Bruce comments on Superdry’s auditor resignation and summarises Q3 trends at UK banks.

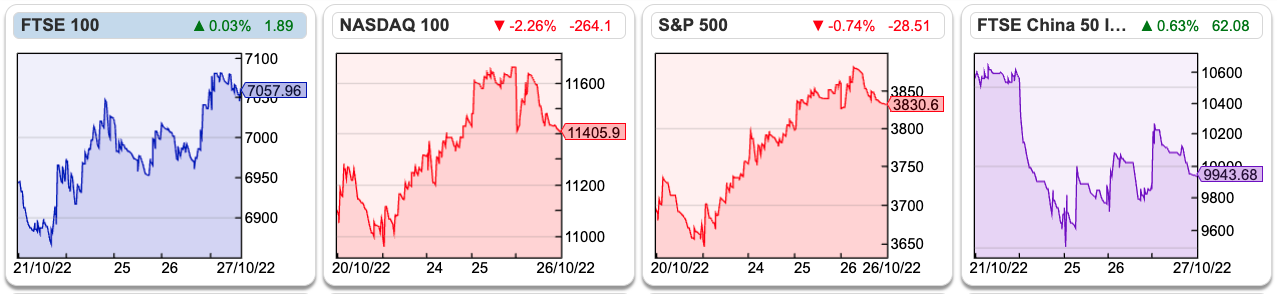

The FTSE 100 rose above 7000 to 7,057. Nasdaq and the S&P 500 were around +3.0% and +4.5% over the last 5 days. Brent crude remains at mid $94 per barrel. The UK 10Y bond yield fell to 3.62% and the US 10Y bond yield fell to 4.06%.

Interest rate expectations have begun to move down in the UK from the previous c. 6% peak next year, as the politics has stabilised. Market participants are now pricing in Bank of England interest rates to peak at 5% next summer, up from 2.25%. Two-year gilt yields fell to below 3.3%, which is the level before the former Chancellor’s ‘mini-budget’.

In the US Google was down -9% after it reported disappointing revenues in the core search ads division and Facebook was down -19% after quarterly revenues fell -4%. For some reason, investors thought that targeted advertising was going to be less sensitive to companies cutting traditional media spending in a recession. In retrospect that now looks to be Panglossian. Elon Musk’s deal to buy Twitter could turn out to be this cycle’s equivalent of Fred Goodwin buying ABN Amro in H2 2007, just as the cycle turned.

Below I look at Superdry’s auditor resignation, plus UK bank Q3 revenue growth. As we face a recession, it’s inevitable that bad debts will rise, but I think the investment case for banks hinges on their sustainable revenue growth and margin expansion. Confusingly, bank management have made a large number of adjustments, even to the revenue line. Perhaps this is an attempt to appeal to investors without the government introducing a windfall tax on profits?

Net interest margin expansion is currently caused by banks not passing on the benefits of rate rises to their customers, and I don’t think this is sustainable in the medium term. Looking at my own balance sheet, I’m sitting on cash earning a negative real return but continue moving money out of my savings into equity markets.

It feels like written commentary can go out of date very quickly as markets move around so much. I’ve discussed with the management at SharePad and will switch to shorter but more timely pieces 2x a week. This is an experiment, so we’d welcome your feedback: marketing@sharescope.co.uk

Superdry auditor resignation

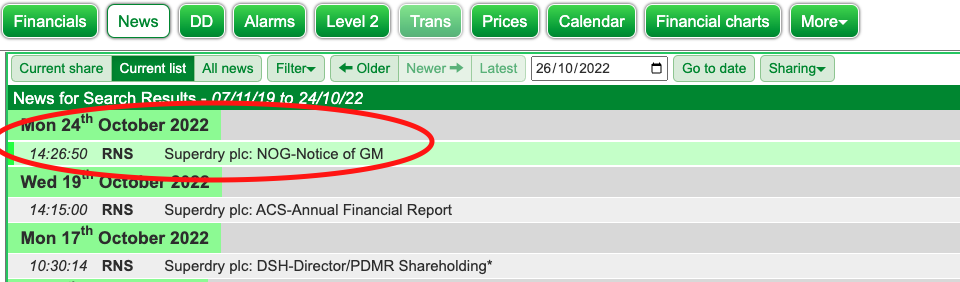

At the start of this week, Superdry announced their auditor, Deloitte, had resigned. Unhelpfully it was titled NOG-Notice of GM.

The company is legally required to inform shareholders that the auditor has resigned, and also explain in a letter what has happened. Superdry chose to alert investors to this with a misleading RNS headline – which they are allowed to do, but that’s very far from best practice. At the very least it makes shareholders wonder what other disclosure management have made publicly available but tried to keep under the radar.

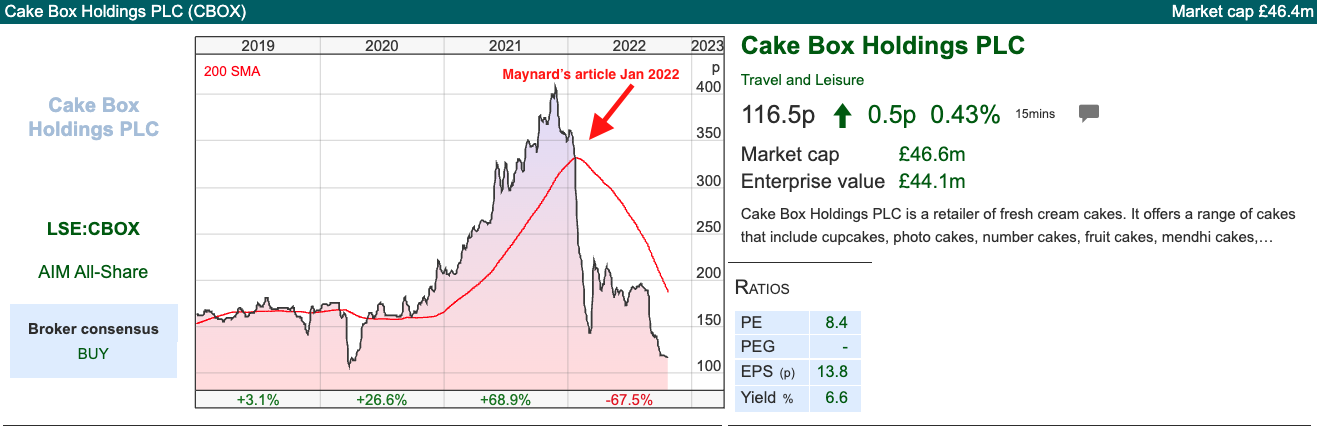

Maynard did some great work on Cake Box at the start of the year parsing available information. The CBOX auditor resigned in September 2021 and Maynard published his analysis in January 2022. The share price has not recovered, though in part that’s also because fundamentals have deteriorated over the course of this year. Maynard’s article was an early red flag for holders of CBOX and the chart shows that it was better to sell at the start of the year rather than ‘shoot the messenger’.

The Superdry situation shares some similarities with CBOX, a charismatic founder/entrepreneur who owns 25% of the business and has weak financial controls. That is, neither company is a fraud in the usual sense of the word. I think this a symptom of founders being charismatic, externally focused on growth, brand etc and not interested in IT systems or governance leaving others to pick up the pieces. Another example of a fast-growing, founder-run business with control problems is Sir Martin Sorrell’s S4 Capital (share price -71% YTD).

Numbers and reality: As an aside, I’ve had a similar experience with my craft beer bar; after we filed for insolvency my business partner and I had a beer to discuss what went wrong, and he said that:

“Bruce, the problem was you were too focused on bookkeeping, systems, contracts etc. You pay too much attention to numbers. They don’t represent reality. There was a German company called Wirecard, and no one knew it was a fraud.”*

A business partner who thinks that numbers don’t reflect reality, plus a pandemic, perhaps you can see why the business failed?

The weak controls at SDRY are a concern, as well as the fact the auditors complained 2 years ago and the problems have been recurring since then. Investors can read the whole ‘key audit matters’ section in the FY Apr 2022 on page 137 of the Annual Report. In fact, Superdry has a long history of accounting bloopers. Chas Howes, the former Finance Director had to issue a profit warning in 2012 when he confused a minus/plus sign in a spreadsheet cell and admitted that there would be an £8m shortfall in profits.

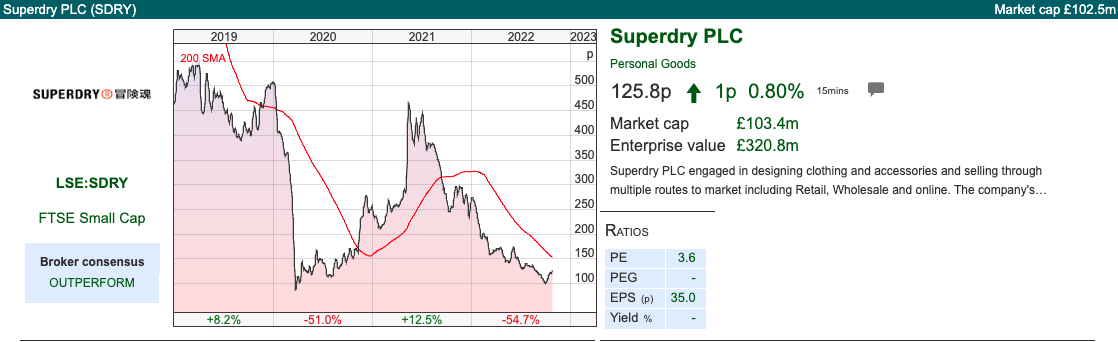

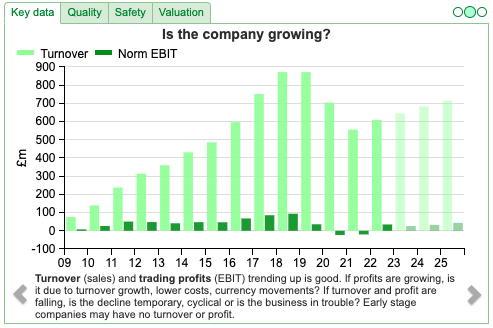

The difference between Superdry and Cake Box is that Superdry has already taken a cumulative £255m charge for write-down of lease assets in 2019 and 2020. The chart above shows SDRY FY Apr 2022 revenue at £609m is down -30% from its peak 3 years ago, that compares to a current market cap of £103m. Inventory levels have also been cut by 28% since 2019. The current £133m level of stock does not look high relative to sales. The shares are trading on a mid-single-digit PER, so I think it’s fair to say that expectations are already low.

Opinion: Following their results last week on 7th October, Julian Dunkerton the founder/CEO bought another £2m Superdry shares. He currently owns 24% of the company. I’ve followed him in, with a starter position because I think so much bad news is in the price.

If we’re going to become value investors, I think that the retail sector could present more opportunities than banks. SDRY is not the only retailer looking good value; on Mello, at the start of this week Alan Charlton was suggesting Sosander, Smith News (dividend yield of 12%) and SCS (net cash of £71m versus a market cap of £52m). Most retailers are facing a difficult environment but hopefully Sharepad can help you filter through the numbers and pick stocks that fit your risk appetite.

UK banks revenue growth

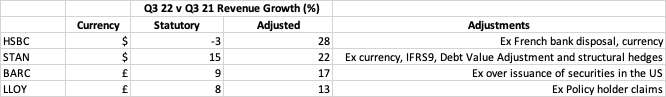

Rising interest rates are now driving revenue growth in UK banks. I have summarised their revenue performance below in table. Even on the revenue line there are plenty of adjustments.

I could write pages on each of these revenue adjustments because banks have a tendency to play around with their disclosure but statutory accounting numbers can also paint a confusing picture.

For instance, HSBC has adjusted out the disposal of its French bank, STAN adjusted out an IFRS 9 and Debt Valuation Adjustment. The latter is an artifice of Fair Value accounting, when bank balance sheets are stressed, the value of the liabilities that they have already issued increases creating an accounting profit just when common sense would least expect it. Similarly, when a bank’s credit quality improves and their Credit Default Spreads narrow, this creates an accounting loss.

Barclays also adjusts out the effects of the over-issuance of ETF securities in the US. Matt Levine has covered this in detail, but the basic problem is someone forgot to fill in some paperwork, and Barclays has to reimburse clients for the mistake, whereas any profits clients have made they get to keep. Annoyingly shareholders end up paying for the mistake twice: i) to reimburse clients half a billion dollars, ii) paying a $200m fine to regulators.

Barclays has also been fined $55m by the FCA for disclosure that management failed to make to shareholders over its 2008 fundraising. This seems bizarre – shareholders weren’t told about fees paid to Qatari investors, so the regulator chooses to fine the bank, and that fine is ultimately paid by shareholders. Regulators are punishing shareholders for behaviour that they didn’t know about, and which damaged them. The Serious Fraud Office did try to pursue criminal charges against Barclays management, but all (Roger Jenkins, Tom Kalaris and Richard Boath) were acquitted by a jury at the Old Baily in February 2020.

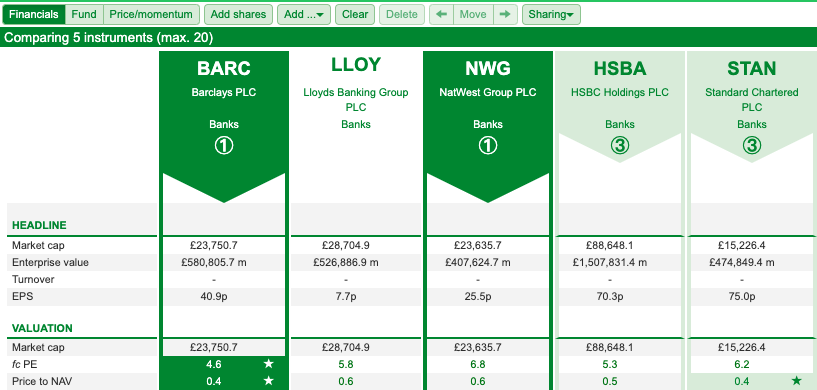

I’ve used Sharepad to chart the FTSE bank sector back to 1999. I have to say that despite the recovery from pandemic lows, this long-term sector chart doesn’t look very inspiring.

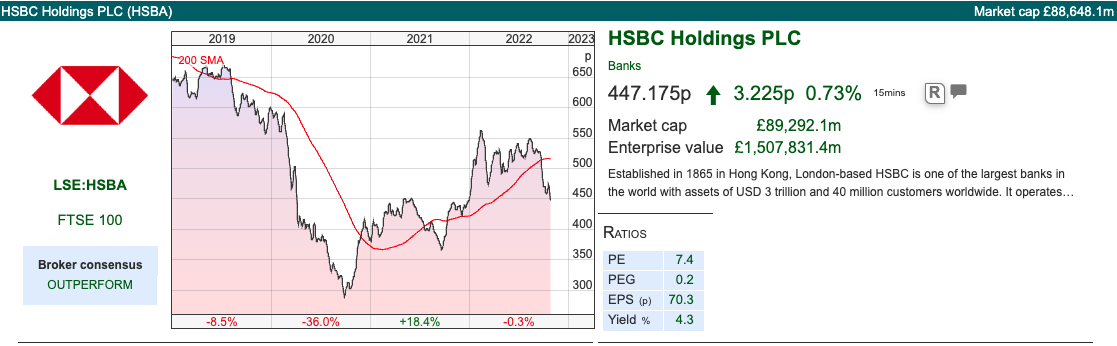

Below I look at HSBC’s quarterly results and discuss the long history of bad deals – as I think this highlights some of the problems of investing in UK banks.

HSBC Q3 results and acquisition history

HSBC adjusted revenue was up +28% Q3 2022 v the same quarter last year, Net Interest Income line, which benefits from rising interest rates was up +40%. Impairments for Expected Credit Losses (which used to be called bad debts) has swung from a $561m release Q3 last year to a $1.075bn charge. That’s driven by continuing problems with China’s Commercial Real Estate market and heightened economic uncertainty in the UK. Management expects the FY23 ECL charge to be towards the top end of their through-the-cycle

range of 30-40bps – that is still an order of magnitude lower than the 2.5% charge ($25bn) in both 2008 and 2009. Despite the deteriorating environment adjusted PBT was up +18% to $6.5bn and they still expect to achieve 12% or greater Return on Tangible Equity in FY Dec 2023F.

Bad deals: Rather than bad debts, the bank took a $2.4bn bad deal charge for their retreat from France. HSBC management always struck me as solid traditional bankers, but terrible at acquisitions and strategy. Household International the US subprime lender which they bought for $14.3bn in 2003 was their worst deal. However, there was also Edmund Safra’s private bank Republic which they bought at the top of the market in 1999 on 40x earnings and were later fined for helping clients evade taxes. It was a similar story for the Mexican bank, Bital, for which they were fined $1.9bn for helping cocaine dealers launder money. HSBC has also lost billions in Argentina and sold their loss-making Brazilian operations in 2016.

France: We can add their French bank to that long list of problem acquisitions. They bought CCF in 2000, paying 3.5x book value and outbidding rival banks. Since then, investors and customers have questioned whether banks really need a global footprint. HSBC struggled to cut costs and reduce staff because of France’s labour laws and unions. They have been trying to exit France since 2019 but the disposal won’t be complete until H2 2023, when Cerberus will pay HSBC a single euro to assume $2 billion of tangible book capital and receive 244 branches and nearly 4,000 staff. Cerberus will also own $25bn of CCF customer loans and $23bn of customer deposits.

Complexity: It’s very hard to innovate from inside a large organisation. HSBC has $32bn of FY operating expenses, whereas Wise has £320m – roughly 100x less. Wise is forecast to double revenues in the next two years, whereas HSBC’s revenue is the same level as 2005.

Das Kapital: Management are also under pressure from their largest shareholder, Chinese insurance company Ping An, to break up the whole group. There’s a suspicion that the Chinese Communist Party is keen to sidestep possible US sanctions, which is driving Ping An’s campaign. The irony is that a communist government may be encouraging an activist investor in a badly performing capitalist bank, while the FT has been suggesting that large banks are effectively communist institutions (run for the benefit of staff, who extract capital at the expense of long-suffering shareholders).

Opinion: Banks’ share prices are discounting lots of bad news. From a trading perspective, they could outperform other sectors like they did in the 2000-2003 sell-off, but I’ve grown more cautious over the last month. The LDI fiasco has emphasised how 15 years of low-interest rates and QE have created hidden risks in the financial system. Many of these risks will first appear outside the regulated banks, but history suggests that problems eventual transfer to the mainstream lenders.

So, I will remain cautious on UK banks for now.

Notes

*I met Dan McCrum a few times as the Wirecard scandal was progressing, he and many other people knew it was a fraud. It just took so long time to unravel because the auditor failed to check that there was €2bn of cash in the bank. Basic stuff. I pointed this out to my former business partner.

The ‘numbers don’t matter’ attitude isn’t completely stupid though. I’m sure Steve Jobs didn’t spend his time chasing missing invoices and Elon Musk doesn’t seem to pay much attention to signed legal contracts.

The author owns shares in Superdry

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary Part 2 | 28/10/22 |SDRY, BARC, HSBA, LLOY, NWG, STAN| Numbers reflect reality

Bruce comments on Superdry’s auditor resignation and summarises Q3 trends at UK banks.

The FTSE 100 rose above 7000 to 7,057. Nasdaq and the S&P 500 were around +3.0% and +4.5% over the last 5 days. Brent crude remains at mid $94 per barrel. The UK 10Y bond yield fell to 3.62% and the US 10Y bond yield fell to 4.06%.

Interest rate expectations have begun to move down in the UK from the previous c. 6% peak next year, as the politics has stabilised. Market participants are now pricing in Bank of England interest rates to peak at 5% next summer, up from 2.25%. Two-year gilt yields fell to below 3.3%, which is the level before the former Chancellor’s ‘mini-budget’.

In the US Google was down -9% after it reported disappointing revenues in the core search ads division and Facebook was down -19% after quarterly revenues fell -4%. For some reason, investors thought that targeted advertising was going to be less sensitive to companies cutting traditional media spending in a recession. In retrospect that now looks to be Panglossian. Elon Musk’s deal to buy Twitter could turn out to be this cycle’s equivalent of Fred Goodwin buying ABN Amro in H2 2007, just as the cycle turned.

Below I look at Superdry’s auditor resignation, plus UK bank Q3 revenue growth. As we face a recession, it’s inevitable that bad debts will rise, but I think the investment case for banks hinges on their sustainable revenue growth and margin expansion. Confusingly, bank management have made a large number of adjustments, even to the revenue line. Perhaps this is an attempt to appeal to investors without the government introducing a windfall tax on profits?

Net interest margin expansion is currently caused by banks not passing on the benefits of rate rises to their customers, and I don’t think this is sustainable in the medium term. Looking at my own balance sheet, I’m sitting on cash earning a negative real return but continue moving money out of my savings into equity markets.

It feels like written commentary can go out of date very quickly as markets move around so much. I’ve discussed with the management at SharePad and will switch to shorter but more timely pieces 2x a week. This is an experiment, so we’d welcome your feedback: marketing@sharescope.co.uk

Superdry auditor resignation

At the start of this week, Superdry announced their auditor, Deloitte, had resigned. Unhelpfully it was titled NOG-Notice of GM.

The company is legally required to inform shareholders that the auditor has resigned, and also explain in a letter what has happened. Superdry chose to alert investors to this with a misleading RNS headline – which they are allowed to do, but that’s very far from best practice. At the very least it makes shareholders wonder what other disclosure management have made publicly available but tried to keep under the radar.

Maynard did some great work on Cake Box at the start of the year parsing available information. The CBOX auditor resigned in September 2021 and Maynard published his analysis in January 2022. The share price has not recovered, though in part that’s also because fundamentals have deteriorated over the course of this year. Maynard’s article was an early red flag for holders of CBOX and the chart shows that it was better to sell at the start of the year rather than ‘shoot the messenger’.

The Superdry situation shares some similarities with CBOX, a charismatic founder/entrepreneur who owns 25% of the business and has weak financial controls. That is, neither company is a fraud in the usual sense of the word. I think this a symptom of founders being charismatic, externally focused on growth, brand etc and not interested in IT systems or governance leaving others to pick up the pieces. Another example of a fast-growing, founder-run business with control problems is Sir Martin Sorrell’s S4 Capital (share price -71% YTD).

Numbers and reality: As an aside, I’ve had a similar experience with my craft beer bar; after we filed for insolvency my business partner and I had a beer to discuss what went wrong, and he said that:

“Bruce, the problem was you were too focused on bookkeeping, systems, contracts etc. You pay too much attention to numbers. They don’t represent reality. There was a German company called Wirecard, and no one knew it was a fraud.”*

A business partner who thinks that numbers don’t reflect reality, plus a pandemic, perhaps you can see why the business failed?

The weak controls at SDRY are a concern, as well as the fact the auditors complained 2 years ago and the problems have been recurring since then. Investors can read the whole ‘key audit matters’ section in the FY Apr 2022 on page 137 of the Annual Report. In fact, Superdry has a long history of accounting bloopers. Chas Howes, the former Finance Director had to issue a profit warning in 2012 when he confused a minus/plus sign in a spreadsheet cell and admitted that there would be an £8m shortfall in profits.

The difference between Superdry and Cake Box is that Superdry has already taken a cumulative £255m charge for write-down of lease assets in 2019 and 2020. The chart above shows SDRY FY Apr 2022 revenue at £609m is down -30% from its peak 3 years ago, that compares to a current market cap of £103m. Inventory levels have also been cut by 28% since 2019. The current £133m level of stock does not look high relative to sales. The shares are trading on a mid-single-digit PER, so I think it’s fair to say that expectations are already low.

Opinion: Following their results last week on 7th October, Julian Dunkerton the founder/CEO bought another £2m Superdry shares. He currently owns 24% of the company. I’ve followed him in, with a starter position because I think so much bad news is in the price.

If we’re going to become value investors, I think that the retail sector could present more opportunities than banks. SDRY is not the only retailer looking good value; on Mello, at the start of this week Alan Charlton was suggesting Sosander, Smith News (dividend yield of 12%) and SCS (net cash of £71m versus a market cap of £52m). Most retailers are facing a difficult environment but hopefully Sharepad can help you filter through the numbers and pick stocks that fit your risk appetite.

UK banks revenue growth

Rising interest rates are now driving revenue growth in UK banks. I have summarised their revenue performance below in table. Even on the revenue line there are plenty of adjustments.

I could write pages on each of these revenue adjustments because banks have a tendency to play around with their disclosure but statutory accounting numbers can also paint a confusing picture.

For instance, HSBC has adjusted out the disposal of its French bank, STAN adjusted out an IFRS 9 and Debt Valuation Adjustment. The latter is an artifice of Fair Value accounting, when bank balance sheets are stressed, the value of the liabilities that they have already issued increases creating an accounting profit just when common sense would least expect it. Similarly, when a bank’s credit quality improves and their Credit Default Spreads narrow, this creates an accounting loss.

Barclays also adjusts out the effects of the over-issuance of ETF securities in the US. Matt Levine has covered this in detail, but the basic problem is someone forgot to fill in some paperwork, and Barclays has to reimburse clients for the mistake, whereas any profits clients have made they get to keep. Annoyingly shareholders end up paying for the mistake twice: i) to reimburse clients half a billion dollars, ii) paying a $200m fine to regulators.

Barclays has also been fined $55m by the FCA for disclosure that management failed to make to shareholders over its 2008 fundraising. This seems bizarre – shareholders weren’t told about fees paid to Qatari investors, so the regulator chooses to fine the bank, and that fine is ultimately paid by shareholders. Regulators are punishing shareholders for behaviour that they didn’t know about, and which damaged them. The Serious Fraud Office did try to pursue criminal charges against Barclays management, but all (Roger Jenkins, Tom Kalaris and Richard Boath) were acquitted by a jury at the Old Baily in February 2020.

I’ve used Sharepad to chart the FTSE bank sector back to 1999. I have to say that despite the recovery from pandemic lows, this long-term sector chart doesn’t look very inspiring.

Below I look at HSBC’s quarterly results and discuss the long history of bad deals – as I think this highlights some of the problems of investing in UK banks.

HSBC Q3 results and acquisition history

HSBC adjusted revenue was up +28% Q3 2022 v the same quarter last year, Net Interest Income line, which benefits from rising interest rates was up +40%. Impairments for Expected Credit Losses (which used to be called bad debts) has swung from a $561m release Q3 last year to a $1.075bn charge. That’s driven by continuing problems with China’s Commercial Real Estate market and heightened economic uncertainty in the UK. Management expects the FY23 ECL charge to be towards the top end of their through-the-cycle

range of 30-40bps – that is still an order of magnitude lower than the 2.5% charge ($25bn) in both 2008 and 2009. Despite the deteriorating environment adjusted PBT was up +18% to $6.5bn and they still expect to achieve 12% or greater Return on Tangible Equity in FY Dec 2023F.

Bad deals: Rather than bad debts, the bank took a $2.4bn bad deal charge for their retreat from France. HSBC management always struck me as solid traditional bankers, but terrible at acquisitions and strategy. Household International the US subprime lender which they bought for $14.3bn in 2003 was their worst deal. However, there was also Edmund Safra’s private bank Republic which they bought at the top of the market in 1999 on 40x earnings and were later fined for helping clients evade taxes. It was a similar story for the Mexican bank, Bital, for which they were fined $1.9bn for helping cocaine dealers launder money. HSBC has also lost billions in Argentina and sold their loss-making Brazilian operations in 2016.

France: We can add their French bank to that long list of problem acquisitions. They bought CCF in 2000, paying 3.5x book value and outbidding rival banks. Since then, investors and customers have questioned whether banks really need a global footprint. HSBC struggled to cut costs and reduce staff because of France’s labour laws and unions. They have been trying to exit France since 2019 but the disposal won’t be complete until H2 2023, when Cerberus will pay HSBC a single euro to assume $2 billion of tangible book capital and receive 244 branches and nearly 4,000 staff. Cerberus will also own $25bn of CCF customer loans and $23bn of customer deposits.

Complexity: It’s very hard to innovate from inside a large organisation. HSBC has $32bn of FY operating expenses, whereas Wise has £320m – roughly 100x less. Wise is forecast to double revenues in the next two years, whereas HSBC’s revenue is the same level as 2005.

Das Kapital: Management are also under pressure from their largest shareholder, Chinese insurance company Ping An, to break up the whole group. There’s a suspicion that the Chinese Communist Party is keen to sidestep possible US sanctions, which is driving Ping An’s campaign. The irony is that a communist government may be encouraging an activist investor in a badly performing capitalist bank, while the FT has been suggesting that large banks are effectively communist institutions (run for the benefit of staff, who extract capital at the expense of long-suffering shareholders).

Opinion: Banks’ share prices are discounting lots of bad news. From a trading perspective, they could outperform other sectors like they did in the 2000-2003 sell-off, but I’ve grown more cautious over the last month. The LDI fiasco has emphasised how 15 years of low-interest rates and QE have created hidden risks in the financial system. Many of these risks will first appear outside the regulated banks, but history suggests that problems eventual transfer to the mainstream lenders.

So, I will remain cautious on UK banks for now.

Notes

*I met Dan McCrum a few times as the Wirecard scandal was progressing, he and many other people knew it was a fraud. It just took so long time to unravel because the auditor failed to check that there was €2bn of cash in the bank. Basic stuff. I pointed this out to my former business partner.

The ‘numbers don’t matter’ attitude isn’t completely stupid though. I’m sure Steve Jobs didn’t spend his time chasing missing invoices and Elon Musk doesn’t seem to pay much attention to signed legal contracts.

The author owns shares in Superdry

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.