Greg Robinson from Fire Revolution spells out how you can double or even treble increase dividend yield with covered calls. We’ll help you understand:

Worked example of a Covered Call: Tesco plc

As you are no doubt aware, the FTSE 100 is currently trading on a Cyclically Adjusted Price-to-Earnings (CAPE) ratio that marks it out as one of the cheapest developed markets in the world. And that makes it a fertile hunting ground for the dividend-yielding blue-chip shares favoured by income investors such as myself. Phil Oakley has written a number of valuable articles on how to invest for dividends, including how to pick shares with high dividend growth potential, how to avoid dividend traps and the case for dividend investing in dangerous markets.

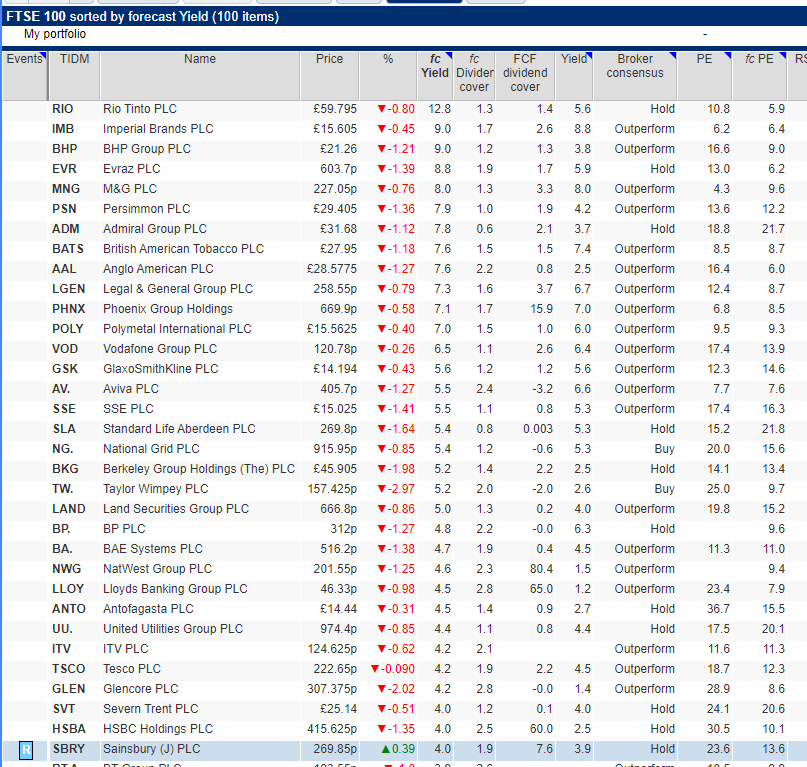

A quick search in SharePad shows that a third of the FTSE 100 companies have forecast dividend yields north of 4%.

That’s great. You can simply buy the shares and then sit back and watch your dividends roll in twice — or four times — a year. Of course — as we saw last year — there is always the risk that the dividend will be cut, but there are many examples of companies that have well-covered dividends that have generally increased in value over the years.

That — along with the currently attractive valuation of the FTSE 100 — makes a pretty compelling basis for a long-term equity investment strategy.

But, what if I told you there was a straightforward way to treble that yield? So, instead of settling for 4 or 5 or 6%, you could enjoy double-digit income from the same stocks.

I presume that is something you would be interested in? Well, welcome to the world of selling Covered Calls.

Now before I dig into the details of the strategy, I should make it clear that you can use this approach on most of the stocks in the FTSE 100 and many hundreds more on the US markets. The key point is that you should be happy to own the shares in the first place. So, your usual fundamental and technical filters still apply when assessing suitable shares. We are just going to add an additional step to the process.

To show you how you can generate additional income from stocks using Covered Calls, I’ll have to get a little bit technical I’m afraid.

Please bear with me. Once you’ve applied this technique a couple of times, you’ll see it’s no more complicated than buying the shares in the first place.

What is a Covered Call?

The technique we are going to discuss is Called Selling Covered Calls.

Let’s start by breaking down exactly what that means.

A Call is simply an options contract that allows the holder to buy a set number of shares, at a fixed price, within a certain period of time.

Now, if your heart sank at the word options, don’t worry, I get it. For some reason, they have gained a negative press when they really don’t deserve it. Used correctly, they actually reduce the risk of owning shares. I’ll explain why shortly.

Options are traded on an exchange and bought and sold through a broker in a very similar way to shares. So, if you have ever bought some shares from an online broker, you already have half the skills you need.

Selling Covered Calls

The key point here is that we are going to sell the Call.

That means that we are obligated to sell the shares the Call owner may wish to buy. And the Call buyer pays us a premium that is ours to keep whatever the outcome of the transaction. That’s where the additional income comes from.

Now notice that I say that the Call is Covered. That is very important and simply means that the Call we sell is backed by the actual shares required, if the holder decides to exercise it. In other words, we must buy the shares before selling a Call on those shares.

So, if you like the idea of receiving dividends twice or four times a year, how would you like to receive option premiums as frequently as once a month that can juice your income yield up into the teens?

Okay, enough of the theory – let’s have a look at a real example to help clarify the process:

Case Study: Tesco Plc

As I’m sure you know, Tesco are the biggest supermarket in the UK and also have branches in Ireland and Eastern Europe. They run huge supermarkets, local convenience stores and also have a 35% digital market share and exposure to cash-and-carry via their 2017 acquisition of Booker Group.

It doesn’t get much more exciting than that, eh?

Only kidding, it’s a pretty boring company really and that’s great. The less there is to get excited about the less stressful the share ownership is likely to be.

First things first. Let’s have a look at Tesco’s fundamental credentials.

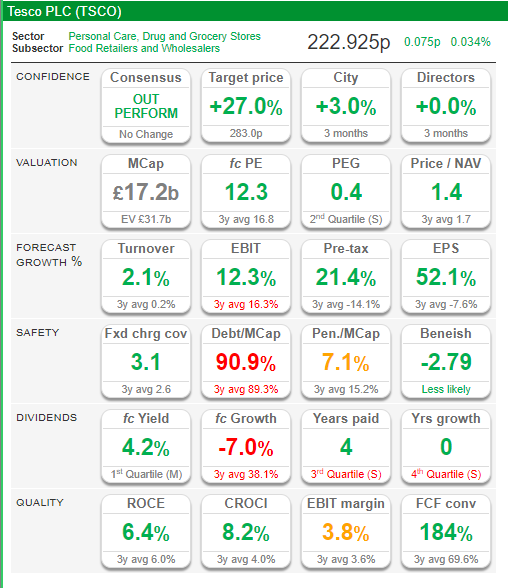

Well, a quick check in SharePad tells me that Tesco are trading at a tad under 223p, and the shares have a forecast dividend of 4.2% that is Covered 1.9x times by their earnings — that’s certainly acceptable.

They also have good forecast growth figures, are trading on a very reasonable forecast PE ratio of 12.3 and have an analyst’s consensus price target 27% higher than the current trading price.

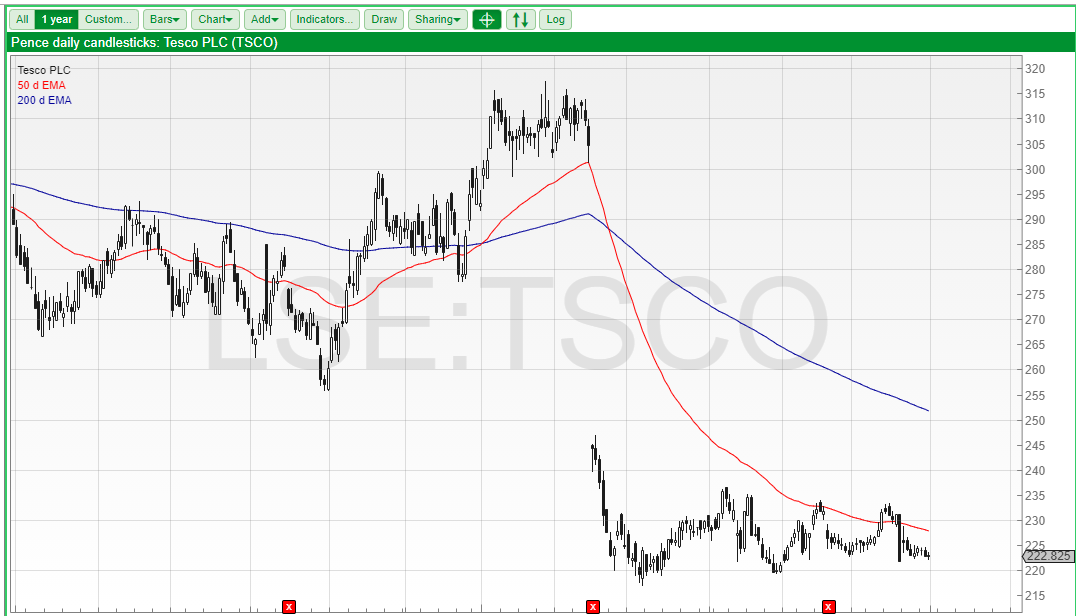

I can also see from the chart that the shares are trending sideways with support around the 220p level. That makes them an ideal candidate for selling Covered Calls on.

So, assuming that you have done your research and have decided that you like the look of Tesco for your long-term portfolio — you can simply buy the shares, sit back, relax, and enjoy your 4.2% — and hopefully growing — dividend income. Nothing wrong with that.

Or, for a little extra work we could super-charge that income. Here’s how.

Remember that Tesco is trading at 222.9p per share.

Let’s assume that you buy 1,000 shares for a total of £2,229 plus commissions and stamp duty of half a per cent. That would allow you to sell one Tesco Covered Call on your shares.

Why 1,000? Well, a single UK option contract represents 1,000 of the underlying shares. In the US, an option represents 100 shares. So that’s the minimum number you need to own for this strategy to work.

At any one time, there are quite a few different Call contracts available on a given stock.

They have different strike prices — the price at which the holder can buy shares from you — and expiration dates — the amount of time they have to exercise that right. If you can picture a matrix of the different options available, you are on the right track.

I won’t get into the nuts and bolts of why you would choose a particular strike and expiration at this time — let’s just examine a real example.

Selling a Covered Call on our Tesco shares

Looking at my broker’s online platform I can see that — amongst the many alternatives on offer — you could currently sell a Tesco Call with a strike price of 228p and an expiration date of the 17th of September for £57.50.

Okay, so what does that actually mean?

It simply means that you could sell one Call contract on your 1,000 Tesco shares and immediately pocket £57.50. That’s yours to keep whatever happens.

As a seller of the Call, you are now obligated to sell 1,000 shares of Tesco to the buyer of the Call for 228p each IF they exercise their option on, or before, the 17th of September.

Exercising a Call option simply means that the owner of the Call instructs their broker to buy the shares at the agreed strike price.

The key point here is that they can choose to buy your shares for 228p each — that’s over 5p MORE than you paid for them. Why would they do that?

Good question. The buyer of the Call is hoping that the shares will shoot up in value by the 17th of September. They will then be able to buy them from you cheaper than they are trading on the open market.

And, for that privilege, they are prepared to pay you £57.50. And of course, you can multiply this premium by each block of 1,000 shares that you own.

So, what happens next?

Well, if the share price is trading below 228p on the 17th of September, the Call simply expires worthless. Your obligation is lifted, you keep the £57.50, and can simply sell another Call.

Rinse and repeat. As often as you wish.

You received the £57.50 for a 79-day commitment. That’s an annualised yield of 11.9% of the current price of Tesco shares.

Oh, and of course, you would still collect the dividend twice a year for as long as you owned the shares.

But what if the Call is exercised?

We have just looked at the situation whereby the share price doesn’t end up above the strike price. That’s a good outcome.

But of course, sometimes you will sell a Call and the share price will rise above the strike price by the expiration date.

What happens then?

Well, the holder of the Call will likely exercise their option and you will be obligated to sell them the 1,000 shares that you own in Tesco.

In our real-world example, we have assumed that you paid 222.9p per share (plus stamp duty and commissions).

If the holder of the Call exercises their option, you will be obligated to sell them 1,000 shares at 228p each. So that’s a profit of 5.1p per share, or £51 for the 1,000 shares.

And of course, you still get to keep the £57.50 premium the Call buyer originally paid you plus any dividends that have been accrued whilst you owned the shares. So, that’s a pretty good result as well.

What’s the catch?

As all good investors know, you don’t get any reward without taking a corresponding risk. So, what is the catch here — where is our risk?

The main risk that you face is from owning the shares in the first place. We all know, that shares can go down in value as well as up.

As an income-oriented investor, a wandering share price is a lot less relevant than the income received, but we all know it doesn’t feel great when shares go down in value.

However, selling the Call on the shares actually reduces the risk of simply holding the shares.

With a single transaction, you have collected a £57.50 premium that’s yours to keep whatever happens. But the real strength of this approach becomes apparent when you repeat that sale over and over. All that premium soon adds up and can be offset against any drop in the value of the Tesco shares.

Therefore, your risk from selling the option is that the buyer will exercise it and you will have to sell your shares at a price that is lower than the current market price. You should still make a profit on the shares, but you will not get all the profit.

But, as we have seen, as long as we choose a strike price that is higher than the price we have paid for the shares, we are perfectly safe.

The key point here is that the Call is Covered by the shares that we already own. You must never sell an un-Covered Call — that is risky. Luckily, most brokers will not allow new option traders to do this, so it’s not an issue.

So, the risk is that the share price may shoot way up. For example, if Tesco shares jump to 235p each by September 17th, your Covered Call means that you will be obligated to sell them at 228p each. Not the 235p you could get in the open market.

Of course, you would still make over 5p profit on each of the shares and get to keep the premium, and any dividends, but you get the idea.

You are giving up some potential future upside in return for some definite income now. Personally, I think that’s a pretty good deal.

Greg Robinson

If you are interested to learn more about using Covered Calls as a strategy then please email me at greg@fire-revolution.co.uk or check out our website www.fire-revolution.co.uk where you can register for our next webinar.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Which broker are you using to sell covered calls on individual stocks?

Hi David, we go into the pros and cons of a number of different brokers on the training programme that are suitable for selling covered calls. I’m not allowed to make any specific recommendations, but I personally use Interactive Brokers and Saxo as they are registered in the UK and allow you to sell options on UK and US stocks.

Great read, Greg.

It’s not a strategy I use, but it’s knowledge, and accumulating knowledge is key to making educated decisions limiting risk as much as possible.

Regards,

Elric

Hi Greg,

This was a great read. Do you know if it is possible to sell covered calls on ETFs? I feel more comfortable holding ETFs than individuals stocks. I know in the US, it is possible but not seen any one talking about it in the UK. many thanks 🙏

In the UK it is only FTSE 100 shares that have options