Bruce looks at a couple of stocks that have benefited from the US dollar strength / weak pound. HLN and BGEO.

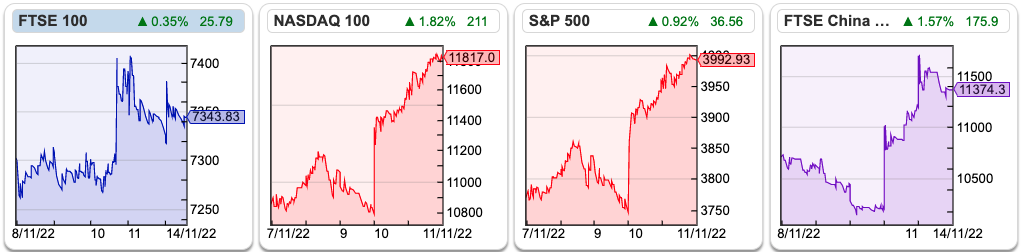

The FTSE 100 was up +0.65% to 7343 in the last 5 days. The Nasdaq100 and S&P500 were much stronger, +7.7% and 4.9%. Nasdaq has been strong despite the collapse of Sam Bankman-Fried’s FTX crypto exchange. Details are still emerging, but it does look like the FTX ‘exchange’ wasn’t operating in the same way as a traditional exchange. If people question the value of Enron or similar, this doesn’t blow up the NYSE. Whereas if commentators question the value of assets held by Lehman Brothers, then that can cause a run as everyone rushes to withdraw their money from the bank. So, at the very least, it looks like nomenclature was deceptive, and FTX was operating more like a bank, calling itself an exchange.

US Consumer Price Inflation data came out at the end of last week has been more significant for equity markets than the implosion of crypto. US CPI showed a +7.7% increase which led some to believe that the Fed might only raise rates by 0.5% in December. The FTSE China 50 was up +6% in the last 5 days, as Beijing announced a plan to support the overly indebted Chinese property developers. There were some more indications that China might roll back their Covid Zero policy, followed by official refutations.

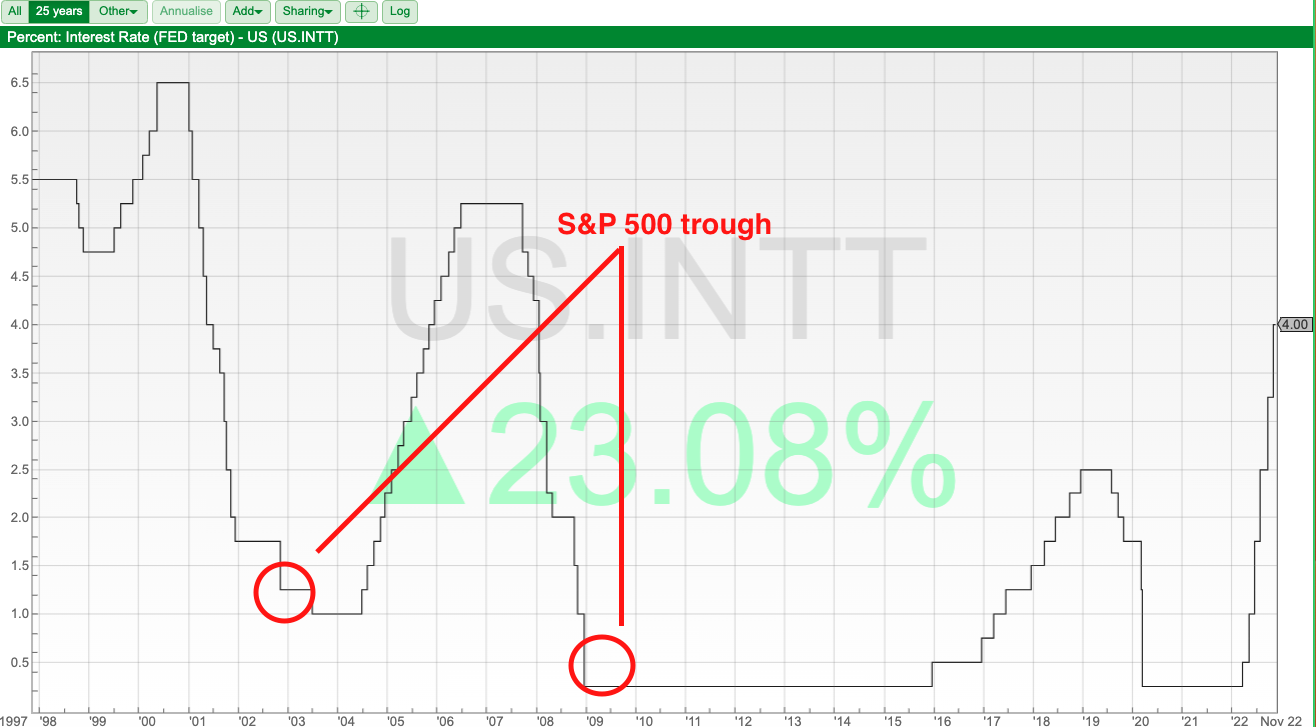

Before we get too far ahead of ourselves, I used Sharepad to check when the Fed target interest rate (US.INTT) peaked (May 2000 and June 2006) in the last couple of bear markets. I then compared these dates with when the S&P 500 troughed (Oct 2002 and March 2009). That suggests interest rates peak between 2-3 years before the bear market ends. We can see similar in the UK: Bank of England rates peaked in Feb 2000 and July 2007, the market bottomed March 2003 and March 2009.

Of course, the cycle may be different this time. SharePad has US.INTT going back to 1979. When the US Central Bank rates peaked at 20% in the early 1980s, that did herald the start of a long bull market. However, I’m not sure that’s very reassuring if we need rates to go so high to precipitate a bull market.

This week is Mello physical event in Chiswick. I hope everyone enjoys themselves. Here’s a link to the companies and speakers, and which day they are speaking on.

This week I look at GSK consumer health brands spin-off Haleon for the first time, plus a short comment on Bank of Georgia Q3 results. Both companies are currently benefiting from a strong US dollar.

Haleon Q3 results

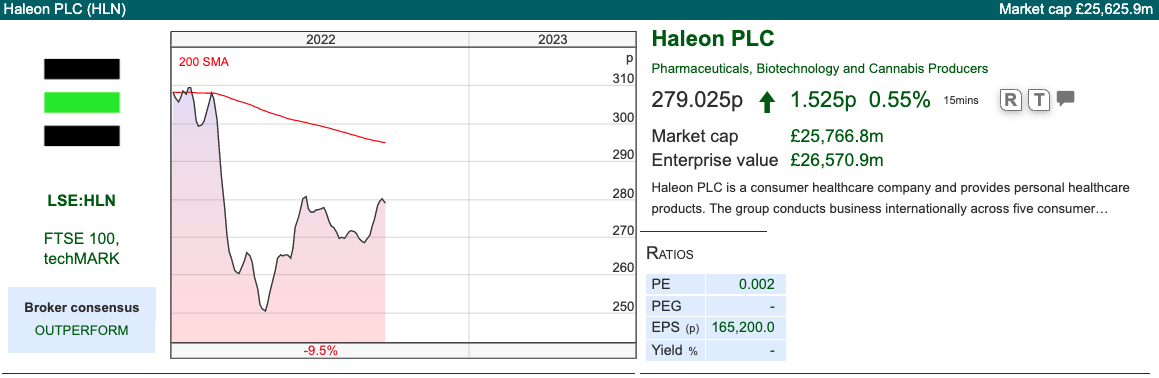

This summer Glaxo divested their consumer brands division, and with the help of Goldman Sachs, Citi and Merrill Lynch and a 467-page prospectus (including 29 pages of ‘risk factors’) the business is now a FTSE 100 company. Indeed, with a market cap of £25.8bn Haleon is currently the 20th largest FTSE 100 company, above Barclays, NatWest and Prudential. GSK remains in the top 10.

HLN reported Q3 results, with organic revenue +8.1%, and reported revenue +16% helped by a strong US dollar. Reported PBT down -2% to £495m. That decline was caused by higher finance costs, without which operating PBT was up +12% to £569m. I think it’s fair enough to exclude the £74m increase in net finance costs because they didn’t allocate any interest costs when they were part of GSK in Q3 last year.

They tweaked up FY Dec 2022 organic revenue growth guidance to 8.0-8.5% (previously 6-8%) and said adj operating profit margin should expand above the level of last year (FY 2021: 22.8%) helped by favourable FX movements (ie a strong dollar). Net debt is £10.8bn, and there were £28bn of intangible assets on the balance sheet at the half year, so net tangible book value is negative.

History: Glaxo’s history goes back over a hundred years, and has been listed on the LSE since before the war. Back in the 1950s, Glaxo Labs used to trade on a stunningly low single-digit PER multiple as investors believed (rightly) that profits would be invested back into the business rather than paid out to shareholders. Finance theory has moved on, and investors now reward companies that don’t pay a dividend as long as management can demonstrate they are reinvesting to grow profitably – but that wasn’t always the case.

Then in the 1970s Glaxo developed Zantac, an anti-ulcerant treatment for heartburn, which became the world’s best-selling drug. Following various mergers, first with Wellcome in 1995, then SmithKline Beecham in 2000 they ended up with a pharmaceutical business and a consumer brands business.

Then in July 2019 GSK and Pfizer combined their consumer businesses into a joint venture. GSK owned 68% of the JV, with Pfizer holding the remaining 32%. This became Haleon, and the shares were spun-out and began trading on the LSE on 18th July this year at just above 300p.

Zantac is now subject to approximately 2,000 personal injury lawsuits as well as unfiled claims in the USA, which claim the drug causes cancer. There are also legal cases in countries outside the USA. Though Haleon doesn’t sell Zantac in the USA, GSK and Pfizer are trying to get Haleon to indemnify them against liability for damages that the US courts may award. There are also more legal liabilities from a Proton Pump Inhibitor and a third legal matter involving German competition law. The best place to read about these in detail is the prospectus.

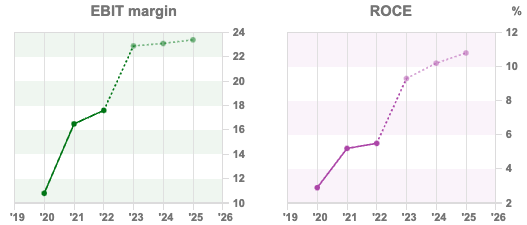

Brands: I would imagine that a consumer health brands company like this ought to generate mid-teens RoCE and the 8% organic revenue growth seems realistic (maybe a little on the high side depending on the geographic mix?) Sales ought to be defensive during a recession, possibly sales of some brands like Panadol rise. However, the potential legal liability from Zantac makes me cautious.

Valuation: The shares are trading on 14x Dec 2023F and 13x Dec 2024F. I had assumed that if there were no legal liabilities then the shares would be trading on north of 20x earnings. However, I just cross-checked it against Unilever PER 15x and Reckitt Benckiser PER 14x, both Dec 2024F. So it strikes me as a valuation as slightly below, but not at a significant discount to peers.

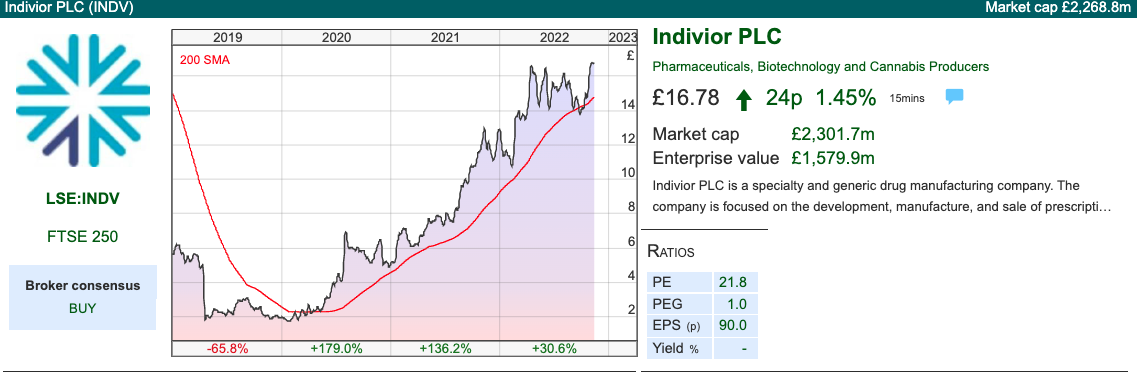

Invidious comparison: This situation reminds me of Indivior, which was the opiates business that Reckitt and Benckiser span out roughly a decade ago. The INDV shares trebled following the spin-off, but then investors worried about patent expiry of Suboxone Film, which is a way of gradually administering heroin to help withdrawal symptoms, that addicts can’t tamper to receive their high all in one go. There was also a legal liability risk with any business involved with opiates, the former Chief Exec was sentenced to 6 months in prison for making misleading statements about Suboxone Film.

Indivior crashed 90%, below £2 in 2020, and settling criminal and civil liability cost $600m for Indivior and $1.4bn for parent Reckitt Benckiser. Reckitt sued Indivior in an attempt to indemnify them from the liability, the INDV share price dropped 20% on the day this was announced. There was an indemnity clause in the 2014 demerger agreement, but resolving the dispute with Reckitt cost a further $50m. INDV shares have now recovered to almost £17.

Opinion: I think readers should be wary of Haleon until the situation with Zantac is clearer. Plenty of companies have gotten into trouble underestimating the size of damages that US courts can award. There are alternatives like Unilever and Reckitt Benckiser which own equally strong consumer brands, so no reason to take a position.

Bank of Georgia Q3 results

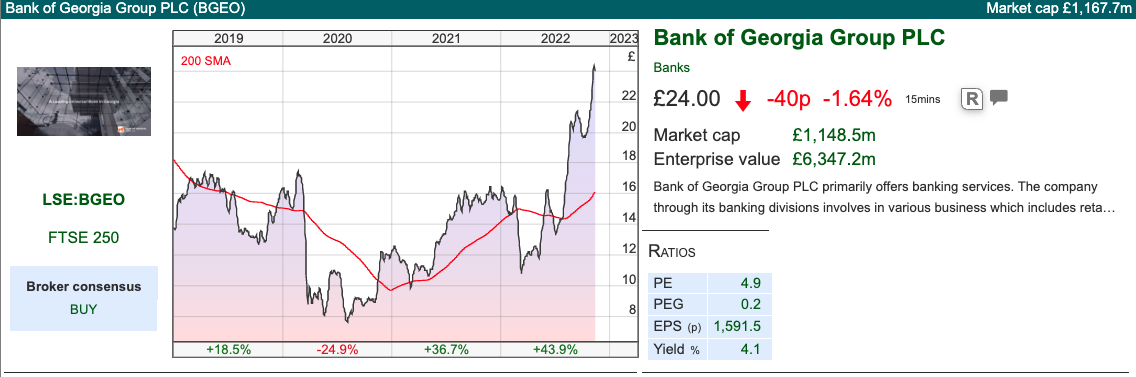

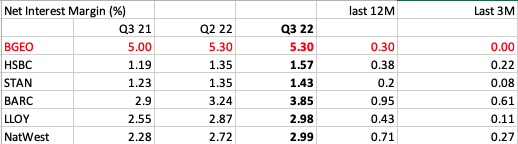

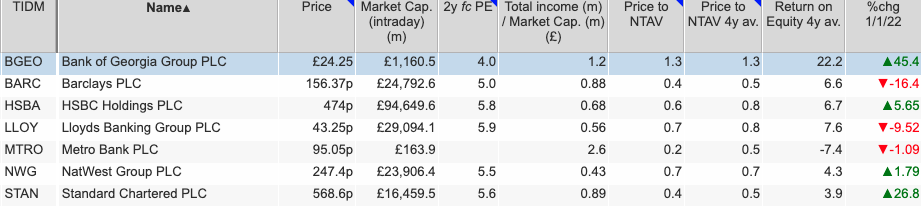

A quick mention of the Tbilisi headquartered bank, which reported Q3 results. The bank reported total income +51% to 526m GEL, helped by a forex currency gain. Even without that one-off gain, Net Interest Income rose +21% in local currency. The bank’s Net Interest Margin was 5.3% up by 30bp versus the same quarter last year. I’ve updated my UK banks Net Interest Margin table, which shows that BGEO has not enjoyed the margin expansion that Barclays or NatWest have, but it was starting from a much better starting point (Net Interest Margin 5.0% in Q3 2021 rather than below 3% for UK banks).

BGEO Q3 PBT was up +54% and the bank reported a RoE of 32%. That compares to a core equity tier-one ratio of 14.8%. In other words, Bank of Georgia is far more profitable and better capitalised than any UK Bank.

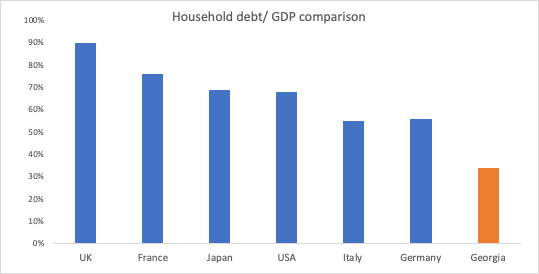

Household debt is around 3x lower in Georgia (34% v 90%) than in the UK. Similarly, UK public debt is around 90% of GDP in the UK but Georgian public debt should be 40% by the end of 2022F.

57% of the Georgian bank’s customer deposits are dollar-denominated matched by 45% of the loan book in US dollars. Hence the Georgian Lari has strengthen against the pound by almost 25%, from above 4 to the pound at the start of the year to 3.19 Lari to the pound.

Valuation: BGEO shares are up +44% YTD, making it the best-performing UK bank. Despite that, the shares are still only on a PER 4x Dec 2023F and 3.5x Dec 2034F.

Opinion: I’ve owned the shares since the IPO in London a decade ago, and am flagging the comparison because many readers seem to be trying to time an investment in the large banks like HSBC or Lloyds. That’s a big call for professional fund managers, who are benchmarked versus the FTSE All Share and are trying to outperform by making sector calls; I’m not sure it makes much sense for amateur investors though.

Comparing UK banks versus BGEO, the latter is growing the top line at a faster rate, is more profitable (4-year avg RoE 22% v 7-4% for UK banks) and better capitalised. Obviously, it’s a bit too close to Russia for comfort, but that hasn’t held back the share price performance this year and does mean that the bank trades at an attractive valuation.

Notes

The author owns shares in Bank of Georgia

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary Part 1| 15/11/22 |HLN, BGEO| Timing the cycle

Bruce looks at a couple of stocks that have benefited from the US dollar strength / weak pound. HLN and BGEO.

The FTSE 100 was up +0.65% to 7343 in the last 5 days. The Nasdaq100 and S&P500 were much stronger, +7.7% and 4.9%. Nasdaq has been strong despite the collapse of Sam Bankman-Fried’s FTX crypto exchange. Details are still emerging, but it does look like the FTX ‘exchange’ wasn’t operating in the same way as a traditional exchange. If people question the value of Enron or similar, this doesn’t blow up the NYSE. Whereas if commentators question the value of assets held by Lehman Brothers, then that can cause a run as everyone rushes to withdraw their money from the bank. So, at the very least, it looks like nomenclature was deceptive, and FTX was operating more like a bank, calling itself an exchange.

US Consumer Price Inflation data came out at the end of last week has been more significant for equity markets than the implosion of crypto. US CPI showed a +7.7% increase which led some to believe that the Fed might only raise rates by 0.5% in December. The FTSE China 50 was up +6% in the last 5 days, as Beijing announced a plan to support the overly indebted Chinese property developers. There were some more indications that China might roll back their Covid Zero policy, followed by official refutations.

Before we get too far ahead of ourselves, I used Sharepad to check when the Fed target interest rate (US.INTT) peaked (May 2000 and June 2006) in the last couple of bear markets. I then compared these dates with when the S&P 500 troughed (Oct 2002 and March 2009). That suggests interest rates peak between 2-3 years before the bear market ends. We can see similar in the UK: Bank of England rates peaked in Feb 2000 and July 2007, the market bottomed March 2003 and March 2009.

Of course, the cycle may be different this time. SharePad has US.INTT going back to 1979. When the US Central Bank rates peaked at 20% in the early 1980s, that did herald the start of a long bull market. However, I’m not sure that’s very reassuring if we need rates to go so high to precipitate a bull market.

This week is Mello physical event in Chiswick. I hope everyone enjoys themselves. Here’s a link to the companies and speakers, and which day they are speaking on.

This week I look at GSK consumer health brands spin-off Haleon for the first time, plus a short comment on Bank of Georgia Q3 results. Both companies are currently benefiting from a strong US dollar.

Haleon Q3 results

This summer Glaxo divested their consumer brands division, and with the help of Goldman Sachs, Citi and Merrill Lynch and a 467-page prospectus (including 29 pages of ‘risk factors’) the business is now a FTSE 100 company. Indeed, with a market cap of £25.8bn Haleon is currently the 20th largest FTSE 100 company, above Barclays, NatWest and Prudential. GSK remains in the top 10.

HLN reported Q3 results, with organic revenue +8.1%, and reported revenue +16% helped by a strong US dollar. Reported PBT down -2% to £495m. That decline was caused by higher finance costs, without which operating PBT was up +12% to £569m. I think it’s fair enough to exclude the £74m increase in net finance costs because they didn’t allocate any interest costs when they were part of GSK in Q3 last year.

They tweaked up FY Dec 2022 organic revenue growth guidance to 8.0-8.5% (previously 6-8%) and said adj operating profit margin should expand above the level of last year (FY 2021: 22.8%) helped by favourable FX movements (ie a strong dollar). Net debt is £10.8bn, and there were £28bn of intangible assets on the balance sheet at the half year, so net tangible book value is negative.

History: Glaxo’s history goes back over a hundred years, and has been listed on the LSE since before the war. Back in the 1950s, Glaxo Labs used to trade on a stunningly low single-digit PER multiple as investors believed (rightly) that profits would be invested back into the business rather than paid out to shareholders. Finance theory has moved on, and investors now reward companies that don’t pay a dividend as long as management can demonstrate they are reinvesting to grow profitably – but that wasn’t always the case.

Then in the 1970s Glaxo developed Zantac, an anti-ulcerant treatment for heartburn, which became the world’s best-selling drug. Following various mergers, first with Wellcome in 1995, then SmithKline Beecham in 2000 they ended up with a pharmaceutical business and a consumer brands business.

Then in July 2019 GSK and Pfizer combined their consumer businesses into a joint venture. GSK owned 68% of the JV, with Pfizer holding the remaining 32%. This became Haleon, and the shares were spun-out and began trading on the LSE on 18th July this year at just above 300p.

Zantac is now subject to approximately 2,000 personal injury lawsuits as well as unfiled claims in the USA, which claim the drug causes cancer. There are also legal cases in countries outside the USA. Though Haleon doesn’t sell Zantac in the USA, GSK and Pfizer are trying to get Haleon to indemnify them against liability for damages that the US courts may award. There are also more legal liabilities from a Proton Pump Inhibitor and a third legal matter involving German competition law. The best place to read about these in detail is the prospectus.

Brands: I would imagine that a consumer health brands company like this ought to generate mid-teens RoCE and the 8% organic revenue growth seems realistic (maybe a little on the high side depending on the geographic mix?) Sales ought to be defensive during a recession, possibly sales of some brands like Panadol rise. However, the potential legal liability from Zantac makes me cautious.

Valuation: The shares are trading on 14x Dec 2023F and 13x Dec 2024F. I had assumed that if there were no legal liabilities then the shares would be trading on north of 20x earnings. However, I just cross-checked it against Unilever PER 15x and Reckitt Benckiser PER 14x, both Dec 2024F. So it strikes me as a valuation as slightly below, but not at a significant discount to peers.

Invidious comparison: This situation reminds me of Indivior, which was the opiates business that Reckitt and Benckiser span out roughly a decade ago. The INDV shares trebled following the spin-off, but then investors worried about patent expiry of Suboxone Film, which is a way of gradually administering heroin to help withdrawal symptoms, that addicts can’t tamper to receive their high all in one go. There was also a legal liability risk with any business involved with opiates, the former Chief Exec was sentenced to 6 months in prison for making misleading statements about Suboxone Film.

Indivior crashed 90%, below £2 in 2020, and settling criminal and civil liability cost $600m for Indivior and $1.4bn for parent Reckitt Benckiser. Reckitt sued Indivior in an attempt to indemnify them from the liability, the INDV share price dropped 20% on the day this was announced. There was an indemnity clause in the 2014 demerger agreement, but resolving the dispute with Reckitt cost a further $50m. INDV shares have now recovered to almost £17.

Opinion: I think readers should be wary of Haleon until the situation with Zantac is clearer. Plenty of companies have gotten into trouble underestimating the size of damages that US courts can award. There are alternatives like Unilever and Reckitt Benckiser which own equally strong consumer brands, so no reason to take a position.

Bank of Georgia Q3 results

A quick mention of the Tbilisi headquartered bank, which reported Q3 results. The bank reported total income +51% to 526m GEL, helped by a forex currency gain. Even without that one-off gain, Net Interest Income rose +21% in local currency. The bank’s Net Interest Margin was 5.3% up by 30bp versus the same quarter last year. I’ve updated my UK banks Net Interest Margin table, which shows that BGEO has not enjoyed the margin expansion that Barclays or NatWest have, but it was starting from a much better starting point (Net Interest Margin 5.0% in Q3 2021 rather than below 3% for UK banks).

BGEO Q3 PBT was up +54% and the bank reported a RoE of 32%. That compares to a core equity tier-one ratio of 14.8%. In other words, Bank of Georgia is far more profitable and better capitalised than any UK Bank.

Household debt is around 3x lower in Georgia (34% v 90%) than in the UK. Similarly, UK public debt is around 90% of GDP in the UK but Georgian public debt should be 40% by the end of 2022F.

57% of the Georgian bank’s customer deposits are dollar-denominated matched by 45% of the loan book in US dollars. Hence the Georgian Lari has strengthen against the pound by almost 25%, from above 4 to the pound at the start of the year to 3.19 Lari to the pound.

Valuation: BGEO shares are up +44% YTD, making it the best-performing UK bank. Despite that, the shares are still only on a PER 4x Dec 2023F and 3.5x Dec 2034F.

Opinion: I’ve owned the shares since the IPO in London a decade ago, and am flagging the comparison because many readers seem to be trying to time an investment in the large banks like HSBC or Lloyds. That’s a big call for professional fund managers, who are benchmarked versus the FTSE All Share and are trying to outperform by making sector calls; I’m not sure it makes much sense for amateur investors though.

Comparing UK banks versus BGEO, the latter is growing the top line at a faster rate, is more profitable (4-year avg RoE 22% v 7-4% for UK banks) and better capitalised. Obviously, it’s a bit too close to Russia for comfort, but that hasn’t held back the share price performance this year and does mean that the bank trades at an attractive valuation.

Notes

The author owns shares in Bank of Georgia

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.