Our funds specialist returns with a star performer in the relatively unloved European equities space: Montanaro European Smaller Companies Trust. He reckons now is the time to focus on fast growing European small caps.

This week I have a relatively short note for you, outlining why I think now might be an interesting moment to invest in European small caps outside the UK. Before we get to this very specialist and frankly under researched space, lets first retrace our steps.

Why small caps? My hunch – and it is only that – is that we are at the first or maybe second stage of multi year equity bull market which might continue for much further than everyone thinks. I think the next few months may be a bit choppy but I’d much rather be 100% equities than any other asset class.

If you agree with this medium to long term bullish prognosis then small caps tend to be a smart place to be. They tend to outperform as an economic upswing intensifies and investors look for diversification. You’d also logically expect these small caps to be able to grow faster than very large caps. Globally I’d be bullish for funds such as Edinburgh Worldwide and the Smithson Trust.

Why Europe? Very simply Europe is under owned relative to the US and European small cap is much more under owned relative to the US. That used to be because there were many more fast growing small caps listed in the US but over time that has changed. Markets such as the Swedish exchange, Switzerland and Germany now have many fast growing small caps, many of which are in the more exciting IT and healthcare space.

This underlines a key point. Over the last decade European growth sectors have expanded greatly at the expense of more traditional, boring, value sectors such as financial services. Europe is now a go-to geography for fast growth venture capitalists as well.

Why excludes the UK? Another of my hunches is that most UK investors are already heavily exposed to the UK and especially to UK small caps and thus they probably don’t need any extra exposure to the local market. I would guess that they are highly unlikely to be over exposed to European small caps.

Lastly why now, this particular moment? In summary, earnings are rebounding very strongly in Europe. But don’t just take my words for it. The very latest report by European equity analysts at investment bank Morgan Stanley looks at the European equity reporting season which is now upon us.

And those numbers show that Europe is back in business. The MS team report that:

“….2Q21 results are on track to deliver another beat…. European earnings season has started strongly with 53% of companies beating EPS estimates, meanwhile 20% have missed, giving a net beat of 33% of companies. As we expected, this net beat is less broad than the record beat posted in 1Q21 when positive EPS revisions hit an all-time high in Europe.”

“…with European Earnings coming in ahead of expectations again.2Q results are coming in well ahead of expectations with weighted EPS currently beating consensus by 17%. Since these are still early days, it’s arguably more relevant to focus on the median stock level, where results have so far beaten on Sales and Earnings by a healthy 2% and 6%, respectively.”

In simple terms, European equities have momentum behind them in terms of earnings growth. If that is true and persists then one might reasonably expect European small caps to outperform.

Which brings me to the latest addition to my Dynamic 35 list of funds: the Montanaro European Smaller Companies Trust.

Basic details about the fund are in the box below.

Montanaro European Smaller Companies Trust: Fund basics

Ticker : MTE

Fund manager : George Cooke

Benchmark : MSCI Europe Small Cap exc UK

Gross assets: £314m

Number of holdings : 56

Media market cap £3.3bn

Benchmark Index : MSCI Europe Small Cap exc Uk : The MSCI Europe ex UK Small Cap Index captures small cap representation across 14 Developed Markets (DM) countries in Europe, with 759 constituents. Country weights: Sweden 19.6%, Germany 14%, Switzerland 13.5%. Sector weights: Industrials 27%, Financials 12%, Real Estate 10%, healthcare 9.68%, IT 9.3%

Before we drill down into the fund, let’s first make a few observations.

In terms of performance the big table below from Sharepad, shows what I think is a consistent pattern of outperformance by the fund versus its peers in both investment trust land and amongst ETF benchmarks. The Montanaro fund hasn’t outperformed over every period, but it has done over most. That record helps explain why its discount is the lowest in the investment trust peer group.

| Name | Price | TIDM | % change | |||||

| 1 mth | 6 mth | 1 yr | 2 yr | 3 yr | 5 yr | |||

| JPMorgan European Discovery Trust PLC | 507.5p | JEDT | 4.21 | 11.8 | 36.1 | 35.3 | 26.1 | 72.8 |

| Montanaro European Smaller Companies Trust PLC | 1940p | MTE | 13.1 | 22.8 | 48.7 | 78 | 114 | 224 |

| TR European Growth Trust PLC | 1447.5p | TRG | -3.5 | 15.8 | 60.1 | 61.4 | 42.3 | 114 |

| European Assets Trust NV | 138.5p | EAT | 1.47 | 18.4 | 40 | 27.1 | 16.6 | 33.8 |

| ETFs | ||||||||

| iShares MSCI EMU Small Cap UCITS ETF | 23205p | CES1 | 0.498 | 13.5 | 33.6 | 26.9 | 26 | 78.8 |

| X-trackers X MSCI Europe Small Cap | 5186p | XXSC | 2.09 | 15.1 | 35.7 | 31.5 | 27.9 | 77.2 |

| Name | Market Cap. | Prem/Disc | Volatility (20) | Yield | 3yr Sharpe | Beta | %chg 21/2/20 to 23/3/20 | |

| to NAV % | ratio | |||||||

| JPMorgan European Discovery Trust PLC | £809.30 | -15.21 | 0.836 | 1.3 | 0.51 | 1.11 | -43.7 | |

| Montanaro European Smaller Companies Trust PLC | £337.50 | 0.79 | 0.667 | 0.1 | 1.08 | 0.92 | -40.6 | |

| TR European Growth Trust PLC | £725.30 | -11.94 | 1.31 | 1.5 | 0.7 | 1.28 | -42.1 | |

| European Assets Trust NV | £498.70 | -5.5 | 1.08 | 0.71 | 0.97 | -35.3 | ||

| ETFs | ||||||||

| iShares MSCI EMU Small Cap UCITS ETF | 0.869 | 0.47 | 1 | -29.3 | ||||

| X-trackers X MSCI Europe Small Cap | 0.818 | 0.48 | 1.01 | -34.2 | ||||

One possible explanation for this outperformance is that the fund management group behind the trust (Montanaro) is a specialist in smaller cap UK and European equities. That’s all it does. It’s focused and has a clear philosophy of buying high quality, higher than average growth rate stocks, but at sensible prices. I suppose one could call it growth at a reasonable price although there is a strong growth bias towards the stocks its fund managers pick.

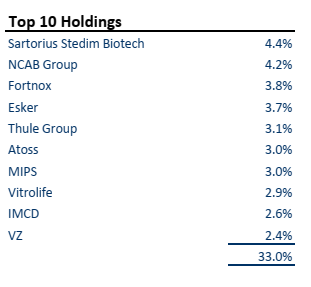

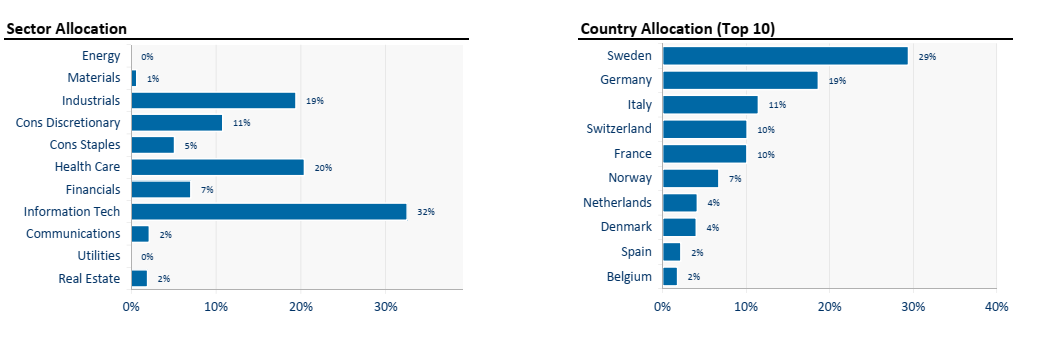

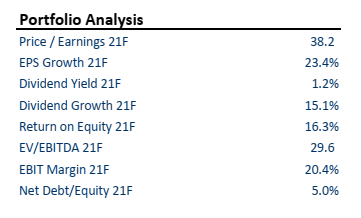

We can see that clearly in the current composition of the portfolio. The next couple of boxes are taken form the end June fact sheet for the fund. The average price to earnings ratio, PE ratio, for the fund is 38 which is above the average but insanely so. But forecast EPS growth is running at 23%.

If we look at the sector composition, the fund is clearly overweight; it stocks at 32% of the portfolio and healthcare at 20%. In terms of country mix, Sweden and Germany dominate the holdings at just under 50%, followed by Italy. Top holding is one of my favourite biotech businesses, German based outfit Sartorius.

Risks and Rewards?

The last table above reminds us that the small caps in this portfolio are highly priced, with an average forecast PE ratio for 21 of 38.2. As I have already said, that is not cheap. And that should also alert you to an obvious risk.

This is a small cap fund investing in less mainstream geographies (Sweden and Switzerland), with a more growth sector portfolio composition. That means that if these kinds of stocks fall out of favour, this portfolio could underperform say a bog standard, value oriented European large cap portfolio.

Now I don’t think that will happen because the growth in earnings is likely to be fastest in smaller cap, growth sectors vs Euro large cap cyclicals, but it could happen. I’d also have to admit that the peers of this fund – outfits such as TR European Growth Trust and European Assets Trust – have larger discounts and are thus objectively cheaper.

But I think Montanaro’s track record speaks for itself – and justifies the smaller discount – and I think the kinds of stocks the fund is invested in, are the right kind of stocks for this part of the cycle.

David Stevenson

Do you think MTE belongs on the Dynamic 35 list? We’d love to hear from you in the comments section below

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.