Bruce looks at the FT30 index, which Sharepad has going back to 1935. Plus a couple of hydrogen stocks, that are currently too speculative for him: ATOM and AFC

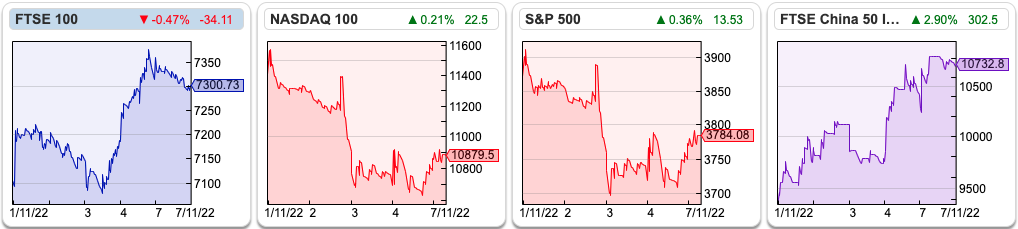

The FTSE 100 has recovered well in the last 5 days up +2.9%. By contrast, the Nasdaq100 and S&P500 were down -4.7% and 2.3% respectively in the last 5 days. The US 10-year government bond yield rose to 4.2% and the UK 10-year gilt yield is currently at 3.6%, the same level as before the mini budget in late September.

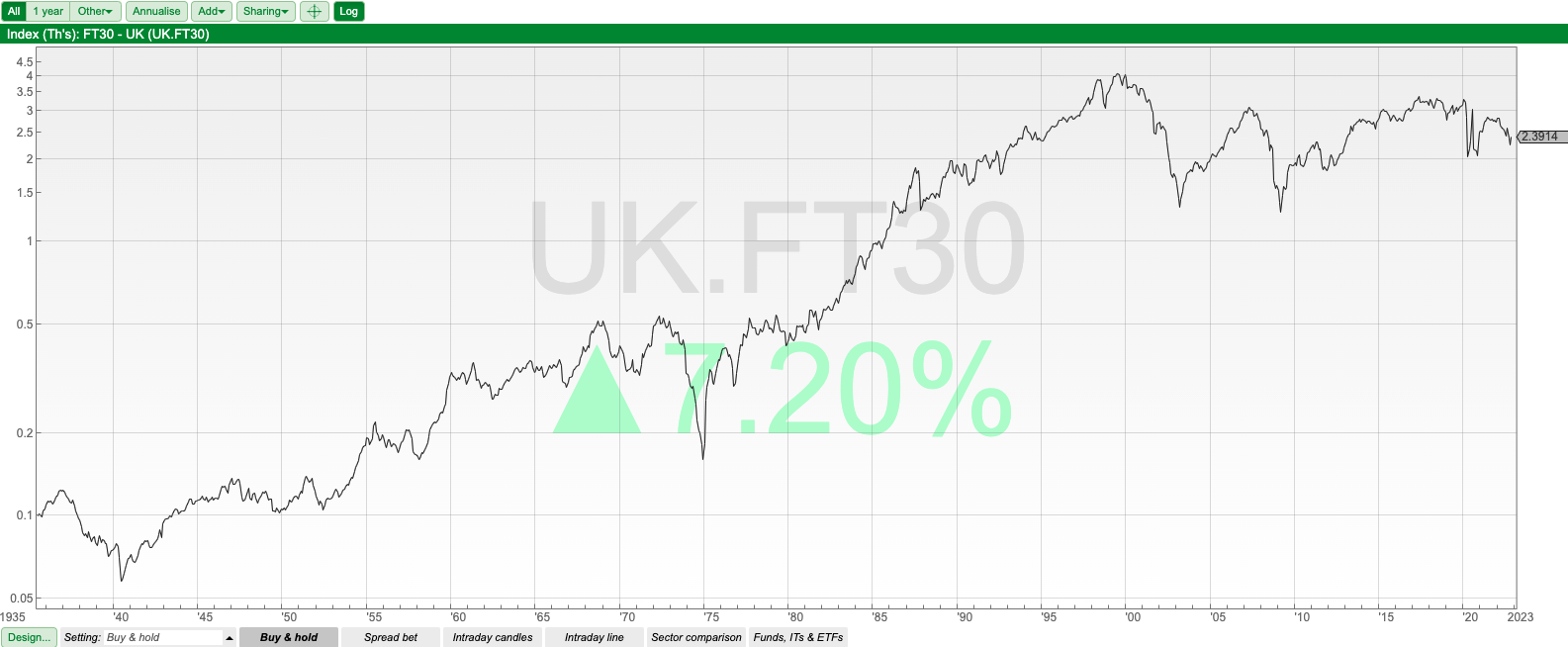

I’ve just made another fun discovery. SharePad has the FT30 going back to 1935 (ticker: UK.FT30). This is the oldest continuous index in the UK and one of the oldest in the world.

In the 1930’s Maurice Green and Richard “Otto” Clarke, respectively editor and chief leader writer of the Financial News (later to merge into the FT), constructed what Clarke later called “a truly modern and sensitive industrial ordinary share index”, the FT30. They deliberately choose stocks that were among the most actively traded, not the largest companies. But he and Green also aimed to reflect the shape of the UK industry. Interestingly there were no oil & gas companies or banks in the indices, even though these sectors would come to dominate the FTSE 100. Instead, textile companies such as Fine Spinners and Doublers were well represented in the original index but have disappeared, as have coal mines which departed after nationalisation, as did Rolls Royce. Oil company shares were added to the index in 1977, with the inclusion of British Petroleum, and in 1984 National Westminster Bank became the first bank to be added. BT and British Gas were added after privatisation. Only one company has remained in the index since its inception: Tate & Lyle. See appendix at the end for the 1935 list of FT30 originals* (see below).

Unlike the FTSE 100 and Allshare, it’s a price-weighted, rather than market cap-weighted index. Constituents change only when a company is taken over, merge or fails. The above chart on log scale shows the long run history and perhaps rather depressingly showing the index peaked at the end of 1999.

I look at a couple of RNS from hydrogen stocks listed on AIM, AFC Energy and Atome Energy that both made announcements on Monday. These are more speculative than I would normally look at, there’s already one hydrogen company that has been de-listed: Intelligent Energy. However, the hydrogen bubble has burst and I think the hydrogen sector is worth keeping an eye on as valuations become more realistic (with the recent falls, I still think we have gone from insanely expensive to merely unreasonably expensive). I covered ITM Power a couple of months ago.

AFC Energy

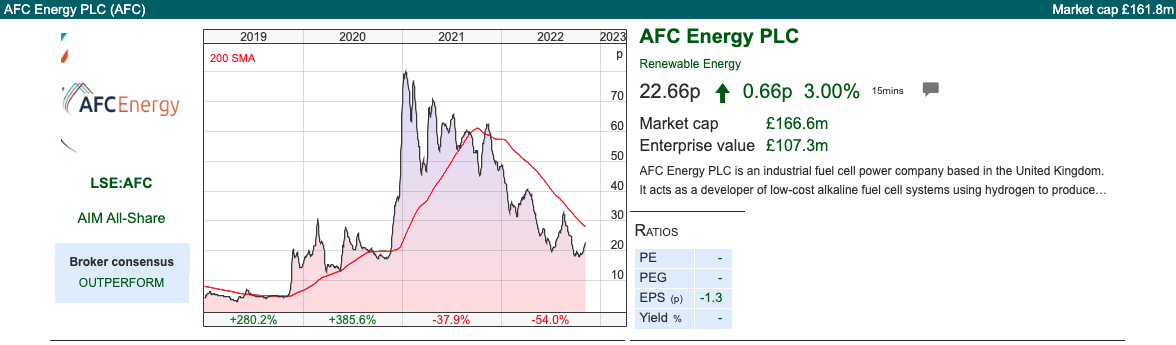

This “flex fuel cell” manufacturer, which has been listed on since 2007 specialises in off-grid decentralised power systems. They announced a successful field trial of their first prototype Methanol Fuel Tower with Acciona (ticker: ANAE, market cap: €10bn, engineering company listed in Spain). The trial operated for 100 hours continuously.

History: The company goes back to the late 1990s, and was originally part of Eneco, a Dutch company now owned by Mitsubishi (80%) and Chubu (20%). There are competing methods for hydrogen fuel cells, and AFC developed alkaline fuel cell versus alternatives (eg Proton Exchange Membrane, some of which use platinum). AFC uses nickel in its electrodes, which is much cheaper than components with precious metals. In 2007, they listed on AIM raising £2.4m at 23p per share, giving the company a market cap of £20m. Since then the company has reported 15 years of continuous losses, funded by issuing more shares and the share count has increased from 88m to 734m. Like the other hydrogen stocks, its share price peaked at over 80p at the end of 2020, as part of the pandemic liquidity bubble. The share price has now fallen back to 23p, the listing price all those years ago in 2007.

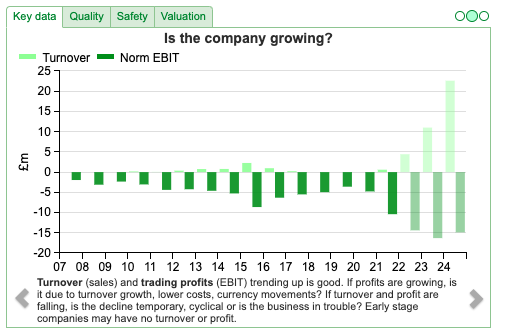

For most of its history AFC has been ‘pre-revenue’, however, if forecasts are to be believed it looks like it should begin to be generating sales, if not actual profits and positive cashflow.

Valuation: Unfortunately, even if the revenues double next year, then double again as forecast, this still looks far too expensive, on 7x 2024F revenues. Losses are forecast to remain at c. £15m a year until 2024F. I’m not sure how long investors are going to keep funding this sort of thing. There are no institutional investors on the shareholder list, with the exception of Ervington Investments, owned by Roman Abramovich. Although the Russian oligarch has been forced to sell his high-profile Chelsea FC investment, oddly the UK media seem less concerned that he owns shares in this loss-making hydrogen fuel cell company!

Opinion: Not for me, and I think this is probably beyond the risk tolerance of most readers. Like ITM Power, this looks like ‘Growth at an UNreasonable Price’. I think the hydrogen sector could be valuable one day, but if this company is anything to go by, profits are still a long way off.

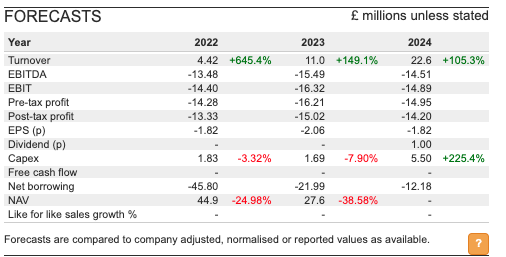

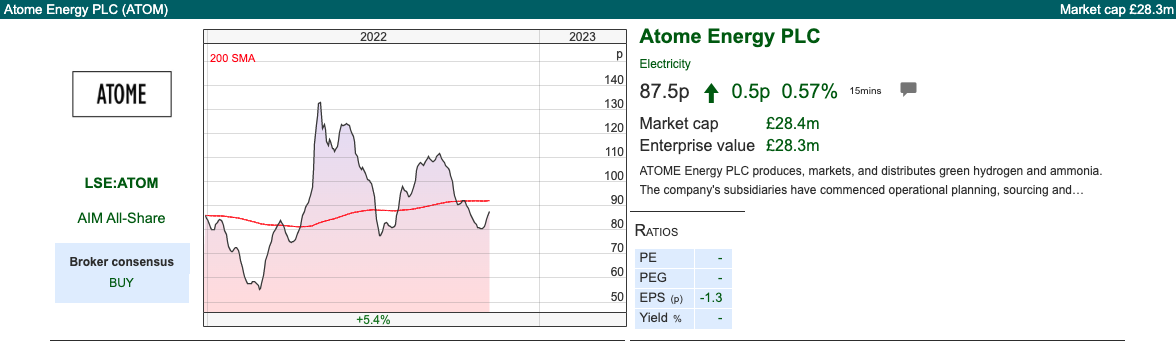

Atome Energy

This “green” hydrogen company has projects in Paraguay and Iceland and has announced that it signed a non-binding Memorandum of Understanding with Paraguay-based fuel company called Puma. Unlike ITM and AFC, it only recently listed on AIM at the end of last year. The reason that the projects are in such far-flung places is that their fuel cell technology requires a constant power source to operate efficiently, which means that solar and wind power won’t work. Instead, Iceland has an abundance of hydro and geothermal, and Paraguay has hydro.

History: This is a spin-out from President Energy, which has just announced a change of name to Molecular Energies (still listed on AIM, ticker: MEN market cap: £13m). President was involved in oil & gas exploration in Argentina, but judging by its current market cap, that looks to have been unsuccessful. President then span out Atome, raising £6m at 80p valuing ATOM at £26m. Following admission President still held a 28% shareholding, and Peter Levine (Atome’s chairman) held a further 28%. Schroders, which holds 5.2%, is the only institution that I recognise.

Peter Levine founded and was the largest shareholder of Imperial Energy, which he listed on AIM in 2004. This had most of its oil field assets in Western Siberia, Russia. He sold Imperial Energy for US$2.4 billion to ONGC Videsh (foreign investment arm of the Indian state oil company) in January 2009. This was lucky timing because ONCG Videsh first made an approach in the summer of 2008, and the price of oil dropped by two-thirds due to the financial crisis. Similar to Elon Musk’s recent bid for Twitter, the Indian company made a binding offer for Imperial Energy in the second half of 2008 at 1250p, and merger arbitrageurs feared that they would try to negotiate the price lower in the time it took for the deal to complete. That didn’t happen, the deal completed in January 2009.

FinnCap, who are their joint broker believe that ATOM will need to spend $660m on Capex over the next five years. In total, they believe $440m of debt and $160m of additional equity is required.

Opinion: I’d suggest that it’s impossible to value a business that needs to raise 20x its current market cap over the next five years, and which currently doesn’t have many institutions on its shareholder register. Peter Levine clearly has a high-risk appetite, and has been lucky once (Russia) but not a second time (Argentina). Perhaps third time lucky again? It does seem to me that there’s been a lot of inflows into “green” and ESG funds, which probably is now looking for a home. The hydrogen sector could benefit from those institutional flows. For me, caveat emptor.

Notes

Original companies of FT 30 in the United Kingdom as of 1 July 1935

Associated Portland Cement, Austin Motor, Bass, Bolsover Colliery, Callenders Cables & Construction, Coats, Courtaulds, Distillers, Dorman Long, Dunlop Rubber, Electrical & Musical Industries, Fine Spinners and Doublers, General Electric Company, Guest Keen & Nettlefolds, Harrods, Hawker Siddeley, Imperial Chemical Industries, Imperial Tobacco, International Tea Co. Stores, London Brick, Murex, Patons & Baldwins, Pinchin Johnson & Associates, Rolls-Royce, Tate & Lyle, Turner & Newall, United Steel Companies, Vickers-Armstrongs, Watney Combe & Reid, FW Woolworth & Co

Most recent list of constituents https://www.ft.com/ft30

Associated British Foods, BAE Systems, BP, British American Tobacco, BT, Burberry, Compass, Diageo, Experian, GlaxoSmithKline, International Consolidated Airlines Group, ITV, Land Securities, Legal & General, Lloyds Banking Group, Man Group, Marks & Spencer, Melrose Industries, National Grid, Next, Reckitt Benckiser, Royal Bank of Scotland, RSA Insurance, Smiths Group, Standard Life Aberdeen, Tate & Lyle, Tesco, Vodafone, WPP, 3i

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Bi-Weekly Market Commentary Part 1 | 8/11/22 |ATOM,AFC | A look at hydrogen

Bruce looks at the FT30 index, which Sharepad has going back to 1935. Plus a couple of hydrogen stocks, that are currently too speculative for him: ATOM and AFC

The FTSE 100 has recovered well in the last 5 days up +2.9%. By contrast, the Nasdaq100 and S&P500 were down -4.7% and 2.3% respectively in the last 5 days. The US 10-year government bond yield rose to 4.2% and the UK 10-year gilt yield is currently at 3.6%, the same level as before the mini budget in late September.

I’ve just made another fun discovery. SharePad has the FT30 going back to 1935 (ticker: UK.FT30). This is the oldest continuous index in the UK and one of the oldest in the world.

In the 1930’s Maurice Green and Richard “Otto” Clarke, respectively editor and chief leader writer of the Financial News (later to merge into the FT), constructed what Clarke later called “a truly modern and sensitive industrial ordinary share index”, the FT30. They deliberately choose stocks that were among the most actively traded, not the largest companies. But he and Green also aimed to reflect the shape of the UK industry. Interestingly there were no oil & gas companies or banks in the indices, even though these sectors would come to dominate the FTSE 100. Instead, textile companies such as Fine Spinners and Doublers were well represented in the original index but have disappeared, as have coal mines which departed after nationalisation, as did Rolls Royce. Oil company shares were added to the index in 1977, with the inclusion of British Petroleum, and in 1984 National Westminster Bank became the first bank to be added. BT and British Gas were added after privatisation. Only one company has remained in the index since its inception: Tate & Lyle. See appendix at the end for the 1935 list of FT30 originals* (see below).

Unlike the FTSE 100 and Allshare, it’s a price-weighted, rather than market cap-weighted index. Constituents change only when a company is taken over, merge or fails. The above chart on log scale shows the long run history and perhaps rather depressingly showing the index peaked at the end of 1999.

I look at a couple of RNS from hydrogen stocks listed on AIM, AFC Energy and Atome Energy that both made announcements on Monday. These are more speculative than I would normally look at, there’s already one hydrogen company that has been de-listed: Intelligent Energy. However, the hydrogen bubble has burst and I think the hydrogen sector is worth keeping an eye on as valuations become more realistic (with the recent falls, I still think we have gone from insanely expensive to merely unreasonably expensive). I covered ITM Power a couple of months ago.

AFC Energy

This “flex fuel cell” manufacturer, which has been listed on since 2007 specialises in off-grid decentralised power systems. They announced a successful field trial of their first prototype Methanol Fuel Tower with Acciona (ticker: ANAE, market cap: €10bn, engineering company listed in Spain). The trial operated for 100 hours continuously.

History: The company goes back to the late 1990s, and was originally part of Eneco, a Dutch company now owned by Mitsubishi (80%) and Chubu (20%). There are competing methods for hydrogen fuel cells, and AFC developed alkaline fuel cell versus alternatives (eg Proton Exchange Membrane, some of which use platinum). AFC uses nickel in its electrodes, which is much cheaper than components with precious metals. In 2007, they listed on AIM raising £2.4m at 23p per share, giving the company a market cap of £20m. Since then the company has reported 15 years of continuous losses, funded by issuing more shares and the share count has increased from 88m to 734m. Like the other hydrogen stocks, its share price peaked at over 80p at the end of 2020, as part of the pandemic liquidity bubble. The share price has now fallen back to 23p, the listing price all those years ago in 2007.

For most of its history AFC has been ‘pre-revenue’, however, if forecasts are to be believed it looks like it should begin to be generating sales, if not actual profits and positive cashflow.

Valuation: Unfortunately, even if the revenues double next year, then double again as forecast, this still looks far too expensive, on 7x 2024F revenues. Losses are forecast to remain at c. £15m a year until 2024F. I’m not sure how long investors are going to keep funding this sort of thing. There are no institutional investors on the shareholder list, with the exception of Ervington Investments, owned by Roman Abramovich. Although the Russian oligarch has been forced to sell his high-profile Chelsea FC investment, oddly the UK media seem less concerned that he owns shares in this loss-making hydrogen fuel cell company!

Opinion: Not for me, and I think this is probably beyond the risk tolerance of most readers. Like ITM Power, this looks like ‘Growth at an UNreasonable Price’. I think the hydrogen sector could be valuable one day, but if this company is anything to go by, profits are still a long way off.

Atome Energy

This “green” hydrogen company has projects in Paraguay and Iceland and has announced that it signed a non-binding Memorandum of Understanding with Paraguay-based fuel company called Puma. Unlike ITM and AFC, it only recently listed on AIM at the end of last year. The reason that the projects are in such far-flung places is that their fuel cell technology requires a constant power source to operate efficiently, which means that solar and wind power won’t work. Instead, Iceland has an abundance of hydro and geothermal, and Paraguay has hydro.

History: This is a spin-out from President Energy, which has just announced a change of name to Molecular Energies (still listed on AIM, ticker: MEN market cap: £13m). President was involved in oil & gas exploration in Argentina, but judging by its current market cap, that looks to have been unsuccessful. President then span out Atome, raising £6m at 80p valuing ATOM at £26m. Following admission President still held a 28% shareholding, and Peter Levine (Atome’s chairman) held a further 28%. Schroders, which holds 5.2%, is the only institution that I recognise.

Peter Levine founded and was the largest shareholder of Imperial Energy, which he listed on AIM in 2004. This had most of its oil field assets in Western Siberia, Russia. He sold Imperial Energy for US$2.4 billion to ONGC Videsh (foreign investment arm of the Indian state oil company) in January 2009. This was lucky timing because ONCG Videsh first made an approach in the summer of 2008, and the price of oil dropped by two-thirds due to the financial crisis. Similar to Elon Musk’s recent bid for Twitter, the Indian company made a binding offer for Imperial Energy in the second half of 2008 at 1250p, and merger arbitrageurs feared that they would try to negotiate the price lower in the time it took for the deal to complete. That didn’t happen, the deal completed in January 2009.

FinnCap, who are their joint broker believe that ATOM will need to spend $660m on Capex over the next five years. In total, they believe $440m of debt and $160m of additional equity is required.

Opinion: I’d suggest that it’s impossible to value a business that needs to raise 20x its current market cap over the next five years, and which currently doesn’t have many institutions on its shareholder register. Peter Levine clearly has a high-risk appetite, and has been lucky once (Russia) but not a second time (Argentina). Perhaps third time lucky again? It does seem to me that there’s been a lot of inflows into “green” and ESG funds, which probably is now looking for a home. The hydrogen sector could benefit from those institutional flows. For me, caveat emptor.

Notes

Original companies of FT 30 in the United Kingdom as of 1 July 1935

Associated Portland Cement, Austin Motor, Bass, Bolsover Colliery, Callenders Cables & Construction, Coats, Courtaulds, Distillers, Dorman Long, Dunlop Rubber, Electrical & Musical Industries, Fine Spinners and Doublers, General Electric Company, Guest Keen & Nettlefolds, Harrods, Hawker Siddeley, Imperial Chemical Industries, Imperial Tobacco, International Tea Co. Stores, London Brick, Murex, Patons & Baldwins, Pinchin Johnson & Associates, Rolls-Royce, Tate & Lyle, Turner & Newall, United Steel Companies, Vickers-Armstrongs, Watney Combe & Reid, FW Woolworth & Co

Most recent list of constituents https://www.ft.com/ft30

Associated British Foods, BAE Systems, BP, British American Tobacco, BT, Burberry, Compass, Diageo, Experian, GlaxoSmithKline, International Consolidated Airlines Group, ITV, Land Securities, Legal & General, Lloyds Banking Group, Man Group, Marks & Spencer, Melrose Industries, National Grid, Next, Reckitt Benckiser, Royal Bank of Scotland, RSA Insurance, Smiths Group, Standard Life Aberdeen, Tate & Lyle, Tesco, Vodafone, WPP, 3i

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.