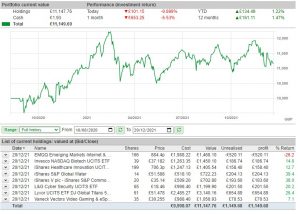

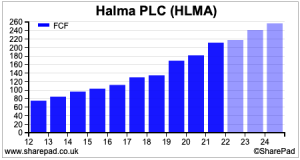

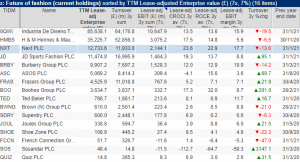

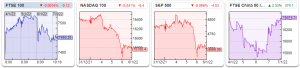

Bruce looks at how 3 ideas he crowded sourced from readers did in 2021, and asks for suggestions for 2022. Plus 4 companies that have been busy with corporate activity (acquisitions, approaches, disposals). The FTSE 100 was up +1% in the first week of 2022 at 7,450. Markets in the US were less positive […]