start of this week, the pound rose to 1.13 to the dollar and the gilt yield fell back to 3.9%, as it became clear that Rishi Sunak’s leadership would not be contested by Boris. For comparison, the UK 10Y government bond yield is now trading at 4.24%, and US debt govt debt/GDP is 121%. The Japanese 10Y bond yield is still below 25bp, despite Japan’s debt to GDP being double the US levels, though the Yen has slid past 150 to the dollar in response.

I think that most of this gilt market volatility is noise. Effectively, whoever is running the country there is now a ceiling on how much the UK government can borrow: financial markets are unlikely to let the UK’s Govt debt rise much above the level of GDP (both are £2.4 trillion, roughly the same level).

It feels like written commentary can go out of date very quickly as markets move around so much. I’ve discussed with the management at Sharepad and will switch to shorter but more timely pieces 2x a week. This is an experiment, so we’d welcome your feedback: marketing@sharescope.co.uk

Below I look at a couple of the currency trading firms Alpha FX and Wise which have both enjoyed a tailwind from the market conditions.

Finally, I wanted to flag that there will be a physical event of Mello taking place next month: MelloLondon will take place on the 16th & 17th of November at the Clayton Hotel & Conference Centre in Chiswick. It’s good to meet fellow investors face-to-face and perhaps this session will prove therapeutic as we share disaster stories about some of the year’s worst performers but also feel inspired by getting some calls right.

Alpha FX Q3 update

Alpha FX (AFX, not to be confused with AFMC) announced a trading update for FY Dec. Like Argentex which I covered a couple of weeks ago, they are benefiting from currency market volatility, but also from rising interest rates in their Alternative Banking division. As a reminder, AFX has two divisions i) Risk Management 70% of revenue, growing revenue at +35%, provides spot and forward hedging ii) Alternative Banking Solutions 30% of revenue, growing revenues at +47% at H1. This is smaller, more frequent transfers, such as paying invoices. I last wrote about AFX H1 results, which were released in early September here, with revenue up +35% to £46m and reported PBT was up +16% to £18m. SharePad shows the quality metrics for the business are impressive.

One concern that I flagged with all the forex currency firms was that recent market volatility has merely transferred revenue from the future to the present quarter, and we could see the sector hit the doldrums in H1 2023. AFX management specifically denies this, saying in last week’s RNS that: “the recent volatility has not brought forward any material revenues and trading has followed a consistent pattern of growth to the prior year. This is because our ethos is to encourage clients to adopt a formalised and structured approach to currency risk management, rather than hedging disproportionately and speculatively in response to isolated macro-conditions.”

The implication is that, unlike (say) IG Index, CMC, and Plus500 (perhaps even interdealer broker TP ICAP), there is a fundamental business purpose to the currency market activity, and this should result in more stable, higher-quality revenue growth. Given their track record (share price +313% in the last 5 years, revenues and profits up by more than 9x) I will give AFX management the benefit of the doubt on this.

In the past management of large banks have said that their forex dealing profits are to facilitate client activity; later it turned out that client activity is leveraged hedge funds and so the dealing profits weren’t sustainable. Just one example of bank management saying something that is technically correct, but utterly misleading. UK banks are reporting this week, so it will be interesting to see how they are doing in the current conditions, but I would treat their outlook statements with caution.

Although these currency trading firms have less credit risk than lenders like Lloyds or NatWest, they do provide credit facilities and in the more challenging environment expect client defaults to increase. For instance, if they are a counterparty to retailers, I could imagine that risk has increased versus a year ago. They respond that credit losses from failing corporates are factored into their expectations and are part of the business model. There’s less risk than committed credit facilities because they can refuse to trade with a client that looks like it might be in trouble. To date, they say that there has been no significant change in client default rates compared to their original expectations set at the start of the year. That does mean that we might see higher default rates in 2023F though.

Benefits from rising interest rates: The other benefit that AFX is enjoying comes from the ‘float’ of customers’ balances in their Alternative Banking Solutions division. This interest is being generated against sterling, euro, and dollar-denominated client funds that are held overnight and off-balance sheet as part of the Group’s safeguarding arrangements for its Alternative Banking division. This additional interest income is expected to contribute circa £6m between the end of August and December 2022 and therefore result in profits for the year being materially ahead of expectations. They don’t give consensus, but Sharepad shows PBT Dec of 2022F £39m, so a 15% uplift. However, that’s for just 5 months of the year, annualising £6m (5/12) gives £14m or a 31% uplift to Dec 2023F PBT. That’s not baked in, management say that could vary according to three key variables: 1.) the size of customer balances 2.) currency mix, and 3.) the interest rate environment.

Opinion: I like AFX, but the valuation seems full at above 11x revenue. That’s slightly below WISE, which also reported an update last week, but a significant premium to both AGFX and EQLS that are on 3.3x revenue. There is an argument to suggest that this is a scale business and the larger players will beat the smaller, in the same way that Amazon can create a virtuous circle feedback loop, winning by sharing the benefits of scale with customers. That could explain why WISE, the largest currency trader is also the least profitable in terms of RoCE and EBIT margins. I look at their results below.

Wise Q2 update

Wise, which has a March year-end, also reported a strong Q2 (ie July-Sept), with revenue growing +59%, and total income, which includes interest from customer balances +73% to £229m. We can do a similar exercise for Wise as AFX, and annualise the £17.5m of net interest income, to give £70m (or £53m for the last three quarters of FY March 2023) so a 6% benefit from rising interest rates as a percentage of forecast revenue. Importantly there should be very little cost associated with this extra income, so it drops straight through to profit, meaning an increase of +45% in profits for FY Mar 2023F, or 42% of FY Mar 2024F. That’s assuming that all of the benefit goes to shareholders though, Wise management have explicitly stated that they are following the Costco / Amazon model of sharing the benefits of scale with customers. Current forecasts are for WISE to double revenue in 2 years, from £560m FY Mar 2022A to £1.2bn FY Mar 2024F. Thus the WISE expensive price/turnover multiple does halve to 6x 2024F.

There’s some talk that now might be the time to buy UK banks, for instance, this piece from a former competitor of mine: Tom Rayner. I must admit that I have dabbled with this idea too. The problem with the ‘buy UK banks, because rising interest rates will increase net interest margin’ argument, is that, if interest rates rise too fast there will be bad debts from credit risk. The UK bank sector has gone ex-growth, in part because of FinTech and new entrants are picking off the more profitable parts of the banking business model, like forex transfers. Lloyds revenue, at £39bn is the same level as 2012, Barclays revenue is down by a third versus a decade ago.

A second risk is from a political perspective, banks are unpopular, so an easy target for the government that is seeing its borrowing costs rise to target for a windfall tax. It’s all rather uncertain because a windfall tax would also mean the government would struggle to sell its 48% stake in NatWest, left over from the credit crisis when it paid £45.5bn to rescue the bank. *

It seems to me that these forex currency traders which hold lots of cash can demonstrate revenue growth and benefit from client activity are a better way to play the rising interest rate theme. Wise and AFX are perhaps too richly valued, but I think either EQLS or AGFX could be worth holding as a source of uncorrelated returns. I own AGFX, but please don’t follow me blindly, SharePad is a great tool for helping you to do research and supporting your own thinking.

Notes

The author owns shares in AGFX

*This was structured as 58% of the ordinary shares, but a further tranche of B shares that were later converted to ordinary shares. NatWest’s investor relations website has the detailed history.

On government debt/ GDP comparisons, there seem to be all sorts of figures floating around on the internet. I’ve used Office of National Statistics in the UK, and St Louis Fed in the USA as my source. The OECD has this comparison graph, with completely different numbers! I’ve heard the 90-100% figure quoted for the UK several times, so I’ve gone with that.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.