Our funds expert embraces his inner bear, focusing on a long-established and successful Russian investment fund. For those worried about the fragile US monetary order, or wanting to play the upside in energy prices, Russia is a great starting point. And valuations are cheap.

Before we delve a little deeper into our new fund for the Dynamic 35, let’s front up the obvious challenges. Russia is not everyone’s cup of tea. Its political elite leaves much to be desired – based on Western liberal standards – and its military likes to make frequent threatening noises in the direction of the Baltic states. Corruption is a big problem, which is probably the understatement of the century. And overall corporate governance amongst mega large cap Russian stocks is ‘challenging’ to say the least. But I also suspect that there is a whiff of double standards.

All of these worries – and many more – can be directed at China and yet the West has been happy to steer countless hundreds of billions into the land of the Chinese Communist Party. At least Russia’s elite doesn’t try and fool anyone with all the talk of socialism and common prosperity. There’s also a distinct ESG undertow. Now that we are all ESG investors (!?), Russia looks a bit ‘old world’, legacy, dated with its huge energy complex.

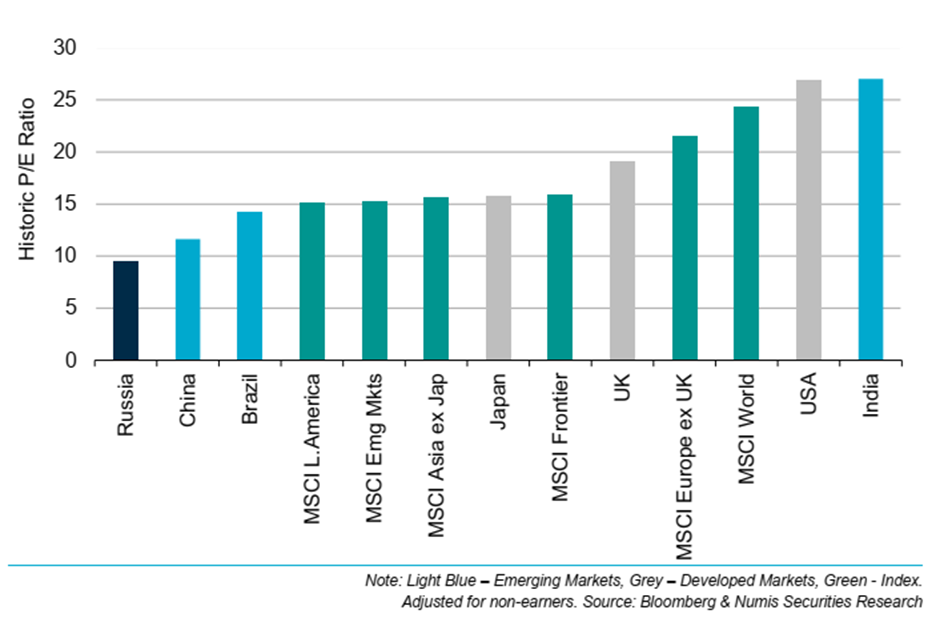

Whatever the reasons for Russia’s dog house status, the net effect is that Russian shares are cheap. Here’s some basic statistics. One of the main indices tracking local Russian equities is called the FTSE Russia which currently trades at an average of 8.04 times earnings, and a price to book ratio of 1.10. Another major index is called the MSCI Russia index which also boasts some impressive fundamentals: the dividend yield is 4.47%, the average price to earnings ratio or PE is 9.31, the forward PE ratio is6.79 and the price to book value 1.22. The chart below is a little more dated and comes from earlier this summer, and is from a fund analyst at Numis. The point probably doesn’t need repeating – by virtually any measure Russian equities are dirt cheap.

That might make sense if the biggest industry – resource extraction via the energy complex and mining – was in the doldrums. But it isn’t. In fact, I think oil prices may well rise even further, pushing past $100 a barrel. The Russian government budget is based on an oil price of $42 per barrel and current prices of $70plus per barrel will benefit the budget and the government’s ability to spend to support investment projects. As for those natural gas exports, President Putin has said that Russia could increase gas exports to Europe by 10% as soon as it gets regulatory approval, as the first Nord Stream 2 gas pipeline ‘is filled with gas’. You can almost hear the gasps of delight amongst German politicians that President Biden won’t turn them into enemy number one for building that wretched pipeline!

So, in my view, Russia ticks two obvious boxes: its local equities are dirt cheap and there’s a real prospect of earnings growth as energy prices head higher. There’s also another potential plus: Russia could be a beneficiary if there is a risk of global financial disorder as America’s dominance begins to fade.

Russia is a prime example of a financial system that has decided to partially insulate itself from the US monetary order. It’s also an economy already facing up to a sudden inflationary surge. That in turn has turned its central bank into something of a paragon of hawkishness. Recently, for example, the Central Bank of Russia (CBR) has hiked its policy rate by more than expected as Governor Elvira Nabiullina prioritises anchoring inflation expectations. To be precise, the CBR has hiked its policy rate by 75bps to 7.5% (the consensus had been 25bps) and said further rate hikes are possible over the next meetings. The hawkish stance was justified by higher-than-expected inflation as expectations for end of 2022 remained at 4.0% – 4.5% (slightly above the 4.0% target). That in turn has helped to produce a strong performance across Russian assets.

The long-term perspective is important though. Russia’s banks aren’t locked into the US-led monetary order, with the Russians even developing their own surprisingly durable fintech leading edge. The CBR doesn’t hold lots of US dollars or Treasuries and the Russian government is a paragon of virtue when it comes to fiscal austerity (though that of course has a real impact on poorer citizens). So, let’s add this up: a vital source of strategic energy assets plus other assorted mining projects including lashings of battery-friendly nickel; a central bank that is not deeply mired in quantitative easing and is already on the front foot as regards inflationary pressures; a government that doesn’t seem to be that bothered about populism.

To this cynical observer – who thinks that the Russian political elite is shamelessly ignoring their own citizens and deliberately encouraging geopolitical mischief – this looks like a much better alternative to western money fiat, with a hard currency and plenty of reserves at the central bank. Add in that state-dominated, large cap energy bias – which helps explain why large cap funds do better than small cap trackers – and I think you have the makings of a perfect post QE equity diversifier.

Fund details

- JP Morgan Russian Securities

- Share price 878p

- NAV per share 974p

- Discount 10%

- Market cap £359

- Yield 4%

- Management fee 1%

- Manager Oleg Biryulyov, who has managed the fund since 2002

Buyback policy: buyback programme for at least 6% of share capital pa, and a performance-triggered tender offer for up to 20% of share capital at a 2% discount, if the NAV total return is behind the RTS Index over the five years to 31 October 2021

Fund Performance

Given how unpopular Russian equities are amongst most global investors and those dirt-cheap valuations, you might assume that Russian equities have been a dog in terms of returns. In some respects it has: over the last ten years, Russia has underperformed Emerging Markets, although extremely strong returns in 2016 (+91%) and 2019 (+51%) means it has outperformed over the last five years. Look at the box below which shows returns not only for the fund but also for a widely used index benchmark from MSCI.

Two points stand out. The first is that Russian equities overall have produced more than decent returns – the challenge has been that other markets such as China and India have produced even better returns. The second point is that the fund in question, the JPMorgan Russian Equities fund has consistently outperformed that index. That’s not entirely surprising as the emerging markets team at JPMorgan is world class and boasts a fantastic track record in this specialist asset class.

|

Fund/index |

6mths |

1 year |

3 year |

5 year |

10 year |

|

JPMorgan Russian |

37.4 |

59.2 |

100.2 |

143.2 |

154.4 |

|

MSCI Russia 10/40 |

27 |

50.4 |

70.3 |

92.8 |

111 |

What’s inside the Portfolio

The JPMorgan portfolio contains some fairly well-known names, including energy giants Gazprom and Lukoil plus major banks like Sberbank. The table below shows the top ten holdings. It’s important to say that in terms of sector allocations, the fund is very concentrated; c.80% of the fund is in Energy, Materials and Financials.

Top ten holdings

|

Sberbank of Russia PJSC Participating Preferred |

12.2 | |||

|

Gazprom PJSC ADR |

10.3 | |||

|

Gazprom PJSC |

7.8 | |||

|

LUKOIL PJSC ADR |

6.5 | |||

|

NOVATEK PJSC DR |

6.2 | |||

|

Mining and Metallurgical Company NORILSK NICKEL PJ |

4.9 | |||

|

X5 Retail Group NV GDR |

4 | |||

|

PJSC Lukoil |

3.9 | |||

|

Yandex NV Shs Class-A- |

3.4 | |||

|

EPAM Systems Inc |

3.3 |

Currently, the biggest single holding within the fund is Gazprom, which is the largest listed gas producer in the world, with 30% market share in Europe, and a growing market share in Asia. This energy behemoth has been a favourite with many value investors for its lowly ratings but until recently this fund had tended to steer clear of the company. That’s changed in recent years as the business delivers on a number of huge projects such as the controversial Nord Stream 2 gas pipeline running from Russia to Europe across the Baltic Sea. Crucially Gazprom is expected to continue to improve cash generation in 2021, which will help reduce debt and support a dividend payout of 40%, and 50% in 2022.

The next biggest holding is probably a little more unfamiliar – Sberbank is the largest player in the Russian banking sector. It’s also one of the most technologically sophisticated outfits which also boasts fast-growing asset management and insurance arms. Currently Sberbank is invested in a huge range of businesses, including fast-growing businesses in food delivery, taxis, real estate and payment systems, and it has aspirations to generate half of its revenues from these non-banking activities by 2030.

Lukoil Is the only fully private oil company in Russia and is the managers’ preferred play in the sector. They believe Lukoil is a best-in-class operator with a robust management team focused on delivering long-term shareholder returns.

The next table below shows the sector holdings.

|

SECTORS (%) |

|

Energy 51.2 +8.3 |

|

Financials 22.2 +1.0 |

|

Materials 10.1 -6.2 |

|

Communication Services 6.2 -4.6 |

|

Consumer Staples 3.8 +0.6 |

|

Information Technology 2.9 +2.9 |

|

Consumer Discretionary 2.5 -0.4 |

|

Utilities 1.0 -0.4 |

|

Health Care 0.9 +0.9 |

|

Industrials 0.1 -1.0 |

|

Real Estate 0.0 -0.2 |

|

Cash -0.9 |

There are two additional points worth making about the portfolio. The first is that it is overwhelmingly mega large cap-based, with very little, small cap bias. Traditionally small caps have tended to outperform large caps over the long term, but paradoxically in countries such as Russia where government influence is strong, large caps frequently have an easier time dodging intrusive government intervention whilst smaller companies can find themselves the victims of bureaucratic wrangling.

The other observation is that although the fund is called a Russian Securities fund it can also hold up to 10% of its value in companies operating in former Soviet Republics. Currently, on this score, the manager favours Kazakh financials Halyk Bank, and Kaspi.kz

Bottom Line: risks and rewards

This JP Morgan fund has traditionally benefitted from being the only listed fund that exclusively focuses on Russian equities. As we’ll discuss shortly, that brings with it its own challenges, but competition has been negligible. That’s changed over the last few years as more exchange traded funds or ETFs have launched. These tend to offer lower charges than this actively managed fund, but those savings have come with a cost – by and large the passively managed funds have underperformed the active fund managers, partly because they use slightly complicated indices as a benchmark for tracking. Our preference is for actively managed funds in most emerging market geographies, and that’s especially true with Russia where there are many challenges.

Those ‘challenges’ of course speak to the obvious risks. Russian equities can be volatile. Politics of course gets in the way. Think Crimea and the wave of sanctions. The Russian state also has outsize influence over businesses such as Gazprom which is in effect a partly state-owned entity that funds a long list of non-core projects dictated by the kremlin (which is also the case in China, by the way). I think we can also safely predict who Gazprom would put first in their list of priorities if something went wrong: the Russian state or foreign shareholders? And of course, the Russian state itself presents all manner of challenges at the operational level, with various arms of the government sometimes acting independently of each other as they carry out various investigations. We’re also gliding over the very obvious human rights and corruption issues.

We should also be aware that there’s an even more obvious risk – plunging oil and gas prices as the energy transition looms. Russia is doing very well at the moment because energy prices are shooting up. That could change very easily and if one were an ESG oriented investor, one could argue that Russia is one giant, nation-sized ESG challenge.

So, yes Russian shares can be volatile, risky and of questionable ESG value. But Russian businesses can also be well run, focus on cash flows, invest for growth and distribute generous dividends to shareholders, including the Russian stage. And many of these ‘challenges’ also apply across the board in other emerging market geographies, and especially China.

This JPMorgan fund is, we think, the best way into Russia, an economy that has many strengths (and weaknesses) and is still undervalued by Western standards. The future can be guaranteed to be volatile but we think there is even more upside for this fund as the Russian state starts to invest more in the country and energy prices continue to increase.

David Stevenson

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Why not include the ticker at the start of the article?