We take a look at 5 new IPOS listed on the LSE over the past few weeks, including:

Oxford Nanopore Technologies ONT

OXFORD NANOPORE TECHNOLOGIES

Opening date 30 September 2021

Issue price 425p

Market cap £4.5bn

Ticker ONT

At the helm Dr Gordon Sanghera

What they do

One of many companies to benefit during the pandemic, it produces rapid Covid tests and pocket-sized DNA sequencing devices. Dubbed the “smartphone of sequencing”, they can be used far and wide to track Covid variants, a massive advantage over the large and bulky machinery generally used for DNA sequencing. So far, they have been used to track the virus in 85 countries.

As the LSE’s first major biotech listing since 2014, Oxford Nanopore’s share price soared more than 40% on its opening day, reaching 607p by market close.

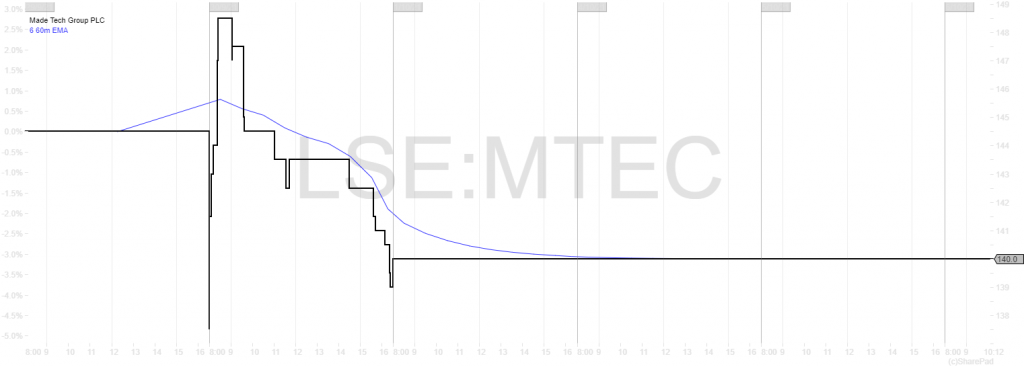

MADE TECH

Opening date 30 September 2021

Issue price 122p

Market cap £180m

Ticker MTEC

At the helm Rory MacDonald

What they do

Founded in 2012, Made Tech digitally transforms legacy-based apps and other services across government, healthcare and other sectors. The company originally focused on helping start-ups build fast and agile digital products, moving into the public sector in 2016 to help deliver better outcomes for the public.

Recently, they worked with HMRC to improve its digital tax platform, developed new recruitment platforms for the NHS and Department of Education, and it is currently helping the DVLA to provide improved digital services for the UK provisional driving licence system.

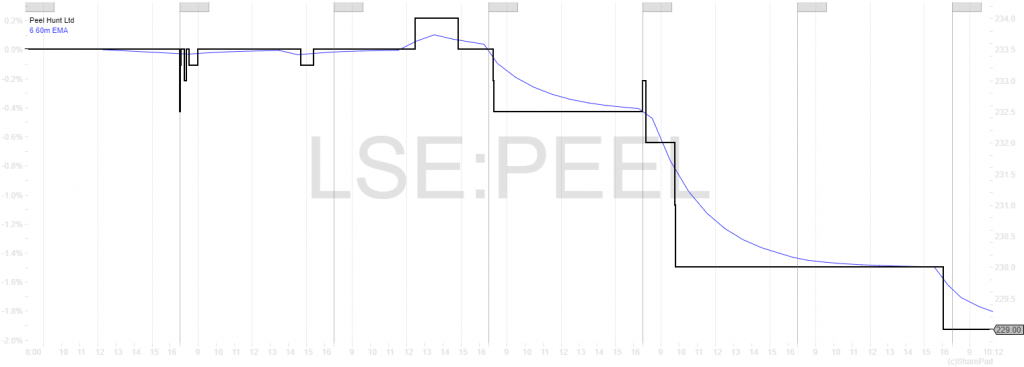

PEEL HUNT

Opening date 30 September 2021

Issue price 228p

Market cap £280m

Ticker PEEL

At the helm Steven Fine

What they do

Peel Hunt, an investment firm founded in 1989, provides advice, corporate broking and research services to SMEs. It claims to have facilited 47% of UK retail enquiries during 2021, and has plans to expand into Europe, invest further into technology and increase its cash holding to meet regulatory requirements.

Revenue growth was strong in 2021, reaching £197m, more than double the £96m earned in 2020. It currently works with 157 corporate clients with an average market cap of £775m, and provides research to 1,200 institutions.

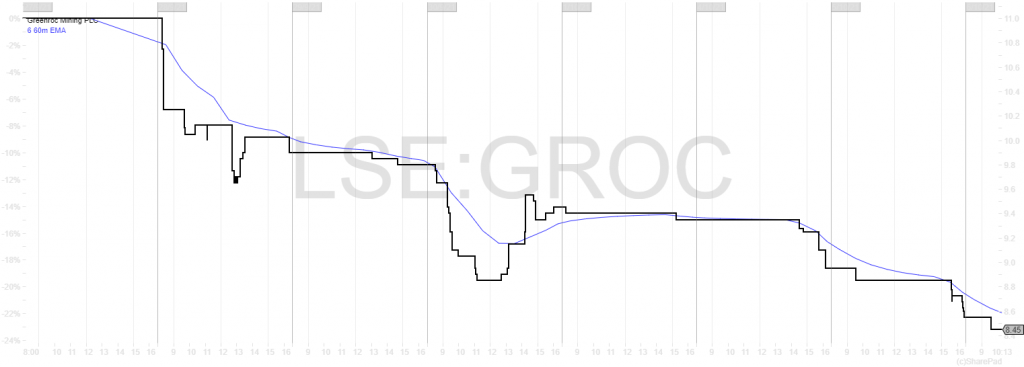

GREENROC MINING

Opening date 1 October 2021

Issue price 10p

Market cap £11m

Ticker GROC

At the helm Kirk Adams

What they do

GreenRoc, a mining enterprise focused on projects in Greenland, aims to become a key supplier of high-demand high-value minerals. Its current portfolio includes the Thule Black Sands Project, a high-grade ilmenite project that has already undergone extensive drilling, and the Inglefield Multi-Element Project which is hoped to yield copper, gold, cobalt and nickel.

Key areas of interest for GreenRoc are the graphite and titanium markets, which the EU and US have labelled as critical. The company reports that demand for graphite will increase up to 2,500% by 2040, propelled by the electric vehicles sector.

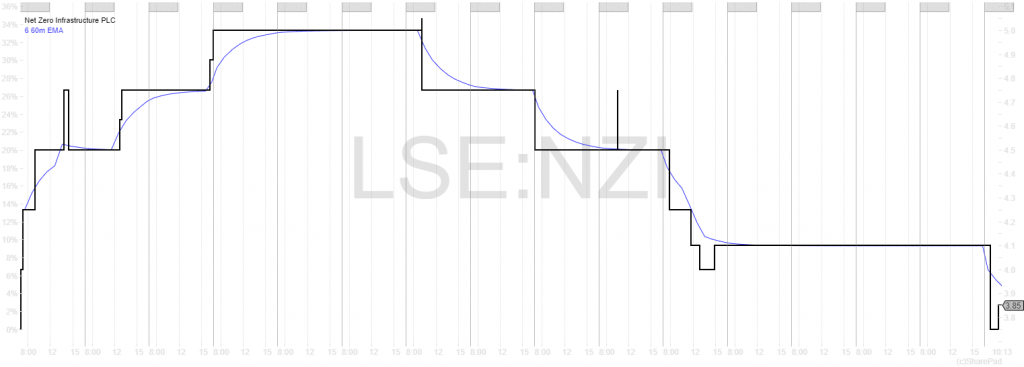

NET ZERO INFRASTRUCTURE

Opening date 14 September 2021

Issue price 3p

Market cap £2.5m

Ticker NZI

At the helm Michael Ellwood

What they do

Essentially a cash shell rather than a company, Net Zero is aiming to acquire businesses in the clean energy sector, businesses that support the UK’s ambitious net zero carbon goals. Like many others, Net Zero concludes that there are “considerable commercial opportunities” in the renewable and green energy sector.

Along with businesses that generate clean energy, Net Zero is also considering energy storage and carbon capture enterprises. The share price surged upon opening and peaked at 5p over the following weeks, though it has since settled back below 4p.

Have you invested in any of the new IPOs, or do you have your eye on one? Let us know in the comments section below.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.