This month I have four new fund ideas for Sharepad susbcribers. As always, you can find out a lot more about these ideas via my regular newsletter at davidstevenson.substack.com. But for now, lets focus on some alternative investment ideas including both investment trusts and exchange traded funds (ETFs) – notably music royalty funds, investing in nuclear power, the former Soviet Union state of Georgia and hedges which pay out if market turbulence increases. On that last point, I’m still fairly bearish and think market volatility will pick up again in the next few months.

For income focussed investors: Hipgnosis Songs Fund

I’ve been fairly reluctant to highlight the listed music funds (Hipgnosis and Roundhill) for a simple reason – I’ve been cautious about valuations. Put simply, the world of music rights is small, closed one. Its basically dominated by the two listed music funds plus a handful of big music labels. Sure, there are other players but basically once you get to a portfolio worth say more than $20m there’s really probably only about 5 to 10 realistic buyers, or perhaps even less.

That poses a problem for an asset class where you need to put a number on private market valuations. Hipgnosis, like its peers, uses a private market valuation process – and valuer – in an attempt to get some marks on the market valuation. But this still leaves me with an uneasy feeling. These private valuation marks could of course be accurate, but they are usually based on difficult to disclose transactions amongst a small handful of players, who presumably all know each other very well. Now, to be fair, private equity funds have similar problems in that valuations are frequently based on market marks using recent transactions which frequently involve fellow PE funds. But the number of players in PE is infinitely greater than music rights, so at least there is some safety in numbers – though I’m not entirely sure that will be much of a safety net in the next few months.

Anyway, back to Hipgnosis. I’ve always been impressed by the quality of the portfolio, though a little skittish about the high prices paid for well known music rights. I’ve also wondered aloud whether less well known catalogues might represent better value but over time I’ve come to accept that Hipgnosis does have a first class catalogue which is being ably augmented by a fast growing sync music rights business. Merck is basically rolling out an integrated music business without the risky A and R stuff which costs money – and that will of course have some value t the right buyer.

Another reason for my caution has been the constant issuance of new equity, which has helped build up the portfolio. I know plenty of shareholders who have pushed back against this constant market tapping and it seems like Merck and the board have listened and seem to have slowed down the pace of new issuance.

It’s also worth saying that a few recent deals point to corporate diversification, I realise that Merck’s deal with PE giant Blackstone ruffled some feathers but it does show he greater market traction and access to more firepower for bigger deals. He’s also just announced “plans to securitise 950 of the songs held within the Blackstone-backed Hipgnosis Songs Capital private fund via a bond issue. The songs are across five sub-catalogues, including those of Justin Timberlake, Nelly Furtado, and Leonard Cohen. The yet-to-be priced bonds have an anticipated repayment date of May 2027 and an advance rate of 65% (i.e., a principal balance of £222m versus an independent catalogue valuation of $341m)” according to Matt Hose at Jefferies. As Matt says, I think this is a big advance because it could help improve the debt position of the fund ($600m) “which is via a relatively expensive (L+325) credit facility maturing in 2025. “ One can know see a pathway to securitising large bits of the portfolio, which is another positive.

So, lets recap where we are. I have real concerns about valuations in the portfolio, but I think it has reached a critical mass in terms of scale. Recent trading has improved and the fund is obviously a net beneficiary of the rise of streaming – we have a strong BUY on Spotify. On a side note, Hipgnosis revealed that global streaming revenue grew by 24% in 2021 and the market is expected to reach $103bn by 2030, which would represent a 9% CAGR. Last but by no means least, new share issuance has slowed down and the fund has a way of improving its debt costs.

Crucially though, the share price has also been weak recently. By my calculations using the net operational net asset value, the fund is trading at a discount of around 25%, although data on the Numis funds research website shows a discount of closer to 8%. I prefer to use the bigger number and for me that discount is enough to assuage my concerns about valuations. I would not have been a buyer of the fund when it traded at a premium but everything has changed – the fund is at scale, with improving cashflows. A 25% discount strikes me as a reasonable margin of safety. In addition I think that during then next market upswing (23 or 24), Hipgnosis will be big enough and integrated enough to be attractive to a big media buyer.

Basic fund facts

|

Left field idea: Georgia Capital

My next, very alternative, very leftfield idea has a discount to net asset value that makes the Hipgnosis Songs fund look like a hugely overpriced stock. Georgia Capital invests in a combination of listed and private equity businesses in the former Soviet Union state of Georgia. It’s in effect a highly geared play on the fortunes of a small Caucasian state via an experienced private equity team, and currently trades a cavernous 60% discount to NAV.

The first obvious thought is – you must be mad, investing in a country which has been subject to previous Russian aggression? This was certainly in the minds of many investors immediately after the Ukrainian invasion when anything Russian related plummeted in value. But Russia’s slow progress on the battlefield – and in some cases retreat – has made many change their minds. Russia would certainly have trouble invading two countries at once and in reality, if Russia wanted to up the ante against the West, then Georgia is unlikely to be a target. In the meantime, Georgia is booming. According to fund researchers at Numis “real GDP has grown 10.5% y-o-y in H1, following 10.4% growth in 2021. Strong foreign demand throughout the year has been supplemented by substantial remittance inflows, with money transfers being up by 65% y-o-y in 1H22. Merchandise exports grew by 35% y-o-y in 1H22, and the tourism revenues reached 79% of 2019 levels in 1H22, including 92% in May-June 2022, reflecting the global resumption of travel. The Lari strengthened 11.6% over the quarter, 14.7% over H1 from 4.1791, and has since strengthened a further 7.4% to 3.3018 vs Sterling driven by growing demand for Georgian exports, robust remittance inflows, tight monetary policy and accelerated foreign currency lending, as well as the travel recovery and strong market confidence. Furthermore, the Georgia has seen the arrival of Russian, Belarusian and Ukrainian citizens since the onset of the war, many of which work in highly paid IT and software jobs.”

Given this strong domestic economy, you won’t be surprised to discover that Georgia Capital’s portfolio is looking very strong at the moment. The key sectors within the portfolio include shares in the UK listed Bank of Georgia comprising 17% of the portfolio, a pharmacist business 25% of the portfolio, as well as a hospitals business at18%, insurance at 9%, renewables 6.4%, and an finally education business at 5.6%. For the interim results (the six months to 30 June), net asset value per share was up 0.2% over the quarter in local currency terms, and up 14.4% in Sterling terms to 1,478p due to a strengthening of the Lari. This reflected a stabilisation following a 16.5% fall in NAV Q1 (in GEL) due to the impact of the Russia-Ukraine war on listed peer multiples and Bank of Georgia. So, in sum – this is a very left field suggestion whose share price is at a huge discount. The risks are very obvious and probably you don’t need me to labour them. But Georgia Capital does offer a diversified portfolio of high quality assets in a country that is fast pushing ahead in the development markets pack. A discount for both the country and the private equity portfolio is warranted but not 60%.

Big Theme: Uranium and Yellow Cake

The 2010s weren’t a good decade for uranium and nuclear industry stocks. A series of nasty surprises hit the whole sector for six: Germany’s decision to close plants, Japanese reactor meltdowns and the slow decline of nuclear power as a transition technology to a net zero world. Renewables were in, but expensive, always late nuclear power was out. Uranium oxide prices fell, sharpy in thinly traded spot markets, as more Russian and Kazakh product found its way on to the market.

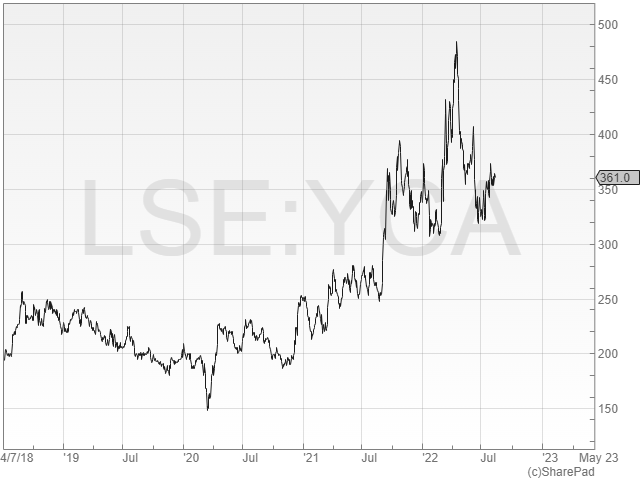

Over the last few years there’s been a remarkable turnaround. Suddenly nuclear power is back in fashion, best exemplified by the EU’s decision to include nuclear power as an essential energy source. The Japanese have stopped closing reactors and a host of developing countries – especially China – are building new power plants. Crucially not much new uranium mining output has come on line which means that as demand from power plant operators ramps up, it will run into supply problems, made worse by the dominance of Russian and Kazakh supplies. This switch in momentum can be seen clearly in the chart below – it shows the share price for Yellow Cake an AIM listed investment vehicle which owns physical uranium oxide supplies, stored in a Cameco safe place in Canada. It’s a pure play on the uranium price, unlike say miners or power station operators (with mixed energy portfolios). Many hedge funds have jumped into this thinly traded space and one advisory firm, Ocean Wall, reckons that the mismatch between increasing demand and constrained, secure supplies is so great that we are entering a multi year bull market – which they describe as the investment opportunity of the decade. I’m not sure I’d go that far but I think uranium and nuclear power has positive momentum and I’m a happy owner of Yellow Cake long term.

ETFs worth thinking about: WisdomTree S&P 500 VIX Short-Term Futures 2.25x Daily Leveraged (VILX) / 3x Short ARK Innovation (SARK $ ARKS GB)

My last set of fund ideas is centred on the exchange traded funds sector. More specifically I’m looking at two leveraged funds. These are products strictly for active investors on shorter time horizons (days, weeks or a few months). They take a benchmark like the Vix index which tracks volatility or an individual share, and then multiply up and down the returns. In both cases I’m suggesting a bearish trade. In the first case its related to the vix volatility index which tracks the ups and downs of the S&P 500 constituents. The product is from Wisdom Tree and is leveraged 2.5 times the value of the index (the Vix) on a daily basis. In very simplistic terms, if the Vix goes up 10% in a day, then the Wisdom Tree product will increase in value by 25% that day. The logic here should be obvious if you, like me, are still fairly bearish. Maybe you’ve seen the rally of recent weeks and think its another bear market bounce (the fifth by my counting). Or maybe you simply think investors have got ahead of themselves in reacting to a recession and will sell in September or October. In this case you might reasonably expect volatility to increase from the current 15-25 level (for the Vix) to something say above 30 for the Vix. The Wisdom Tree product would be an immediate beneficiary – thus it acts as a kind of hedge, producing gains in a more volatile market. But its important to say that those losses can magnify on the other side as well i.e markets continue to quieten down and this product loses value sharply. Crucially this is a trading product – do not sit tight for weeks on end as the daily volatility compounds over time and destroys the value of the product.

The Short ARK Innovation tracker is from Leverage Shares and is a short leveraged three times on the (in)famous US tech innovation ETF managed by Cathie Woods of Ark fame. Again, the play here is bearish. You might think (like I do) that the sell off in tech shares hasn’t quite hit the peak yet and you expect more selling to come. Thus, you think there will be growth stock sell offs and thus more tech stock sell offs. If that is the case, Cathie Woods basket of mid to small cap stocks will be especially vulnerable as they tend not to be as financially secure as the big FAANGs stocks. That means it might be reasonable to expect the sell off to be especially severe for stocks in Woods ARK innovation ETF. If that is the case, the Leverage Shares product will shoot up in value, with that three times leverage on the short side i.e a 10% daily fall in the value of ARKs Innovation ETF would produce a 30% gain in the Leverage Shares product. But, again, note my cautions – if you are wrong and tech stocks stabilise and carry on rallying, this product will be hit hard. And like the Wisdom Tree products, this is absolutely not a buy and hold investment.

David Stevenson

Got some thoughts on David’s Fund suggestions? Share these in the SharePad chat. Login to SharePad – select or search for the specific funds he mentions”– click on the chat icon in the top right – scroll down to the Current Share section and click on the specific fund chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.