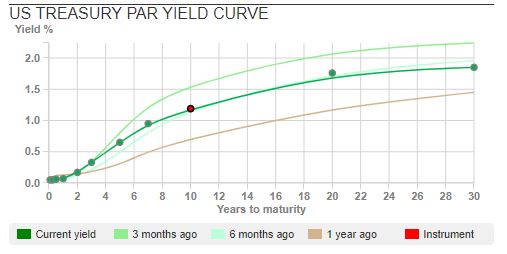

Last week the FTSE 100 was up +1.1% to 7,111, Nasdaq was up 1.5% to 15,181, outperforming the S&P 500, up +0.8% to 4,429. Both the Hang Seng index in Hong Kong and the FTSE China 50 Index were up less than 1% last week. The US 10Y bond yield continued to fall to 1.19% and the shape of the yield curve looks very similar to conditions 6 months ago (pale green line).

Japan’s yield curve fell into negative territory, while Germany’s 10Y debt traded at -0.51%. There’s currently $16 trillion of negative yielding debt in the world, up from $12 trillion in May this year. For context there is $71 trillion of bonds outstanding according to Barclays H1 results presentation.

Normally the sharp fall in 10 year bond yields would suggests risk aversion and a slowdown is coming. Yet Moderna said last week that their vaccine was 93% effective against the virus 6 months after vaccination, and produced a “robust” response against the Delta variant. It’s hard to believe that the bond market is being driven by concerns over a resurgence in the virus if the vaccine really is that effective. An alternative explanation could be what’s happening in China.

Tencent, the Chinese tech firm bidding for Sumo, shares fell -6% to $59 per share, and Tencent shares are now down by a quarter in the last 3 months. Sumo shares are trading at 477p, 7% below the cash offer that the Chinese company announced on 19th July. In a social media post Tencent said it was limiting the amount of time children could spend playing video games, after an article in a Chinese Communist Party newspaper equated computer games with opium. Computer games represent 30% of revenue for Tencent, which also has a social media platform and payment app.

Meanwhile S&P downgraded Evergrande’s debt for the second time in weeks to triple C minus, and the FT carried a story saying that short sellers were targeting the debt, not just the equity, of the company. It seems unlikely that Evergrande will be able to sell property assets to other Chinese developers, because those developers are also constrained by the Chinese authorities attempts to limit leverage. There’s a fun story about Andrew Left, who was banned from Hong Kong by the securities regulator for writing a detailed 57 page short selling report on Evergrande in 2012. The ban expires this October. He suggests the Chinese authorities knew about the problems with Evergrande 10 years ago, but didn’t want a short seller to publicise them. “They’ve been insolvent for years,” Left said. “They issued junk debt [and] were bailed out left and right.”

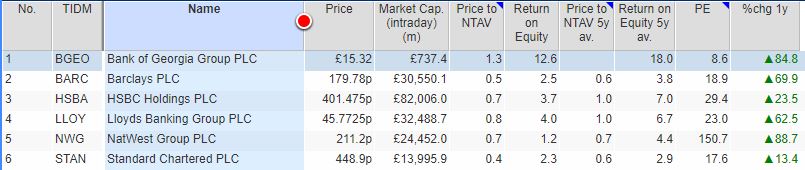

Worries over a China slowdown would also explain the relative share price underperformance of HSBC and Standard Chartered versus the likes of more UK and US-focused banks like Lloyds and Barclays.

This week I move up the market cap scale to look at UK banks H1 results, and what they might mean for the wider investment environment. Plus computer game companies Team17 and Keywords Studios H1 trading updates, and IP Group H1 results, the intellectual property company formed to take advantage of university research and innovation.

UK Bank H1 results

UK clearing banks have now all reported H1 results. Three of the four showed falling revenues versus H1 last year, which itself was a difficult half as the impact of Covid-19 became obvious.

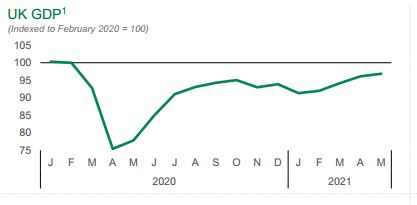

The exception was Lloyds, which reported +2% revenue growth, helped by growth in the open mortgage book. Mortgages are just under 70% of Lloyd’s loan book. All the banks have suffered difficult conditions in cards (as consumers paid off their more expensive unsecured borrowing) and corporate lending, so really the results represent how banks’ balance sheets are positioned for low interest rates. Lloyds put up a chart (below) showing the UK GDP recovering close to the February 2020 level.

HSBC, which reports in US dollars and has more Asian exposure, saw Commercial Banking revenue fall -9% and Global Banking and Markets revenue fall -8%. Group revenue was down -4%, so the bank is still shrinking, announcing the potential sale of retail banking in France and an exit of domestic retail banking in the US. 15 years ago HSBC used to report the highest Net Interest Margins of any UK bank at 3.1%, because of their US Household subprime consumer lending business, but at 1.21% H1 2021 the bank now has the lowest NIM of any UK bank.

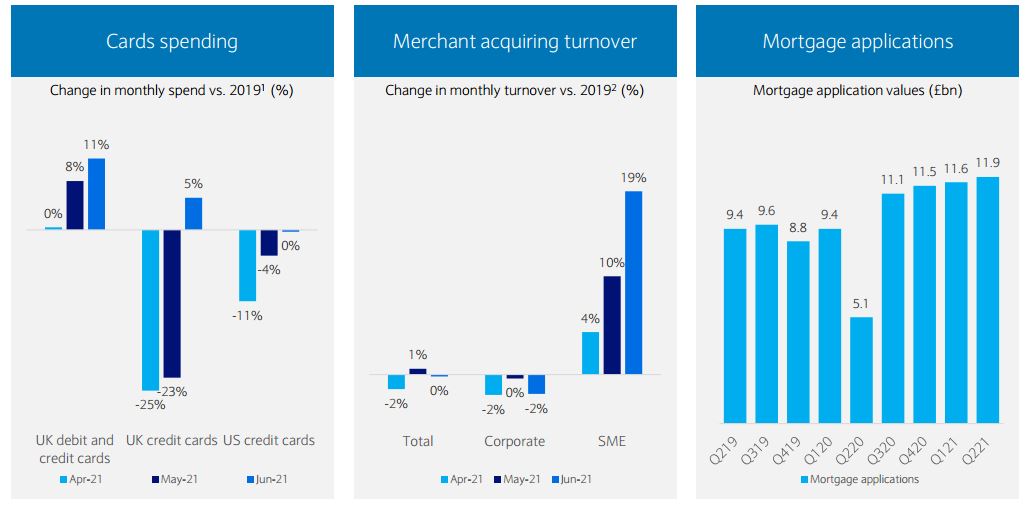

Barclays corporate and investment bank (the old BarCap business) saw revenue down 5% H1 on H1, which is perhaps disappointing given how buoyant markets have been and the strength of US bank results. Within this there were contrasting trends with Fixed Income Currency and Commodities (FICC) down -37%. Equities which historically has been a smaller proportion of revenue at Barclays was up +38%, with Equity Capital Markets (ECM) +90% and Advisory +59% presumably benefiting from IPOs, the SPAC boom and takeover bids. Barclays also put up a slide showing card spending recovering and SME business rebounding more strongly than larger corporates, plus strong mortgage applications.

NatWest, formerly known as RBS, saw revenue fall much more steeply than peers, down -9% which management blamed on the flat yield curve, subdued transaction banking activity and a tough comparative H1 last year where NatWest Markets benefited from the volatility. Despite the fall in revenue, total assets were up +1% to £776bn, because the interest rate environment meant that Net Interest Margin was down 16bp to 1.62%. The bank announced a 3p dividend and a share buyback of up to £750m. The UK Government still owns 54.8%, down from 97% (or £45bn invested) in 2008.

Revenue declining for the last decade

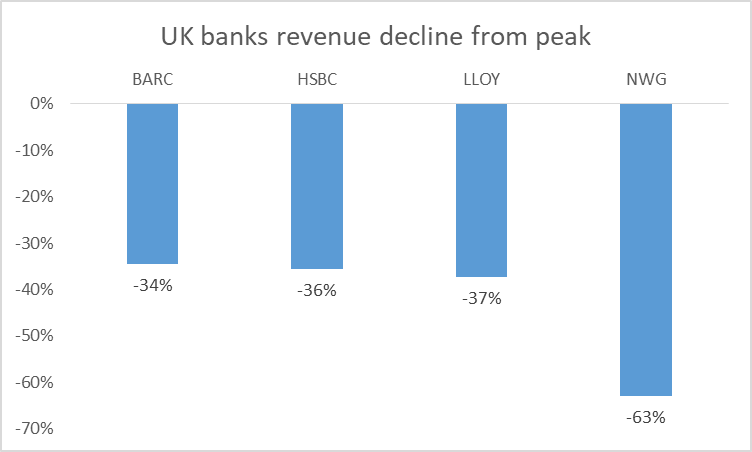

SharePad lets us see results going back 20 years, which reveals why share prices have struggled over the longer term. High levels of indebtedness means that there’s little scope to grow banks’ core business, there’s currently £1.6trillion of UK mortgages outstanding. So banks have reported long term declining revenue, caused in part by regulation (mis-selling artificially boost the top line, but tends to be clawed back in the provisions line), competition from the likes of Wise and Revolut and a retreat from the international banking empires that had been built pre-2007. A flat yield curve means that banks don’t generate any profits from the term structure of interest rates by taking short term customer deposits and lending them out over longer maturities. The chart shows the long term decline in revenues since they peaked 10 years ago versus reported FY 2020.

Or put another way, NatWest Total Income is now lower than it was 20 years ago, before (Sir) Fred’s expensive international shopping spree that culminated with the disastrous purchase of ABN Amro. HSBC’s revenue is now lower than that reported in 2004. I haven’t included Standard Chartered, because their revenue peaked a couple of years later in 2013, from when their revenue is down by -20%.

The chart below uses SharePad’s “multigraph” feature to compare share prices over the last 2 years. Having bounced hard with the vaccine rally, UK banks are not the “deep value” bargains that they were when I wrote about them this time last year.

Barclays, Lloyds and NatWest shares are up by c. +66% since the 1st week of November when the vaccine was announced. HSBC and Standard Chartered are up less than +25%, perhaps held back by worries over China exposure.

The last time UK banks outperformed was the aftermath of the TMT / internet bubble bursting from 2000-2003, because banks were defensive versus the overhyped TMT sectors. So I can understand the attractions of banks’ relative value versus expensive software and healthcare companies.

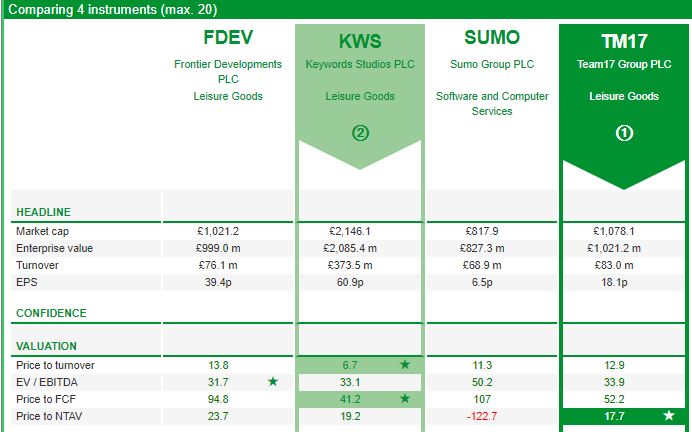

We’re in an expensive, tech-driven market where, for example, computer games companies are trading on over 10x sales and above 30x EV/EBITDA multiples (see below for valuation table using SharePad’s compare tool and next page comments on Keywords and Team17).

Keywords Studios H1 trading update

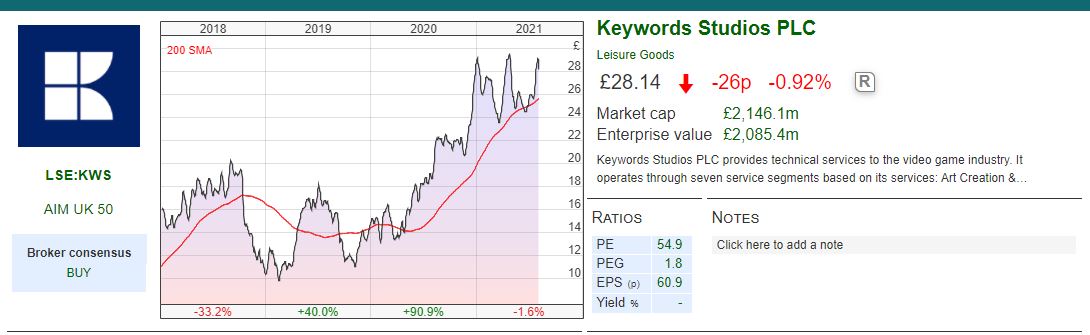

Keywords Studios, the technical and creative computer games services company, announced a detailed trading update for H1 to June, with organic revenue growth +23% (or +37% including acquisitions). They intend to announce H1 results on 15 September. You might think that 2.5 months is a long time to wait for results; to me it reveals the complexity of managing an international business of 69 studios in 22 countries that has grown by 52 acquisitions since the IPO in 2013. I was cautious about the complexity and deal making and sold my shares a few years ago, but so far there have been no stumbles.

Computer games companies have benefited from the pandemic, and +23% growth H1 vs H1 20 represents an acceleration on the +15% growth that Keywords reported H2 20 vs H2 19, as gaming companies have rushed to develop new content to try to keep players engaged. KWS expects adjusted PBT to be c. €40m, +80% vs H1 last year and had €84m of net cash at the end of June. The acquisition led growth has continued buying Tantalus ($47m total consideration announce March this year) and Climax Studios (£43m total consideration announced April this year).

The CEO Andrew Day announced on 15th June that he plans to retire following a health scare, and the board is conducting a search process to find a successor. In the meantime they have a joint CEO structure with Jon Hauck (joined in 2019 as CFO) and Sonia Sedler (joined January 2021 as COO).

Ownership Franklin Templeton owns 7.9%, Liontrust 6%, Octopus 4.9%, T Rowe Price 4.65. The retiring Chief Exec Andrew day owns 4.5%.

Outlook Management expect strong demand to continue across most service lines. FY results to December are expected to be “at least” in line with market expectations, albeit with growth rates and margins expected to moderate against stronger second half 2020 comparatives. They’ve also flagged rising costs with the easing of restrictions (presumably international travel?)

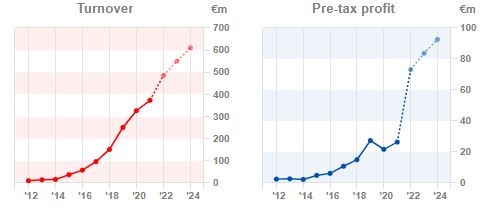

Forecasts SharePad shows the topline growth at double digit rates out to 2023. Current forecasts are for €0.95 in 2023F, putting the shares on 34x that EPS. That strikes me as expensive as the fast growth has suppressed ROCE and the EBIT margin of 7.6% suggests the benefits of scale don’t show up in the accounting numbers. ROCE has also been on a long-term declining trend.

Opinion Well done to holders, because the shares are up +742% in the last five years. I think that the valuation is too demanding for me, given the mediocre profitability metrics. Turnover forecast to rise to above €600m in 2023F up 100x from a decade ago is certainly an impressive achievement. But growth only creates value if it generates returns above the cost of equity.

Team17

Team17 the computer games and app content creation company also announced a much more laconic trading update in line with the board’s expectations, without saying what those expectations are. Their results are scheduled for 14 September.

Team17 the computer games and app content creation company also announced a much more laconic trading update in line with the board’s expectations, without saying what those expectations are. Their results are scheduled for 14 September.

TM17 are also growing by acquisition, announcing in January the purchase of Golf with Your Friends IP for £12m and in July the acquisition of StoryToys for $49m total consideration, which produces “edutainment” for children under the age of eight. The profitability metrics are more attractive than KWS though.

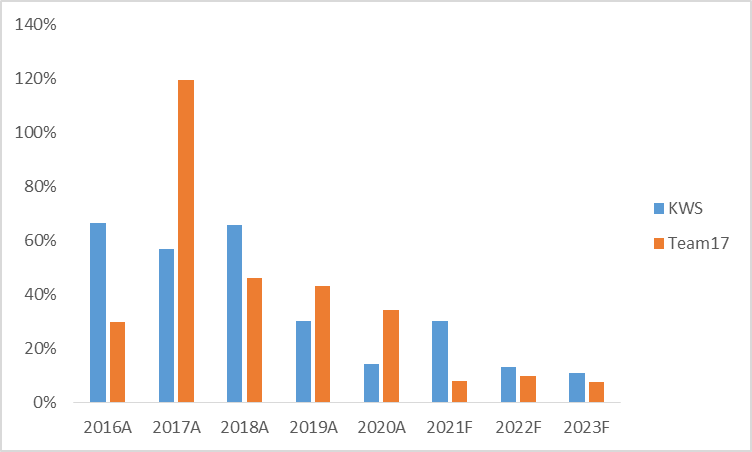

I’ve also used SharePad to compare historic year on year revenue growth over the last five years and forecasts. In absolute terms KWS revenues are much higher €374m 2020 reported vs £83m for Team17. You might think that the smaller company, Team17 would be forecast to grow more strongly, but that’s not the case, as the chart below shows.

Ownership Debbie Bestwick the current CEO owns 22%. Abrdn 9.7%, JP Morgan AM 4.9%, Janus Henderson 4.6%, BlackRock 4.6%.

Opinion Both companies are trading on a similar EV/EBITDA multiple of 34x. SharePad’s compare tool highlights that Team17 does better on most quantitative metrics. I agree with that, but also note that on 13x turnover, and 53x FCF the valuation is anticipating a rosy future. Lockdown restrictions easing may mean that gamer spend falls from the high levels seen over the last 18 months as people remember the “real life” attractions of pubs, restaurants, live music etc. So I don’t feel that now is a good time to be buying expensive computer gaming companies.

IP Group H1

This intellectual property company formed to commercialise research from universities (originally Imperial College, but now also Oxford and Cambridge) announced H1 results. IPG has been listed for 20 years, but only recently paid its first dividend in June this year. In last week’s announcement they said that they’d pay an interim dividend of 0.48p and using £20m of cash from realisations to buy back shares.

They have c. 130 companies in their portfolio, successes include Ceres, the hydrogen fuel cell company (originally a rescue funding package from IP Group in 2012). They exited last year selling at £128m or 7x their cost. IP Group still owns 14.5% of Oxford Nanopore which is planning to IPO in H2 this year. Circassia, the cat allergy turned asthma device company that I wrote about a few weeks ago was also one of theirs.

In some ways this looks similar to Burford, with asymmetric payoffs from all sorts of weird and wonderful Life Sciences (38% of Fair Value), Deeptech (17% of Fair Value), Cleantech (5% of Fair Value) and Strategic (34% of Fair Value) assets. For instance, there’s a nuclear fusion company called First Light Fusion which they’ve Fair Valued at £20.5m. Probably most of the portfolio will disappoint, but there could be a few more big winners like Ceres.

The group reported net assets of £1.4bn or 135p per share, versus a share price of 122p. The portfolio gain was up +12% (or £143m) in H1. Of that £143m, 40% was gains on disposal (ie a number crystalised by a sale) and 60% was fair value revaluation (ie a number that should be treated with some scepticism). £6.2m of gains were from 11 companies they hold which are listed on AIM*, and £29m was unquoted companies. There was also a £22m unrealised fair value gain when one of their companies (ApcinteX) was acquired by a company Centessa Pharmaceuticals, which then IPO’ed on Nasdaq.

Ownership Railways Pension Scheme owns 15%, Baillie Gifford 4.9% and Lansdowne Partners 4%, Liontrust 4.2%. That seems an interesting mix of cautious pension fund money and risk taking Baillie Gifford and Lansdowne who have invested in some strong winners over the last 10 years.

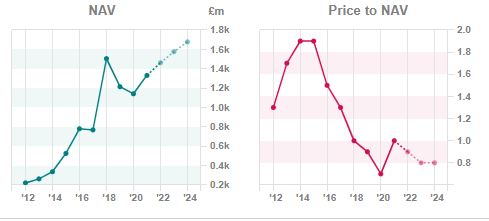

Valuation I’d expect this business to trade around book value of 135p. Perhaps in a bull market a 30% premium and in a bear market a 30% discount. The long-term share price performance is rather disappointing (down -24% over the last five years), they need more successes for the shares to trade at a premium to book value. The chart below shows that NAV has grown over the years, but that the Price/NAV has fallen, as investors have grown more sceptical.

Opinion I don’t think that it’s possible to have a high conviction about this company. Even if they back winners, they need to time their sales well (they sold their holding in Avacta too early, just before it announced a deal to develop a Covid 19 test). I think it’s an interesting company to follow, and if you see IP Group on the shareholder register of a company it means some very clever people have some confidence in a positive outcome. However, there’s a Charlie Munger quote about investing, where he’d rather be the guy with an IQ of 130, who falsely believes his IQ is 128, than the guy with the IQ of 190, who falsely believes his IQ is 240. Clever people can lose lots of money too.

That said, I think I’ll buy a few shares because it should offer returns that are uncorrelated with the wider economy and after 20 years they ought to have improved their process and understood better what generates winners. Plus it’s good to see that the stock market is being used as a platform to direct money towards funding innovation in health or energy, as opposed to all the shenanigans going on with meme stocks.

*They don’t list out all 11 companies listed on AIM in their Annual Report. But they include: Diurnal, Mirriad Advertising, Actual Experience among others.

Bruce Packard

You can follow more of Bruce’s investing thoughts and blog at brucepackard.com and on Twitter @bruce_packard

Notes

Author’s mother owns shares in Keywords Studios.

Got some thoughts on this week’s commentary? We’d love to hear from you! Share them in the comments section below.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Commentary 09/08/21: What $16 trillion of negative yields are signalling

Last week the FTSE 100 was up +1.1% to 7,111, Nasdaq was up 1.5% to 15,181, outperforming the S&P 500, up +0.8% to 4,429. Both the Hang Seng index in Hong Kong and the FTSE China 50 Index were up less than 1% last week. The US 10Y bond yield continued to fall to 1.19% and the shape of the yield curve looks very similar to conditions 6 months ago (pale green line).

Japan’s yield curve fell into negative territory, while Germany’s 10Y debt traded at -0.51%. There’s currently $16 trillion of negative yielding debt in the world, up from $12 trillion in May this year. For context there is $71 trillion of bonds outstanding according to Barclays H1 results presentation.

Normally the sharp fall in 10 year bond yields would suggests risk aversion and a slowdown is coming. Yet Moderna said last week that their vaccine was 93% effective against the virus 6 months after vaccination, and produced a “robust” response against the Delta variant. It’s hard to believe that the bond market is being driven by concerns over a resurgence in the virus if the vaccine really is that effective. An alternative explanation could be what’s happening in China.

Tencent, the Chinese tech firm bidding for Sumo, shares fell -6% to $59 per share, and Tencent shares are now down by a quarter in the last 3 months. Sumo shares are trading at 477p, 7% below the cash offer that the Chinese company announced on 19th July. In a social media post Tencent said it was limiting the amount of time children could spend playing video games, after an article in a Chinese Communist Party newspaper equated computer games with opium. Computer games represent 30% of revenue for Tencent, which also has a social media platform and payment app.

Meanwhile S&P downgraded Evergrande’s debt for the second time in weeks to triple C minus, and the FT carried a story saying that short sellers were targeting the debt, not just the equity, of the company. It seems unlikely that Evergrande will be able to sell property assets to other Chinese developers, because those developers are also constrained by the Chinese authorities attempts to limit leverage. There’s a fun story about Andrew Left, who was banned from Hong Kong by the securities regulator for writing a detailed 57 page short selling report on Evergrande in 2012. The ban expires this October. He suggests the Chinese authorities knew about the problems with Evergrande 10 years ago, but didn’t want a short seller to publicise them. “They’ve been insolvent for years,” Left said. “They issued junk debt [and] were bailed out left and right.”

Worries over a China slowdown would also explain the relative share price underperformance of HSBC and Standard Chartered versus the likes of more UK and US-focused banks like Lloyds and Barclays.

This week I move up the market cap scale to look at UK banks H1 results, and what they might mean for the wider investment environment. Plus computer game companies Team17 and Keywords Studios H1 trading updates, and IP Group H1 results, the intellectual property company formed to take advantage of university research and innovation.

UK Bank H1 results

UK clearing banks have now all reported H1 results. Three of the four showed falling revenues versus H1 last year, which itself was a difficult half as the impact of Covid-19 became obvious.

The exception was Lloyds, which reported +2% revenue growth, helped by growth in the open mortgage book. Mortgages are just under 70% of Lloyd’s loan book. All the banks have suffered difficult conditions in cards (as consumers paid off their more expensive unsecured borrowing) and corporate lending, so really the results represent how banks’ balance sheets are positioned for low interest rates. Lloyds put up a chart (below) showing the UK GDP recovering close to the February 2020 level.

HSBC, which reports in US dollars and has more Asian exposure, saw Commercial Banking revenue fall -9% and Global Banking and Markets revenue fall -8%. Group revenue was down -4%, so the bank is still shrinking, announcing the potential sale of retail banking in France and an exit of domestic retail banking in the US. 15 years ago HSBC used to report the highest Net Interest Margins of any UK bank at 3.1%, because of their US Household subprime consumer lending business, but at 1.21% H1 2021 the bank now has the lowest NIM of any UK bank.

Barclays corporate and investment bank (the old BarCap business) saw revenue down 5% H1 on H1, which is perhaps disappointing given how buoyant markets have been and the strength of US bank results. Within this there were contrasting trends with Fixed Income Currency and Commodities (FICC) down -37%. Equities which historically has been a smaller proportion of revenue at Barclays was up +38%, with Equity Capital Markets (ECM) +90% and Advisory +59% presumably benefiting from IPOs, the SPAC boom and takeover bids. Barclays also put up a slide showing card spending recovering and SME business rebounding more strongly than larger corporates, plus strong mortgage applications.

NatWest, formerly known as RBS, saw revenue fall much more steeply than peers, down -9% which management blamed on the flat yield curve, subdued transaction banking activity and a tough comparative H1 last year where NatWest Markets benefited from the volatility. Despite the fall in revenue, total assets were up +1% to £776bn, because the interest rate environment meant that Net Interest Margin was down 16bp to 1.62%. The bank announced a 3p dividend and a share buyback of up to £750m. The UK Government still owns 54.8%, down from 97% (or £45bn invested) in 2008.

Revenue declining for the last decade

SharePad lets us see results going back 20 years, which reveals why share prices have struggled over the longer term. High levels of indebtedness means that there’s little scope to grow banks’ core business, there’s currently £1.6trillion of UK mortgages outstanding. So banks have reported long term declining revenue, caused in part by regulation (mis-selling artificially boost the top line, but tends to be clawed back in the provisions line), competition from the likes of Wise and Revolut and a retreat from the international banking empires that had been built pre-2007. A flat yield curve means that banks don’t generate any profits from the term structure of interest rates by taking short term customer deposits and lending them out over longer maturities. The chart shows the long term decline in revenues since they peaked 10 years ago versus reported FY 2020.

Or put another way, NatWest Total Income is now lower than it was 20 years ago, before (Sir) Fred’s expensive international shopping spree that culminated with the disastrous purchase of ABN Amro. HSBC’s revenue is now lower than that reported in 2004. I haven’t included Standard Chartered, because their revenue peaked a couple of years later in 2013, from when their revenue is down by -20%.

The chart below uses SharePad’s “multigraph” feature to compare share prices over the last 2 years. Having bounced hard with the vaccine rally, UK banks are not the “deep value” bargains that they were when I wrote about them this time last year.

Barclays, Lloyds and NatWest shares are up by c. +66% since the 1st week of November when the vaccine was announced. HSBC and Standard Chartered are up less than +25%, perhaps held back by worries over China exposure.

The last time UK banks outperformed was the aftermath of the TMT / internet bubble bursting from 2000-2003, because banks were defensive versus the overhyped TMT sectors. So I can understand the attractions of banks’ relative value versus expensive software and healthcare companies.

We’re in an expensive, tech-driven market where, for example, computer games companies are trading on over 10x sales and above 30x EV/EBITDA multiples (see below for valuation table using SharePad’s compare tool and next page comments on Keywords and Team17).

Keywords Studios H1 trading update

Keywords Studios, the technical and creative computer games services company, announced a detailed trading update for H1 to June, with organic revenue growth +23% (or +37% including acquisitions). They intend to announce H1 results on 15 September. You might think that 2.5 months is a long time to wait for results; to me it reveals the complexity of managing an international business of 69 studios in 22 countries that has grown by 52 acquisitions since the IPO in 2013. I was cautious about the complexity and deal making and sold my shares a few years ago, but so far there have been no stumbles.

Computer games companies have benefited from the pandemic, and +23% growth H1 vs H1 20 represents an acceleration on the +15% growth that Keywords reported H2 20 vs H2 19, as gaming companies have rushed to develop new content to try to keep players engaged. KWS expects adjusted PBT to be c. €40m, +80% vs H1 last year and had €84m of net cash at the end of June. The acquisition led growth has continued buying Tantalus ($47m total consideration announce March this year) and Climax Studios (£43m total consideration announced April this year).

The CEO Andrew Day announced on 15th June that he plans to retire following a health scare, and the board is conducting a search process to find a successor. In the meantime they have a joint CEO structure with Jon Hauck (joined in 2019 as CFO) and Sonia Sedler (joined January 2021 as COO).

Ownership Franklin Templeton owns 7.9%, Liontrust 6%, Octopus 4.9%, T Rowe Price 4.65. The retiring Chief Exec Andrew day owns 4.5%.

Outlook Management expect strong demand to continue across most service lines. FY results to December are expected to be “at least” in line with market expectations, albeit with growth rates and margins expected to moderate against stronger second half 2020 comparatives. They’ve also flagged rising costs with the easing of restrictions (presumably international travel?)

Forecasts SharePad shows the topline growth at double digit rates out to 2023. Current forecasts are for €0.95 in 2023F, putting the shares on 34x that EPS. That strikes me as expensive as the fast growth has suppressed ROCE and the EBIT margin of 7.6% suggests the benefits of scale don’t show up in the accounting numbers. ROCE has also been on a long-term declining trend.

Opinion Well done to holders, because the shares are up +742% in the last five years. I think that the valuation is too demanding for me, given the mediocre profitability metrics. Turnover forecast to rise to above €600m in 2023F up 100x from a decade ago is certainly an impressive achievement. But growth only creates value if it generates returns above the cost of equity.

Team17

TM17 are also growing by acquisition, announcing in January the purchase of Golf with Your Friends IP for £12m and in July the acquisition of StoryToys for $49m total consideration, which produces “edutainment” for children under the age of eight. The profitability metrics are more attractive than KWS though.

I’ve also used SharePad to compare historic year on year revenue growth over the last five years and forecasts. In absolute terms KWS revenues are much higher €374m 2020 reported vs £83m for Team17. You might think that the smaller company, Team17 would be forecast to grow more strongly, but that’s not the case, as the chart below shows.

Ownership Debbie Bestwick the current CEO owns 22%. Abrdn 9.7%, JP Morgan AM 4.9%, Janus Henderson 4.6%, BlackRock 4.6%.

Opinion Both companies are trading on a similar EV/EBITDA multiple of 34x. SharePad’s compare tool highlights that Team17 does better on most quantitative metrics. I agree with that, but also note that on 13x turnover, and 53x FCF the valuation is anticipating a rosy future. Lockdown restrictions easing may mean that gamer spend falls from the high levels seen over the last 18 months as people remember the “real life” attractions of pubs, restaurants, live music etc. So I don’t feel that now is a good time to be buying expensive computer gaming companies.

IP Group H1

This intellectual property company formed to commercialise research from universities (originally Imperial College, but now also Oxford and Cambridge) announced H1 results. IPG has been listed for 20 years, but only recently paid its first dividend in June this year. In last week’s announcement they said that they’d pay an interim dividend of 0.48p and using £20m of cash from realisations to buy back shares.

They have c. 130 companies in their portfolio, successes include Ceres, the hydrogen fuel cell company (originally a rescue funding package from IP Group in 2012). They exited last year selling at £128m or 7x their cost. IP Group still owns 14.5% of Oxford Nanopore which is planning to IPO in H2 this year. Circassia, the cat allergy turned asthma device company that I wrote about a few weeks ago was also one of theirs.

In some ways this looks similar to Burford, with asymmetric payoffs from all sorts of weird and wonderful Life Sciences (38% of Fair Value), Deeptech (17% of Fair Value), Cleantech (5% of Fair Value) and Strategic (34% of Fair Value) assets. For instance, there’s a nuclear fusion company called First Light Fusion which they’ve Fair Valued at £20.5m. Probably most of the portfolio will disappoint, but there could be a few more big winners like Ceres.

The group reported net assets of £1.4bn or 135p per share, versus a share price of 122p. The portfolio gain was up +12% (or £143m) in H1. Of that £143m, 40% was gains on disposal (ie a number crystalised by a sale) and 60% was fair value revaluation (ie a number that should be treated with some scepticism). £6.2m of gains were from 11 companies they hold which are listed on AIM*, and £29m was unquoted companies. There was also a £22m unrealised fair value gain when one of their companies (ApcinteX) was acquired by a company Centessa Pharmaceuticals, which then IPO’ed on Nasdaq.

Ownership Railways Pension Scheme owns 15%, Baillie Gifford 4.9% and Lansdowne Partners 4%, Liontrust 4.2%. That seems an interesting mix of cautious pension fund money and risk taking Baillie Gifford and Lansdowne who have invested in some strong winners over the last 10 years.

Valuation I’d expect this business to trade around book value of 135p. Perhaps in a bull market a 30% premium and in a bear market a 30% discount. The long-term share price performance is rather disappointing (down -24% over the last five years), they need more successes for the shares to trade at a premium to book value. The chart below shows that NAV has grown over the years, but that the Price/NAV has fallen, as investors have grown more sceptical.

Opinion I don’t think that it’s possible to have a high conviction about this company. Even if they back winners, they need to time their sales well (they sold their holding in Avacta too early, just before it announced a deal to develop a Covid 19 test). I think it’s an interesting company to follow, and if you see IP Group on the shareholder register of a company it means some very clever people have some confidence in a positive outcome. However, there’s a Charlie Munger quote about investing, where he’d rather be the guy with an IQ of 130, who falsely believes his IQ is 128, than the guy with the IQ of 190, who falsely believes his IQ is 240. Clever people can lose lots of money too.

That said, I think I’ll buy a few shares because it should offer returns that are uncorrelated with the wider economy and after 20 years they ought to have improved their process and understood better what generates winners. Plus it’s good to see that the stock market is being used as a platform to direct money towards funding innovation in health or energy, as opposed to all the shenanigans going on with meme stocks.

*They don’t list out all 11 companies listed on AIM in their Annual Report. But they include: Diurnal, Mirriad Advertising, Actual Experience among others.

Bruce Packard

You can follow more of Bruce’s investing thoughts and blog at brucepackard.com and on Twitter @bruce_packard

Notes

Author’s mother owns shares in Keywords Studios.

Got some thoughts on this week’s commentary? We’d love to hear from you! Share them in the comments section below.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.