Bruce looks at the root causes of the conflict in Ukraine, and outlines two scenarios that the Bank of Georgia research team (who know a thing or two about Russian invasions) have discussed. Plus 3 companies reporting last week.

“All civil wars are dynastic wars, my lord King; all overseas wars are trade wars…Troy commanded the Hellespont, and therefore controlled the rich trade of the Black Sea and beyond.”

– Robert Graves Homer’s Daughter

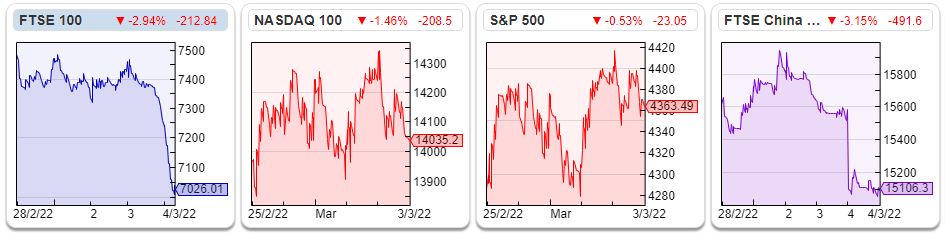

The FTSE 100 fell -6%, but remained above 7,000 at the time of writing last week. The S&P 500 was down -0.5% and the Nasdaq100 fell -1.1% last week. Brent Crude traded at over $110 per barrel. Inflation in Turkey rose to +54% according to Turkish government figures, the highest in 20 years. The price of wheat, which you can find on Sharepad as KE-MT was up +20% last week and is now up +34% since 1st Jan.

The news continued to be dominated by the Ukraine conflict. The roots of this go back to 2013 when Kyiv negotiated an Association Agreement and trade deal with the EU, but the corrupt president Viktor Yanukovych refused to sign (likely under pressure from Putin). A friend who knows about these things told me that Putin fears EU expansion, not just the military power of NATO, but the EU as a trading block. Ordinary Ukrainians can see how much better off Poland and the Baltics are and look in that direction to the future. So Yanukovych’s refusal to sign that agreement sparked protests and the former president fled the country to Moscow. He left behind his house, which cost $2bn (tennis courts, golf course, zoo including ostriches, beautiful gardens, yacht on the Dnieper and underground carpark full of expensive cars).

A new government signed the EU deal, but within weeks Moscow had annexed Crimea and sparked a separatist uprising in the East of the country. Yanukovych’s house is now open to the public as a museum of political corruption and is featured in the Lonely Planet guide as a tourist attraction. Below is a picture I took when I visited a couple of years ago.

I’m still on Bank of Georgia research distribution list and their research team have outlined 2 scenarios:

Scenario1, resolution of war in 1-2 months: this scenario is based on the current situation (EU/US sanctions on Russia throughout 2022, including SWIFT exclusion for some Russian banks, etc.) and assumes a cease-fire between Russia and Ukraine can be reached. The Russian invasion of Georgia only lasted a couple of weeks in August 2008.

Scenario 2, protracted war: this scenario assumes additional sanctions on Russia (e.g. sanctions on oil and gas) and long term conflict. Events in the Battle of Grozny in the Second Chechen War show Putin is unconcerned about urban warfare and civilian casualties. Let’s hope this doesn’t happen.

This week I look at 2 trading updates from Calnex Solutions and 1Spatial plus Nichols FY results.

Calnex Solutions Trading Update

This maker of test equipment, which helps telecom networks (customers include BT, China Mobile, NTT, Nokia, Ericcson, Intel and IBM) to check the performance of their infrastructure announced a trading update with a full order book suggesting that FY March 2023F will be “materially ahead” on both revenue and profits line. They do warn about supply chain difficulties in the final quarter of this year (ie Jan-Mar 2022) at the moment they expect forecasts inline with market expectations though.

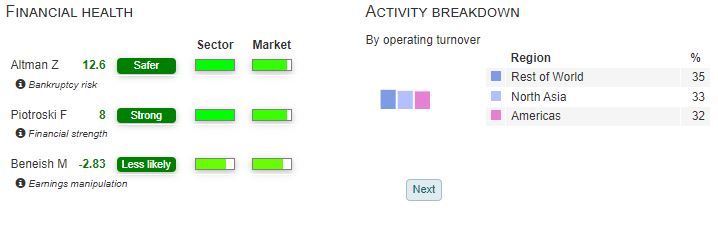

The RNS reads as if they are highlighting the components shortages, so that if they do miss in the final quarter of the year, investors should not mark down the shares as management don’t expect the problems to carry through to 2023F. In fact, they say that 2023F contains an order from a large data centre customer. In any case, the business has no debt and closing cash of £13.6m (30th Sept), which is reflected in SharePad’s Financial Health metrics.

Pleasingly this RNS comes on the back of a previous above expectations statement last year. It’s good to see a company IPO and then exceed expectations 12-18 months later. The Chief Exec, Tommy Cook sold a quarter of his shares at the IPO, but still owns 21% which suggests this was not an attempt to “cash out at the maximum valuation”.

Pleasingly this RNS comes on the back of a previous above expectations statement last year. It’s good to see a company IPO and then exceed expectations 12-18 months later. The Chief Exec, Tommy Cook sold a quarter of his shares at the IPO, but still owns 21% which suggests this was not an attempt to “cash out at the maximum valuation”.

History Calnex was founded in 2006, by Tommy Cook (previous experience with Hewlett Packard and Agilent). The company’s first product Paragon was launched a year later to test the synchronisation of telecoms base stations (such as the telecoms towers located roadside or on rooftops, which manage the radio connections to mobile phones). The company IPO’ed in October 2020, at 48p raising £6m of new money and valuing the company at £42m market cap. Selling shareholders (management Tom Cook, Ann Budge, Anand Ram, Eric Percival and other staff plus Scottish Enterprise and Scottish Loan Fund, which are Scotland’s national economic development agencies) together sold £16m.

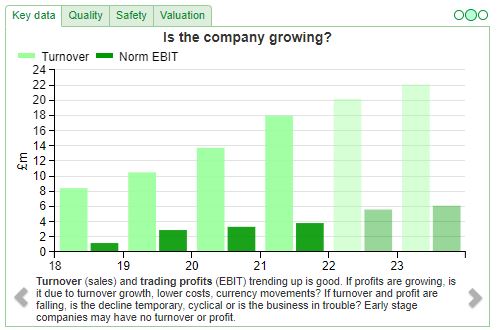

Broker Forecasts Cenkos, their broker, left FY March 2022F numbers unchanged, with revenue of £20m and PBT of £5.6m. The broker has increased their FY March 2023E revenue and PBT forecasts by 15.4% to £25.5m and 17% to £7m respectively. They haven’t published any 2024F numbers, I think that suggests that the company want to see how their data centre business opportunities develop before giving any long term guidance to their brokers.

Valuation Those numbers imply 22x Mar 2023F PER and 4.8x Mar 2023F sales. The company has 11% of its market cap in cash. That valuation looks good given the growth prospects, in my view.

Opinion Maynard wrote up Calnex in July, and noticed the similarity with AB Dynamics, which benefited from the need for testing equipment for self driving cars. He also noted a few odd looking changes to the financial results around the time of the IPO. He suggests investors need to understand the lack of cash taxes paid in the past and probably related grant funding (R&D tax credits?) This is on my watchlist, but my rule of thumb is to wait at least a couple of years following an IPO.

Nichols FY Dec Results

This international soft drinks maker (Vimto brand, but also SLUSH PUPPiE and Sunkist) with sales in 73 countries announced FY Dec results. The company’s history goes back over 100 years, and they’ve been listed on AIM since 2004 (previously listed on the main London Stock Exchange.)

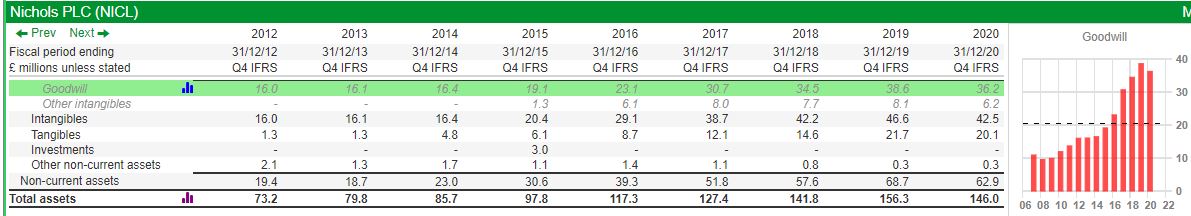

Dec 2021 FY revenue was up +22% to £144m, but still below FY 2019 revenue of £147m. They announced a statutory loss of £18m following a £36m goodwill writedown for OoH (Out of Home business), with the writedown representing a quarter of 2020 total assets.

The impairment is non cash, and adjusted PBT was £22m and free cashflow was £17m. That compares to £32m adjusted PBT and free cashflow of £41m in FY 2019 before the pandemic.

The company had said in a January trading update that they intended to take a writedown. Using Sharepad to look at the balance sheet over the long term, this doesn’t look like one large acquisition that has gone wrong. Instead over the last decade the company has been expanding by buying brands for £2-3m and following the pandemic management decided that these brands are permanently impaired.

Strategic Review Yet Out of Home (OoH) has now recovered from the previous year with revenues +77% – that doesn’t strike me as a business that has been permanently impaired! They do say that the gross margin progression previously anticipated in OoH is now unlikely to be achieved. Overhead cost estimates have been increased to reflect both inflationary pressures and the cost required to serve the customer base. So during 2022 the Board has commenced a full strategic review into its OoH route to market in terms of customer and product mix, as well as ways to ensure appropriate margin and profitability. That sounds to me like they might look to exit some businesses, and the impairment writedown is a precursor to that.

The company has £57m (11% of the market cap) of cash on its balance sheet and no bank borrowing.

Outlook Management feel confident enough to say that they are happy with FY Dec 2022F consensus expectations of adjusted PBT £25.2m, implying +15% profit growth this year. They also talk about 2023F where they expect revenue growth but also cost pressure, suggesting single digit growth in Group Adjusted PBT versus FY 2022F.

Valuation the shares are trading on 26x Dec 2022F PER falling to 21x Dec 2024F and 3.1x sales for the same year. Has obviously been hard hit by the pandemic, but we should see profitability rebound.

Ownership Members of the Nichols Family hold approximately 35% of the company’s shares. The Non Exec Chairman is Peter John Nichols (grandson of the founder who has worked there for 50 years) and the size of their combine stake allows them to appoint a second Non Exec Director (James Nichols – great grandson of the founder.) Institutional shareholders include Octopus 8.2% and Schroders 5%. This is also a Lord Lee stock.

Opinion Richard compares Nichols to Fever Tree here. Looking at the long term chart back to 1990 he points out that high levels of capital expenditure, have been followed by sustained periods of falling returns – not really what you’d expect. SharePad shows that capex has been falling in recent years, but is now forecast to start rising. Let’s hope that future returns don’t fall and repeat that pattern again.

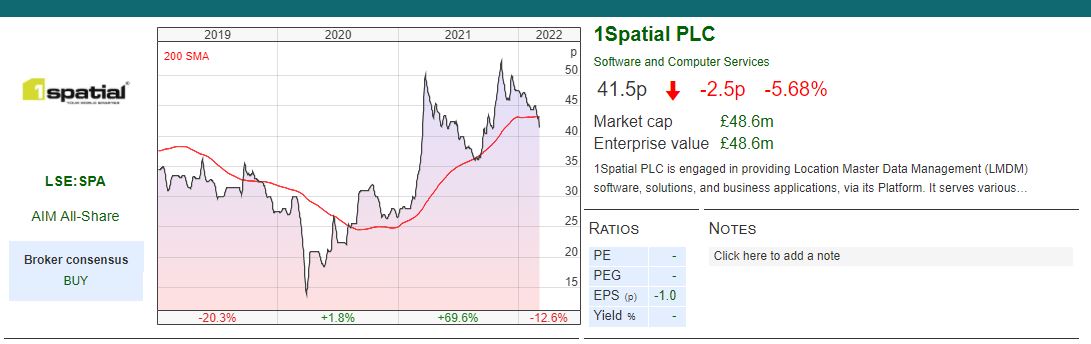

1spatial Trading Update FY Jan 2022

This is a stock that @glasshalfull on Twitter mentioned as a pick at the start of the year. They do Location Master Data Management (LMDM) software for utilities, government, transportation and infrastructure, defence and engineering companies. The 2021 Annual report says that they’ve signed contracts with the Energy Networks Association, Ordnance Survey, Rural Payments Agency, Google and now have over a thousand customers. The core SPA business is data quality for organisations that need to trust their location-based information, roughly 50% of revenue comes from government projects according to the company.

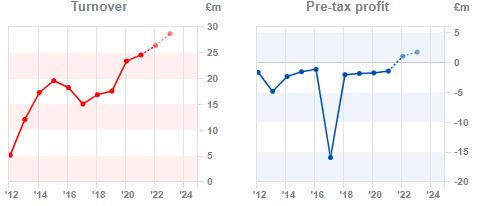

SPA announced an inline trading update for their year which ends 31 Jan 2022, with revenue expected to be +7% to £26m, including double digit recurring revenue growth. Inevitably for a loss making company they don’t mention PBT, but adjusted EBITDA is expected to be £3.8m (v £3.6m FY Jan 2021). Management have capitalised £5.8m of investment in software development costs on to their balance sheet and intangible assets were £15m Jan 2021, versus shareholders equity £14.7m – so tangible book is negative.

Net cash of £3.2m at the end of January was lower than expectations due to the working capital requirements on larger contracts signed in H2, and the decision to invest free cash in expanding the sales and delivery team and cloud technology, as part of the three-year growth plan. That sounds reasonable to me, if a company has accelerating growth expectations then it can put a strain on cash. Management also mentioned at their H1 some reversal of Covid support (ie they now have to pay this year and last year’s VAT).

History 1Spatial can trace its history back to a Cambridge University laser tracking and mapping technology company founded in 1969 called Laser-Scan. Laser-Scan listed on AIM, but in 2000 was bought by Yeoman Group plc (an early car GPS company) in a hostile bid, which wanted to develop in-car navigation services via mobile phone. Laser-Scan technology was used to build the advanced spatial database that supported accurate navigation. At the time of the bid Laser-Scan reported £7m in revenues and a loss of £100K.

In June 2003 Yeoman Group restructured and put Laser-Scan into administration, there then followed a management buy-out of assets from the administrator which established 1Spatial. As an aside – it’s fascinating reading through old Admission Documents, because you see how many good ideas were ahead of their time but failed due to bad execution (Yeoman was eventually bought by TrafficMaster, itself valued at £650m in the internet bubble but in 2010 delisted by Private Equity for less than £100m).

Back to 1Spatial in October 2010 they re-listed by reversing into a cash shell IQ Holdings Plc, valuing the company at £10m. At the time of the IPO 1Spatial had revenue of £8m and PBT of less than £75K. Since then management have generated revenue growth but no profits – though current forecasts are for £1.1m PBT in 2022F.

Valuation Expensive on a forecast PER 38x 2022F but reasonable on P/Sales of less than 2x the same year. This looks like a company where the economics ought to be attractive, a specialist niche with high rates of customer retention and a gross margin of 50% – which is quite low for a software company. So far though the track record doesn’t bear that out: SharePad shows that revenue has trebled to £25m since the IPO in 2010, but the business has yet to make a profit. Management said at H1 presentation that they’re not really focused on profitability, but instead are investing to accelerate revenue growth.

Opinion In theory this should be a business with operational gearing – but in practice management have failed to demonstrate this historically. In investor presentations the company has said their data is required for transition to net zero, for instance where to put EV charging points and locations of flood defences. For me “green agenda” investing (they also mention the cloud and machine learning) is something of a red flag, but I will watch progress with interest.

Bruce Packard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

A very awesome blog post. We are really grateful for your blog post. You will find a lot of approaches after visiting your post.

online casino philippines gcash