Our funds specialist returns form a summer break with a new addition to the Prudent 15. It’s a lending fund that has built up a solid track record and offers cautious, income-oriented investors a solid 8% plus yield.

My latest addition to the Prudent 15 is a slightly alternative income-oriented fund that has built up a solid track record of churning out a steady 8% plus yield. I have to also admit that although I think it will appeal to cautious, income-based investors, it has been involved in some controversy and debate in the past that might concern some.

Let’s deal with that last point first. The fund is called the Honeycomb Investment Trust and its core business is in lending out money to other corporates, in this case usually other non-bank lenders, who in turn lend out money to final borrowers. These might range from property developers through to electric vehicle suppliers using a subscription model.

That word lending might immediately cause some red lights to start flashing. Over the last few years we’ve seen a number of lending funds emerge, raising many hundreds of millions of pounds. Some were involved in peer-to-peer lending, others like Honeycomb in more mainstream lending. And in truth the track record of these funds has not been great. Losses from lending to the wrong sorts of businesses have accumulated and more than a few of the funds are being wound down. This should remind us of the old adage – its easy to lend money, but much more difficult to get that money back. Honeycomb has an excellent track record in this regard as we shall see.

Honeycomb’s managers, Pollen Street, is a respected mainstream outfit but they were involved in managing another lending fund which had originally been called P2P Global Investors. This was one of those P2P funds I mentioned that had its fair share of challenges. Pollen Street took it over and renamed it Pollen Street Secured Lending but after some pushing and shoving – and a few letters from the board – this fund changed name again, and is now called the Alternative Credit Investments and is under new management.

Last but by no means least, market observers such as yours truly had been a bit wary of Honeycomb IT, not because it was badly run – quite the opposite – but because at various points it traded at a sizeable premium to its NAV. That, I felt, was unsustainable but to be fair to Honeycomb, the premium was a reflection that it was popular with big institutions, and especially Mark Barnett over at Invesco Perpetual. Without wanting to dig up that particular story, Barnett (a Woodford protégé) has now moved on and Invesco have sold down their holdings. Subsequently that premium has vanished, turning into a discount.

So, as I think you can see, there have been some controversial moments that touch on Honeycomb, but throughout this the fund has maintained an excellent track record, as we’ll discuss. If you are after a solid income paying vehicle that should yield consistently above 8% then this is a potentially great home. It excels at doing one thing very well – lending to specialists to provide a secured income.

Fund Facts

- Ticker HONY

- Inception: 23 December 2015

- Management fee 1% plus 10% performance fee

- Honeycomb Investment Trust

- Mkt Cap £331m

- Net investment assets £620m

- Net debt to equity 71%

- Share price 940p

- Prem/(disc) -8.2%

- Div yield 8.5%

- NAV per share at 31 July 2021 – 1,024p,

- ~YTD NAV Return to July 5.05%

Recent numbers

One of the best ways of understanding the Honeycomb model is to look at recent performance. In simple terms, the Honeycomb model is easy to understand:

- It lends capital to other corporates

- The duration of these loans is largely in the 2 to 3 year range

- The underlying portfolio yield hovers around the 9 to 10% range before costs

- These loans are usually secured in some way and are also mostly senior which means there’s no other borrowers sitting above the loans in the corporate structure

- Losses from lending do happen and are called impairments. The trick to smart lending is to make sure that a) you minimise those losses and b) make sure that all your borrowers pay back on time

Recent numbers, post-pandemic (or at least the first few waves) show that Honeycomb is firing on all cylinders, despite worries that losses might shoot up because of the business closures of the last 18 months. Looking at numbers for the first half of 2020 the annualised impairment charge was 0.2%. According to house broker Liberum the vast “majority of the portfolio is either in structured facilities (borrower provides first loss equity) or loans with hard asset collateral, resulting in a low impairment charge.“ In 2020 that impairment charge was 1.0% (2019: 1.3%).

Crucially Honeycomb and its managers Pollen Street have been active in trading some of their assets. For instance, it recently sold off a bond portfolio at a small premium to book value. That was quite some achievement as those bonds included notes issued by Amigo, the struggling subprime lender. The portfolio had a book value of £22.1m and included Amigo senior secured bonds with a book value of £9.8m.

| Summary financials & valuation (£m) |

| Calendar year |

| Valuation (CY) | 20A | 21E | 22E | 23E |

| Prem/Disc (%) | (5.0) | (5.1) | (5.4) | (5.7) |

| Div Yield (%) | 8.3 | 8.3 | 8.3 | 8.3 |

| P/E (x) | 17.0 | 11.9 | 11.6 | 11.5 |

| Financial year (December year end) |

| Financials (FY) | 20A | 21E | 22E | 23E |

| FD EPS (p) | 56.5 | 80.6 | 83.2 | 84.1 |

| DPS (p) | 80.0 | 80.0 | 80.0 | 80.0 |

| NAV per share (p) | 1,013 | 1,014 | 1,017 | 1,021 |

| Tot Ret % (NAV + Divi) | 7.7 | 8.0 | 8.2 | 8.3 |

| Source: Liberum, Bloomberg |

| All numbers are on a post-IFRS 16 basis (e.g. net debt includes finance leases) |

The Portfolio

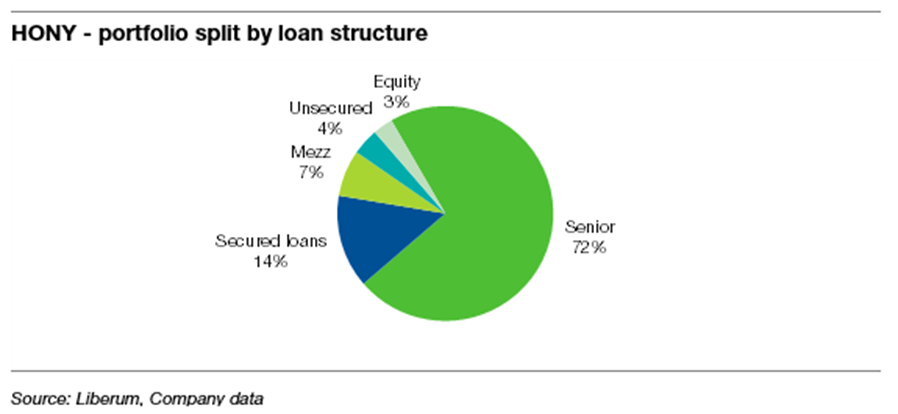

To understand the funds business model in a bit more detail, we have to dig around in these numbers to see what kind of loans sit inside the portfolio. The two charts below give us some idea of the funds lending structure – the first shows that over 70% of the loans are senior secured with only 4% unsecured. In simple terms being secured means there’s usually not only some equity sitting above the loan structure, but that there’s also asset backing for the loans which can be secured. Crucially the senior term means that there are no other loans sitting higher in the structure with more power over this security.

I’d also draw attention to various other features of the portfolio of loans:

- In terms of loan duration, 32% are under 12 months, 36% between 24 and 36 months, Only 8% over 60 months

- 44% of the portfolio loans are yielding between 7.5% and 10%

- In total there over 40 different investments/loans

- In aggregate terms the average duration of loans is 2 to 3 years

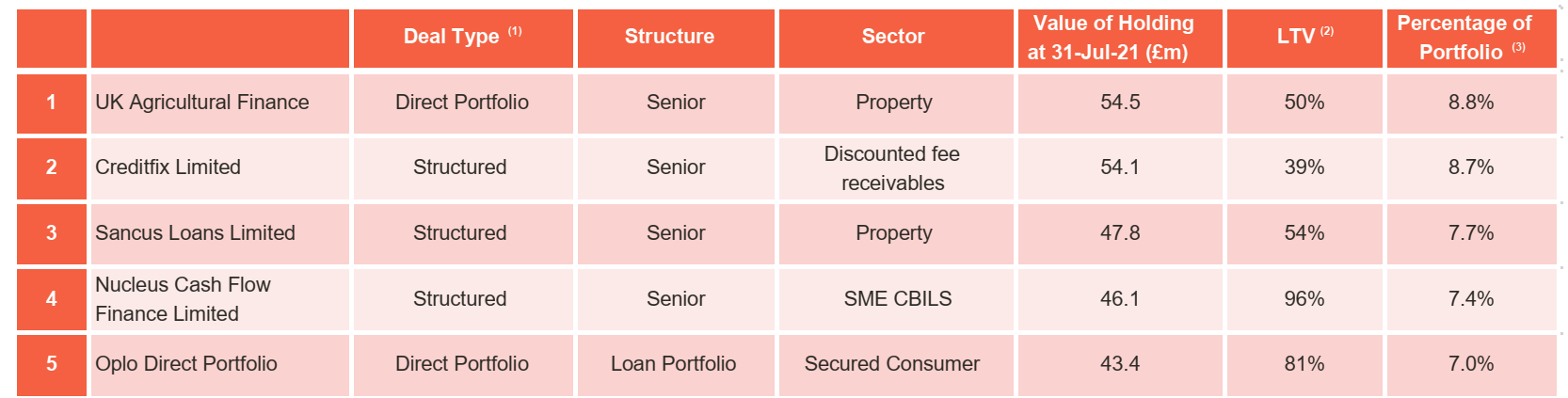

The table below from the July fact sheet highlights the top five individual loans. This reinforces the central point of the fund – it advances loans to other non-bank specialist lenders who in turn lend that money to the end borrower.

Top 5 holdings

There’s another key point to consider – if the average duration of the loans is 2 to 3 years, that means the fund could end up with a lot of cash unless the amortising (repaying) loans are replaced with a new pipeline of high-quality lenders. According to the funds managers the “pipeline of near-term opportunities is £1.2bn, mainly comprising structurally secured opportunities in SME lending (37%), property-backed loans (36%) and consumer (27%)”.

The last few fact sheets also give us some idea of who the fund has been lending to –

- A revolving credit facility with one of Europe’s largest small business lenders and the facility will enable the business to grow its UK loan offering.

- A £30m commitment made to a new credit vehicle run by the investment manager that is focused on asset-backed lending to non-bank lenders.

- The Company also participated in a senior asset-backed facility to the largest pure-play electric vehicle subscription business in Europe. The facility is directly secured on the fleet of electric vehicles and will fund growth in the number of cars to meet customer demand and drive increased access and adoption of electric vehicles across Europe.

It’s also worth mentioning one particular focus of the fund – lending into property market. Back in March the fund argued that there were significant opportunities in providing bridging and development loans to mid-size borrowers (loan sizes £5-25m), driven by falling supply and increased demand for housing since the 2008 financial crisis, with a growing funding gap.

According to a Numis fund analysts report from March “ the supply constraint is driven by declines in lending by traditional banks and building societies due to regulatory and capital requirements. Despite falling supply, demand for housing has continued to grow and the UK government projects 300,000 new homes per year are required. The manager believes the liquidity shortfall is particularly evident in the mid-size lending space as the cost and expertise required to underwrite more granular loans within a bank or building society no longer fits their business models. This market gap has been successfully addressed by non-bank lenders, as product specialists with expert underwriting models and efficient cost structures that enable healthy returns in the market, while mitigating downside risks through underwriting processes and prudent loan-to value ratios”.

That highlighted section above in bold is I think a succinct overview of how Honeycomb makes money. Sure, the big high street banks are flush with central bank money (much of it not far off free) but they are also still very conservative. You might think that it’s easy to find cheap money at sub 5% levels as a borrower but in reality there are plenty of niches where decent borrowers are still forced to pay between 5% and 10% per annum. That’s the space that Honeycomb operates in.

Performance

The test of this strategy is not whether it ‘makes sense’ but whether it has actually delivered the promised returns to investors. On this record, most of Honeycomb’s peers have failed miserably – not so this fund.

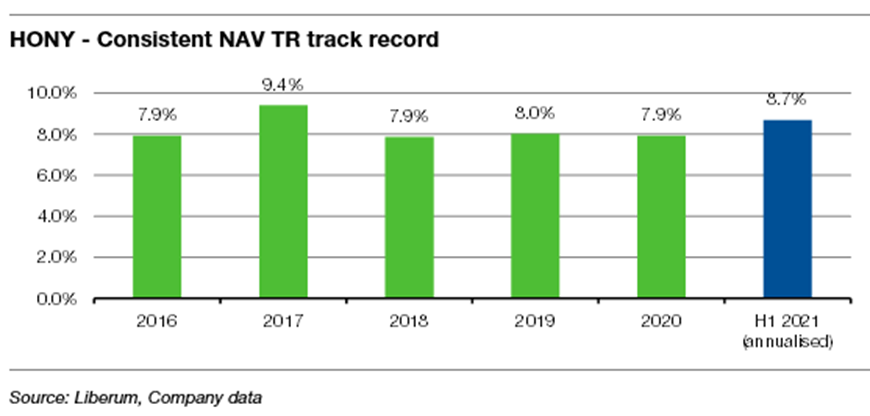

HONY has generated a consistent 8% NAV return for over five years – in fact since IPO in 2015 the fund has delivered an annualised net asset value total return (including dividends and allowing for impairments) of 8.2% per annum. We can see this pattern of solid, even boring returns in the most recent monthly numbers – in July the fund produced a net asset value return of 0.72% in the month (8.4% annualised). The annualised risk-adjusted yield from the portfolio in the month was 9.4% net of impairments.

Bottom Line

Currently Honeycomb trades on an 8% discount to NAV (3.9% average premium since IPO) and boasts a prospective 8.3% dividend yield, which analysts at Liberum expect to be fully covered in 2021.

The fund is most certainly not without its risks. We could have another slowdown – or market crash – at which point impairments could spike up, clobbering the portfolio yield. But Honeycomb has been through a savage recession and emerged almost unscathed which is a testament to its solid under writing approach. I think its entirely possible that in a big slow down the discount could rise above 10% but its also possible that the discount could close towards par. Whatever happens, I think there’s a decent chance that it will keep churning out a solid 8% plus return, based on a solid, secured portfolio of loans. In a world of next to zero interest rates, that’s not a bad investment proposition for a cautious investor.

David Stevenson

Liberum (house brokers) view

July’s strong update brings the YTD NAV return to 5.1% and the company remains on track to exceed NAV returns in recent years. The monthly portfolio return net of impairments has been consistently above 9% in 2021. Over half of Honeycomb’s portfolio is comprised of debt provided to non-bank lenders. These loans are primarily senior and secured on portfolios of small balance loans. We believe the company’s defensive portfolio of asset-backed loans to non-bank lenders provides scope to earn enhanced returns and retain underwriting control. We regard the 8.5% dividend yield as highly attractive given the consistent track record and the level of protection within the loan structures.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.