Richard slims down his flabby SharePad setup to start the year with a lean, clean investing machine. He sets out his goals for 2022 and says thank you to Phil Oakley, who hung up his boots in December.

It is that time of year when many of us eat and drink too much and then vow to join a gym, take up jogging or just stop eating three mince pies a day, and get fit again.

A lean, clean, investing machine

In investing terms, I also invoke a keep fit routine. Unlike many traders, mine does not involve an annual performance review, because performance over a single year is not significant in the career of a long-term investor. I do review the prospects of every single share I own once a year, but that happens when each company publishes its annual report.

My annual keep fit routine relates to my investing process, rather than the outcomes. Over the course of the year I make many innovations, new filters, new settings, new layouts. Some of them are useful and stick, but my SharePad interface is also cluttered by experiments that seemed like a good idea and have not stood the test of time.

I delete the failed filters and seldom used settings so I can start the New Year with a lean, clean, investing machine and, having buffed it up, I can share it with you.

Putting the long-term back into SharePad

Having switched from a five window layout back to a default two window layout two years ago I have flipped again and am now using a three window layout. The innovation has stuck because I was missing the long-term view.

Typically, I use SharePad two ways. I spacebar my way through lists of shares (usually my portfolios and watchlists) reading the news in the right hand pane, or I spacebar my way through the whole market sorted by the date each company last published its annual report and read the single page summary in the right hand pane. The former is my principal way of keeping tabs on companies I own. The latter is my principal way of discovering new shares.

While the single page summary contains four years of data, I am always hankering for more. I want to see how a company has performed in the past: to understand whether it is cyclical (profits vary strongly with economic fluctuations) or whether it has suffered self-inflicted injuries before.

Either way, the starting point is to find out when it performed poorly. Then we can read the results and stockmarket announcements from that time and get a feel for what happened. The final stage, of course, is to figure out how likely it is to happen again.

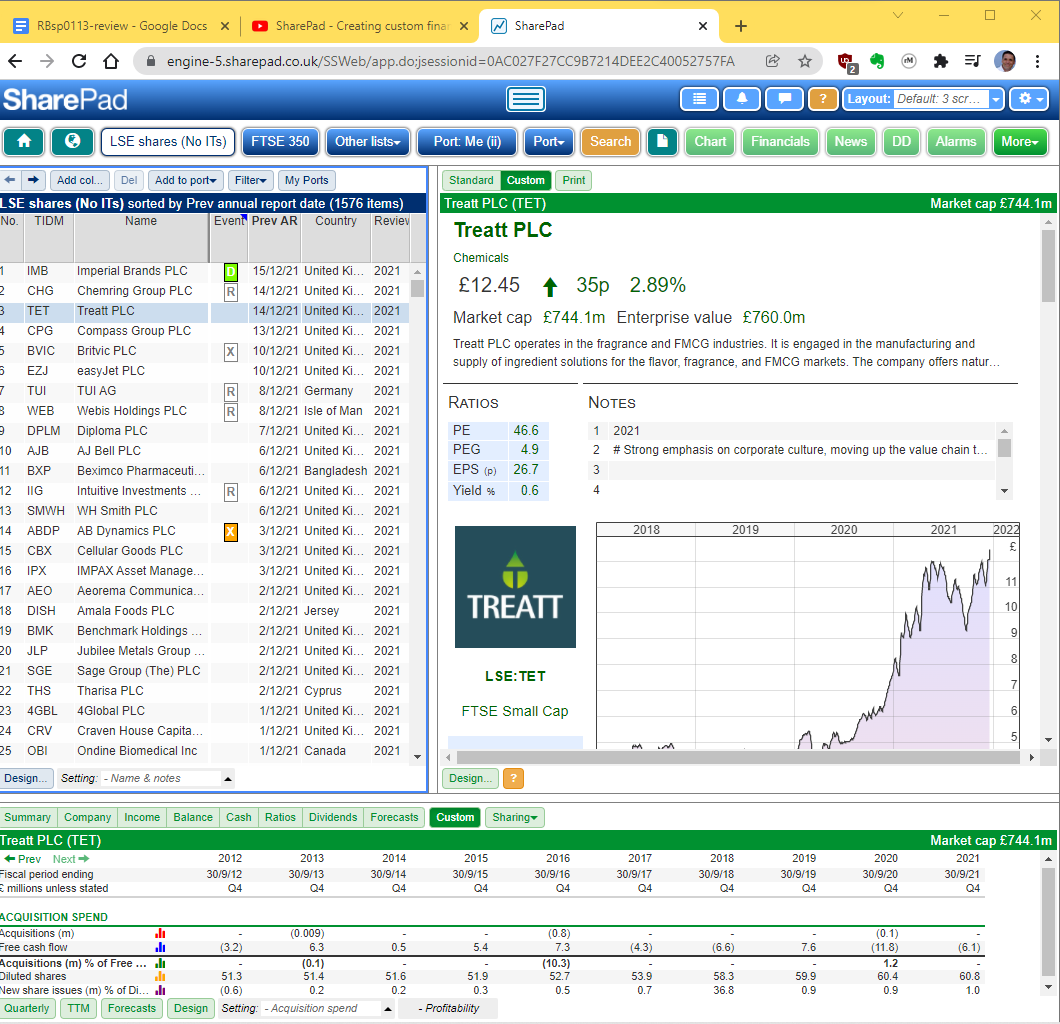

My solution is a third window that snakes along the bottom of the screen containing custom tables of data (this YouTube video explains how to make custom tables):

SharePad three window layout showing a list of shares (lhs), the single page summary (rhs) and profitability ratios going back many years (bottom). Click on the image for a larger version.

Custom tables can be toggled in the settings box beneath them. Each one only has a few rows so the bottom window only takes up a small amount of the screen when my browser window is maximised. Here are two I use heavily (i.e. all the time):

Acquisition spend: Shows acquisitions (m) and Free cash flow. I like businesses that spend less on acquisitions each year than they earn in free cash flow. This is a sign a business is self-sustaining and does not need to raise money from shareholders or borrow to grow. A third row calculates acquisitions (m) as a percentage of Free cash flow.

Profitability: This table shows EBIT margin and Capital turnover, which are the components of Return on Capital Employed as explained in this article on DuPont analysis. I look for businesses that earn a ROCE of more than 10% in most years. Occasionally they can dip under this value, but I must understand why, and be confident it will not happen often in future.

I also use tables examining Cash Return on Capital Invested (CROCI), Net obligations (cash, borrowing and the pension deficit) and percentage growth in revenue, profit and cashflow.

I think this innovation is a keeper. Maybe it will last as long as one of my oldest: The Irrelevant news filter, which screens out all routine news announcements I do not read.

Putting my money where my mouth is

I investigated and wrote up many businesses in 2022 (you can browse the back catalogue here), but only invested in one, the giant everything store that is Bunzl, a distributor of consumables like packaging and toilet paper, used by businesses and other large organisations. Size can sometimes breed complexity, which is anathema to me, but Bunzl shows that big businesses can be suitable for simple minded investors!

I admired Bunzl’s straightforward acquire, improve, repeat roll-up strategy, and felt it could continue growing by funding the acquisition of smaller distributors from its own profits for at least another ten years. The bigger it gets, the more buying power it has, and the more efficiently it can supply customers around the globe. Because the products it sells are simple commodities, the company does not have to become more complex as it grows. It is instead, doing more of the same thing.

New Year challenge

A reader, Chris, has set me a challenge for the New Year: to write a “detailed article on filtering”.

Chris writes:

“The extent of the financial and technical filters that you can build into Sharepad is mind-boggling. I find if I design a filter including a number of metrics such as PEG, ROCE, free cash flow, gearing, earnings yield et cetera you can easily get 10 or 12 criteria which when applied lead to a nil selection!

I would be very interested to hear your thoughts on the hierarchy and importance of some of these criteria so that one ends up with a meaningful selection of shares to research.”

I too have experienced the disappointment of elaborate filters returning no results. A simple list of all the filter criteria available in SharePad would fill an article by itself though, and since I only use a very small subset a detailed article is beyond me (given enough time and research it might be a book!)

SharePad has a number of tutorials on filtering on this page, though, and I should have something to say about the second part of Chris’ request: thoughts on the hierarchy and importance of criteria, at least from my long-term perspective.

Your correspondence has, as always, inspired and amused me. One of my favourites this year came not by email but as a comment on an article. Rusty was not at all interested in DFS, the sofa maker and retailer I had written about, he asked who made the boots I was wearing in the photo I had used to illustrate it. Much as I like the sofa, the boots are my pride and joy.

Beyond writing some common sense guidance on filtering, my goals for the new year are straightforward. I hope to get to know more companies, and tell you about how they make money, how they plan to make more, and what could stop them.

A leaving speech for Phil

Phil Oakley, formerly of this parish, retired from investment writing in December. Phil is a friend of mine, and in what can sometimes be a lonely job, he has been a colleague too. He recommended me to Ionic when it recruited me as a writer, and I think there is nobody better at rendering financial analysis intelligible to investors. He has also been prolific. Thankfully, he wrote the book on picking quality shares and a ton of material for SharePad users, so we can still turn to him when we need to.

Judging by his newsletters John Hughman, Phil’s partner in the investment site Invest-ability, is great company but there is only one of him so I guess Phil did not get much of a leaving do. To mark this moment, then, I thought I would contribute this little speech at the end of my article to thank Phil for educating me and wish him all the best.

We are planning to meet up for a coffee in January, and if like me, you appreciated his work and would like me to pass on a message, my email address, as always is at the bottom of my article.

Happy New Year!

Richard Beddard

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Hi Richard, I would like to take you up on you kind offer to allow me to send a message to Phil Oakley. I have followed Phil from his days at Sharepad and a visit he made to our Signet group in Waterloo to talk about Sharepad. Phil started his company analysis career in the 1990s with a clear and precise style of fact based analysis. It could be described as dynamic quality. It challenged the boundary of knowledge and moved the evolution of knowledge a step. This boundary of knowledge has embraced the change and has advanced to a new static quality boundary. I wish you well, Phil, with all future endeavours.

Colin Farrier

Thanks Colin, I will certainly pass on your message! Happy New Year.

Always interesting and informative. Thank you for educating me too.

Thanks Linda, I will make sure Phil gets this.

Richard, I would indeed like to leave a message for Phil – I have always enjoyed and appreciated your writings Phil – your talents are rare, as you have a knack for analysing and drilling down not only into the financial guts of a business, but also for describing a much broader assessment of the likely prospects for the business. Your articles have taught me a lot, and it says a lot for you that your book is the only investment book that I’ve ever bought! You will be missed and I wish you the very best for the future.

Thanks Steve, much appreciated – I will pass on your message – and wow! The only investment book you’ve ever bought, that’s impressive: an endorsement of Phil’s book and your self reliance.

Appreciation of Phil

I have only been a serious investor for a couple of years but from the start i was always interested in what Phil had to say, particularly with regards the search for quality companies for the longer term. I have followed his sagely views via SharePad, Investors Chronicle and Invest-ability always with great anticipation and for me the spirit of Phil will live on; and hopefully keep my investing on the right track. Thank you so much.

Thanks Stewart, I’ll pass your message along.

thank you Richard for the opportunity

I owe Phil and his SharePad articles, then book, then more articles in IC getting my path started into financial freedom years ago. His knowledge and his ability to simplify the complex into words are outstanding and have always been (and will be) in my journey. In my investment decisions, I ask myself … how would Phil face this? Hope everything is ok with Phil and all the best in the future. Looking very much forward to continuing to learn from him.

“How would Phil face this” – love that. Thanks Jordi I will forward your words

Phil leaves a void at Sharescope. But, his wisdom will be shared via his podcast, no doubt.

All the best.

Elric

Hi Richard,

Yes, it’s a shame to see Phil heading off towards the great investment sunset. It would be good to have him around for a few more years/decades, so perhaps he’ll consider a return with shorter-form articles or a less demanding schedule?

Happy new year,

John

Thanks John. Maybe!

Phil, thanks for educating me on investing. i have read your book and many articles from different sources. You are the main man for common sense and practical investing

Thanks Tony.

Hello Richard,

Please give my best wishes to Phil Oakley, for my money the best analyst writer who will be sorely missed by the investment community.

Good job we’ve still got you to hold the fort.

Best wishes,

Dave Moore

Very kind. I’ll pass on your message Dave.

All the best,

Richard.

Very kind. I’ll pass on your message Dave.

All the best,

Richard.

Hi Richard,

Phil was probably the first investment writer I followed in any detail. I think the reason for that is the clarity of his writing – clearly someone who knows is subject but also someone who thinks about how to articulate it in a way that appeals to all abilities. I too purchased his book and I’m sure I’ll be reading and re-reading it for years to come.

Thank you Phil for educating us PI’s and giving us the confidence to invest on the basis of analysis rather than hunches. You will be sorely missed

All the best

Ian

Thanks Ian

Thank you Richard. All the best for 2022.

Phil was the reason I signed up to Sharepad. I also have his book. Nuts and bolts spring to mind and despite the virtual world which some would have us believe is the holy future, reality and the laws of physics might just have the last say…

Thanks Martin, will do.

Hi Richard, Please pass on my thanks to Phil Oakley. I read everything he wrote for Investors Chronicle and for his new venture with John Hughman. Their podcasts were also really informative and Phil’s book “How to Pick Quality Shares” is one of the best I have. Unfortunately it’s unusual to find company analysis which addresses the numbers, what might be hidden by accounting trickery, the business strategy and market. I’ve learnt a lot from Phil. I’m not sure whether a new career path or health issues are the cause of Phil retiring from investment writing but either way I’d like to wish him the very best.

Thanks Roger, I’ll make sure he gets your message

I already miss Phil’s articles and his grumpy voice on the podcast.

I have learnt a lot from his articles and his book.

Wishing him all the best.

Tim

Thanks Tim.

Hi Richard,

Please pass on my thanks to Phil. I revisited his step by step Sharepad articles, which are a great resource. I also really enjoyed the Invest-ability podcasts with John.

Separately, liking the 3rd window idea above and looking forward to reading more of your own output in 2022.

Best wishes,

Andrew

Thanks Andrew

Hi Richard

Like the many of the respondents above, I’d also like to pass on my best wishes and thanks to Phil as he takes a step back from frontline investment writing. Listening to his podcasts with John was a guilty pleasure and I was looking forward to seeing where he would take things with Invest-ability. His rare mix of listenability (no pun intended!), straightforward, logical analysis and willingness to put his views out on record was a real boon for the private investor. I have and will continue to plunder the back catalogue of books, articles and podcasts for wisdom while wishing him health, happiness and the very best for the future.

As has already been said, we are lucky to have such similar abilities in you Richard so keep up the good work and know you are appreciated.

Thanks Chris, I’m seeing him on Tuesday. Will pass your message along.